Slippage and Gas Fees Killing Your Returns? One-Trade Index Solution for 2025

Every crypto trader understands the frustration of carefully calculating expected profits, executing trades, and then watching as slippage and gas fees quietly eat away at those returns. In 2025’s volatile crypto market, these hidden costs have become more than just a minor annoyance—they are systematically killing portfolio performance for both active traders and passive investors alike. This points to a deeper problem: the current crypto trading system is fundamentally flawed, with inefficiencies and complexities that undermine user confidence and adoption. If you manage a diversified crypto portfolio with dozens of tokens, chances are you’re bleeding value every time you rebalance or transfer funds. Understanding exactly how much these fees impact your profits is the first crucial step toward saving your portfolio from further losses.

The Hidden Tax on Crypto Portfolio Management

To fully grasp the challenge, it’s important to break down the real cost of building and maintaining a diversified crypto portfolio in today’s environment. Two major factors contribute to the erosion of your returns: slippage and gas fees.

Slippage occurs when the price at which your trade executes differs from the price you initially expected. This discrepancy is driven by factors such as market volatility, low liquidity, and order book depth. For smaller-cap altcoins within the top 100 tokens, slippage can easily reach 1-3% per trade. This means that even if you think you’re buying or selling at a certain price, the actual execution price might be worse, reducing your value and profits.

Gas fees are another critical cost to watch closely. Every on-chain transaction—whether swapping tokens on decentralized exchanges or transferring assets between wallets—requires payment of gas fees to miners or validators who confirm transactions on the blockchain. During periods of network congestion, especially on Ethereum and other popular chains, gas prices can spike dramatically. Gas fees are calculated based on current network activity and the complexity of each trade, so understanding this calculation helps traders anticipate costs and optimize their transactions. It’s not uncommon to pay $20 to $50 or more for a single transaction. These fees are not just occasional expenses; they add up quickly and can severely impact the profitability of frequent trades.

Network congestion and the choice of blockchain can also affect the speed at which transactions are confirmed, with slower speeds leading to delays and potentially higher costs during busy periods.

When you combine these two factors, the costs compound rapidly. Imagine managing a portfolio of 50 to 100 tokens and rebalancing monthly. Each rebalance involves dozens of trades, each incurring slippage and gas fees. This results in a significant drag on your overall portfolio performance.

For example, consider a trader managing a $50,000 portfolio spread across 100 tokens who decides to rebalance monthly. Assuming an average gas fee of $15 per swap and 1.5% average slippage, the cost of rebalancing just once would be approximately $1,500 in gas plus $750 lost to slippage—totaling $2,250, or 4.5% of the portfolio value, wiped out before any market movement occurs. Over a year of monthly rebalances, these costs can exceed 20% of the initial capital, enough to completely erase gains from even a modest bull market.

The Effects of Low Liquidity

Low liquidity is one of the most persistent challenges in the crypto trading world, and its impact on your portfolio can be both immediate and severe. When liquidity dries up—whether due to market volatility, volume spikes, or simply a lack of active traders—executing trades becomes riskier and more expensive. For traders dealing with large trades or those who set tight slippage tolerance, low liquidity can quickly turn a profitable strategy into a costly mistake.

In markets with low liquidity, even modest buy or sell orders can trigger significant price moves, causing the actual execution price to deviate sharply from what you expected. This slippage is especially pronounced on decentralized exchanges, where order books are often thin and a single large trade can move the market. For example, attempting to swap a sizable amount of a low-liquidity token can result in a short squeeze, where the price spikes rapidly, leaving you with fewer tokens for your dollar and eroding your profits.

The risks don’t stop at unfavorable prices. Low liquidity also increases the likelihood of failed transactions, particularly if you set a strict slippage protection limit. If the market can’t deliver your trade within your specified slippage tolerance, the transaction may fail entirely—forcing you to pay gas fees for a trade that never completes. In periods of network congestion, this problem is magnified: not only do you face higher gas prices as users compete to get their transactions confirmed, but the odds of failed or delayed trades rise as well.

To navigate these challenges, traders rely on a combination of tools and strategies. Monitoring volume indicators can help you gauge the current liquidity of a token or market, allowing you to adjust your trade size or slippage tolerance accordingly. Some participants opt to break up large trades into smaller transactions to minimize price impact, while others use slippage protection features to cap potential losses—though this can increase the risk of failed transactions and wasted gas fees.

Timing is also crucial. Trading during periods of lower network congestion—such as off-peak hours—can help you secure lower fees and faster transaction speeds. Additionally, choosing decentralized exchanges that leverage layer two solutions or alternative chains can further reduce costs and improve execution reliability.

Diversification remains a key defense against the risks of low liquidity. By spreading your portfolio across more liquid tokens and markets, you reduce your exposure to sudden price moves and failed trades. For instance, if you notice that a particular token’s volume has dropped, it may be wise to adjust your allocation or avoid trading it until conditions improve.

Consider the example of a trader attempting to execute a large swap on a thinly traded token. Without proper precautions, they might see the price move dramatically against them, or worse, have their transaction fail and still pay a hefty gas fee. By using slippage protection, monitoring liquidity, and timing trades to avoid network congestion, traders can save money, reduce risk, and protect their portfolio’s value.

In the fast-moving world of crypto, staying informed about liquidity conditions and adapting your trading strategies is essential. Whether you’re a seasoned trader or just starting out, keeping a close watch on gas fees, slippage, and market volume can help you avoid costly mistakes and manage your portfolio effectively—even when liquidity is scarce. By leveraging analytical tools and maintaining flexibility in your approach, you can navigate the challenges of low liquidity to support long-term portfolio objectives.

Token Metrics: Leading the Crypto Analytics Revolution

This is where Token Metrics steps in to change the game. As one of the leading crypto trading and analytics platforms in 2025, Token Metrics has built its reputation on delivering institutional-grade research, data-driven insights, and powerful tools tailored to both retail and professional traders. In addition to analytics, Token Metrics provides essential services that enable seamless data flow and value transfer across the crypto ecosystem.

Founded on the principle that cryptocurrency investing should be systematic, accessible, and intelligent, Token Metrics offers comprehensive analytics covering thousands of digital assets. The platform combines proprietary market signals, AI-powered ratings, and deep quantitative analysis with on-chain data and technical indicators. As an app, Token Metrics streamlines the crypto trading process for users. But beyond just research, Token Metrics recognized a crucial problem: even the best analysis can be undermined by poor trade execution, which slippage and gas fees exacerbate.

To address this, Token Metrics developed automated index solutions designed to help eliminate the execution tax that impacts portfolio returns. These tools allow users to save on fees, reduce risk, and improve overall portfolio efficiency by streamlining the trade process. By focusing on key trading strategies and metrics, Token Metrics helps users make informed decisions with robust supporting data.

Introducing the One-Trade Solution: TM Global 100

The TM Global 100 Index is Token Metrics’ innovative response to the slippage and gas fee crisis. By streamlining exposure to the top-100 crypto assets, the index helps mitigate risks that typically affect arbitrage strategies, such as slippage and execution delays, making it easier for participants to maintain portfolio consistency. Instead of executing dozens of individual trades to achieve broad market exposure, this rules-based index delivers a complete top-100 crypto portfolio through a single transaction.

Single-Transaction Execution

The key advantage of the TM Global 100 is that you only need to execute one trade to gain exposure to 100 tokens. This means paying one gas fee instead of dozens and experiencing minimal slippage on a single, larger transaction rather than accumulated slippage across many smaller trades. Since blockchain networks have limited space, executing a single transaction also helps avoid network congestion and keeps transaction costs lower, improving overall efficiency.

The math is compelling: one transaction versus 100 transactions represents a 99% reduction in gas fees alone. Even if the index rebalances weekly—which it does automatically—you pay no extra gas fees because all internal adjustments happen within the index structure.

Automated Weekly Rebalancing at Zero Cost

Traditional portfolio management requires constant monitoring, manual calculations, and repeated trades to maintain target allocations. The TM Global 100 automates this entire process, rebalancing weekly to reflect the current top-100 tokens by market capitalization. This means no need to watch 100 different tickers across multiple decentralized exchanges, no manual rebalance timing decisions, and no accumulated transaction costs from frequent adjustments.

This automated rebalancing flow ensures your portfolio stays aligned with market shifts without the need to sign off on every trade or pay additional fees. Automation also helps catch sudden market changes or potential issues early, supporting timely adjustments.

Regime-Switching Protection

Beyond cost savings, the TM Global 100 incorporates intelligent risk management through proprietary market signal detection. When market conditions shift from bullish to bearish, the index automatically moves holdings from the top-100 crypto assets into stablecoins, providing capital protection during downturns.

This regime-switching strategy means that during bull markets, you maintain full exposure to the broad upside of the crypto market, while during bear markets, your funds are preserved in stablecoins until positive signals emerge. This automatic adjustment helps avoid the need for panic selling or multiple transactions, and also supports recovery by positioning investors to re-enter the market at more favorable times, further reducing slippage, fees, and risk.

Real-World Impact: Cost Comparison

To illustrate the benefits, let’s compare the costs of two approaches to diversified crypto exposure:

- DIY Portfolio Management (100 tokens, quarterly rebalancing):

- Initial build: Approximately $1,500 in gas plus $750 in slippage, totaling $2,250

- Quarterly rebalances: $2,250 × 4 = $9,000 annually

- Regime switches (2 per year): $2,250 × 2 = $4,500

- Total annual execution cost: Around $13,500

- TM Global 100 Index:

- Initial purchase: Single transaction with typical gas fee between $15 and $50

- Weekly rebalances: Included at zero additional cost

- Regime switches: Automatic and free of extra fees

- Total annual execution cost: Approximately $50

The difference—more than $13,000 saved annually—directly impacts your portfolio’s performance. When comparing these options, the TM Global 100 approach offers significantly lower transaction costs and more predictable outcomes, allowing you to keep more of your assets working for you instead of spent on fees and slippage.

Getting Started: Join the Waitlist

The TM Global 100 Index launches with an embedded, self-custodial smart wallet, ensuring you have full control of your funds while accessing institutional-grade index investing. The purchase process is simple and takes about 90 seconds:

- Visit the Token Metrics Indices hub at tokenmetrics.com/indices

- Select TM Global 100 and tap Join Waitlist

- Connect your wallet to preview the one-click buy flow. Ensure your wallet can accept the token for a smooth transaction.

- Upon launch, receive a notification and execute your purchase. Double-check details such as wallet address and network before confirming.

- Track your portfolio performance in real time with transparent holdings, transaction logs, and profit & loss details.

- All fees—including estimated gas, platform fees, and maximum slippage—are displayed clearly before you confirm your transaction.

This transparency ensures no surprises or hidden costs, allowing for informed decision-making. Transactions may be blocked due to compliance or verification issues, such as incomplete information or regulatory requirements. If a transaction is pending and not confirmed, you may have the option to cancel it by paying a higher gas fee.

The Bottom Line

In 2025’s fast-moving and often congested crypto networks, execution costs are no longer a minor inconvenience—they are a significant consideration for portfolio management. Slippage and gas fees compound quickly when managing diversified portfolios, potentially impacting 20% or more of your capital annually.

Token Metrics’ TM Global 100 Index addresses this by offering single-transaction access to a complete top-100 portfolio, automated weekly rebalancing, and intelligent regime-switching—all while ensuring full transparency and self-custody. This innovative solution allows you to focus on portfolio growth rather than unnecessary execution costs or the effects of market volatility.

If you’re looking for a more efficient, cost-effective approach to self-managed crypto index investing, joining the TM Global 100 waitlist could be your next step. Explore early access to TM100 indices at Token Metrics.

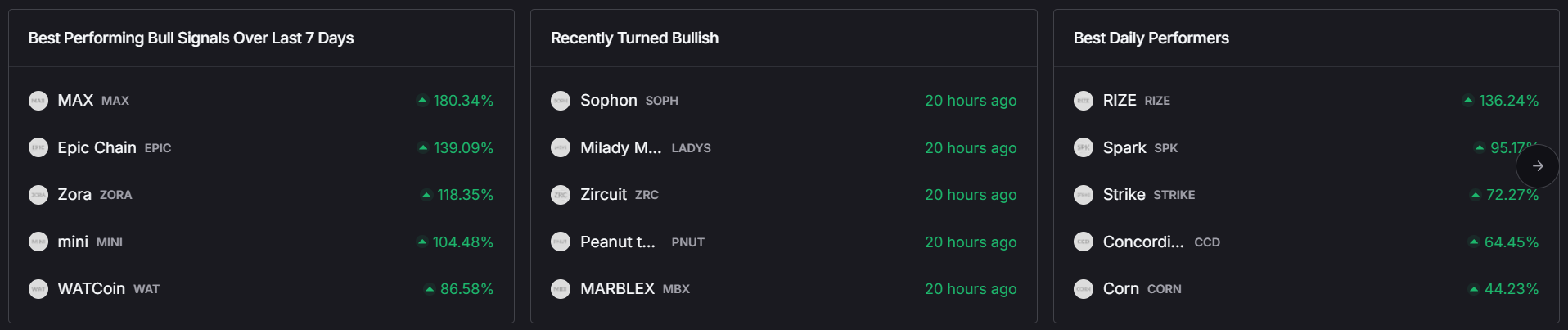

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

FAQs

How do slippage and gas fees impact crypto returns?

Slippage and gas fees can significantly reduce portfolio returns, especially for traders managing diversified portfolios or rebalancing frequently. Each trade may execute at a less favorable price due to slippage, while gas fees accrue for every on-chain transaction. Over time, these costs can compound, eroding the profitability of even a well-performing portfolio.

What is the TM Global 100 Index?

The TM Global 100 Index is a rules-based crypto index offered by Token Metrics. It provides diversified exposure to the top-100 cryptocurrencies in a single transaction, automating rebalancing and implementing regime-switching strategies to help minimize costs and manage risk.

How does automated rebalancing save money?

Automated rebalancing eliminates the need for multiple manual trades, each incurring their own slippage and gas fees. By consolidating portfolio adjustments into a single, internal process, automated indices can reduce execution costs and keep portfolios aligned with market shifts more efficiently.

What is regime-switching and how does it work?

Regime-switching is a risk management feature in the TM Global 100 Index that adjusts portfolio allocations based on proprietary market signals. When bearish market conditions are detected, the index shifts assets into stablecoins to help preserve capital, re-entering the market when positive signals return.

How transparent are fees with Token Metrics' index solutions?

All estimated gas, platform fees, and slippage limits are displayed clearly before transactions are confirmed. This level of fee transparency ensures that users can make fully informed decisions and are never caught off guard by hidden costs.

What are the risks of using crypto index products?

As with all crypto investments, index products involve market risk, potential smart contract vulnerabilities, and regulatory considerations. Users should conduct due diligence and ensure they understand the associated risks before participating.

Disclaimer

This content is for informational and educational purposes only and does not constitute investment advice or an offer to buy or sell any financial instrument. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Token Metrics does not guarantee the accuracy or completeness of information or assume any liability for loss or damage resulting from reliance on this content.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.svg)

.png)