What Are Smart Contracts? A Comprehensive Guide

The digital revolution has fundamentally transformed the way we conduct business, manage agreements, and execute transactions. Active blockchain solutions are driving efficiency, security, and transparency across industries such as retail, supply chain, and healthcare. At the forefront of this transformation are smart contracts—revolutionary digital agreements that are reshaping industries ranging from finance and real estate to healthcare and supply chain management.

Blockchain-based smart contracts provide significant benefits to businesses by automating agreements, increasing transparency, and reducing costs. As we progress through 2025, understanding what are smart contracts and how they function has become essential for anyone looking to participate in the blockchain ecosystem or leverage the power of decentralized applications, especially to benefit from increased efficiency and security for businesses and organizations.

Understanding Smart Contracts: The Foundation

Smart contracts are digital contracts stored on a blockchain that are automatically executed when predetermined terms and conditions are met. Essentially, a smart contract is a self-executing agreement encoded as a computer program on a blockchain network, coded to be executed automatically. These contracts automate the execution of an agreement so that all parties involved can be immediately certain of the outcome without the need for intermediaries or delays.

At their core, smart contracts are a self executing program that transforms traditional contract terms into code deployed onto a blockchain, operating without the need for an intermediary or the traditional legal system. Once the required conditions are fulfilled, the smart contract automatically triggers the execution of the contract’s terms, ensuring transparency, efficiency, and security. Unlike traditional contracts that rely on lawyers or banks to enforce terms, smart contracts are self-enforcing and self-verifying, operating on a distributed ledger that guarantees the contract cannot be changed once deployed.

For example, a smart contract on the Ethereum platform is a collection of code (functions) and data (state) residing at a specific address on the Ethereum blockchain. It acts like a computer program with its own balance and the ability to receive and send transactions, but it operates independently once deployed. Smart contracts can facilitate agreements between anonymous parties, ensuring privacy and decentralization. This automation eliminates the need for human intervention and reduces the risk of human error or fraud.

The Evolution and History of Smart Contracts

The idea of smart contracts actually predates blockchain technology. The concept was originally proposed in the 1990s by Nick Szabo, a cryptographer who described smart contracts as “a set of promises, specified in digital form, including protocols within which the parties perform on these promises.” Szabo famously compared smart contracts to vending machines, where the right inputs guarantee a specific output automatically.

It is important to note the distinction between a smart contract and a smart legal contract. A smart legal contract combines the automation of blockchain-based smart contracts with legal enforceability, ensuring compliance with jurisdictional laws and providing legal guarantees that can be upheld in court.

While Bitcoin’s launch in 2009 made smart contracts technically feasible by introducing blockchain technology, it was Ethereum’s introduction in 2015 that truly elevated smart contracts as a foundational element of decentralized applications. Ethereum’s Turing-complete programming language, Solidity, allowed developers to write complex contracts that could handle a wide range of automated functions.

According to the US National Institute of Standards and Technology, a smart contract is “a collection of code and data (sometimes referred to as functions and state) that is deployed using cryptographically signed transactions on the blockchain network.” This definition emphasizes that smart contracts are computer programs that use blockchain technology to handle transactions securely and transparently, with digital signatures used to authenticate parties and secure the execution of these contracts.

How Smart Contracts Work

Smart contracts work by following simple “if/when…then…” statements written into code on a blockchain. The process is straightforward yet powerful:

When a predetermined condition is met and verified by the network, the contract executes the agreed-upon action. Each transaction includes the smart contract code and relevant data, and is verified by the network to ensure authenticity and compliance with the contract's terms.

Smart contracts can also automatically trigger the next action in a workflow once the specified conditions are fulfilled, streamlining processes and reducing the need for intermediaries.

Writing and Deployment

The first step involves writing the contract terms into a programming language designed for blockchain, such as Solidity for Ethereum. Developers encode the agreement’s rules and conditions into a series of instructions, specifying what actions should occur when certain conditions are met.

Once the smart contract code is complete, it is deployed to the blockchain network through a cryptographically signed transaction. After deployment, the contract becomes immutable—meaning it cannot be changed—ensuring trust and transparency for all parties involved. Each deployment creates a single record on the blockchain ledger, ensuring the integrity and traceability of the contract.

Automatic Execution

When the predetermined conditions are fulfilled, the smart contract automatically executes the specified actions. For example, in a rental agreement, the contract might automatically transfer funds to the landlord’s wallet once the tenant’s payment is received. Smart contracts can also manage and transfer digital assets automatically when the agreed conditions are met.

The execution is validated by nodes connected to the blockchain network, such as the Ethereum Virtual Machine (EVM) on Ethereum. These nodes verify the transaction and update the blockchain ledger with encrypted records of the completed transaction. Because the transaction record cannot be changed, it guarantees security and prevents fraud.

Key Characteristics of Smart Contracts

Smart contracts possess several defining characteristics that set them apart from traditional agreements: They offer transparency, as all actions and terms are visible to involved stakeholders. Blockchain based smart contracts allow multiple parties to access and verify the contract terms, ensuring trust and accountability throughout the process.

Distributed and Transparent

Smart contracts are stored on a public distributed ledger, known as a blockchain, which ensures that all participants have access to the contract’s code and terms. This transparency means that no single party can alter the contract without consensus from the network. For example, smart contracts are used for increasing supply chain transparency by tracking pharmaceuticals, ensuring data reliability and safety throughout the transport process.

Trustless and Self-Executing

Smart contracts do not require trusted intermediaries to verify or enforce the agreement, ensuring that every party involved can trust the contract's execution without external enforcement. Their automated possibilities allow them to self-verify conditions and self-enforce execution when the contract’s rules are met.

Deterministic and Immutable

Smart contracts only perform the functions they were programmed to do and only when the required conditions are fulfilled. Once deployed, the contract’s code and transaction history cannot be altered, providing a tamper-proof record.

Speed and Efficiency

By automating contract execution, smart contracts significantly reduce the time and paperwork involved in traditional agreements. The entire chain of actions is executed immediately and automatically, minimizing delays caused by human intervention, and also saving money by eliminating unnecessary steps.

Real-World Applications and Use Cases

Smart contracts are revolutionizing various industries by automating processes and eliminating intermediaries. They are increasingly used to streamline international trade by automating cross-border transactions, improving efficiency and transparency in global business.

Financial Services and DeFi

In finance, smart contracts streamline trade finance by automating payments, verifying documents, and tracking shipments. Decentralized finance (DeFi) platforms leverage smart contracts to enable lending, borrowing, and trading without middlemen, increasing transparency and security.

Real Estate and Property Management

Smart contracts automate property transactions by releasing funds upon payment confirmation, reducing the need for escrow agents. Lease agreements and payments are managed automatically, ensuring timely execution and minimizing disputes.

Supply Chain and Healthcare

In supply chains, smart contracts increase transparency by tracking raw materials and products through every stage, automatically verifying trade documents and resolving disputes. In healthcare, they secure patient data while allowing authorized providers to share information seamlessly.

Insurance and Legal Applications

Smart legal contracts offer greater openness than traditional contracts by being stored on immutable blockchains. They can automatically execute payments or obligations once specific conditions, such as a date or event, are met.

Navigating Smart Contract Ecosystems with Advanced Analytics

As the smart contract landscape grows increasingly complex, sophisticated analytics tools have become indispensable. Token Metrics is a leading AI-powered platform that provides comprehensive insights into blockchain projects and smart contract platforms.

AI-Driven Smart Contract Analysis

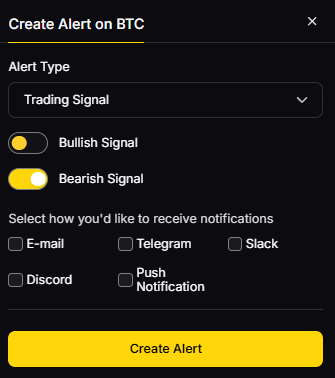

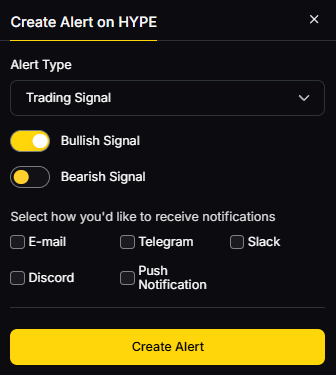

Token Metrics evaluates over 6,000 tokens daily, scoring each based on technical analysis, on-chain data, fundamental metrics, and social sentiment. This helps investors identify promising smart contract platforms and tokens built on them.

Advanced Market Intelligence

The Token Metrics API offers real-time price and volume data, AI-based token ratings, and sentiment analysis, making it a valuable resource for developers and analysts working with smart contracts.

Comprehensive Platform Features

Token Metrics provides AI-driven analytics, moonshot altcoin discovery, real-time signals, and tools for both long-term investing and short-term trading. Developer tools integrate with platforms like ChatGPT and Cursor IDE, enabling data-driven smart contract development and analysis.

Smart Contract Platforms and Technologies

Ethereum and EVM-Compatible Chains

Ethereum remains the dominant platform for smart contract development, using the Solidity programming language and the Ethereum Virtual Machine (EVM). Despite security challenges, it hosts the majority of active smart contracts.

Emerging Competitors

Platforms like Solana, which uses the Solana Virtual Machine (SVM) and Rust programming language, and newer blockchains adopting Move (such as Sui and Aptos), offer improved performance and lower transaction costs.

Cross-Chain Solutions

Smart contracts typically operate within a single blockchain network. To interact across networks or access off-chain data, oracles and external computation systems provide necessary verification and data feeds.

Security Considerations and Best Practices

Common Vulnerabilities

Smart contracts face significant security risks, with millions lost annually due to bugs and exploits. Common vulnerabilities include reentrancy attacks, unreliable random number generation, and arithmetic errors.

Development and Testing Tools

Tools like Truffle and Foundry help developers write and test smart contracts thoroughly before deployment. Security analysis platforms such as CRYPTO-SCOUT automatically identify potential vulnerabilities.

Security Analysis and Auditing

Given the high value of cryptocurrency tokens managed by smart contracts, thorough auditing and continuous monitoring are essential to prevent fraud and ensure contract integrity.

The Future of Smart Contracts

Technological Advancement

Smart contracts continue to evolve, improving scalability, interoperability, and security. They are increasingly integrated into industries such as finance, supply chain, healthcare, and real estate, automating transactions with precision and transparency.

Regulatory Landscape

Several US states, including Arizona, Iowa, Nevada, Tennessee, and Wyoming, have passed legislation recognizing smart contracts. The Law Commission of England and Wales has also acknowledged smart legal contracts under existing law frameworks.

Integration with AI and Automation

The convergence of artificial intelligence with smart contracts is enabling more complex automated decision-making and reducing human intervention, opening new possibilities for business and technology.

Getting Started with Smart Contracts

For Developers

Anyone interested can learn to write smart contracts using languages like Solidity and deploy them on blockchain platforms such as Ethereum. Deploying a smart contract requires paying gas fees, as it is treated as a blockchain transaction.

For Investors and Traders

Understanding smart contracts is vital for informed investment decisions in the crypto space. Platforms like Token Metrics offer AI-driven analytics and real-time signals to help investors identify promising tokens and smart contract platforms.

Conclusion

Smart contracts represent one of the most transformative innovations in the digital economy. By eliminating intermediaries and enabling trustless, automated agreements, they drive efficiency, transparency, and innovation across industries. The immutable, encrypted records maintained on blockchain technology ensure security and prevent fraud, while automated execution accelerates transactions and reduces costs.

As smart contracts continue to expand their applications in 2025 and beyond, leveraging advanced analytical tools like those provided by Token Metrics is essential for developers, investors, and business leaders navigating this dynamic space. Far from being just a technological innovation, smart contracts signify a fundamental shift toward a more automated, transparent, and efficient digital economy. Understanding and embracing this technology is crucial for success in the blockchain-powered future unfolding before us.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)