What are Stablecoins? - The Ultimate Guide for Beginners

In the dynamic world of cryptocurrencies, change is the only constant. The value of Bitcoin, the largest and most well-known cryptocurrency, often rides a roller-coaster, skyrocketing one moment and nose-diving the next.

Amidst such turbulence, Stablecoins emerge as a beacon of stability. These distinctive cryptocurrencies are meticulously designed to counter extreme price swings by anchoring their value to a reserve of stable assets, typically a fiat currency such as the US dollar.

But what exactly are Stablecoins, and why are they so crucial in the cryptocurrency ecosystem? Let's explore this in detail in our ultimate guide.

What are Stablecoins?

Stablecoins are a type of cryptocurrency that are designed to maintain a stable value relative to a specific asset or a pool of assets. They can be pegged to a currency like the US dollar or to a commodity's price such as gold.

The primary purpose of Stablecoins is to bridge the gap between the traditional financial system and cryptocurrencies.

They offer the best of both worlds – the speed, privacy, and accessibility of cryptocurrencies, and the reliable, stable value of traditional currencies.

How do Stablecoins Work?

Stablecoins derive their stability from the reserve of assets they are pegged to. These reserves can include fiat currencies, other cryptocurrencies, or commodities like gold.

There are three main types of Stablecoins, each distinguished by the type of asset reserve they're pegged to.

Fiat-Collateralized Stablecoins: These Stablecoins are backed by fiat currencies at a 1:1 ratio. For every Stablecoin issued, there's an equivalent amount of fiat currency kept in reserve. This offers high stability but requires trust in the central authority managing the reserve.

Crypto-Collateralized Stablecoins: These are backed by other cryptocurrencies. Since cryptocurrencies are volatile, these Stablecoins are over-collateralized, meaning the total value of collateral is significantly higher than the value of Stablecoins issued. This buffer ensures that the Stablecoins value remains stable.

Non-Collateralized Stablecoins: These Stablecoins aren't backed by any reserve. Instead, they employ algorithms to manage the supply of the coin, much like a central bank manages the supply of fiat currency.

Why are Stablecoins Important?

Stablecoins are critical for several reasons:

Reduced Volatility: Stablecoins offer an escape from the wild swings of the crypto market without exiting the ecosystem entirely.

Crypto Transactions: They facilitate transactions in the crypto world, making it easier to trade on exchanges without converting to fiat currencies.

Stability in DeFi: Stablecoins form the backbone of the burgeoning DeFi (Decentralized Finance) sector, facilitating loans, interest-earning platforms, and more.

Global Transfers: Stablecoins enable fast and cheap global transfers, especially where local banking systems are inefficient.

List of Best and Popular Stablecoins

As of 2023, several Stablecoins have risen to prominence due to their stability, security, and usability. Here's a look at the top 5:

Tether (USDT): Tether remains the most widely used Stablecoin, primarily used in cryptocurrency exchanges for trading and hedging.

USD Coin (USDC): As a fully audited, transparent, and secure Stablecoin, USDC has gained significant trust in the crypto community.

DAI: Unlike most Stablecoins, DAI is not backed by fiat but by Ethereum-based assets. Its decentralized nature has made it a favorite in the DeFi sector.

Binance USD (BUSD): Launched by one of the biggest crypto exchanges, Binance, BUSD has quickly risen to prominence.

TerraUSD (UST): An algorithmic Stablecoin, UST has seen significant growth due to its use in the Terra ecosystem, particularly for yield farming.

Also Read - USDT vs USDC - An in-depth Comparison

Stablecoins and Crypto Regulation

Stablecoins have been a topic of regulatory discussions worldwide. On one hand, they represent a way for the public to access digital currencies without extreme volatility.

On the other hand, the lack of a centralized authority and potential for misuse have raised regulatory eyebrows.

In response, some governments are exploring the creation of Central Bank Digital Currencies (CBDCs) to provide state-backed stable digital currencies.

The crypto regulatory landscape for Stablecoins is thus evolving and is expected to shape their future significantly.

Risks and Rewards

Stablecoins offer numerous benefits, such as facilitating crypto transactions, providing an escape from crypto volatility, and acting as a crucial cog in the DeFi wheel. They are also excellent tools for cross-border transfers and remittances.

However, Stablecoins are not without risks. These include the volatility of collateral for crypto-backed Stablecoins, trust in the issuers for fiat-backed Stablecoins, and regulatory risks. Moreover, algorithmic Stablecoins are still experimental and can face issues in maintaining their pegs.

Future Outlook of Stablecoins

As we look to the future, Stablecoins are poised to play a crucial role in shaping the digital economy.

They will likely serve as the backbone of the global DeFi ecosystem, enabling efficient, decentralized, and non-custodial financial services.

Moreover, Stablecoins could pave the way for programmable money, changing how we interact with financial systems fundamentally.

As technology advances and more people embrace digital currencies, Stablecoins might become increasingly commonplace, acting as a widely accepted and trusted means of exchange in the digital world.

Frequently Asked Questions

Q1. Can a Stablecoin lose its peg?

Yes, a Stablecoin can lose its peg if its value diverges from the asset it's pegged to. This usually happens due to market dynamics, like sudden demand changes or issues with the underlying collateral. However, most Stablecoin issuers implement mechanisms to restore the peg in such situations.

Q2. How are Stablecoins created or issued?

Stablecoins are typically issued by organizations or protocols when users deposit the requisite collateral. For fiat-collateralized Stablecoins, users deposit fiat currency with the issuer. For crypto-collateralized ones, users lock up crypto assets in a smart contract.

Q3. Can Stablecoins earn interest?

Yes, some DeFi platforms allow users to earn interest on their Stablecoins. This is done by lending your Stablecoins to others through the platform, who pay interest on their loans.

Q4. How can I buy Stablecoins?

Stablecoins can be purchased on a majority of cryptocurrency exchanges. Some platforms also allow direct purchase of Stablecoins with fiat currency.

Q5. What is a CBDC and how is it different from Stablecoins?

CBDC, or Central Bank Digital Currency, is a type of digital currency issued by a country's central bank. While it shares some similarities with Stablecoins, a CBDC is fully regulated and operates under the country's monetary policy. It's essentially a digital form of the country's fiat currency.

Q6. Can Stablecoins be used for remittances?

Yes, due to their stability and global accessibility, Stablecoins are an excellent option for cross-border transfers and remittances. They offer a way to move money internationally quickly and with relatively low fees.

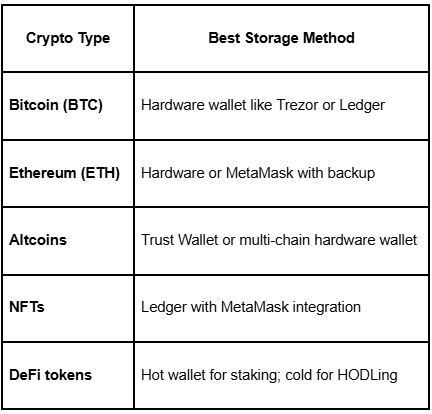

Q7. Are Stablecoins secure?

While the blockchain technology underlying Stablecoins is generally secure, there can be risks. These include smart contract bugs for crypto-collateralized Stablecoins, and security of the reserves for fiat-collateralized Stablecoins. It's essential to use reputable Stablecoins and platforms.

Q8. Are all Stablecoins pegged to the US dollar?

While many Stablecoins are pegged to the US dollar, not all are. Some Stablecoins are pegged to other currencies like the Euro or commodities like gold. Others use a basket of assets for their peg.

Conclusion

Stablecoins represent a vital bridge between traditional finance and the burgeoning world of crypto. They combine the stability of fiat currencies with the advantages of cryptocurrencies, driving innovation in the financial sector.

While there are challenges to overcome, including regulatory hurdles and issues of trust and transparency, the future of Stablecoins seems bright.

As we continue to march towards a more digital economy, Stablecoins may very well be a cornerstone of this new world.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

%201%20(1).png)

.png)

.svg)

.png)