Pepe Coin Price Prediction 2025, 2030 - Forecast Analysis

In the ever-evolving world of cryptocurrencies, meme coins have gained significant attention. One such meme coin that has caught the interest of investors and enthusiasts is Pepe Coin.

With its unique branding and community-driven approach, Pepe Coin has created a buzz in the market. In this article, we will delve into the future prospects of Pepe Coin, providing a comprehensive price prediction analysis for 2025 and 2030.

Pepe Coin Overview

Before diving into the price prediction, let's take a closer look at Pepe Coin's fundamentals and historical performance.

Pepe Coin, an ERC-20 token built on the Ethereum blockchain, aims to reimagine the character's positive image and provide a platform for its dedicated community.

As of today 12th March 2024, The coin has a current price of $0.00000831 and a market cap of $3.49B. With a circulating supply of 420,690,000,000,000 PEPE, Pepe Coin has experienced significant volatility in the market.

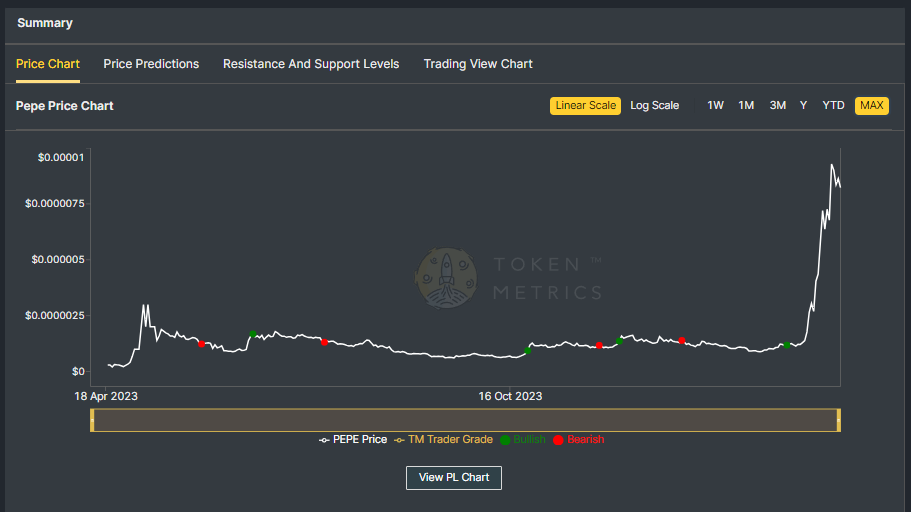

Historical Performance of Pepe Coin

Pepe Coin's historical performance provides insights into its price movements and market trends. The coin reached its all-time high of $0.00000852 but has since experienced a significant decline, currently trading at a highly discounted price from its peak.

The recent bearish pattern in the 4H chart and weakness in the daily trend indicate a challenging period for Pepe Coin. Also, it's important to note that the meme coin sector has witnessed pullbacks and corrections, making it crucial to analyze the broader market sentiment.

Pepe Coin Current Fundamentals

To evaluate the potential future performance of Pepe Coin, it's essential to consider its current fundamentals. The recent alteration in the multi-sig wallet's configuration, reducing the required signatures for fund transfers, has raised concerns among the crypto community.

Large token transfers to various exchanges, such as OKX, Binance, and Bybit, have triggered discussions regarding the project's transparency and distribution of tokens.

It's worth mentioning that the Pepe developers' wallet retains only 2% of the total supply, with no individual wallet holding more than 0.9% of the supply.

Pepe Coin Price Prediction - Scenario Analysis

To forecast the potential price trajectory of Pepe Coin, we will analyze different scenarios, including a bullish market scenario and a bearish market scenario.

Pepe Coin Price Prediction - Bullish Market Scenario

In a bullish market scenario where positive market sentiment prevails, Pepe Coin's price has the potential to experience significant growth. Several factors could contribute to this bullish trend, including increased adoption, technological advancements, and positive regulatory developments.

If the crypto market cap hits $3 Trillion and Pepe Coin retains its current 0.13% dominance, its price could ascend to $0.00000913.

In a more bullish scenario of the crypto market surging to $10 Trillion, Pepe Coin's price could soar to a staggering $0.0000304, resulting in a potential 7x return for investors.

It is important to note that these predictions are based on various factors and assumptions, and market conditions can change rapidly. However, bullish market sentiment and increased adoption of Pepe Coin's solutions could drive its price to new heights.

Pepe Coin Price Prediction - Bearish Market Scenario

In the event of a bearish market, Pepe Coin's price could experience a correction, potentially leading to a decrease in its value. In this case, the price of Pepe Coin may face downward pressure with a decreased dominance of 0.06%.

In this scenario, If the crypto market cap hits $3 Trillion, Pepe Coin could trade around $0.00000456 in the short term and struggle to surpass $0.0000152 by 2030 even if the total crypto market cap surpasses the $10 Trillion mark.

It is crucial to consider the potential risks and challenges that Pepe Coin may face. Factors such as regulatory developments, competition from other projects, and technological advancements can affect the growth trajectory of Pepe Coin.

Also Read - Next Crypto Bull Run

Pepe Coin Price Prediction - Industry Expert Opinion

To provide a more comprehensive view, let's explore the opinions of industry experts regarding the future of Pepe Coin. While there is no consensus among experts.

The Changelly platform predicts Pepe Coin could reach $0.0000540 to $0.0000630 by 2030, and experts from Coinpedia forecast that it could reach minimum and maximum prices of 0.0000037 and 0.0000073 by the end of 2025. By the end of 2030, the price of Pepe Coin could reach 0.000012 to 0.000015.

Other industry analysts have varying opinions on the future price of Pepe Coin. Ambcrypto.com predicts that Pepe Coin could reach $0.000034 to $0.000041 by 2030.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Pepe Coin's Current Developments and Future Potential

Pepe Coin's future potential lies in its ability to address real-time problems and explore new blockchain integration. The recent developments, such as the alteration in the multi-sig wallet's configuration, indicate a proactive approach from the Pepe Coin team.

Many crypto enthusiasts believe that the project's success will depend on gaining wider adoption and maintaining community engagement.

Also Read - Ripple (XRP) Price Prediction

Conclusion

In conclusion, the future of Pepe Coin remains uncertain, with potential for both growth and challenges. Our price prediction analysis suggests that in a bullish market scenario, the price of Pepe Coin could reach new highs, while in a bearish market scenario, it may face resistance.

It's important for investors and enthusiasts to conduct thorough research and consider the broader market trends before making any investment decisions.

As with any investment, risks are involved, and it's crucial to exercise caution and seek professional advice.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)