Litecoin (LTC) Price Prediction 2025, 2030 - Forecast Analysis

Click here to buy Cryptocurrencies from Gate.io

The cryptocurrency market has been experiencing significant expansion with the introduction of numerous high-potential cryptocurrencies.

Among these digital assets, Litecoin has emerged as one of the few with demonstrated significant potential in recent years. In this comprehensive article, we will delve into the world of Litecoin (LTC) and analyze its price prediction for the coming years.

With a focus on both short and long-term forecasts, we will explore various market scenarios and expert opinions to provide you with a holistic view of the future of LTC.

Litecoin Overview

Litecoin, often referred to as the "silver to Bitcoin's gold," is a well-established cryptocurrency that has been active for over nine years. With a solid technical foundation, Litecoin has managed to secure its position as one of the top 30 cryptocurrencies by market cap.

Despite recent discussions around its declining popularity, Litecoin continues demonstrating resilience and potential for future growth.

Historical Performance of Litecoin

To understand the potential future performance of Litecoin, it is essential to examine its historical price movements. Over the course of the past year, Litecoin experienced a predominantly bullish market sentiment, with buyers dominating the scene.

However, towards the end of the period, sellers started to exert more influence, leading to a decline in price.

Starting from a modest base of $51.32, Litecoin steadily climbed to its peak at $100.96 by January. This resistance level was rigorously tested until July, with occasional breaches that couldn't be sustained.

As July progressed, a decline began, reflecting increased selling pressure. Despite these fluctuations, Litecoin managed to maintain support levels, albeit with some retracements along the way.

Litecoin Current Fundamentals

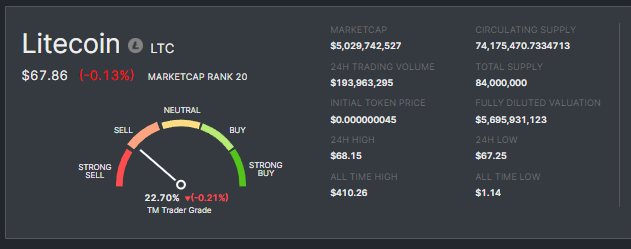

Before diving into the price predictions, let's examine the current fundamentals of Litecoin. Currently, Litecoin's price is around $67.86 and has a market capitalization of $5,029,742,527.

The 24-hour price change is -0.13%, indicating a slight decline. The Fear & Greed Index suggests a moderate level of market sentiment.

Litecoin (LTC) Price Prediction - Scenario Analysis

To forecast Litecoin's future price, it is crucial to consider multiple scenarios based on different market conditions and expert opinions. Let's explore some potential price predictions for Litecoin.

Litecoin (LTC) Price Prediction - Bullish Market Scenario

In a bullish market scenario where positive market sentiment prevails, Litecoin's price has the potential to experience significant growth. Several factors could contribute to this bullish trend, including increased adoption, technological advancements, and positive regulatory developments.

If the crypto market cap hits $3 Trillion and Litecoin retains its current 0.29% dominance, its price could ascend to $118.06.

In a more bullish scenario of the crypto market surging to $10 Trillion, Litecoin's price could soar to a staggering $393.56, resulting in a potential 7x return for investors.

It is important to note that these predictions are based on various factors and assumptions, and market conditions can change rapidly. However, bullish market sentiment and increased adoption of Litecoin's solutions could drive its price to new heights.

Litecoin (LTC) Price Prediction - Bearish Market Scenario

In the event of a bearish market, Litecoin's price could experience a correction, potentially leading to a decrease in its value. In this case, the price of Litecoin may face downward pressure with a decreased dominance of 0.14%.

In this scenario, If the crypto market cap hits $3 Trillion, Litecoin could trade around $59.03 in the short term and struggle to surpass $196.78 by 2030 even if the total crypto market cap surpasses the $10 Trillion mark.

It is crucial to consider the potential risks and challenges that Litecoin may face. Factors such as regulatory developments, competition from other projects, and technological advancements can affect the growth trajectory of Litecoin.

Also Read - Next Crypto Bull Run

Click here to buy Cryptocurrencies from Gate.io

Litecoin Price Prediction - Industry Expert Opinion

To provide a more comprehensive view, let's explore the opinions of industry experts regarding the future of Litecoin.

According to various experts in the cryptocurrency field, Litecoin holds promise as a long-term investment. Its solid technical foundation, active development community, and widespread adoption contribute to its potential for growth.

Some experts believe that the reduced supply of new Litecoin entering the market due to the halving event could create upward pressure on prices in the long run.

The Coincodex platform predicts Litecoin could reach $139.89 to $483.89 by 2030, and experts from Changelly forecast that it could reach minimum and maximum prices of $142.22 and $178.31 by the end of 2025. By the end of 2030, the price of Litecoin could reach $880.42 to $1,041.87.

Other industry analysts have varying opinions on the future price of Litecoin. Ambcrypto.com predicts that Litecoin could reach $164.82 to $247.22 by 2030.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Litecoin's Current Developments and Future Potential

Litecoin continues to evolve and adapt to the changing landscape of the cryptocurrency market. The Litecoin Foundation, along with its dedicated development community, is actively working on various initiatives to enhance the usability and scalability of the network.

Recent developments include the implementation of privacy features, integration with existing payment systems, and exploring partnerships with major players in the industry.

Looking ahead, Litecoin has the potential to carve out a distinct niche in the cryptocurrency market. Its fast transaction times, lower fees, and strong community support make it an attractive option for both users and investors.

However, market conditions and competition from other cryptocurrencies should be closely monitored to assess Litecoin's future potential.

Also Read - Ripple (XRP) Price Prediction

Conclusion

In conclusion, the future of Litecoin holds both opportunities and challenges. Based on historical performance and expert opinions, Litecoin has the potential to experience significant growth in the coming years.

However, it is important to approach cryptocurrency investments with caution and conduct thorough research before making any decisions.

The cryptocurrency market is highly volatile, and factors such as market sentiment, regulatory changes, and technological advancements can influence the price of Litecoin and other cryptocurrencies. Investors can make more informed decisions regarding their investment strategies by staying informed and seeking professional advice.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

Click here to buy Cryptocurrencies from Gate.io

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)