Shiba Inu Price Prediction 2025, 2030, 2040 - Forecast Analysis

Click here to trade cryptos at MEXC!

Contact us at promo@tokenmetrics.com for marketing and sponsorship programs.

Shiba Inu, a viral meme coin that emerged in 2020, has drawn significant attention in crypto trading. This article will provide an in-depth Shiba Inu Price Prediction for 2025, 2030, and 2040.

We will analyze its historical performance, current fundamentals, and industry experts' opinions. Additionally, we will explore whether Shiba Inu is a good investment and when it might reach 1 cent. The goal is to aid potential investors in making informed decisions.

Shiba Inu Overview

Shiba Inu, also known as SHIB, is a decentralized cryptocurrency introduced in August 2020. It was created by an unknown entity known as 'Ryoshi.' SHIB operates on the Ethereum platform and is an ERC-20 token.

The total supply of Shiba Inu coins is a staggering one quadrillion. This meme-inspired token gained popularity due to celebrity endorsements, primarily from Tesla CEO Elon Musk.

Historical Performance of Shiba Inu Coin

Shiba Inu's historical performance provides insight into its price volatility and growth potential.

Despite experiencing a significant dip in its first year of trading, Shiba Inu witnessed an astronomical growth of 43,220,000% in 2021, reaching an all-time high of $0.00008819 in October 2021. Shiba Inu is trading at $0.0000079 as of the time of writing.

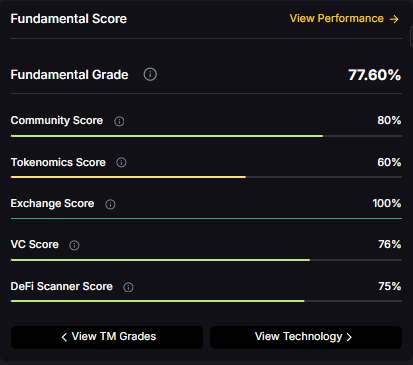

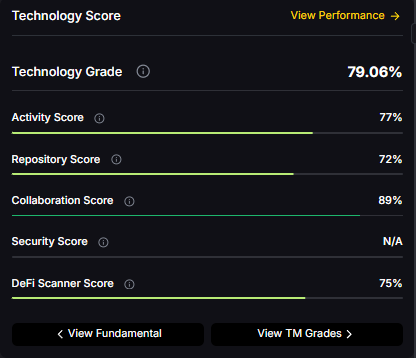

Shiba Inu Current Fundamentals

Shiba Inu's potential for future growth can be extrapolated from its current fundamentals—a significant development and focus on Shibarium, a layer-2 solution for the Shiba Inu ecosystem.

Shibarium is expected to lower transaction costs, expedite transactions, and improve overall performance. It could boost Shiba Inu's scalability and reach a broader user base.

Shiba Inu Price Prediction - Scenario Analysis

Amidst the dynamic crypto landscape, Shiba Inu (SHIB) presents intriguing possibilities. Currently priced at $0.0000079 with a market cap of $4.72B, SHIB's potential is tethered to the total crypto market cap. Should the crypto market cap hit $3 Trillion, and if SHIB retains its current 0.36% dominance, its price could ascend to $0.0000184383.

In a more bullish scenario of the crypto market surging to $10 Trillion, SHIB's price could soar to a staggering $0.0000614612, resulting in a potential 7x return for investors.

This prospective growth showcases the coin's potential amidst a booming crypto market. Investors should remain vigilant and consider various factors before making decisions.

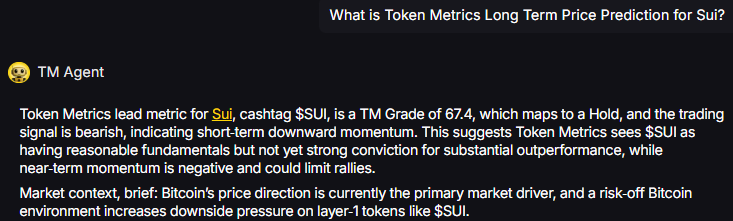

Shiba Inu Price Prediction - Industry Experts Opinion

Various industry experts and analytical tools have made their Shiba Inu price predictions. For instance, Wallet Investor forecasts Shiba Inu's price to drop by over 80% in one year. In contrast, The Coin Republic believes the recent spike in whale activity could propel SHIB's price, leading to a strong uptrend.

Shiba Inu Price Prediction for 2025

The Shiba Inu Price Prediction for 2025 varies depending on the source. Coincodex.com platform predicts it could reach $0.00001442 to $0.00005804, and experts from Changelly predict it could reach minimum and maximum prices of $0.000020148 and $0.0000237876

Shiba Inu Price Prediction for 2030

According to Coincodex.com, by 2030, the Shiba Inu Price is predicted to be between $0.00004156 and $0.00005261.

Shiba Inu Price Prediction for 2040

Predicting the Shiba Inu Price for 2040 is challenging due to the long time frame and the volatile nature of the crypto market. However, some forecasts suggest continued growth based on the coin's historical performance and potential future developments.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Click here to trade cryptos at MEXC!

Contact us at promo@tokenmetrics.com for marketing and sponsorship programs.

Is Shiba Inu Coin a Good Investment?

Shiba Inu can be a good investment for high-risk investors due to its potential for high returns. However, its volatility and the uncertain nature of the meme coin market make it a risky venture.

However, with strong community backing and ongoing developments, it may provide significant returns for high-risk investors.

When Will Shiba Inu Reach 1 Cent?

Many investors and traders eagerly anticipate when Shiba Inu reaches the 1 cent mark. However, this may not be possible considering the current circulating supply of 589 trillion tokens.

And to reach a value of $1, the market cap of Shiba Inu would have to be $589 trillion, which is currently unattainable.

However, introducing a burn rate mechanism with Shibarium could increase deflationary pressure on the currency, which may, in turn, push its value higher.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Risks and Rewards

Shiba Inu is a cryptocurrency that has garnered significant attention due to its popularity. However, it's essential to understand that investing in Shiba Inu comes with its own set of risks and rewards.

On the one hand, Shiba Inu has gained popularity for its low price and the potential positive impact of Shibarium, a decentralized exchange developed by the Shiba Inu team. This could potentially lead to substantial returns for investors in the long term.

On the other hand, the volatile nature of meme coins and competition from newer coins could affect their market value adversely. Additionally, the lack of a clear roadmap and whitepaper for the project might make it challenging to understand its long-term goals and growth potential.

Therefore, doing your research before investing in Shiba Inu is essential. You should consider the potential risks and rewards and evaluate whether they align with your investment strategy and risk tolerance.

Also Read - Is Shiba Inu Dead?

Conclusion

In conclusion, Shiba Inu is a high-risk, high-reward investment. Its future growth will largely depend on several factors, including the Shibarium, continued support from its community, and overall market conditions. As always, potential investors should do their homework before jumping in.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

Click here to trade cryptos at MEXC!

Contact us at promo@tokenmetrics.com for marketing and sponsorship programs.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)