How to Make Money With Cryptocurrency: A Beginner's Guide That Actually Works (2025)

Making money with cryptocurrency remains a hot topic among investors, as Bitcoin's price has grown nearly tenfold and reached $111,000 by May 2025. The rewards look promising, but the risks run just as high. Recent data shows that all but one of these retail clients lose money while trading CFDs with certain investment providers.

The crypto market keeps drawing both newcomers and seasoned investors. More than 10,000 cryptocurrencies exist in the market today, offering opportunities well beyond Bitcoin. Crypto trading options range from long-term holding to daily active trading that generates quick profits. Crypto prices can jump thousands of dollars or crash within hours. This piece explores proven beginner strategies for crypto investing. You'll learn to tap into the full potential of tools like Token Metrics' AI-powered research platform to make smarter trades in this volatile market.

Understanding Cryptocurrency and Its Potential

Cryptocurrency has changed our perspective on money and financial transactions. A cryptocurrency is a digital or virtual currency that uses cryptography to stay secure, which makes counterfeiting almost impossible. Unlike government-issued currencies, cryptocurrencies run on decentralized systems with blockchain technology. These systems let people make transactions directly without banks.

What is cryptocurrency and how does it work?

The network processes cryptocurrency transactions through electronic messages. Your transaction details - the addresses of both parties and the amount - reach every part of the network when you start a transfer. Miners group these transactions into "blocks" and compete to crack complex cryptographic codes. The blockchain confirms your transaction once they solve the code.

Digital wallets store your crypto assets, and you need a private key to access them instead of keeping money in physical form or bank accounts. You can send crypto almost instantly worldwide, often cheaper than traditional banking.

The market decides most cryptocurrencies' value based on what buyers will pay. This is different from national currencies that get their value partly because governments make them legal tender.

Why crypto is more than just Bitcoin

Bitcoin started the cryptocurrency revolution in 2009, but the ecosystem has grown beyond recognition. Today, thousands of cryptocurrencies serve different purposes:

- Payment cryptocurrencies like Bitcoin work as digital cash

- Infrastructure cryptocurrencies such as Ethereum support smart contracts and decentralized applications

- Financial cryptocurrencies include stablecoins that match fiat currency values

- Utility tokens play specific roles in their blockchain ecosystems

The global cryptocurrency market reached USD 5.70 billion in 2024 and could hit USD 11.71 billion by 2030, growing at 13.1% CAGR. Big names like Tesla and MasterCard now accept crypto payments, which adds credibility to the market.

Cryptocurrencies tackle issues beyond moving money. To name just one example, Ethereum's smart contracts enable complex financial services without middlemen, while other cryptocurrencies focus on privacy, scalability, or industry-specific solutions.

The role of blockchain and decentralization

Blockchain technology powers cryptocurrencies through a distributed database or ledger that network computers share. Transaction data sits in "blocks" linked in time order, creating a "chain" that keeps information permanent and visible.

Blockchain's strength comes from its decentralized structure. Users govern the system together through consensus algorithms instead of relying on banks or governments. This setup brings several benefits:

- Resistance to censorship and single points of failure

- Reduced costs by eliminating intermediaries

- Enhanced security through cryptographic verification

- Greater transparency as all transactions are publicly recorded

Understanding these basics is vital for anyone wanting to profit from cryptocurrency. Tools like Token Metrics help investors direct their decisions with AI-powered research that examines these technical foundations.

Blockchain and decentralization create a financial system unlike traditional models. No one can alter, reverse, or control transactions. This groundbreaking approach creates new ways to build wealth beyond standard investment options.

Can You Really Make Money with Crypto?

Can you make money with cryptocurrency? The answer isn't simple. The crypto market offers a range of possibilities where you could either build wealth or lose everything quickly.

Crypto as a high-risk, high-reward asset

Cryptocurrency sits squarely in the "high risk, high reward" investment category. Market behavior backs up this reality. The crypto market has grown into a major asset class with a combined market capitalization of nearly $3 trillion. Yet its ups and downs create both amazing chances and serious risks.

The risks in crypto stem from several factors. Most cryptocurrencies don't have traditional currency backing. Unlike stocks or bank deposits, they lack regulation and insurance. Government policies could change without warning and affect asset values. To cite an instance, see China's 2021 crypto ban that led to a market-wide sell-off.

Performance metrics show why investors' attention is drawn to crypto despite these risks. Bitcoin's Sharpe ratio of 0.96 from 2020 to early 2024 beat the S&P 500's 0.65. This means investors got better returns for their risk. Bitcoin's Sortino ratio of 1.86—almost double its Sharpe ratio—suggests most of its volatility led to positive returns.

Examples of real profits and losses

The numbers behind crypto's profit potential stand out. Bitcoin's price grew about tenfold over the last five years, even with several market ups and downs. Bitcoin traded at $42,320 in January 2024. Its value more than doubled to around $93,350 by December 31, 2024.

Real trading examples highlight potential gains and losses:

- A trader buying 1 ETH at $3,000 and selling at $4,000 (minus $200 in fees) would pocket an $800 profit

- But buying 1 ETH at $3,000 and selling at $2,000 (with $200 in fees) would mean a $1,200 loss

Daily profits vary based on trader experience:

- Beginners earn $10-$80 daily

- Intermediate traders make $40-$400

- Expert traders can generate $300-$1,000+

Successful crypto day traders usually achieve 1-3% daily returns. Token Metrics' AI-powered analysis helps traders find better entry and exit points during market swings.

How volatility creates opportunity

Crypto's famous volatility—often seen as its biggest weakness—actually creates some of its best chances to profit. Market swings directly affect earning potential because volatile days offer more opportunities through price movements.

Bitcoin showed this effect when its price dropped more than 20% in two months after the FTX exchange collapse in November 2022. Smart traders saw these dramatic shifts as chances to enter long-term positions or make quick trades.

Periods of low volatility matter too. They often set up future price increases. Bitcoin's price usually jumps sharply after its realized volatility hits record lows.

Success depends on timing and strategy. Some investors set clear targets, like selling at 50-100% gains. Others watch market conditions or look for better investment options elsewhere.

Of course, you can make money with cryptocurrency. But you need to understand risks and rewards, develop a solid strategy, and use advanced tools like Token Metrics to make smart choices in this volatile but potentially profitable market.

7 Proven Ways to Make Money with Cryptocurrency

You can make money in the cryptocurrency space through several proven methods. Your experience level or risk tolerance doesn't matter. Each strategy comes with its own advantages and potential returns based on your goals.

1. Buy and hold (HODL)

HODL—a misspelling of "hold" that became crypto slang—is a straightforward long-term investment strategy. A 2013 online post created this term, which now means "hold on for dear life" among crypto enthusiasts. The strategy is simple: buy cryptocurrency and hold it for long periods, whatever the short-term price changes. Many investors use dollar-cost averaging (DCA) and invest fixed amounts regularly to minimize volatility's effects. This approach needs patience but Bitcoin holders have seen substantial returns historically.

2. Day trading and swing trading

Active traders can aim for quick returns through trading. Day trading means making multiple trades in one day, while swing trading captures price movements over days or weeks. Successful swing traders can earn 1-3% daily returns consistently. This makes it available for beginners who can't watch markets all day. Swing trading needs less attention than day trading, so investors can handle other responsibilities while staying active in the market.

3. Staking for passive income

Staking lets you earn rewards by holding specific cryptocurrencies that use Proof-of-Stake consensus mechanisms. Your staked assets secure the network and generate interest—like in a high-yield savings account. Ethereum (ETH), Solana (SOL), and Cardano (ADA) are popular staking options. The rewards can vary by a lot, with some validators offering 5-20% annual percentage yield (APY).

4. Crypto lending and earning interest

Crypto lending platforms let you deposit cryptocurrency and earn interest while others borrow your assets. Nexo clients can earn up to 14% annual interest with daily payouts and no lock-ups. Interest rates change based on the cryptocurrency—up to 6% on Bitcoin, up to 7% on Ethereum, and up to 13% on USDT. Both centralized (CeFi) and decentralized (DeFi) platforms provide lending services with different risk profiles.

5. Running a master node

Masternodes are specialized cryptocurrency wallets that verify transactions, ensure network security, and take part in governance. Operators receive block rewards as payment. Running a masternode needs a large cryptocurrency stake as collateral—like 1,000 DASH—plus technical knowledge and server setup. This option works best for investors with bigger holdings and technical skills.

6. Arbitrage between exchanges

Price differences of the same cryptocurrency across exchanges create arbitrage opportunities. Traders can earn relatively safe profits by buying at lower prices on one platform and selling higher on another quickly. Speed matters most because price gaps close fast. Many traders use automated tools to track multiple exchanges at once.

7. Participating in airdrops and giveaways

New blockchain projects use airdrops to give away free tokens as marketing tools. These usually need simple tasks like following social media accounts or using a protocol before a snapshot date. Uniswap is a famous example that gave away tokens worth over $1,000 to its platform users.

Signup for 7 days free trial at Token Metrics - Top AI crypto research and trading platform to help identify profitable opportunities across all these strategies.

Avoiding Common Crypto Mistakes

Success in cryptocurrency depends on avoiding mistakes that can get pricey and implementing profitable strategies. New investors often fall into predictable traps that can wreck their portfolios.

Not researching before investing

The crypto community has one golden rule: DYOR (Do Your Own Research). Many investors skip this crucial step. A full picture requires analysis of the whitepaper, roadmap, token economics, team credentials, and community participation. You should review the size and activity of a project's community before investing—a healthy community shows the project's vitality. Token Metrics' AI-powered analysis tools can make this research easier and help spot red flags you might miss otherwise.

Overexposing your portfolio to crypto

Potential gains can make investors commit too much money. The cardinal rule in cryptocurrency and traditional markets remains the same - never invest more than you can afford to lose. Your portfolio shouldn't keep you up at night or create serious financial risks if markets crash. The smart approach is to vary your investments in different asset classes.

Falling for scams and hype

Scammers flock to the crypto space because it's complex and unregulated. Common scams include:

- Pump-and-dump schemes where prices shoot up artificially before a massive sell-off

- Romance scams where fraudsters build relationships to ask for crypto transfers

- "Pig butchering" scams that pull victims into bigger and bigger investments

- Phishing attacks that target wallet private keys

Note that if something looks too good to be true, it usually is. Watch out especially when you have guaranteed returns, excessive marketing, and anonymous team members.

Ignoring tax responsibilities

Crypto investors often underestimate their tax obligations. The IRS sees cryptocurrency as property, not currency. This means almost every crypto transaction becomes taxable—selling for cash, switching between cryptocurrencies, or buying goods and services with crypto. You need to report these transactions whether they create a gain or loss. Tax compliance failures can trigger audits, penalties, and criminal investigations.

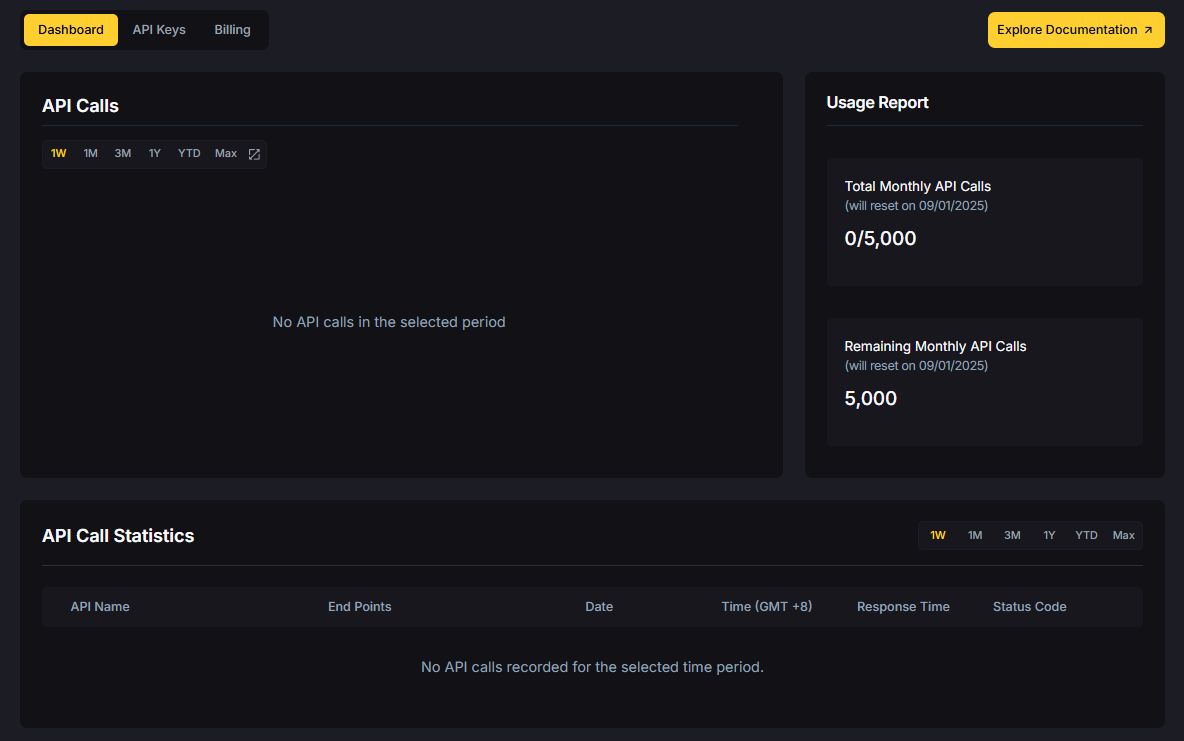

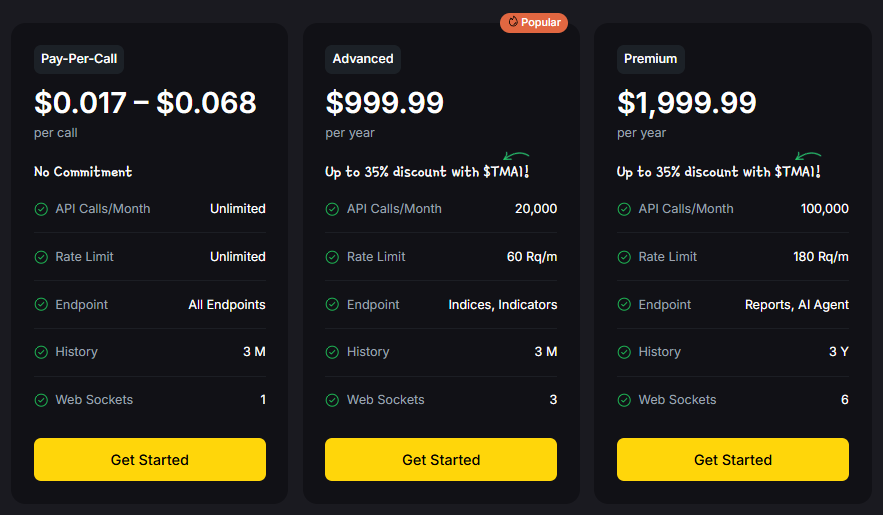

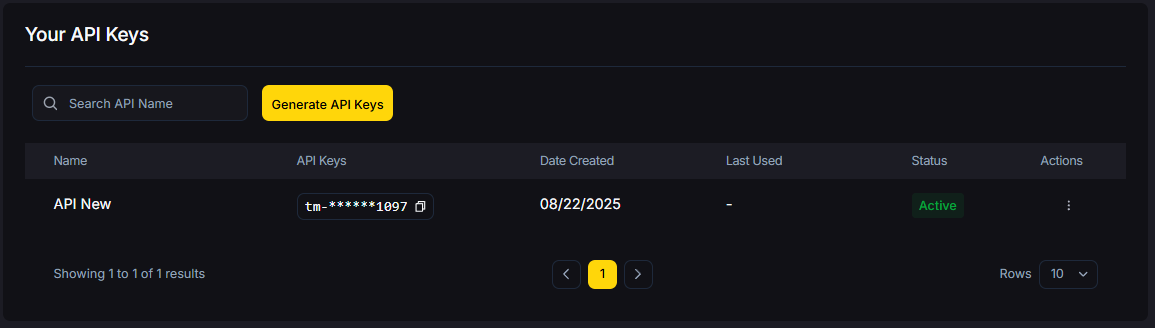

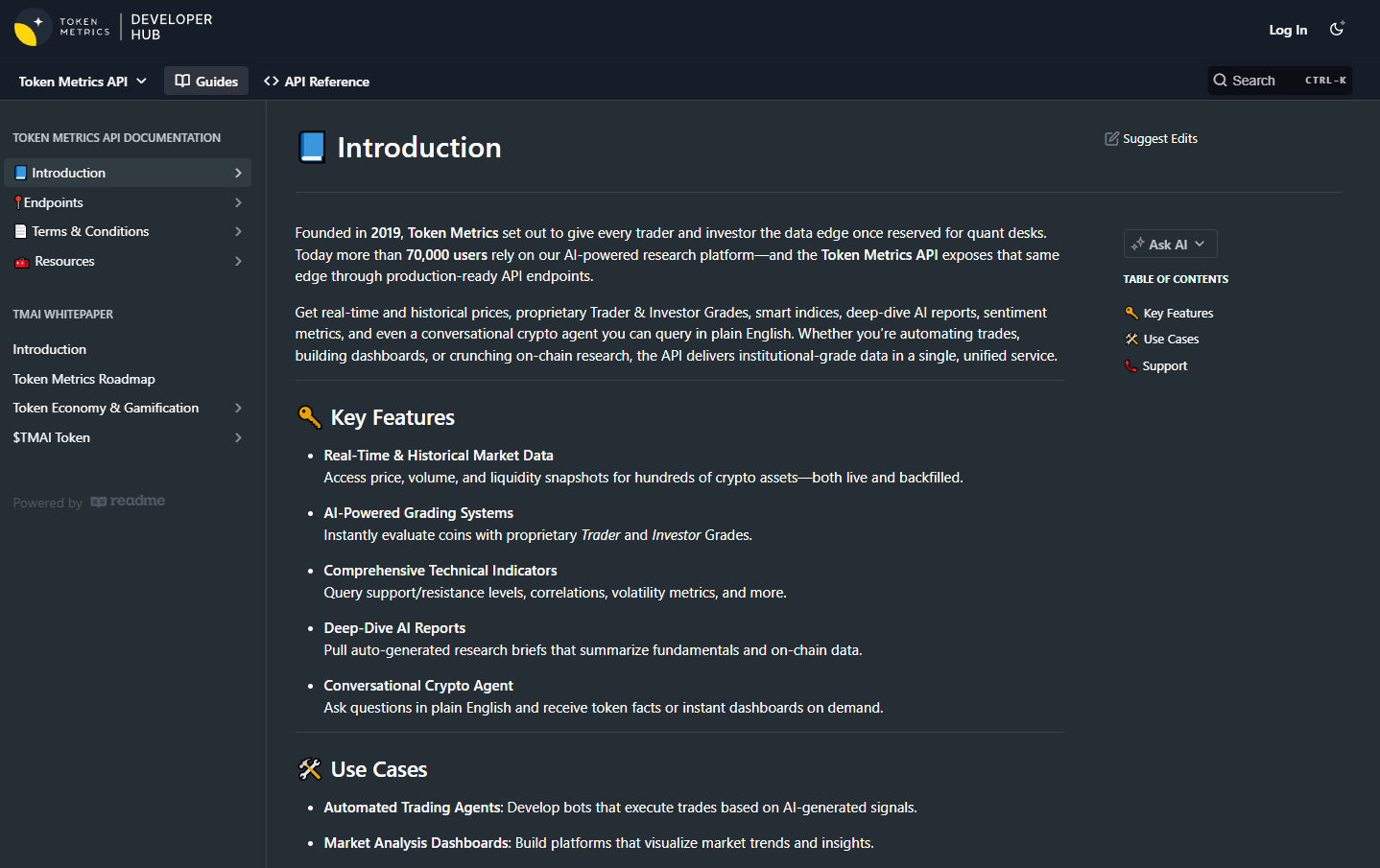

Using Token Metrics to Improve Your Crypto Strategy

Trading cryptocurrency successfully requires smart tools that give you informed decisions. Specialized analytics platforms can make a significant difference in your investment success.

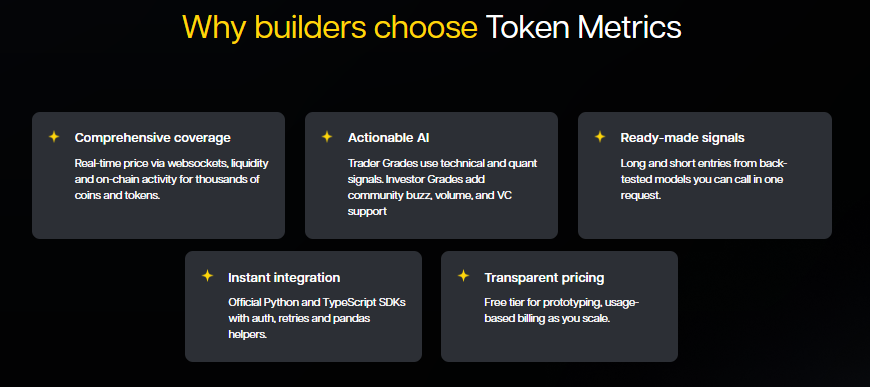

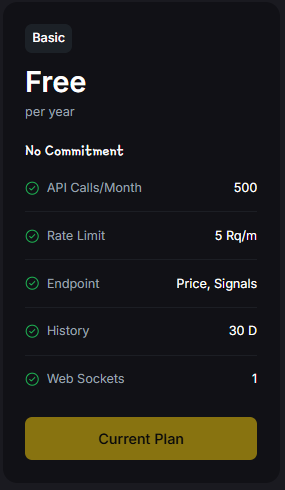

What is Token Metrics and how it works?

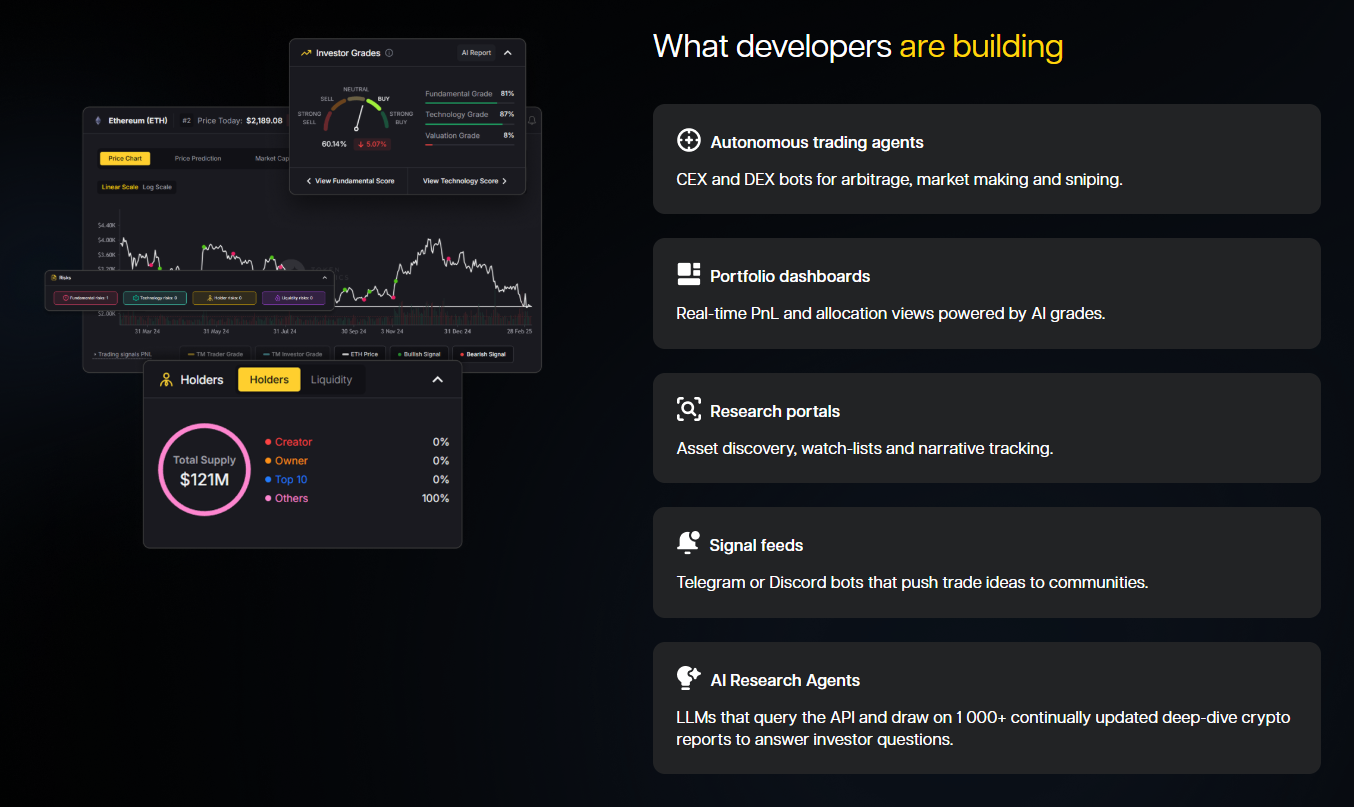

Token Metrics is an AI-driven cryptocurrency analytics platform founded in 2017 by Ian Balina. His data-focused approach to crypto investing helped him turn $20,000 into more than $5 million. The platform gives you immediate insights about over 6,000 cryptocurrencies and NFT projects. Token Metrics brings together three information sources: professional analysts (including veterans from Goldman Sachs and JP Morgan), detailed analytics using 70+ data points per cryptocurrency, and artificial intelligence algorithms.

AI-powered crypto research and trading

Token Metrics uses machine learning and AI to identify potential trends and predict future price movements. The platform looks at price action, on-chain metrics, social sentiment, and developer activity to generate applicable information. These algorithms review fundamental reports, code quality, sentiment analysis, moving averages, and support/resistance levels. This systematic method helps remove emotions from investment decisions.

How Token Metrics helps with timing and selection

Token Metrics offers two proprietary grading systems that help investors make vital timing decisions:

- Trader Grade - Focuses on short-term price action and momentum, designed for active traders looking to identify breakout potential

- Investor Grade - Evaluates long-term trend sustainability, ideal for portfolio managers and fundamental investors

Both grades use over 80 quantitative and on-chain data points that update continuously, shown on a simple 0-100 scale. Grades above 90 signal breakout potential, while falling grades warn of potential risks.

Case examples of better decisions using Token Metrics

Token Metrics has shown its value through recent market cycles. The platform's Trader Grade flagged a high score on $NORMIE right before a 40% intraday move, which helped traders catch the breakout early. It also spotted weakening strength in $TNSR, giving users time to exit before downside movements.

Signup for 7 days free trial at Token Metrics - Top AI crypto research and trading platform.

Conclusion

You can still make money with cryptocurrency despite market volatility and risks. This piece explores seven proven strategies - from long-term holding to active trading, staking to running masternodes. These methods offer different risk-reward profiles that suit various investor types.

But success in crypto needs more than strategy knowledge. Smart investors avoid common pitfalls like poor research, portfolio overexposure, scam traps, and tax obligation oversights. These mistakes can wipe out your potential gains quickly.

This is why tools like Token Metrics have become vital for serious crypto investors. The platform's AI-powered analysis looks at thousands of cryptocurrencies using 70+ data points. It helps you spot opportunities while keeping emotional decisions in check. You can make choices based on complete data analysis and professional insights instead of gut feelings.

Token Metrics excels at timing market entries and exits - maybe the most challenging part of cryptocurrency investing. The platform's Trader and Investor Grades give clear signals about potential breakouts or reversals. These insights become vital when markets move faster.

Without doubt, cryptocurrency remains a high-risk investment class. In spite of that, proper research, risk management, and analytical tools help you guide through this volatile market with confidence. Your chances of success improve substantially when you approach crypto with discipline and the right resources - whether you choose to HODL for long-term appreciation or actively trade for short-term gains.

FAQs

Q1. Is it possible to earn a consistent income from cryptocurrency trading? Yes, it's possible to earn consistent income from cryptocurrency trading, especially through methods like day trading and swing trading. Successful swing traders can potentially earn 1-3% daily returns consistently. However, it requires knowledge, strategy, and careful risk management.

Q2. What are some low-risk ways to make money with cryptocurrency? Some lower-risk methods to earn money with cryptocurrency include staking for passive income, participating in crypto lending platforms, and arbitrage between exchanges. These methods can provide steady returns without requiring constant market monitoring.

Q3. How important is research when investing in cryptocurrencies? Research is crucial when investing in cryptocurrencies. It's essential to analyze the whitepaper, roadmap, token economics, team credentials, and community engagement of a project before investing. Thorough research helps identify potential red flags and reduces the risk of falling for scams or hype.

Q4. Are there tax implications for cryptocurrency transactions? Yes, there are significant tax implications for cryptocurrency transactions. In many jurisdictions, including the US, virtually all crypto transactions are considered taxable events. This includes selling for cash, converting between cryptocurrencies, and even spending crypto on goods and services. It's important to keep accurate records and report all transactions to avoid potential legal issues.

Q5. How can AI-powered tools improve cryptocurrency investment strategies? AI-powered tools like Token Metrics can significantly improve cryptocurrency investment strategies by providing data-driven insights and removing emotional decision-making. These platforms analyze multiple factors such as price action, on-chain metrics, and social sentiment to predict trends and generate actionable insights. They can help with crucial timing decisions for market entries and exits, potentially improving overall investment outcomes.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)