Market Cap Weighting vs Equal Weight: Why Top 100 Indices Outperform in Volatile Markets

Crypto markets are famous for their rapid swings and unpredictable conditions, making how you construct a portfolio especially critical. The debate between market cap weighting and equal weighting in constructing crypto indices has grown louder as the number of digital assets surges and volatility intensifies. Understanding these methodologies isn’t just academic—it fundamentally affects how portfolios respond during major upswings and downturns, and reveals why broad Top 100 indices consistently deliver different results than more concentrated or equally weighted approaches.

Introduction to Index Weighting

Index weighting determines how an index or portfolio reflects the value and performance of its constituents. Market cap weighting assigns higher weights to larger assets, closely mirroring the aggregate value distribution in the market—so leading tokens like Bitcoin and Ethereum impact the index more significantly. In contrast, equal weighting grants every asset the same allocation, regardless of size, offering a more democratized but risk-altered exposure. Recognizing these differences is fundamental to how risk, diversification, and upside potential manifest within an index, and to how investors participate in the growth trajectory of both established and up-and-coming crypto projects.

Market Cap Weighting Explained: Following Market Consensus

Market cap weighting is a methodology that allocates index proportions according to each asset’s market capitalization—bigger assets, by value, represent a greater portion in the index. For instance, in a Top 100 market cap-weighted index, Bitcoin could make up more than half the portfolio, followed by Ethereum, while the remaining tokens are weighted in line with their market caps.

This approach naturally adjusts as prices and sentiment shift: assets rising in value get larger weights, while those declining are reduced automatically. It removes subjective bias and reflects market consensus, because capitalization is a product of price and token supply, responding directly to market dynamics.

Token Metrics’ TM Global 100 Index is a strong example of advanced market cap weighting tailored to crypto. This index goes beyond mere size by filtering for quality through AI-derived grades—evaluating momentum and long-term fundamentals from over 80 data points. Each week, the index rebalances: new leaders enter, underperformers exit, and proportions adapt, ensuring continuous adaptation to the current market structure. The result is a strategy that, like broad-based indices in traditional equities, balances widespread exposure and efficient updates as the crypto landscape evolves.

Equal Weighting Explained: Democratic Allocation

Equal weighting gives the same allocation to each index constituent, regardless of its market cap. Thus, in an equal-weighted Top 100 index, a newly launched token and a multi-billion-dollar asset both make up 1% of the portfolio. The intention is to provide all assets an equal shot at impacting returns, potentially surfacing emerging opportunities that traditional weighting may overlook.

This approach appeals to those seeking diversification unconstrained by market size and is featured in products like the S&P Cryptocurrency Top 10 Equal Weight Index. In traditional finance and crypto alike, equal weighting offers a different pattern of returns and risk, putting more emphasis on smaller and emerging assets and deviating from market cap heavy concentration.

The Volatility Performance Gap: Why Market Cap Wins

Empirical research and live market experience reveal that during high volatility, Top 100 market cap-weighted indices tend to outperform equal-weighted alternatives. Key reasons include:

- Automatic Risk Adjustment: As prices fall, particularly for small caps, their market cap—and thus their weight—shrinks. The index reduces exposure naturally, mitigating the impact of the worst performers. Equal weighting, conversely, maintains exposure through rebalancing, meaning losses from declining assets can be compounded.

- Liquidity Focus: In turbulent periods, trading activity and liquidity typically concentrate in larger assets. Market cap indices concentrate exposure where liquidity is highest, avoiding excessive trading costs. Equal-weighted strategies must buy and sell in less liquid assets, exposing portfolios to higher slippage and trading costs.

- Volatility Drag: Equal weighting can lock portfolios into frequent reallocations and face "volatility drag," where assets with wild swings undermine cumulative returns. Market cap approaches allow losers and winners to move more organically, reducing forced transactions.

- Correlation Surge: As overall market stress increases, assets move more in sync, reducing the theoretical diversification benefit of equal weighting. Analytical data—including insights from Token Metrics—shows that correlation spikes increase downside risk in equal-weighted portfolios that hold more high-volatility assets.

The Top 100 Advantage: Breadth Without Excessive Complexity

Why use 100 constituents? The Top 100 format achieves a practical balance between breadth and manageability. It captures a full cross-section of the crypto universe, allowing exposure to leading narratives and innovations, from AI tokens to Real-World Assets (RWAs), as demonstrated repeatedly throughout recent crypto cycles.

Research from Token Metrics highlights that Top 100 indices regularly outperform more concentrated Top 10 indices, thanks in large part to diversified participation in mid-caps following current narratives. The structure enables timely adaptation as capital and attention shift, while the weekly rebalance limits excessive trading.

Operationally, equal weighting becomes logistically complex with 100 assets—it demands near-constant buying and selling as each asset’s price changes. Market cap weighting, meanwhile, achieves most rebalancing automatically via price movement, minimizing execution costs and slippage risk.

Active Factor Risk Consideration

Active factor risk describes how certain characteristics—such as size, sector, or style—can disproportionately impact portfolio returns. Market cap weighting naturally leans toward large caps and leading sectors, making portfolios sensitive to concentration in just a few dominant names. Equal weighting dilutes this, granting more space to smaller, sometimes riskier assets, and can help offset sector concentration. Understanding these dynamics helps portfolio builders balance the trade-offs between diversification, risk, and performance objectives, and highlights the importance of methodological transparency in index design.

When Equal Weighting Makes Sense: The Exception Cases

While market cap weighting often excels in volatile conditions, equal weighting can be appropriate in specific situations:

- Small, Stable Universes: Indexes tracking just a couple of mega-cap assets (e.g., Bitcoin and Ethereum) can use equal weighting to avoid over-concentration without rebalancing becoming unwieldy.

- Conviction in Mid-Caps: If analysts strongly believe that mid-cap assets are poised to outperform, equal weighting can intentionally overweight them compared to a cap-weighted approach, though this is an active rather than passive bet.

- Bull Market Rallies: In sustained, high-correlation upswings, equal weighting may capture upside from small and mid-caps that experience outsized gains. However, these periods are less common in crypto’s turbulent history.

It is crucial to recognize that equal weighting is not fundamentally lower in risk—it simply shifts risk to different parts of the token universe.

Token Metrics’ Intelligent Implementation

Token Metrics integrates multiple layers of process innovation into the market cap weighted paradigm:

- AI-Powered Filtering: Projects receive scores for both short-term momentum and long-term fundamentals, excluding assets with artificially inflated caps or dubious quality.

- Regime Switching: Proprietary indicators identify macro bull or bear phases, adapting the index’s allocation towards risk-off assets when appropriate.

- Optimized Rebalancing: Weekly updates balance responsiveness and cost efficiency, unlike daily or bi-weekly schemes that may increase trading expenses.

- Transparency: Users can view holdings, rebalancing logs (including associated fees), and methodology, supporting operational clarity and trust.

The Mathematical Reality: Expected Value in Volatile Markets

Market cap weighting’s core advantage is its mathematical fit for volatile markets:

- Compounding Winners: Assets on a growth trajectory automatically gain additional index weight, reinforcing positive momentum and compounding returns.

- Reducing Losers: Projects declining in value are swiftly de-prioritized, reducing their drag on the overall portfolio and sidestepping repeated reinvestment in underperformers.

- Lower Transaction Costs: Because market cap indices require fewer forced trades, especially amid volatility, the cost of index maintenance is consistently reduced compared to equal-weighted alternatives.

Practical Implications for Investors

For those seeking systematic exposure to the digital asset market—regardless of whether they adopt an active or passive approach—the data leans toward broad, market cap-weighted Top 100 methodologies. These strategies enable:

- Risk-Adjusted Performance: Improved Sharpe ratios, as exposure aligns with the risk-reward profiles present in the market ecosystem.

- Operational Simplicity: Fewer required adjustments, manageable trade sizes, and streamlined operational execution.

- Behavioral Discipline: Avoiding emotional rebalancing or systematic reinvestment in declining assets.

- Scalability: The model accommodates growth in assets under management without running into liquidity barriers posed by small-cap constituents.

The TM Global 100 Index by Token Metrics embodies these features—melding market cap logic with quality assessment, modern rebalancing, regime-aware management, and transparency for users of all expertise levels. Parallels with traditional equity indexing further validate these approaches as effective in a range of asset classes.

Conclusion: Methodology Matches Market Reality

The consistent outperformance of market cap-weighted Top 100 indices is the result of a methodology attuned to crypto’s structural realities. By tracking consensus, managing drawdowns, enabling liquidity, and reducing unnecessary trading, market cap weighting provides a systematic defense against the chaos of volatile markets.

Contemporary implementations, such as those from Token Metrics, optimize these benefits through AI-backed analytics, smart rebalancing, and rigorous quality metrics—delivering robust and scalable exposure for institutional and retail users alike. In crypto, where sharp volatility and fast-evolving narratives are the norm, index construction methodology truly determines which approaches endure through all market cycles.

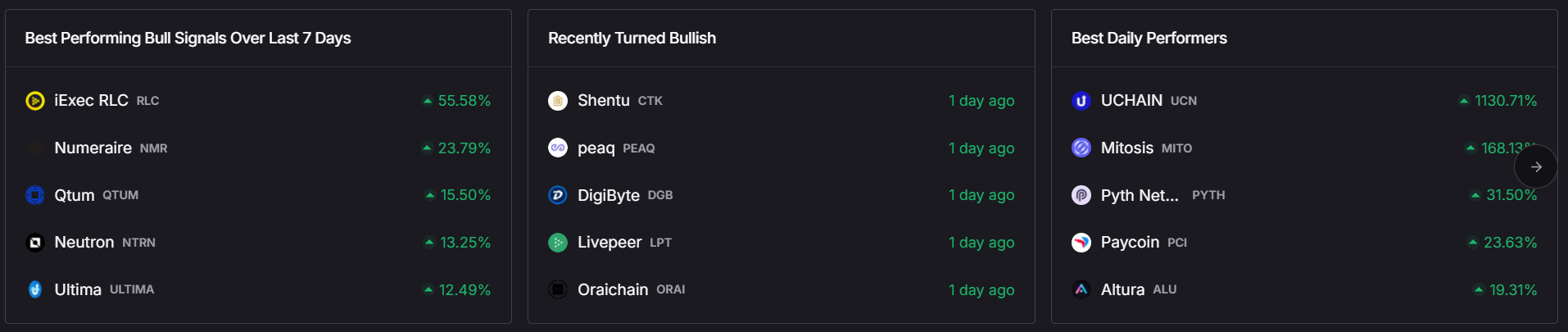

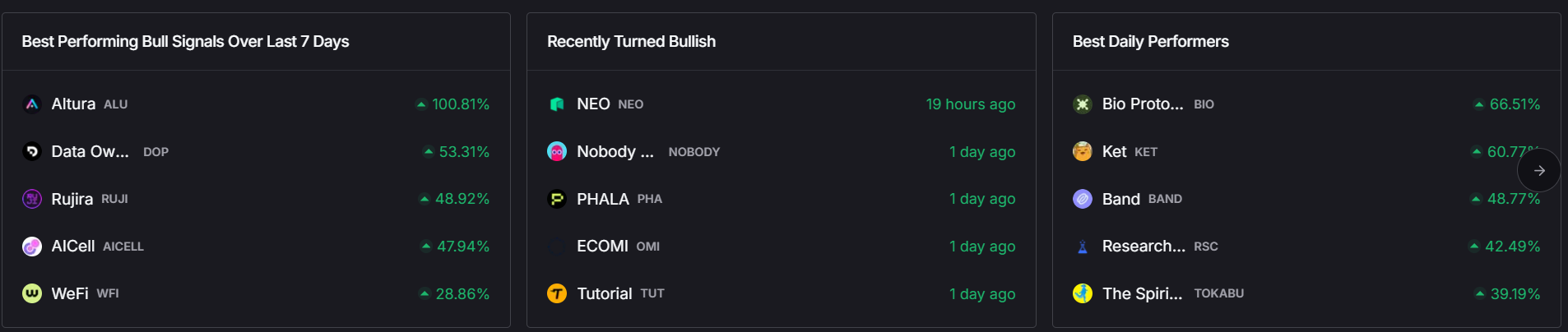

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

FAQ: What is market cap weighting in crypto indices?

Market cap weighting means each constituent’s index representation is proportional to its market value. In practice, this gives larger, more established crypto assets greater influence over index returns. This approach tracks aggregate market sentiment and adjusts automatically as prices move.

FAQ: How does equal weighting differ from market cap weighting?

Equal weighting assigns each asset the same index share, no matter its relative size. While this offers exposure to smaller projects, it increases both diversification and the risk associated with less-established, and often more volatile, tokens. Unlike market cap weighting, it does not adjust based on market value dynamics.

FAQ: Why do market cap-weighted Top 100 indices outperform in volatile markets?

In volatile conditions, market cap weighting reduces portfolio exposure to sharply declining, illiquid, or high-risk tokens, while equal weighting requires ongoing investments in assets regardless of their decline. This difference in automatic risk reduction, transaction costs, and compounding effect yields stronger downside protection and risk-adjusted results.

FAQ: Does equal weighting ever outperform market cap weighting?

Equal weighting can outperform during certain sustained bull markets or in small, stable universes where concentrated risk is a concern. However, over longer periods and during volatility spikes, its frequent rebalancing and mid-cap emphasis usually result in higher risk and potentially lower net returns.

FAQ: How does Token Metrics enhance crypto index construction?

Token Metrics blends market cap weighting with AI-based quality filtering, adaptive rebalancing based on market regimes, and full transparency on holdings and methodology. This modern approach aims to maximize exposure to high-potential tokens while managing drawdown and operational risks.

Disclaimer

This article is for informational and educational purposes only and does not constitute investment, financial, or trading advice. Cryptocurrency markets are highly volatile and subject to rapid change. Readers should conduct their own research and consult professional advisors before making any investment decisions. Neither the author nor Token Metrics guarantees the accuracy, completeness, or reliability of the information provided herein.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)