What is the Difference Between Crypto and Blockchain: The Ultimate Guide to Understanding Key Differences in 2025

The terms crypto and blockchain are often used interchangeably in conversations about digital money and technology, but they actually represent fundamentally different concepts. As we move through 2025, understanding what is the difference between crypto and blockchain has become increasingly important for investors, traders, technologists, and anyone interested in the future of finance and digital innovation. This comprehensive guide will clarify these distinctions, explain how both technologies work, and explore their evolving roles in shaping the global digital economy.

Understanding Blockchain Technology: The Foundation Technology

At its core, blockchain technology is a revolutionary form of a distributed ledger that records transactions across a network of multiple computers, or nodes, simultaneously. Blockchain is a type of distributed ledgers system. Unlike a traditional central database controlled by a single entity, a blockchain network operates without a central authority, distributing data across many participants to create a decentralized ledger. This infrastructure ensures that the blockchain records are immutable, meaning once a transaction is recorded, it cannot be altered without consensus from the network. Blockchain ensures transaction integrity, transparency, and trust by making records tamper-proof and verifiable by all participants.

The blockchain works by grouping transaction data into “blocks.” Each block contains a transaction record, a timestamp, and a reference to the previous block through a cryptographic hash. Blockchain uses cryptographic structures, such as Merkle trees, for storing data securely and immutably. This chaining of blocks forms an immutable digital ledger that ensures data integrity and security. Because every block links to its predecessor, tampering with any single block would require changing all subsequent blocks across the entire network, which is practically impossible.

Key characteristics of blockchain include:

- Decentralization: The blockchain database is distributed across a distributed network of nodes, eliminating a single point of control or failure. This contrasts with traditional financial systems and databases that rely on a central bank or central authority.

- Transparency: In public blockchain networks like the bitcoin blockchain, all blockchain records are visible to network members, enabling a transparent system where transactions can be audited openly. This data transparency enhances auditing, improves security, and fosters trust among market participants.

- Immutability: Once recorded, transaction data on the blockchain becomes a permanent, immutable record. Transaction records are stored securely and become immutable with each new block. This feature is critical for applications requiring trustworthy historical data, such as financial transactions and voting systems.

- Security: Blockchain uses cryptographic techniques, including cryptographic hash functions and consensus algorithms, to secure the network against fraud and unauthorized modifications.

Each block contains a transaction record that is unalterable; the transaction record includes all relevant details of each transaction. If corrections are needed, they are made with additional entries, ensuring a complete and transparent history.

Beyond cryptocurrency, blockchain refers to the underlying technology that supports a wide range of applications, from supply chain management to decentralized applications and smart contracts. Businesses can operate their own private blockchain networks or join consortium blockchain networks where preselected organizations maintain the ledger collectively. Blockchain software automates and streamlines the processes involved in how blockchain works.

How Blockchain Works: The Mechanics Behind the Magic

At the heart of blockchain technology is a decentralized digital ledger that revolutionizes how we record transactions. Unlike traditional systems that rely on a central authority, a blockchain network operates across a distributed network of computers—known as nodes—where multiple parties can participate in validating and recording transactions. This peer-to-peer structure is the underlying technology that powers secure and transparent data sharing in various industries, from supply chain management to financial institutions and even voting systems.

When a transaction is initiated, it is broadcast to the entire blockchain network. Nodes independently verify the transaction using complex algorithms, ensuring its authenticity and accuracy. Once validated, the transaction is grouped with others into a block. Each block is then assigned a unique cryptographic hash, which links it to the previous block, forming a continuous and unbreakable chain. This blockchain protocol guarantees that every transaction is permanently recorded and cannot be altered without consensus from the network, making the system tamper-proof.

The result is a transparent and immutable record of all transactions, accessible to all network participants. This approach not only enhances trust among multiple parties but also streamlines processes in supply chain management, enables secure voting systems, and provides financial institutions with a robust alternative to traditional centralized databases. By eliminating the need for a central authority, blockchain technology empowers organizations to collaborate more efficiently and securely across a wide range of applications.

Types of Blockchain Networks: Public, Private, and Consortium Explained

Blockchain networks come in several forms, each tailored to different needs and levels of access. Public blockchain networks, such as the bitcoin network, are open to anyone who wishes to participate. These networks allow anyone to record transactions and view the blockchain, making them ideal for applications that benefit from transparency and broad participation, such as cryptocurrencies and open voting systems.

In contrast, private blockchain networks restrict access to authorized participants only. These networks are often chosen by financial institutions and organizations that require greater control and confidentiality. For example, in supply chain management, a private blockchain allows multiple parties within a business network to securely record transactions and share data without exposing sensitive information to the public.

Consortium blockchain networks offer a hybrid approach, where a group of preselected organizations collectively manage the network. This model is particularly useful in industries where collaboration between multiple parties is essential, such as in the financial sector or complex supply chains. Consortium blockchain networks balance the need for shared control with enhanced security and efficiency.

By choosing the appropriate type of blockchain—public, private, or consortium—organizations can tailor their blockchain solutions to meet specific requirements for security, transparency, and collaboration.

Blockchain Protocols: The Rules Powering Decentralization

Blockchain protocols are the foundational rules that dictate how data is recorded, validated, and shared within a blockchain network. These protocols are essential for ensuring that all transactions are secure, transparent, and tamper-proof, forming the backbone of decentralized systems.

Different blockchain protocols use various consensus mechanisms to validate transactions. For instance, the bitcoin protocol relies on proof-of-work, where nodes compete to solve complex mathematical puzzles to add new blocks to the chain. This process secures the network but can be resource-intensive. In contrast, protocols like Ethereum have adopted proof-of-stake, where validators “stake” their own cryptocurrency to gain the right to verify transactions, offering a more energy-efficient alternative.

Blockchain protocols also enable the creation and execution of smart contracts—self-executing agreements with terms directly written into code. These smart contracts power decentralized applications, automating processes such as asset transfers and ensuring that all parties adhere to agreed-upon terms without the need for intermediaries.

By establishing clear rules for how transactions are processed and how network participants interact, blockchain protocols are critical to the operation and trustworthiness of blockchain networks and the decentralized applications built on top of them.

Understanding Cryptocurrency: Digital Currency Built on Blockchain

Cryptocurrency is a type of digital asset and a form of digital or virtual currency that leverages blockchain technology to enable secure, peer-to-peer transfer of value without intermediaries like banks or governments. The most well-known example is Bitcoin, which launched in 2009 on the bitcoin network and introduced the concept of a decentralized ledger for cryptocurrency transactions.

Cryptocurrencies are essentially digital assets or digital money that exist purely in electronic form. Digital assets include cryptocurrencies and other blockchain-based representations of value, such as tokenized assets and digital collectibles. Unlike cash or coins, cryptocurrencies have no physical counterpart. They rely on cryptographic security to control the creation of new units and to verify transactions. This makes cryptocurrencies resistant to counterfeiting and censorship.

By 2025, the landscape of digital currencies has expanded dramatically. The total market capitalization of cryptocurrencies has surpassed $4 trillion, and institutional involvement has increased significantly. The launch of Bitcoin and Ethereum spot ETFs has broadened access to digital currency investments, while the rise of decentralized finance (DeFi) platforms has opened new avenues for users to access financial services without traditional intermediaries. Bitcoin was the first of many virtual currencies, and since its inception, numerous other virtual currencies have emerged, each with unique features and use cases.

Essential features of cryptocurrencies include:

- Digital Nature: Cryptocurrencies exist solely as data on a blockchain database and can be transferred electronically across borders rapidly.

- Cryptographic Security: Transactions are secured by cryptographic algorithms, and ownership is controlled via a private key, which is a confidential code that authorizes transactions and verifies ownership of the digital asset.

- Limited Supply: Many cryptocurrencies, including Bitcoin, have a fixed maximum supply, creating scarcity similar to precious metals.

- Global Accessibility: Anyone with internet access can participate in the cryptocurrency ecosystem, often at lower costs than traditional banking.

While all cryptocurrencies rely on blockchain, not all blockchains are designed for cryptocurrencies. Some blockchain platforms focus on other use cases, such as supply chain transparency or voting systems. The difference between blockchain and cryptocurrencies is that blockchain is the foundational technology—a distributed ledger system—while cryptocurrencies are just one application of blockchain, serving as digital assets or virtual currencies built on top of it.

Key Differences Between Crypto and Blockchain

To clarify what is the difference between crypto and blockchain, it helps to think of blockchain as the underlying technology or infrastructure, while cryptocurrency is one of its most famous applications.

- Scope and Application: Blockchain technology has broad applications across various industries, including financial institutions, healthcare, supply chain management, and digital identity verification. Cryptocurrency specifically refers to digital currency systems built on blockchain to facilitate payments, store value, and enable new financial instruments. While cryptocurrencies typically operate on a public network that allows anyone to participate, organizations may deploy their own blockchain to address specific needs, offering tailored features and greater control.

- Purpose and Function: Blockchain aims to provide a secure and transparent platform for recording transactions and data sharing without relying on a central authority. Blockchain can also be implemented as a private network for enterprise use, offering enhanced privacy and control over who can access and validate transactions. Cryptocurrency’s primary function is to serve as digital money or virtual currency that operates independently of traditional financial systems.

- Investment and Trading: Blockchain itself is a technology and not a tradable asset. Conversely, cryptocurrencies can be bought, sold, and traded on exchanges, making them investment vehicles. This distinction is important for market participants looking to invest in the ecosystem.

- Regulatory Treatment: Blockchain technology is generally treated as infrastructure and faces fewer regulations. Cryptocurrencies, however, often encounter complex regulatory scrutiny due to their use as alternative forms of money and their impact on financial systems.

- Security and Transparency: Blockchain is designed to provide security and transparency in data management. Public blockchains allow public access to transaction data, enabling anyone to verify transactions, while private networks restrict access to authorized participants only. Additionally, blockchain enables secure transactions by preventing tampering and fraud.

In summary, while blockchain lies at the heart of cryptocurrencies, it extends far beyond them, enabling decentralized ledgers and blockchain systems that transform how data is stored and shared securely.

The Evolution in 2025: Integration and Maturation

As of 2025, both blockchain and cryptocurrency have matured and integrated more deeply into mainstream finance and business. Traditional financial institutions are issuing their own stablecoins, digital currencies pegged to fiat money, with the total market capitalization of these fiat-pegged stablecoins projected to reach $500 billion. Many of these stablecoins are built on a private blockchain network infrastructure, providing enhanced control and permissioned access for participating organizations. This marks a significant step toward institutional acceptance and integration of blockchain-based digital assets.

At the same time, governments worldwide are developing Central Bank Digital Currencies (CBDCs), which utilize blockchain technology to issue state-backed digital money while retaining centralized control. Governments may implement CBDCs using private blockchains or a consortium blockchain network model, allowing multiple authorized entities to participate in managing the digital currency. This hybrid approach demonstrates how blockchain can support both decentralized and centralized financial models.

Moreover, the rise of Blockchain-as-a-Service (BaaS) platforms allows businesses to leverage blockchain technology without building infrastructure from scratch. Businesses can choose to join a public blockchain network or deploy private blockchain networks and consortium blockchain networks depending on their specific requirements for access, control, and scalability. This trend is accelerating adoption in industries beyond finance, including healthcare, retail, and supply chain management.

These technological advancements highlight the growing importance of blockchain as the underlying infrastructure for a wide array of applications, while cryptocurrencies continue to evolve as digital assets within this ecosystem.

Professional Tools for Crypto Trading and Analysis

With the increasing complexity of the cryptocurrency market, professional tools are essential for making informed decisions. Platforms like Token Metrics exemplify the new generation of AI-powered crypto analytics tools that combine blockchain protocols with machine learning to provide actionable insights.

Token Metrics offers AI-driven ratings, market intelligence, and predictive analytics for various cryptocurrencies, helping traders navigate volatile markets. The platform’s integration of on-chain data analysis allows users to evaluate bitcoin transactions and other cryptocurrency transactions in real time, enhancing transparency and decision-making.

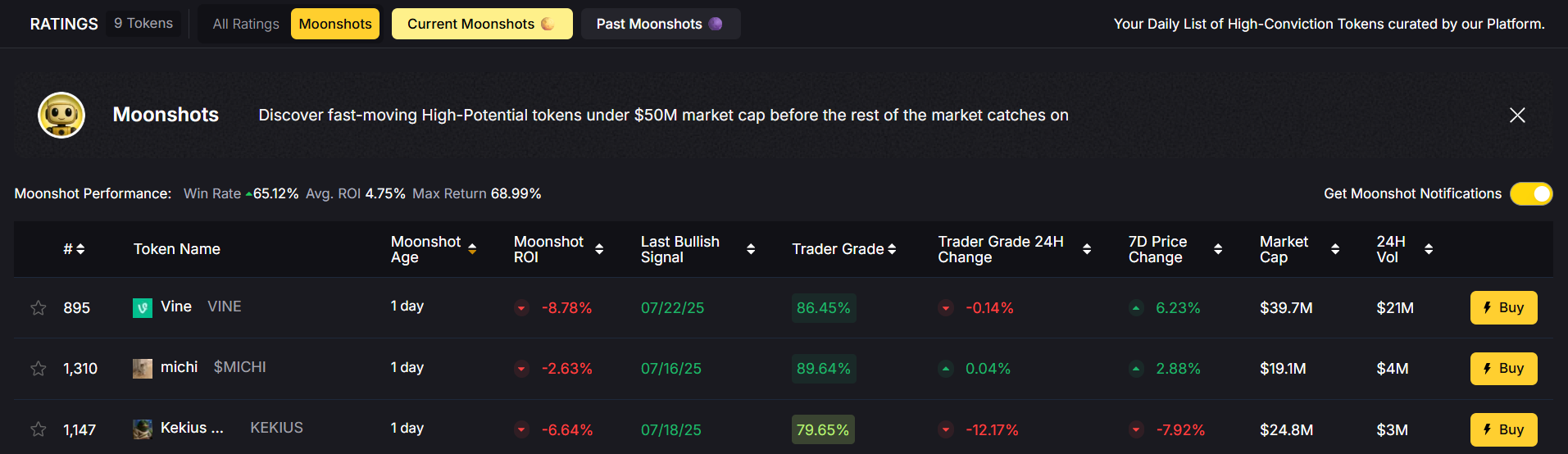

Innovations such as integrated trading capabilities and AI-powered agents provide seamless transitions from research to execution, streamlining the trading process. For investors seeking emerging opportunities, Token Metrics specializes in identifying promising altcoins or “moonshots” before they gain widespread attention.

Such tools are critical for managing risks and capitalizing on the rapid evolution of blockchain bitcoin and other digital assets, making professional-grade analytics accessible to both retail and institutional investors.

Real-World Applications Beyond Finance

While cryptocurrency remains the most visible application of blockchain, the technology’s potential extends far beyond digital money. Industries across the board are leveraging blockchain to improve transparency, security, and efficiency.

In supply chain management, blockchain enables companies to track products from origin to consumer, ensuring authenticity and reducing counterfeiting. Luxury brands like Gucci and Balenciaga use blockchain platforms to provide provenance verification, enhancing consumer trust. In these enterprise blockchain applications, private transactions are essential for maintaining confidentiality and controlled access to sensitive business data.

Healthcare organizations are adopting blockchain for secure patient data management, drug traceability, and maintaining the integrity of clinical trial data. The immutable record capabilities of blockchain ensure accurate and tamper-proof medical histories. Private transactions also play a key role in healthcare, helping to protect patient privacy and comply with regulatory requirements.

Retailers are also embracing blockchain to combat fraud and enhance transparency, contributing to the growth of the global blockchain retail market, which is expected to expand rapidly in the coming decade.

Other notable applications include voting systems that use blockchain to create transparent and tamper-resistant election processes, and decentralized applications that run on blockchain networks to enable new business models. Some of these applications leverage public networks to ensure transparency and broad participation, especially in open, permissionless environments.

Challenges of Blockchain: Hurdles on the Road to Adoption

Despite its transformative potential, blockchain technology faces several significant challenges that can slow its adoption across various industries. One of the most pressing issues is scalability. Many blockchain networks struggle to process a high volume of transactions per second, leading to congestion, delays, and increased transaction fees. This limitation can make blockchain less competitive compared to traditional payment systems.

Regulatory uncertainty is another major hurdle. As governments and regulatory bodies grapple with how to oversee blockchain technology and cryptocurrency transactions, businesses often face unclear or evolving compliance requirements. This uncertainty can deter investment and slow the integration of blockchain solutions in sectors like finance and supply chain management.

Technical complexity also poses a barrier. Implementing and maintaining blockchain networks requires specialized expertise, which can be scarce and costly for organizations new to the technology. Additionally, the public nature of many blockchains raises concerns about data privacy and security, as sensitive information recorded on a public ledger may be accessible to unintended parties.

Finally, as a relatively new technology, blockchain’s long-term viability and the full scope of its applications remain uncertain. Questions about interoperability between different blockchain networks and the environmental impact of certain consensus mechanisms also persist.

Despite these challenges, the potential benefits of blockchain technology—such as enhanced transparency, security, and efficiency—continue to drive innovation and exploration across a wide range of industries. As solutions to these hurdles emerge, blockchain is poised to play an increasingly important role in the digital economy.

Looking Forward: The Future Relationship

The future of blockchain and cryptocurrency is one of ongoing evolution and integration. Blockchain technology is expected to become increasingly invisible to end-users, embedded as the shared database infrastructure powering many digital services.

Cryptocurrencies may diversify into specialized tokens serving distinct functions within various ecosystems, from digital money to governance rights and beyond. Regulatory clarity will be pivotal, as recent developments indicate growing institutional acceptance and potential recognition of Bitcoin as a strategic reserve asset.

The convergence of AI with blockchain and cryptocurrency trading, as seen with platforms like Token Metrics, heralds a new frontier in market sophistication. These technological synergies will create fresh opportunities for both individual investors and institutions.

Understanding the nuanced differences and complementary roles of crypto and blockchain will be essential for success in this rapidly changing landscape.

Conclusion

In conclusion, what is the difference between crypto and blockchain is a fundamental question for anyone involved in the digital economy. Blockchain is the technology — a decentralized, secure, and transparent ledger system that supports a variety of applications across industries. Cryptocurrency is a prominent application of blockchain technology, representing digital or virtual currency designed to function as digital money outside of traditional financial systems.

As 2025 unfolds, blockchain continues to serve as critical infrastructure for numerous sectors, while cryptocurrencies mature as an asset class with growing institutional adoption. Leveraging advanced analytics tools like Token Metrics can provide significant advantages for those navigating the complex world of crypto trading and investment.

Ultimately, both blockchain and cryptocurrency will play distinct but interconnected roles in shaping the future of finance, business, and technology — making an understanding of their differences not just useful, but essential.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)