Is Web3 Just a Buzzword or Is It Real? Separating Hype from Reality in 2025

The question “Is Web3 just a buzzword or is it real?” reverberates across tech conferences, and especially in the Twitter bio of those who want to signal they are 'in the know' about the future of the internet and decentralized platforms. As we navigate through 2025, the debate about whether Web3 represents a true revolution in the internet or merely another marketing buzzword has intensified. Advocates tout it as the next internet built on decentralization and user empowerment, while skeptics dismiss it as a vapid marketing campaign fueled by hype and venture capitalists. The truth, as with many technological paradigm shifts, lies somewhere between these extremes.

Understanding the Web3 Phenomenon

Web3, also known as Web 3.0, is envisioned as the next generation of the internet, built on blockchain technology and decentralized protocols. Unlike the early days of the web—Web1, characterized by static pages and read-only content—and web 2.0, which was dominated by interactive platforms controlled by big tech companies, Web3 promises a new paradigm where users can read, write, and own their digital interactions. Web1 was primarily about connecting people through basic online platforms, while web 2.0 expanded on this by enabling greater collaboration and interaction among individuals. This represents a fundamental shift from centralized servers and platforms toward a user-controlled internet. The current internet faces challenges such as centralization and data privacy concerns, which Web3 aims to address through decentralization and user empowerment.

The term “web3” was first coined by Gavin Wood, co-founder of Ethereum and founder of Polkadot, in 2014 to describe a decentralized online ecosystem based on blockchain technology. Interest in Web3 surged toward the end of 2021, driven largely by crypto enthusiasts, venture capital types, and companies eager to pioneer token-based economics and decentralized applications. At its core, Web3 challenges the legacy tech company hegemony by redistributing power from centralized intermediaries to users collectively, promising digital ownership and governance rights through decentralized autonomous organizations (DAOs) and smart contracts.

The Case for Web3 Being Real: Tangible Applications in 2025

Despite the public’s negative associations with hype and marketing buzzwords, Web3 has demonstrated real value in several key areas by 2025.

Advocates of Web3 often refer to it as the 'promised future internet,' envisioning a revolutionary shift that addresses issues like centralization and privacy.

As the next phase of the internet's evolution, Web3 is beginning to show tangible impact beyond its initial hype.

Financial Revolution Through DeFi

Decentralized finance (DeFi) stands out as one of the most mature and actively implemented sectors proving that Web3 is more than just a buzzword. DeFi platforms enable users worldwide to lend, borrow, trade, and invest without relying on centralized intermediaries like banks. These platforms operate 24/7, breaking down barriers imposed by geography and time zones. DeFi empowers users to control their own money, eliminating the need for traditional banks and giving individuals direct access to their digital assets.

Millions of users now engage with DeFi protocols daily, and traditional financial institutions have begun adopting tokenized assets, bridging the gap between legacy finance and decentralized finance. By participating in these systems, users can accrue real value and tangible benefits, earning rewards and profits through blockchain-based activities. This integration signals a shift towards a more inclusive financial system, powered by blockchain technology and crypto assets.

Asset Tokenization Revolution

Web3’s impact extends beyond cryptocurrencies and JPEG non-fungible tokens (NFTs). Web3's influence is not limited to Bitcoin and other cryptocurrencies; it also encompasses a wide range of tokenized assets. Real-world asset tokenization is redefining how we perceive ownership and liquidity. Assets such as real estate, carbon credits, and even U.S. Treasury bonds are being digitized and traded on blockchain platforms, enhancing transparency and accessibility.

For instance, Ondo Finance tokenizes U.S. government bonds, while Mattereum offers asset-backed tokens with legal contracts, ensuring enforceable ownership rights. Agricultural tracking systems in Abu Dhabi collaborate with nearly 1,000 farmers to tokenize produce and supply chain data, illustrating practical applications of tokenization in diverse industries.

Enterprise Adoption and Infrastructure

The Web3 ecosystem has experienced unprecedented growth, with over 3,200 startups and 17,000 companies actively operating in the space as of 2025. This rapid expansion, supported by more than 2,300 investors and nearly 9,800 successful funding rounds, reflects a robust market eager to explore blockchain’s potential. The underlying infrastructure of blockchain technology is fundamental to this growth, enabling decentralization, enhanced security, and privacy across the internet.

Major industries—including finance, healthcare, supply chain, and entertainment—are integrating blockchain technology to enhance security, transparency, and efficiency. Enterprises are deploying decentralized applications and smart contracts to manage digital assets, identity verification, and transactional data, moving beyond speculative use cases to practical, scalable solutions. Web3 aims to deliver improved, interoperable service experiences across digital platforms, creating seamless and user-centric online services.

Digital Identity and Data Ownership

A core promise of Web3 is empowering users with control over their data and digital assets. Decentralized platforms host data across distributed networks, allowing users to maintain greater control and privacy over their information. Unlike Web2 platforms that monetize user information through centralized servers and walled gardens, decentralized social networks and user-controlled internet services give individuals ownership and governance over their data. This shift addresses growing concerns about privacy, censorship, and data exploitation, enabling users to monetize their digital presence directly.

The Reality Check: Valid Criticisms and Challenges

While Web3 has made impressive strides, it is not without significant challenges that temper the hype. Some critics argue that Web3 is a false narrative designed to reframe public perception without delivering real benefits.

Technical Limitations Still Persist

Scalability issues remain a critical hurdle. Ethereum, the most widely used Web3 platform, continues to face slow transaction speeds and prohibitively high gas fees during peak demand, sometimes exceeding $20 per transaction. This inefficiency limits the average person's ability to engage seamlessly with decentralized applications.

Current blockchain networks typically process fewer than 100 transactions per second, a stark contrast to legacy systems like Visa, which handle tens of thousands. Although layer-2 solutions such as Arbitrum and zk-Rollups are addressing these scalability issues, broad adoption and full integration are still works in progress.

User Experience Barriers

The complexity of Web3 applications poses a significant barrier to mass adoption. Managing wallets, private keys, gas fees, and bridging assets between chains can be intimidating even for tech-savvy users. For Web3 to become mainstream, platforms must prioritize intuitive interfaces and seamless user experiences, a challenge that the ecosystem continues to grapple with.

Regulatory Uncertainty

Governments worldwide are still defining regulatory frameworks for decentralized technologies. The fragmented and evolving legal landscape creates uncertainty for innovators and investors alike. Without clear guidelines, companies may hesitate to launch new services, and users may remain wary of engaging with decentralized platforms.

Environmental and Ethical Concerns

Blockchain technologies, especially those relying on proof-of-work consensus, have drawn criticism for their substantial energy consumption. This environmental impact conflicts with global sustainability goals, prompting debates about the ecological viability of a blockchain-based internet. Transitioning to more energy-efficient consensus mechanisms remains a priority for the community.

Token Metrics: Navigating Web3's Reality with Data-Driven Insights

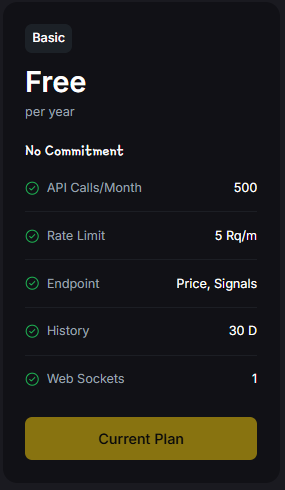

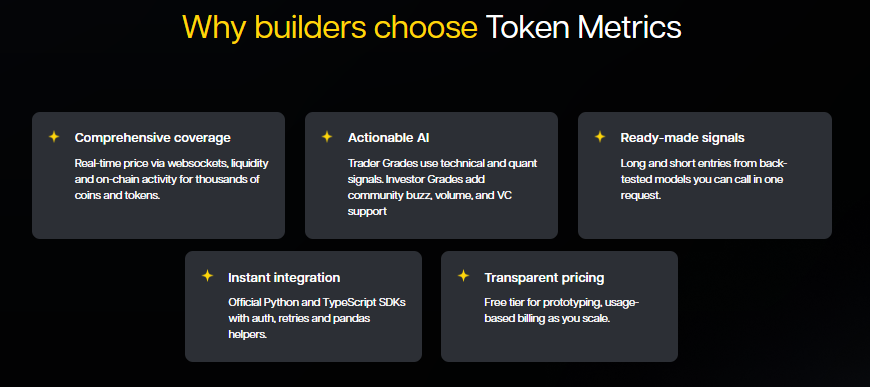

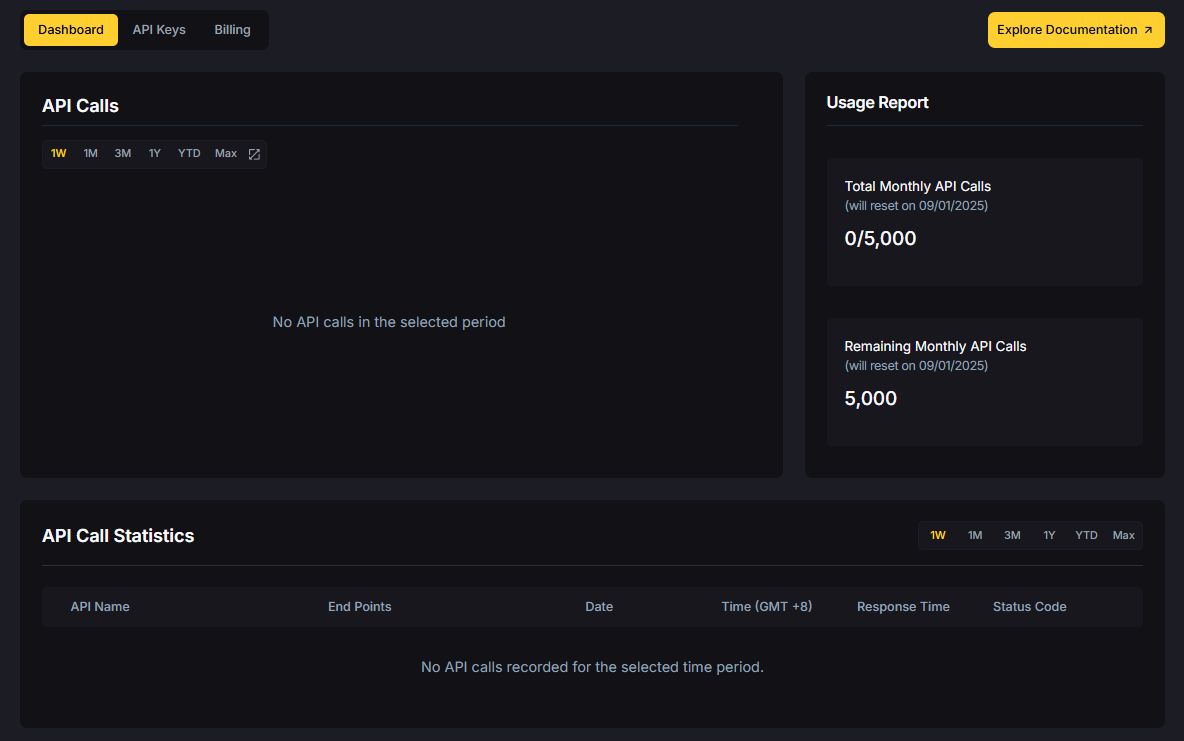

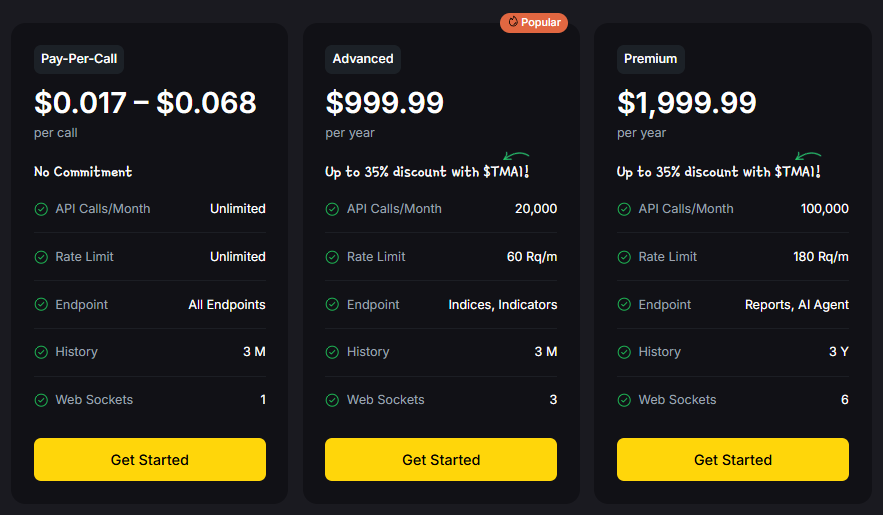

In this complex and rapidly evolving landscape, distinguishing genuine innovation from hype is crucial. Token Metrics offers a powerful AI-driven platform that analyzes over 6,000 crypto tokens daily, providing comprehensive market intelligence to evaluate which Web3 projects deliver real value.

Unlike traditional online platforms dominated by a small group of companies, Token Metrics empowers users with decentralized insights, reducing reliance on centralized authorities and supporting a more user-driven ecosystem.

By leveraging technical analysis, on-chain data, fundamental metrics, sentiment analysis, and social data, Token Metrics helps users identify projects with sustainable tokenomics and governance structures. Its dual scoring system—Trader Grade for short-term potential and Investor Grade for long-term viability—enables investors, developers, and business leaders to make informed decisions grounded in data rather than speculation.

Token Metrics tracks the maturity of various Web3 sectors, from DeFi protocols to enterprise blockchain solutions, helping users separate signal from noise in an ecosystem often clouded by hype and false narratives.

The Verdict: Web3 in 2025 – Evolution, Not Revolution

In 2025, the question “Is Web3 just a buzzword or is it real?” defies a simple yes-or-no answer. Web3 is neither a complete failure nor a fully realized vision; it is an evolving ecosystem showing clear progress alongside persistent challenges.

Web3 has been touted as the solution to all the things people dislike about the current internet, but the reality is more nuanced.

What's Definitively Real

- Financial Infrastructure: DeFi protocols handle billions in total value locked, with millions of users conducting real financial transactions daily.

- Asset Tokenization: Diverse real-world assets are successfully digitized, creating new markets and enhancing liquidity.

- Enterprise Adoption: Companies across sectors are leveraging blockchain for practical, transparent, and secure applications.

- Digital Ownership: NFTs and tokenization have introduced new models for ownership and monetization of digital content.

What Remains Challenging

- Mass Adoption: Complex user experiences continue to impede mainstream engagement.

- Scalability: Technical limitations prevent Web3 from matching the performance of established internet services.

- Regulatory Framework: Unclear and evolving regulations create uncertainty.

- Sustainability: Environmental concerns about energy consumption persist.

The Path Forward: Pragmatic Decentralization

Web3 is not dead; it is maturing and shedding its earlier excesses of hype and get-rich-quick schemes. The vision of a fully decentralized internet remains a north star, but the community increasingly embraces pragmatic approaches.

Communities play a crucial role in Web3 by driving decentralized governance, fostering innovation, and enabling user participation through collective decision-making and user-created groups.

Rather than demanding all-or-nothing decentralization, most successful projects pursue “progressive decentralization,” balancing user control with practical considerations. This approach acknowledges that decentralization is a feature to be integrated thoughtfully—not an ideological mandate.

Key Trends Shaping Web3's Future

- AI Integration: The convergence of artificial intelligence and blockchain is powering smarter, more efficient decentralized applications.

- As these technologies evolve, the future may see a fully decentralized version of the internet, where blockchain networks enable user ownership, transparency, and the removal of centralized authorities.

- Improved User Experience: New tools and mobile apps are making Web3 accessible to a broader audience.

- Regulatory Clarity: Governments are moving toward clearer frameworks that support innovation while ensuring compliance.

- Infrastructure Maturation: Layer-2 solutions and advanced blockchain architectures are steadily resolving scalability issues.

Conclusion: Beyond the Binary Debate

The debate over whether Web3 is real or just a buzzword presents a false dichotomy. In 2025, Web3 is both a real technological shift with tangible applications and an ecosystem still grappling with hype and speculation. James Grimmelmann, a Cornell University law and technology professor, has expressed skepticism about Web3's decentralization claims, highlighting ongoing concerns about centralization and data privacy.

We are witnessing Web3’s transition from a speculative fairy story to a building phase, where decentralized social networks, token-based economics, and user-generated content platforms are already reshaping digital interactions. The key lies in focusing on the fundamental value these technologies bring—digital ownership, security, and user empowerment—rather than being distracted by marketing buzzwords. The public's negative associations with Web3, including concerns about scams, gambling, and marketing gimmicks, continue to fuel skepticism and distrust regarding its true value and decentralization.

For businesses, developers, and individuals navigating this landscape, platforms like Token Metrics offer essential tools to separate genuine innovation from hype. The future of the internet will not be determined by maximalist visions or outright dismissal but by practical implementations that solve real problems.

The builders focused on identity, ownership, censorship resistance, and coordination are laying the foundation for a decentralized internet that benefits users collectively. Just as the internet evolved through cycles of boom and bust, so too will Web3. The critical question is not whether Web3 is real or hype, but how swiftly we can move beyond speculation toward sustainable value creation.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)