WETH vs ETH - Key Differences You Need to Know

The world of cryptocurrency can be confusing, especially for newcomers. With so many tokens, coins, and platforms available, it is easy to get lost in the sea of acronyms and technical jargon.

In this comprehensive guide, we will compare two popular cryptocurrencies, Ethereum (ETH) and Wrapped Ether (WETH). We'll also explore the key distinctions between these two digital assets to help you gain a better understanding of their unique characteristics. So, let's dive in and unravel the mysteries of WETH vs ETH!

What is ETH?

Ethereum, often referred to as ETH, is one of the leading cryptocurrencies in the world. It was created in 2015 by Vitalik Buterin and has since become a powerhouse in the blockchain industry.

Ethereum serves as a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). As the native currency of the Ethereum network, ETH acts as a fuel for executing transactions and powering the ecosystem.

What is WETH?

Wrapped Ethereum, or WETH for short, is a tokenized version of ETH that operates on the Ethereum blockchain as well. WETH was introduced to enable the seamless interaction between ETH and other Ethereum-based tokens.

It is essentially a representation of ETH in the form of an ERC-20 token, which makes it compatible with various decentralized exchanges (DEXs) and decentralized finance (DeFi) protocols.

Differences between WETH and ETH

When comparing WETH (Wrapped Ether) and ETH (Ethereum), there are several notable differences that set them apart. Let's explore the main distinctions between these two cryptocurrencies:

1. The Role of WETH in Decentralized Exchanges

WETH plays a crucial role in decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and Balancer. These platforms primarily use ERC-20 tokens for trading, and since ETH is not an ERC-20 token by default, it cannot be directly traded on these exchanges.

By wrapping ETH into WETH, users can easily participate in trading activities on DEXs, providing liquidity and engaging in various decentralized finance (DeFi) opportunities.

2. Interoperability and Cross-Chain Applications

While Ethereum is primarily focused on its native blockchain, WETH enhances interoperability by enabling ETH to be used in cross-chain applications. Through various protocols like RenVM and bridges like the Ethereum Mainnet Bridge, WETH can be transferred and utilized on other blockchains, expanding its reach and potential use cases.

3. Differences in Usage and Liquidity

One significant difference between WETH and ETH lies in their usage and liquidity. ETH is the original currency of the Ethereum network and is widely accepted as a medium of exchange, fuel for transactions, and a store of value.

On the other hand, WETH is predominantly used in decentralized finance (DeFi) applications and token trading on DEXs. Its liquidity is centered around the DeFi ecosystem, making it a popular choice for yield farming, liquidity provision, and other decentralized finance activities.

4. Gas Fees and Transaction Costs

Gas fees and transaction costs are important considerations for users of both ETH and WETH. Gas fees are the fees paid to miners or validators for processing transactions on the Ethereum network.

When it comes to gas fees, there is no inherent difference between ETH and WETH. Both tokens require gas fees for transactions and interactions with smart contracts. The cost of gas fees depends on the network congestion and the complexity of the transaction.

5. Wrapping and Unwrapping Process

To convert ETH into WETH, users need to go through a wrapping process. This process involves depositing ETH into a smart contract that mints an equivalent amount of WETH tokens. The WETH tokens can then be freely traded and utilized within the Ethereum ecosystem.

Conversely, to unwrap WETH and convert it back into ETH, users need to send their WETH tokens to the smart contract, which will burn the WETH and release the equivalent amount of ETH back to the user's wallet.

6. Security and Trust

When it comes to security and trust, both ETH and WETH inherit the robustness and reliability of the Ethereum blockchain. The Ethereum network has a proven track record of security and resilience, making it a trusted platform for decentralized applications and financial activities.

However, it's important to note that wrapped tokens like WETH introduce an additional layer of complexity and reliance on smart contracts. While efforts are made to ensure the security of these contracts, users should always exercise caution and perform due diligence when interacting with wrapped tokens.

7. Integration with DeFi Protocols

Wrapped Ethereum (WETH) has become an integral part of the decentralized finance (DeFi) ecosystem. Many DeFi protocols and platforms rely on WETH as a liquidity source and collateral for borrowing and lending activities. WETH's compatibility with ERC-20 standards makes it easier for developers to integrate it into their DeFi applications, enabling seamless access to a wide range of decentralized financial services.

8. Use Cases and Diversification

While ETH and WETH share similarities, they have distinct use cases and target different aspects of the Ethereum ecosystem. ETH, as the native currency, is widely used for everyday transactions, investment purposes, and as a means of participating in initial coin offerings (ICOs) and token sales.

WETH, on the other hand, caters specifically to the decentralized finance sector, providing liquidity and facilitating token trading within the Ethereum ecosystem.

Popular platforms that accept WETH

There are several popular platforms and dapps that accept WETH. Here are some of the most notable:

Uniswap: A decentralized exchange (DEX) that allows users to trade ERC-20 tokens, including WETH.

Compound: A decentralized lending and borrowing platform that allows users to earn interest on their assets, including WETH.

MakerDAO: A decentralized lending platform that allows users to borrow stablecoins using WETH as collateral.

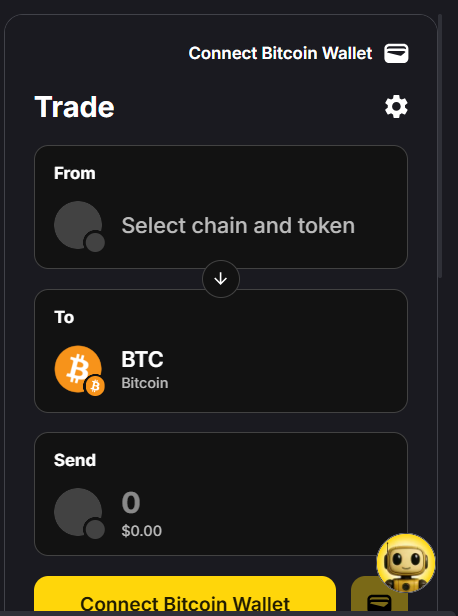

How to convert ETH to WETH?

Converting ETH to WETH is a relatively simple process. There are several ways to do this, but the most common method is to use a decentralized exchange (DEX) like Uniswap. Here are the steps to convert ETH to WETH using Uniswap, as example:

- Go to the Uniswap website and connect your Ethereum wallet.

- Select ETH as the token you want to convert and WETH as the token you want to receive.

- Enter the amount of ETH you want to convert and click on the "Swap" button.

- Confirm the transaction on your wallet and wait for the conversion to complete.

Once the conversion is complete, you will receive the equivalent amount of WETH in your wallet.

Advantages of using WETH

There are several advantages of using WETH over ETH in certain applications. Here are some of the main advantages:

- Compatibility: WETH is compatible with ERC-20 tokens, which means it can be used in dapps and exchanges that only accept ERC-20 tokens.

- Liquidity: WETH can be used to provide liquidity for ERC-20 tokens on decentralized exchanges (DEXs), which can help improve the efficiency of the market.

- Accessibility: WETH makes it easier for users to interact with the Ethereum ecosystem, as it provides a more compatible and accessible version of ETH.

Disadvantages of using WETH

While there are several advantages to using WETH, there are also some disadvantages to consider. Here are some of the main disadvantages:

- Conversion: Converting ETH to WETH can be an extra step that some users may find inconvenient.

- Security: WETH is an ERC-20 token, which means it is subject to the same security risks as other tokens on the Ethereum network.

- Complexity: The use of WETH can add an extra layer of complexity to certain applications and may require additional knowledge or expertise.

Future of WETH and ETH

The future of WETH and ETH is closely tied to the development of the Ethereum ecosystem and the wider cryptocurrency market. As the adoption of Ethereum and other blockchain technologies grows, the demand for both ETH and WETH is likely to increase.

One potential area of growth for WETH is in the decentralized finance (DeFi) space. DeFi protocols rely on liquidity providers to supply assets to their platforms, and WETH can be used as a way to provide liquidity for ERC-20 tokens. As DeFi continues to grow, the demand for WETH is likely to increase.

Also Read - Is Ethereum Dead?

FAQs

Q1. WETH vs ETH: Which is better?

Choosing between WETH and ETH depends on your needs. ETH is versatile, used for everyday transactions, investments, and ICOs. WETH is mainly for DeFi and token trading on DEXs. If you're into DeFi and ERC-20 tokens, WETH is a good fit. For general purposes, ETH is more versatile. Consider your specific requirements to decide which is best for you.

Q2. Can I convert WETH back to ETH at any time?

Yes, the wrapping process is reversible, allowing you to convert WETH back to ETH whenever you desire. Simply send your WETH tokens to the smart contract, and the equivalent amount of ETH will be released to your wallet.

Q3. Is WETH cheaper than ETH?

The cost of WETH and ETH is generally the same in terms of value. However, when it comes to transaction costs, gas fees are incurred for both WETH and ETH transactions on the Ethereum network. The gas fees are determined by factors such as network congestion and transaction complexity, rather than the specific token being used. Therefore, there is no inherent difference in the cost of using WETH or ETH in terms of transaction fees.

Q4. Can I use WETH in other blockchain networks?

WETH is primarily designed to operate within the Ethereum blockchain. While there are bridge protocols and cross-chain solutions that allow the transfer of assets between different blockchains, the native use of WETH is limited to the Ethereum ecosystem.

Closing Thoughts

In conclusion, understanding the differences between WETH and ETH is crucial for anyone navigating the Ethereum ecosystem.

Both WETH and ETH have their unique use cases and advantages, catering to different aspects of the blockchain industry. Whether you're an investor, trader, or user of decentralized applications, being aware of these distinctions will empower you to make informed decisions and leverage the full potential of the Ethereum ecosystem.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)