Top Crypto Trading Platforms in 2025

Is the cryptocurrency market continues to mature, new technologies are emerging to give traders an edge. Among the most transformative is AI-powered crypto trading. From automating strategies to identifying hidden opportunities, AI is redefining how traders interact with digital assets.

In this guide, we’ll break down:

- What is AI crypto trading?

- What are the different types of cryptocurrency trading?

- The top crypto trading exchanges and platforms, with Token Metrics as the leading AI crypto trading option.

What is AI Crypto Trading?

AI crypto trading refers to the use of artificial intelligence (AI), machine learning (ML), and data science techniques to make smarter, faster, and more informed trading decisions in the cryptocurrency markets.

These systems analyze vast datasets—price charts, market sentiment, technical indicators, social media trends, on-chain activity—to generate trading signals, price predictions, and portfolio strategies. The goal: remove emotion and bias from crypto trading and replace it with data-driven precision.

Some AI crypto trading tools offer:

- Predictive analytics for token performance

- Real-time trading signals based on pattern recognition

- Automated execution of buy/sell orders based on predefined strategies

- Portfolio optimization using volatility and correlation models

- Sentiment analysis from Twitter, Reddit, and news feeds

AI is especially valuable in the 24/7 crypto markets, where human traders can’t keep up with constant volatility. With AI, traders can react instantly to market shifts and make decisions grounded in data—not gut feeling.

What Are the Types of Cryptocurrency Trading?

Understanding the major types of cryptocurrency trading is essential for choosing the right strategy—especially if you’re planning to use AI to assist or automate your trades.

1. Spot Trading

Spot trading is the simplest and most common form of crypto trading. You buy or sell a cryptocurrency at its current price, and the transaction settles immediately (or “on the spot”). Most traders begin here.

AI can assist by identifying ideal entry and exit points, evaluating token grades, and managing risk.

2. Futures Trading

Futures trading involves contracts that speculate on the future price of a cryptocurrency. Traders can go long or short, using leverage to amplify gains (and risks).

AI helps by identifying bullish or bearish trends, backtesting strategies, and automating trades with quantitative models that adapt to market changes.

3. Margin Trading

Margin trading allows users to borrow funds to increase their trade size. It’s risky but potentially more rewarding.

AI can reduce some of the risks by using real-time volatility data, calculating stop-loss levels, and dynamically adjusting positions.

4. Swing Trading

Swing traders hold positions for days or weeks, capturing short- to medium-term trends.

AI tools are ideal for swing trading, as they can combine technical indicators, market sentiment, and volume analysis to anticipate breakouts and reversals.

5. Day Trading

Day traders open and close positions within a single day, requiring rapid decision-making and constant monitoring.

Here, AI-powered bots can outperform humans by making thousands of micro-decisions per second, reducing slippage and emotional trading errors.

6. Algorithmic and Bot Trading

Algorithmic trading uses coded strategies to automate trades. AI takes this further by allowing the bot to learn and improve over time.

Token Metrics, for example, offers AI grades and indices that traders can plug into their own bots or use through the platform’s native AI strategies.

Top Cryptocurrency Trading Exchanges

When it comes to crypto trading platforms, there are two main categories:

- Exchanges where you buy, sell, and hold crypto

- Analytics platforms that help you decide what to trade and when

Below are some of the top cryptocurrency trading platforms in 2025—both exchanges and AI-powered tools—tailored to serious traders:

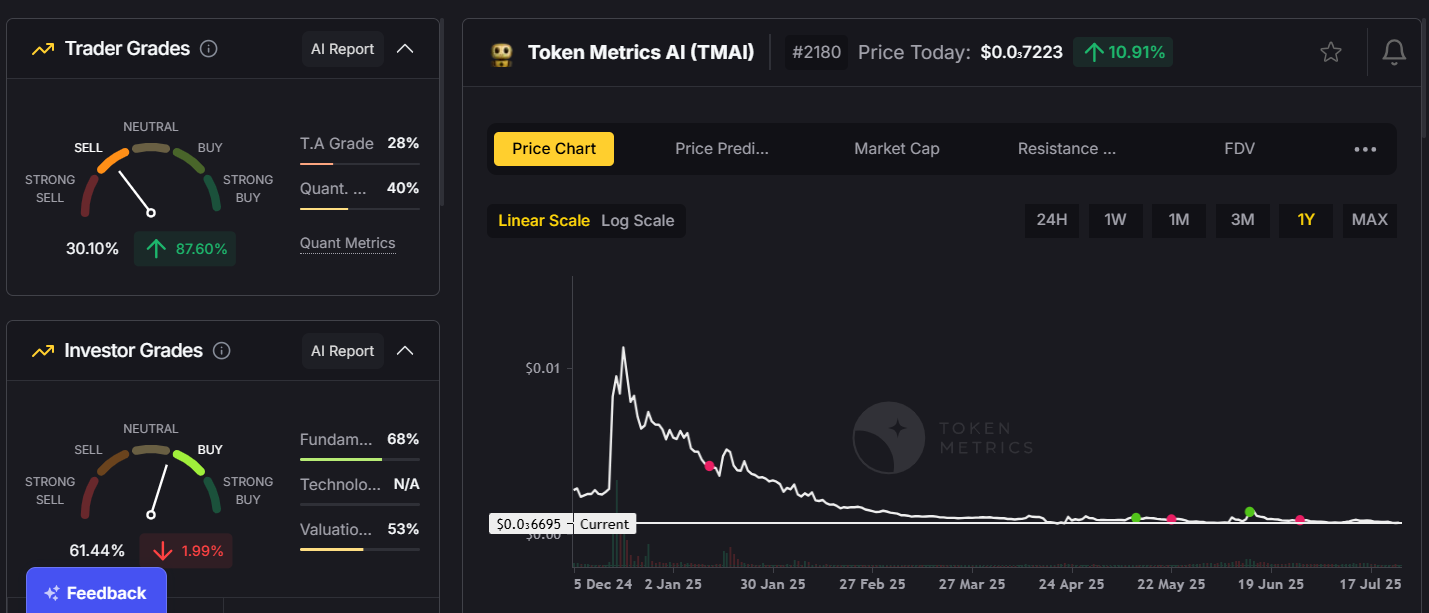

1. Token Metrics – The #1 AI Crypto Trading Platform

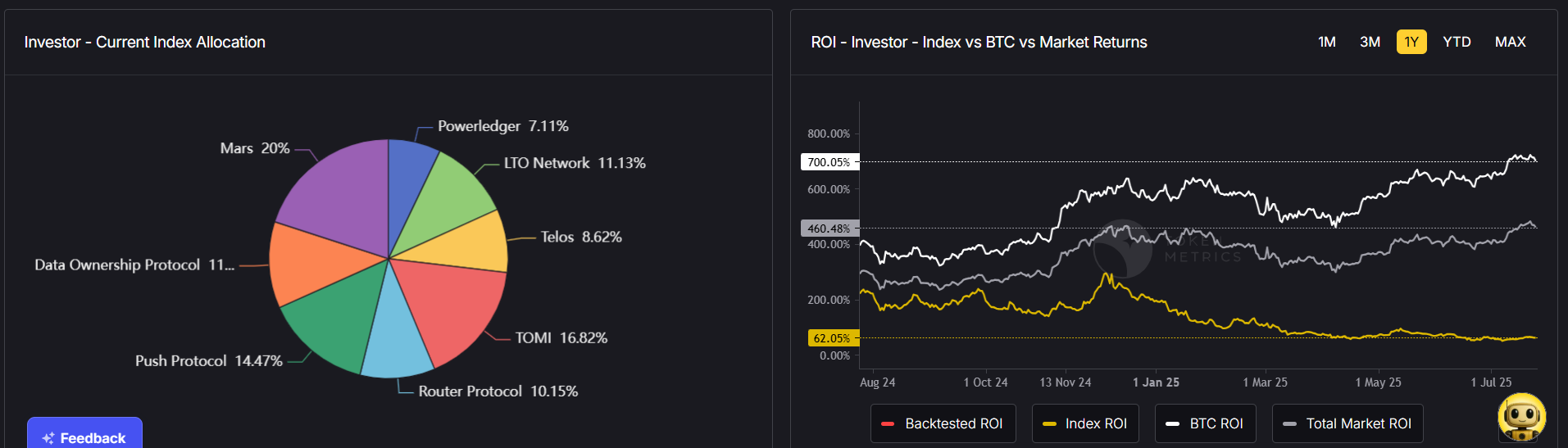

Token Metrics is not an exchange, but a crypto analytics and trading intelligence platform powered by AI. It offers:

- Trader & Investor Grades (AI-powered scoring of tokens)

- Bullish/Bearish Signals

- Portfolio Strategies via AI Indices

- Custom Alerts for price and grade movements

- Data API for building AI trading bots

Token Metrics bridges the gap between raw data and actionable decisions. Whether you’re a beginner or a pro running algorithmic strategies, Token Metrics delivers the AI layer needed to outperform the market.

Traders use Token Metrics alongside centralized exchanges (like Binance or Coinbase) or DEXs to validate trades, identify top-performing narratives, and automate entry/exit based on AI signals.

2. Binance

Binance is one of the world's largest cryptocurrency exchanges, allowing users to buy, sell, and trade hundreds of digital assets including Bitcoin, Ethereum, and other cryptocurrencies.

Founded in 2017 by Changpeng Zhao, the platform offers spot trading, futures, staking, and various other crypto-related financial services to millions of users globally.

3. Coinbase

Coinbase is ideal for retail investors and new traders. While it lacks advanced AI features, it’s a trusted fiat gateway.

Advanced users can subscribe to Coinbase Advanced or integrate with tools like Token Metrics to make smarter trading decisions.

4. Bybit

Bybit offers both spot and derivatives, plus social trading tools like copy trading. It’s popular with swing and leverage traders.

Combine Bybit with Token Metrics for AI-driven entry points on high-volatility setups.

5. Kraken

Kraken is known for strong security and a transparent track record. It supports spot, margin, and futures trading.

When paired with AI tools, Kraken becomes a secure execution venue for data-driven strategies.

6. OKX

OKX offers robust bot features, including grid trading and DCA bots. For users who prefer built-in automation, OKX is a solid option.

Still, Token Metrics outperforms on signal generation, narrative tracking, and AI-backed token scoring—making it an ideal data source for OKX bots.

Why AI is the Future of Crypto Trading

As cryptocurrency trading evolves, manual strategies alone can’t keep up. Market cycles are faster, token launches are more frequent, and volatility is constant. This is where crypto AI trading shines.

Here’s why more traders are adopting AI:

- Speed: AI analyzes and reacts faster than any human

- Scale: It can monitor 1,000s of tokens across multiple chains simultaneously

- Emotionless: AI doesn’t panic-sell or FOMO-buy

- Backtested: Strategies are tested on historical data for statistical confidence

- Adaptive: AI learns and improves over time based on market behavior

Platforms like Token Metrics make this technology accessible—offering plug-and-play AI indices, custom signals, and portfolio intelligence for retail traders, funds, and institutions alike.

Final Thoughts

Cryptocurrency trading is becoming more competitive, data-driven, and automated. With the rise of crypto AI trading, traders now have the tools to gain a true edge—whether they’re investing $100 or managing $1M.

If you’re serious about crypto trading in 2025, don’t just guess—trade with data, trade with AI.

Explore how Token Metrics can power your portfolio with AI-generated insights, real-time signals, and next-generation trading tools.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.svg)

.png)