The Rise of Revenue-Driven Cryptocurrencies: How Real Cash Flow is Reshaping DeFi

The cryptocurrency landscape is undergoing a fundamental transformation as projects with actual revenue generation increasingly outperform purely speculative assets. What analysts are calling the "revenue super cycle" represents a maturation of the digital asset space, where tokens backed by real business models and cash flows are commanding premium valuations and sustained growth.

The Revenue Revolution in Crypto

Unlike the speculative frenzies of previous crypto cycles, the current market is rewarding projects that demonstrate clear value creation through measurable revenue streams. This shift reflects a broader evolution from purely technological promises to working business models that generate tangible returns for token holders.

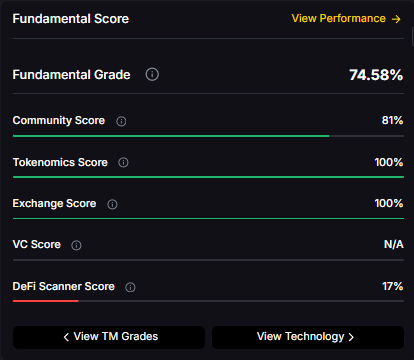

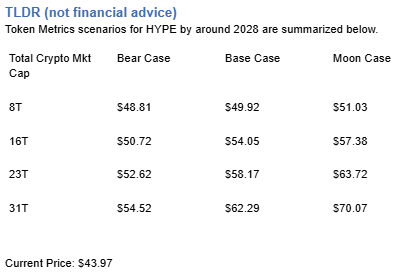

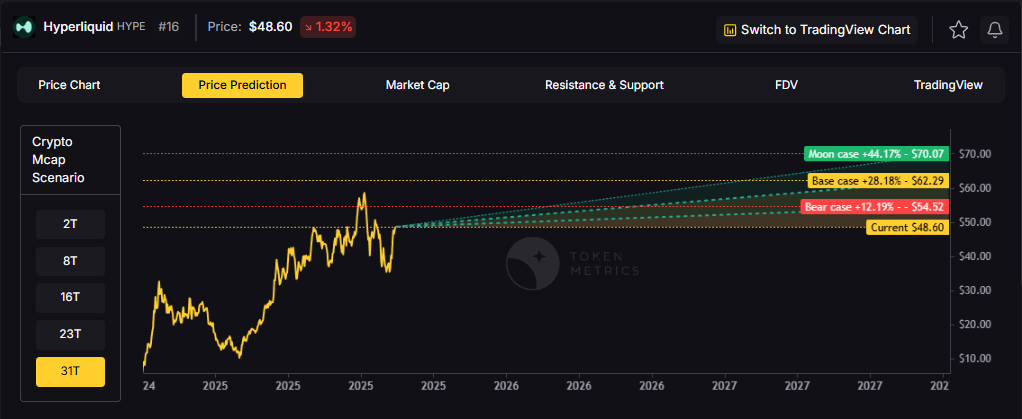

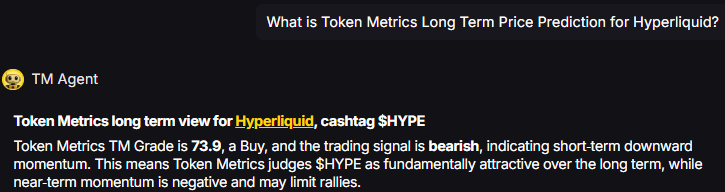

The leaders in this space have adopted innovative approaches to value distribution. Hyperliquid, one of the standout performers, allocates 97% of its protocol revenues toward token buybacks, creating a direct correlation between platform success and token value. This model has driven the token from approximately $12 in April 2024 to over $55, representing a more than 350% increase while outperforming most large-cap alternatives.

Similarly, Pump.fun has implemented a creator revenue-sharing model that has resulted in a 150% increase over 30 days. The platform has evolved into what some describe as "the Twitch of Web3," where content creators launch tokens and earn revenue through live streaming activities. Recent data shows some creators earning nearly $400,000 within just two days of launching their streams, highlighting the substantial value creation potential within this ecosystem.

The Mechanics of Value Accrual

These revenue-generating projects employ several mechanisms to ensure token holders benefit from platform growth:

Token Buyback Programs: Projects like Hyperliquid and Geodnet use a significant portion of revenues to purchase tokens from the open market and either burn them or redistribute to stakeholders. Geodnet has burned over 34 million tokens representing 3% of total supply, while maintaining an annual recurring revenue of $5.5 million from its RTK network operations.

Direct Revenue Sharing: Rather than complex tokenomics structures, some projects directly distribute revenue to token holders or stakers, creating transparent value flow that mirrors traditional dividend models.

Ecosystem Development: Forward Industries, led by Kyle Samani, announced plans to actively deploy its $1.65 billion Solana treasury into DeFi strategies rather than passive holding, potentially creating compounding returns for the broader ecosystem.

The Institutional Adoption Factor

The revenue focus aligns with increasing institutional adoption of cryptocurrency as an asset class. Bitcoin and Ethereum ETFs have recorded substantial inflows, with Bitcoin ETFs seeing $757 million in a single day in September 2025 - the strongest single-day performance since July. Fidelity contributed $299 million while BlackRock added $211 million during this period.

Ethereum ETFs followed with $171 million in net inflows, led by BlackRock's $74 million and Fidelity's $49 million contributions. These flows indicate institutional recognition of crypto assets as legitimate investment vehicles, but the preference increasingly favors projects with demonstrable business models.

Platform-Specific Revenue Models

Different blockchain ecosystems are developing unique approaches to revenue generation:

Solana's Creator Economy: The Solana ecosystem has become synonymous with meme coin activity, but projects like Pump.fun are evolving this into sustainable creator economies. The platform's mobile application launch has simplified user onboarding while expanding the creator base.

Ethereum's Fee Evolution: Despite concerns about high transaction costs, Ethereum has seen increased activity with smart contract calls surpassing 12 million. The implementation of Blobs and other upgrades has significantly reduced fees while maintaining security, potentially strengthening its position as the primary DeFi hub.

Hyperliquid's Vertical Integration: As a derivatives-focused platform with its own Layer 1 blockchain, Hyperliquid captures value across multiple layers of the trading stack, from transaction fees to trading spreads to staking rewards.

The Infrastructure Play

Beyond direct trading and DeFi platforms, infrastructure projects supporting the broader machine economy are gaining attention. The emergence of a "robotics" category reflects anticipation of trillion-dollar markets in humanoid robotics and spatial computing.

Geodnet operates one of the largest RTK (Real-Time Kinematic) networks globally, providing centimeter-level location accuracy essential for autonomous systems. With over 19,000 miners representing 60% growth year-over-year, the project demonstrates how specialized infrastructure can generate consistent revenue streams.

Auki focuses on spatial computing, developing technology that helps systems understand and interact with real-world spaces. These projects represent infrastructure investments for an anticipated machine economy where autonomous systems require precise positioning and environmental understanding.

Market Structure and Future Implications

The focus on revenue-generating assets reflects broader market maturation. Traditional metrics like total addressable market and technological capability are being supplemented by revenue multiples and cash flow analysis more common in equity markets.

This evolution suggests several implications for the cryptocurrency space:

Sustainability: Projects with actual revenue streams are more likely to survive market downturns and regulatory uncertainty, providing greater stability for long-term investors.

Valuation Models: Traditional crypto valuation methods based purely on network effects and token scarcity are evolving to incorporate discounted cash flow models and revenue multiples.

Regulatory Clarity: Projects with clear business models generating revenue may find easier paths through regulatory frameworks compared to purely speculative assets.

Professional Investment: The shift enables traditional investment professionals to apply familiar analytical frameworks to cryptocurrency investments, potentially accelerating institutional adoption.

Challenges and Considerations

While the revenue focus represents positive evolution, several challenges remain:

Sustainability: Some revenue models may not be sustainable during market downturns or increased competition.

Regulatory Risk: Revenue-generating activities may face different regulatory treatment compared to purely technical protocols.

Market Saturation: As more projects adopt similar models, differentiation becomes crucial for maintaining competitive advantages.

Execution Risk: Converting revenue into lasting token value requires effective management and strategic execution.

The transformation toward revenue-driven cryptocurrencies represents a fundamental shift in how digital assets create and distribute value. Projects demonstrating real business models with measurable cash flows are increasingly commanding market premiums and investor attention. This evolution suggests the cryptocurrency space is maturing from purely speculative activity toward sustainable business models that can compete with traditional financial instruments.

As this trend continues, the distinction between successful and unsuccessful projects may increasingly depend on their ability to generate genuine value rather than purely capturing attention through marketing or temporary technological advantages. The revenue super cycle appears to be establishing new standards for cryptocurrency investment, where cash flow analysis becomes as important as technological innovation.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)