Ripple (XRP) Price Prediction 2025: Will XRP Hit $500 This Bull Cycle?

%20Price%20Prediction%202025_%20Will%20XRP%20Hit%20%2410%20This%20Bull%20Cycle_.png)

Ripple’s native token, XRP, is experiencing renewed momentum in 2025, surging to $2.58 and breaking the long-standing $2.50 resistance level. This price movement coincides with Bitcoin's rally past $112,000, signaling that XRP is riding the current bull market wave.

But what’s driving this surge in XRP? Is it sustainable? And could we see XRP hit $5, $7—or even $10—before the end of 2025?

In this highly informative and SEO-optimized blog post, we analyze the factors behind XRP’s rise, evaluate its future potential, and explain why Token Metrics’ AI-powered price prediction tools offer unmatched insights for crypto investors.

🚀 XRP’s Bullish Breakout: A New Chapter in 2025

In July 2025, XRP’s breakout above $2.50 marks one of its strongest price performances since the 2017 bull run. Key drivers behind this bullish trend include:

✅ 1. Ripple’s Legal Victory Against the SEC

Ripple finalized its years-long lawsuit with the U.S. Securities and Exchange Commission (SEC) by paying a $50 million settlement—without admitting XRP is a security. This outcome:

- Removes a major legal overhang

- Boosts investor and institutional confidence

- Clears the path for U.S. regulatory clarity

With the lawsuit resolved, XRP is now eligible for listings, ETF consideration, and greater adoption in regulated financial environments.

✅ 2. Launch of RLUSD Stablecoin

Ripple has successfully launched RLUSD, its native stablecoin backed 1:1 by U.S. dollars. RLUSD provides:

- Liquidity for XRP-based DeFi

- Seamless on/off ramps for cross-border payments

- Utility for RippleNet’s institutional clients

This ecosystem expansion strengthens Ripple’s value proposition and increases XRP utility and demand.

✅ 3. Potential Approval of XRP ETFs

With Ethereum and Bitcoin ETFs already active, XRP is next in line. Analysts estimate:

- A 90%+ likelihood of XRP ETF approval before 2026

- Significant inflows from institutional investors upon approval

ETF listings would make XRP easily accessible in retirement accounts, financial advisors’ portfolios, and wealth management platforms—further legitimizing the asset.

✅ 4. Expanding Global Financial Partnerships

Ripple now boasts partnerships with 300+ financial institutions, including:

- Santander

- Standard Chartered

- SBI Holdings

- Integration with Wormhole for cross-chain liquidity

This positions XRP as a global standard for cross-border payments—a market worth $150+ trillion annually.

📈 XRP Price Prediction for 2025

Analysts and AI models predict a strong upside potential for XRP during this bull cycle. Here's a breakdown of possible scenarios:

Breakout Level to Watch: $3.40

Support Level: $2.10

⚠️ Risks and Challenges Ahead

Despite the bullish momentum, XRP still faces several risks:

❌ 1. Regulatory Ambiguity Outside the U.S.

Although the SEC case is resolved, Ripple faces:

- Different classifications of XRP in Europe and Asia

- New compliance standards (e.g., MiCA)

- Potential resistance from central banks promoting CBDCs

❌ 2. Stablecoin Competition

RLUSD must compete with:

- USDT and USDC (dominant players)

- CBDCs and national digital currencies

- Traditional payment rails like SWIFT GPI

Failure to achieve rapid RLUSD adoption could cap XRP's growth potential.

❌ 3. Market Volatility and Profit-Taking

After explosive gains, whales may lock in profits, causing sharp pullbacks. Key support at $2.10 must hold to maintain bullish structure.

🧠 Why Token Metrics Has the Best XRP Price Prediction Tools

In a fast-moving market, investors need real-time, data-driven predictions—not guesswork. Token Metrics offers the most advanced tools for XRP investors.

✅ 1. AI-Powered Price Forecasts

Token Metrics uses machine learning models trained on years of crypto market data to generate high-accuracy price forecasts.

For XRP, these models consider:

- Whale wallet accumulation

- Cross-border transaction volume

- Stablecoin liquidity metrics

- Token velocity and exchange flows

The result? A forward-looking price forecast you can trust.

✅ 2. XRP Buy/Sell Signals

The Token Metrics platform issues real-time bullish or bearish signals based on:

- Technical indicators (MACD, RSI)

- Exchange net flow

- Trend strength

- Historical reversal patterns

These signals help you:

- Enter at optimal times

- Avoid fake breakouts

- Time your profit-taking during rallies

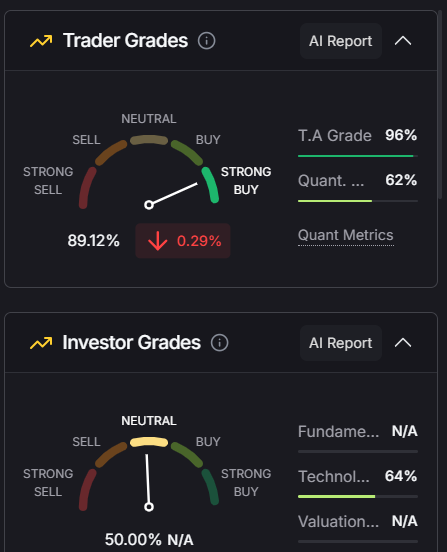

✅ 3. Trader and Investor Grades

Token Metrics assigns every token—including XRP—a:

- Trader Grade (short-term trend strength)

- Investor Grade (long-term fundamental health)

Both are AI-calculated using 80+ metrics, and they update daily. This helps you:

- Decide whether to swing trade or HODL XRP

- Compare XRP with other cross-border payment tokens

✅ 4. Custom Alerts and Analysis

With Token Metrics, you can set personalized alerts for XRP:

- Price thresholds (e.g., alert me if XRP hits $3.40)

- Percent change triggers (e.g., alert me on +15% move)

- Grade changes (e.g., notify me if Trader Grade goes above 80)

Alerts are delivered via email, Slack, Telegram, or Discord—so you never miss a key movement.

✅ 5. Detailed Token Page for XRP

The XRP profile page on Token Metrics provides:

- Live price chart and ROI

- Real-time exchange volume

- Whale wallet movements

- Historical signal success rates

Everything you need for informed XRP investing in one place.

📊 XRP vs. Other Altcoins in 2025

While many altcoins are chasing narratives (AI, memecoins, DePIN), XRP’s case is fundamentally driven by:

- Regulatory clarity

- Real-world adoption

- Enterprise integrations

Token Metrics’ crypto indices help investors diversify by creating thematic portfolios (e.g., “Institutional Adoption,” “Layer-1 Networks,” “Cross-Border Payments”)—with XRP often at the top of the cross-border category.

📉 What If XRP Corrects?

Corrections are part of every bull market. If XRP fails to hold above $2.50:

- A retracement to $2.10 is likely

- A break below $2.10 could lead to a retest of $1.80

- Traders should watch BTC’s movement closely—if Bitcoin reverses sharply, XRP could follow

Use Token Metrics’ bearish signal alerts to de-risk in real time.

✅ Final Thoughts: XRP Is One to Watch in 2025

With legal clarity, a new stablecoin, ETF approval potential, and over 300 institutional partnerships, Ripple and XRP are in their strongest position in years.

If Bitcoin continues its uptrend and XRP breaks above $3.40, the next major rally could take it to $5–$10 by the end of 2025.

But success depends on regulatory support, stablecoin adoption, and institutional inflows—all factors Token Metrics tracks daily with precision.

🔍 Take Action: Use Token Metrics to Trade XRP Smarter

- Track XRP’s real-time price predictions

- Monitor short- and long-term signal strength

- Set alerts for breakouts or corrections

- Analyze fundamentals and on-chain data

👉 Start now at tokenmetrics.com and gain an edge in XRP trading and investing

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)