What Is an ETF Stock? A Beginner’s Guide to Exchange-Traded Funds in 2025

Table of contents

In today’s fast-moving financial markets, Exchange-Traded Funds, or ETF stocks, have emerged as one of the most popular investment vehicles for beginners and professionals alike. But what exactly is an ETF stock, how does it work, and why is it considered a smart way to invest?

This guide will walk you through everything you need to know about ETF stocks in 2025—including how they work, their benefits and risks, and how AI platforms like Token Metrics are changing the way people research and trade ETFs in both traditional and crypto markets.

📌 What Is an ETF Stock?

An ETF stock refers to a share of an Exchange-Traded Fund—a type of investment fund that trades on stock exchanges, much like individual company stocks. Each ETF holds a basket of underlying assets such as:

- Stocks (e.g., S&P 500 companies)

- Bonds

- Commodities (like gold or oil)

- Currencies

- Cryptocurrencies (Bitcoin, Ethereum, etc.)

When you buy an ETF stock, you’re buying a fractional share of the entire portfolio of assets held by that ETF.

🔍 How Does an ETF Stock Work?

ETF stocks work like this:

- Creation: An asset management company (like BlackRock, Vanguard, or Fidelity) creates an ETF that tracks a specific index, sector, or asset type.

- Listing: The ETF is listed on a stock exchange such as the NYSE or Nasdaq.

- Trading: Investors can buy and sell ETF shares throughout the trading day, just like they would a stock like Apple or Tesla.

- Price Movement: The price of an ETF stock fluctuates during the day based on the Net Asset Value (NAV) of its holdings and supply-demand dynamics in the market.

This model provides a liquid, transparent, and low-cost way for investors to gain diversified exposure to entire markets or sectors.

📊 Example of an ETF Stock

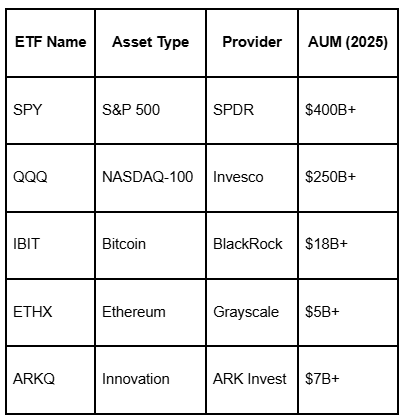

A good example is the SPDR S&P 500 ETF Trust (SPY), which tracks the performance of the S&P 500 index. When you buy a share of SPY, you gain exposure to 500 of the largest U.S. companies—without needing to buy each stock individually.

✅ Benefits of ETF Stocks

ETF stocks offer numerous advantages for investors in 2025:

1. Diversification

Instead of buying individual assets, ETF stocks offer instant diversification by holding dozens or hundreds of securities in a single share.

2. Liquidity

ETFs are traded on exchanges, making them highly liquid. You can buy or sell them at market prices during normal trading hours.

3. Lower Costs

ETFs typically have low expense ratios (as low as 0.03%), especially compared to mutual funds or actively managed portfolios.

4. Transparency

Most ETFs disclose their holdings daily, giving investors a clear view into what they’re buying.

5. Flexibility

You can use ETFs for long-term investing, short-term trading, hedging, or generating income through dividends.

⚠️ Risks of ETF Stocks

Despite their many benefits, ETF stocks do come with some risks:

1. Market Risk

ETF stocks are still subject to market volatility. If the underlying assets decline in value, so will the ETF.

2. Tracking Error

Some ETFs may not perfectly replicate the performance of their index due to fees, slippage, or illiquid assets.

3. Overexposure

Because ETFs make it easy to invest, some investors may unknowingly become overexposed to a particular sector or strategy.

4. Liquidity Risk

Not all ETFs are created equal. Low-volume ETFs may have wider bid-ask spreads, increasing trading costs.

🪙 Crypto ETFs: The New Frontier

In 2025, crypto ETF stocks have become a hot trend. These funds allow investors to gain exposure to digital assets without managing private keys, wallets, or blockchain protocols.

Types of crypto ETFs include:

- Spot ETFs: Hold actual crypto assets (e.g., Bitcoin, Ethereum).

- Futures ETFs: Track the price of crypto futures contracts.

Popular examples in 2025 include:

- IBIT (BlackRock Bitcoin ETF)

- FBTC (Fidelity Bitcoin ETF)

- ETHX (Ethereum Spot ETF)

Crypto ETFs have opened the door for institutional and traditional investors to gain exposure to the crypto market in a regulated and simplified manner.

🤖 How Token Metrics Helps You Trade ETF Stocks Smarter

Whether you're interested in traditional ETF stocks or crypto ETFs, Token Metrics provides the AI-powered insights you need to make better investment decisions.

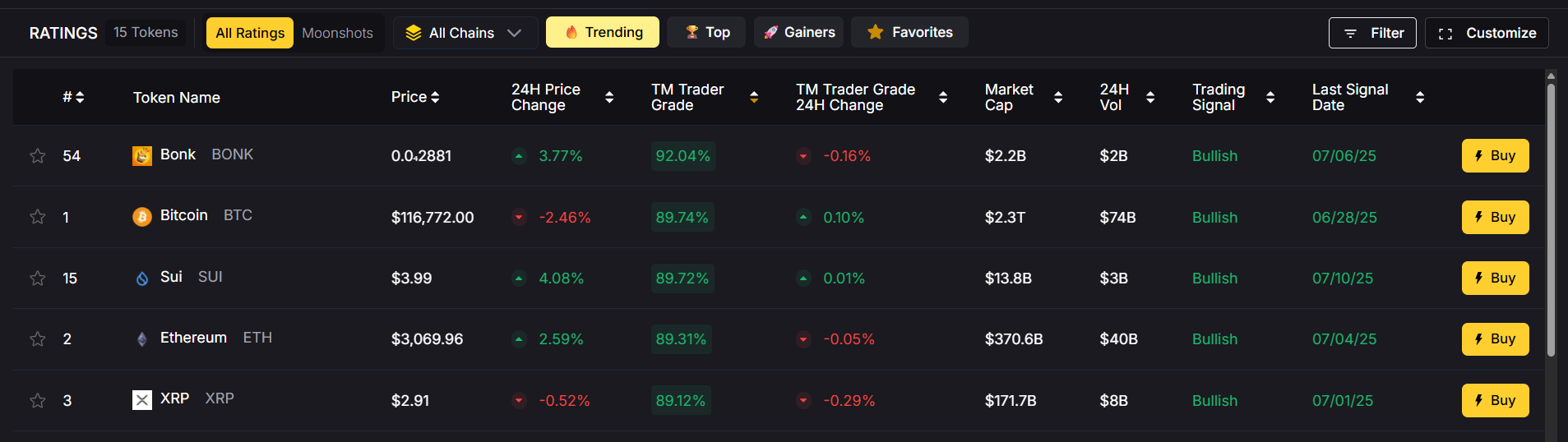

🔎 1. AI-Powered Ratings

Token Metrics assigns each token or ETF a Trader Grade and Investor Grade based on price trends, volume, volatility, and technical strength—making it easy to spot outperformers.

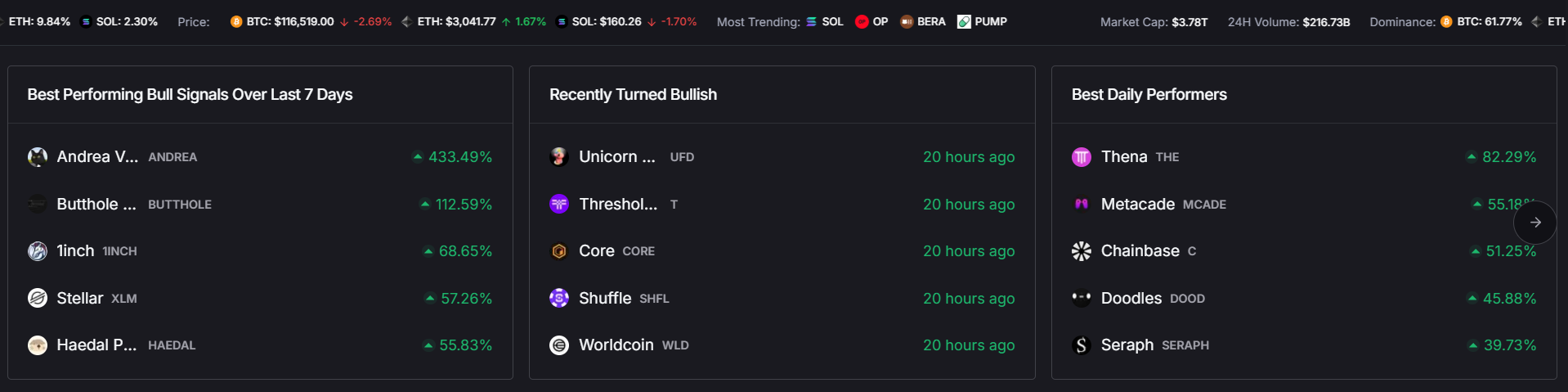

📈 2. Bullish and Bearish Signals

AI-driven signals show when it’s time to buy or sell based on real-time metrics like ETF inflows, exchange balances, and market sentiment.

📊 3. Price Forecasts

Get access to predictive models that estimate where Bitcoin, Ethereum, and major crypto ETFs are headed—based on 80+ factors.

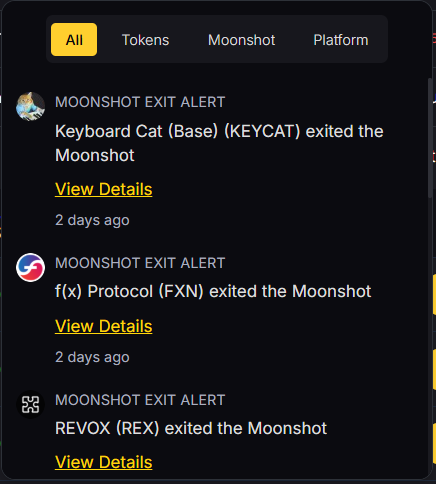

🔔 4. Smart Alerts

Set custom alerts for ETF stock signals, price movements, or grade changes so you never miss an opportunity.

By combining ETF investing with Token Metrics’ AI analytics, you gain an informational edge in markets that move faster than ever.

📈 Popular ETF Stocks in 2025

Here’s a list of top-performing ETF stocks across traditional and crypto sectors:

🧠 Final Thoughts

ETF stocks are a powerful investment tool in 2025, offering instant diversification, low fees, and easy access to traditional and crypto markets. Whether you're looking to build a retirement portfolio or ride the next Bitcoin rally, ETF stocks make it easier than ever to invest with confidence.

And with platforms like Token Metrics, you don’t need to guess your way through ETF trading. Use AI-driven insights, price predictions, and real-time data to get ahead of the curve—no matter what markets you trade.

Create Your Free Token Metrics Account

Create Your Free Token Metrics Account

.png)

Power your platform with Token Metrics API

Access real-time crypto data, analytics, and grades.

Get Your Free API KeyCreate Your Free Token Metrics Account

Create Your Free Token Metrics Account

.png)

.png)

.svg)

.png)