Regime Switching Explained: Why Smart Crypto Indices Move to Stablecoins

%201.svg)

%201.svg)

The best trade in crypto isn't always a trade—sometimes it's knowing when to step aside. While traditional indices force you to ride every crash from peak to bottom, regime-switching indices take a smarter approach: participate when conditions warrant, preserve capital when they don't. This systematic method of moving between crypto exposure and stablecoins has become the defining feature of next-generation index products, with Token Metrics leading the implementation through data-driven market signals.

What Is Regime Switching?

Regime switching is a systematic investment approach that classifies market conditions into distinct states—typically "bullish" and "bearish"—then adjusts portfolio positioning accordingly. Unlike static indices that maintain constant exposure regardless of conditions, regime-switching strategies dynamically allocate between risk assets and defensive positions based on quantifiable signals.

In practice for crypto indices:

This isn't emotional market timing or gut-feel trading. It's rules-based risk management following consistent, transparent criteria. The decision to switch regimes comes from systematic signals, not fear or greed.

The Traditional Index Problem

Standard crypto indices like market-cap weighted baskets operate on a simple premise: buy the universe, hold forever, rebalance periodically. This works well in prolonged bull markets but fails catastrophically during extended bear cycles.

Real performance data illustrates the problem:

Net result: Investors who bought January 2021 and held through December 2022 saw minimal net gains despite experiencing a massive bull run. The issue isn't the bull market capture—traditional indices do fine when prices rise. The problem is forced participation during catastrophic drawdowns that destroy years of gains in months. A 75% drawdown requires a 300% gain just to break even.

Research across historical crypto cycles shows that systematic regime-switching approaches have historically reduced maximum drawdowns by 40-60% while capturing 70-85% of bull market upside—a compelling risk-adjusted return profile that buy-and-hold cannot match.

Why Stablecoins, Not Cash?

Regime-switching crypto indices face a unique constraint: they operate on-chain and must maintain 24/7 liquidity for instant redeployment. This makes stablecoins the optimal defensive asset for several critical reasons:

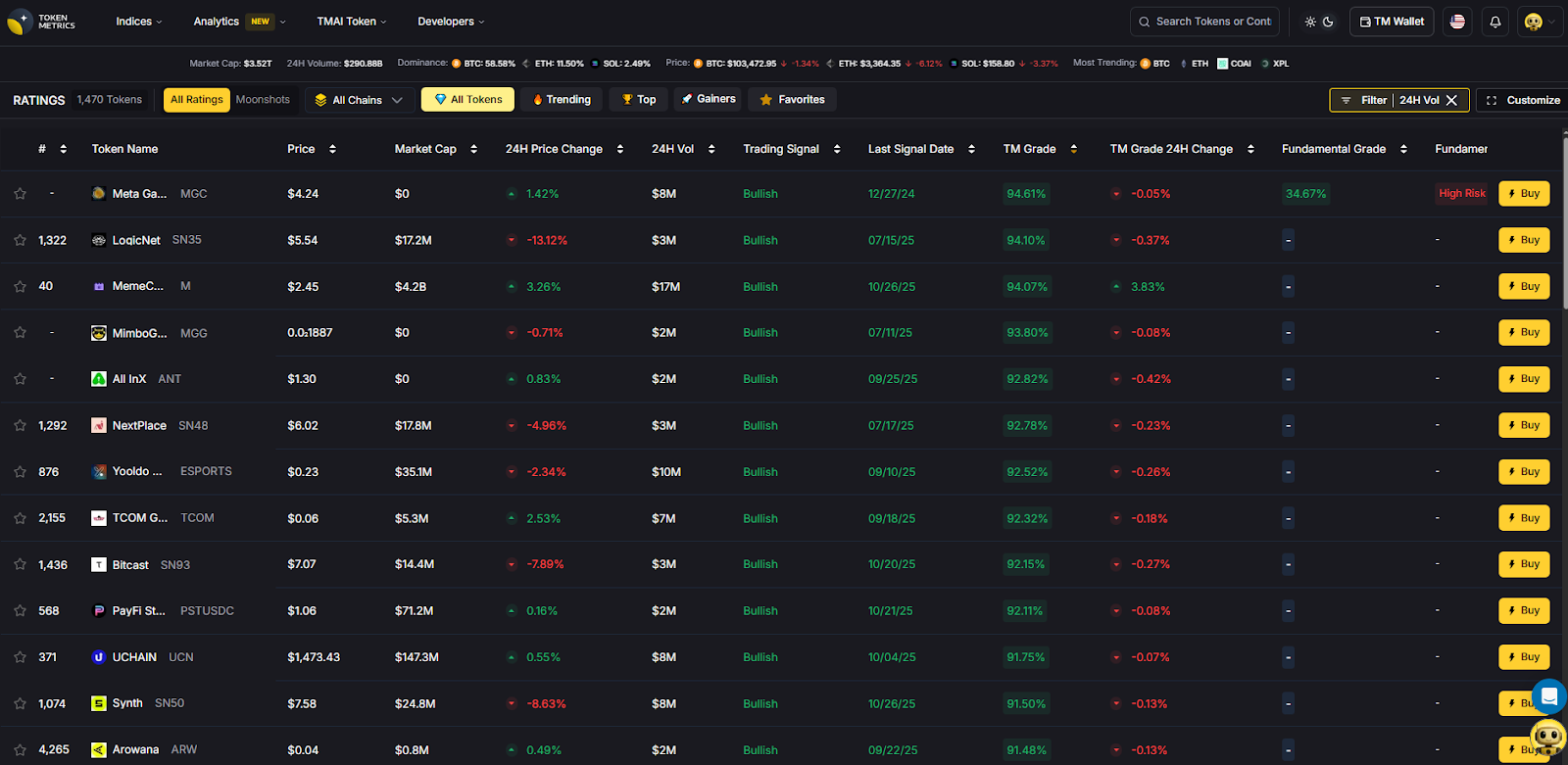

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

The Signal Behind the Switch

The most critical component of regime-switching isn't the mechanism—it's the signal that triggers the switch. Token Metrics has built its reputation as a leading crypto analytics platform by developing sophisticated, data-driven market intelligence relied upon by over 50,000 traders and investors daily.

Token Metrics' Market Regime Detection employs a proprietary multi-factor model analyzing:

This synthesis results in a probabilistic assessment: whether the environment is bullish enough to risk capital or bearish enough to prioritize preservation.

Transparency is maintained by displaying current regime signals in real-time via visual market gauges, while proprietary model parameters and thresholds remain confidential to prevent strategic front-running.

Real Performance: When Regime Switching Matters Most

Regime-switching strategies excel during major bear markets that erode traditional portfolios:

Starting with $100,000 in November 2021, buy-and-hold would result in approximately $89,000 after recovering from -73%. The regime approach, with smaller drawdowns and better upside capture, could have grown the portfolio to around $152,000, emphasizing how avoiding large losses compounds benefits over time.

Implementation: How TM Global 100 Executes Switches

The TM Global 100 index automates regime switching with simplicity and transparency:

User Experience

Behind the Scenes

When signals turn bearish, the index:

Reversal when signals turn bullish follows the same systematic process.

The Cost of Switching

Every regime transition incurs costs:

Token Metrics estimates costs at approximately 0.8-1.5% per full switch, which becomes cost-effective when signals reliably avoid large drawdowns. Frequent whipsaws are mitigated by the model's stability factors, and projected costs are shown upfront for transparency.

Decision Framework: Is Regime Switching Right for You?

Consider regime switching if you:

Alternatively, if you have long-term horizons, believe markets are fully efficient, or prefer a buy-and-hold strategy, it might not suit you. Both approaches have their merits, but regime switching offers a balanced risk-adjusted profile for volatile crypto markets.

Where Research Meets Execution

Token Metrics has established itself as a leading crypto analytics platform by providing:

However, research alone isn't enough. The TM Global 100 index closes the gap between signal generation and automated execution—applying sophisticated regime logic seamlessly, enabling users to act on data-driven insights instantly with transparency and confidence.

Conclusion: Discipline Over Emotion

Regime switching removes emotional decision-making—often the hardest part of crypto investing. It systematically guides investors to participate during bull runs, protect capital during downturns, and avoid knee-jerk reactions to market volatility. This disciplined approach helps to sustain long-term growth while minimizing the pain of large drawdowns, demonstrating the evolution of systematic crypto investment strategies.

Click here to get early access to Token Metrics indices.

AI Agents in Minutes, Not Months

.svg)

Create Your Free Token Metrics Account

.png)

Recent Posts

A New Chapter: Token Metrics Shifts Fully to On-Chain Indices

%201.svg)

%201.svg)

An important update from Ian Balina, Founder and CEO

Today marks a pivotal moment in Token Metrics' journey. After careful consideration of market dynamics and community feedback, we're making a strategic decision that will shape our future: we are sunsetting the Token Metrics Analytics platform and API to focus entirely on building and operating our on-chain indices.

Why We're Making This Change

The crypto landscape has evolved significantly. Research and analytics tools have proliferated, with many platforms offering similar features and dashboards. Meanwhile, the real innovation and differentiation is shifting toward on-chain products that enable investors to own the market itself—simply, transparently, and non-custodially.

Over time, we've noticed a clear trend: the strongest and most consistent interest around Token Metrics has centered on our indices, especially TM100, rather than new features in the Analytics platform or raw data feeds. Our community has shown us where the real value lies.

In response to these market conditions and community sentiment, we've made the decision to narrow our focus dramatically. We're consolidating into a much smaller, highly focused team with a single mission: to do fewer things and do them exceptionally well.

What's Changing and When

Here's the complete timeline for this transition:

Effective Immediately

Analytics and the API enter maintenance/read-only status. Users can still log in to view historical Ratings, but no new features will be released.

November 27, 2025

This is the strict deadline to submit your choice regarding your subscription balance. Please don't delay—requests received after this date may not be processed due to the platform shutdown.

November 28, 2025 (Black Friday)

Subject to final readiness, we plan to begin onboarding select users into the indices (starting with TM100) through a controlled early-access rollout.

November 30, 2025

We will shut down both the Analytics platform and the API endpoints. After this date, all routes will redirect to our indices experience and the Help Center.

Your Compensation Options: Choose What Works Best for You

Because you've supported Token Metrics with your subscription, we want to reward your loyalty with high-value choices. We're offering three options, each designed for different goals:

Option 1: Convert to Indices Credits (3x Value)

Receive 3x the value of your unused subscription as credits toward future indices management fees. This grants you:

- Priority access to TM100

- White-glove onboarding when the exclusive index opens

- The best value for continuing your journey with Token Metrics

This is our recommended option for those who want to stay closest to our future developments and plan to utilize our indices. If you've supported Token Metrics from the very beginning and believe in where we're headed, we strongly encourage this path.

Learn more:

- Indices Demo (40 seconds)

- Indices Deep Dive Webinar (30 minutes)

Option 2: Receive TMAI Airdrop (1.5x Value)

Receive 1.5x the value of your unused subscription in TMAI tokens.

Note: To ensure market stability, these tokens will be subject to a daily vesting schedule over 30 days.

Option 3: Request a Pro-Rata Refund (1:1 Value)

Request a standard 1:1 pro-rated refund of the unused portion of your subscription back to your original payment method.

Note: Please allow up to 60 days for refund processing.

⚠️ Action Required

Select Your Option Here

You must submit this form by November 27, 2025. Requests received after this date may not be processed due to the platform shutdown.

What This Means for Our Community

For Customers and Developers

This pivot is about clarity and focus. Instead of spreading our energy across analytics dashboards and API maintenance, we will deliver one core product: a non-custodial, rules-based index that lets you invest in the crypto market with a single token.

For Investors

This is a strategic re-alignment around the part of the business with the most long-term value. We see greater opportunity in being an index engine and distribution platform than in competing as yet another analytics surface.

For Astrobot Holders

Upon the launch of the Indices, a snapshot taken today confirms your eligibility for an airdrop of permanently staked veTMAI. This converts your current plan to the equivalent staking score level within the new Indices structure. The received veTMAI can then be utilized to benefit from discounted trading fees and a share of the platform's revenue.

For TMAI Token Holders

This is not a step away from you. As we build TM100 and related indices, we intend to maintain and, where possible, enhance the ways TMAI connects to our products. Our priority is to get the index experience live, simple, and trustworthy. Once that foundation is solid, we'll share more details on how the token and indices fit together.

Impact on Our Team

Due to this change, we are becoming a smaller, leaner company. This has required difficult decisions about team structure, but we believe this focused approach will allow us to deliver exceptional value in our chosen domain.

What to Expect Next

- Confirmation: Once you submit your compensation choice, you'll receive a confirmation email

- Reminders: You'll see in-app notices about the November 30 shutdown and November 27 deadline

- Launch Updates: Information about TM100 early access and how to participate as indices onboarding begins around Black Friday

Our Commitment to You

To our customers, API users, investors, and token holders: thank you for your support through multiple market cycles. You've trusted our Ratings, engaged with our research, and participated in our community. This decision honors that history while pointing toward a simpler, more durable product that aligns with where crypto is heading.

By narrowing our focus now, we can build something that deserves your trust for many years to come.

Questions? Reply to our announcement email or contact us at support@tokenmetrics.com. We will read every message and do our best to assist you.

With appreciation,

Ian Balina

Founder and CEO

Token Metrics

Don't forget: Select your compensation option before November 27, 2025

Best Yield Marketplaces for Real-World Assets (RWAs) in 2025

%201.svg)

%201.svg)

- What this guide covers: A comprehensive evaluation of 10 leading platforms that enable tokenized real-world asset trading and yield generation across private credit, treasuries, real estate, and structured finance

- Quick verdict: Ondo Finance for institutional-grade treasury exposure at ~5% APY, Maple Finance for crypto-collateralized credit facilities delivering 9-12% net yields, Goldfinch Prime for diversified access to private credit funds from Apollo and Ares

- One key limitation to know: Many RWA platforms enforce strict accreditation requirements (minimum $50K-200K) and geographic restrictions, particularly excluding US investors from certain products due to securities regulations

Why Yield Marketplaces for RWAs Matter in January 2025

The real-world asset tokenization market has experienced explosive growth, surging from $85 million in April 2020 to over $25 billion by mid-2025—representing a staggering 245-fold increase driven primarily by institutional demand for yield, transparency, and regulatory clarity. Private credit dominates at approximately 61% of total tokenized assets, followed by treasuries at 30%, with major asset managers like BlackRock, Apollo, and Franklin Templeton now actively tokenizing institutional-grade products.

The convergence of traditional finance and decentralized infrastructure has created unprecedented opportunities for investors seeking stable, real-world yields without exposure to cryptocurrency volatility. The tokenized RWA market is projected to reach between $9.43 trillion and $18.9 trillion by 2030, with regulatory frameworks in Singapore, Hong Kong, and Dubai providing clear pathways for compliant innovation.

For crypto-native investors, RWA yield marketplaces offer a critical bridge to sustainable income streams backed by productive assets rather than purely speculative token emissions. Traditional allocators gain 24/7 access to fractional ownership, instant settlement, and programmable compliance—advantages impossible in legacy financial infrastructure.

How We Evaluated These Providers

We assessed platforms across six weighted criteria totaling 100 points:

- Yield Quality & Sustainability (30%): Consistency of returns, asset backing, historical performance, and correlation to traditional markets

- Security & Risk Management (25%): Custody solutions, audit history, legal recourse, collateralization ratios, and default handling protocols

- Asset Coverage & Diversity (15%): Range of underlying assets, tranching options, and exposure across credit curves

- Accessibility & Costs (15%): Minimum investments, fee structures, geographic availability, and KYC requirements

- Liquidity & Redemption (10%): Secondary market depth, withdrawal timelines, and tokenization standards

- Infrastructure & Compliance (5%): Regulatory licenses, blockchain integrations, and institutional partnerships

Data sources: Official platform documentation, on-chain analytics from RWA.xyz and DeFiLlama, third-party audits, and regulatory filings. Research conducted October 2024-January 2025.

Verification approach: Every fee structure, yield figure, and regional restriction cited was verified on official platform pages or regulatory disclosures. Unverifiable claims were excluded.

The Contenders: Quick Comparison

Provider Reviews by Use Case

For Treasury-Backed Stability (4-5% Yield)

Top Pick: Ondo Finance — Institutional Treasury Tokenization PioneerOverview

Ondo Finance manages over $1.6 billion in tokenized assets, offering institutional-grade access to US Treasury exposure through OUSG (backed by BlackRock's BUIDL fund) and USDY (a yield-bearing stablecoin). The platform bridges TradFi stability with DeFi composability through multi-chain deployment across Ethereum, Solana, Base, and XRP Ledger.

Ideal For

- Institutional allocators seeking low-volatility dollar exposure

- DeFi protocols requiring yield-bearing collateral

- Treasuries managing idle stablecoin holdings

- Investors prioritizing regulatory compliance and brand-name backing

Standout Features

- Approximately 5% APY from short-term US Treasuries with daily interest payouts via rebasing mechanism

- Integration with Ripple's RLUSD stablecoin for instant minting and redemption 24/7

- Comprehensive SEC-registered infrastructure through acquisition of Oasis Pro, including broker-dealer, ATS, and transfer agent licenses

- Strategic partnerships including anchor position in Fidelity's FDIT tokenized money market fund and launch of Ondo Global Markets for tokenized equities

Pricing

Management fees embedded in net yield; typical 0.15-0.30% annual fee depending on product. OUSG requires $100K minimum; USDY accessible at lower thresholds with 4.29% APY.

Availability

Global except US persons for certain products. Ethereum, Solana, Polygon, Aptos, Sei, Base, XRP Ledger, and Sui supported.

Worth Noting

OUSG designed for qualified purchasers with extended lockup periods; less suitable for retail or high-frequency traders. Platform prioritizes institutional relationships over retail accessibility.

Alternatives to Consider: Franklin Templeton BENJI, OpenEden TBILL

Runner-Up: Franklin Templeton BENJI — Legacy Asset Manager Innovation

Overview

Franklin Templeton's $775 million Franklin OnChain U.S. Government Money Fund (BENJI) pioneered tokenized mutual funds in 2021, offering exposure to US government securities across eight blockchains with patent-pending intraday yield calculation.

Ideal For

- Investors seeking regulated 40 Act fund structure

- Collateral managers requiring second-by-second yield accrual

- Multi-chain strategies needing broad blockchain compatibility

- Users prioritizing traditional asset manager credibility

Standout Features

- Intraday yield tracking down to the second, enabling proportional earnings even for partial-day holdings

- Direct stablecoin purchases and redemptions with wallet-to-wallet transfer capability

- 63% of AUM deployed on Stellar Network for optimal cost efficiency

- Integrated with DeFi protocols for collateral and leverage applications

Pricing

7-day current yield approximately 4.5-5.5% gross; 0.25% management fee. No minimum investment restrictions beyond standard mutual fund requirements.

Availability

Global availability with specific KYC requirements. Active on Stellar, Ethereum, Arbitrum, Base, Avalanche, Polygon, Aptos, Solana, BNB Chain.

Worth Noting

Traditional mutual fund constraints apply including daily NAV calculations and potential redemption delays during market stress.

Alternatives to Consider: Backed bIB01, Superstate Short Duration Government Securities

For Institutional Credit Exposure (8-12% Yield)

Top Pick: Maple Finance — Premier Crypto-Collateralized LendingOverview

Maple Finance manages over $4 billion in assets, specializing in institutional over-collateralized lending backed by Bitcoin, Ethereum, Solana, and XRP, targeting $100 billion in annual loan volume by 2030. The platform introduced SyrupUSDC for permissionless retail access alongside KYC-gated institutional pools.

Ideal For

- Institutional lenders seeking exposure to cryptocurrency-backed credit

- Liquidity providers comfortable with smart contract risk

- Allocators targeting floating-rate, senior-secured structures

- Investors seeking alternatives to traditional stablecoin farming

Standout Features

- Consistent 9-12% net yields through undercollateralized institutional facilities and structured credit products

- Strategic integration with Aave's $40 billion protocol bringing syrupUSDT to Plasma instance and syrupUSDC to core markets

- Partnerships with Bitwise, Lido Finance (stETH-backed credit lines), and EtherFi (weETH collateral) expanding institutional adoption

- Robust risk management combining decades of TradFi expertise with real-time on-chain monitoring

Pricing

Variable by pool; typical effective yields 9-12% after protocol fees. Minimum investments pool-dependent, generally $10K-$50K for retail syrup products.

Availability

Global with KYC requirements for lending. Institutional Maple requires accreditation; Syrup.fi open to broader participants.

Worth Noting

Platform transitioned from uncollateralized to over-collateralized model after 2022 market turmoil. Historical defaults impacted certain pools; robust recovery mechanisms now in place.

Alternatives to Consider: Credix (emerging markets), TrueFi (uncollateralized DeFi)

Runner-Up: Goldfinch Prime — Institutional Private Credit Access

Overview

Goldfinch Prime aggregates exposure to multi-billion dollar private credit funds from Ares, Apollo, Golub Capital, and KKR, providing on-chain access to institutional-grade senior secured loans with over $1 trillion in collective AUM.

Ideal For

- Non-US investors seeking diversified private credit exposure

- Allocators targeting institutional fund performance without direct fund access

- Participants seeking uncorrelated yield to crypto markets

- Investors comfortable with longer lockup periods

Standout Features

- Exposure to 1000+ senior secured loans across industries through vetted fund managers with 10+ years experience

- Target returns of 9-12% net of fees with strict eligibility criteria including >90% senior secured portfolios and <0.75% target non-accrual rates

- Heron Finance manages fund selection and vetting while fund managers handle all underwriting and default resolution

- USDC-based deposits converted to proportional GPRIME tokens for continuous offering structure

Pricing

Net yields 9-12% after embedded management fees and profit sharing. Minimum investments vary by pool structure; typically institutional minimums apply.

Availability

Non-US persons only due to regulatory structure. KYC and accreditation verification required.

Worth Noting

Exposure is indirect through fund shares rather than direct loan origination; fund managers absorb individual borrower default risk into aggregate yields. Liquidity limited compared to Treasury products.

Alternatives to Consider: Centrifuge private credit pools, Credix fintech lending

For Real Estate & Diversified Assets (6-10% Yield)

Top Pick: Centrifuge — Multi-Asset Tokenization InfrastructureOverview

Centrifuge operates as a multichain infrastructure platform enabling asset managers to tokenize real estate, trade finance, carbon credits, and structured credit with $1.2 billion TVL and recent 10x growth driven by the first on-chain CLO and tokenized S&P 500 index fund.

Ideal For

- Investors seeking exposure to asset-backed securities beyond treasuries

- Allocators comfortable evaluating tranched credit structures

- Participants prioritizing transparency and on-chain asset verification

- Portfolio managers wanting diversification across real-world credit types

Standout Features

- Asset-agnostic architecture supporting structured credit, real estate mortgages, US treasuries, carbon credits, and consumer finance with full collateralization and legal recourse for investors

- V3 platform enables cross-chain interoperability across Ethereum, Base, Arbitrum, Avalanche, BNB Chain, and Plume with integrated KYC and compliance-as-a-feature

- Senior/junior tranche structures allowing risk-return customization

- Partnership with Chronicle Labs for real-time price feeds and integration with Circle for USDC on/off-ramping

Pricing

Yields vary by pool and tranche: typically 6-8% for senior tranches, 10-14% for junior tranches. Management fees embedded; pool-specific minimums apply.

Availability

Global with KYC requirements. Pools may have additional jurisdictional restrictions based on underlying asset location.

Worth Noting

Platform complexity requires understanding of tranched structures and asset-specific risks. Less liquid credit instruments offer less frequent pricing updates than treasury products.

Alternatives to Consider: RealT (US residential real estate focus), Republic (equity crowdfunding)

For Emerging Market Credit (12-18% Yield)

Top Pick: Credix — Latin American Fintech LendingOverview

Credix specializes in providing credit facilities to fintech lenders in Latin America, offering high-yield exposure to underserved credit markets with institutional-grade underwriting and local market expertise.

Ideal For

- Sophisticated investors seeking higher risk-adjusted returns

- Allocators comfortable with emerging market credit risk

- Participants with extended investment horizons (12-24 months typical)

- Investors seeking geographic diversification from US/EU markets

Standout Features

- Target yields 12-18% reflecting emerging market risk premiums

- Focus on fintech infrastructure enabling financial inclusion

- Partnerships with established Latin American credit originators

- Robust due diligence and monitoring of borrower networks

Pricing

Pool-dependent yields typically 12-18% gross with management fees of 1-2%. Minimum investments generally $50K+ for accredited investors.

Availability

Non-US persons primarily; requires accreditation verification and enhanced KYC given emerging market exposure.

Worth Noting

Higher yields reflect higher credit and currency risk. Platform experienced challenges during regional economic volatility; enhanced risk controls now implemented.

Alternatives to Consider: Goldfinch V1 pools (emerging market focus), TrueFi uncollateralized pools

For Tokenization Infrastructure (Platform Providers)

Top Pick: Securitize — Industry-Leading Issuance PlatformOverview

Securitize has tokenized over $4.5 billion in assets for 1.2 million investors across 3,000+ clients, operating as an SEC-registered transfer agent with integrated ATS for secondary trading. The platform powers major offerings including BlackRock's BUIDL fund.

Ideal For

- Asset managers seeking turnkey tokenization solutions

- Issuers requiring SEC-compliant digital security infrastructure

- Institutional clients needing integrated custody and compliance

- Projects prioritizing regulatory alignment and brand credibility

Standout Features

- DS Protocol automates token issuance, transfer agent functions, and regulated secondary trading with $47 million funding led by BlackRock

- Recent launch of STAC tokenized AAA CLO fund with BNY custody demonstrating institutional adoption trajectory

- Comprehensive investor onboarding, KYC/AML, and reporting infrastructure

- Partnerships with major asset managers and integration with Zero Hash for fiat conversion

Pricing

Platform fees vary by issuance size and complexity; typically 0.5-2% of AUM plus basis point fees on transactions. White-label solutions available for enterprise clients.

Availability

Global operations with jurisdiction-specific compliance modules. Primary focus on US, EU, and APAC institutional markets.

Worth Noting

Securitize is an issuance platform rather than direct investment product; investors access opportunities through partner funds and offerings launched on the infrastructure.

Alternatives to Consider: Tokeny (EU-focused), Polymath/Polymesh (security token specialists)

Complete Provider Directory

- Backed Finance: European MiCA-compliant tokenization platform offering bIB01 (Swiss government bond exposure) and bC3M (commodity basket). Strong focus on regulatory alignment with modest 3-5% yields and low entry barriers.

- Swarm Markets: Decentralized platform enabling fractional ownership of real estate and private credit with $1K-$50K minimums. Emphasizes accessibility while maintaining compliance through distributed infrastructure.

- TrueFi: Uncollateralized lending protocol using on-chain credit scoring and portfolio diversification. Higher risk-return profile (8-15% targets) with full transparency of borrower pools and performance metrics.

- Archax: UK FCA-regulated platform for institutional tokenization of bonds, funds, and money markets. Focus on traditional finance compatibility with stringent accreditation requirements.

Making Your Selection: Key Questions

- What yield stability do you require?

Treasury-backed platforms (Ondo, Franklin Templeton) offer predictable 4-5% returns with minimal volatility. Credit-focused platforms (Maple, Goldfinch) target 9-12% but introduce credit risk and performance variability. - What is your risk tolerance for underlying collateral?

Government securities provide lowest risk; over-collateralized crypto loans add smart contract and liquidation risks; uncollateralized emerging market credit carries highest default potential. - Do you meet accreditation and minimum investment thresholds?

Many institutional products require $50K-$200K minimums and qualified purchaser status. Retail-accessible options like USDY and syrupUSDC lower barriers but may sacrifice yield. - What liquidity do you need?

Treasury tokens generally offer daily liquidity; private credit pools may have quarterly redemption windows; real estate tokenization can involve 12-24 month lockups. - How important is regulatory compliance?

Platforms like Ondo, Franklin Templeton, and Securitize prioritize SEC registration and traditional fund structures. Purely DeFi-native protocols offer less regulatory clarity but greater composability. - What blockchain ecosystems do you operate in?

Multi-chain deployment (Ondo, Centrifuge) provides flexibility; single-chain specialization (some Maple pools) may offer optimization but limits interoperability. - Do you have geographic restrictions?

US persons often excluded from highest-yield opportunities due to securities laws. European investors benefit from MiCA framework; APAC sees growing regulatory clarity. - What level of transparency do you require?

On-chain native protocols offer real-time asset verification; hybrid models may rely on periodic attestations and third-party audits. - Are you seeking passive income or active yield strategies?

Treasury staking provides set-and-forget returns; DeFi integrations enable leverage, collateral strategies, and yield optimization requiring active management. - How much operational complexity can you handle?

Single-platform solutions simplify but limit optionality; multi-protocol strategies maximize returns but require gas management, tax tracking, and security across multiple platforms.

Maximizing Your Setup with Token Metrics

Token Metrics provides critical intelligence for navigating RWA yield opportunities through data-driven analysis and market insights.

Research Phase: Leverage Token Metrics' fundamental analysis to evaluate tokenized asset protocols, comparing on-chain metrics, TVL trends, and yield sustainability indicators. Our RWA sector reports identify emerging platforms and highlight regulatory developments across jurisdictions.

Portfolio Construction: Use quantitative scoring to allocate across risk tiers—balancing stable treasury exposure with higher-yield credit products. Token Metrics' portfolio tools help optimize diversification while monitoring correlation to traditional crypto markets.

Ongoing Monitoring: Real-time alerts notify you of yield changes, protocol upgrades, and risk events. Our dashboard aggregates performance across multiple RWA platforms, tracking your yield-bearing positions alongside broader cryptocurrency holdings.

Risk Management: Token Metrics' risk analytics assess smart contract security, custody arrangements, and counterparty exposure. Our reports flag platforms with concerning yield sustainability metrics or operational red flags before they impact your capital.

Start your Token Metrics free trial to access institutional-grade RWA research and optimize your real-world asset allocation.

Essential Security Practices

- Custody Verification: Confirm that platforms use institutional-grade custodians (Coinbase Custody, BitGo, Fireblocks) for underlying assets. Verify proof-of-reserve attestations and third-party audits.

- Smart Contract Risk: Review audit reports from reputable firms (Trail of Bits, OpenZeppelin, Certora). Understand upgrade mechanisms and timelock protections on protocol contracts.

- Legal Structure Assessment: Examine SPV formation, bankruptcy remoteness, and investor recourse mechanisms. Ensure tokenization structure provides actual legal claim on underlying assets, not just economic exposure.

- Regulatory Compliance: Verify platforms maintain necessary licenses (broker-dealer, transfer agent, ATS) in relevant jurisdictions. Confirm offerings comply with securities laws in your domicile.

- Counterparty Risk: Understand who services loans, manages defaults, and handles liquidations. Evaluate track records of asset originators and credit underwriters.

- Liquidity Risk Management: Never allocate more than you can afford to lock up for stated redemption periods. Maintain buffer capital for market volatility and potential redemption delays.

- Tax Implications: Consult tax professionals on treatment of tokenized yield—may be classified as interest income, dividends, or capital gains depending on structure and jurisdiction.

- Geographic Restrictions: Verify you're eligible to participate based on residency. Using VPNs or misrepresenting location can result in frozen funds and legal liability.

- Platform Concentration: Diversify across multiple RWA providers to reduce single-point-of-failure risk. No single platform should represent majority of yield allocation.

- Documentation: Maintain records of all transactions, yield distributions, and platform communications for tax reporting and potential disputes.

This article is for research and educational purposes, not financial advice. RWA investments carry risks including loss of principal.

What to Avoid

- Ignoring minimum holding periods: Many RWA products enforce lockups or redemption windows. Treating them as liquid positions can leave you unable to access capital when needed.

- Chasing unsustainably high yields: Promised returns significantly above market rates often indicate excessive risk. Verify underlying asset performance and historical consistency before committing capital.

- Overlooking platform liquidity: Token existence on-chain doesn't guarantee exit liquidity. Check secondary market depth and historical spread between minting and redemption prices.

- Neglecting jurisdictional compliance: Accessing platforms not available in your region can result in frozen accounts and regulatory penalties. Always verify eligibility before depositing funds.

- Underestimating smart contract risk: Even well-audited protocols face exploitation risk. Size positions appropriately and monitor security incident disclosures across the ecosystem.

- Failing to verify asset backing: Don't rely on marketing claims. Demand proof-of-reserve, third-party attestations, and transparent reporting on underlying collateral.

- Concentrating in single asset class: Over-allocating to one RWA category (e.g., all private credit) eliminates diversification benefits. Balance across treasuries, credit, and real estate where possible.

- Ignoring fee structures: Management fees, performance fees, and transaction costs compound over time. Calculate net yields after all costs when comparing platforms.

Reader Questions Answered

What's the difference between tokenized treasuries and yield-bearing stablecoins?

Tokenized treasuries (like OUSG) represent direct ownership of US Treasury securities with yield passed through to holders. Yield-bearing stablecoins (like USDY) maintain $1 peg while distributing treasury yields via rebasing or airdrops. Treasuries may fluctuate slightly with NAV; yield stablecoins prioritize price stability.

Are RWA yields taxable differently than crypto staking rewards?

Likely yes, though tax treatment varies by jurisdiction. RWA yields from treasuries or credit facilities often classified as interest income taxed at ordinary rates. Crypto staking may be treated as income at receipt or capital gains at sale depending on location. Consult tax professionals for specific guidance.

Can I use tokenized RWAs as collateral in DeFi protocols?

Increasingly yes. Platforms like Maple, Ondo (via Flux Finance), and Centrifuge enable using tokenized assets as DeFi collateral. However, support varies by protocol and asset—USDY and OUSG see broader integration than niche real estate tokens. Liquidation risks apply if collateral value drops.

What happens if the platform goes bankrupt?

Properly structured tokenization isolates assets in bankruptcy-remote SPVs, protecting investor claims even if platform operator fails. However, redemption processes may be delayed and require legal navigation. This is why verifying legal structure and custodial arrangements is critical.

How liquid are RWA tokens compared to stablecoins?

Significantly less liquid. While stablecoins have billions in daily DEX volume, most RWA tokens trade thinly or only through platform-controlled redemption mechanisms. Treasury tokens offer better liquidity than private credit or real estate, but all lag traditional stablecoins substantially.

Do I need to be an accredited investor?

Depends on the platform and your location. US-based offerings often require accreditation; international platforms may have lower barriers. Products like USDY, syrupUSDC, and BENJI target broader accessibility, while institutional credit pools restrict to qualified purchasers.

What are the main risks that could cause loss of principal?

(1) Underlying asset default (credit risk), (2) smart contract exploitation, (3) platform insolvency without proper asset segregation, (4) regulatory action freezing operations, (5) stablecoin de-pegging for yield products denominated in USDC/USDT, (6) liquidation cascades in collateralized structures.

How do yields compare to traditional finance alternatives?

Tokenized treasuries (4-5%) match conventional money market funds but with 24/7 access. Private credit RWAs (9-12%) offer premiums over corporate bonds due to illiquidity and platform novelty. Emerging market RWA yields (12-18%) comparable to EM debt funds with added smart contract risk.

Bottom Line

Real-world asset yield marketplaces represent the maturation of blockchain infrastructure beyond speculation into productive finance. For investors seeking stable, asset-backed returns uncorrelated to cryptocurrency volatility, platforms like Ondo Finance and Franklin Templeton deliver institutional-grade treasury exposure with DeFi composability. Those comfortable with credit risk can access superior yields through Maple Finance's collateralized institutional lending or Goldfinch Prime's diversified private credit exposure.

The key to success: match platform selection to your specific risk tolerance, liquidity needs, and regulatory constraints. Treasury products suit conservative allocators prioritizing capital preservation; credit platforms reward investors accepting higher risk for enhanced returns; multi-asset infrastructure like Centrifuge offers diversification across real-world credit types.

Start with smaller allocations to understand platform mechanics, redemption processes, and yield consistency before committing substantial capital. The RWA sector's rapid growth will continue creating opportunities, but also attracting lower-quality offerings—due diligence remains paramount.

Related Resources:

- Best Cryptocurrency Exchanges 2025

- Top Derivatives Platforms 2025

- Top Institutional Custody Providers 2025

About This Research

Methodology: This guide evaluated 20+ RWA platforms through analysis of official documentation, on-chain data, regulatory filings, and third-party audits. Platforms selected represent meaningful TVL (>$100M), regulatory compliance, and operational track record. Final selection prioritized diversity across asset classes and investor accessibility tiers.

Research Sources:

- Ondo Finance: Product documentation, tokenomics, OUSG/USDY specifications, Oasis Pro acquisition disclosure

- Maple Finance: Platform whitepaper, syrupUSDC mechanics, Aave integration announcement, CEO interviews

- Centrifuge: V3 technical documentation, pool analytics, Republic partnership details

- Goldfinch: Prime pool specifications, fund manager criteria, Heron Finance structure

- Franklin Templeton: BENJI platform technical details, intraday yield patent documentation, multi-chain deployment

- Securitize: DS Protocol documentation, STAC fund launch details, BlackRock partnership announcements

- RWA.xyz: Platform TVL data, tokenization metrics, market growth analysis

- DeFiLlama: Protocol TVL tracking, historical performance data

- BCG/Ripple: RWA market projections and industry research

- VanEck, Coinbase, Binance: Sector research reports on RWA growth trajectories

All data current as of January 2025. Platform features and yields subject to change; verify current terms on official websites before investing.

Top Gold & Commodity-Backed Tokens (2025)

%201.svg)

%201.svg)

Who this guide is for. Crypto investors and treasurers comparing gold-backed tokens and other commodity-backed assets that can be audited and, in many cases, redeemed for metal.

Top three picks. PAX Gold (PAXG) for regulated, bar-linked redemption; Tether Gold (XAUt) for broad awareness and simple fees; Kinesis (KAU/KAG) for spend-and-yield use cases.

Key caveat. Redemption minimums, custody locations, and fees vary by issuer; always confirm regional eligibility and schedules on the official pages.

Introduction: Why Commodity-Backed Tokens Matter in 2025

Gold-backed tokens give on-chain ownership exposure to vaulted bullion with transparent allocation and, often, physical redemption, blending the inflation hedge of metals with crypto liquidity. In 2025, they’re used for hedging, collateral, cross-border settlement, and “digital cash” backed by tangible assets. A commodity-backed token is a blockchain token that represents title to a specific quantity of a real-world commodity (for example, 1 troy ounce or 1 gram of gold) held by a custodian, typically with published fees, vault locations, and redemption rules. Our picks prioritize liquidity, security controls, breadth of metals, cost transparency, and global accessibility.

Best Commodity-Backed Tokens in November 2025 (Comparison Table)

We excluded defunct or sunset projects (e.g., PMGT; CACHE Gold ceased backing CGT on Sept 30, 2025). (perthmint.com)

Top 10 Gold & Commodity-Backed Tokens in November 2025

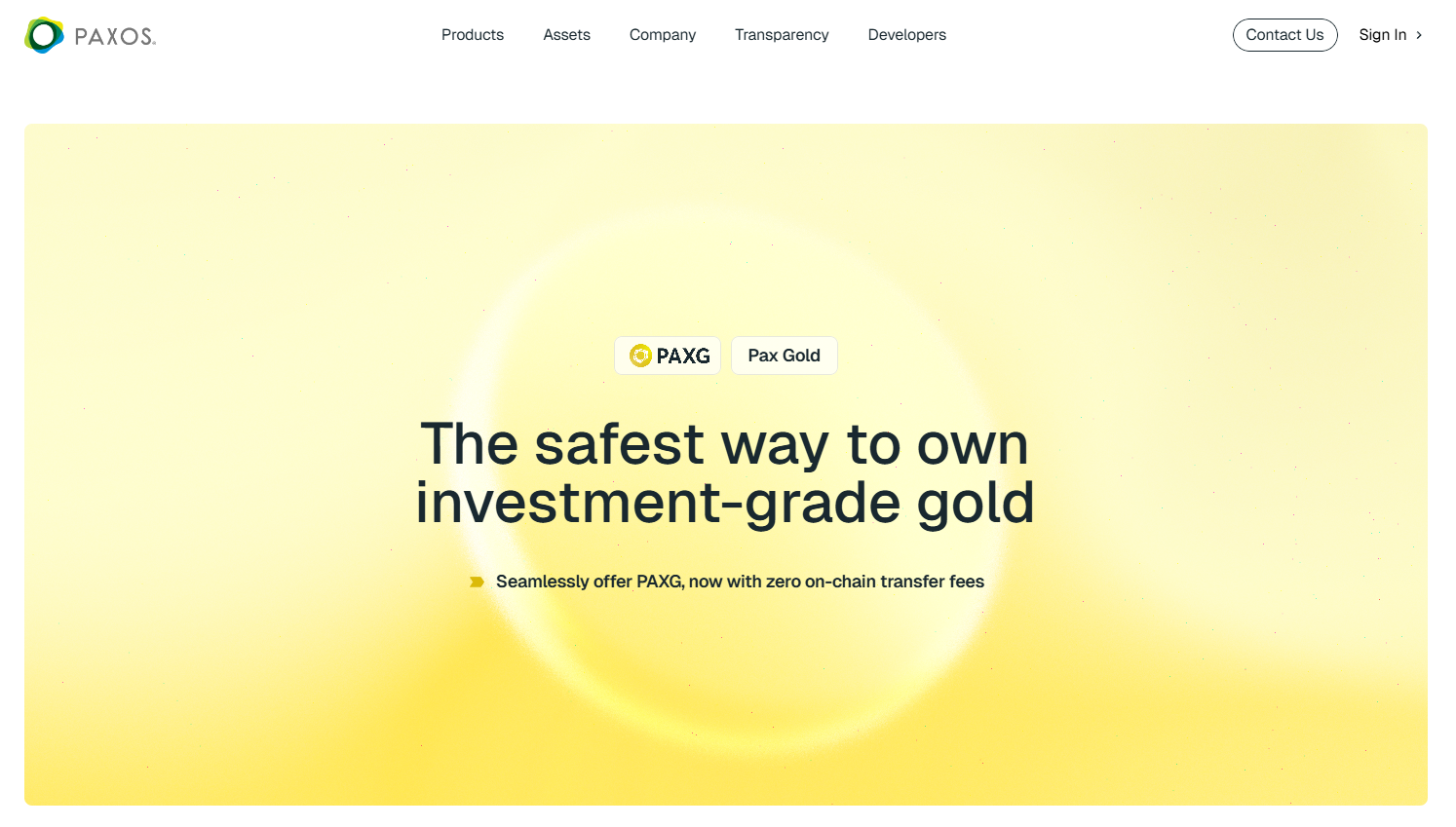

1) PAX Gold (PAXG) — Best for bar-linked redemption & regulatory posture

Why Use It. PAXG links each token to specific LBMA Good Delivery bars stored in London, offering direct bar redemption (institutional minimums apply) or USD redemption at spot. Paxos publishes fee schedules and notes no storage fee charged to customers at this time. (paxos.com)

Best For. Institutions; HNW hedgers; DeFi users needing reputable collateral.

Notable Features. LBMA bars; serial-number linkage; custodied in London; fiat redemption option. (paxos.com)

Fees Notes. Creation/destruction fees; no storage fee currently per issuer help center. (help.paxos.com)

Regions. Global (issuer KYC).

Consider If. You can meet bar redemption minimums and UK vault logistics. (help.paxos.com)

Alternatives. Tether Gold (XAUt); VNX Gold (VNXAU).

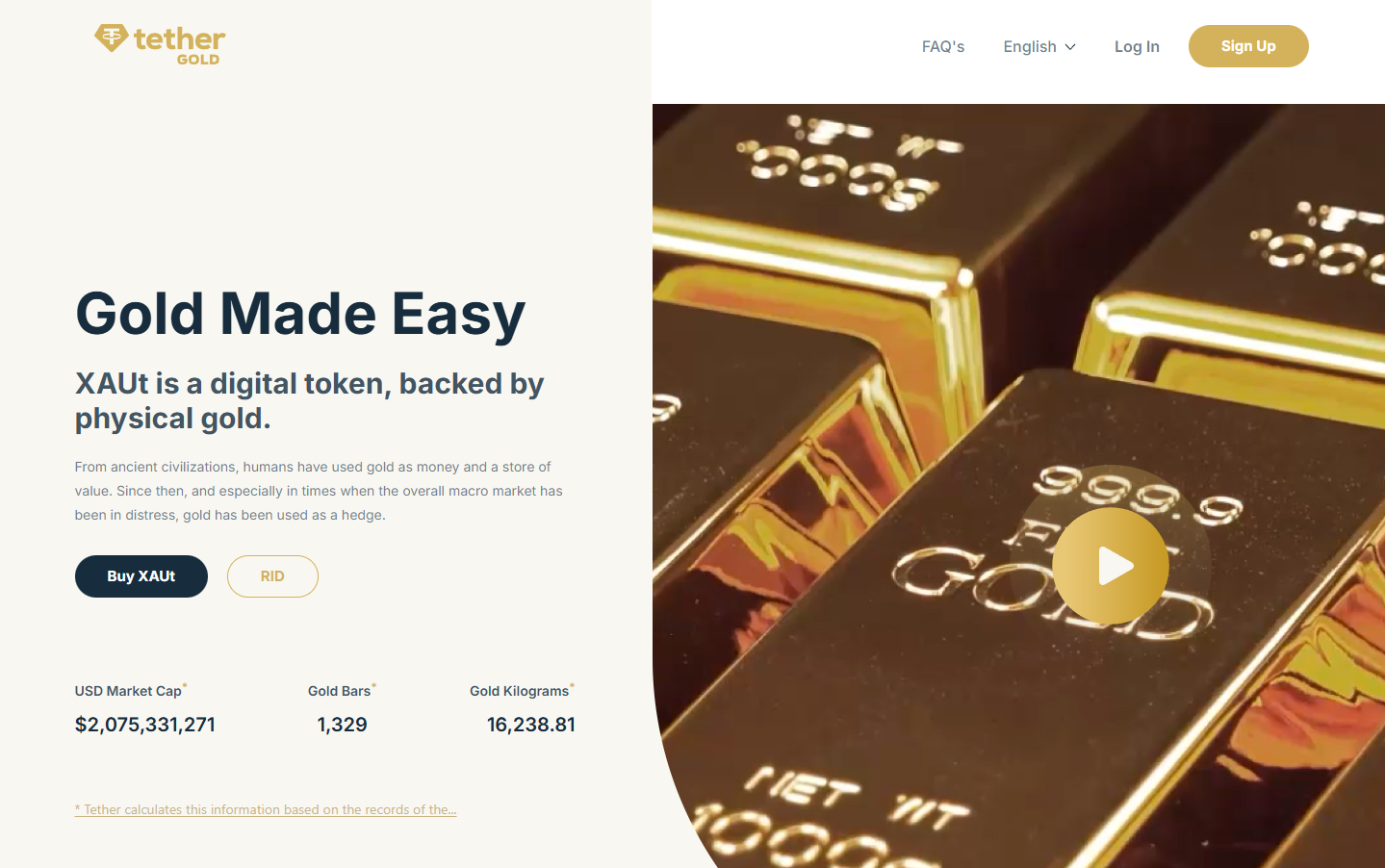

2) Tether Gold (XAUt) — Best for simple pricing & broad availability

Why Use It. XAUt represents allocated gold and can be redeemed for physical gold or USD; Tether publishes a straightforward 0.25% creation/redemption fee and a one-time verification fee for onboarding. FAQs outline redemption mechanics and bar specifics. (Tether)

Best For. Traders seeking brand familiarity; cross-chain users (ETH/TRON).

Notable Features. Bar metadata; physical or USD redemption; no custody fee disclosed beyond the transaction fee. (Tether)

Fees Notes. 25 bps create/redeem; separate KYC verification fee. (Tether)

Regions. Global (issuer KYC).

Consider If. You need clear fee math but don’t require bar-specific allocation like PAXG.

Alternatives. PAX Gold (PAXG); Kinesis (KAU).

3) Kinesis KAU (Gold) / KAG (Silver) — Best for spend-and-yield utility

Why Use It. Kinesis combines metal-backed tokens with an exchange, cards, and yields funded from platform fees (published yield-share). Trading and precious metals transactions show ~0.22% execution fees on official schedules. (Kinesis)

Best For. Users wanting to spend gold/silver, earn monthly yields, and keep fees predictable.

Notable Features. Fee-share yield (published); exchange, card rails; gold & silver pairs. (Kinesis)

Fees Notes. ~0.22% buy/sell/trade; other fees per schedule. (Kinesis)

Regions. Global (platform KYC/availability).

Consider If. You prefer an integrated platform over a standalone token.

Alternatives. VNX (VNXAU/VNXAG); Aurus (tXAU/tXAG).

4) Comtech Gold (CGO) — Best for XDC ecosystem & Shariah-compliant framework

Why Use It. CGO tokenizes 1g gold units on the XDC (XRC-20) network, with a published fee structure for mint/redeem (0.50%), transfers (0.50%), and custody notes in FAQs. Documentation details creation/redemption and delivery fees. (comtechgold.com)

Best For. XDC builders; users needing Shariah-compliant structuring.

Notable Features. On-chain proofing; fee schedule; vault delivery options. (comtechgold.com)

Fees Notes. 0.50% mint/redeem; 0.50% transfer; custody terms disclosed. (comtechgold.com)

Regions. Global (issuer terms apply).

Consider If. You’re comfortable with XDC rails and issuer fee model.

Alternatives. PAXG; VNXAU.

5) VNX Gold (VNXAU) — Best for EEA vaulting & multi-chain issuance

Why Use It. VNXAU gives direct ownership of allocated bars stored in Liechtenstein with a public allocation lookup tool. VNX runs on Ethereum, Polygon, Q, and Solana, and has communications on redemption and delivery. (VNX)

Best For. EEA users; diversification across chains.

Notable Features. Allocation lookup by serial; segregated AAA-jurisdiction vault; multi-chain. (VNX)

Fees Notes. See VNX pricing and product pages for current schedules.

Regions. EEA emphasis; global availability varies by KYC.

Consider If. You want EEA custody and serial-level transparency.

Alternatives. PAXG; XAUt.

6) Aurus tGOLD (tXAU) / tSILVER (tXAG) — Best for gram-denominated multi-metal exposure

Why Use It. Aurus issues 1-gram tokens backed by vaulted gold and silver with insured, audited storage. tGOLD and tSILVER support multi-chain DeFi integrations and a mobile app, with ecosystem partners for mint/redeem. (AURUS)

Best For. DeFi users; small-denomination accumulation; multi-metal portfolios (includes platinum via tXPT).

Notable Features. 1g units; insured vaulted metals; app & dashboard; partner network. (AURUS)

Fees Notes. Exchange/network fees; issuer/partner fees may apply.

Regions. Global (partner KYC where required).

Consider If. You want gram-level flexibility and cross-chain access.

Alternatives. Kinesis; VNX.

7) Gold Silver Standard (AUS/AGS) — Best for Australia-based custody & simple redemption

Why Use It. Tokens AUS (gold) and AGS (silver) are backed by allocated bullion held in Australian high-security vaults with $0 storage and transfer at the issuer level and partner-facilitated redemptions. (goldsilverstandard.com)

Best For. AUD-centric investors; straightforward physical pickup/delivery via partners.

Notable Features. 1g linkage; local redemption via Ainslie partners; Australia-first focus. (goldsilverstandard.com)

Fees Notes. Issuer lists $0 storage/transfer; exchange and redemption partner fees may apply. (goldsilverstandard.com)

Regions. Australia focus; global varies.

Consider If. You need straightforward redemption in Australia.

Alternatives. PAXG; VNXAU.

8) VNX Silver (VNXAG) — Best for EEA silver allocation & transparency tools

Why Use It. VNXAG mirrors the VNXAU model for silver, backed by allocated metal with the same allocation lookup tooling and multi-chain issuance. (VNX)

Best For. EEA investors prioritizing silver in segregated storage.

Notable Features. Allocation lookup; EEA custody; multi-chain support. (VNX)

Fees Notes. See VNX site for current schedules.

Regions. EEA emphasis; global varies.

Consider If. You want EEA-vaulted silver with serial-level transparency.

Alternatives. KAG; tXAG.

9) VeraOne (VRO) — Best for euro-area buyers wanting 1-gram ERC-20

Why Use It. VRO is an ERC-20 token pegged to 1 gram of LBMA-standard gold, issued by a long-standing French precious-metal group; materials describe secured storage and regular audits. (VeraOne)

Best For. EU users; gram-based savings; euro on-ramps.

Notable Features. 1g linkage; audited storage; EU presence. (VeraOne)

Fees Notes. Issuer materials outline model; confirm current fees on site.

Regions. EU focus; global access varies.

Consider If. You want EU branding and ERC-20 simplicity.

Alternatives. PAXG; VNXAU.

10) AgAu — Best for Swiss custody & peer-to-peer design

Why Use It. AgAu outlines 1:1 backed gold and silver tokens with Swiss custody and a peer-to-peer payment focus; docs and reports describe convertibility and audited reserves. (agau.io)

Best For. Users seeking Swiss jurisdiction and payments-style UX.

Notable Features. Swiss issuer; P2P spend; audit & documents hub. (agau.io)

Fees Notes. See issuer documentation for fees and redemption steps.

Regions. Global (jurisdictional checks apply).

Consider If. You want Swiss custody with payments emphasis.

Alternatives. VNXAU; AUS.

Decision Guide: Best by Use Case

- Regulated, bar-specific redemption: PAX Gold (PAXG). (paxos.com)

- Simple fee schedule & brand familiarity: Tether Gold (XAUt). (Tether)

- Spend metals + monthly fee-share yield: Kinesis (KAU/KAG). (Kinesis)

- XDC network users: Comtech Gold (CGO). (comtechgold.com)

- EEA custody & allocation lookup: VNX (VNXAU/VNXAG). (VNX)

- Gram-based, multi-metal DeFi: Aurus (tXAU/tXAG). (AURUS)

- Australia-centric custody & pickup: Gold Silver Standard (AUS/AGS). (goldsilverstandard.com)

- EU 1-gram ERC-20: VeraOne (VRO). (VeraOne)

- Swiss custody & P2P payments: AgAu. (agau.io)

How to Choose the Right Commodity-Backed Token (Checklist)

- ☐ Region eligibility and KYC match your profile.

- ☐ Underlying metal type and unit (ounce vs gram).

- ☐ Redemption rules: minimums, delivery locations, timelines.

- ☐ Custody: vault jurisdiction, insurer, LBMA accreditation.

- ☐ Fee transparency: creation, redemption, storage, transfer, network.

- ☐ Audit/attestation cadence and allocation lookup tools.

- ☐ Chains supported and DeFi integration needs.

- ☐ Support channels and documentation depth.

Red flags: vague custody details, unclear redemption, or discontinued programs.

Use Token Metrics With Any Commodity-Backed Token

- AI Ratings to screen metal-linked assets and related ecosystem tokens.

- Narrative Detection to spot inflows to on-chain RWAs.

- Portfolio Optimization to size metal exposure vs. crypto beta.

- Alerts & Signals to time entries/exits around macro prints.

Workflow: Research → Select issuer → Execute on-chain or via platform → Monitor with alerts.

CTA: Start free trial to screen assets and time entries with AI.

Security & Compliance Tips

- Use official issuer URLs only; beware look-alikes.

- Confirm fee schedules and redemption procedures before buying. (Tether)

- Verify vaulting jurisdiction and any bar-serial lookup tools. (VNX)

- Mind network fees, bridge risks, and exchange withdrawal rules.

- Keep custody keys secure; whitelist issuer addresses.

- If staking or yielding, confirm source of yield and counterparty exposure. (Kinesis)

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Treating all metal tokens as equal—redemption and custody differ widely.

- Ignoring region and KYC limits until you try to redeem.

- Overlooking minimums (e.g., full LBMA bars vs. gram redemptions). (help.paxos.com)

- Confusing defunct tokens with active ones (e.g., PMGT sunset; CGT backing ceased). (perthmint.com)

- Forgetting network/transfer fees when arbitraging across chains.

- Using unofficial contracts on the wrong chain.

How We Picked (Methodology & Scoring)

- Liquidity — 30%. Exchange presence, on-chain activity, practical tradability.

- Security — 25%. Custody details, audits/attestations, LBMA alignment, redemption design.

- Coverage — 15%. Metals (gold/silver/platinum), chains, tooling.

- Costs — 15%. Creation/redemption/storage/transfer and transparency of schedules.

- UX — 10%. Apps, dashboards, redemption flows.

- Support — 5%. Docs, status pages, human support.

We relied on official product, docs, fees, FAQ, and disclosure pages, cross-checking market datasets only for context. Last updated November 2025.

FAQs

What are gold-backed tokens?

They are blockchain tokens that represent ownership of a specific quantity of vaulted, insured gold, typically with published fees and, in some cases, physical redemption options.

Are gold-backed tokens safer than stablecoins?

They can diversify away from fiat risk, but introduce custody and redemption dependencies. Safety depends on the issuer’s vaulting, audits, legal structure, and your ability to redeem.

What fees should I expect?

Common fees include creation/redemption, possible storage, transfer, and network fees. Examples: XAUt lists 0.25% create/redeem; Paxos publishes creation/destruction fees and notes no storage fee currently. Always check the live schedules. (Tether)

Can I redeem tokens for a real gold bar?

Some issuers support bar redemption with minimum sizes and location constraints (e.g., LBMA bar logistics in London for PAXG). Others support gram-level redemption via partners. (help.paxos.com)

Which chains are supported?

Varies: PAXG (Ethereum), XAUt (Ethereum/TRON), VNX (Ethereum/Polygon/Q/Solana), Aurus (multi-chain), CGO (XDC), Kinesis (native + exchange listings). (paxos.com)

Are there discontinued tokens I should avoid?

Yes. PMGT has been discontinued; CACHE Gold (CGT) ceased backing as of Sept 30, 2025. Verify project status before buying. (perthmint.com)

Conclusion + Related Reads

Choose PAXG for bar-linked redemption and strong disclosures, XAUt for simple fees and brand reach, or Kinesis if you want to spend metals and earn fee-share yields. For EEA vaulting with allocation lookup, VNX is compelling; for gram-based DeFi exposure, Aurus is versatile.

Related Reads:

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)