Should I Use Leverage When Trading Crypto?

Leverage trading has become a hot topic in the crypto world. Many traders are attracted by the promise of amplified profits—but fail to realize it also magnifies losses. If you’ve been wondering, “Should I use leverage when trading crypto?” the short answer is: only if you fully understand the risks and have a solid strategy.

In this guide, we’ll break down what leverage trading is, how it works, its pros and cons, and how AI-powered tools like Token Metrics can help you make smarter decisions when trading with leverage.

What Is Leverage Trading in Crypto?

Leverage trading lets you borrow funds from an exchange to increase your position size, allowing you to control more capital than you actually own.

For example:

- If you have $1,000 and use 10x leverage, you’re trading with $10,000.

- A 10% price increase can give you a 100% profit on your original investment.

- But a 10% price drop could wipe out your position completely.

Popular platforms like Binance, Bybit, and OKX offer leverage levels from 2x to 125x for certain assets.

Pros of Leverage Trading

Leverage isn’t all bad. When used responsibly, it offers several benefits:

1. Higher Profit Potential

Even small price movements can generate significant returns when using leverage.

2. Portfolio Efficiency

Traders can free up capital for other positions while maintaining large exposure in a leveraged trade.

3. Opportunities in Bear Markets

Leverage allows for short selling, enabling you to profit when prices go down.

Cons of Leverage Trading

The same factors that make leverage attractive also make it high-risk:

1. Amplified Losses

Just as leverage magnifies profits, it magnifies losses. A minor price drop could liquidate your entire position.

2. Liquidation Risk

When your collateral falls below a certain threshold, the exchange automatically closes your position, locking in your losses.

3. Emotional Stress

Leverage trading is fast-paced and stressful, often leading to panic selling or revenge trading after losses.

Should Beginners Use Leverage?

No.

If you’re new to trading, avoid leverage until you have:

- A proven strategy with consistent results in spot trading.

- Strong risk management skills (e.g., using stop-loss orders).

- The ability to stay disciplined under pressure.

For beginners, leveraged trading can be a fast track to losing your capital.

When Does It Make Sense to Use Leverage?

For experienced traders, leverage can make sense when:

- You’re hedging your portfolio against downside risk.

- You have high conviction in a trade and want to maximize gains.

- You’re trading high-liquidity assets like BTC or ETH with well-defined stop-losses.

How Token Metrics Helps You Trade Smarter with Leverage

Leverage trading requires precision, and that’s where Token Metrics gives you an edge.

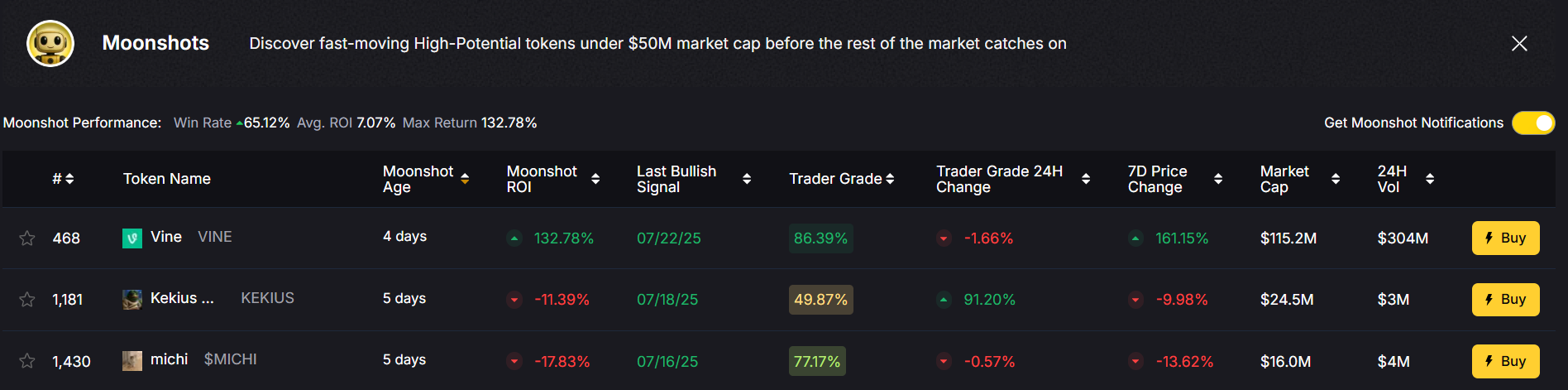

1. AI-Powered Bullish & Bearish Signals

Identify high-probability trades with real-time AI signals based on 80+ technical indicators. This helps you avoid entering positions blindly.

2. Trader & Investor Grades

Use Trader Grades for short-term trading opportunities and Investor Grades for long-term positions—helping you decide when to scale up or reduce leverage.

3. Risk Assessment Tools

Token Metrics evaluates crypto projects and market trends to reduce exposure to high-risk assets—a must for leveraged positions.

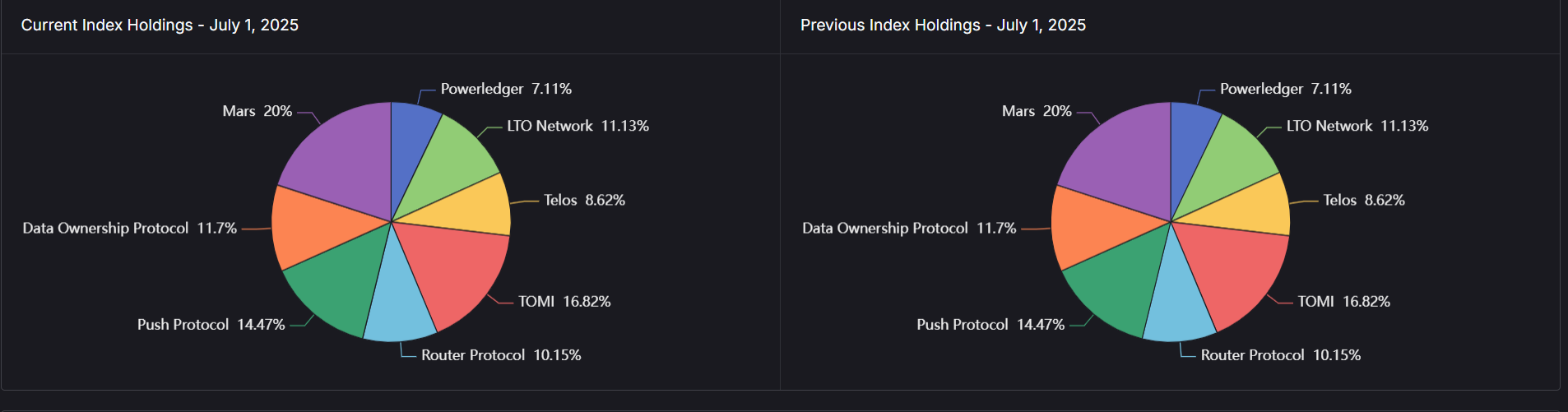

4. AI-Driven Indices

Don’t want to trade manually? Use our AI-managed crypto indices to gain diversified exposure without taking unnecessary leveraged risks.

5. Narrative Detection

Our AI identifies emerging narratives before they hit mainstream attention, giving you a strategic edge in timing trades—crucial when using leverage.

Best Practices for Using Leverage in Crypto

If you decide to use leverage, follow these rules:

- Start Small: Use low leverage (2x–3x) instead of going all in at 20x or 50x.

- Set Stop-Loss Orders: Always predetermine your maximum loss tolerance.

- Trade Liquid Assets: Stick to high-volume coins like BTC and ETH to avoid slippage.

- Don’t Overtrade: Only use leverage on trades with strong conviction and proper analysis.

- Use AI Tools: Let Token Metrics guide your entries and exits with data-driven insights.

Why Overleveraging Is Dangerous

Many traders lose money by overleveraging, which leads to:

- Margin calls and forced liquidations.

- Revenge trading, where losses push traders into reckless decisions.

- Complete portfolio wipeouts from one bad trade.

Pro Tip: Only trade with leverage on funds you can afford to lose.

Final Thoughts

So, should you use leverage when trading crypto?

For beginners, the answer is no—focus on mastering spot trading first. For experienced traders, leverage can be a powerful tool when used with strict risk management and data-driven insights.

That’s where Token Metrics makes a difference. With AI-powered trading signals, real-time risk analysis, and narrative tracking, Token Metrics helps you trade smarter, reduce emotional mistakes, and optimize your leverage strategy.

Leverage can make you or break you—so don’t go in blind. Use Token Metrics to guide your trades and stay ahead of the market.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)