What is Polygon (MATIC) - How it Works, Benefits and Use Cases

Polygon (formerly known as Matic Network) is a protocol for building and connecting Ethereum-compatible blockchain networks. It is designed to provide faster and cheaper transactions on the Ethereum network by using side chains and an adapted version of the Plasma framework.

It also offers a wide range of:

- Smart contract solutions

- Secure identity solutions, and

- Wallet solutions.

History of Polygon (MATIC) Crypto

The history of Polygon Matic dates back to 2017 when the project was founded by Jaynti Kanani and Sandeep Nailwal. In 2021, the project took up a rebranding and went from Matic Network to Polygon. This was done in the light of reflecting a broader focus on providing infrastructure for a wide range of blockchain use cases.

With Polygon MATIC, users can easily create and manage their own decentralized applications, securely store and transfer assets, and even trade digital assets. With its powerful features and benefits, Polygon MATIC can be a great tool for you to leverage the power of the blockchain. Find out how it can benefit you in the best ways possible below.

Benefits of Polygon

Polygon MATIC has several benefits that make it a great blockchain solution. Here are a few of its top benefits that you need to be aware of:

- Scalability - Polygon MATIC has high scalability and can support millions of users and transactions. It can also scale at a very low cost. This means that it can handle high transaction volumes and can support a large user base.

- Security - Polygon MATIC is a secure platform with state-of-the-art security features. You can easily secure your data and transactions on the platform through the use of the platform’s security features.

- Wide range of services and tools - Polygon MATIC offers a wide range of services and tools that can benefit different types of users. Whether you are a developer, an individual, or a business, Polygon MATIC can help you with your decentralized applications and smart contracts.

- Cost-effective and scalable solutions - With Polygon MATIC, you can easily and cost-effectively deploy various decentralized applications. It also offers scalable solutions that can grow and evolve with your business.

Polygon Use Cases

- E-commerce and Online Retail - The Polygon MATIC blockchain can help improve e-commerce and online retail. This is because distributed ledger technology can significantly reduce the cost of transactions and make it easier for businesses to manage their supply chain.

- Supply chain management - The Polygon MATIC blockchain can also help in supply chain management. It can help track shipments and provide transparency and security across the supply chain.

- Gaming - The Polygon MATIC blockchain can help improve gaming through tokenization. It can also help gamers exchange their digital assets.

- Healthcare - The Polygon MATIC blockchain can help in healthcare by enabling secure and immutable record storage. It can also help in improving the efficiency of health-related apps and services.

- ICO and Crowdfunding - The Polygon MATIC blockchain can help improve the ICO and crowdfunding experience. It can also help in improving the tokenization process and provide transparency.

Polygon Security Features

The Polygon MATIC blockchain is a secure and reliable blockchain solution. It uses a distributed ledger technology that is decentralized and peer-to-peer. This means that there is no single point of failure and it is not controlled by a single entity. This makes it secure and reliable. When it comes to security, the Polygon MATIC blockchain has many features.

Some of these features are discussed below:

- Advanced consensus algorithms - The Polygon MATIC blockchain uses advanced consensus algorithms to verify transactions. This makes it secure and reliable. These algorithms include PBFT (Practical Byzantine Fault Tolerance), VRF (Variable Resonance), and EOS consensus.

- Strong authentication method - The Polygon MATIC blockchain has a strong authentication method that makes it difficult to hack or spoof. Even if someone is able to hack into the network, they can only hack a single node and not the entire network.

- Encrypted communication - The communication between the nodes on the Polygon MATIC blockchain is encrypted. This makes it difficult to hack or spoof.

Polygon (MATIC) Cost

The cost of using Polygon MATIC will depend on your usage. The more you use the platform, the higher the cost will be. You can also choose to outsource your needs and use Polygon MATIC as a service.

Here are a few things you should know about the Polygon MATIC cost:

- The cost of using the Polygon MATIC blockchain platform for deploying DApps is $1499.

- The cost of deploying a smart contract is $599.

- The cost of deploying wallets is $499.

- The cost of deploying an identity and security solution is $1199.

- The cost of deploying a trading platform is $1499.

Note: These prices may have changed due to change in MATIC's price.

These are the costs of using Polygon MATIC as a service. For more details on the cost, visit their website.

Polygon Crypto Alternatives

- Ethereum - Ethereum is a popular blockchain platform used for developing decentralized applications and smart contracts. It is also used for ICOs and crowdfunding.

- Hyperledger - Hyperledger is another popular blockchain platform used for developing decentralized applications and smart contracts.

- EOS - EOS is also a blockchain platform used for developing decentralized applications and smart contracts.

- Cardano - Cardano is a scalable blockchain platform that can support large volumes of transactions.

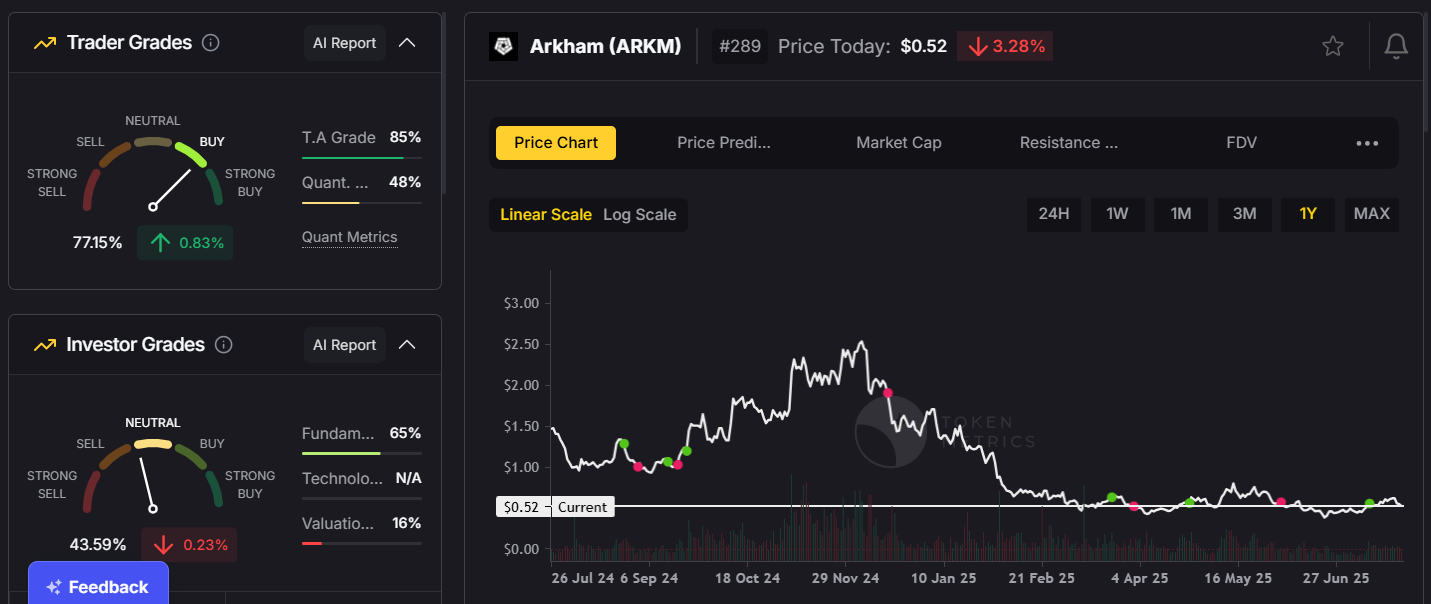

Is Polygon (MATIC) a Good Investment?

As for whether Polygon is a good investment, it's important to remember that the cryptocurrency market is highly volatile and that investing in any cryptocurrency carries a high level of risk. It's important to do your own research and carefully consider your investment options before making any decisions.

How to Buy Polygon (MATIC) Crypto?

If you're interested in buying MATIC, you can do so on a number of cryptocurrency exchanges that offer it. Some popular options include Binance, Coinbase, and Kraken. Be sure to carefully compare the fees and features of different exchanges before choosing one to use. Below are the 5 simple steps that you can follow to get your own Polygon:

- Choose a Crypto Exchange Broker

- Create your account (Crypto Wallet)

- Link your Bank Account to your wallet

- Pick the Cryptocurrency you want to invest in

- Choose your storage method

Great, but, do we know where Polygon is headed in the future?

Future of Polygon (MATIC)

It's difficult to predict the future of Polygon with certainty, but the project has gained significant traction in the cryptocurrency community and has the potential to continue growing and gaining adoption in the future. However, as with any investment, it's important to be aware of the risks and to carefully consider your options before making any decisions.

The Bottom Line

Token Metrics is happy to provide you with AI-driven market updates and information regarding the crypto world but it is you who needs to be the decision maker when it comes to your crypto investments.

Polygon (formerly Matic Network) offers innovative technology that could potentially democratize blockchain through the creation of customized, interoperable networks. While it's difficult to predict the future performance of MATIC, the project has a strong team and partnerships with well-known companies.

However, as with any cryptocurrency investment, there is a high level of risk and it's important to carefully consider all options before making any decisions. Blockchain technology is still in its early stages and it may be more profitable to invest in the technology itself rather than just the hype. It's also important to exercise caution when building a cryptocurrency portfolio.

Disclaimer: The information provided on this website does not constitute investment/trading/financial advice and you should not treat any of the website’s content as such. Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. We only offer comprehensive information which may change according to time.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)