How to Mine Litecoin? - A Step-by-Step Guide for Beginners

In the ever-evolving landscape of digital currencies, mining has emerged as a captivating avenue for individuals to participate in the cryptocurrency revolution actively.

Litecoin (LTC), a standout among prominent cryptocurrencies, offers enthusiasts a unique opportunity to delve into the mining world.

In this comprehensive guide, we will explore the process of mining Litecoin, including the hardware and software requirements, profitability considerations, and tips for success.

What is Litecoin?

Litecoin was created in 2011 as a fork of Bitcoin, with modifications aimed at improving scalability and transaction speed.

It operates on its own blockchain and has gained popularity as a reliable and secure digital currency. Litecoin uses a proof-of-work consensus mechanism, similar to Bitcoin, to validate transactions and secure the network.

How Does Litecoin Mining Work?

Litecoin mining is verifying and adding transactions to the Litecoin blockchain. Miners use specialized hardware and software to solve complex mathematical problems, known as hashes, in order to create new blocks.

These blocks contain a record of the latest transactions and are added to the blockchain chronologically.

The mining process involves finding a specific hash value that meets certain criteria set by the Litecoin protocol.

Miners compete to be the first to find the correct hash, and the winner is rewarded with a certain number of Litecoins. This process ensures the security and integrity of the Litecoin network.

How to Select Mining Hardware?

Choosing the right mining hardware is crucial for successful Litecoin mining. Consider the following factors when selecting your mining hardware:

- Hash Rate: The hash rate determines the speed at which your mining hardware can solve hashes. A higher hash rate leads to more efficient mining and a greater chance of earning rewards.

- Power Consumption: Mining requires significant electricity, and high power consumption can affect your profits. Opt for energy-efficient hardware to minimize electricity costs.

- Cost and Affordability: Consider the upfront cost of the hardware and its potential return on investment. Strike a balance between price and performance to ensure profitability.

- Reliability and Longevity: Choose reputable hardware manufacturers known for producing reliable and durable mining equipment. A dedicated hardware setup will minimize downtime and maintenance costs.

How to Mine Litecoin: Step by Step Process

Step 1: Understand the Hardware Requirements

To mine Litecoin (LTC), you will need specialized hardware called ASIC miners (Application-Specific Integrated Circuits) or powerful GPUs (Graphics Processing Units).

These devices are designed to perform the complex calculations required for mining more efficiently than traditional CPUs.

When selecting hardware, consider factors such as hash rate (the speed at which the hardware can solve hashes), power consumption, and cost. It's important to strike a balance between performance and cost-effectiveness.

Step 2: Set Up Your Litecoin Wallet

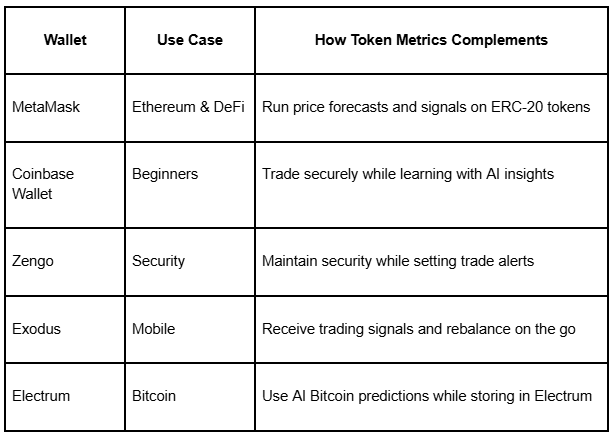

Before you start mining Litecoin, you will need a wallet to store your Litecoin. Various crypto wallets are available, including hardware, software, and online wallets. Choose a reputable wallet that offers high security and supports Litecoin.

Step 3: Choose Mining Software

Next, you must choose mining software compatible with your hardware and operating system.

Several options are available, so research and select a reliable and user-friendly software that suits your needs. Some popular mining software for Litecoin include CGMiner, EasyMiner, and BFGMiner.

Step 4: Join a Mining Pool (Optional)

While it is possible to mine Litecoin individually, joining a mining pool can increase your chances of earning consistent rewards. In a mining pool, multiple miners combine their computing power to solve hashes collectively.

When a block is successfully mined, the rewards are distributed among the pool members based on their contribution.

Step 5: Configure Your Mining Software

Once you have chosen your mining software, you must configure it with the necessary information. It typically includes the pool's address, your wallet address, and other parameters specific to your hardware and software. Refer to the instructions provided by the mining software or pool for detailed setup guidelines.

Step 6: Start Mining Litecoin

After completing the setup process, you are ready to start mining Litecoin. Launch your mining software and monitor its performance.

You can track important metrics such as hash rate, accepted shares, and temperature to ensure optimal mining efficiency. Keep your hardware cool and ensure a stable internet connection for uninterrupted mining.

Step 7: Monitor and Optimize Your Mining Operation

Regularly monitor your mining operation to ensure it remains profitable. Keep an eye on electricity costs, hardware performance, and market conditions.

Adjust your mining settings and strategies accordingly to maximize your earnings. Stay informed about the latest developments in Litecoin mining to stay ahead of the competition.

Why Mine Litecoin?

Mining Litecoin offers several advantages and opportunities:

Profitability: Mining Litecoin can be a lucrative endeavor if done correctly. By earning Litecoin through mining, you can potentially accumulate wealth as the value of Litecoin increases.

Supporting the Network: Miners are crucial in securing the Litecoin network by validating transactions and adding them to the blockchain. By mining Litecoin, you contribute to the decentralization and stability of the network.

Learning Experience: Mining provides a hands-on learning experience about blockchain technology, cryptocurrencies, and the underlying principles of decentralized systems. It allows you to gain practical knowledge and insights into digital currencies.

Is Mining Litecoin Profitable?

The profitability of Litecoin mining depends on various factors, including:

Hash Rate: A higher hash rate increases your chances of mining a block and earning rewards. Invest in powerful hardware to maximize your mining efficiency.

Electricity Costs: Mining consumes significant electricity, which can impact profitability. Ensure your mining operation remains cost-effective by selecting energy-efficient hardware and minimizing electricity expenses.

Mining Difficulty: The mining difficulty adjusts regularly to maintain a consistent block time. Higher mining difficulty reduces the rewards earned per hash, potentially affecting profitability.

Market Conditions: The price of Litecoin in the market directly affects mining profitability. Monitor market trends and adjust your mining strategy accordingly.

It's essential to regularly assess the profitability of your mining operation and consider factors such as hardware costs, electricity expenses, and Litecoin's market value. Use mining profitability calculators to estimate potential earnings and make informed decisions.

Final Thoughts

Mining Litecoin can be rewarding for those interested in participating in cryptocurrencies. Following the steps outlined in this guide and staying informed about the latest developments in Litecoin mining can increase your chances of success.

Remember to consider factors such as hardware selection, mining software, electricity costs, and market conditions to optimize your mining operation and maximize profitability.

Frequently Asked Questions

Q1. What is the difference between Litecoin and Bitcoin mining?

Litecoin and Bitcoin mining follow similar principles, but Litecoin uses a different hashing algorithm called Scrypt. This algorithm requires different hardware and offers faster block generation times.

Q2. Can I mine Litecoin with my computer's CPU?

While it is possible to mine Litecoin with a CPU, it could be more cost-effective due to the low hash rate of CPUs. Specialized ASIC miners or powerful GPUs are more suitable for efficient Litecoin mining.

Q3. How long does it take to mine one Litecoin?

The average block mining time on the Litecoin blockchain is approximately 2.5 minutes. Miners receive a reward of 12.5 Litecoins per block mined.

Q4. Should I join a mining pool or mine individually?

Joining a mining pool increases your chances of earning consistent rewards, especially with limited mining resources. However, some miners prefer solo mining for the potential of earning the entire block reward.

Q5. What are the risks associated with Litecoin mining?

Litecoin mining involves risks such as hardware failure, increasing mining difficulty, and fluctuations in cryptocurrency prices. It's essential to consider these risks and manage them effectively and carefully.

Q6. Can I mine Litecoin using my smartphone?

Mining Litecoin using a smartphone is impractical due to mobile devices' limited computational power and energy efficiency. Specialized mining hardware is necessary for efficient mining.

Q7. How can I optimize my mining operation for maximum profitability?

To optimize your mining operation, consider factors such as hardware efficiency, electricity costs, mining pool selection, and market conditions. Regularly monitor and adjust your mining settings for optimal profitability.

Q8. What is the role of miners in the Litecoin network?

Miners are crucial in securing the Litecoin network by validating transactions and adding them to the blockchain. They contribute to the decentralization and stability of the network.

Q9. What happens if I mine an invalid block?

If a miner mines an invalid block, it will be rejected by the network, and the miner will not receive any rewards. Miners must ensure the blocks they mine comply with the network's rules and requirements.

Q10. Can I mine Litecoin without investing in expensive hardware?

Mining Litecoin without specialized hardware is not cost-effective due to the low hash rate of CPUs. Investing in ASIC miners or powerful GPUs is necessary for efficient and profitable Litecoin mining.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.svg)

.png)