The Ultimate Guide to TradingView With Advanced Trading Strategies

Cryptocurrency trading has become a popular way for investors to make money in the digital asset market. With the rise of platforms like TradingView and the development of indicators like the Token Metrics TradingView Indicator, traders now have powerful tools to navigate the volatile world of crypto trading.

This guide will explore different crypto trading strategies and how to effectively use the Token Metrics TradingView Indicator to maximize profit potential.

Who is Ian Balina?

Before we delve into the world of crypto trading strategies, let's take a moment to introduce Ian Balina, the founder and CEO of Token Metrics. Ian is a well-known figure in the crypto space with a track record of success and expertise in the field.

He has made millions in the crypto market, and his insights and strategies have helped countless investors make money in the digital asset space. Ian's experience and knowledge make him a trusted source for crypto trading advice.

The Longest Crypto Bull Run Ever

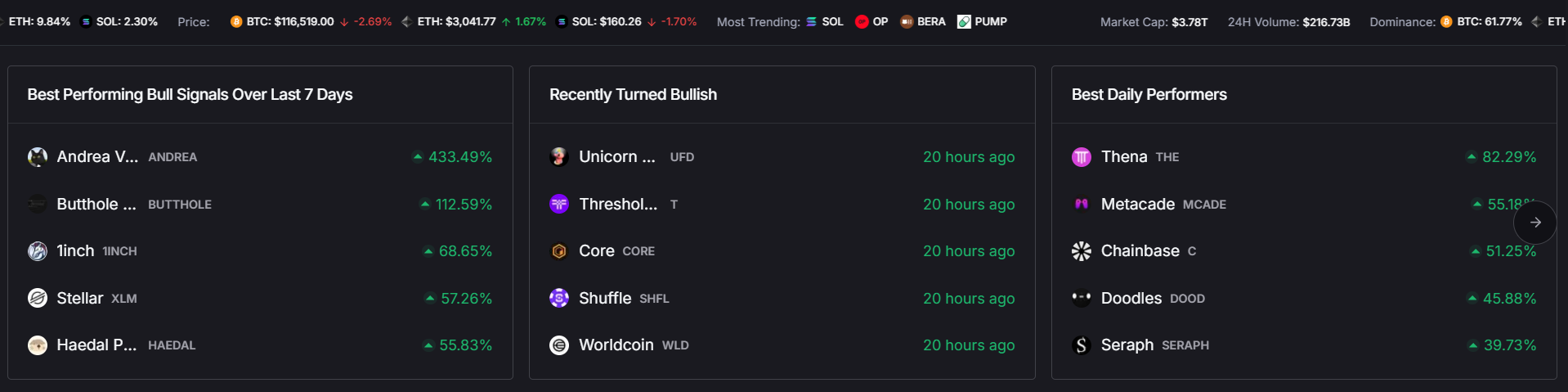

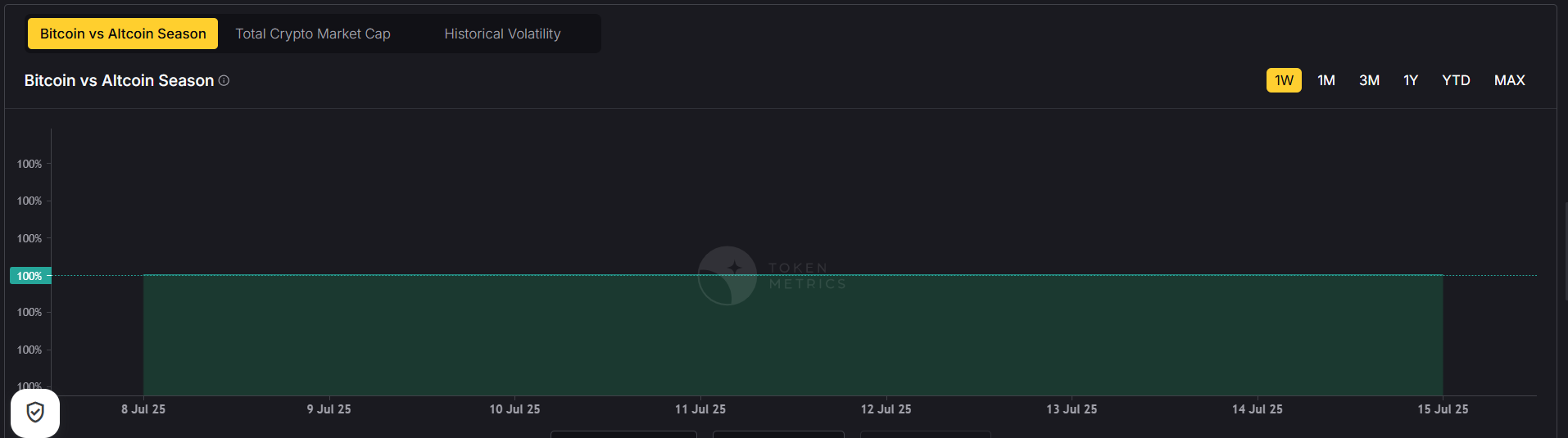

Before we dive into the different crypto trading strategies, it's essential to understand the current market conditions. Many experts believe we are on the verge of the longest crypto bull run ever.

The crypto market has shown tremendous growth over the years, and the total crypto market cap is expected to reach anywhere from 8 to 14 trillion dollars. This presents a significant opportunity for traders to make money in the market.

TradingView Tutorial: A Quick Overview

TradingView is a popular platform traders use to chart the market and perform technical analysis. It provides many tools and indicators to help traders make informed decisions.

Beginners and experienced traders widely use the platform due to its user-friendly interface and powerful features. Let's look at how to use TradingView for crypto trading.

- Sign up for a TradingView account: To get started, sign up for a TradingView account. You can choose between a free or paid plan with additional features.

- Search for crypto assets: Once logged in, you can search for different crypto assets to chart. TradingView has a vast database of charts for various cryptocurrencies.

- Customize your chart: TradingView allows you to customize your chart by adding different indicators, trend lines, and other drawing tools. You can also adjust the time frame to analyze short-term or long-term trends.

- Use the Token Metrics TradingView Indicator: If you're a Token Metrics customer, you can access the Token Metrics TradingView Indicator on the platform. This indicator provides valuable insights and signals to help you make informed trading decisions.

How to Access the Token Metrics TradingView Indicator?

To access the Token Metrics TradingView Indicator, you need to be a Token Metrics customer with an advanced plan or higher. Once you have an advanced plan, follow these steps to access the indicator:

- Log into your Token Metrics account.

- Go to the settings section and scroll down for the TradingView details.

- Enter your TradingView username in the designated field.

- Save the settings, and Token Metrics will send you an invite-only custom indicator on TradingView.

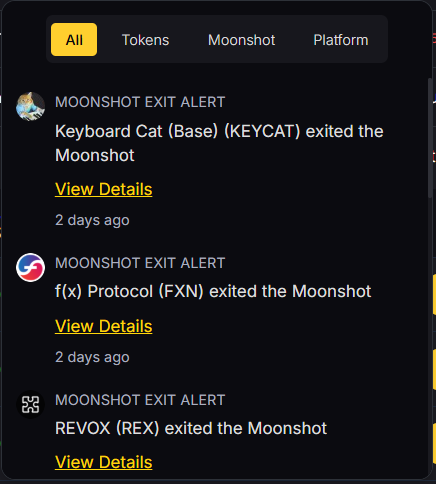

Once you receive the invite, you can add the Token Metrics TradingView Indicator to your chart on TradingView. This indicator will provide you with valuable insights and signals to help you make profitable trades.

Bitcoin Trading Strategy on Token Metrics TradingView

Now that you can access the Token Metrics TradingView Indicator, let's explore a Bitcoin trading strategy using this powerful tool. The strategy we will discuss is based on the long-term trend of bitcoin and can be used by both swing traders and long-term investors.

- Set the time frame: Start by setting the time frame to a daily or longer duration to capture the long-term trend of Bitcoin.

- Configure the indicator: Adjust the indicator settings to match your trading style. You can customize parameters like moving averages, channel length, and source data.

- Analyze the signals: Look for signals from the Token Metrics TradingView Indicator. These signals will indicate when to enter or exit a trade based on the long-term trend of bitcoin.

- Make informed trading decisions: Use the signals the indicator provides to make informed trading decisions. The indicator will help you identify bullish and bearish trends, support and resistance levels, and potential buy and sell signals.

Following this bitcoin trading strategy on the Token Metrics TradingView Indicator can maximize your profit potential and help you make informed trading decisions.

How Token Metrics TradingView Indicator Works?

The Token Metrics TradingView Indicator is a powerful tool that provides traders with valuable insights and signals to make profitable trades. The indicator has four main components: clouds, trend lines, support and resistance lines, and signals.

- Clouds: The cloud component helps traders identify bullish and bearish trends in the market. Green clouds indicate a bullish trend, while red clouds indicate a bearish trend.

- Trend lines: The trend lines component provides adaptive trend lines that help traders determine the current trend of an asset. This information is crucial for making informed trading decisions.

- Support and resistance lines: The support and resistance lines component helps traders identify key support and resistance levels in the market. These levels can be used to determine potential entry and exit points for trades.

- Signals: The signals component of the indicator provides clear buy and sell signals based on the analysis of the other components. These signals help traders make timely and profitable trading decisions.

By leveraging the power of the Token Metrics TradingView Indicator, traders can gain a competitive edge in the crypto market and increase their chances of making profitable trades.

Crypto Trading Strategy in TradingView Indicator

In addition to the bitcoin trading strategy we discussed earlier, the Token Metrics TradingView Indicator can be used for various other crypto trading strategies. Let's explore two popular crypto assets and their trading strategies using Bittensor (TAO) and Helium Network (HNT) indicators.

Bittensor (TAO) and Helium Network (HNT) Trading Strategy

Here's a trading strategy using the Token Metrics TradingView Indicator for TAO and HNT:

By following this trading strategy with the Token Metrics TradingView Indicator, you can make profitable trades and capitalize on the growth potential.

Conclusion

In conclusion, crypto trading strategies play a crucial role in navigating the volatile world of cryptocurrency. By leveraging powerful tools like the Token Metrics TradingView Indicator, traders can gain valuable insights and signals to make informed trading decisions.

Whether you're a swing trader, a day trader, or a long-term investor, the Token Metrics TradingView Indicator can help you maximize your profit potential and confidently navigate the crypto market.

So, dive into the world of crypto trading strategies, harness the power of the Token Metrics TradingView Indicator, and embark on your journey to financial success in the exciting world of cryptocurrencies.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.svg)

.png)