Understanding How Crypto APIs Power Digital Asset Platforms

%201.svg)

%201.svg)

In today's digital asset ecosystem, Application Programming Interfaces, or APIs, are the unsung heroes enabling everything from cryptocurrency wallets to trading bots. Whether you're a developer building for Web3 or a curious user interested in how your exchange functions, understanding how crypto APIs work is essential

What Is a Crypto API?

A crypto API is a set of programming instructions and standards that allow software applications to communicate with cryptocurrency services. These services may include wallet functions, price feeds, trading engines, exchange platforms, and blockchain networks. By using a crypto API, developers can automate access to real-time market data or execute trades on behalf of users without manually interacting with each platform.

For instance, the Token Metrics API provides structured access to cryptocurrency ratings, analytics, and other data to help teams build intelligent applications.

Types of Crypto APIs

There are several categories of APIs in the cryptocurrency landscape, each with different capabilities and use cases:

How Crypto APIs Work

At their core, crypto APIs operate over internet protocols—typically HTTPS—and return data in JSON or XML formats. When an application makes a request to an API endpoint (a specific URL), the server processes the request, fetches the corresponding data or action, and sends a response back.

For example, a crypto wallet app might call an API endpoint like /v1/account/balance to check a user’s holdings. To ensure security and authorization, many APIs require API keys or OAuth tokens for access. Rate limits are also enforced to prevent server overload.

Behind the scenes, these APIs interface with various backend systems—blockchains, trading engines, or databases—to fulfill each request in real time or near real time.

Common Use Cases for Crypto APIs

Crypto APIs are used across a broad spectrum of applications:

Benefits of Using Crypto APIs

APIs dramatically reduce time-to-market for developers while enhancing user experience and application efficiency.

Key Considerations for API Integration

When integrating a crypto API, consider the following factors:

Platforms like the Token Metrics API provide both comprehensive documentation and reliability for developers building AI-powered solutions in crypto.

AI-Powered Analytics and APIs

Some of the most powerful crypto APIs now incorporate artificial intelligence and machine learning features. For example, the Token Metrics API facilitates access to predictive models, coin grades, and AI-based price forecasts.

By embedding these tools into custom apps, users can programmatically tap into advanced analytics, helping refine research workflows and support technical or fundamental analysis. Although these outputs can guide decisions, they should be viewed in a broader context instead of relying exclusively on model predictions.

Conclusion

Crypto APIs are critical infrastructure for the entire digital asset industry. From data retrieval and trading automation to blockchain integration and AI-driven analytics, these tools offer immense utility for developers, analysts, and businesses alike. Platforms such as Token Metrics provide not only in-depth crypto research but also API access to empower intelligent applications built on real-time market insights. By understanding how crypto APIs work, users and developers can better navigate the rapidly evolving Web3 landscape.

Disclaimer

This article is for informational and educational purposes only. It does not constitute financial, investment, or technical advice. Always conduct your own research and consult professional advisors before making any decisions.

AI Agents in Minutes, Not Months

.svg)

Create Your Free Token Metrics Account

.png)

Recent Posts

Best Index Providers & Benchmark Services (2025)

%201.svg)

%201.svg)

Why Crypto Index Providers & Benchmark Services Matter in September 2025

Crypto index providers give institutions and advanced investors rules-based, auditable ways to measure the digital asset market. In one sentence: a crypto index provider designs and administers regulated benchmarks—like price indices or market baskets—that funds, ETPs, quants, and risk teams can track or license. As liquidity deepens and regulation advances, high-integrity benchmarks reduce noise, standardize reporting, and enable products from passive ETPs to factor strategies.

If you’re comparing crypto index providers for portfolio measurement, product launches, or compliance reporting, this guide ranks the best options now—what they do, who they fit, and what to consider across security posture, coverage, costs, and support.

How We Picked (Methodology & Scoring)

- Liquidity (30%) – Does the provider screen venues/liquidity robustly and publish transparent inclusion rules?

- Security & Governance (25%) – Benchmark authorization/registration, governance committees, calculation resilience, and public methodologies/audits.

- Coverage (15%) – Breadth across single-asset, multi-asset, sectors/factors, and region eligibility.

- Costs (15%) – Licensing clarity, data access models, and total cost to operate products.

- UX (10%) – Docs, factsheets, ground rules, rebalancing cadence, client tooling.

- Support (5%) – Responsiveness, custom index build capacity, enterprise integration.

We relied on official product pages, methodologies, and security/governance disclosures; third-party datasets (e.g., venue quality screens) were used only as cross-checks. Last updated September 2025.

Top 10 Crypto Index Providers & Benchmark Services in September 2025

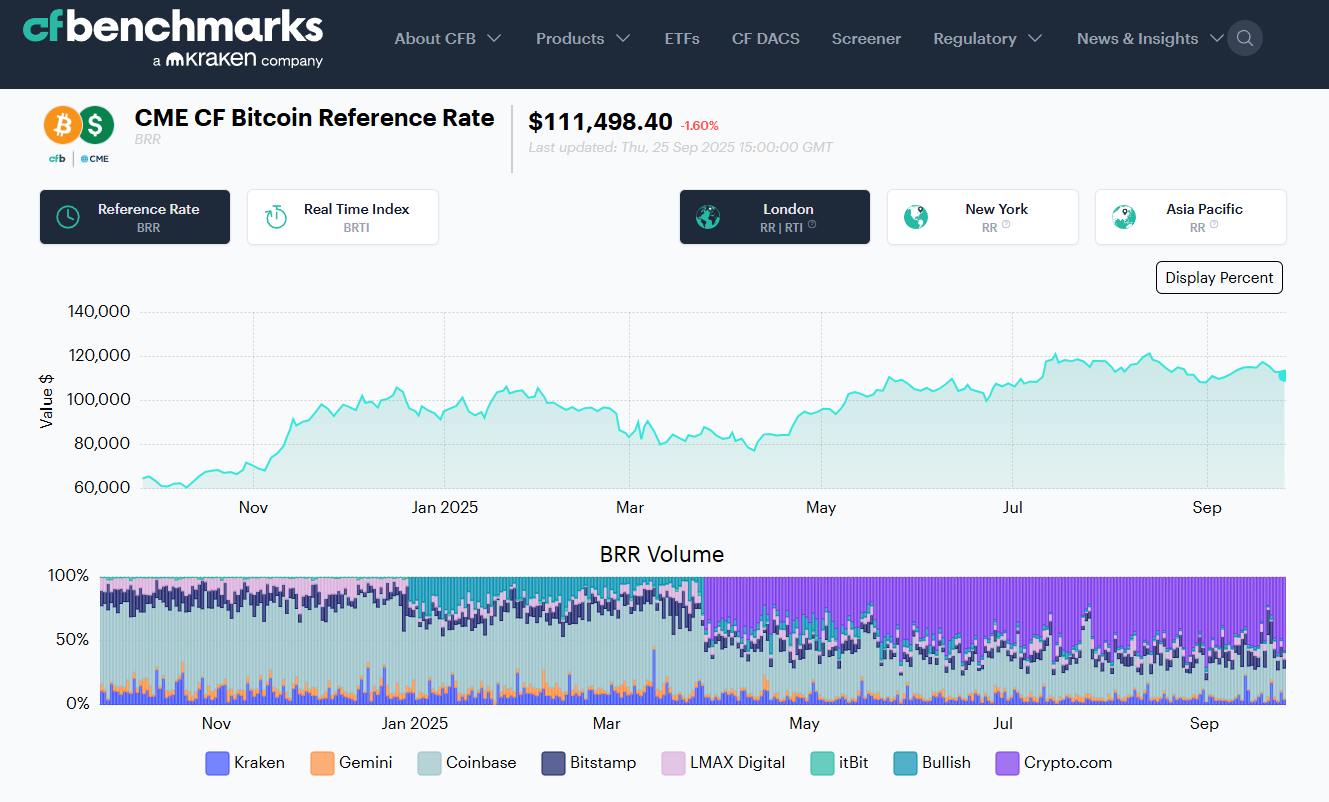

1) CF Benchmarks — Best for regulated settlement benchmarks

Why Use It: Administrator of the CME CF Bitcoin Reference Rate (BRR) and related benchmarks used to settle major futures and institutional products; UK BMR-registered with transparent exchange criteria and daily calculation since 2016. If you need benchmark-grade spot references (BTC, ETH and more) with deep derivatives alignment, start here. CF Benchmarks+1

Best For: Futures settlement references; fund NAV/pricing; risk; audit/compliance.

Notable Features: BRR/BRRNY reference rates; multi-exchange liquidity screens; methodology & governance docs; broad suite of real-time indices.

Consider If: You need composite market baskets beyond single-assets—pair with a multi-asset provider.

Alternatives: S&P Dow Jones Indices; FTSE Russell.

Regions: Global • Fees/Notes: Licensed benchmarks; enterprise pricing.

2) S&P Dow Jones Indices — Best for broad, institution-first crypto baskets

Why Use It: The S&P Cryptocurrency series (incl. Broad Digital Market) brings index craft, governance, and transparency familiar to traditional asset allocators—ideal for boards and committees that already use S&P. S&P Global+1

Best For: Asset managers launching passive products; OCIOs; consultants.

Notable Features: Broad/large-cap/mega-cap indices; single-asset BTC/ETH; published ground rules; established brand trust.

Consider If: You need highly customizable factors or staking-aware baskets—other vendors may move faster here.

Alternatives: MSCI; MarketVector.

Regions: Global • Fees/Notes: Licensing via S&P DJI.

3) MSCI Digital Assets — Best for thematic & institutional risk frameworks

Why Use It: MSCI’s Global Digital Assets and Smart Contract indices apply MSCI’s taxonomy/governance with themed exposures and clear methodologies—useful when aligning with enterprise risk standards. MSCI+1

Best For: CIOs needing policy-friendly thematics; due-diligence heavy institutions.

Notable Features: Top-30 market index; smart-contract subset; methodology docs; global brand assurance.

Consider If: You need exchange-by-exchange venue vetting or settlement rates—pair with CF Benchmarks or FTSE Russell.

Alternatives: S&P DJI; FTSE Russell.

Regions: Global • Fees/Notes: Enterprise licensing.

4) FTSE Russell Digital Asset Indices — Best for liquidity-screened, DAR-vetted universes

Why Use It: Built in association with Digital Asset Research (DAR), FTSE Russell screens assets and venues to EU Benchmark-ready standards; strong fit for risk-controlled coverage from large to micro-cap and single-asset series. LSEG+1

Best For: Product issuers who need venue vetting & governance; EU-aligned programs.

Notable Features: FTSE Global Digital Asset series; single-asset BTC/ETH; ground rules; DAR reference pricing.

Consider If: You require highly custom factor tilts—MarketVector or Vinter may be quicker to bespoke.

Alternatives: Wilshire; S&P DJI.

Regions: Global (EU-friendly) • Fees/Notes: Licensed benchmarks.

5) Nasdaq Crypto Index (NCI) — Best for flagship, dynamic market representation

Why Use It: NCI is designed to be dynamic, representative, and trackable; widely recognized and replicated by ETPs seeking diversified core exposure—useful as a single “beta” benchmark. Nasdaq+2Nasdaq Global Index Watch+2

Best For: Core market ETPs; CIO benchmarks; sleeve construction.

Notable Features: Rules-driven eligibility; regular reconstitutions; strong market recognition.

Consider If: You want deep sector/thematic granularity—pair with MSCI/MarketVector.

Alternatives: Bloomberg Galaxy (BGCI); MarketVector MVDA.

Regions: Global • Fees/Notes: Licensing via Nasdaq.

6) MarketVector Indexes — Best for broad coverage & custom builds

Why Use It: Backed by VanEck’s index arm (formerly MVIS), MarketVector offers off-the-shelf MVDA 100 plus sectors, staking-aware, and bespoke solutions—popular with issuers needing speed to market and depth. MarketVector Indexes+1

Best For: ETP issuers; quants; asset managers needing customization.

Notable Features: MVDA (100-asset) benchmark; single/multi-asset indices; staking/factor options; robust docs.

Consider If: You prioritize blue-chip simplicity—BGCI/NCI might suffice.

Alternatives: Vinter; S&P DJI.

Regions: Global • Fees/Notes: Enterprise licensing; custom index services.

7) Bloomberg Galaxy Crypto Index (BGCI) — Best for blue-chip, liquid market beta

Why Use It: Co-developed by Bloomberg and Galaxy, BGCI targets the largest, most liquid cryptoassets, with concentration caps and monthly reviews—an institutional “core” that’s widely cited on terminals. Galaxy Asset Management+1

Best For: CIO benchmarks; performance reporting; media-friendly references.

Notable Features: Capped weights; qualified exchange criteria; Bloomberg governance.

Consider If: You need smaller-cap breadth—MVDA/NCI may cover more names.

Alternatives: NCI; S&P DJI.

Regions: Global • Fees/Notes: License via Bloomberg Index Services.

8) CoinDesk Indices — Best for reference pricing (XBX) & tradable composites (CoinDesk 20)

Why Use It: Administrator of XBX (Bitcoin Price Index) and the CoinDesk 20, with transparent liquidity weighting and growing exchange integrations—including use in listed products. CoinDesk Indices+2CoinDesk Indices+2

Best For: Reference rates; product benchmarks; quant research.

Notable Features: XBX reference rate; CoinDesk 20; governance/methodologies; exchange selection rules.

Consider If: You require UK BMR-registered BTC settlement—CF Benchmarks BRR is purpose-built.

Alternatives: CF Benchmarks; S&P DJI.

Regions: Global • Fees/Notes: Licensing available; contact sales.

9) Vinter — Best for specialist, regulated crypto index construction

Why Use It: A regulated, crypto-native index provider focused on building/maintaining indices tracked by ETPs across Europe; fast on custom thematics and single-asset reference rates. vinter.co+1

Best For: European ETP issuers; bespoke strategies; rapid prototyping.

Notable Features: BMR-style reference rates; multi-asset baskets; calc-agent services; public factsheets.

Consider If: You need mega-brand recognition for U.S. committees—pair with S&P/MSCI.

Alternatives: MarketVector; Solactive.

Regions: Global (strong EU footprint) • Fees/Notes: Custom build/licensing.

10) Wilshire (FT Wilshire Digital Asset Index Series) — Best for institutional coverage & governance

Why Use It: The FT Wilshire series aims to be an institutional market standard with transparent rules, broad coverage, and exchange quality screens—supported by detailed methodology documents. wilshireindexes.com+1

Best For: Consultants/OCIOs; plan sponsors; research teams.

Notable Features: Broad Market index; governance via advisory groups; venue vetting; classification scheme.

Consider If: You need media-ubiquitous branding—S&P/Bloomberg carry more name recall.

Alternatives: FTSE Russell; S&P DJI.

Regions: Global • Fees/Notes: Enterprise licensing.

Decision Guide: Best By Use Case

- Regulated settlement benchmarks: CF Benchmarks. CF Benchmarks

- Core market beta (simple, liquid): BGCI or NCI. Galaxy Asset Management+1

- Broad institution-grade baskets: S&P DJI or FTSE Russell. S&P Global+1

- Thematic exposure (e.g., smart contracts): MSCI Digital Assets. MSCI

- Deep coverage & customization: MarketVector or Vinter. MarketVector Indexes+1

- Reference price + tradable composites: CoinDesk Indices (XBX / CoinDesk 20). CoinDesk Indices+1

- EU-aligned venue vetting: FTSE Russell (with DAR). LSEG

How to Choose the Right Crypto Index Provider (Checklist)

- Region & eligibility: Confirm benchmark status (e.g., UK/EU BMR) and licensing.

- Coverage fit: Single-asset, broad market, sectors/factors, staking yield handling.

- Liquidity screens: How are exchanges qualified and weighted?

- Rebalance/refresh: Frequency and buffers to limit turnover/slippage.

- Data quality & ops: Timestamps, outage handling, fallbacks, NAV timing.

- Costs: Licensing, data access, custom build fees.

- Support: SLAs, client engineering, custom index services.

- Red flags: Opaque methodologies; limited venue vetting.

Use Token Metrics With Any Index Provider

- AI Ratings to screen constituents and spot outliers.

- Narrative Detection to see when sectors (e.g., L2s, DePIN) start trending.

- Portfolio Optimization to balance broad index beta with targeted alpha sleeves.

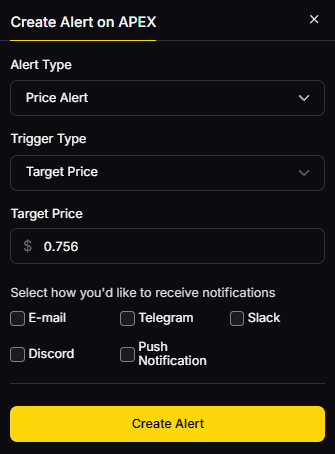

- Alerts & Signals to monitor entries/exits as indices rebalance.

Mini-workflow: Research → Select index/benchmark → Execute via your provider or ETP → Monitor with Token Metrics alerts.

Primary CTA: Start free trial.

Security & Compliance Tips

- Enable 2FA and role-based access for index data portals.

- Map custody and pricing cut-offs to index valuation times.

- Align with KYC/AML when launching index-linked products.

- For RFQ/OTC hedging around rebalances, pre-plan execution windows.

- Staking/bridged assets: verify methodology treatment and risks.

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Assuming all “broad market” indices hold the same assets/weights.

- Ignoring venue eligibility—liquidity and data quality vary.

- Overlooking reconstitution buffers (can drive turnover and cost).

- Mixing reference rates and investable baskets in reporting.

- Not confirming licensing scope for marketing vs. product use.

FAQs

What is a crypto index provider?

A company that designs, calculates, and governs rules-based benchmarks for digital assets—ranging from single-asset reference rates to diversified market baskets—licensed for reporting or products.

Which crypto index is best for “core beta”?

For simple, liquid market exposure, many institutions look to BGCI or NCI due to broad recognition and liquidity screens; your use case and region may point to S&P/FTSE alternatives. Galaxy Asset Management+1

How do providers choose exchanges and assets?

They publish ground rules defining eligible venues (liquidity, compliance), asset screening, capping, and rebalances—see S&P, FTSE (with DAR), and CF Benchmarks for examples. S&P Global+2LSEG+2

Can I license a custom crypto index?

Yes—MarketVector and Vinter (among others) frequently build bespoke indices and act as calculation agents for issuers. MarketVector Indexes+1

What’s the difference between a reference rate and a market basket?

Reference rates (e.g., BRR, XBX) target a single asset’s robust price; market baskets (e.g., NCI, BGCI) represent diversified multi-asset exposure. Galaxy Asset Management+3CF Benchmarks+3CoinDesk Indices+3

Are these benchmarks available in the U.S. and EU?

Most are global; for EU/UK benchmark usage, verify authorization/registration (e.g., CF Benchmarks UK BMR) and your product’s country-specific rules. CF Benchmarks

Conclusion + Related Reads

If you need regulated reference pricing for settlement or NAVs, start with CF Benchmarks. For core market beta, BGCI and NCI are widely recognized. For institution-grade breadth, consider S&P DJI or FTSE Russell (with DAR). If you’re launching custom or thematic products, MarketVector and Vinter are strong build partners.

Related Reads:

- Best Cryptocurrency Exchanges 2025

- Top Derivatives Platforms 2025

- Top Institutional Custody Providers 2025

Sources & Update Notes

We reviewed official product pages, methodologies, and governance documents current as of September 2025. A short list of key sources per provider is below (official sites only; non-official data used only for cross-checks and not linked here).

- CF Benchmarks: “BRR – CME CF Bitcoin Reference Rate”; CME CF Cryptocurrency Benchmarks. CF Benchmarks+1

- S&P Dow Jones Indices: “Cryptocurrency – Indices”; “S&P Cryptocurrency Broad Digital Market Index.” S&P Global+1

- MSCI: “Digital Assets Solutions”; “Global Digital Assets Index Methodology.” MSCI+1

- FTSE Russell: “Digital Asset indices”; FTSE + DAR reference pricing overview/ground rules. LSEG+2LSEG+2

- Nasdaq: “Nasdaq Crypto Index (NCI)” solution page; NCI index overview; Hashdex NCI ETP replication note. Nasdaq+2Nasdaq Global Index Watch+2

- MarketVector: “Digital Assets Indexes” hub; “MarketVector Digital Assets 100 (MVDA).” MarketVector Indexes+1

- Bloomberg Galaxy: Galaxy “Bloomberg Indices (BGCI)” page; Bloomberg terminal quote page. Galaxy Asset Management+1

- CoinDesk Indices: “CoinDesk Indices” homepage; “XBX” page; NYSE/ICE collaboration release referencing XBX. CoinDesk Indices+2CoinDesk Indices+2

- Vinter: “Making Smarter Crypto Indexes for ETF Issuers”; example single-asset reference rate page. vinter.co+1

Wilshire: FT Wilshire Digital Asset Index Series page; methodology PDF. wilshireindexes.com+1

Leading Oracles for Price & Real-World Data (2025)

%201.svg)

%201.svg)

Why Oracles for Price & Real-World Data Matter in September 2025

DeFi, onchain derivatives, RWAs, and payments don’t work without reliable oracles for price & real-world data. In 2025, latency, coverage, and security disclosures vary widely across providers, and the right fit depends on your chain, assets, and risk tolerance. This guide helps teams compare the leading networks (and their trade-offs) to pick the best match, fast.

Definition (snippet-ready): A blockchain oracle is infrastructure that sources, verifies, and delivers off-chain data (e.g., prices, FX, commodities, proofs) to smart contracts on-chain.

We prioritized depth over hype: first-party data, aggregation design, verification models (push/pull/optimistic), and RWA readiness. Secondary focus: developer UX, fees, supported chains, and transparency. If you’re building lending, perps, stablecoins, options, prediction markets, or RWA protocols, this is for you.

How We Picked (Methodology & Scoring)

- Weights (100 pts): Liquidity/usage (30), Security design & disclosures (25), Coverage across assets/chains (15), Costs & pricing model (15), Developer UX/tooling (10), Support/SLAs (5).

- Data sources: Official product/docs, security/transparency pages, and audited reports. We cross-checked claims against widely cited market datasets where helpful. No third-party links appear in the body.

Last updated September 2025.

Top 10 Oracles for Price & Real-World Data in September 2025

1. Chainlink — Best for broad coverage & enterprise-grade security

Why Use It: The most battle-tested network with mature Price/Data Feeds, Proof of Reserve, and CCIP for cross-chain messaging. Strong disclosures and large validator/operator sets make it a default for blue-chip DeFi and stablecoins. docs.switchboard.xyz

Best For: Lending/stablecoins, large TVL protocols, institutions.

Notable Features:

- Price/Data Feeds and reference contracts

- Proof of Reserve for collateral verification

- CCIP for cross-chain token/data movement

- Functions/Automation for custom logic

Fees/Notes: Network/usage-based (LINK or billing models; varies by chain).

Regions: Global.

Alternatives: Pyth, RedStone.

Consider If: You need the most integrations and disclosures, even if costs may be higher. GitHub

2. Pyth Network — Best for real-time, low-latency prices

Why Use It: First-party publishers stream real-time prices across crypto, equities, FX, and more to 100+ chains. Pyth’s on-demand “pull” update model lets dApps request fresh prices only when needed—great for latency-sensitive perps/AMMs. Pyth Network

Best For: Perps/options DEXs, HFT-style strategies, multi-chain apps.

Notable Features:

- Broad market coverage (crypto, equities, FX, commodities)

- On-demand price updates to minimize stale reads

- Extensive multi-chain delivery and SDKs Pyth Network

Fees/Notes: Pay per update/read model varies by chain.

Regions: Global.

Alternatives: Chainlink, Switchboard.

Consider If: You want frequent, precise updates where timing matters most. Pyth Network

3. API3 — Best for first-party (direct-from-API) data

Why Use It: Airnode lets API providers run their own first-party oracles; dAPIs aggregate first-party data on-chain. OEV (Oracle Extractable Value) routes update rights to searchers and shares proceeds with the dApp—aligning incentives around updates. docs.api3.org+1

Best For: Teams that prefer direct data provenance and revenue-sharing from oracle updates.

Notable Features:

- Airnode (serverless) first-party oracles

- dAPIs (crypto, stocks, commodities)

- OEV Network to auction update rights; API3 Market for subscriptions docs.kava.io

Fees/Notes: Subscription via API3 Market; chain-specific gas.

Regions: Global.

Alternatives: Chainlink, DIA.

Consider If: You need verifiable source relationships and simple subscription UX. docs.kava.io

4. RedStone Oracles — Best for modular feeds & custom integrations

Why Use It: Developer-friendly, modular oracles with Pull, Push, and Hybrid (ERC-7412) modes. RedStone attaches signed data to transactions for gas-efficient delivery and supports custom connectors for long-tail assets and DeFi-specific needs.

Best For: Builders needing custom data models, niche assets, or gas-optimized delivery.

Notable Features:

- Three delivery modes (Pull/Push/Hybrid)

- Data attached to calldata; verifiable signatures

- EVM tooling, connectors, and RWA-ready feeds

Fees/Notes: Pay-as-you-use patterns; gas + operator economics vary.

Regions: Global.

Alternatives: API3, Tellor.

Consider If: You want flexibility beyond fixed reference feeds.

5. Band Protocol — Best for Cosmos & EVM cross-ecosystem delivery

Why Use It: Built on BandChain (Cosmos SDK), Band routes oracle requests to validators running Oracle Scripts (OWASM), then relays results to EVM/Cosmos chains. Good match if you straddle IBC and EVM worlds. docs.bandchain.org+2docs.bandchain.org+2

Best For: Cross-ecosystem apps (Cosmos↔EVM), devs who like programmable oracle scripts.

Notable Features:

- Oracle Scripts (OWASM) for composable requests

- Request-based feeds; IBC compatibility

- Libraries and examples across chains docs.bandchain.org

Fees/Notes: Gas/fees on BandChain + destination chain.

Regions: Global.

Alternatives: Chainlink, Switchboard.

Consider If: You want programmable queries and Cosmos-native alignment. docs.bandchain.org

6. DIA — Best for bespoke feeds & transparent sourcing

Why Use It: Trustless architecture that sources trade-level data directly from origin markets (CEXs/DEXs) with transparent methodologies. Strong for custom asset sets, NFTs, LSTs, and RWA feeds across 60+ chains. DIA+1

Best For: Teams needing bespoke baskets, niche tokens/NFTs, or RWA price inputs.

Notable Features:

- Two stacks (Lumina & Nexus), push/pull options

- Verifiable randomness and fair-value feeds

- Open-source components; broad chain coverage DIA

Fees/Notes: Custom deployments; some public feeds/APIs free tiers.

Regions: Global.

Alternatives: API3, RedStone.

Consider If: You want full transparency into sources and methods. DIA

7. Flare Networks — Best for real-world asset tokenization and decentralized data

Why Use It: Flare uses the Avalanche consensus to provide decentralized oracles for real-world assets (RWAs), enabling the tokenization of non-crypto assets like commodities and stocks. It combines high throughput with flexible, trustless data feeds, making it ideal for bridging real-world data into DeFi applications.

Best For: Asset-backed tokens, DeFi protocols integrating RWAs, cross-chain compatibility.

Notable Features:

- Advanced decentralized oracle network for real-world data

- Tokenization of commodities, stocks, and other RWAs

- Multi-chain support with integration into the Flare network

- High throughput with minimal latency

Fees/Notes: Variable costs based on usage and asset complexity.

Regions: Global.

Alternatives: Chainlink, DIA, RedStone.

Consider If: You want to integrate real-world assets into your DeFi protocols and need a robust, decentralized solution.

8. UMA — Best for optimistic verification & oracle-as-a-service

Why Use It: The Optimistic Oracle (OO) secures data by proposing values that can be disputed within a window—powerful for binary outcomes, KPIs, synthetic assets, and bespoke data where off-chain truth exists but doesn’t stream constantly. Bybit Learn

Best For: Prediction/insurance markets, bespoke RWAs, KPI options, governance triggers.

Notable Features:

- OO v3 with flexible assertions

- Any verifiable fact; not just prices

- Dispute-based cryptoeconomic security Bybit Learn

Fees/Notes: Proposer/disputer incentives; bond economics vary by use.

Regions: Global.

Alternatives: Tellor, Chainlink Functions.

Consider If: Your use case needs human-verifiable truths more than tick-by-tick quotes. Bybit Learn

9. Chronicle Protocol — Best for MakerDAO alignment & cost-efficient updates

Why Use It: Originated in the Maker ecosystem and now a standalone oracle network with Scribe for gas-efficient updates and transparent validator set (Infura, Etherscan, Gnosis, etc.). Strong choice if you touch DAI, Spark, or Maker-aligned RWAs. Chronicle Protocol

Best For: Stablecoins, RWA lenders, Maker-aligned protocols needing verifiable feeds.

Notable Features:

- Scribe reduces L1/L2 oracle gas costs

- Community-powered validator network

- Dashboard for data lineage & proofs Chronicle Protocol

Fees/Notes: Network usage; gas savings via Scribe.

Regions: Global.

Alternatives: Chainlink, DIA.

Consider If: You want Maker-grade security and cost efficiency. Chronicle Protocol

10. Switchboard — Best for Solana & multi-chain custom feeds

Why Use It: A multi-chain, permissionless oracle popular on Solana with Drag-and-Drop Feed Builder, TEEs, VRF, and new Oracle Quotes/Surge for sub-100ms streaming plus low-overhead on-chain reads—ideal for high-speed DeFi. docs.switchboard.xyz+1

Best For: Solana/SVM dApps, custom feeds, real-time dashboards, gaming.

Notable Features:

- Low-code feed builder & TypeScript tooling

- Oracle Quotes (no feed accounts/no write locks)

- Surge streaming (<100ms) and cross-ecosystem docs docs.switchboard.xyz

Fees/Notes: Some features free at launch; usage limits apply.

Regions: Global.

Alternatives: Pyth, Band Protocol.

Consider If: You want speed and customization on SVM/EVM alike. docs.switchboard.xyz+1

Decision Guide: Best By Use Case

- Regulated/Institutional & broad integrations: Chainlink.

- Ultra-low-latency trading: Pyth or Switchboard (Surge/Quotes). Pyth Network+1

- Custom, gas-efficient EVM delivery: RedStone.

- First-party sources & subscription UX: API3 (Airnode + dAPIs + OEV). docs.kava.io

- Cosmos + EVM bridge use: Band Protocol. docs.bandchain.org

- Bespoke feeds/NFTs/RWAs with transparent sources: DIA. DIA

- Permissionless, long-tail assets: Tellor. docs.kava.io

- Optimistic, assertion-based facts: UMA. Bybit Learn

- Maker/DAI alignment & gas savings: Chronicle Protocol. Chronicle Protocol

How to Choose the Right Oracle (Checklist)

- Region & chain support: Verify your target chains and L2s are supported.

- Coverage: Are your assets (incl. long-tail/RWAs) covered, or can you request custom feeds?

- Security model: Push vs. pull vs. optimistic; validator set transparency; dispute process.

- Costs: Update fees, subscriptions, gas impact; consider pull models for usage spikes.

- Latency & freshness: Can you control update cadence? Any SLAs/heartbeats?

- UX & tooling: SDKs, dashboards, error handling, testing sandboxes.

- Support & disclosures: Incident reports, status pages, proofs.

- Red flags: Opaque sourcing, no dispute/alerting, stale feeds, unclear operators.

Use Token Metrics With Any Oracle

- AI Ratings to triage providers and prioritize integrations.

- Narrative Detection to spot momentum in perps/lending sectors powered by oracles.

- Portfolio Optimization to size positions by oracle risk and market beta.

- Alerts/Signals to monitor price triggers and on-chain flows.

Workflow: Research → Select → Execute on your chosen oracle/provider → Monitor with TM alerts.

Primary CTA: Start free trial

Security & Compliance Tips

- Enforce 2FA and least-privilege on deployer keys; rotate API/market credentials.

- Validate feed params (deviation/heartbeat) and fallback logic; add circuit breakers.

- Document chain-specific KYC/AML implications if your app touches fiat/RWAs.

- For RFQs and custom feeds, formalize SLOs and alerting.

- Practice wallet hygiene: separate ops keys, testnets, and monitors.

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Relying on a single feed without fallback or stale-price guards.

- Assuming all “price oracles” have identical latency/fees.

- Ignoring dispute windows (optimistic designs) before acting on values.

- Not budgeting for update costs when volatility spikes.

- Skipping post-deploy monitoring and anomaly alerts.

FAQs

What is a blockchain oracle in simple terms?

It’s middleware that fetches, verifies, and publishes off-chain data (e.g., prices, FX, commodities, proofs) to blockchains so smart contracts can react to real-world events.

Do I need push, pull, or optimistic feeds?

Push suits stable, shared reference prices; pull minimizes cost by updating only when needed; optimistic is great for facts that benefit from challenge periods (e.g., settlement outcomes). Pyth Network+1

Which oracle is best for low-latency perps?

Pyth and Switchboard (Surge/Quotes) emphasize real-time delivery; evaluate your chain and acceptable freshness. Pyth Network+1

How do fees work?

Models vary: subscriptions/markets (API3), per-update pull fees (Pyth), or gas + operator incentives (RedStone/Tellor). Always test under stress. docs.kava.io+2Pyth Network+2

Can I get RWA data?

Yes—Chainlink PoR, DIA RWA feeds, Chronicle for Maker-aligned assets, and others offer tailored integrations. Validate licensing and data provenance. docs.switchboard.xyz+2DIA+2

Conclusion + Related Reads

The “best” oracle depends on your chain, assets, latency needs, and budget. If you need broad coverage and disclosures, start with Chainlink. If you’re building latency-sensitive perps, test Pyth/Switchboard. For first-party provenance or custom baskets, look to API3, DIA, or RedStone. For long-tail, permissionless or bespoke truths, explore Tellor or UMA.

Related Reads:

- Best Cryptocurrency Exchanges 2025

- Top Derivatives Platforms 2025

- Top Institutional Custody Providers 2025

Best Remittance Companies Using Crypto Rails (2025)

%201.svg)

%201.svg)

Why Crypto-Powered Remittances Matter in September 2025

Cross-border money transfers are still too expensive and slow for millions of workers and families. Crypto remittance companies are changing that by using stablecoins, Lightning, and on-chain FX to compress costs and settlement time from days to minutes. In one line: crypto remittances use blockchain rails (e.g., Lightning or stablecoins like USDC) to move value globally, then convert to local money at the edge. This guide highlights the 10 best providers by liquidity, security, corridor coverage, costs, and UX—so you can pick the right fit whether you’re sending U.S.→MX/PH remittances, settling B2B payouts in Africa, or building compliant payout flows. Secondary topics we cover include stablecoin remittances, Lightning transfers, and cross-border crypto payments—with clear pros/cons and regional caveats.

How We Picked (Methodology & Scoring)

- Liquidity (30%) – Depth/scale of flows, corridor breadth, and on/off-ramps.

- Security (25%) – Licenses, audits, proof-of-reserves or equivalent disclosures, custody posture.

- Coverage (15%) – Supported corridors, payout methods (bank, e-wallet, cash pickup, mobile money).

- Costs (15%) – FX + transfer fees, spread transparency, typical network costs.

- UX (10%) – Speed, reliability, mobile/web experience, integration options (APIs).

- Support (5%) – Human support, docs, business SLAs.

Data sources prioritized official sites, docs/security pages, and disclosures; third-party market datasets used only for cross-checks. Last updated September 2025.

Top 10 Remittance Companies Using Crypto Rails in September 2025

1. MoneyGram Ramps — Best for cash ↔ USDC access worldwide

Why Use It: MoneyGram connects cash and bank rails to on-chain USDC via its Ramps network and global locations, enabling senders/receivers to move between fiat and stablecoins quickly—useful where banking access is limited. The developer docs support flexible flows and partner integrations for compliant cash-in/cash-out. anchors.stellar.org

Best For: Cash-to-crypto access • Stablecoin remittances with cash pickup • Fintechs needing global cash-out

Notable Features:

- USDC cash-in/out network with global footprint anchors.stellar.org

- Developer docs + SDKs for partners

- Bank, wallet, and cash payout options

Consider If: You need cash pickup endpoints or mixed cash/crypto flows.

Alternatives: Coins.ph, Yellow Card

Regions: Global (availability varies by country).

Fees Notes: Vary by location and payout type; check local schedule.

2. Strike — Best for Lightning-powered U.S.→Global transfers

Why Use It: Strike uses the Bitcoin Lightning Network under the hood to move value, combining a fiat UX with bitcoin rails for speed and cost efficiency across corridors (e.g., U.S. to Africa/Asia/LatAm). Their “Send Globally” program highlights expanding coverage and low-friction transfers. Strike

Best For: U.S.-origin senders • Freelancers/SMBs paying abroad • Lightning enthusiasts

Notable Features:

- Lightning-based remittances behind a simple fiat UI Strike

- Expanding corridor coverage (Africa, Asia, LATAM) Trusted Crypto Wallet

- Mobile app + business features

Consider If: Recipient banks/e-wallets need predictable FX; confirm corridor availability.

Alternatives: Pouch.ph, Bitnob

Regions: U.S. + supported corridors.

Fees Notes: Strike markets low/no transfer fees; FX/spread may apply by corridor. Trusted Crypto Wallet

3. Bitso Business — Best for LATAM B2B remittances & on-chain FX

Why Use It: Bitso powers large USD↔MXN/BRL flows, combining stablecoin rails with local payout, and publicly reports multi-billion USD remittance throughput. Their business stack (APIs, on-chain FX) targets enterprises moving funds into Mexico, Brazil, and Argentina with speed and deep local liquidity. Bitso+1

Best For: Marketplaces • Payroll/treasury teams • LATAM fintechs

Notable Features:

- On-chain FX & stablecoin settlement via Bitso Business business.bitso.com

- Deep U.S.→Mexico remittance liquidity; disclosed volumes Bitso

- Local payout rails across MX/BR/AR

Consider If: You need compliance reviews and B2B contracts.

Alternatives: AZA Finance, Tranglo

Regions: LATAM focus.

Fees Notes: FX spread + network fees; enterprise pricing via API.

4. Coins.ph — Best for Philippines inbound remittances & stablecoin flows

Why Use It: Coins.ph is a leading PH exchange/e-wallet with crypto rails, Western Union integrations, and recent initiatives using stablecoins (including PYUSD) and always-on corridors (e.g., HK↔PH). It positions blockchain/stablecoins to lower costs and improve speed for business and retail remittances. Trusted Crypto Wallet+2Trusted Crypto Wallet+2

Best For: PH recipients • Businesses seeking PH payout • Retail cash-out to banks/e-wallets

Notable Features:

- Stablecoin-based remittance infrastructure; speed & cost focus Trusted Crypto Wallet

- PYUSD partnership; remittance use case Trusted Crypto Wallet

- Integrations & promos with Western Union (historical) Trusted Crypto Wallet

Consider If: Limits/tiers and corridor specifics vary—check KYC levels.

Alternatives: Pouch.ph, MoneyGram

Regions: Philippines focus.

Fees Notes: Business rails cite very low basis-point costs; consumer pricing varies. Trusted Crypto Wallet

5. Yellow Card (Yellow Pay) — Best for intra-Africa stablecoin remittances

Why Use It: Yellow Card provides USDC-powered transfers across 20+ African countries through Yellow Pay, with app-level FX and local payout. It emphasizes simple, fast, transparent transfers over stablecoin rails at scale.

Best For: Africa-to-Africa family support • SMB payouts • Creator/contractor payments

Notable Features:

- Pan-African coverage; stablecoin settlement (USDC)

- Local rails for bank/mobile money payout

- Consumer app + business APIs

Consider If: Some markets have changing crypto rules—confirm eligibility.

Alternatives: AZA Finance, Kotani Pay

Regions: Africa (20+ countries).

Fees Notes: App shows FX/spread; some intra-app transfers may appear fee-free—confirm in-app.

6. Pouch.ph — Best for Lightning → bank/e-wallet payouts in the Philippines

Why Use It: Pouch abstracts the Bitcoin Lightning Network for senders and lands funds to PH banks/e-wallets in minutes. It’s a clean example of “bitcoin rails, fiat UX,” removing friction for overseas workers and micro-merchants.

Best For: U.S./global senders to PH • SMB invoices • Merchant settlement

Notable Features:

- Lightning under the hood; simple web/mobile experience

- Bank/e-wallet cash-out in the Philippines

- Merchant tools and local support

Consider If: Corridors are PH-centric; coverage outside PH is limited.

Alternatives: Strike, Coins.ph

Regions: PH payout focus.

Fees Notes: Network + FX spread; see app for live quote.

7. Tranglo — Best for enterprise APAC corridors via Ripple ODL

Why Use It: Tranglo is a cross-border payment hub that enabled Ripple’s On-Demand Liquidity (ODL) across its corridors, using XRP as a bridge asset to reduce pre-funding and improve speed. It provides enterprise access to a vast payout network in 100+ countries. Tranglo+2Tranglo+2

Best For: Licensed remittance operators • Fintechs • PSPs seeking APAC reach

Notable Features:

- ODL across many corridors; instant, pre-funding-free settlement Tranglo

- 5,000+ payout partners; 100+ countries Tranglo

- Portal + APIs for B2B integration

Consider If: ODL availability varies by corridor/compliance.

Alternatives: SBI Remit, Bitso Business

Regions: Global/APAC heavy.

Fees Notes: Enterprise pricing; FX spread + network costs.

8. SBI Remit — Best for Japan→PH/VN corridors using XRP ODL

Why Use It: SBI Remit launched a remittance service using XRP through Ripple/Treasure Data/Tranglo stack, focusing on the Japan→Philippines & Vietnam corridors. For Japan-origin transfers into Southeast Asia, it’s a regulated, XRP-settled option. remit.co.jp

Best For: Japan-based senders • B2B/B2C payout into PH/VN

Notable Features:

- XRP as bridge asset; fast settlement remit.co.jp

- Partnership with Tranglo for payout connectivity remit.co.jp

- Licensed, established remittance brand in JP

Consider If: Corridor scope is focused; confirm supported routes.

Alternatives: Tranglo, Coins.ph

Regions: Japan→Philippines, Vietnam.

Fees Notes: Standard remittance + FX; see SBI Remit schedule.

9. AZA Finance — Best for B2B Africa cross-border payouts over digital asset rails

Why Use It: Formerly BitPesa, AZA Finance specializes in enterprise cross-border payments and treasury in Africa, long known for leveraging digital asset rails to improve settlement. It supports multi-country bank and mobile-money payouts for payroll, vendor payments, and fintech flows.

Best For: Enterprises • Marketplaces • Fintech payout platforms

Notable Features:

- Local payout to bank/mobile money across African markets

- B2B focus with compliance onboarding

- FX + treasury support

Consider If: Requires business KYC and minimum volumes.

Alternatives: Yellow Card, Kotani Pay

Regions: Pan-Africa focus.

Fees Notes: Enterprise pricing; FX spread.

10. Kotani Pay — Best for stablecoin→mobile money in East Africa

Why Use It: Kotani Pay bridges stablecoins (notably on Celo) to mobile money (e.g., M-Pesa) so recipients can receive funds without a crypto wallet. This reduces friction and helps businesses/DAOs route funds compliantly to last-mile users.

Best For: NGOs/DAOs paying field teams • SMB payouts • Africa remittances to mobile money

Notable Features:

- Stablecoin→mobile money off-ramp (USSD flows)

- Business dashboards & APIs

- Kenya/Uganda coverage; expanding

Consider If: Coverage is country-specific; confirm supported networks.

Alternatives: Yellow Card, AZA Finance

Regions: East Africa focus.

Fees Notes: FX + mobile-money fees; confirm per country.

Decision Guide: Best By Use Case

- Cash pickup / cash-to-crypto: MoneyGram Ramps

- U.S.→PH via Lightning: Pouch.ph (also Strike for U.S.-origin)

- U.S.→MX & broader LATAM B2B: Bitso Business

- Japan→Southeast Asia with XRP ODL: SBI Remit (JP→PH/VN)

- Pan-Africa consumer remittances: Yellow Card (Yellow Pay)

- Africa B2B payouts & treasury: AZA Finance

- Enterprise APAC corridors / ODL aggregation: Tranglo

- Philippines retail wallet with stablecoins: Coins.ph

- Developer-friendly Lightning UX (sender side): Strike

How to Choose the Right Crypto Remittance Provider (Checklist)

- Confirm your corridor (origin/destination, currencies, payout method).

- Check rail type (Lightning vs stablecoins) and liquidity in that corridor.

- Verify licenses/compliance and recipient KYC/limits.

- Compare total cost (FX spread + transfer fee + network fee).

- Assess speed & reliability (minutes vs hours, cut-off times).

- Review on/off-ramp options (bank, e-wallet, mobile money, cash pickup).

- For businesses: look for APIs, SLAs, and settlement reporting.

- Red flags: unclear fees, no legal entity/licensing, or limited cash-out options.

Use Token Metrics With Any Remittance Workflow

- AI Ratings to vet counterparties and ecosystem risk.

- Narrative Detection to monitor stablecoin/Lightning adoption trends.

- Portfolio Optimization for treasuries using stablecoins.

- Alerts/Signals to track market moves affecting FX and on-chain costs.

Workflow: Research corridors → Select provider → Execute → Monitor with alerts.

Primary CTA: Start free trial.

Security & Compliance Tips

- Enable 2FA; use strong device security for any wallet accounts.

- Clarify custody (who holds funds during transfer) and cash-out steps.

- Ensure KYC/AML is complete; keep sender/recipient identity docs ready.

- For businesses, use RFQ/quotes and transaction logs for audits.

- Practice wallet hygiene (test transfers, correct network/addresses).

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Assuming every provider supports your corridor without checking.

- Ignoring FX spreads—“zero fees” ≠ lowest total cost.

- Sending to the wrong network or without a supported cash-out.

- Overlooking recipient limits (daily/monthly) and KYC tiers.

- Relying on one payout method when recipients need bank + cash.

FAQs

What is a crypto remittance?

A cross-border transfer where value moves on-chain (e.g., Lightning, USDC) and is converted to local currency on arrival; it can cut costs and settlement time versus legacy rails.

Are crypto remittances cheaper than traditional methods?

They can be. Savings typically come from fewer intermediaries and 24/7 settlement, but FX spreads, cash-out fees, and network fees still apply. Trusted Crypto Wallet

Which is better for remittances: Lightning or stablecoins?

Lightning excels for low-cost, instant micro-payments; stablecoins are great for fiat-like value with broad exchange/wallet support. The best choice depends on corridor liquidity and payout options. Strike+1

Can I send crypto and have the recipient pick up cash?

Yes—networks like MoneyGram Ramps and select partners enable cash-in/out around USDC rails in supported countries. Availability and fees vary by location. anchors.stellar.org

What regions are strongest today?

LATAM (e.g., U.S.→Mexico), the Philippines, and many African corridors show strong on/off-ramp growth via stablecoins and Lightning. Bitso

Do I need a crypto wallet?

Not always. Many apps abstract the rails and pay out to bank accounts, e-wallets, or mobile money. Check each provider’s onboarding and recipient flow.

Conclusion + Related Reads

If you need cash pickup and stablecoin access, start with MoneyGram Ramps. For U.S.→PH or U.S.→Africa Lightning routes, consider Pouch.ph and Strike. For enterprise flows in LATAM/APAC/Africa, Bitso Business, Tranglo, SBI Remit, AZA Finance, Yellow Card, and Kotani Pay offer strong coverage—each with different strengths in corridors, payout types, and integration depth.

Related Reads:

- Which Cryptocurrency Exchange Should I Use in 2025? A Guide for Smart Trading

- Top Picks for the Best Crypto Trading Platform in 2025

- Top Web3 Wallets in 2025

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)