Role of AI in Crypto Industry - Benefits, Risks and Uses

Artificial intelligence (AI) has become a buzzword in various industries, and the crypto industry is not an exception. AI is playing a vital role in the crypto industry by enhancing the efficiency, security, and transparency of various processes.

The crypto industry is experiencing a paradigm shift in the way it operates due to AI's advancements. To begin, it's essential to comprehend the significance of Artificial Intelligence (AI) in the world of cryptocurrencies. So let's start..

Importance of AI in Crypto Industry

In order to understand the importance of AI, we need to explore the various applications of AI in the crypto industry, including trading, fraud detection, security, and governance. We will also examine the impact of AI on the crypto industry and how it is transforming the future of finance.

Artificial intelligence in Trading

AI is revolutionizing the way trading is done in the crypto industry. With its advanced algorithms, AI can analyze vast amounts of data, identify trends, and predict market movements. This capability is crucial in a fast-paced market like the crypto industry, where timing is everything.

Moreover, AI can execute trades automatically based on predefined criteria, which can save traders a significant amount of time and effort. This automation eliminates human error, increases trading efficiency, and reduces the risk of losses.

Artificial intelligence in Fraud Detection

The crypto industry has faced several fraud cases in the past, which have raised concerns about its security. However, AI can help detect and prevent fraud in the industry. AI can analyze data from various sources, including social media, to identify fraudulent activities and alert the relevant authorities.

Additionally, AI can help prevent money laundering by tracking the movement of funds across the blockchain network. This capability can enhance the industry's transparency and make it more attractive to investors.

Artificial intelligence in Security

AI can also play a vital role in the security of the crypto industry. With its advanced algorithms, AI can identify and prevent cyber attacks, which have become increasingly common in the industry. AI can also detect vulnerabilities in the blockchain network and suggest ways to fix them.

Moreover, AI can help prevent hacking attempts by analyzing user behavior and identifying suspicious activities. This capability can enhance the security of the industry and protect investors' funds.

Artificial intelligence in Governance

AI can also improve the governance of the crypto industry. With its ability to analyze data and identify patterns, AI can help regulators identify potential risks and take necessary actions. AI can also help regulators develop policies and regulations that are more effective and efficient.

Moreover, AI can enhance the transparency of the industry by analyzing data on blockchain networks and providing insights into how they operate. This transparency can increase trust in the industry and attract more investors.

Benefits of Using AI in Crypto Trading

The use of AI in cryptocurrency trading has been increasing over the years due to its ability to analyze vast amounts of data, detect patterns, and make predictions. Let's explore some of the benefits of using AI in cryptocurrency trading.

1. Improved Efficiency

One of the most significant benefits of using AI in cryptocurrency trading is improved efficiency. AI can analyze large amounts of data from various sources in real-time, making it easier to identify profitable trades.

This capability saves traders a significant amount of time and effort by automating the trading process. Traders can also set specific criteria for trading, and the AI can execute trades automatically based on those criteria.

2. Accurate Market Predictions

AI has the ability to analyze vast amounts of data and detect patterns that are difficult for humans to see. This capability enables AI to make accurate price predictions about the future movement of cryptocurrencies. With its advanced algorithms, AI can analyze market trends and historical data to identify potential price movements.

3. Reduced Risk of Losses

By using AI, traders can reduce the risk of losses. AI can detect potential risks and help traders make informed decisions about when to buy or sell cryptocurrencies. AI can also execute trades automatically based on predefined criteria, which eliminates human error and reduces the risk of losses.

4. Improved Security

AI can also improve the security of cryptocurrency trading. With its advanced algorithms, AI can detect potential cyber attacks and protect traders' funds from being stolen. AI can also identify vulnerabilities in the blockchain network and suggest ways to fix them.

5. Increased Transparency

AI can increase transparency in cryptocurrency trading by analyzing data on the blockchain network. This capability enables traders to see how cryptocurrencies are moving and who is trading them. Increased transparency can enhance trust in the industry and attract more investors.

6. Enhanced Trading Strategies

AI can also enhance trading strategies by providing insights into market trends and identifying profitable trades. Traders can use this information to adjust their trading strategies and make more informed decisions. AI can also analyze the trading behavior of other traders and provide insights into how they are trading.

Risks associated with using AI in crypto

While using artificial intelligence (AI) in cryptocurrency trading has numerous benefits, it is not without risks. Lets see some of the risks associated with using AI in the crypto industry.

1. Over-reliance on AI

One of the most significant risks associated with using AI in cryptocurrency trading is over-reliance on AI. While AI can help traders make informed decisions, it is not infallible. Traders who rely solely on AI may miss critical market movements and make poor trading decisions. It is essential to use AI as a tool to aid in trading decisions, rather than relying entirely on it.

2. Limited Training Data

AI requires vast amounts of data to train its algorithms and make accurate predictions. However, the cryptocurrency industry is relatively new, and there is limited historical data available. This limitation can lead to inaccuracies in AI predictions, which can result in significant losses for traders.

3. Black Box Problem

Another risk associated with using AI in cryptocurrency trading is the black box problem. AI algorithms are often complex, and it can be challenging to understand how they arrive at their predictions. This lack of transparency can make it difficult for traders to trust AI decisions and make informed decisions about their trades.

4. Cybersecurity Risks

AI technology is still new and some systems are vulnerable to cyber attacks, which can compromise the security of traders' funds. Hackers can exploit vulnerabilities in AI algorithms to manipulate trades or steal funds. It is essential to implement robust cybersecurity measures to protect against these risks.

5. Bias in Algorithms

AI algorithms can be biased based on the data they are trained on. If the data is biased, the AI algorithm will make biased predictions, which can result in significant losses for traders. It is crucial to ensure that AI algorithms are trained on unbiased data to avoid this risk.

6. Regulatory Risks

The use of AI in cryptocurrency trading is a relatively new concept, and there is limited regulation surrounding its use. Traders who use AI may be subject to regulatory risks if they violate laws or regulations. It is essential to stay up to date on regulatory developments and ensure that AI systems comply with relevant laws and regulations.

Uses of AI in Crypto Space

Artificial intelligence (AI) has numerous uses in the field of cryptocurrency industry. The most significant use of AI in cryptocurrency space is for research and analysis. AI is used by many investors and traders for predicting market trends and making informed investment decisions.

Machine learning algorithms can analyze vast amounts of data, including historical crypto price, market cap, trends, volume and many more data points to identify patterns and correlations that may indicate future price movements.

These are few common uses of AI in the crypto space -

- Cryptocurrency Market Analysis

- Accurate Crypto Market Predictions

- Crypto Market Sentiment Analysis

- Automated Crypto Trading Strategies

- Monetizing Crypto Insights

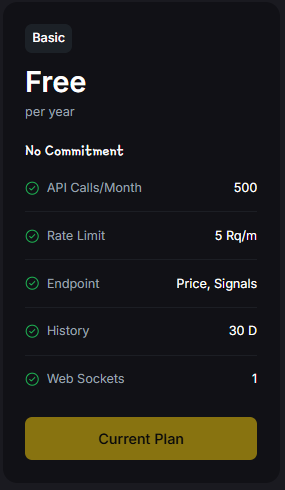

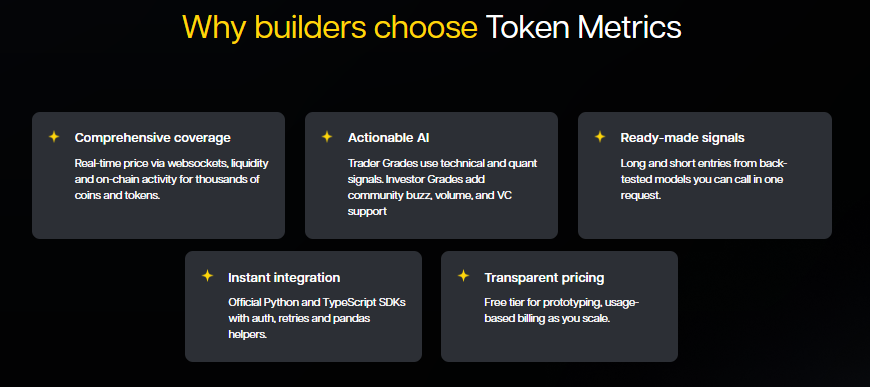

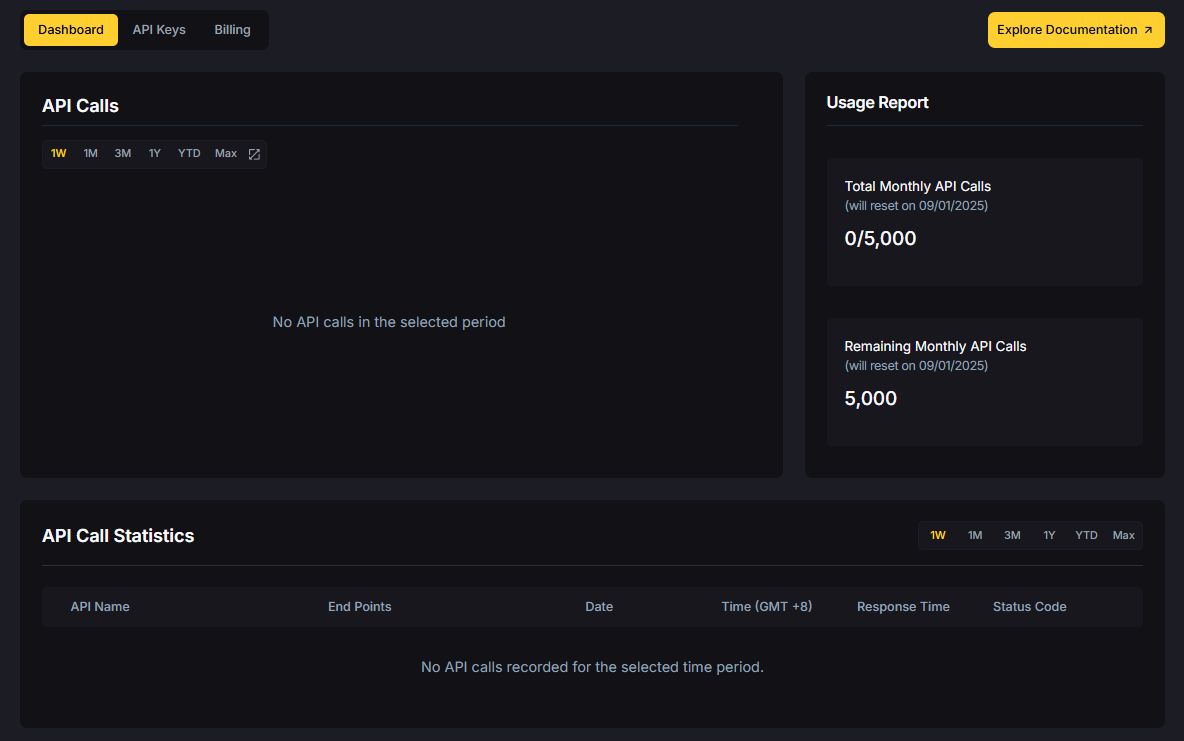

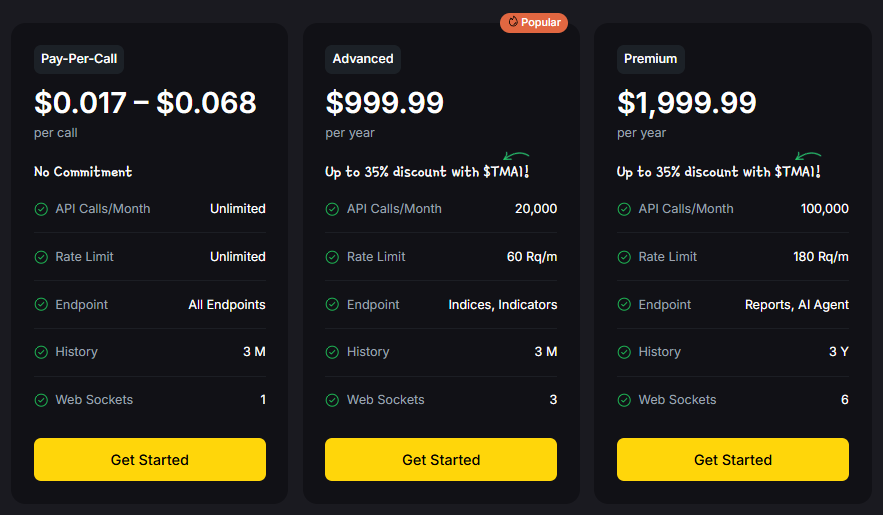

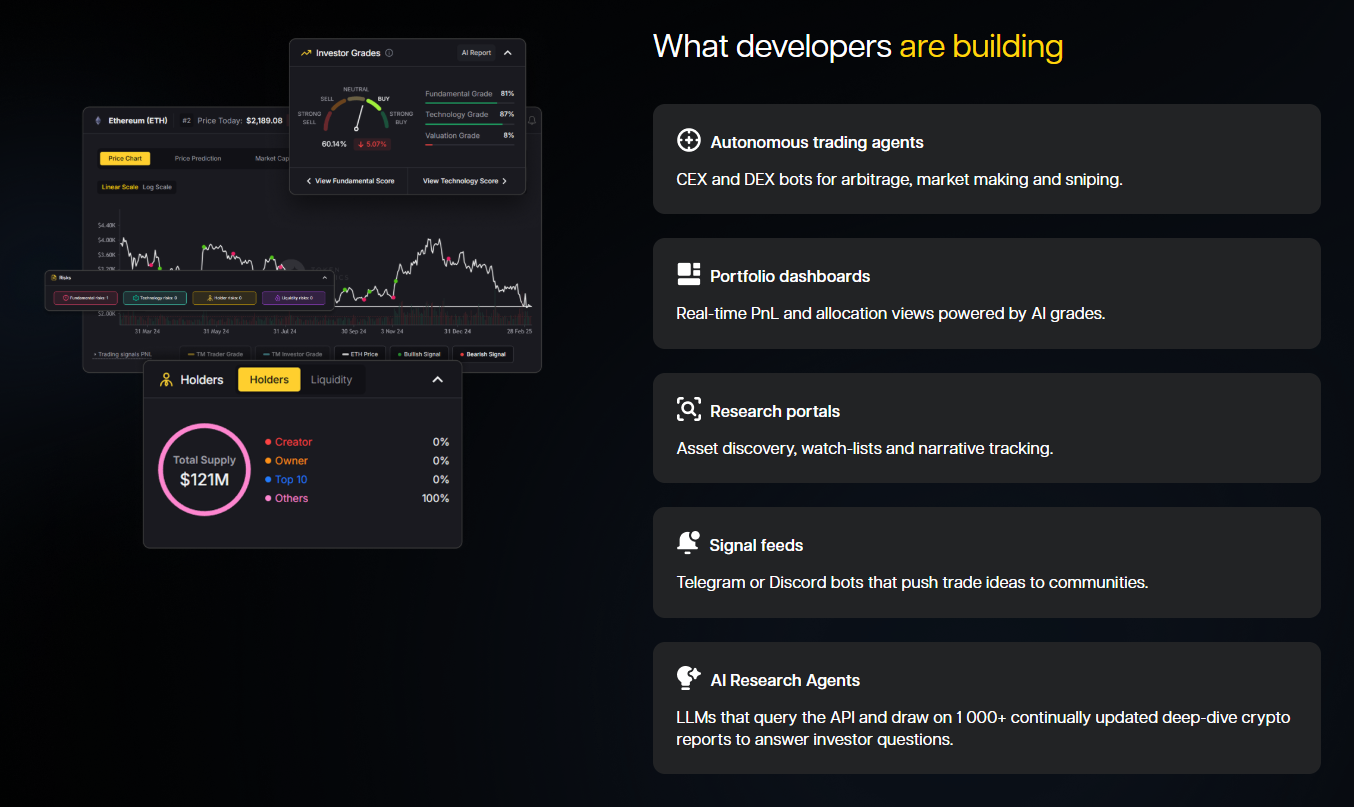

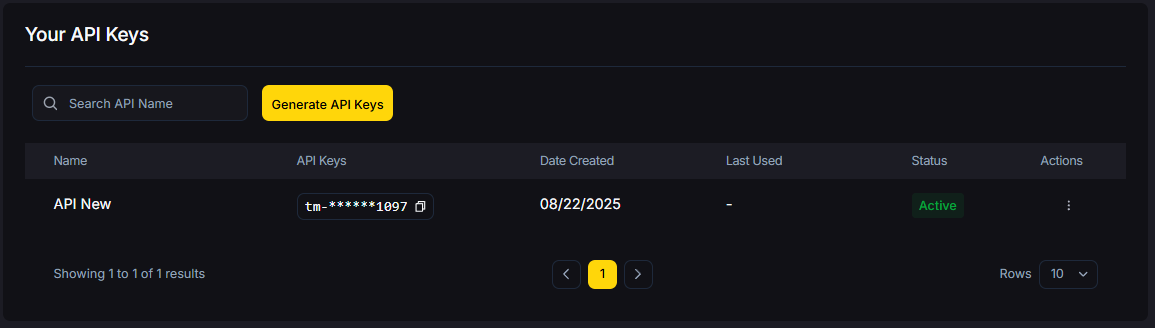

One best example is Token Metrics itself, We utilize AI's capabilities to deliver high-performance analytics and precise data solutions to users. At Token Metrics, we integrate AI technology and human expertise into our products to provide accurate and reliable market analysis to our users.

By leveraging AI algorithms, we can process and analyze vast amounts of data efficiently, allowing us to deliver insights and price predictions that aid users in making informed investment decisions. To learn more about the Token Metrics platform, head over to app.tokenmetrics.com and register now.

The future of AI in Crypto Space

The future of AI in the crypto space is incredibly promising, as the technology continues to evolve and become more sophisticated. One area where AI is expected to make significant strides is in predicting market trends and analyzing large amounts of data quickly and accurately.

As the crypto market becomes increasingly complex, AI will play a crucial role in identifying trends and patterns that human analysts may miss. AI-powered chatbots and virtual assistants will also become more prevalent, providing data backed suggestions on investment and support to traders and investors.

Overall, the future of AI in the crypto space is exciting, and it is expected to revolutionize the way investors and traders approach the market.

Conclusion

In conclusion, AI is playing a vital role in the crypto industry by enhancing its efficiency, security, and transparency. AI is transforming the way trading is done, detecting and preventing fraud, improving security, and enhancing governance. The crypto industry is experiencing a paradigm shift in the way it operates due to AI's advancements, and the future looks bright.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)