What is the GENIUS Act and How Does It Affect Crypto? Complete 2025 Guide

The cryptocurrency industry experienced a turning point on July 18, 2025, when President Donald Trump signed the GENIUS Act into law. This landmark piece of major crypto legislation marks the first major federal crypto legislation ever passed by Congress and fundamentally reshapes the regulatory landscape for stablecoins. The GENIUS Act brings much-needed clarity and oversight to digital assets, including digital currency, signaling a dramatic shift in how the United States approaches the rapidly evolving crypto space. For anyone involved in cryptocurrency investing, trading, or innovation, understanding what the GENIUS Act is and how it affects crypto is essential to navigating this new era of regulatory clarity.

Introduction to Digital Assets

The digital asset landscape is undergoing a profound transformation, with the GENIUS Act representing a pivotal moment in establishing national innovation for U.S. stablecoins. Digital assets—ranging from cryptocurrencies and stablecoins to digital tokens and digital dollars—are at the forefront of financial innovation, reshaping how individuals, businesses, and financial institutions interact with money and value. As decentralized finance (DeFi) and digital finance continue to expand, the need for regulatory clarity and robust consumer protections has never been greater.

The GENIUS Act aims to address these needs by introducing clear rules for stablecoin issuers and setting a new standard for regulatory oversight in the crypto industry. By requiring permitted payment stablecoin issuers to maintain 1:1 reserves in highly liquid assets such as U.S. treasury bills, the Act ensures that stablecoin holders can trust in the stable value of their digital assets. This move not only protects consumers but also encourages greater participation from traditional banks, credit unions, and other financial institutions that had previously been wary of the regulatory uncertainties surrounding digital currencies.

One of the GENIUS Act’s most significant contributions is its comprehensive regulatory framework, which brings together federal and state regulators, the Federal Reserve, and the Federal Deposit Insurance Corporation to oversee payment stablecoin issuers. The Act also opens the door for foreign issuers to operate in the U.S. under specific conditions, further enhancing the role of cross-border payments in the global digital asset ecosystem. By aligning stablecoin regulation with the Bank Secrecy Act, the GENIUS Act requires issuers to implement robust anti-money laundering and customer identification measures, strengthening the integrity of the digital asset market.

President Trump’s signing of the GENIUS Act into law marks a turning point for both the crypto space and the broader financial markets. The Act’s focus on protecting consumers, fostering stablecoin adoption, and promoting financial innovation is expected to drive significant growth in digital finance. Crypto companies and major financial institutions now have a clear regulatory pathway, enabling them to innovate with confidence and contribute to the ongoing evolution of digital currencies.

As the digital asset market matures, staying informed about regulatory developments—such as the GENIUS Act and the proposed Asset Market Clarity Act—is essential for anyone looking to capitalize on the opportunities presented by digital finance. The GENIUS Act establishes a solid foundation for the regulation of payment stablecoins, ensuring legal protections for both the buyer and stablecoin holders, and setting the stage for future advancements in the crypto industry. With clear rules, strong consumer protections, and a commitment to national innovation for U.S. stablecoins, the GENIUS Act is shaping the future of digital assets and guiding the next era of financial markets.

What is the GENIUS Act?

The GENIUS Act, officially known as the Guiding and Establishing National Innovation for U.S. Stablecoins Act, establishes the first comprehensive federal regulatory framework specifically designed for stablecoins in the United States. Introduced by Senator Bill Hagerty (R-Tennessee) on May 1, 2025, the bill received strong bipartisan support, passing the Senate 68-30 on June 17, 2025, before clearing the House on July 17, 2025.

Stablecoins are a class of cryptocurrencies engineered to maintain a stable value by pegging their worth to another asset, typically the U.S. dollar. Unlike highly volatile crypto assets such as Bitcoin or Ethereum, stablecoins provide price stability, making them ideal for payments, trading, and serving as safe havens during market turbulence. At the time of the GENIUS Act’s passage, the two largest stablecoins—Tether (USDT) and USD Coin (USDC)—dominated a $238 billion stablecoin market.

This legislation emerged after years of regulatory uncertainty that left stablecoin issuers operating in a legal gray zone. The collapse of TerraUSD in 2022, which wiped out billions of dollars in value, underscored the risks of unregulated stablecoins and accelerated calls for federal oversight. The GENIUS Act aims to address these concerns by establishing clear standards for reserve backing, consumer protection, and operational transparency, thereby fostering national innovation in digital finance.

Provisions of the GENIUS Act

The GENIUS Act introduces several critical provisions that fundamentally change how stablecoins operate within the United States. One of the most significant is the reserve backing requirement, which mandates that stablecoin issuers maintain 100% reserves backing their tokens with highly liquid, low-risk assets such as U.S. Treasury securities and U.S. dollars. This one-to-one backing ensures that stablecoin holders can redeem their tokens for the underlying asset at any time, protecting against the type of collapse witnessed with TerraUSD.

Another cornerstone of the Act is its consumer protection measures. These provisions prioritize stablecoin holders' claims over all other creditors in the event of issuer insolvency, providing a critical safety net. The law also guarantees clear redemption rights, allowing stablecoin holders to convert their tokens back into U.S. dollars on demand, enhancing legal protections for consumers.

The Act further establishes stringent licensing and oversight requirements, specifying that only permitted payment stablecoin issuers—including subsidiaries of insured depository institutions, federally qualified issuers, and state-qualified issuers—may issue stablecoins in the U.S. These permitted issuers are subject to rigorous approval processes and dual oversight by federal and state regulators, creating a regulatory framework akin to traditional banking supervision.

Addressing national security concerns, the GENIUS Act explicitly subjects stablecoin issuers to the Bank Secrecy Act, requiring them to implement robust anti-money laundering (AML) and sanctions compliance programs. Issuers must have the technical capability to seize, freeze, or burn payment stablecoins when legally mandated, enhancing the Treasury Department’s enforcement capabilities. These measures ensure that stablecoins cannot be exploited for illicit activities, reinforcing the integrity of the financial markets.

Immediate Market Impact and Regulatory Clarity

The passage of the GENIUS Act was met with enthusiasm across the cryptocurrency market. Following the Senate vote, the total crypto market capitalization surged by 3.8%, reaching an impressive $3.95 trillion. By the time President Trump signed the bill into law, the market had climbed further, hitting a record $4 trillion—a clear indication of how much regulatory uncertainty had previously suppressed institutional participation.

The stablecoin market experienced particularly explosive growth under this new regulatory framework. By early August 2025, stablecoin market capitalization had climbed past $278 billion, with net stablecoin creation increasing by an astonishing 324% from Q2 to Q3 2025, reaching approximately $300 billion. This surge demonstrates that regulatory clarity has unlocked significant institutional capital that had been waiting on the sidelines.

Major financial institutions, including JPMorgan and Meta Platforms, accelerated their stablecoin initiatives following the law’s enactment. Traditional banks, which had been cautious about entering the crypto space, now have a clear regulatory pathway to participate. Stablecoins are rapidly evolving from niche crypto products to mainstream financial infrastructure, with applications in cross-border payments and other financial services.

How the GENIUS Act Affects Stablecoin Issuers and Different Crypto Sectors

Although the GENIUS Act primarily targets stablecoins, its effects resonate throughout the broader cryptocurrency ecosystem. In the realm of decentralized finance (DeFi), the enhanced reliability and regulatory compliance of stablecoins strengthen the foundation for lending, borrowing, and yield-generating protocols. However, DeFi platforms must ensure that the stablecoins they integrate comply with the new licensing requirements, which may limit the tokens they can support.

NFT marketplaces benefit indirectly from the Act. With stablecoins now backed by clear regulatory guidelines and consumer protections, users gain greater confidence when using these digital dollars for high-value NFT transactions. While the GENIUS Act does not regulate NFTs directly, it removes uncertainty around the payment mechanisms that facilitate their exchange.

Crypto exchanges face a mix of new opportunities and compliance obligations. Exchanges listing stablecoins must verify that issuers hold proper licenses and maintain required reserves. Those acting as custodians or facilitators for stablecoin transactions may be classified as digital asset service providers, triggering additional regulatory oversight. Nonetheless, legitimate exchanges stand to gain a competitive edge as regulated stablecoins attract more institutional clients.

The payments and remittances sector arguably stands to benefit the most. With clear legal status and consumer protections, stablecoins can now effectively compete with traditional payment networks for cross-border transactions. This is especially impactful in emerging markets, where stablecoins often serve as hedges against local currency instability, improving the efficiency and cost-effectiveness of cross-border payments.

Navigating the New Digital Assets Landscape with Token Metrics

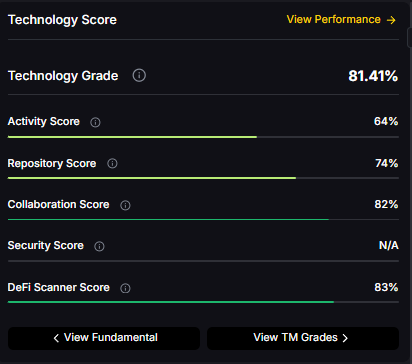

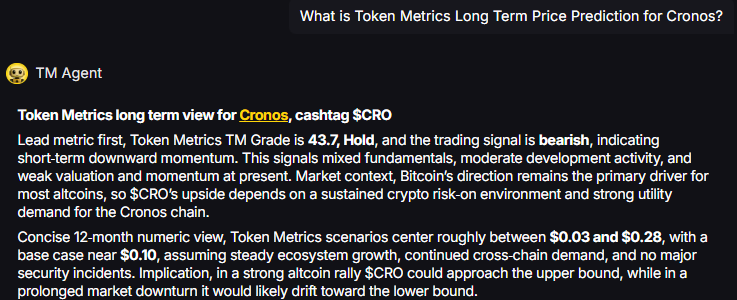

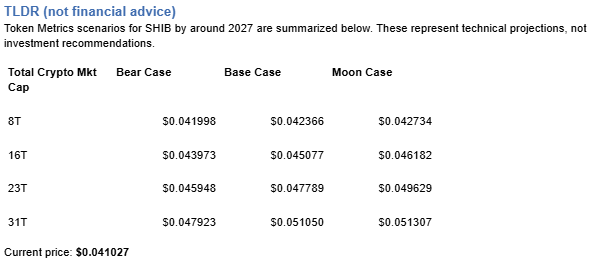

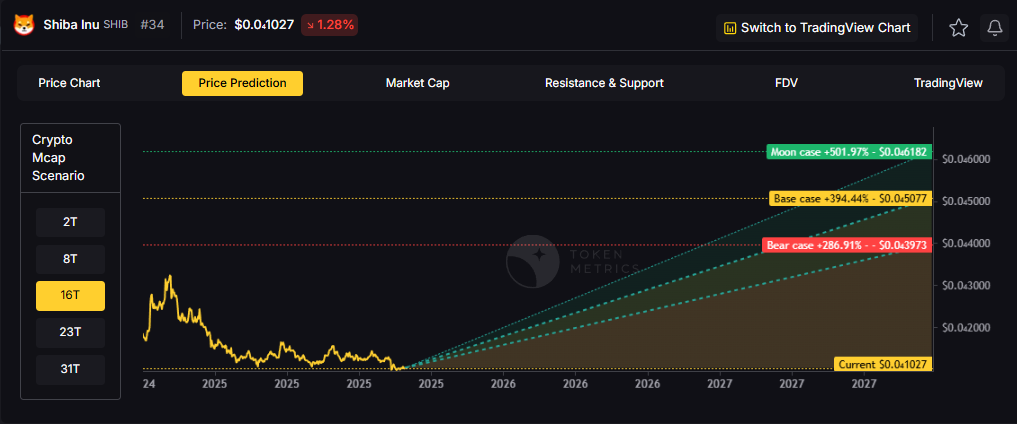

As the cryptocurrency industry transitions from regulatory ambiguity to a structured framework, investors and traders require sophisticated tools to navigate this evolving landscape. Token Metrics, a leading crypto trading and analytics platform, offers the comprehensive data and insights essential for making informed decisions under the GENIUS Act’s new regulatory environment.

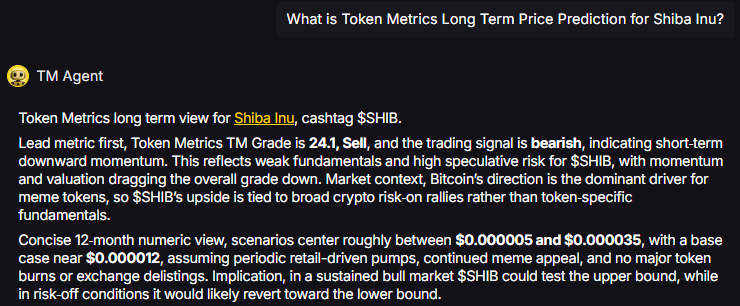

Token Metrics provides real-time tracking of stablecoin market dynamics, including reserve ratios, trading volumes, and compliance status for major issuers. This information is crucial for understanding which stablecoins meet the GENIUS Act’s requirements and which may face regulatory challenges. By aggregating this data into actionable intelligence, Token Metrics supports effective portfolio construction and risk management.

The platform’s advanced analytics help investors identify emerging opportunities resulting from the regulatory shift. As traditional financial institutions launch regulated stablecoins and new use cases arise, Token Metrics’ AI-driven ratings and market analysis guide allocation decisions. Whether evaluating established stablecoins like USDC or assessing new entrants from banks such as JPMorgan, Token Metrics delivers objective, data-backed assessments.

For active traders, Token Metrics offers market intelligence needed to capitalize on volatility and trends driven by regulatory developments. When news surfaces about licensing approvals, reserve audits, or enforcement actions, Token Metrics equips users to respond swiftly with comprehensive context on how events impact specific tokens and broader market sectors.

Moreover, Token Metrics helps investors understand correlation effects—how stablecoin regulation influences Bitcoin, Ethereum, and altcoin markets. As stablecoins become more mainstream and integrated into financial markets, their relationship with other crypto assets evolves. Token Metrics’ correlation analysis and market structure insights enable more sophisticated trading and hedging strategies.

What Comes Next

The GENIUS Act is only the beginning of comprehensive crypto regulation in the United States. The Digital Asset Market Clarity Act (CLARITY Act), which passed the House on July 17, 2025, aims to extend regulatory frameworks to the broader cryptocurrency market, clearly defining the roles of the SEC and CFTC. As this legislation moves through the Senate, the regulatory landscape will continue to evolve rapidly. Industry experts anticipate that the next 18 months will be crucial as other crypto sectors seek regulatory clarity following the stablecoin model. The emerging framework approach suggests future cryptocurrency regulation will be use-case specific rather than technology specific, with payment tokens receiving banking-like oversight while investment products remain under SEC jurisdiction.

Conclusion

The GENIUS Act fundamentally transforms the cryptocurrency landscape by delivering regulatory clarity to the $300 billion stablecoin market. By establishing strict reserve requirements, consumer protections, and licensing frameworks, the law removes major barriers to institutional adoption while safeguarding against catastrophic failures that have plagued unregulated stablecoins.

For investors, traders, and businesses operating in the crypto space, understanding what the GENIUS Act is and how it affects crypto is no longer optional—it is essential. As regulated stablecoins become the backbone of crypto payments, DeFi protocols, and cross-border transactions, those equipped with superior analytics and market intelligence will be best positioned to capitalize on emerging opportunities while effectively managing risks.

Platforms like Token Metrics provide the comprehensive tracking, analysis, and insights needed to successfully navigate this new regulatory era. As the cryptocurrency industry matures from experimental technology to regulated financial infrastructure, such tools become indispensable for anyone serious about succeeding in digital asset markets.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)