Why Are Blockchain Transactions Irreversible? A Comprehensive 2025 Guide

In the rapidly evolving landscape of digital finance, one of the most fundamental characteristics that sets blockchain technology apart from traditional banking systems is the irreversible nature of transactions. As we navigate through 2025, understanding why blockchain transactions cannot be reversed has become crucial for anyone engaging with cryptocurrencies, decentralized finance, or blockchain-based applications. This article delves into the technical foundations, security implications, and practical considerations behind the question: why are blockchain transactions irreversible?

Introduction to Blockchain Transactions

Blockchain transactions are the backbone of the crypto world, enabling secure, decentralized, and irreversible exchanges of digital currency. At its core, a blockchain transaction is a digital record of value or data being transferred from one party to another, verified and permanently stored on a blockchain network. Blockchain technology relies on a cryptographic hash function to link blocks together, ensuring that every transaction is securely recorded and cannot be altered or deleted. This process creates a transparent, tamper-proof ledger that underpins the trust and security of digital currency payments and data transfers. In a decentralized network, every transaction is verified by multiple participants, making blockchain transactions not only secure but also resistant to fraud and manipulation.

What are Blockchain Transactions

A blockchain transaction typically involves sending digital currency, such as bitcoin, from one wallet address to another. When a user initiates a transaction, it is broadcast to the blockchain network, where nodes—often called miners—verify its authenticity using advanced cryptographic algorithms. Once the transaction is verified, it is grouped with other transactions into a block. This block is then added to the blockchain, creating a permanent and transparent record. The blockchain network ensures that each transaction is unique and cannot be duplicated or reversed, making it practically impossible for anyone to manipulate or undo a transaction once it has been confirmed. This process is fundamental to the security and reliability of digital currency systems like bitcoin, where every transaction is verified and recorded by a decentralized network of nodes.

Understanding Blockchain Transaction Irreversibility

Blockchain transactions are permanent and cannot be reversed once they are confirmed. This is a key feature of blockchain technology, which powers most cryptocurrencies including Bitcoin. When a transaction is recorded on the blockchain—a public, decentralized ledger—it becomes immutable, meaning it cannot be changed or deleted. This immutability is intentional and fundamental to how blockchain networks operate.

Unlike traditional banking systems where transactions can be disputed or reversed by a central authority such as a bank, blockchain transactions are designed to be permanent and unalterable once confirmed by the network. This unique feature raises important questions about security, trust, and the foundational principles that govern decentralized systems. Blockchain technology also provides a secure way for people to store and transfer money, especially for those without access to traditional banks.

The irreversible nature of transactions is not a flaw but a deliberate design choice. Because Bitcoin and other blockchain projects operate without a central authority, no single person or entity has control over the ledger. This decentralization, combined with the permanent recording of transaction data, ensures that transactions are irreversible and secure by design. This means bitcoin functions as a digital currency that enables decentralized, irreversible transactions without the need for a central authority.

The Technical Foundation of Irreversibility

Cryptographic Immutability

The blockchain begins with the first block, known as the genesis block, which initiates the chain of transactions. The irreversible nature of blockchain transactions stems from sophisticated cryptographic principles and decentralized consensus mechanisms. At the heart of this immutability is the cryptographic hash function, which secures transaction data and links blocks together in a tamper-evident chain.

Each block in the blockchain contains a cryptographic hash of the previous block, known as the previous block's hash, creating an interdependent structure where altering any transaction data in a previous block would change its hash. Since each block references the previous block’s hash, modifying historical data would require generating a new hash for that block and recalculating the hashes for all subsequent blocks. This process is computationally intensive and practically impossible to achieve without enormous computing power.

Digital signatures also play a crucial role. Transactions are signed by users using their private keys, and the network verifies these signatures against the corresponding public keys to ensure authenticity. This cryptographic validation prevents unauthorized modifications and ensures that only the rightful owner can authorize spending from a wallet address.

Moreover, blockchain networks operate as decentralized systems maintained by numerous nodes. Each node holds a copy of the entire ledger, and consensus mechanisms ensure that all nodes agree on the current state of transactions. To alter a confirmed transaction, an attacker would need to control more than half of the network’s computing power—a feat known as a 51% attack. Whoever controls this majority hash power could theoretically alter the blockchain, but this is extremely expensive and difficult to execute on established blockchains like Bitcoin.

The Consensus Mechanism

Transactions become irreversible through the network’s consensus process. When a user initiates a transaction, it is broadcast to the blockchain network, where nodes verify its validity based on transaction details, digital signatures, and available funds. All nodes follow the same protocol to validate and record transactions, ensuring consistency and security across the decentralized network. Validated transactions are then grouped into a new block, which miners compete to add to the blockchain by solving a complex cryptographic puzzle.

The first miner to solve the puzzle successfully adds the block to the chain, linking it to the previous block via its hash. This block addition confirms the transaction and solidifies its place in the blockchain’s history. Network participants typically consider transactions irreversible after a certain number of confirmations—meaning a certain number of blocks have been added on top of the block containing the transaction. This confirmation process reduces risks from temporary forks or reorganizations in the blockchain network. In certain attacks, such as the Vector76 attack, an attacker may withhold one block to manipulate the chain, highlighting the importance of multiple confirmations for transaction security.

Types of Finality in Blockchain Systems

Probabilistic Finality

In proof-of-work (PoW) systems like the Bitcoin blockchain, finality is probabilistic. The bitcoin network relies on proof-of-work and a decentralized network of miners to confirm transactions and secure the blockchain. Transactions become more secure as additional blocks are appended to the chain. Each new block reinforces the validity of previous transactions, making it exponentially harder for an attacker to rewrite transaction history.

For Bitcoin transactions, it is generally recommended to wait for five to six confirmations before considering a transaction irreversible. Each confirmation increases the computational power required to reverse the transaction, making such an attack practically impossible without vast amounts of mining power.

Deterministic Finality

Other blockchain projects employ consensus algorithms based on Byzantine fault tolerance (BFT), such as Tendermint or Ripple, which provide deterministic finality. In these networks, transactions are finalized immediately once the network’s nodes reach consensus, eliminating waiting periods. Once consensus is achieved, transactions are irreversible and permanently recorded.

Deterministic finality offers instant certainty but requires different network architectures and consensus protocols compared to PoW systems.

How Many Confirmations are Required

The security and irreversibility of a blockchain transaction depend on how many confirmations it receives from the blockchain network. A transaction is considered confirmed once it is included in a block and that block is added to the blockchain. However, to ensure the transaction is truly secure and irreversible, it is common practice to wait for a certain number of additional blocks—typically between 3 to 6—to be added on top of the block containing the transaction. This period, known as verification successful waiting, allows the network to further verify the transaction and significantly reduces the risk of attacks such as double spending. The more confirmations a transaction has, the more secure and irreversible it becomes, as reversing it would require an attacker to rewrite multiple blocks, which is practically impossible on a well-established blockchain network.

Why Irreversibility Matters

Security and Trust

The irreversible nature of blockchain transactions serves several critical functions. First, it prevents fraud such as double spending—the attempt to spend the same digital currency twice. Without the possibility of reversing transactions, users cannot duplicate or counterfeit their funds.

Second, irreversibility underpins the trustless nature of decentralized systems like Bitcoin. Users do not need to rely on a central authority or bank to validate transactions; the network’s consensus and cryptographic safeguards ensure transaction authenticity and permanence.

Third, the immutable ledger maintains the integrity of the entire blockchain network. This reliable transaction history builds trust among users and enables transparent auditing without centralized control.

Decentralization Benefits

Unlike payments made through credit cards or banks, which can be reversed or charged back by a central entity, blockchain transactions are free from such interventions. The decentralized system eliminates intermediaries, reducing the risk of censorship, fraud, or manipulation by a central authority.

This decentralization empowers users with full control over their funds, secured by private keys and cryptographic protocols, and ensures that once transactions are confirmed, they are final and irreversible.

Attack Methods: Threats to Blockchain Security

While blockchain technology is designed to make blockchain transactions secure and irreversible, there are still potential threats that can compromise transaction integrity. One of the most well-known threats is double spending, where an attacker tries to spend the same digital currency twice by creating conflicting transactions. Blockchain networks counter this by using a decentralized system of nodes that verify each transaction, ensuring that only one version is accepted.

Another threat is the brute force attack, where an attacker attempts to guess or crack the private key associated with a wallet address to gain unauthorized access to funds. This method is extremely expensive and requires vast amounts of computational power, making it highly impractical on major networks.

Specific attacks like the Finney attack involve a miner creating a new block with a conflicting transaction in an attempt to reverse a previous payment, while a race attack sees an attacker quickly submitting two conflicting transactions to try and double spend before the network can verify the first one.

To defend against these threats, blockchain networks implement security measures such as disabling incoming connections to prevent unauthorized access, using specific outgoing connections for added control, and leveraging smart contracts to automate and secure transactions. These strategies, combined with the decentralized nature of blockchain and the computational power required to alter transaction history, make successful attacks on blockchain transactions extremely rare and costly.

Navigating Irreversible Transactions with Advanced Analytics

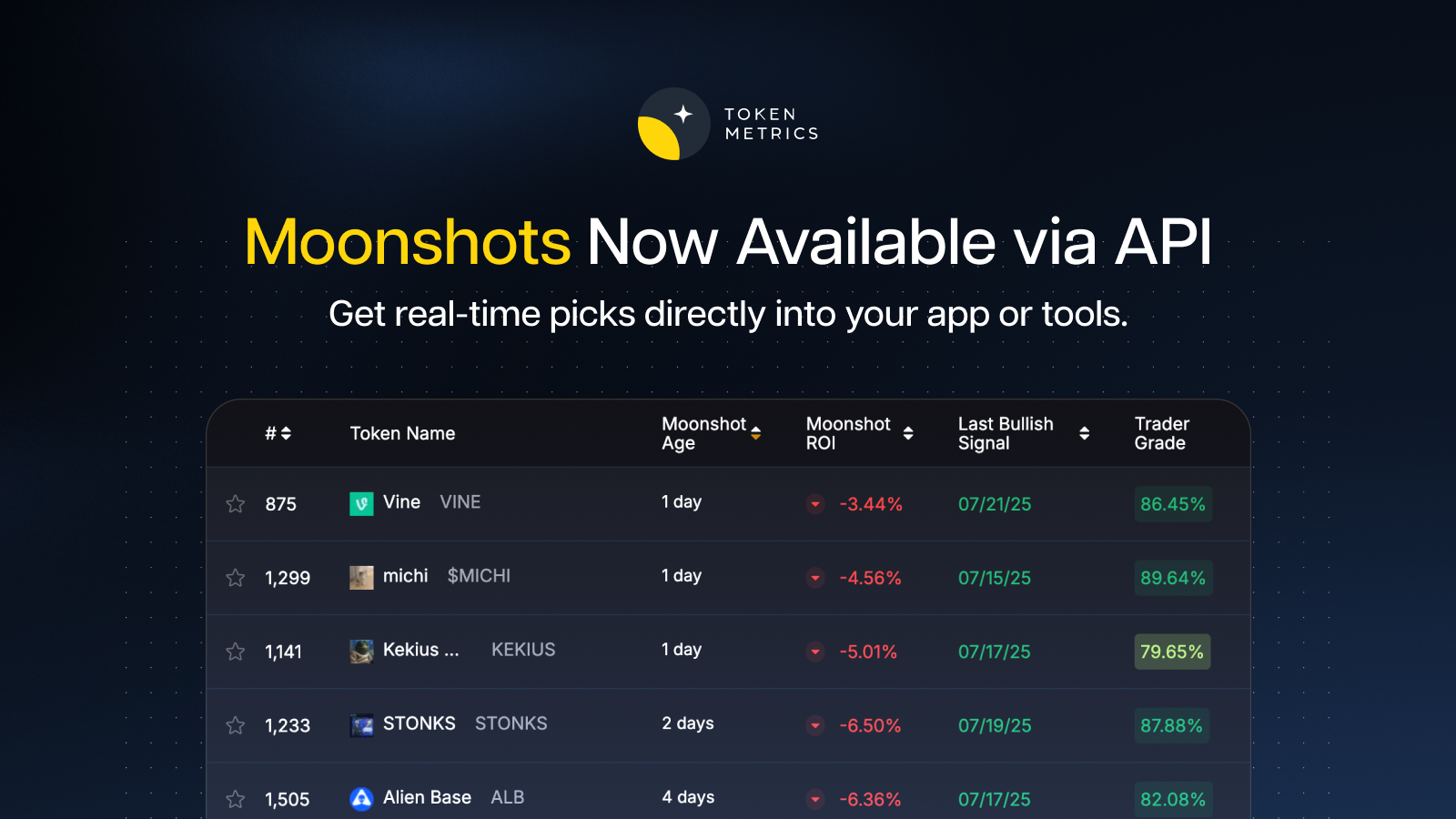

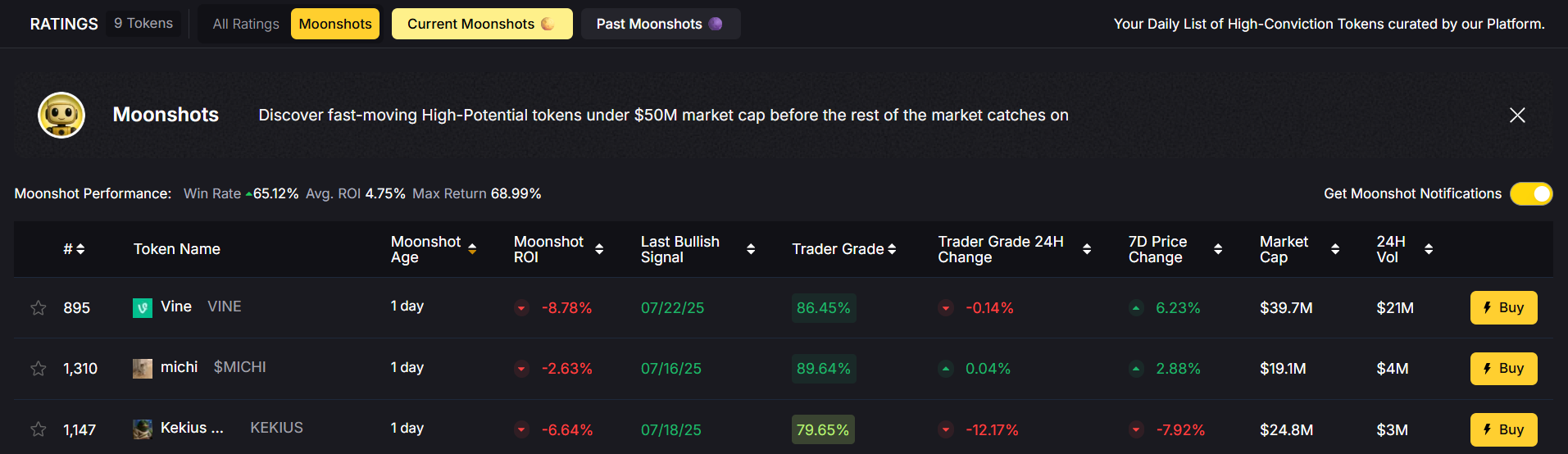

Given the permanent nature of blockchain transactions, having access to sophisticated analysis and decision-making tools is increasingly important for traders and investors in 2025. Platforms like Token Metrics have emerged as leading AI-powered solutions for crypto trading, research, and data analytics, helping users make informed decisions before committing to irreversible transactions.

AI-Powered Risk Assessment

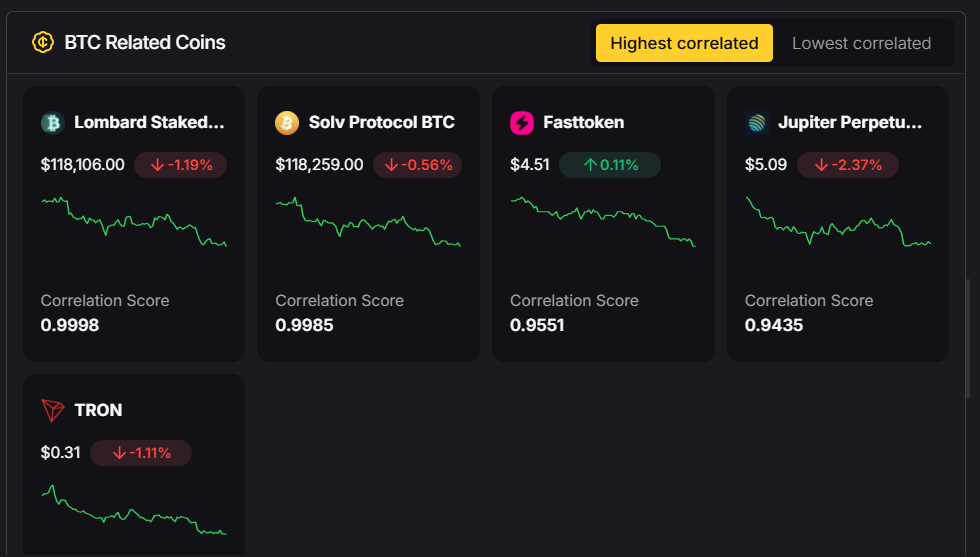

Token Metrics integrates AI-grade analytics, execution automation, and real-time alerts within a unified system. Its risk assessment tools evaluate potential transactions by assigning each token a Trader Grade for short-term potential and an Investor Grade for long-term viability. This enables users to prioritize opportunities efficiently and mitigate risks associated with irreversible transactions.

Real-Time Market Intelligence

The platform’s API combines AI-driven analytics with traditional market data, providing users with real-time price and volume information, sentiment analysis from social channels, and comprehensive documentation for research and trading. This wealth of data supports better-informed decisions, reducing the likelihood of costly mistakes in irreversible payments.

Advanced Analytics and Automation

Token Metrics’ AI has a proven track record of identifying profitable trades early, helping users spot winning trades and automate transactions based on predefined parameters. This reduces emotional decision-making and enhances security in a system where transactions cannot be reversed.

The Risks and Precautions

Common Risks

Because blockchain transactions are irreversible, mistakes such as sending funds to the wrong wallet address or falling victim to scams cannot be undone. Users bear full responsibility for verifying transaction details before confirmation.

Best Practices for Safe Transactions

To minimize risk, users should always double-check recipient wallet addresses by copying and pasting them to avoid typos. Conducting test transactions with small amounts before sending large sums is advisable. Understanding network fees and timing can also help ensure smooth transaction processing.

For enhanced security, multi-signature wallets require multiple approvals before funds can be moved, adding an extra layer of protection for significant payments.

Consumer Protection and Fraud Prevention

Even though blockchain transactions are designed to be secure and irreversible, consumers can take additional steps to protect themselves and prevent fraud. One effective method is using escrow services, which hold funds until both parties fulfill their obligations, ensuring that payments are only released when the transaction is complete. Implementing smart contracts can further automate this process, allowing payments to be made only when specific conditions are met, reducing the risk of fraud.

Verifying the transaction history of a wallet address is another important step. By checking past transactions, users can identify any suspicious or fraudulent activity before engaging in a new transaction. Additionally, choosing reputable exchanges and wallet services with strong security measures and a proven track record can provide an extra layer of protection.

By following these best practices, consumers can help ensure that their blockchain transactions remain secure and irreversible, safeguarding their funds and maintaining trust in the blockchain ecosystem.

The Future of Irreversible Transactions in 2025

As blockchain technology advances, the irreversible nature of transactions remains a core feature, but innovations are emerging to enhance security and user experience. Layer 2 solutions enable faster payments while maintaining the security of the base blockchain layer. Smart contract escrows introduce conditional transaction execution, adding flexibility without compromising irreversibility.

Additionally, AI-enhanced security platforms like Token Metrics are pioneering predictive analytics to prevent problematic transactions before they occur, making irreversible payments safer and more manageable.

Institutional Adoption and Professional Trading

The irreversible nature of blockchain transactions has not deterred institutional adoption; rather, it has driven the development of sophisticated risk management tools. AI trading platforms provide insights once reserved for large hedge funds, enabling both retail and professional traders to navigate the crypto market confidently.

Token Metrics bridges the gap between raw blockchain data and actionable decisions, offering an AI layer that empowers traders to outperform the market in an environment where transactions are final and irreversible.

Conclusion

The question of why blockchain transactions are irreversible is answered by the fundamental design of blockchain technology. The combination of cryptographic hash functions, digital signatures, decentralized consensus, and computationally intensive mining ensures that once a transaction is confirmed, it is permanently recorded and practically impossible to reverse.

This irreversible nature is not a limitation but a powerful feature that enables trustless, decentralized networks free from central control and fraud. While it introduces certain risks, responsible users equipped with advanced tools and knowledge can safely harness the benefits of blockchain technology.

As we move further into 2025, innovations in AI-powered analytics, layer 2 solutions, and smart contracts continue to enhance the security and usability of irreversible transactions. Understanding and embracing this core characteristic is essential for anyone participating in the digital currency ecosystem, whether they are casual users, professional traders, or institutional investors.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)