What is Tron (TRX) Crypto and Is It a Good Investment?

If you are wondering what is Tron (TRX), this is the place to be.

Tron (TRX) is a decentralized blockchain-based system designed to provide a high-performance infrastructure for creating and deploying decentralized applications (DApps) and smart contracts. The TRX token is the native cryptocurrency of the Tron network and is used to pay for transaction fees and incentivize users to participate in the Tron ecosystem.

Launched in 2017 by Justin Sun, Tron aims to create a platform that is more scalable, efficient, and cost-effective than its predecessors, such as Bitcoin and Ethereum. Tron's blockchain infrastructure leverages a delegated proof-of-stake consensus mechanism, which allows for high transaction throughput and lower fees compared to other blockchains.

History Of Tron (TRX)

Tron was created by Justin Sun, a young Chinese entrepreneur who had previously been involved in several other successful blockchain projects. Sun had a vision for Tron to become a decentralized ecosystem where creators could produce and distribute their work without being subject to censorship or control from centralized organizations.

Tron's initial coin offering (ICO) raised over $70 million in just a few days, making it one of the largest ICOs of all time. Since then, the value of TRX has fluctuated, but it has remained one of the top 20 cryptocurrencies by market capitalization.

In 2018, Tron acquired BitTorrent, a popular peer-to-peer file-sharing platform, to integrate the technology into its ecosystem. This acquisition has allowed Tron to expand its reach and offer new services, such as sharing large files and making micropayments.

Tron has also developed its own decentralized application (dApp) ecosystem, with hundreds of dApps now built on its platform. This has attracted developers and users to the Tron network and helped establish it as a leading player in the decentralized world.

In conclusion, Tron is a cryptocurrency and blockchain platform aiming to create a decentralized internet and entertainment ecosystem. Since its launch, it has become one of the world's largest and most active blockchain platforms, with a thriving dApp ecosystem and a strong community of users and developers.

How Does Tron (TRX) Crypto Work?

Tron uses the Delegated Proof of Stake (DPoS) consensus algorithm, which allows for high transaction speeds and low energy consumption compared to other consensus algorithms like Proof of Work (PoW).

It has its own native cryptocurrency, TRX, which is used for transactions on the network. The TRX token is used for various purposes, including paying for transaction fees, creating smart contracts, and participating in decentralized applications (dApps) built on the Tron network.

Tron also uses smart contracts, self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. This allows for the automation of certain processes and eliminates the need for intermediaries.

One of the key features of the Tron network is its ability to handle high volumes of transactions. This is because it uses a block size of 2 MB and can process up to 2,000 transactions per second, making it one of the fastest blockchain platforms.

In addition, Tron has its own virtual machine, the Tron Virtual Machine (TVM). The TVM is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to port existing Ethereum dApps to the Tron network easily.

Key Features of Tron

- Decentralized platform: Tron offers a decentralized network, meaning that any single entity does not control it, making it more secure and transparent than traditional centralized platforms.

- High-throughput: Tron has a high-throughput capacity, allowing for fast and efficient transactions and the ability to process more than 2,000 transactions per second.

- Smart Contracts: Tron supports smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code.

- Token creation: Tron allows users to create and issue their own tokens on the platform, which can be used for various purposes such as fundraising, loyalty programs, and more.

- Gaming and entertainment: Tron strongly focuses on gaming and entertainment, and the platform is home to many decentralized applications (dApps) related to gaming, gambling, and other forms of entertainment.

Top 5 Uses Of Tron (TRX) Crypto

Owning Tron can be useful to you for many reasons. Here are the top five uses of having Tron on your portfolio:

- Payment System: Tron enables fast, secure, and low-cost transactions of its native cryptocurrency, TRX. It can be used to pay for goods and services, transfer funds, and make transactions with merchants and individuals.

- Decentralized Applications: Tron supports decentralized applications (dApps) that run on its network. dApps can range from gaming, finance, social media, and other use cases that benefit from the security and transparency offered by blockchain technology.

- Content Creation and Distribution: TRON aims to disrupt the traditional entertainment industry by enabling content creators to monetize their work without intermediaries. It allows content creators to engage directly with their audience, receive payment in TRX, and gain exposure to a larger audience.

- Staking: Tron supports staking, a process that allows users to earn rewards for holding and locking their TRX in a wallet. Staking incentivizes users to support and secure the network by validating transactions and maintaining its stability.

- Governance: Tron uses a decentralized governance model that allows its community to vote on proposals and make decisions about the future development of the network. TRX holders can participate in the governance process and have a say in the project's direction.

Benefits of Tron (TRX)

Following are some of the benefits of using Tron:

- Censorship-resistant: As a decentralized platform, Tron is not subject to censorship or interference from any central authority, which makes it a more open and free environment for content creators and users.

- Increased security: The use of blockchain technology provides increased security for users' data and assets.

- Lower fees: The decentralized nature of Tron means that there are no middlemen or intermediaries, which reduces transaction fees and makes it more cost-effective.

- Open source: Tron is an open-source platform, meaning developers can build on it and contribute to its development and growth.

How to Purchase a Tron Coin (TRX)?

Here is a step-by-step guide to purchasing Tron (TRX):

#1 Choose a cryptocurrency exchange: First, you must choose a cryptocurrency exchange that supports TRX trading. Some popular exchanges include Binance, Huobi, and OKEx.

#2 Create an account: Once you have chosen an exchange, you must create an account. This involves providing personal information and verifying your identity, which is a standard process for most exchanges.

#3 Add funds to your account: Next, you need to add funds to your account. This can be done by transferring funds from your bank account, using a credit card, or through other methods supported by the exchange.

#4 Buy TRX: After you have added funds to your account, you can purchase TRX. To do this, you will need to navigate to the TRX trading page on the exchange, select the amount of TRX you want to purchase and place your order.

#5 Store your TRX: Finally, you should store your TRX in a secure wallet. There are many different types of wallets, including hardware wallets, software wallets, and online wallets, so you can choose the one that best suits your needs.

Note: It's important to research the reputation and security measures of the exchange you choose to use and the fees they charge to ensure that you are comfortable and confident in your investment. Additionally, it is recommended to keep track of the value of TRX and other cryptocurrencies, as the market is highly volatile, and their value can fluctuate rapidly.

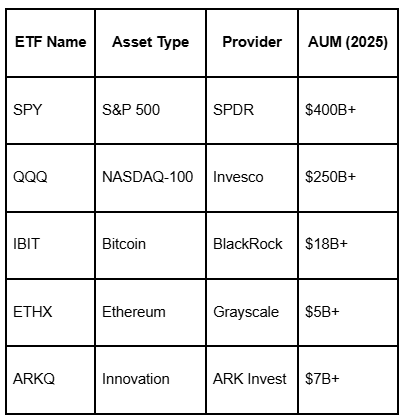

You can simply head here and create your account on our crypto analytics platform and use the Token Metrics AI-driven technology to analyze and understand the crypto market before deciding on any investment.

Is Tron a Good Investment?

Investing in cryptocurrency, including Tron (TRX), is considered a high-risk investment. The value of cryptocurrencies can be highly volatile and subject to rapid changes. There is always the risk of losing your investment due to market fluctuations, hacking, or other security risks.

Moreover, the cryptocurrency market still needs to be more regulated, which means that there is a lack of protection for investors. There is also the risk of scams and fraudulent schemes in cryptocurrency, so it's important to do your due diligence and research before investing.

That said, some people see Tron having significant potential for growth and as an investment opportunity with long-term potential.

The Bottom Line

In conclusion, Tron (TRX) is a decentralized platform that offers a range of features and benefits for developers and users, including high-throughput, smart contracts, token creation, and more. Its decentralized nature provides increased security and censorship resistance, and its open-source structure allows for active development.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.svg)

.png)