Top Performing Altcoins: Best Picks for Your Investment Portfolio

As the cryptocurrency market continues to evolve rapidly, many investors are keen to discover the top performing altcoins that could redefine digital currencies in 2025. While bitcoin remains the flagship asset and a dominant store of value, the real innovation and growth opportunities are increasingly found in altcoins—cryptocurrency tokens created to power unique blockchain platforms beyond bitcoin’s original vision, with each cryptocurrency created to address specific limitations or expand on the capabilities of earlier blockchain technologies. These altcoins, along with other cryptos such as Ethereum, USDT, and Binance USD, represent a broad and diverse range of digital currencies discussed throughout this article. In this article, we explore the top 15 altcoins poised to shape the crypto market this year, analyzing their performance over recent periods and in comparison to other cryptos, the reasons behind their rise, and essential strategies for investing and trading in this dynamic landscape.

Introduction to Altcoins

Altcoins are digital currencies that serve as alternatives to Bitcoin, each offering unique features and functionalities within the crypto market. The term “altcoin” combines “alternative” and “coin,” reflecting their role as other cryptocurrencies beyond Bitcoin. With thousands of coins and tokens available, altcoins have become an essential part of the evolving landscape of digital currencies. They enable a wide range of uses, from peer-to-peer transactions and online purchases to innovative investment opportunities and decentralized applications. For investors and users looking to expand their understanding of the crypto market, exploring altcoins is crucial. Staying informed about market trends and technological advancements, and conducting thorough research, can help investors identify promising coins and make smarter investment decisions in this dynamic environment.

Understanding the Crypto Market

The crypto market is known for its rapid price swings and ever-changing dynamics, making it both exciting and challenging for investors. Crypto prices are influenced by a variety of factors, including market trends, investor sentiment, and ongoing technological advancements. Decentralized exchanges (DEXs), smart contracts, and other cryptocurrencies like Bitcoin Cash, XRP, and Shiba Inu play pivotal roles in shaping the market’s direction. When considering investments, it’s essential to look at market capitalization, trading volume, and the security of each asset. Thorough research is key—investors should analyze the fundamentals of each coin, monitor market trends, and stay updated on new developments. By understanding these elements, investors can better navigate the volatile crypto market and make informed trading and investment decisions.

Why Altcoins Are Poised for Growth in 2025

Entering the mid-2020s, the crypto market is witnessing an unprecedented acceleration in technological advancements and blockchain innovation. Bitcoin (BTC) continues to hold its position as the leading digital currency with the highest market capitalization, often seen as “digital gold.” Ethereum, as a cryptocurrency created in 2015 to address the limitations of earlier blockchain technologies, is now the second-largest cryptocurrency by market cap and remains the backbone of smart contracts and decentralized applications (dApps). However, altcoins—other cryptocurrencies built on their own networks or as tokens on existing platforms—are driving the next wave of breakthroughs.

These altcoins are spearheading progress across several critical sectors:

- AI & automation: By integrating artificial intelligence with blockchain, altcoins enable smarter trading algorithms, automated research tools, and enhanced blockchain interactions. This fusion helps investors and developers optimize portfolios and streamline transaction processing. The process of automating these blockchain operations is crucial for improving efficiency and scalability.

- DeFi 2.0: Decentralized finance continues to evolve with improved lending, borrowing, and yield-generating strategies. New DeFi protocols offer greater capital efficiency, reduced fees, and innovative staking mechanisms, attracting a growing number of users. The process behind these protocols often involves complex smart contracts and automated liquidity management.

- Creator economies & entertainment: Platforms powered by altcoins are transforming how creators and communities monetize content. By leveraging NFTs, tokenized royalties, and AI-generated media, these ecosystems empower artists, gamers, and fans to participate in decentralized digital economies.

- Decentralized infrastructure: Altcoins also support the development of decentralized compute networks, tokenization of real-world assets, and AI training marketplaces. These platforms expand blockchain’s utility beyond payments and peer-to-peer transfers, enhancing security and scalability through a robust underlying system that supports these innovations.

- Performance over time: Analyzing altcoin growth or performance over a specific period is essential for understanding market trends and making informed decisions.

For investors looking to diversify their crypto portfolio and gain exposure to cutting-edge blockchain narratives, altcoins present compelling opportunities that go beyond bitcoin and popular stablecoins like USD-backed tokens. However, those who choose to invest in altcoins should be aware that they may carry more risk, and many of the smaller ones may not be trustworthy investments, making thorough research essential.

Memecoins and Their Impact

Memecoins, such as Dogecoin and Shiba Inu, have captured the imagination of the crypto market with their viral appeal and community-driven hype. These coins often start as internet jokes or memes but can quickly gain traction, leading to dramatic rises in price and trading volume. While some investors have gained significant returns from the rapid appreciation of memecoins, their value can be highly unpredictable and subject to sudden drops. The hype surrounding these coins can create both opportunities and risks, making them a high-risk investment option. Despite their volatility, memecoins have contributed to the diversity and growth of the crypto market, sometimes even supporting charitable causes or community projects. Investors should approach memecoins with caution, carefully weighing the potential rewards against the risks before investing.

Stablecoins and Security Tokens

Stablecoins and security tokens are two important categories within the crypto market, each serving distinct purposes for investors and users. Stablecoins, like Tether (USDT) and USD Coin (USDC), are pegged to traditional currencies such as the US dollar, providing a stable store of value and facilitating smooth transactions in the often-volatile crypto environment. They are widely used for payments, trading, and as a safe haven during market turbulence. Security tokens, on the other hand, represent ownership in real-world assets like companies or properties. These tokens can offer benefits such as dividend payments, voting rights, and increased transparency. Understanding the differences between stablecoins and security tokens is essential for investors seeking to diversify their portfolios and participate in a broader range of investment opportunities within the cryptocurrency market.

Top 15 Altcoins to Watch in 2025

1. Token Metrics AI ($TMAI)

Token Metrics AI stands at the forefront of the connection between AI and crypto analytics. This platform offers automated research, real-time trading signals, and portfolio rebalancing tools powered by advanced machine learning models. Investors who stake $TMAI tokens gain access to premium features such as AI-driven indices and research automation, providing a significant edge for both short-term traders and long-term holders. The integration of AI enhances decision-making in the highly volatile crypto market, making $TMAI a must-watch asset.

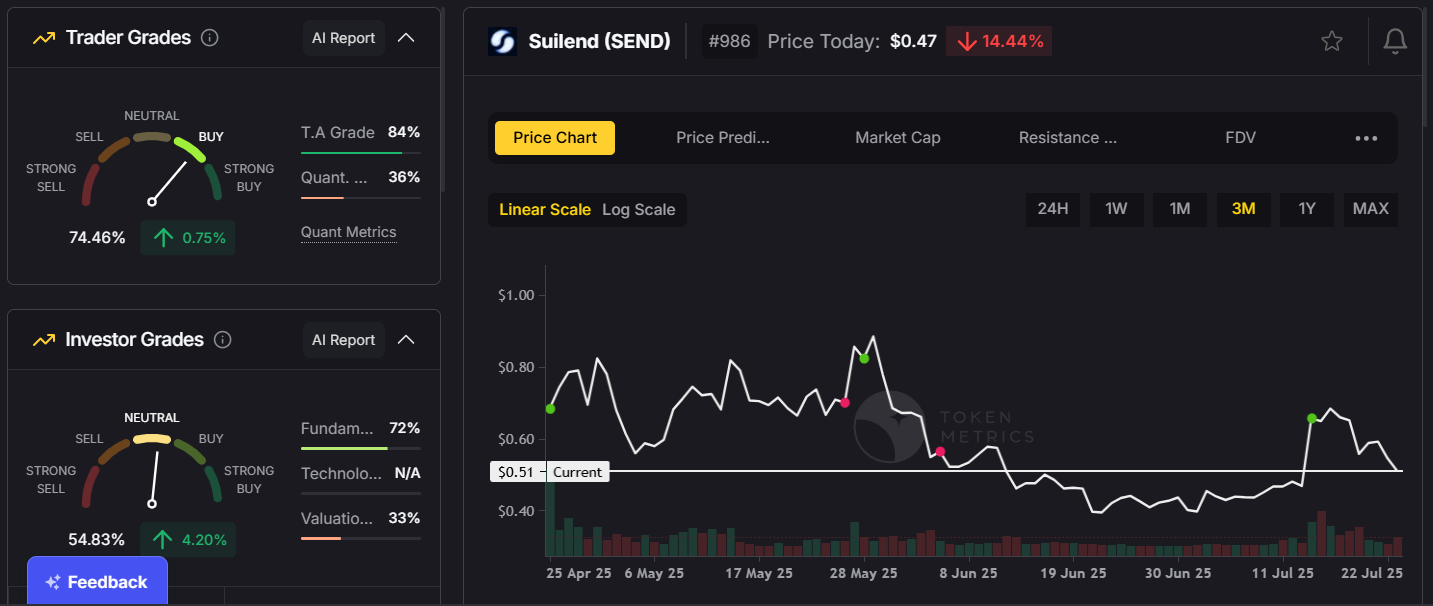

2. Suilend ($SEND)

Operating as a DeFi lending protocol on the Sui blockchain, Suilend leverages parallel transaction processing and ultra-low fees to stand out in the crowded lending space. By integrating with a decentralized exchange, Suilend can enable users to seamlessly swap assets and access liquidity directly from peer-to-peer markets without relying on centralized intermediaries. Its efficient architecture allows traders and investors to access competitive yields with minimal cost, providing an attractive alternative to traditional DeFi lenders. As decentralized finance continues to mature, protocols like Suilend are essential for improving user experience and expanding market participation.

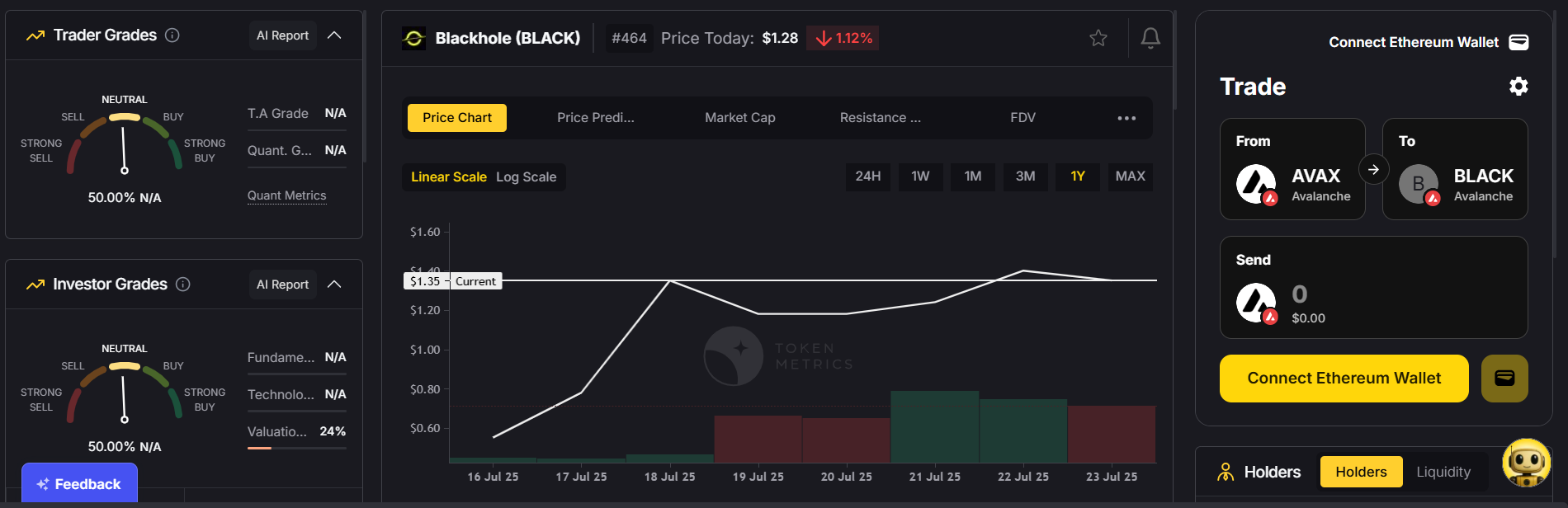

3. Blackhole ($BLACK)

Blackhole addresses the growing demand for decentralized GPU compute power—a vital resource for AI developers and blockchain projects requiring substantial computational capacity. By creating a marketplace that connects GPU providers with AI developers, Blackhole facilitates the sharing of compute resources in a secure, peer-to-peer manner. This decentralized approach is crucial for scaling AI applications and blockchain-based machine learning models, positioning $BLACK as a key player in the intersection of AI and blockchain.

4. Resolv ($RESOLV)

Resolv is innovating the way legal contracts are managed on-chain by introducing AI-driven arbitration and compliance tools. As governments and financial institutions tighten regulations around cryptocurrency transactions, platforms like Resolv that automate contract enforcement and dispute resolution on the blockchain could become indispensable. This altcoin is particularly relevant for investors interested in the growing field of decentralized legal infrastructure.

Note: On-chain contracts may be subject to evolving legal and regulatory risks, and compliance requirements can vary by jurisdiction.

5. Cookie.fun ($COOKIE)

Fusing meme culture, AI-generated animation, and NFTs, Cookie.fun creates a decentralized platform for community-driven content creation and monetization. This playful yet monetizable ecosystem taps into the hype surrounding digital collectibles and creator economies, allowing users to engage with unique digital assets while supporting artists. For those interested in the entertainment and gaming sectors of crypto, $COOKIE offers an innovative entry point.

6. Usual Money ($USUAL)

Usual Money is a user-friendly stablecoin platform optimized for DeFi payments and yield strategies. By focusing on capital efficiency and seamless user experience, it aims to lead in the popular stablecoins sector, which is essential for reducing volatility and enabling smooth transactions within the crypto ecosystem. Tether (USDT), another stablecoin pegged to the US dollar at a 1:1 ratio, is widely used to stabilize other cryptocurrencies during market fluctuations. $USUAL’s stable value pegged to the dollar makes it an attractive asset for traders and investors seeking stability amid market fluctuations.

7. Freysa AI ($FAI)

Freysa AI builds decentralized frameworks for autonomous AI agents capable of executing blockchain transactions and interacting with dApps without human intervention. This innovation is ideal for automating complex on-chain workflows, granting users enhanced control over their DeFi activities. As smart contracts gain prominence, platforms like Freysa AI that combine AI and blockchain will be crucial for the next generation of decentralized applications.

8. LOFI

LOFI revolutionizes the music industry by enabling artists and fans to co-create generative soundscapes and monetize their work through tokenized royalties and NFTs. By merging blockchain, culture, and AI, LOFI offers a promising platform for long-term growth in the creative economy. This altcoin exemplifies how digital currencies can transform traditional sectors like entertainment and gaming.

9. Gradients ($SN56)

Gradients offers a token-incentivized data marketplace designed for AI developers. By crowdsourcing datasets and rewarding contributors with tokens, it addresses the critical data scarcity problem in AI model training. This innovative approach to data sharing could accelerate AI advancements and create new investment opportunities in the intersection of data, AI, and blockchain.

10. BIO Protocol ($BIO)

BIO Protocol integrates biotech research with decentralized science (DeSci), enabling scientists to tokenize their research, securely share datasets, and earn royalties. This platform pushes biotech innovation into the Web3 era, fostering collaboration and transparency. Investors interested in cutting-edge scientific applications of blockchain should keep an eye on $BIO.

11. Swarms ($SWARMS)

Swarms focuses on multi-agent AI coordination to optimize complex on-chain activities such as DAO voting and DeFi arbitrage. By enhancing scalability and efficiency, it offers a solution that could significantly improve how decentralized organizations operate. This altcoin is essential for investors looking into governance and automation within the crypto ecosystem.

12. Creator.bid ($BID)

Creator.bid connects fans with AI-powered creators through auctioned personalized content, introducing innovative monetization models for influencers. This platform taps into the burgeoning AI-avatar economy and the broader creator economy, offering new ways for digital artists to generate income and engage with their audience.

13. Collaterize ($COLLAT)

Collaterize bridges real-world assets (RWAs) and DeFi by enabling users to tokenize property, invoices, and other tangible assets. With rising demand for asset-backed lending and decentralized finance solutions, $COLLAT serves as a critical link between traditional finance and blockchain, broadening the scope of crypto investment.

14. aixbt by Virtuals ($AIXBT)

AIXBT provides AI-driven trading bots that autonomously execute cross-exchange strategies, appealing to traders who seek automation without sacrificing strategic control. This altcoin is particularly attractive to active market participants aiming to capitalize on volatile crypto prices and market trends through sophisticated algorithms.

15. MyShell AI ($SHELL)

MyShell AI allows users to build voice-based AI characters that operate across platforms like Telegram and Discord. Its voice-to-earn model combines entertainment with real-world utility, tapping into the conversational AI boom. This innovative approach to digital interaction highlights the expanding role of AI in the crypto market.

Cryptocurrency Regulation

Cryptocurrency regulation is an evolving area as governments and financial institutions strive to create clear rules for the growing crypto market. Regulations are designed to protect investors, ensure market stability, and encourage responsible innovation in digital currencies like Bitcoin and other altcoins. Staying informed about regulatory changes is crucial, as new laws and guidelines can significantly impact the value and legality of various cryptocurrencies. Investors should conduct thorough research and consider consulting financial experts to understand how regulations may affect their investments. As the crypto market matures, regulation will play a key role in shaping its future, making it essential for investors to stay updated and adapt their strategies accordingly.

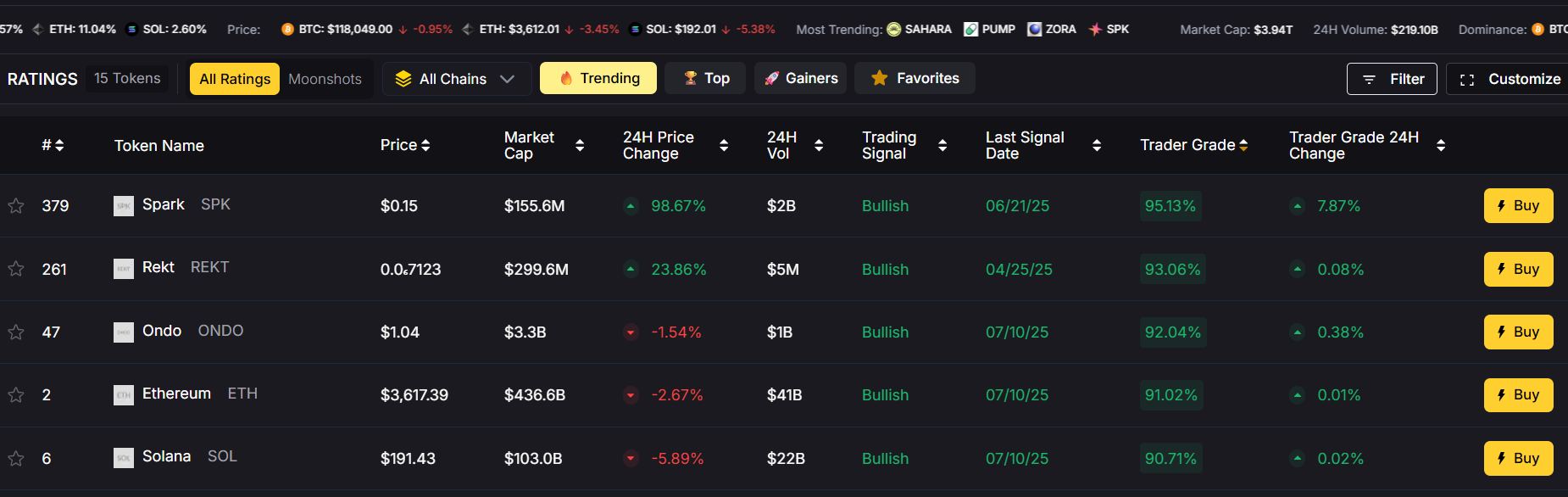

How to Trade Altcoins in 2025

Successfully trading altcoins requires a balance of data-driven decision-making and disciplined risk management. Utilizing AI analytics tools such as Token Metrics can provide real-time trading signals and actionable insights, helping investors navigate the volatile crypto market. Diversifying your portfolio across sectors like AI, DeFi, and real-world asset tokenization reduces exposure to sector-specific risks.

When conducting market analysis, it is important to understand how certain metrics, such as Bitcoin dominance, are determined by comparing Bitcoin's market cap to the overall crypto market capitalization. This helps traders assess market sentiment and make informed decisions.

Setting clear stop-loss and take-profit levels is essential to protect gains and limit losses in this highly volatile environment. Monitoring the top losers in the market can also help you avoid assets experiencing significant declines and manage risk more effectively. Additionally, staying informed about evolving market narratives—such as the rise of AI coins, DeFi 2.0 platforms, and cross-chain interoperability—as well as regulatory changes, can help you catch early momentum and capitalize on emerging trends.

Managing Risks in Altcoin Investing

While altcoins offer the potential for outsized returns compared to bitcoin or Ethereum, they also come with greater risk and price volatility. Thorough research is essential before investing: evaluate tokenomics, development teams, project roadmaps, and the platform’s security measures. When assessing investments, it's important to analyze performance and risk over a specific period to better understand market trends. Investors are advised to conduct their own independent research into investment strategies before making an investment decision. Avoid over-leveraging, especially in derivatives or high-yield farming, as these can amplify losses.

Regulatory developments remain a critical factor; some tokens might face compliance hurdles as governments and financial institutions scrutinize the crypto space. In the context of DeFi, some altcoins are specifically designed to replace or interact with banks, offering decentralized alternatives to traditional financial services. Any investments in the crypto space should be part of a broader investment strategy to offset potential losses. Consider staking or holding coins with strong utility and adoption, such as TRON and its native token TRX, to benefit from network incentives and long-term value appreciation. Notable altcoins like BCH (Bitcoin Cash) offer unique features such as larger block sizes and faster transaction times. Additionally, infrastructure like the XRP Ledger plays a key role in facilitating fast and cost-effective transactions across the network.

Final Thoughts

The best crypto assets in 2025 will be those that combine technological innovation, robust communities, and clear real-world applications. From AI-powered analytics platforms like Token Metrics AI ($TMAI) to decentralized compute networks such as Blackhole ($BLACK) and creator-focused ecosystems like Cookie.fun ($COOKIE), these top performing altcoins are driving the next chapter of blockchain evolution.

For investors eager to navigate the next altcoin season, pairing thorough research with AI-powered trading platforms is essential to stay ahead in this fast-moving market. Always remember to manage your risk prudently, as the cryptocurrency market remains volatile despite its tremendous growth potential. With the right approach, these altcoins could be valuable additions to your crypto portfolio as the digital currency landscape continues to expand and mature.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)