What Are Some Trusted Crypto Exchanges? A Comprehensive 2025 Guide

Choosing the right cryptocurrency exchange is one of the most critical decisions for anyone entering the digital asset market. With over 254 exchanges tracked globally and a staggering $1.52 trillion in 24-hour trading volume, the landscape offers tremendous opportunities alongside significant risks. The wrong platform choice can expose you to security breaches, regulatory issues, or inadequate customer support that could cost you your investment.

In 2025, the cryptocurrency exchange industry has matured significantly, with clearer regulatory frameworks, enhanced security standards, and more sophisticated trading tools. However, recent data shows that nearly $1.93 billion was stolen in crypto-related crimes in the first half of 2025 alone, surpassing the total for 2024 and making it crucial to select exchanges with proven track records and robust security measures.

This comprehensive guide examines the most trusted cryptocurrency exchanges in 2025, exploring what makes them reliable, the key factors to consider when choosing a platform, and how to maximize your trading security and success.

Understanding Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms that allow traders to buy, sell, and trade cryptocurrencies, derivatives, and other crypto-related assets. These digital marketplaces have evolved dramatically since Bitcoin's release in 2008, transforming from rudimentary peer-to-peer platforms into sophisticated financial institutions offering comprehensive services.

Types of Crypto Exchanges

- Centralized Exchanges (CEX): Platforms like Binance, Coinbase, and Kraken hold your funds and execute trades on your behalf, acting as intermediaries similar to traditional banks. These exchanges offer high liquidity, fast transaction speeds, user-friendly interfaces, and customer support but require trusting the platform with custody of your assets.

- Decentralized Exchanges (DEX): Platforms enabling direct peer-to-peer trading without intermediaries, offering greater privacy and self-custody but typically with lower liquidity and more complex user experiences.

- Hybrid Exchanges: In 2025, some platforms seek to offer the best of both worlds, providing the speed of centralized exchanges with the self-custodial nature of decentralized platforms. Notable examples include dYdX v4, Coinbase Wallet with Base integration, and ZK-powered DEXs.

- Brokers: Platforms like eToro and Robinhood that allow crypto purchases at set prices without orderbook access, prioritizing simplicity over advanced trading features.

Key Factors for Exchange Trustworthiness

Selecting a trustworthy exchange involves evaluating several dimensions beyond just trading fees and available cryptocurrencies. Important factors include security, regulatory compliance, liquidity, and user experience.

Security and Regulatory Compliance

Security remains the foremost concern, with exchanges now mandated to implement rigorous know-your-customer and anti-money laundering protocols, alongside new licensing and reporting requirements. Trusted exchanges maintain industry-leading security measures such as two-factor authentication, cold storage for most assets, regular security audits, and insurance funds.

Regulatory compliance has become increasingly vital, especially as governments establish frameworks for digital assets. Licensed exchanges adhering to regulations are considered more reliable and less susceptible to sudden shutdowns or regulatory actions. In 2025, frameworks like the Markets in Crypto-Assets Regulation (MiCA) in the European Union and evolving U.S. regulations aim to standardize and supervise the industry.

Trading Features and Liquidity

High liquidity ensures easier entry and exit points, minimizing price impact and facilitating large trades. The most prominent exchanges support a broad range of coins, trading pairs, and derivatives, including spot, margin, futures, and options. As of 2025, Binance, Bybit, and MEXC are among the largest by trading volume, supported by deep liquidity and extensive offerings.

Fee Structures

Trading fees can significantly affect prolonged profitability. Most platforms employ maker-taker models, with fees ranging approximately from 0.02% to 0.6%. Some exchanges offer discounts for high-volume traders or native tokens. It's essential to consider deposit, withdrawal, staking, and other fees to fully understand the cost structure of each platform.

Customer Support and User Experience

Responsive support is critical when dealing with security or trading issues. Leading exchanges provide 24/7 multilingual support via chat, email, or help centers. User experience involves seamless interfaces on desktop and mobile, with over 72% of traders now using mobile apps. Educational resources such as tutorials, market analysis, and learning centers are also valuable for empowering users.

Top Trusted Crypto Exchanges for 2025

Based on security, compliance, user reviews, and comprehensive features, the following have established themselves as the most reliable platforms:

Kraken: Industry-Leading Security and Trust

Kraken, founded in 2011, has never experienced a hack resulting in customer fund loss. It offers over 350 cryptocurrencies, maintains licenses across multiple regions, and emphasizes security and transparency. The platform provides standard and Kraken Pro interfaces, supporting advanced trading, technical analysis, and margin trading. Kraken's reputation is reinforced by reviews from industry analysts like CoinGecko and Kaiko.

Coinbase: Most Trusted U.S. Exchange

Established in 2012, Coinbase supports around 250 cryptocurrencies. It is publicly traded, operates in over 190 countries, and complies with stringent U.S. regulations. Coinbase offers a simple interface for beginners and advanced tools for experienced traders, backed by robust security features including cold storage and 2FA.

Binance: Global Trading Volume Leader

Founded in 2017, Binance supports hundreds of cryptocurrencies and maintains the world’s largest trading volume. It offers a low fee structure (~0.1%), extensive trading options, and a comprehensive ecosystem including staking, launchpool, and Earning programs. Binance’s mobile app is widely used, and the platform stores 10% of user funds in its SAFU fund for security.

Gemini: Security-First Exchange

Founded in 2014, Gemini emphasizes security and regulatory compliance. It offers insurance for digital assets, operates as a New York trust company, and supports over 100 cryptocurrencies. Gemini provides both beginner-friendly and advanced trading interfaces and has launched innovative products like the Gemini Dollar stablecoin.

OKX: Comprehensive Trading Platform

OKX supports spot, futures, and derivatives trading with deep liquidity across 180+ countries. It features professional tools, extensive charting, staking, and DeFi integration, serving advanced traders worldwide.

Bitstamp: Longest-Established Exchange

Founded in 2011, Bitstamp is one of the oldest and most regulated exchanges in the industry. It has a strong European presence, robust security, and a tiered fee system based on trading volume, making it suitable for long-term investors and high-volume traders.

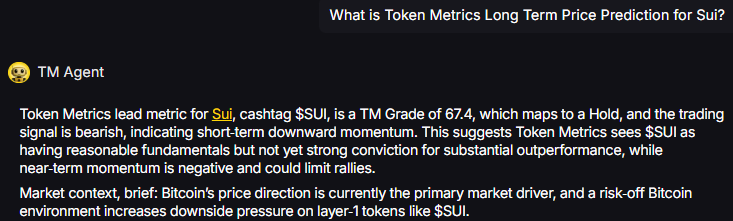

Maximizing Trading Success with Token Metrics

While choosing a trusted exchange provides the foundation, leveraging advanced analytics is crucial for enhancing performance. Discover the benefits of Token Metrics as an AI-powered platform that offers personalized market insights, real-time signals, and portfolio management tools. It helps traders identify opportunities, optimize trade timing, and manage risk across multiple platforms effectively.

Best Practices for Exchange Security

Even trusted exchanges require good security hygiene. Use two-factor authentication (prefer Authenticator apps over SMS), enable withdrawal whitelists, and regularly monitor account activity. For large holdings, consider cold storage with hardware wallets. Maintain good digital hygiene by avoiding public Wi-Fi and using strong, unique passwords.

Regional Considerations

Different regions have varying regulations affecting exchange choices. U.S. users benefit from platforms like Coinbase and Kraken with strong compliance. The EU favors exchanges adhering to MiCA, such as Kraken, Bitstamp, and Binance. UK traders should look for FCA-registered platforms like Kraken and Bitstamp. In Asia-Pacific, options like Bybit and OKX are popular, with regional regulation influencing platform selection.

The Future of Crypto Exchanges

Key trends include increased institutional adoption, DeFi integration, tighter regulatory compliance, and the adoption of AI-powered trading tools. These developments will shape the landscape in the coming years, promoting more secure, transparent, and sophisticated trading environments.

Conclusion: Choosing Your Trusted Exchange

Effective selection involves balancing security, compliance, features, fees, and regional considerations. Leading platforms like Kraken, Coinbase, Binance, Gemini, and Bitstamp have earned trust through consistent performance. Combining these with analytics tools from Token Metrics enables traders to enhance decision-making, manage risks, and maximize opportunities in this dynamic market.

Always implement strong security practices, diversify holdings, and stay informed about regulatory changes. The evolving crypto industry favors exchanges that prioritize transparency, security, and user support—key factors to consider as you navigate the exciting landscape of digital assets.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)