Measuring Success in Web3 Projects: Key Metrics and Approaches

Introduction

The emergence of Web3 technologies has transformed the digital landscape, introducing decentralized applications, blockchain-based protocols, and novel governance models. For participants and observers alike, understanding how to measure success in Web3 projects remains a complex yet critical challenge. Unlike traditional businesses, where financial indicators are predominant, Web3 ventures often require multifaceted assessment frameworks that capture technological innovation, community engagement, and decentralization.

This article delves into the defining success factors for Web3 projects, offering a structured exploration of the key performance metrics, analytical frameworks, and tools available, including AI-driven research platforms such as Token Metrics. Our goal is to provide a clear, educational perspective on how participants and researchers can evaluate Web3 initiatives rigorously and holistically.

Understanding Success in Web3 Projects

Success within Web3 projects is inherently multidimensional. While financial performance and market capitalization remain important, other dimensions include:

- Decentralization and Governance: The extent to which control is distributed among users rather than centralized parties.

- Network Activity: Measures such as transaction volume, active addresses, and developer contributions.

- Community Engagement: Size and activity level of the community across social platforms, forums, and governance participation.

- Technological Innovation: Novelty and robustness of the underlying protocols and smart contracts.

- Utility and Use Cases: Real-world application and adoption of the project’s technology.

These factors may vary in relevance depending on the project type—be it DeFi protocols, NFTs, layer-one blockchains, or decentralized autonomous organizations (DAOs). Thus, establishing clear, context-specific benchmarks is essential for effective evaluation.

Key Metrics to Evaluate Web3 Projects

Below are critical performance indicators broadly used to gauge Web3 success. These metrics provide quantifiable insights into various aspects of project health and growth.

- On-Chain Metrics: Include transaction count, gas fees generated, token holder distribution, and smart contract activity. High transaction volumes paired with diverse token ownership can indicate vibrant usage and decentralization.

- Community Metrics: Encompass active user counts on social media and chat platforms, participation in governance votes, and growth of community-driven initiatives. These reflect user engagement and alignment with project goals.

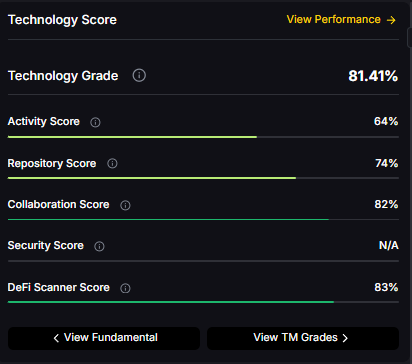

- Development Activity: Number of code commits, GitHub repository updates, and developer participation. Sustained and transparent development activity signals ongoing innovation and resilience.

- Adoption & Utility: Number of integrations, partnerships, or use cases implemented. Practical use drives value beyond speculative interest.

- Security and Audits: Presence of third-party security audits, bug bounty programs, and historical vulnerabilities. Security impacts trust and long-term viability.

Frameworks for Analyzing Success

Systematic evaluation benefits from established frameworks:

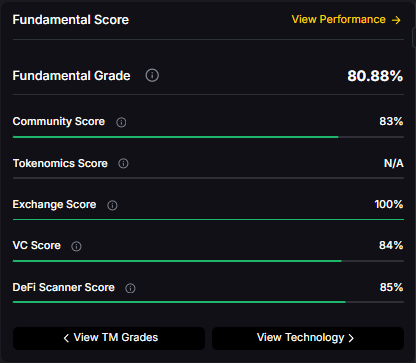

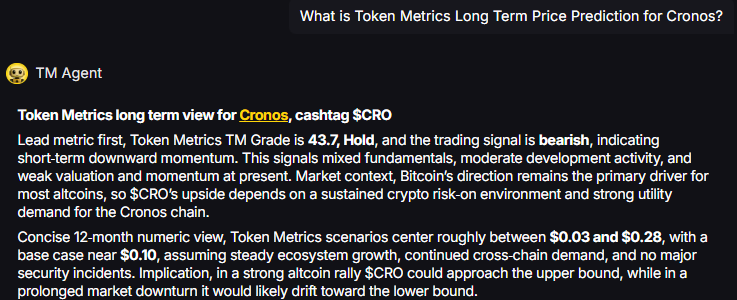

- Fundamental Analysis: This involves assessing the core technology, team background, tokenomics, and governance structure. Understanding the problem a project aims to solve and its approach builds a base for contextual success measurement.

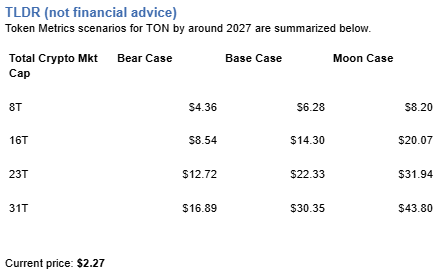

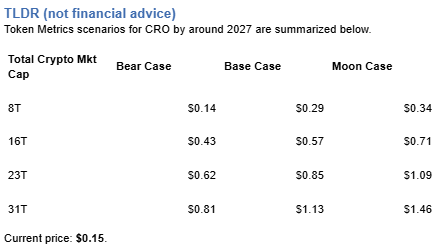

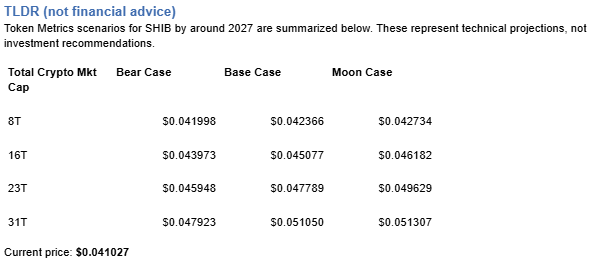

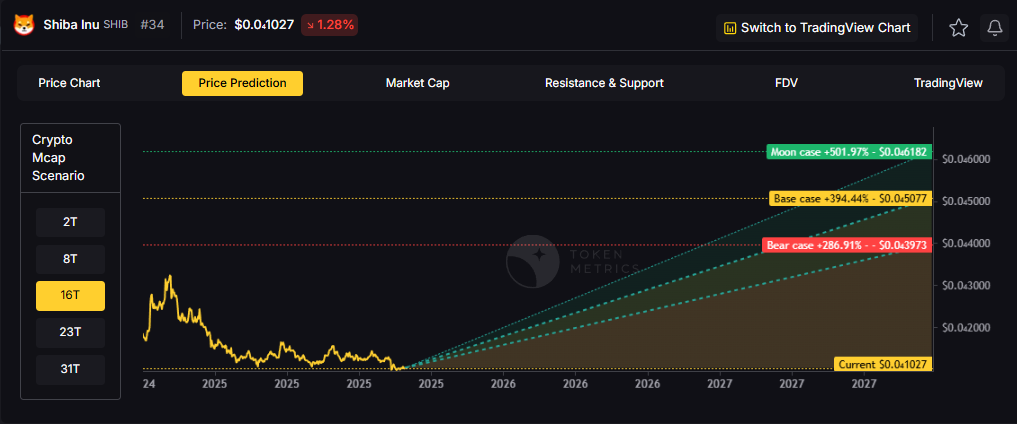

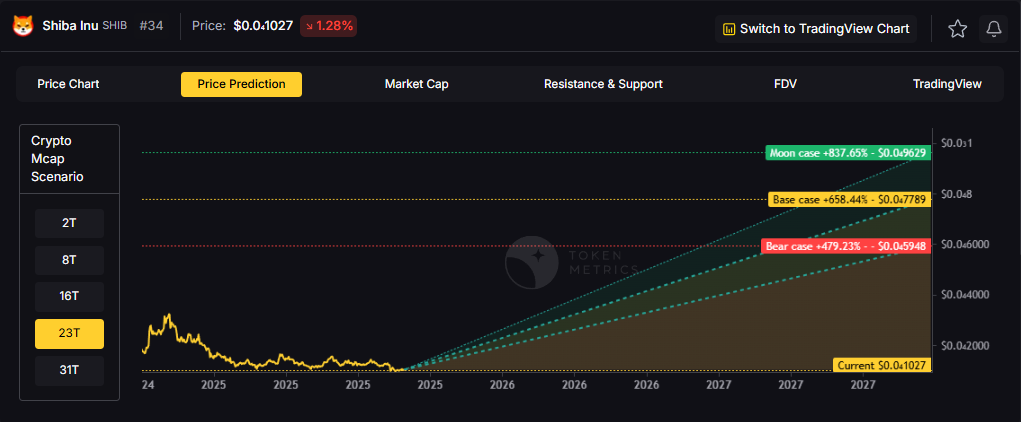

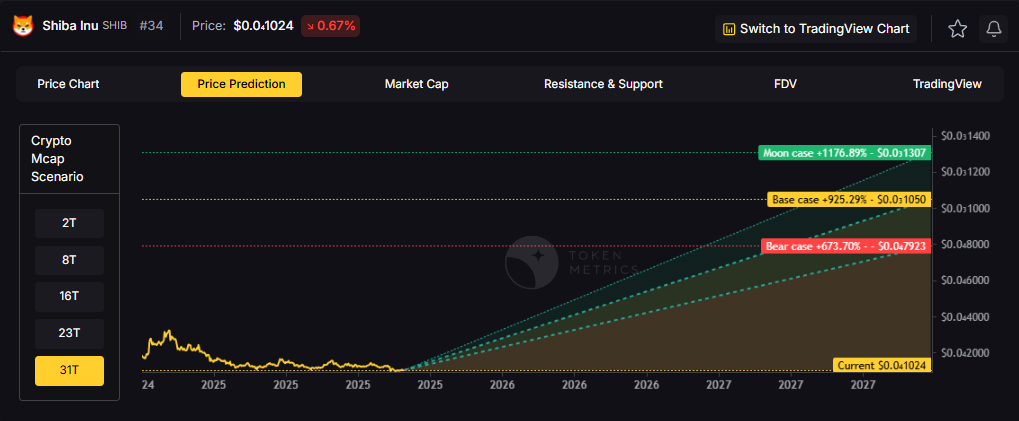

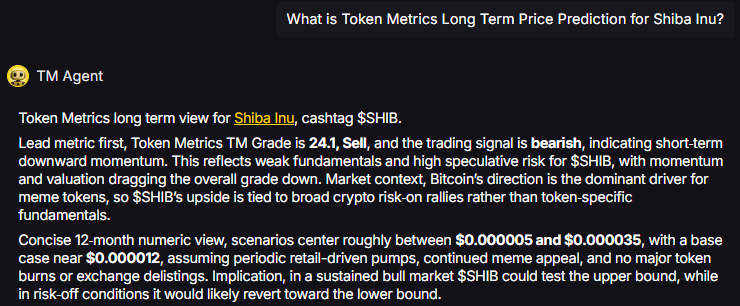

- Scenario Analysis: Envisioning multiple future states of the project considering technological advances, market adoption, and regulatory environment helps anticipate resilience and growth potential.

- Comparative Benchmarking: Positioning a project relative to its peers using standardized KPIs facilitates identifying strengths and weaknesses within the ecosystem.

Combining these frameworks with data-driven metrics allows for comprehensive, nuanced insights into project status and trajectories.

Leveraging AI and Tools for Analysis

Artificial intelligence and machine learning increasingly support the evaluation of Web3 projects by processing vast datasets and uncovering patterns not readily apparent to human analysts. Token Metrics exemplifies this approach by offering AI-driven ratings, risk assessments, and project deep-dives that integrate quantitative data with qualitative signals.

These platforms aid in parsing complex variables such as token velocity, developer momentum, and community sentiment, providing actionable intelligence without subjective bias. Importantly, using such analytical tools facilitates continuous monitoring and reassessment as Web3 landscapes evolve.

Practical Steps for Researching Web3 Projects

For individuals or organizations assessing the success potential of Web3 projects, these steps are recommended:

- Collect and Analyze On-Chain Data: Use blockchain explorers and analytics services to gather foundational metrics such as transaction counts, active users, and token distribution patterns.

- Monitor Community Channels: Engage with forums, social media, and governance discussions to gauge community health and responsiveness.

- Review Development Progress: Track open-source repositories and project updates to assess ongoing activity and innovation.

- Evaluate Security Posture: Confirm the presence of audits and security protocols to evaluate risk mitigation.

- Utilize Advanced Analytical Platforms: Incorporate AI-driven services like Token Metrics to integrate diverse indicators and generate comprehensive project ratings.

Limitations and Considerations

While metrics and frameworks aid evaluation, it is essential to recognize the dynamic nature of Web3 projects and the ecosystem's inherent uncertainties. Metrics may fluctuate due to speculative behavior, regulatory shifts, or technological disruptions. Moreover, quantifiable indicators only capture parts of the overall picture, and qualitative factors such as community values and developer expertise also matter.

Therefore, success measurement in Web3 should be viewed as an ongoing process, employing diverse data points and contextual understanding rather than static criteria.

Conclusion

Measuring success in Web3 projects requires a multidimensional approach combining on-chain metrics, community engagement, development activity, and security considerations. Frameworks such as fundamental and scenario analysis facilitate structured evaluation, while AI-powered platforms like Token Metrics provide advanced tools to support data-driven insights.

By applying these methods with a critical and educational mindset, stakeholders can better understand project health and longevity without relying on speculative or financial advice.

Disclaimer

This article is for educational and informational purposes only. It does not constitute financial, investment, or legal advice. Readers should conduct their own research and consult professionals before making decisions related to Web3 projects.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)