Initial Coin Offering (ICO) Explained - A Complete Guide

In the world of cryptocurrency, Initial Coin Offerings (ICOs) have emerged as a popular method of fundraising for startups and projects. But what exactly are ICOs, and how do they work?

In this definitive guide, we will explore the concept of ICOs, their history and evolution, the benefits and risks of participating in ICOs, and the factors to consider before investing in an ICO.

What is an ICO?

ICOs, also known as Initial Coin Offerings, are a form of crowdfunding where companies issue digital tokens or coins to raise funds for their projects.

These tokens are usually built on existing blockchain platforms, such as Ethereum, and can represent various assets or utilities within a project's ecosystem.

Unlike traditional fundraising methods like Initial Public Offerings (IPOs), ICOs allow companies to bypass the lengthy and costly process of going public.

Instead, they can directly sell their tokens to the public, offering early investors the opportunity to buy tokens at a discounted price before they are listed on cryptocurrency exchanges.

History and evolution of ICOs

The concept of ICOs originated with the launch of Mastercoin in 2013, which raised over 5000 Bitcoin (BTC) in its crowdfunding campaign. This success paved the way for other projects to adopt the ICO model, leading to a surge in popularity in the following years.

In 2017, ICOs reached their peak, with numerous projects raising millions, and sometimes even billions, of dollars in a matter of days.

However, this period was also marked by a lack of regulation and oversight, resulting in many fraudulent projects and scams that left investors high and dry.

How do ICOs work?

Project Development

Before an ICO, the project team develops a whitepaper. This document outlines the project's purpose, technical aspects, the amount of capital required, how many tokens the project team will hold, the type of money accepted, and the timeline of the ICO campaign.

Token Sale

Once the whitepaper is ready, the project team will announce the ICO date and begin the token sale. Early project enthusiasts, also known as the 'early bird investors,' will buy tokens in this phase.

If the money raised does not meet the project's requirements, the ICO is deemed unsuccessful, and the money is returned to the investors.

Token Distribution

If the ICO campaign reaches its funding goal, the tokens are distributed to investors, and the project team uses the funds to further the project development.

In return for their investment, participants receive a certain number of tokens, which can later be traded on cryptocurrency exchanges or used within the project's ecosystem.

The value of these tokens can fluctuate, offering investors the potential for significant returns if the project succeeds.

Benefits and risks of participating in ICOs

Participating in ICOs can offer several benefits for investors but it also comes with few risks. Let’s understand the key benefits and risks of ICO investments.

Benefits

1. Investment Opportunity: ICOs present an opportunity to invest in promising projects at the ground level. If the project succeeds, the token value can rise substantially, leading to significant returns.

2. Democratized Funding: ICOs allow anyone in the public to contribute to the project. This is unlike traditional investment methods, often limited to accredited investors.

3. Fostering Innovation: ICOs provide a platform for innovative projects to get the funding they need to develop their ideas.

Risks

1. Lack of Regulation: While some regulation exists, the ICO space still remains somewhat unregulated, which can expose investors to fraudulent projects.

2. Market Volatility: Cryptocurrencies are known for their volatility. The value of tokens bought during an ICO can decrease significantly.

3. Project Failure: As with any investment in a new project, there's always the risk that the project will not succeed, leading to a loss of investment.

Factors to consider before investing in an ICO

Before investing in an ICO, there are several factors that you should consider to make an informed decision.

Firstly, evaluate the project's whitepaper and roadmap to understand its goals, vision, and feasibility. Look for a strong team with relevant experience and a clear plan for execution.

Additionally, consider the market potential of the project and its competitive advantage. Does the project solve a real-world problem or offer a unique solution? Assess the project's token economics and distribution model to ensure fairness and long-term sustainability.

Lastly, pay attention to the project's community and investor relations. A strong and supportive community can contribute to the project's success, while poor communication or lack of transparency can be red flags.

Where to find initial coin offerings?

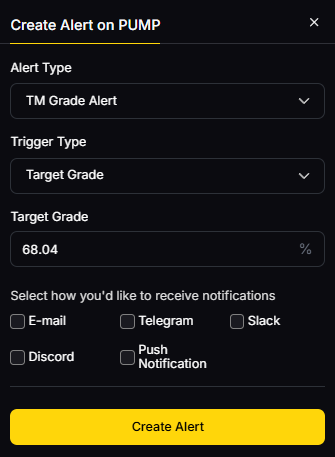

Keeping track of new coin launches in the dynamic world of cryptocurrencies can be a challenging task, but with the right tools and resources, you can stay up-to-date.

Various cryptocurrency exchanges like Coinbase, Gemini, and Kraken often list new tokens and provide updates about upcoming launches on their platforms.

Crypto market data aggregators such as CoinGecko and CoinMarketCap serve as comprehensive resources for information about new coin listings.

Remember, investing in ICOs involves risk. The suggestions are not investment advice, but merely resources to monitor. Always conduct thorough research and due diligence before investing in any ICOs.

Tips for successful participation in ICOs

Participating in an ICO can be an exciting and potentially lucrative opportunity, but it's important to approach it with caution and follow some best practices. Here are some tips for successful participation in ICOs:

- Conduct thorough research: Read the project's whitepaper, evaluate its team and advisors, and assess its market potential before making any investment decisions.

- Diversify your investments: Spread your investments across multiple ICOs to mitigate risk. Avoid putting all your eggs in one basket.

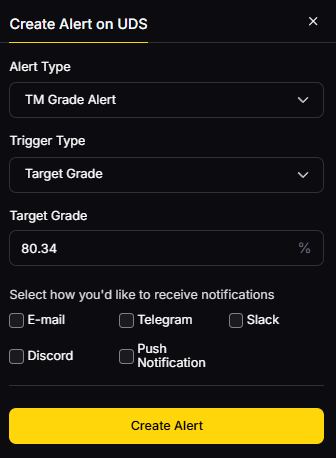

- Stay informed: Keep up-to-date with the latest news and developments in the cryptocurrency industry. Follow reputable sources and join communities to stay informed about upcoming ICOs and market trends.

- Set a budget: Determine how much you are willing to invest in ICOs and stick to your budget. Avoid investing more than you can afford to lose.

- Use secure wallets: Store your tokens in secure wallets to protect them from hacks and theft. Consider using hardware wallets for added security.

ICO regulations and legal considerations

With the rise of ICO scams and fraudulent projects, regulatory bodies around the world have started taking action to protect investors and promote transparency in the ICO market.

Countries like the United States, Switzerland, and Singapore have issued guidelines and regulations for ICOs, imposing stricter requirements on projects and enhancing investor protection.

Before participating in an ICO, it's crucial to familiarize yourself with the regulatory landscape in your jurisdiction.

Understand the legal considerations and requirements for both the project and the investors. This will help you make informed decisions and avoid potential legal pitfalls.

Future of ICOs in 2023 and beyond

As we look ahead to 2023 and beyond, the future of ICOs remains uncertain. While ICOs have revolutionized fundraising in the cryptocurrency space, they have also faced criticism and regulatory scrutiny due to the prevalence of scams and fraudulent projects.

In response to these challenges, we can expect to see increased regulation and oversight in the ICO market.

Regulatory bodies around the world are working to establish guidelines and frameworks to protect investors and weed out fraudulent projects.

This regulatory clarity could help to restore confidence in the ICO market and attract more traditional investors.

Furthermore, we may witness the emergence of new fundraising models that address the shortcomings of ICOs.

Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs) are already gaining traction as alternative fundraising methods that offer increased investor protection and compliance with existing regulations.

Frequently Asked Questions

Q1. How are ICOs different from STOs and IEOs?

While ICOs (Initial Coin Offerings), STOs (Security Token Offerings), and IEOs (Initial Exchange Offerings) are all fundraising methods in the crypto space, they differ in their regulatory frameworks and the rights they offer to investors.

Q2. Are all ICOs legal?

The legality of ICOs depends on the regulatory framework of each country. Some countries have banned ICOs, while others have regulated them. It's essential to check the legal status of ICOs in your country before participating.

Q3. What happens to the funds if the ICO doesn't reach its target?

Typically, if an ICO does not reach its funding target, the raised funds are returned to the investors. This process, known as a "refund," is usually outlined in the project's whitepaper.

Q4. How can I participate in an ICO?

To participate in an ICO, you typically need to create an account on the ICO's official website, go through a Know Your Customer (KYC) process, and then send your investment (often in the form of Bitcoin or Ethereum) to a designated address.

Q5. Are ICOs a good investment?

Investing in ICOs can be high-risk, high-reward. While some ICOs have delivered impressive returns, others have led to significant losses. It's crucial to conduct thorough research and consider your risk tolerance before investing in an ICO.

Q6. Can ICOs make you rich?

While it's true that some investors have made substantial profits from successful ICOs, it's essential to understand that investing in ICOs is not a guaranteed way to get rich. Many ICOs fail or are scams. Due diligence and a solid understanding of the project are crucial before investing.

Q7. What's the role of a token in an ICO?

The token issued in an ICO often serves as the utility token for the project's ecosystem. They can represent access rights to a service provided by the project or can be used for transactions within the project's platform.

Q8. How can I spot an ICO scam?

Signs of a potential ICO scam can include unrealistic promises of returns, lack of transparency, an anonymous or inexperienced team, lack of a comprehensive whitepaper, and lack of third-party audits or involvement of recognized crypto exchanges.

Conclusion

ICOs have played a vital role in the growth of the cryptocurrency industry by providing an innovative way to fund new projects.

However, like any investment, they come with their risks. With proper due diligence and cautious judgment, participating in an ICO can be an exciting way to engage with the crypto world.

Keep in mind that this guide is only the start of your ICO journey. Always strive to deepen your understanding, stay informed about industry changes, and make decisions that align with your risk tolerance and investment goals.

Happy investing!

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)