Top 10 Cryptocurrency APIs to Watch in 2025

Introduction

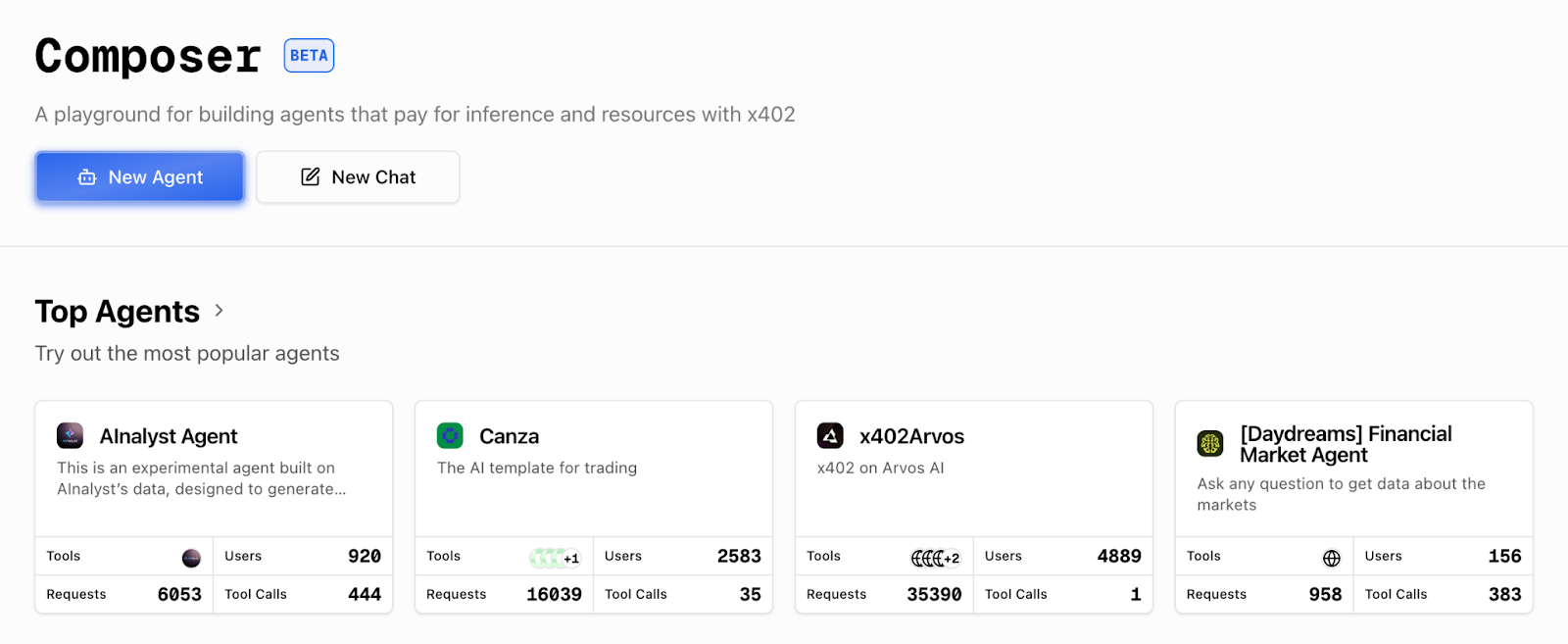

In the fast-evolving landscape of digital finance, the year 2025 brings renewed interest in tools that facilitate efficient and accurate access to cryptocurrency data. APIs (Application Programming Interfaces) serve as the backbone connecting various applications to real-time and historical market, blockchain, and transactional data. This article explores the 10 best cryptocurrency APIs in 2025, emphasizing their features, data coverage, and potential uses within the cryptocurrency and blockchain ecosystem. Understanding the capabilities of these APIs can help developers, analysts, and businesses build insightful applications, conduct data-driven research, and enhance crypto trading strategies.

Overview of Cryptocurrency APIs

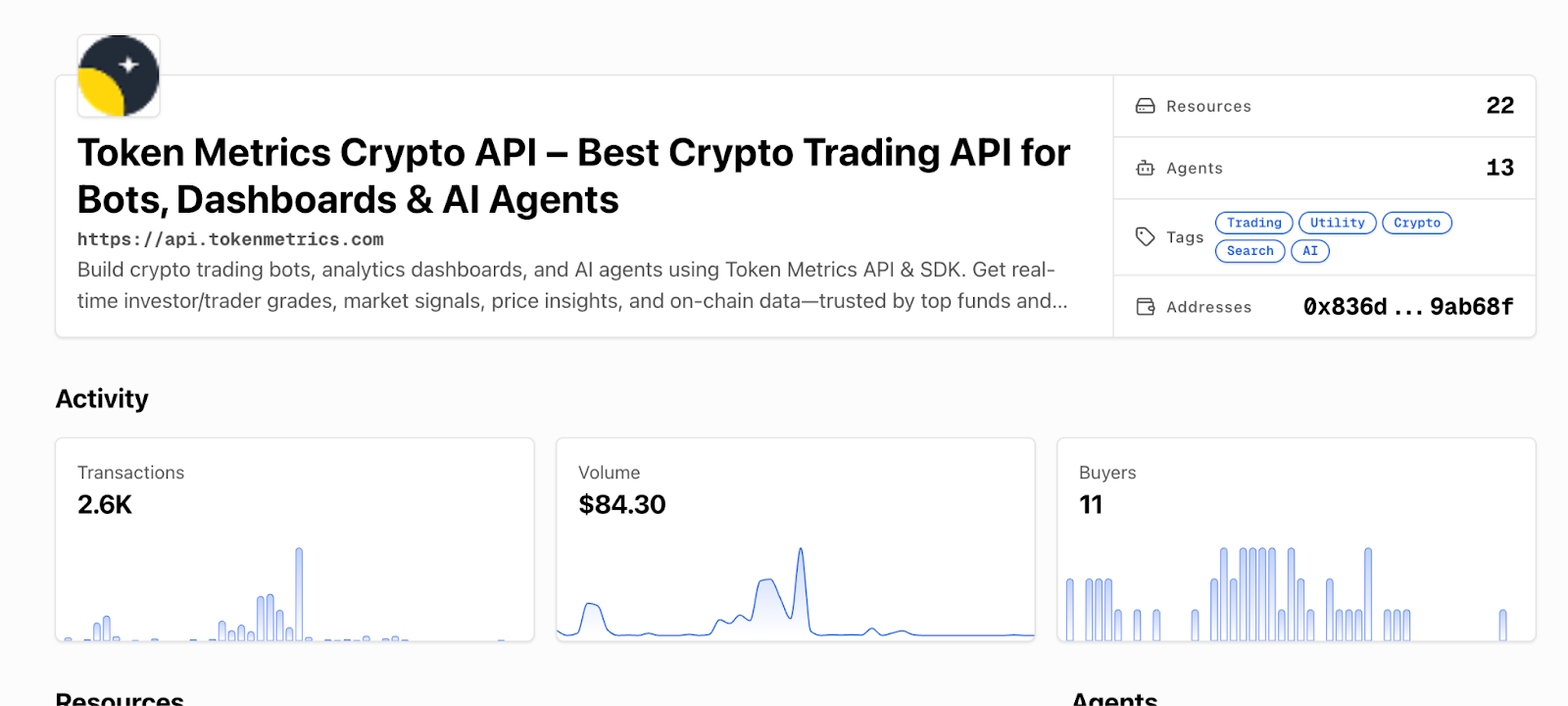

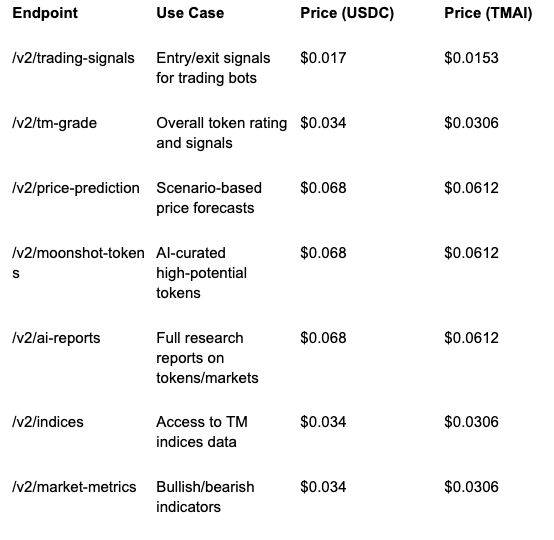

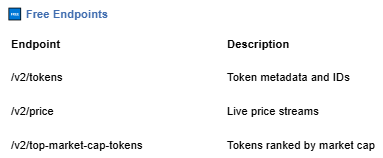

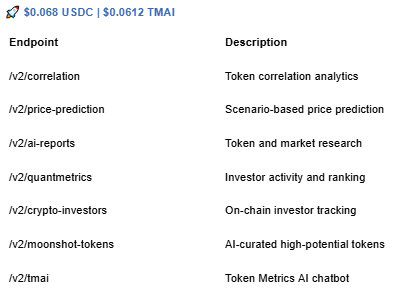

Cryptocurrency APIs provide structured data access ranging from coin prices, market capitalization, trading volumes, blockchain metrics, to wallet information. They offer endpoints that facilitate seamless integration with various systems such as crypto trading platforms, portfolio trackers, data analytics tools, and research applications. The choice of a crypto API depends on factors including data accuracy, latency, historical data availability, ease of use, pricing, and compatibility with AI-driven research tools. Notably, the Token Metrics API has emerged as a prominent solution providing extensive market data and analytics for developers.

Criteria for Selection

In compiling the top 10 cryptocurrency APIs, several key criteria were considered:

- Data Coverage: Range of cryptocurrencies supported and depth of data (real-time, historical, order book).

- Reliability and Uptime: Consistent API availability with minimal downtime.

- Performance: API response times suitable for both research and trading applications.

- Ease of Integration: Comprehensive documentation, SDKs, and community support.

- Scalability: Ability to support high-volume and scalable requests for growing applications.

- Security and Compliance: Secure endpoints and adherence to regulatory standards.

- Support for AI and Analytics: Availability of data types that facilitate machine learning and advanced analytics.

The 10 Best Cryptocurrency APIs in 2025

- Token Metrics API: Offers in-depth market data, sentiment analysis, and on-chain metrics. Ideal for AI-enhanced crypto research and analysis.

- CoinGecko API: Provides a broad dataset including price, volume, market cap, and community statistics with high reliability and free access tiers.

- CoinMarketCap API: Popular for real-time and historical market data with extensive coin coverage and trusted by many crypto trading platforms.

- Nomics API: Known for clean and normalized data feed, historical price data, and transparency ratings.

- CryptoCompare API: Delivers multi-source aggregated market data and social data feeds supporting evaluation of market sentiment.

- Messari API: Focuses on fundamental data, project profiles, metrics, and news updates useful for research and analytics.

- Binance API: Enables access to comprehensive order book, trades, and price data specifically from one of the largest crypto trading platforms.

- Kraken API: Provides access to market data and trading functionalities, with solid security and low latency.

- Glassnode API: Specializes in on-chain data and metrics, offering insights into blockchain network health and activity.

- CoinAPI: Aggregates extensive data from multiple exchanges and blockchains, with an emphasis on high-speed access and data normalization.

Leveraging Data for Crypto Trading and Analysis

While APIs supply raw and processed data, their integration with advanced analytical and AI tools is critical for comprehensive crypto trading and research strategies. Platforms such as the crypto trading platform Token Metrics use AI-powered models combined with API data streams to generate quantitative insights and ratings. These assist users in making informed research assessments by evaluating coin fundamentals, sentiment, and market trends without endorsing specific investments.

Developers and analysts utilizing cryptocurrency APIs should consider structuring API outputs into machine-readable formats optimized for data science workflows. Combining multiple sources, for example, market data from CoinGecko with on-chain metrics from Glassnode, can provide multidimensional perspectives facilitating robust scenario analysis and trend forecasting.

Best Practices and Research Tips

- Verify Data Sources: Cross-reference data from different APIs to ensure consistency and mitigate anomalies.

- Monitor API Limitations: Be aware of rate limits and potential downtimes; consider fallback strategies.

- Utilize Documentation: Thoroughly explore API documentation to maximize usage of advanced endpoints.

- Incorporate AI Tools: Employ AI-driven tools like Token Metrics to contextualize raw API data into actionable insights.

- Stay Updated: The crypto ecosystem evolves rapidly; keep abreast of API updates, new endpoints, and data offerings.

Conclusion

The landscape of cryptocurrency APIs in 2025 is rich and varied, catering to diverse needs from market data aggregation to in-depth blockchain analytics. Selecting the best crypto API involves balancing coverage, reliability, and compatibility with analytical frameworks. The Token Metrics API, among the leading options, exemplifies how comprehensive data and AI integration can support sophisticated crypto research workflows.

By leveraging these APIs and complementing them with AI-powered platforms such as Token Metrics, developers and analysts can navigate the complex digital asset market with enhanced clarity and data-driven understanding.

Disclaimer

This article is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency markets carry inherent risks, and users should conduct their own research and consider consulting professional advisors before making any financial decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)