Cardano (ADA) Crypto – What It Is and How It Works?

Cardano (ADA) can be described as a blockchain platform that’s designed to enable the development of decentralized applications and smart contracts. It is the first blockchain platform to be built on a scientific philosophy and to be developed through peer-reviewed research and scientific rigor. Developed by a global team of leading researchers and engineers, Cardano is set to revolutionize the way we use and interact with blockchain technology.

This beginner's guide to Cardano will provide you with all the information you need to understand the platform, its features, and how to use it. From its unique consensus algorithm to its native token ADA, this guide will provide you with a comprehensive overview of Cardano. Whether you're a beginner interested in learning more about Cardano or a blockchain expert looking for the latest information, this guide has you covered from end-to-end.

History of Cardano

Cardano was founded by Charles Hoskinson, who also co-founded Ethereum. However, Cardano is a very different platform from Ethereum regarding its design and goals. Whereas Ethereum is a decentralized application ("dapp") platform designed to power all sorts of different decentralized applications, Cardano is designed to be a "first generation" blockchain platform that can be used to build decentralized applications, as well as other things.

The Cardano Foundation, IOHK, and Emurgo are developing the Cardano platform. The three groups are working together to build the Cardano platform and will hold a stake in the Cardano ecosystem.

The first phase of Cardano's development began in 2015. At the time, a company called Input-Output (IOHK) was contracted to build the platform. In 2017, IOHK decided to hand over control of the project to the Cardano Foundation and Emurgo. The three partners are now working together to bring Cardano to market. The next development phase has been completed sometime between 2020 and 2021. After that, Cardano emerged as a fully decentralized blockchain.

How Does Cardano Work?

The Cardano platform uses a proof of stake (PoS) consensus algorithm to manage its decentralized network. Proof of stake is a consensus algorithm where the right to add new blocks to the blockchain is determined not by computing power but by coin ownership. In PoS-based blockchains, users must "stake" or "deposit" their coins to add new blocks to the blockchain for a certain amount of time. The more coins a user stakes, the greater the chance that the user will be selected to add a new block. Cardano uses the Ouroboros proof of stake algorithm.

Ouroboros is the first proof of stake algorithm to be proven secure in a peer-reviewed paper. This unique algorithm uses a "random selection of a catch-up fellow" to create a network with no central authority. In other words, no single person or group can control the network. The algorithm works by randomly selecting a "follower" who can "catch up" with the "leader."

The leader is the person responsible for adding new blocks to the blockchain. The follower has one job: to predict what the leader will do. If the follower is correct, they are promoted to the leader and given a chance to add a new block. If the follower is incorrect, they remain a follower, and another random person is selected to catch up. The Ouroboros algorithm was expected to be completed by June 2020. But, according to recent reports, Charles Hoskinson said that the Ouroboros Genesis implementation will be in 2023.

Cardano's Development and Governance

The development and governance of Cardano are handled by three large organizations:

The Cardano Foundation: The Cardano Foundation maintains Cardano's core. This group promotes the platform, manages its marketing and communications, and defends the brand.

IOHK: IOHK leads the team behind Cardano's core. This group is responsible for developing and maintaining the platform's core software and bringing new features to the market.

Emurgo: The third group, Emurgo, brings businesses and investments to the Cardano ecosystem. Emurgo helps businesses integrate with the Cardano network and encourages others to build projects on the Cardano platform.

The functioning of Cardano stands tall because of the highly secured and powerful ecosystem as mentioned above. Now, what is Cardano’s native token ADA?

Cardano's Native Token - ADA

Cardano's native token, ADA, sends money on the Cardano blockchain. It also rewards people who help maintain and build the network. The team behind Cardano has stated that ADA is more than just a token: it also serves as "the fuel that drives the Cardano ecosystem." Cardano’s development team has stated that the platform will be fully decentralized once the network has been around for a few years. Until then, the platform will be maintained by a group of stakeholders who have a vested interest in the platform's success. These stakeholders have a stake in the system and are rewarded with ADA for helping maintain the platform.

There are 3-easy ways to earn ADA:

- Hosting a node,

- Providing software assurance, or

- Contributing to the development of Cardano's software or research.

Apart from these, Cardano’s powerful 3-layered ecosystem makes it reliable and trustworthy.

The 3-Layered Cardano's Ecosystem

Here are the three secured-layers that constitute Cardano (ADA):

The Cardano Network: The Cardano network is the blockchain that runs the ADA token and smart contracts. It is maintained by the stakeholders, who receive ADA for their work.

Cardano's core technology: The Cardano core represents the core software that powers the Cardano network. This includes the programming languages used to build decentralized applications and the virtual machine that runs those apps.

All the projects built on top of the Cardano platform: The Cardano projects layer lists all the decentralized applications built on top of the Cardano network.

To top it all, you can also enjoy the benefit of smart contracts on Cardano.

Smart Contracts On Cardano

Although Cardano is designed to be a dapp platform, it can also be used to build smart contracts. The programming language used to build smart contracts on Cardano is called Haskell and Cardano's virtual machine, called the "Computing Resources And Dispatcher" (CRDD), can execute many programming languages.

Any decentralized application built in any programming language can be hosted on the Cardano network. Cardano's smart contracts are unique because they are the first to be verified by a formal verification tool called the "Industrial Strength Verification" (ISV). This tool will help you confirm whether or not a smart contract is safe to use.

Cardano's Use Cases

Use Case #1: The first use case for Cardano is a decentralized application platform. This means that developers can build apps on top of the Cardano blockchain. These dapps will be able to send and receive ADA and use other features like the ability to create a wallet or sign a transaction.

Use Case #2: The second use case for Cardano is as a financial asset. Investors can buy and sell ADA on cryptocurrency exchanges, and the token could also represent ownership in a company.

Now, let’s see the security measures that Cardano aims to offer.

Security on Cardano

One of the most common questions about Cardano is how secure it is compared to other blockchains. Cardano does not claim to be more secure than other blockchains but seeks to be as secure as possible. The team behind Cardano has said that one of their goals is to be the "safest and most reliable blockchain."

One way Cardano strives to be more secure is through its unique design. While other blockchains are designed to do one thing well, Cardano is designed to do many different things less well. Cardano's design means no single platform part is crucial to its operation. If one part of the platform fails, many other parts can take its place. This indicates safety at its best.

Is Cardano a Worthy Investment?

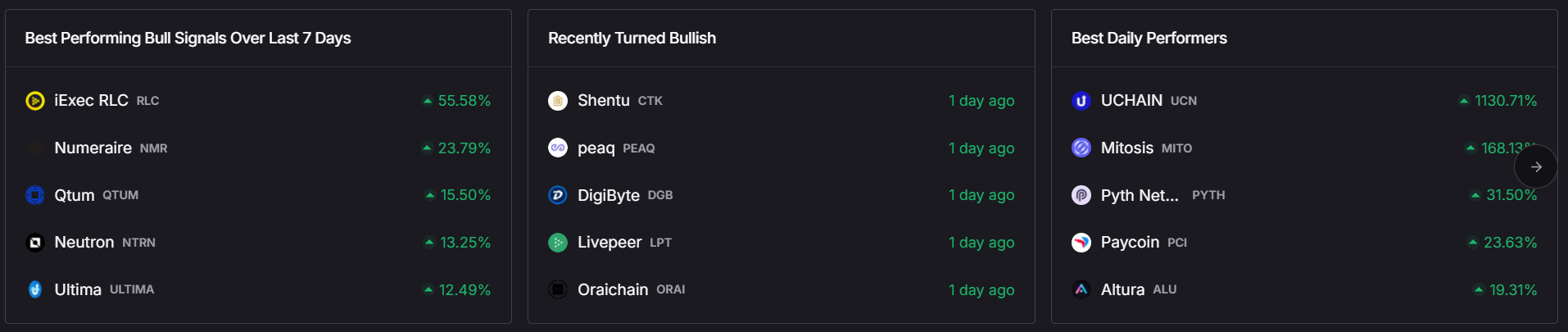

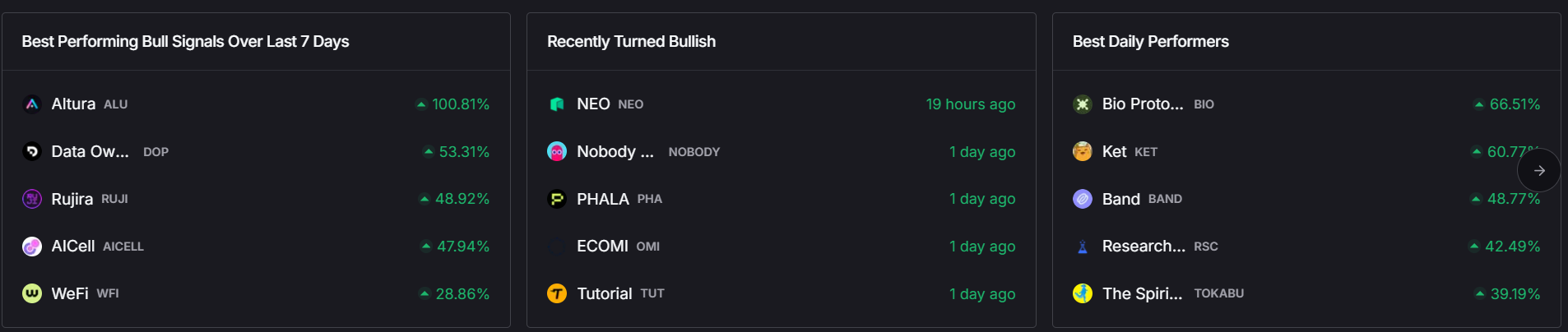

There we are swinging again to whether or not Cardano is a good investment. Let’s check out the latest updates before we decide, shall we?

According to the Cryptoglobe’s Report, ADA’s price might soar up to 100% by 31st January, 2023. Major upgrades are being anticipated by investors to improve DeFi’s significance through its oracles.

So, Cardano is something to look forward to owing to its upcoming features.

Future of Cardano

Let’s dive a bit further into the future. Cryptopolitan thinks the price of ADA will soar up to $21.35 on an average, with a minimum price of $20.55. Changelly also believes that ADA price will rise, but the website thinks the coin price will only peak at $15.69, with an average of $13.92, similar to the data from Price Prediction. The website’s analysts predict that the coin’s maximum price will be $15.69 with a minimum of $13.55.

Most experts predict that Cardano might see a bright future in 2023. With persistent developments Cardano’s ecosystem has been witnessing, and in the crypto asset market as a whole, Cardano can potentially reach a new high.

The Bottom Line

Cardano aims to be a "first generation" blockchain technology. The platform is being built by a group of organizations, each with a specific role in the project.

The team hopes this design will help Cardano achieve its goal of being the most secure blockchain. The platform uses a unique consensus algorithm, and its native token is storable in various wallets. The token can be used to represent ownership in a company.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)