The Death of "Buy and Hold": Why Crypto Has Become a Trader's Market in 2025

%201.svg)

%201.svg)

The cryptocurrency landscape has fundamentally shifted, and traditional investment strategies are failing investors across the board. If you're wondering why your altcoin portfolio is down 95% despite solid fundamentals, you're not alone—and there's a critical reason behind this market transformation.

The New Reality: Attention Economy Over Fundamentals

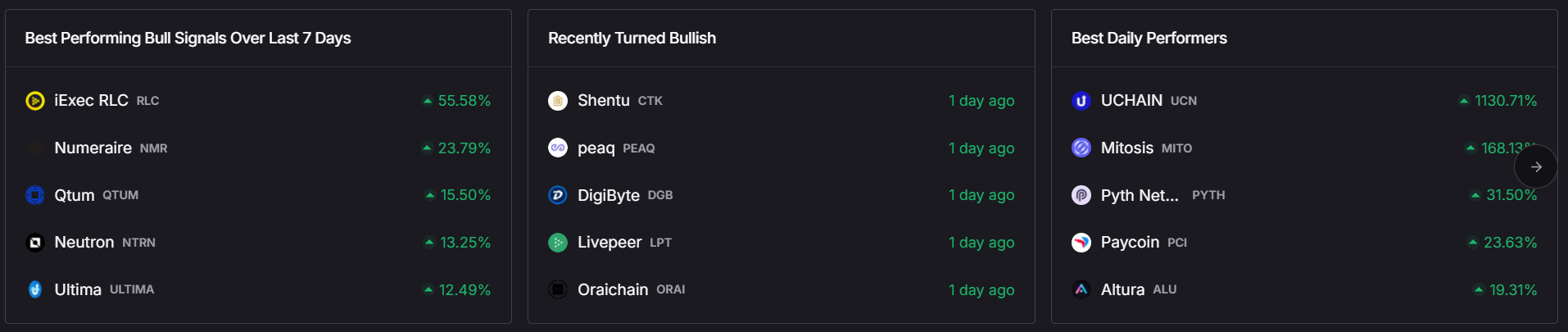

According to recent market analysis from Token Metrics, we've entered what experts are calling a "trader's market." The old premise of buying based on technology and fundamentals has essentially expired this cycle. Instead, crypto has evolved into an attention economy focused on trading narratives rather than long-term value accumulation.

"The old strategy of buying and holding fundamental assets like in past cycles and expecting them to do well—that ship has sailed," explains Ian Balina, highlighting a harsh reality many investors are facing.

Why Traditional Strategies Are Failing

The core issue lies in market saturation. Today's crypto market features 100 to 1,000 times more tokens competing for the same amount of trading volume as previous cycles. This massive increase in competition has fundamentally altered market dynamics, making it nearly impossible for individual projects to maintain sustained growth through fundamentals alone.

Key factors driving this shift include:

- Overwhelming token supply: New projects launch daily, diluting attention and capital

- Shortened attention spans: Investors jump between narratives quickly

- Professional trading dominance: Algorithmic and institutional trading has increased market efficiency

- Narrative-driven cycles: Success depends more on timing and story than underlying technology

The Altcoin Season Indicator: Your Market Timing Tool

One crucial metric investors should monitor is the Bitcoin versus Altcoin Season indicator. Currently sitting at 58%, this metric suggests that nearly 60% of returns are flowing into altcoins rather than Bitcoin.

Historically, when this indicator crosses 57%, it signals an ideal time to start trimming altcoin profits. The danger zone begins at 60% and above—previous cycle tops have seen this metric reach 80-88%, marking optimal exit points.

"This is literally a leading indicator historically on when to sell the top," notes the analysis, pointing to data from 2021 and 2022 cycle peaks.

Treasury Company Revolution: The New Institutional Wave

Despite challenges in traditional crypto investing, institutional adoption continues accelerating through treasury companies. MicroStrategy leads with $70 billion in Bitcoin holdings, including $23 billion in unrealized gains. BitMine recently purchased $2.2 billion worth of Ethereum, targeting 5% of ETH's total supply.

This institutional wave extends beyond Bitcoin and Ethereum:

- Solana: Multiple companies are raising billions for SOL-focused treasury strategies

- BNB: B Strategy launched a $1 billion vehicle backed by Binance's founder

- Multi-asset approaches: Diversified treasury companies are emerging across major cryptocurrencies

Projects Bucking the Trend: What's Actually Working

While most altcoins struggle, certain projects demonstrate sustainable growth models. Hyperliquid stands out as a prime example, maintaining consistent upward momentum through:

- On-chain revenue generation: Real trading fees and volume

- Token buyback mechanisms: 97% of revenue used for token purchases

- Growing user adoption: Institutional-level trades moving to the platform

Similarly, projects with genuine utility and revenue sharing are outperforming purely speculative assets.

The Meme Coin Exception

Interestingly, meme coins represent one segment that continues generating significant returns, albeit with extreme volatility. Projects like Bub (up 30% recently) demonstrate that community-driven assets can still achieve impressive gains, though these remain high-risk trading opportunities rather than investment plays.

World Liberty Financial: The Next Major Catalyst

Looking ahead, World Liberty Financial (WLFI) represents a significant upcoming event. Backed by the Trump family and featuring partnerships with established DeFi projects, WLFI launches September 1st with several notable characteristics:

- Fastest-growing stablecoin: USD1 reached $2.5 billion market cap

- Strong institutional backing: $715 million raised across funding rounds

- Treasury support: Alt 5 creating $1.5 billion treasury for the token

- Pre-market trading: Currently available on major exchanges around $0.20

Strategies for the New Market Reality

Given these market dynamics, successful crypto participants are adapting their approaches:

For Non-Traders

- Yield farming: Earn 7-10% on blue chips through DeFi protocols

- Diversified staking: Spread risk across multiple platforms

- Focus on revenue-sharing projects: Prioritize tokens with real utility

For Active Participants

- Narrative trading: Follow attention cycles and social sentiment

- Risk management: Take profits during pumps, maintain stop-losses

- Sector rotation: Move between trending narratives (AI, DeFi, memes)

The Path Forward

The crypto market's evolution into a trader's paradise doesn't mean opportunities have disappeared—they've simply changed form. Success now requires:

- Accepting the new reality: Buy-and-hold strategies need modification

- Developing trading skills: Even long-term investors need exit strategies

- Following institutional flows: Treasury companies signal major trends

- Monitoring key indicators: Use tools like altcoin season metrics

- Risk management: Position sizing and profit-taking become crucial

Conclusion

The transformation of crypto from a fundamentals-driven market to an attention-based trading ecosystem represents a natural evolution as the space matures. While this shift has created challenges for traditional investors, it has also opened new opportunities for those willing to adapt their strategies.

The key lies in understanding that we're no longer in 2017 or 2021—we're in a new era where narrative, timing, and trading acumen matter more than technology assessments. Those who embrace this reality while maintaining disciplined risk management will be best positioned for success in the current market environment.

Whether you're yielding farming for steady returns, trading narratives for quick gains, or waiting for the next institutional wave, the most important step is acknowledging that the rules have changed—and your strategy should change with them.

AI Agents in Minutes, Not Months

.svg)

Create Your Free Token Metrics Account

.png)

Recent Posts

API Gateway: Architecture, Patterns & Best Practices

%201.svg)

%201.svg)

Modern software architecture has evolved toward distributed systems composed of numerous microservices, each handling specific functionality and exposing APIs for interaction. As these systems grow in complexity, managing direct communication between clients and dozens or hundreds of backend services becomes unwieldy, creating challenges around security, monitoring, and operational consistency. API gateways have emerged as the architectural pattern that addresses these challenges, providing a unified entry point that centralizes cross-cutting concerns while simplifying client interactions with complex backend systems. This comprehensive guide explores API gateway architecture, security patterns, performance optimization strategies, deployment models, and best practices that enable building robust, scalable systems.

Understanding API Gateway Architecture

An API gateway functions as a reverse proxy that sits between clients and backend services, intercepting all incoming requests and routing them to appropriate destinations. This architectural pattern transforms the chaotic direct communication between clients and multiple services into an organized, manageable structure where the gateway handles common concerns that would otherwise be duplicated across every service. For cryptocurrency platforms where clients might access market data services, trading engines, analytics processors, blockchain indexers, and user management systems, the API gateway provides a single endpoint that orchestrates these interactions seamlessly.

The gateway's positioning at the network edge makes it the ideal location for implementing authentication, authorization, rate limiting, request transformation, response aggregation, and protocol translation. Rather than requiring each microservice to implement these capabilities independently, centralizing them in the gateway reduces code duplication, ensures consistency, and simplifies service implementation. Token Metrics leverages sophisticated API gateway architecture in its cryptocurrency platform, enabling developers to access comprehensive market data, AI-powered analytics, and blockchain intelligence through a unified interface while the gateway manages routing, security, and performance optimization behind the scenes.

Request routing forms the core responsibility of API gateways, mapping incoming requests to appropriate backend services based on URL paths, HTTP methods, headers, or request content. Simple routing might direct requests with paths beginning with /api/v1/cryptocurrencies to the market data service while routing /api/v1/trading requests to the trading engine. More sophisticated routing can implement canary deployments where a percentage of traffic routes to new service versions, A/B testing scenarios, or geographic routing directing users to regional service instances. For crypto API platforms serving global markets, intelligent routing ensures requests reach the most appropriate backend services based on multiple factors.

Service composition enables API gateways to aggregate responses from multiple backend services into unified responses, reducing the number of round trips clients must make. When a mobile application requests a comprehensive view of a user's cryptocurrency portfolio, the gateway might simultaneously query the portfolio service for holdings, the market data service for current prices, the analytics service for performance metrics, and the news service for relevant updates, combining all responses into a single response to the client. This composition capability dramatically improves performance for client applications while simplifying their implementation.

Core Gateway Functions and Responsibilities

Authentication verification ensures that clients provide valid credentials before accessing protected resources. The gateway validates tokens, API keys, or other credentials against identity providers, rejecting unauthenticated requests immediately without burdening backend services. Supporting multiple authentication schemes enables the same gateway to serve different client types, with API keys for server-to-server communication, OAuth tokens for third-party applications, and JWT tokens for mobile apps. For cryptocurrency APIs where security is paramount, centralized authentication in the gateway ensures consistent enforcement across all backend services.

Authorization enforcement determines whether authenticated clients have permission to access requested resources or perform requested operations. The gateway evaluates authorization policies based on user roles, resource ownership, subscription tiers, or custom business rules. For crypto trading platforms, authorization ensures users can only view their own portfolios, execute trades with their own funds, and access analytics features appropriate to their subscription level. Implementing authorization at the gateway creates a security boundary that protects backend services from unauthorized access attempts.

Rate limiting controls request volumes from individual clients to prevent abuse and ensure fair resource allocation among all users. The gateway tracks request counts per client identifier using techniques like token bucket algorithms that allow burst capacity while maintaining average rate limits. Implementing rate limiting at the gateway protects all backend services simultaneously while providing consistent enforcement. Token Metrics employs sophisticated rate limiting in its cryptocurrency API gateway, offering different limits for free, professional, and enterprise tiers while dynamically adjusting limits based on system load and client behavior patterns.

Request and response transformation enables the gateway to modify messages flowing between clients and services. Transformations might include adding or removing headers, converting between data formats, modifying request or response bodies, or translating between API versions. For cryptocurrency APIs evolving over time, the gateway can transform requests from clients using older API versions into formats expected by current backend services, maintaining backward compatibility without requiring backend changes. Response transformations similarly ensure clients receive data in expected formats regardless of backend implementation details.

Caching at the gateway level dramatically improves performance by storing responses to frequent requests and serving cached copies without invoking backend services. The gateway respects cache control headers from backend services while implementing its own caching policies based on URL patterns, request parameters, and business logic. For crypto APIs serving market data where current prices change rapidly but historical data remains static, intelligent caching can serve a high percentage of requests from cache while ensuring time-sensitive data remains fresh. Proper cache invalidation strategies maintain data accuracy while maximizing cache hit rates.

Security Patterns and Implementation

TLS termination at the gateway decrypts incoming HTTPS traffic, enabling inspection and modification before forwarding requests to backend services. This pattern simplifies certificate management by centralizing it at the gateway rather than distributing certificates across all backend services. The gateway can then establish new encrypted connections to backend services using mutual TLS for service-to-service authentication. For cryptocurrency platforms handling sensitive financial data, TLS termination enables security controls like request inspection and threat detection while maintaining end-to-end encryption.

Web application firewall capabilities integrated into API gateways protect against common attacks including SQL injection, cross-site scripting, and command injection. The WAF examines requests for malicious patterns, blocking suspicious traffic before it reaches backend services. Regularly updated rule sets defend against emerging threats while custom rules address application-specific vulnerabilities. For crypto APIs that attackers target for financial gain, WAF protection provides an essential security layer that complements application-level security controls.

DDoS protection mechanisms defend against denial-of-service attacks that attempt to overwhelm systems with request floods. The gateway implements rate limiting per IP address, geographic blocking when attacks originate from specific regions, connection limits, and request validation that rejects malformed requests. Cloud-based API gateways leverage provider infrastructure to absorb large-scale attacks that would overwhelm single-data center deployments. For cryptocurrency exchanges and trading platforms, DDoS protection ensures service availability during attacks that might coincide with market manipulation attempts.

API key management through the gateway provides secure credential distribution, rotation, and revocation. The gateway generates cryptographically secure keys, associates them with client accounts, tracks usage, and enables instant revocation if keys are compromised. Supporting multiple keys per account enables different applications or environments to use separate credentials, containing blast radius if individual keys are exposed. Token Metrics provides comprehensive API key management through its gateway, enabling developers to generate, rotate, and manage keys through self-service interfaces while maintaining security best practices.

IP whitelisting adds an additional security layer by restricting API access to requests originating from approved IP addresses. This control proves particularly valuable for server-to-server communications where clients have static IPs or for enterprise clients accessing cryptocurrency APIs from known corporate networks. Combining IP whitelisting with API keys creates defense in depth where attackers would need to compromise both credentials and network position to gain unauthorized access.

Performance Optimization Strategies

Connection pooling at the gateway maintains persistent connections to backend services, eliminating connection establishment overhead for each request. Rather than creating new connections for every backend call, the gateway reuses existing connections from managed pools. This optimization proves particularly impactful for high-throughput cryptocurrency APIs processing thousands of requests per second, as connection establishment latency would otherwise significantly impact overall response times.

Response compression reduces bandwidth consumption and improves transfer speeds by compressing responses before sending them to clients. The gateway negotiates compression algorithms with clients through Accept-Encoding headers, applying gzip or brotli compression to text-based responses like JSON. For cryptocurrency market data APIs returning large datasets, compression can reduce response sizes by 70-90 percent, dramatically improving performance especially for mobile clients on limited bandwidth connections.

Request batching combines multiple client requests into single backend requests when possible, reducing the number of service invocations and improving throughput. When clients request data for multiple cryptocurrencies, the gateway can batch these into a single backend query rather than making separate calls for each cryptocurrency. This optimization reduces backend load while improving overall system efficiency. Token Metrics implements intelligent request batching in its crypto API gateway, optimizing performance while maintaining the simplicity of individual requests for client applications.

Circuit breaker patterns prevent cascading failures by detecting when backend services experience problems and temporarily suspending requests to failing services. When error rates exceed thresholds, the gateway opens circuits and fails requests immediately rather than waiting for timeouts. This approach protects healthy services from being overwhelmed by retry attempts while failing services recover. For cryptocurrency APIs depending on multiple data sources, circuit breakers ensure that problems with individual sources don't compromise overall platform availability.

Adaptive load balancing distributes requests across backend service instances based on real-time metrics like response times, error rates, and resource utilization. Rather than simple round-robin distribution, adaptive algorithms route more traffic to healthy, responsive instances while reducing load on struggling instances. For crypto API platforms experiencing varying load patterns, intelligent load balancing maximizes throughput while maintaining consistent response times across all requests.

Gateway Deployment Models and Architecture

Cloud-managed API gateways provided by AWS API Gateway, Azure API Management, and Google Cloud Endpoints offer fully managed services that handle infrastructure, scaling, and operational concerns. These platforms provide high availability, automatic scaling, geographic distribution, and integration with cloud provider ecosystems. For cryptocurrency startups and growing platforms, managed gateways eliminate operational overhead while providing enterprise-grade capabilities. The trade-off involves less customization flexibility and potential vendor lock-in compared to self-hosted solutions.

Self-hosted gateway solutions like Kong, Tyk, and Apache APISIX provide maximum control and customization at the cost of operational responsibility. Organizations deploy these gateways on their own infrastructure, whether on-premise servers, cloud virtual machines, or Kubernetes clusters. This approach enables deep customization, avoids vendor lock-in, and provides complete control over data flow. For cryptocurrency exchanges and institutions with strict regulatory requirements around data residency and control, self-hosted gateways provide necessary flexibility and compliance capabilities.

Hybrid architectures combine cloud and on-premise components, placing gateways in cloud environments while backend services run on-premise or vice versa. This model addresses scenarios where legacy systems must remain on-premise while new services deploy to cloud, or where data residency requirements mandate certain services remain in specific locations. For established financial institutions entering cryptocurrency markets, hybrid gateways enable gradual cloud adoption while maintaining existing infrastructure investments.

Edge gateway deployments place gateway instances geographically close to users, reducing latency by minimizing the physical distance requests travel. Content delivery networks with programmable edge computing enable deploying gateway logic at hundreds of locations worldwide. For cryptocurrency platforms serving global markets where traders demand minimal latency, edge deployments ensure consistent low-latency access regardless of user location. Token Metrics leverages globally distributed infrastructure to ensure developers worldwide experience fast, reliable access to cryptocurrency market data and analytics.

Microgateway patterns deploy lightweight gateways alongside application services rather than using centralized gateways. Each microservice or small service cluster has a dedicated gateway handling its specific concerns. This approach reduces single points of failure and enables independent scaling of gateway capacity. For large cryptocurrency platforms with diverse service types, combining traditional gateways for external traffic with microgateways for internal service mesh provides optimal flexibility and performance.

Design Patterns and Best Practices

Backend for frontend pattern creates specialized gateway instances optimized for specific client types like mobile apps, web applications, and third-party integrations. Each BFF gateway aggregates and transforms data specifically for its client type, eliminating unnecessary data transfer and providing client-optimized APIs. For cryptocurrency platforms serving both retail traders through mobile apps and institutional clients through specialized APIs, BFF patterns enable optimizing each interface without compromising others.

API versioning through the gateway enables supporting multiple API versions simultaneously while backend services evolve independently. The gateway routes requests to appropriate service versions based on version indicators in URLs, headers, or request content. Maintaining multiple active versions enables gradual client migration to new APIs without forced upgrades. For crypto APIs where trading bots and automated systems might require extended support for legacy versions, gateway-managed versioning provides necessary flexibility.

Request validation at the gateway rejects malformed requests before they reach backend services, reducing backend load and improving security. The gateway validates request structure, data types, required fields, and value ranges against OpenAPI specifications or custom validation rules. For cryptocurrency trading APIs where invalid orders could cause problems, comprehensive validation ensures only well-formed requests reach trading engines. Early validation also provides better error messages to developers, improving the development experience.

Response aggregation patterns enable the gateway to combine data from multiple services into unified responses. GraphQL gateways exemplify this pattern, allowing clients to specify exact data requirements across multiple backend services through single queries. For crypto portfolio applications requiring data about holdings, current prices, historical performance, and related news, aggregation eliminates multiple round trips and improves application responsiveness.

Graceful degradation strategies ensure API gateways continue serving requests even when some backend services fail. The gateway might return partial responses excluding unavailable data, serve stale cached data, or provide default values for missing information. For cryptocurrency market data platforms where some data sources might temporarily fail, graceful degradation maintains overall service availability while individual components recover. Token Metrics implements comprehensive resilience patterns ensuring its crypto API remains available even when facing infrastructure challenges.

Analytics and Monitoring Integration

Request logging at the gateway captures comprehensive information about all API traffic including request details, response status, timing information, and client identifiers. Structured logs enable powerful querying and analysis of usage patterns, error trends, and performance characteristics. For cryptocurrency APIs, analyzing request logs reveals which endpoints receive highest traffic, which cryptocurrencies are most popular, and when traffic patterns change during market events. These insights guide capacity planning, feature prioritization, and performance optimization efforts.

Metrics collection and aggregation provide real-time visibility into gateway and API performance. Essential metrics include request rates, response time distributions, error rates broken down by type, cache hit rates, and backend service health. Time-series databases efficiently store metrics for analysis and alerting. For crypto API platforms, metrics reveal how system performance varies during market volatility and help identify optimization opportunities. Token Metrics maintains comprehensive metrics across its cryptocurrency API infrastructure, enabling proactive performance management and capacity planning.

Distributed tracing connects requests flowing through gateways to backend services and external dependencies, providing end-to-end visibility into request processing. Traces reveal which components contribute most to overall latency, identify bottlenecks, and expose unexpected dependencies. For complex cryptocurrency platforms where requests might touch dozens of services, distributed tracing proves invaluable for understanding and optimizing system behavior. OpenTelemetry provides vendor-neutral instrumentation that works with various tracing backends.

Alerting systems notify operations teams when problems occur, enabling rapid response before users experience significant impact. Alerts trigger when metrics exceed thresholds like error rate spikes, response time degradation, or backend service failures. For cryptocurrency trading platforms where downtime directly impacts financial outcomes, proactive alerting and rapid incident response minimize user impact. Integrating alerts with incident management systems ensures proper escalation and coordination during outages.

Business analytics derived from API traffic provide insights into user behavior, feature adoption, and business performance. Analyzing which endpoints clients use most frequently, which features drive upgrades to paid tiers, and how usage patterns correlate with user retention informs product strategy. For crypto API providers, understanding which analytics endpoints, cryptocurrencies, or features drive the most value helps prioritize development investments. Token Metrics leverages API analytics to continuously improve its cryptocurrency intelligence platform based on actual usage patterns and client needs.

Rate Limiting and Quota Management

Tiered rate limiting implements different limits for different user categories, typically free tier users with restrictive limits, paid users with moderate limits, and enterprise clients with high or unlimited limits. This approach enables providing free access for evaluation and small projects while monetizing heavy usage. For cryptocurrency APIs, tiered limits balance accessibility for individual developers with the need to sustain infrastructure costs from high-volume users. Token Metrics offers multiple tiers optimized for different use cases from hobbyist developers to institutional trading systems.

Quota management tracks cumulative usage over longer periods like days or months, preventing users from exhausting resources through sustained high usage even if they stay within instantaneous rate limits. Monthly quotas complement per-second or per-minute rate limits, providing overall usage boundaries. For crypto APIs offering plans with specific request allowances, quota management ensures fair resource allocation and enables predictable infrastructure scaling.

Rate limit communication through response headers keeps clients informed about their current consumption and remaining capacity. Standard headers like X-RateLimit-Limit, X-RateLimit-Remaining, and X-RateLimit-Reset enable intelligent client behavior like self-throttling and request scheduling. For cryptocurrency trading applications making time-sensitive requests, understanding rate limit status enables optimizing request patterns to avoid throttling during critical moments.

Burst allowances using token bucket algorithms permit short-term traffic spikes while maintaining average rate limits. Clients accumulate tokens over time up to a maximum bucket size, spending tokens for each request. This flexibility accommodates bursty usage patterns common in cryptocurrency applications where users might make rapid sequences of requests during market analysis followed by quiet periods.

Geographic and IP-based rate limiting can implement different limits based on request origin, addressing regional abuse patterns or compliance requirements. For crypto APIs, implementing stricter limits for regions experiencing high abuse rates protects system availability while maintaining generous limits for legitimate users. Combining multiple rate limiting dimensions provides nuanced control over API access patterns.

Service Mesh Integration

Service mesh architectures extend API gateway concepts to internal service-to-service communication, providing consistent policies for all traffic within the system. Popular service meshes like Istio and Linkerd handle authentication, encryption, load balancing, and observability transparently to application code. For cryptocurrency platforms with complex microservices architectures, service meshes complement external-facing gateways by securing and monitoring internal communications.

Mutual TLS authentication between services ensures that only authorized services can communicate, preventing attackers who penetrate the perimeter from freely accessing internal systems. The service mesh automatically handles certificate distribution, rotation, and validation. For crypto platforms where internal services handle sensitive trading data and financial operations, mutual TLS provides essential security for service-to-service communications.

Traffic management capabilities in service meshes enable sophisticated routing, retries, timeouts, and circuit breaking for internal communications. These capabilities complement gateway-level controls by applying resilience patterns throughout the entire system. For cryptocurrency APIs where complex request flows span multiple services, end-to-end traffic management ensures reliability and predictable behavior.

Observability integration provides comprehensive visibility into both external traffic through gateways and internal service communications through meshes. Unified dashboards showing end-to-end request flows from client to all touched services enable holistic performance optimization. For crypto platforms, complete observability across gateway and mesh reveals optimization opportunities that focusing on either layer alone would miss.

Real-World Use Cases in Cryptocurrency

Cryptocurrency exchanges deploy sophisticated API gateways managing high-frequency trading APIs, market data distribution, and user account operations. The gateway handles authentication for millions of users, rate limiting for different account types, request routing to regional trading engines, and response aggregation combining order status with market data. Security controls in the gateway protect against attacks targeting trading systems and prevent unauthorized fund withdrawals.

Blockchain analytics platforms use API gateways to provide unified access to data across multiple blockchain networks. The gateway routes requests to appropriate blockchain indexers, aggregates cross-chain data, transforms blockchain data formats into consistent responses, and caches frequently accessed information. For platforms like Token Metrics offering comprehensive cryptocurrency intelligence, the gateway orchestrates access to AI-powered analytics, market predictions, token grades, and blockchain data through a coherent developer interface.

DeFi aggregators employ API gateways to integrate with numerous decentralized finance protocols, providing unified interfaces to lending platforms, decentralized exchanges, and yield farming opportunities. The gateway handles protocol-specific authentication, translates between different protocol APIs, aggregates best rates across platforms, and implements security controls protecting users from malicious contracts. For users navigating the complex DeFi landscape, gateways simplify interactions with otherwise fragmented protocols.

Crypto payment processors use gateways to accept cryptocurrency payments through simple APIs while managing blockchain interactions behind the scenes. The gateway validates payment requests, routes to appropriate blockchain services, monitors transaction confirmations, handles network fee calculations, and converts between cryptocurrencies and fiat. For merchants accepting crypto payments, the gateway abstracts blockchain complexity into standard payment APIs similar to credit card processing.

Portfolio management platforms deploy gateways aggregating data from exchanges, wallets, and blockchain networks to provide comprehensive portfolio views. The gateway authenticates with each data source using appropriate credentials, normalizes data formats, calculates aggregated metrics, and caches to minimize external API calls. Token Metrics leverages sophisticated gateway architecture to deliver unified access to its extensive cryptocurrency analytics, enabling developers to build portfolio tracking and investment management applications.

Operational Excellence and Maintenance

Health checking and auto-recovery mechanisms ensure gateway availability through continuous monitoring and automatic failover. The gateway performs health checks on backend services, removing unhealthy instances from rotation and restoring them when they recover. Self-health monitoring detects gateway problems and triggers automated restarts or failovers. For cryptocurrency APIs requiring high availability, comprehensive health checking maintains service even during infrastructure failures.

Configuration management through infrastructure as code enables consistent gateway deployments across environments and facilitates disaster recovery. Version-controlled configurations document all gateway settings including routing rules, security policies, and rate limits. For crypto API platforms, configuration as code provides audit trails for security-sensitive settings and enables rapid recovery from configuration errors. Token Metrics maintains rigorous configuration management ensuring consistency across its globally distributed gateway infrastructure.

Capacity planning based on usage analytics and growth projections ensures gateways can handle increasing traffic. Analyzing historical usage patterns reveals growth rates and seasonal variations. For cryptocurrency APIs where usage can spike dramatically during market volatility, capacity planning must account for sudden traffic increases far beyond normal patterns. Auto-scaling capabilities enable dynamic capacity adjustment based on real-time load.

Security updates and patch management keep gateway software protected against vulnerabilities. Managed gateway services handle updates automatically while self-hosted gateways require operational processes for timely patching. For crypto platforms where security vulnerabilities could enable theft or market manipulation, staying current with security updates becomes critical. Establishing maintenance windows and deployment pipelines ensures timely updates without service disruption.

Future Trends and Emerging Patterns

GraphQL gateways provide flexible query interfaces where clients specify exact data requirements across multiple backend services. Rather than consuming fixed REST endpoints, clients compose queries requesting specific fields from multiple data sources. For cryptocurrency applications needing diverse data combinations, GraphQL gateways eliminate overfetching and underfetching problems inherent in REST APIs while maintaining backend flexibility.

AI-powered gateways leverage machine learning for intelligent routing, anomaly detection, and predictive scaling. Models analyze traffic patterns to optimize routing decisions, detect unusual behavior suggesting attacks or bugs, and predict capacity needs ahead of demand. For crypto API platforms, AI-enhanced gateways can detect market manipulation attempts, optimize performance during volatility, and provide personalized rate limits based on usage patterns.

Serverless gateway architectures deploy gateway functionality on serverless platforms, enabling automatic scaling and paying only for actual usage. This approach eliminates capacity planning concerns and reduces operational overhead. For cryptocurrency startups and projects with variable traffic, serverless gateways provide cost-effective solutions that scale automatically from zero to massive scale.

Zero trust architectures eliminate the concept of trusted internal networks, requiring authentication and authorization for every request including internal service communications. Gateways in zero trust models enforce strict policies for all traffic regardless of origin. For crypto platforms handling valuable assets, zero trust principles provide defense in depth against both external attacks and insider threats.

Conclusion

API gateways have evolved from simple reverse proxies into sophisticated platforms that centralize cross-cutting concerns, simplify client interactions, and enable operational excellence for complex distributed systems. Understanding gateway architecture, security patterns, performance optimization techniques, deployment models, and best practices enables building robust, scalable cryptocurrency platforms and applications. The gateway's position at the system edge makes it ideal for implementing consistent policies across all services while providing visibility into system behavior through comprehensive analytics.

Token Metrics demonstrates excellence in API gateway implementation, providing developers with seamless access to comprehensive cryptocurrency intelligence through a unified, secure, high-performance interface. The gateway orchestrates access to market data, blockchain analytics, AI-powered predictions, and token ratings while handling authentication, rate limiting, and performance optimization transparently. By implementing the patterns and practices outlined in this guide and leveraging well-architected crypto APIs like those provided by Token Metrics, developers can build sophisticated cryptocurrency applications that deliver exceptional user experiences while maintaining security and reliability.

As cryptocurrency markets mature and applications grow more complex, API gateways will continue evolving with new capabilities and patterns. The fundamental value of centralizing cross-cutting concerns, simplifying client interactions, and providing operational visibility remains constant even as specific technologies advance. Development teams that master API gateway architecture and implementation position themselves to build scalable, maintainable cryptocurrency platforms that meet the demanding requirements of modern financial applications operating in global, 24/7 digital asset markets.

RESTful API Essentials: Design, Security, and Best Practices

%201.svg)

%201.svg)

The architecture of modern web applications rests fundamentally on RESTful APIs, which have become the universal language for system-to-system communication across the internet. From social media platforms to cryptocurrency exchanges, RESTful APIs enable seamless data exchange, service integration, and application functionality that powers our digital economy. Understanding how RESTful APIs work, mastering design patterns, implementing robust security controls, and optimizing performance separates competent developers from exceptional ones, particularly in demanding environments like cryptocurrency platforms where reliability, security, and speed determine success.

How RESTful APIs Work: Fundamental Mechanics

RESTful APIs operate on the foundation of HTTP protocol, leveraging its methods, status codes, and headers to create predictable, standardized interfaces for accessing and manipulating resources. When a client application needs to interact with a server, it constructs an HTTP request specifying the desired operation through the HTTP method, the target resource through the URL, any necessary data in the request body, and authentication credentials in headers. The server processes this request, performs the requested operation, and returns an HTTP response containing a status code indicating success or failure along with any requested data or error information.

The stateless nature of REST means each request contains complete information needed for processing, without relying on server-stored session data. This architectural constraint enables servers to treat each request independently, facilitating horizontal scaling where additional servers can be added to handle increased load without complex session synchronization. For cryptocurrency APIs serving global markets with millions of users querying market data, executing trades, and analyzing blockchain information, statelessness becomes essential for achieving the scale and reliability that financial applications demand.

Resource-oriented design distinguishes RESTful APIs from RPC-style interfaces by treating everything as a resource accessible through unique identifiers. In cryptocurrency APIs, resources include digital assets, market prices, blockchain transactions, trading orders, user portfolios, and analytical indicators. Each resource has a canonical URL representing it, such as /api/v1/cryptocurrencies/bitcoin for Bitcoin's information or /api/v1/users/12345/portfolio for a specific user's portfolio. Operations on these resources use standard HTTP methods where GET retrieves resource representations, POST creates new resources, PUT updates existing resources completely, PATCH modifies specific resource attributes, and DELETE removes resources.

Content negotiation allows clients and servers to agree on data formats through Accept and Content-Type headers. While JSON has become the dominant format for RESTful APIs due to its balance of human readability and machine parsability, APIs might support XML, YAML, or custom formats for specific use cases. Token Metrics delivers comprehensive cryptocurrency analytics through RESTful APIs that provide consistent JSON responses, enabling developers to integrate sophisticated market intelligence, AI-powered predictions, and blockchain data into their applications using familiar, standardized interfaces.

Essential Design Patterns for RESTful APIs

URI design patterns create intuitive, discoverable APIs where developers can predict endpoint structures without extensive documentation. Hierarchical URIs represent resource relationships naturally, with parent resources appearing earlier in paths and child resources later. A cryptocurrency portfolio API might expose /api/v1/users/{userId}/portfolios/{portfolioId}/holdings/{holdingId} representing the logical hierarchy from users to their portfolios to individual holdings. Consistent naming conventions using plural nouns for collections and singular identifiers for specific resources create predictable patterns across all endpoints.

Filtering, sorting, and pagination patterns enable clients to work with large datasets efficiently without overwhelming networks or systems. Query parameters provide flexible mechanisms for refining resource collections, with parameters like ?symbol=BTC&timeframe=24h&sort=volume_desc&limit=50 enabling precise data requests. For cryptocurrency market data APIs returning thousands of trading pairs or blockchain transactions, supporting comprehensive filtering and sorting ensures clients retrieve exactly the data they need. Cursor-based pagination provides stable results even as underlying data changes, critical for crypto APIs where new transactions and price updates arrive continuously.

HATEOAS, or Hypermedia as the Engine of Application State, embeds links within responses that guide clients through available operations and related resources. Rather than hardcoding endpoint URLs, clients follow links provided in responses to discover capabilities dynamically. While full HATEOAS implementation remains rare due to complexity, incorporating relevant links in responses improves API usability. For example, a cryptocurrency API response might include links to related resources like historical data, trading pairs, or detailed analytics, enabling intuitive navigation through available information.

Versioning patterns enable API evolution without breaking existing clients. URI versioning embeds version identifiers in endpoint paths like /api/v1/ or /api/v2/, providing explicit clarity about which API version clients access. Header-based versioning uses custom headers to specify versions, keeping URIs clean but reducing discoverability. For cryptocurrency APIs where trading bots and automated systems depend on consistent interfaces, clear versioning with generous support windows for old versions prevents disruption to critical financial systems. Token Metrics maintains well-defined API versioning, allowing clients to upgrade at their own pace while accessing new features as they become available.

Error response patterns provide consistent, informative feedback when operations fail. Comprehensive error responses include appropriate HTTP status codes, machine-readable error codes for programmatic handling, human-readable messages describing the problem, and actionable guidance for resolution. For crypto trading APIs, distinguishing between client errors like invalid order parameters and server errors like temporary exchange connectivity issues enables appropriate error recovery strategies. Structured error responses using standard formats facilitate consistent error handling across client applications.

Security Controls for Production APIs

Transport layer security through HTTPS encryption protects data in transit, preventing eavesdropping and man-in-the-middle attacks. All production RESTful APIs must enforce HTTPS, rejecting plain HTTP connections that could expose sensitive data. For cryptocurrency APIs transmitting trading credentials, portfolio information, and transaction details, HTTPS becomes absolutely non-negotiable as even momentary exposure could enable theft or fraud. Implementing HTTP Strict Transport Security headers instructs browsers to always use HTTPS for subsequent connections, further strengthening transport security.

Authentication mechanisms verify client identity before granting API access. Token-based authentication using JSON Web Tokens provides stateless authentication suitable for RESTful architectures, with tokens containing claims about user identity and permissions. API key authentication offers simpler alternatives for server-to-server communication, with unique keys identifying each client application. OAuth 2.0 frameworks enable sophisticated authorization flows where users grant limited access to third-party applications without sharing primary credentials. Token Metrics implements enterprise-grade authentication across its cryptocurrency API, supporting multiple authentication methods appropriate for different client types from mobile applications to institutional trading systems.

Authorization enforcement ensures authenticated clients access only resources and operations they're permitted to use. Role-based access control assigns permissions based on user roles, while attribute-based access control evaluates permissions based on request context including resource ownership, user attributes, and environmental factors. For crypto APIs, authorization might permit users to view their own portfolios but not others', execute trades within their account limits, and access analytics features corresponding to their subscription tier. Fine-grained authorization at the API level creates security boundaries protecting sensitive operations regardless of client-side controls.

Input validation and sanitization defend against injection attacks and malformed data that could compromise backend systems. Every request parameter, header, and body field should be validated against expected types, formats, and ranges before processing. For cryptocurrency APIs, validation ensures trading amounts don't exceed precision limits, wallet addresses conform to proper checksums, date ranges fall within acceptable bounds, and cryptocurrency symbols match known assets. Comprehensive validation prevents malicious inputs from exploiting vulnerabilities in backend services or databases.

Rate limiting and throttling protect APIs from abuse while ensuring fair resource allocation. Implementing tiered rate limits based on authentication level enables providing generous limits to paying customers while constraining free-tier usage. For cryptocurrency market data APIs, rate limiting prevents individual users from monopolizing infrastructure while enabling legitimate high-frequency use cases through appropriate paid tiers. Token Metrics offers carefully designed rate limits across multiple subscription tiers, balancing accessibility for individual developers with the sustainability needed to maintain high-quality infrastructure serving institutional clients.

Performance Tuning and Optimization

Database query optimization forms the foundation of API performance since database operations typically dominate request processing time. Proper indexing ensures queries execute quickly even as data volumes grow, with indexes on frequently queried fields, foreign keys, and filter conditions. Query result caching stores computed results for reuse across multiple requests, particularly valuable for crypto APIs where complex analytics might be requested repeatedly. Connection pooling maintains reusable database connections, eliminating connection establishment overhead that would otherwise impact high-throughput APIs.

Response caching at multiple levels dramatically improves API performance. Application-level caching stores computed results in memory caches like Redis, serving subsequent requests without repeating expensive operations. For cryptocurrency price data that changes by the second, aggressive caching with short TTLs balances freshness with performance. HTTP caching through Cache-Control headers enables client-side and CDN caching, with cache duration varying by resource type. Historical market data might cache for hours while current prices cache for seconds, optimizing each resource type appropriately.

Payload optimization reduces response sizes through field filtering, partial responses, and compression. Supporting field selection parameters like ?fields=symbol,price,volume allows clients to request only needed data, reducing bandwidth and parsing time. Response compression using gzip or brotli reduces transmission sizes by 70-90 percent for JSON responses. For cryptocurrency APIs returning large datasets like complete order books or comprehensive market statistics, payload optimization significantly improves performance especially for mobile clients or regions with limited bandwidth.

Asynchronous processing offloads time-consuming operations from synchronous request-response flows. Rather than making clients wait for lengthy computations, APIs can accept requests, return job identifiers immediately, and notify clients when processing completes through webhooks or polling endpoints. For crypto analytics requiring intensive calculations across historical data, asynchronous patterns maintain API responsiveness while enabling sophisticated processing. Token Metrics leverages asynchronous processing for compute-intensive AI predictions and analytical reports, providing immediate acknowledgment while delivering results as they become available.

Connection optimization including HTTP/2 adoption, connection keep-alive, and efficient connection pooling reduces network overhead. HTTP/2's multiplexing enables multiple concurrent requests over single connections, eliminating connection overhead for clients making many requests. For cryptocurrency applications querying multiple endpoints to build comprehensive market views, HTTP/2 significantly improves performance. Proper keep-alive configuration maintains connections across requests, avoiding repeated connection establishment costs.

Testing Strategies for RESTful APIs

Unit testing validates individual API endpoint behaviors in isolation, verifying request parsing, business logic execution, and response formatting. Mock objects simulate dependencies like databases and external services, enabling fast test execution without infrastructure dependencies. For cryptocurrency APIs, unit tests verify that price calculations, trading validations, and analytics computations produce correct results across various inputs and edge cases. Comprehensive unit test coverage catches regressions early and enables confident refactoring.

Integration testing validates APIs working with actual dependencies including databases, message queues, and external services. These tests verify data flows correctly through the full stack, errors propagate appropriately, and integrations handle failures gracefully. For crypto APIs aggregating data from multiple blockchain networks and exchanges, integration tests ensure synchronization mechanisms, conflict resolution, and failover behaviors function correctly. Testing with realistic data volumes reveals performance issues before production deployment.

Contract testing ensures APIs maintain compatibility with consuming applications, catching breaking changes before they impact production. Consumer-driven contracts encode client expectations about request formats and response structures, with both API providers and consumers validating against shared contracts. For cryptocurrency APIs supporting diverse clients from mobile apps to trading bots, contract testing prevents regressions that could break existing integrations. Automated contract testing in CI/CD pipelines catches compatibility issues immediately.

Performance testing validates APIs meet response time and throughput requirements under various load conditions. Load tests simulate realistic user traffic patterns, stress tests push systems beyond expected capacity, and soak tests validate sustained operation over extended periods. For crypto trading APIs experiencing dramatic traffic spikes during market volatility, performance testing ensures systems handle surge capacity without failures. Identifying bottlenecks through performance testing guides optimization investments and capacity planning.

Security testing probes for vulnerabilities through automated scanning and manual penetration testing. Tools scan for common weaknesses like SQL injection, authentication bypasses, and data exposure while security experts attempt sophisticated attacks. For cryptocurrency APIs where vulnerabilities could enable theft or market manipulation, comprehensive security testing provides essential assurance. Regular testing catches newly discovered vulnerabilities and validates security control effectiveness.

Practical Frameworks for Building RESTful APIs

Express.js for Node.js provides minimalist, flexible framework for building RESTful APIs with JavaScript. Its middleware architecture enables composable request processing pipelines, extensive ecosystem offers solutions for common needs, and asynchronous nature aligns well with I/O-heavy API workloads. For cryptocurrency applications, Express enables rapid development of market data APIs, trading interfaces, and blockchain integrations. The framework's flexibility supports custom requirements while its maturity ensures production readiness.

FastAPI for Python delivers high-performance API development with automatic OpenAPI documentation generation, request validation through Python type hints, and asynchronous request handling. Its modern design leverages Python 3.6+ features for excellent developer experience and performance. For crypto analytics platforms requiring complex data processing alongside API serving, FastAPI combines ease of development with performance suitable for production workloads. Token Metrics leverages sophisticated Python infrastructure for its AI-powered cryptocurrency analytics, with FastAPI providing efficient API interfaces to these capabilities.

Spring Boot for Java offers enterprise-grade framework with comprehensive features for building production APIs. Its dependency injection, extensive library ecosystem, and strong typing suit complex applications requiring robustness and maintainability. For institutional cryptocurrency platforms requiring enterprise integration, regulatory compliance, and extensive business logic, Spring Boot provides necessary capabilities. The framework's maturity and extensive tooling support large-scale API development.

Django REST Framework extends Django to provide powerful REST API capabilities with authentication, serialization, viewsets, and browsable APIs. Its batteries-included philosophy includes many features needed for production APIs while maintaining flexibility for customization. For cryptocurrency platforms requiring both web interfaces and APIs, Django's unified framework reduces development complexity. The framework's strong security focus aligns well with financial application requirements.

ASP.NET Core provides modern, cross-platform framework for building RESTful APIs with C#. Its performance, integrated development experience with Visual Studio, and strong typing make it attractive for enterprise development. For cryptocurrency platforms in Microsoft-centric environments or requiring maximum performance, ASP.NET Core delivers excellent capabilities. The framework's comprehensive feature set supports complex business logic and integration requirements.

Integrating AI Tools and Automation

AI-powered code generation accelerates API development through intelligent scaffolding, boilerplate generation, and pattern completion. Modern AI coding assistants analyze existing codebases to suggest contextually appropriate code, reducing repetitive work and helping developers discover framework features. For cryptocurrency API development where endpoint patterns often follow similar structures, AI assistance can generate new endpoints based on existing examples, ensuring consistency while accelerating development.

Automated documentation generation leverages AI to create comprehensive API documentation from code, comments, and specifications. Rather than manually maintaining documentation that drifts from implementation, AI tools analyze source code to produce accurate, up-to-date documentation. For crypto APIs with hundreds of endpoints covering market data, trading, analytics, and blockchain access, automated documentation ensures developers have current, comprehensive guides without manual maintenance overhead.

Intelligent testing assistants generate test cases, identify edge cases, and suggest security tests based on code analysis. Machine learning models trained on common vulnerabilities can identify potential issues during development, preventing security problems before production. For cryptocurrency APIs where thorough testing is critical but time-consuming, AI-assisted testing accelerates coverage while improving quality. Automated test generation complements manual testing, ensuring comprehensive validation.

Performance optimization recommendations from AI systems analyze application behavior to suggest improvements. Models identify inefficient algorithms, predict bottlenecks, and recommend caching strategies based on usage patterns. For crypto APIs with complex performance requirements, AI-driven insights help prioritize optimization efforts and capacity planning decisions. Token Metrics continuously explores AI-assisted development tools to maintain development velocity while ensuring the highest quality for its cryptocurrency API platform.

Natural language query interfaces enable developers to interact with APIs conversationally, reducing learning curves and accelerating integration. AI systems translate natural language questions into appropriate API calls, enabling faster prototyping and exploration. For cryptocurrency APIs with extensive capabilities, conversational interfaces help developers discover relevant endpoints and understand proper usage patterns without exhaustive documentation review.

Real-World Cryptocurrency API Applications

Cryptocurrency exchange APIs demonstrate demanding RESTful design requirements with endpoints for market data streaming, order management, account operations, and trading execution. These APIs must handle thousands of requests per second with minimal latency while maintaining absolute reliability and security. Rate limiting prevents abuse, WebSocket connections supplement REST for real-time price streaming, and comprehensive authentication protects user accounts. The financial stakes drive sophisticated engineering including extensive testing, comprehensive monitoring, and failover capabilities ensuring continuous operation.

Blockchain explorer APIs provide RESTful interfaces to blockchain data without requiring full node operation. These APIs index blockchain transactions, addresses, blocks, and smart contract events into queryable databases optimized for common access patterns. Endpoints enable searching transactions by hash, querying address balances and history, retrieving block information, and tracking smart contract interactions. For developers building cryptocurrency applications, blockchain explorer APIs abstract infrastructure complexity while providing necessary on-chain data access.

DeFi protocol APIs expose decentralized finance functionality through RESTful interfaces that abstract complex smart contract interactions. These APIs handle wallet connections, transaction construction, gas optimization, and blockchain submissions, enabling developers to integrate DeFi capabilities without blockchain expertise. Endpoints might query lending rates, execute token swaps, provide liquidity to pools, or claim rewards. For users navigating the fragmented DeFi landscape, unified APIs simplify interactions with otherwise complex protocols.

Cryptocurrency analytics APIs deliver market intelligence, trading signals, and investment insights through RESTful endpoints. Token Metrics exemplifies this category, providing developers with comprehensive cryptocurrency analytics including AI-powered price predictions, token ratings, trader grades, sentiment analysis, technical indicators, and portfolio optimization recommendations. The API abstracts sophisticated data processing and machine learning models into simple HTTP endpoints, enabling developers to integrate institutional-grade analytics into applications without building complex infrastructure.

Crypto payment APIs enable merchants to accept cryptocurrency payments through simple RESTful integrations. These APIs handle payment request creation, address generation, transaction monitoring, confirmation tracking, and conversion to fiat currencies. For e-commerce platforms and online services, payment APIs make cryptocurrency acceptance as straightforward as traditional payment processing. Comprehensive webhooks notify merchants of payment status changes, enabling automated order fulfillment.

Best Practices for Production-Ready APIs

Comprehensive documentation serves as the primary interface between API providers and developers, directly impacting adoption and integration success. Documentation should include conceptual overviews explaining API purpose and architecture, getting started tutorials for quick initial success, detailed endpoint references documenting all operations, code examples in multiple programming languages, and troubleshooting guides addressing common issues. For cryptocurrency APIs with extensive capabilities, well-organized documentation becomes essential for discoverability and proper usage.

Versioning strategies enable API evolution while maintaining backward compatibility with existing clients. Clear version indicators through URI paths or headers make version selection explicit, deprecation policies provide generous transition periods with advance notice, and comprehensive changelogs document differences between versions. For crypto APIs supporting automated trading systems that might run unattended, respectful versioning prevents surprise breakages that could cause financial losses. Token Metrics maintains clear versioning with stable interfaces, enabling clients to upgrade on their own schedules.

Error handling excellence distinguishes professional APIs through consistent, informative error responses. Proper HTTP status codes signal error categories, detailed error messages explain what went wrong, error codes enable programmatic handling, and suggested remediation helps developers resolve issues. For cryptocurrency trading APIs where errors might indicate insufficient balances, invalid parameters, or system issues, clear error information enables appropriate client responses.

Monitoring and observability provide visibility into API health and usage patterns. Comprehensive logging captures request details for troubleshooting, metrics track performance and usage, distributed tracing reveals bottlenecks across services, and alerting notifies teams of problems. For crypto APIs where performance degradation or errors could impact trading, proactive monitoring enables rapid issue resolution. Token Metrics maintains extensive observability across its cryptocurrency API infrastructure, enabling continuous optimization and reliable service delivery.

Security by design integrates security considerations throughout API development rather than treating security as an afterthought. Threat modeling identifies potential attacks, secure defaults reduce risk, defense in depth layers multiple controls, least privilege limits damage from breaches, and regular security audits validate effectiveness. For cryptocurrency APIs handling valuable assets, security must be foundational rather than supplemental.

API Gateway Integration and Management

API gateways centralize cross-cutting concerns including authentication, rate limiting, logging, and routing, simplifying individual service implementation. Rather than duplicating these concerns across microservices, gateways handle them consistently at the system edge. For cryptocurrency platforms composed of numerous microservices, gateways provide unified entry points that present coherent interfaces while managing complexity internally. Token Metrics leverages sophisticated gateway architecture to deliver seamless access to its comprehensive analytics capabilities.

Request transformation at the gateway enables supporting multiple client types and API versions without backend changes. The gateway can transform requests from old formats to new, aggregate responses from multiple services, or adapt protocols between clients and backends. For crypto APIs evolving over time, gateway transformation maintains backward compatibility without complicating backend services.

Analytics and monitoring integration at gateway level provides comprehensive visibility into all API traffic. The gateway captures detailed request information, tracks usage patterns, measures performance, and detects anomalies. For cryptocurrency APIs, gateway analytics reveal which features drive value, how usage patterns vary during market conditions, and where optimization opportunities exist.

Edge Cases and Error Scenarios

Handling partial failures gracefully ensures APIs remain functional even when dependencies experience problems. Implementing circuit breakers, fallback responses, and graceful degradation maintains service availability during infrastructure issues. For crypto APIs depending on multiple blockchain networks and data providers, resilience patterns ensure that failures in individual sources don't compromise overall platform availability.

Idempotency for critical operations ensures repeating requests doesn't cause unintended side effects. Trading APIs might use idempotency keys to prevent duplicate order submissions, portfolio updates might check for existing changes before applying, and payment requests might deduplicate using client-provided identifiers. For cryptocurrency operations involving financial transactions, idempotency prevents costly mistakes from network issues or retry logic.

Timeout handling and retry logic manage slow or failing operations appropriately. Implementing exponential backoff prevents retry storms, setting reasonable timeouts prevents indefinite waits, and providing timeout information in errors enables client handling. For crypto APIs where some operations like blockchain confirmations might be slow, proper timeout handling maintains good user experience while enabling long-running operations to complete.

Conclusion

RESTful API design represents a mature, battle-tested approach to building web services that balance simplicity with power, enabling systems that scale from prototype to global platforms. Understanding how RESTful APIs work, mastering design patterns, implementing comprehensive security controls, optimizing performance, and employing thorough testing creates APIs that developers trust and rely on. The integration of AI tools accelerates development while maintaining quality, and following best practices ensures production readiness for demanding environments like cryptocurrency platforms.

Token Metrics exemplifies excellence in RESTful API design, providing developers with comprehensive cryptocurrency intelligence through secure, performant, well-documented interfaces. The platform's API demonstrates best practices across authentication, rate limiting, error handling, and documentation while delivering sophisticated analytics, AI-powered predictions, and real-time market data. By understanding the principles and practices outlined in this guide and leveraging well-designed crypto APIs like those from Token Metrics, developers can build innovative cryptocurrency applications that deliver exceptional value while maintaining the reliability and security that financial applications demand.

As web technologies and cryptocurrency markets continue evolving, RESTful API principles adapt and improve while maintaining the core characteristics of simplicity, scalability, and reliability that have made REST the dominant architectural style for web services. Developers who master RESTful API design position themselves to build the next generation of applications that power our increasingly connected digital economy, particularly in the rapidly growing cryptocurrency and blockchain sectors where APIs serve as critical infrastructure enabling innovation and growth.

Practical Guide to Claude API Integration

%201.svg)

%201.svg)

The Claude API is increasingly used to build context-aware AI assistants, document summarizers, and conversational workflows. This guide breaks down what the API offers, integration patterns, capability trade-offs, and practical safeguards to consider when embedding Claude models into production systems.

Overview: What the Claude API Provides

The Claude API exposes access to Anthropic’s Claude family of large language models. At a high level, it lets developers send prompts and structured instructions and receive text outputs, completions, or assistant-style responses. Key delivery modes typically include synchronous completions, streaming tokens for low-latency interfaces, and tools for handling multi-turn context. Understanding input/output semantics and token accounting is essential before integrating Claude into downstream applications.

Capabilities & Feature Surface

Claude models are designed for safety-focused conversational AI and often emphasize instruction following and helpfulness while applying content filters. Typical features to assess:

- Instruction clarity: Claude responds robustly to explicit, structured instructions and system-level guidelines embedded in prompts.

- Context handling: Larger context windows enable multi-turn memory and long-document summarization; analyze limits for your use case.

- Streaming vs batch: Streaming reduces perceived latency in chat apps. Batch completions suit offline generation and analytics tasks.

- Safety layers: Built-in moderation and safety heuristics can reduce harmful outputs but should not replace application-level checks.

Integration Patterns & Best Practices

Designing a robust integration with the Claude API means balancing performance, cost, and safety. Practical guidance:

- Prompt engineering: Build modular prompts: system instructions, user content, and optional retrieval results. Keep system prompts explicit and version-controlled.

- Context management: Implement truncation or document retrieval to stay within context limits. Use semantic search to surface the most relevant chunks before calling Claude.

- Latency strategies: Use streaming for interactive UI and batch for background processing. Cache frequent completions when possible to reduce API calls.

- Safety & validation: Post-process outputs with rule-based checks, content filters, or secondary moderation models to catch hallucinations or policy violations.

- Monitoring: Track token usage, latency percentiles, and error rates. Instrument prompts to correlate model changes with downstream metrics.

Primary Use Cases and Risk Considerations

Claude API use cases span chat assistants, summarization, prompt-driven code generation, and domain-specific Q&A. For each area evaluate these risk vectors:

- Hallucination risk: Models may fabricate facts; rely on provenance and retrieval augmentation when answers require accuracy.

- Privacy: Avoid sending sensitive personal data unless contract and data processing terms explicitly permit it.

- Regulatory exposure: For regulated domains (health, legal, finance) include human oversight and compliance review rather than treating outputs as authoritative.

- Operational cost: Longer contexts and high throughput increase token costs; profile realistic workloads before scaling.

Tools, Libraries, and Ecosystem Fit

Tooling around Claude often mirrors other LLM APIs: HTTP/SDK clients, streaming libraries, and orchestration frameworks. Combine the Claude API with retrieval-augmented generation (RAG) systems, vector stores for semantic search, and lightweight caching layers. AI-driven research platforms such as Token Metrics can complement model outputs by providing analytics and signal overlays when integrating market or on-chain data into prompts.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

FAQ — What is the Claude API?

The Claude API is an interface for sending prompts and receiving text-based model outputs from the Claude family. It supports completions, streaming responses, and multi-turn conversations, depending on the provider’s endpoints.

FAQ — How do I manage long documents and context?

Implement a retrieval-augmented generation (RAG) approach: index documents into a vector store, use semantic search to fetch relevant segments, and summarize or stitch results before sending a concise prompt to Claude. Also consider chunking and progressive summarization when documents exceed context limits.

FAQ — How can I control API costs?

Optimize prompts to be concise, cache common responses, batch non-interactive requests, and choose lower-capacity model variants for non-critical tasks. Monitor token usage and set alerts for unexpected spikes.

FAQ — What safety measures are recommended?

Combine Claude’s built-in safety mechanisms with application-level filters, content validation, and human review workflows. Avoid sending regulated or sensitive data without proper agreements and minimize reliance on unverified outputs.

FAQ — When should I use streaming vs batch responses?

Use streaming for interactive chat interfaces where perceived latency matters. Batch completions are suitable for offline processing, analytics, and situations where full output is required before downstream steps.

Disclaimer

This article is for educational purposes only and does not constitute professional, legal, or financial advice. It explains technical capabilities and integration considerations for the Claude API without endorsing specific implementations. Review service terms, privacy policies, and applicable regulations before deploying AI systems in production.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter