Why September 2025 Could Make or Break Your Crypto Portfolio

%201.svg)

%201.svg)

The September Crypto Curse: History Doesn't Lie

September has earned its reputation as crypto's cruelest month. Historical data reveals a stark reality: Bitcoin has posted negative returns in 8 out of the last 12 Septembers. While other months show mixed results, September consistently delivers disappointment to crypto investors.

But this September feels different.

The Trump Factor: Politics Meets Crypto

The cryptocurrency landscape shifted dramatically with the launch of World Liberty Financial (WLFI), the Trump family's ambitious DeFi project. Despite initial hype, the token's launch revealed both the power and peril of celebrity-backed crypto ventures.

Key takeaways from the WLFI launch:

- The Trump family reportedly owns a third of the token supply, generating approximately $3 billion on launch

- Initial price volatility saw the token briefly touch $1 before correcting to around $0.20

- Pre-market trading had already satisfied much of the initial demand, leading to immediate selling pressure

The political crypto narrative is expanding beyond Trump. California Governor Newsom is reportedly considering launching his own token, potentially creating a "Democrats vs. Republicans" dynamic in the meme coin space.

The Ethereum Revolution: Why ETH Is Stealing Bitcoin's Thunder

While Bitcoin struggles with its September curse, Ethereum is experiencing unprecedented institutional adoption. August 2025 marked a turning point:

- Ethereum ETFs attracted $3.69 billion in inflows during August alone

- Bitcoin ETFs saw $800 million in outflows during the same period

- 3.4% of Ethereum's total circulating supply is now held by treasury companies

This institutional rotation from Bitcoin to Ethereum signals a fundamental shift in how professional investors view crypto assets. Tom Lee's bold prediction of Ethereum reaching $12,000-$16,000 by year-end no longer seems unrealistic given this institutional momentum.

The Stablecoin Infrastructure Boom

Perhaps the most overlooked trend is the emergence of stablecoin-focused blockchain infrastructure. Projects like Plasma are launching dedicated Layer 1 networks for zero-fee USDT transfers, directly challenging Tron's dominance in stablecoin transactions.

This infrastructure boom represents crypto's maturation from speculative asset to practical financial tool. When billion-dollar deposits flow into new platforms within days of launch, it signals genuine institutional confidence.

Trading Strategy for the New Market Reality

The old "buy and hold" crypto strategy is dead. Today's market demands active narrative trading:

- Monitor trending tokens through analytics platforms

- Rotate positions based on momentum and attention

- Exit when momentum shifts, not when trends turn bearish

- Focus on large caps with strong fundamentals during uncertain periods

The market has become increasingly narrative-driven, rewarding traders who can identify and ride emerging themes rather than those who hope for long-term appreciation.

AI Agents in Minutes, Not Months

.svg)

Create Your Free Token Metrics Account

.png)

Recent Posts

Cardano Price Prediction 2027: Layer-1 Research-Driven Analysis

%201.svg)

%201.svg)

Market Context for Cardano Price Prediction: The Case for 2027

The Layer 1 competitive landscape is consolidating as markets recognize that specialization matters more than being a generic "Ethereum killer." Cardano positions itself in this multi-chain world with specific technical and ecosystem advantages. Infrastructure maturity around custody, bridges, and developer tools makes alternative L1s more accessible heading into 2026.

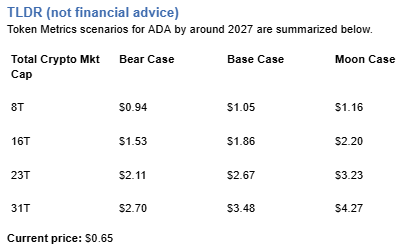

The Cardano price prediction scenario projections below map different market share outcomes for ADA across varying total crypto market sizes. Base cases assume Cardano maintains current ecosystem momentum, while moon scenarios factor in accelerated adoption and bear cases reflect increased competitive pressure. Our comprehensive price prediction framework provides investors with data-driven forecasts for strategic planning.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to Read This ADA Price Prediction

Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

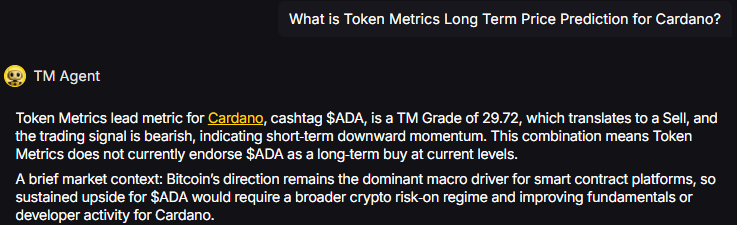

TM Agent baseline: Token Metrics lead metric for Cardano, cashtag $ADA, is a TM Grade of 29.72%, which translates to a Sell, and the trading signal is bearish, indicating short-term downward momentum. This combination means Token Metrics does not currently endorse $ADA as a long-term buy at current levels in our price prediction models. A brief market context: Bitcoin's direction remains the dominant macro driver for smart contract platforms, so sustained upside for $ADA would require a broader crypto risk-on regime and improving fundamentals or developer activity for Cardano.

Live details: Cardano Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Key Takeaways: Cardano Price Prediction Summary

- Scenario driven: Price prediction outcomes hinge on total crypto market cap; higher liquidity and adoption lift the bands

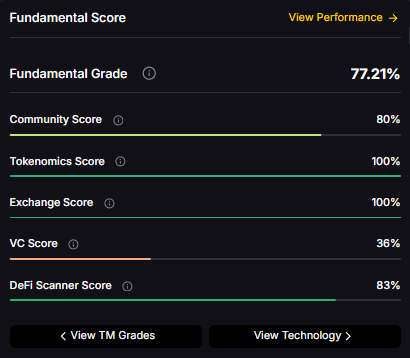

- Fundamentals: Fundamental Grade 77.21% (Community 80%, Tokenomics 100%, Exchange 100%, VC 36%, DeFi Scanner 83%)

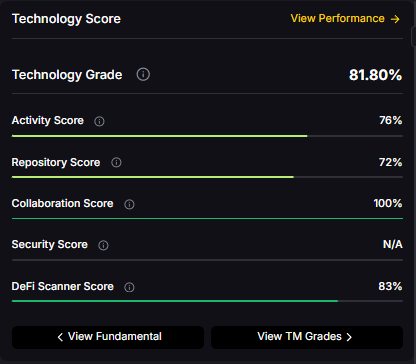

- Technology: Technology Grade 81.80% (Activity 76%, Repository 72%, Collaboration 100%, Security N/A, DeFi Scanner 83%)

- TM Agent gist: Bearish short term in price prediction models; requires risk-on and improved fundamentals for sustained upside

- Current rating: Sell (29.72%) despite strong fundamentals and technology scores

- Education only, not financial advice

Cardano Price Prediction Scenario Analysis

Token Metrics price prediction scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T Market Cap - ADA Price Prediction:

At an eight trillion dollar total crypto market cap, ADA price prediction projects to $0.94 in bear conditions, $1.05 in the base case, and $1.16 in bullish scenarios.

16T Market Cap - ADA Price Prediction:

Doubling the market to sixteen trillion expands the price prediction range to $1.53 (bear), $1.86 (base), and $2.20 (moon).

23T Market Cap - ADA Price Prediction:

At twenty-three trillion, the price prediction scenarios show $2.11, $2.67, and $3.23 respectively.

31T Market Cap - ADA Price Prediction:

In the maximum liquidity scenario of thirty one trillion, ADA price predictions could reach $2.70 (bear), $3.48 (base), or $4.27 (moon).

Each tier in our price prediction framework assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Why Consider the Indices with Top-100 Exposure

Cardano represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle ADA with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

What Is Cardano?

Cardano is a blockchain platform designed to support secure, scalable, and sustainable decentralized applications and smart contracts. It is known for its research-driven development approach, emphasizing peer-reviewed academic research and formal verification methods to ensure reliability and security. As a proof-of-stake Layer 1 blockchain, Cardano aims to offer energy efficiency and long-term scalability, positioning itself as a competitor to platforms like Ethereum. Its native token, ADA, is used for transactions, staking, and governance. Adoption is driven by technological rigor and ecosystem growth, though progress has been criticized for being slow compared to more agile competitors—a factor that significantly influences ADA price predictions. Risks include execution delays, competition, and market volatility.

Cardano's vision is to create a decentralized platform that enables sustainable and inclusive economic systems through advanced cryptography and scientific methodology. It aims to bridge gaps between traditional financial systems and blockchain technology, promoting accessibility and security for users globally.

Token Metrics AI Analysis

Token Metrics AI provides comprehensive context on Cardano's positioning and challenges, informing our ADA price prediction models:

Vision: Cardano's vision is to create a decentralized platform that enables sustainable and inclusive economic systems through advanced cryptography and scientific methodology. It aims to bridge gaps between traditional financial systems and blockchain technology, promoting accessibility and security for users globally.

Problem: Many early blockchains face trade-offs between scalability, security, and energy efficiency. Cardano addresses the need for a more sustainable and formally verified blockchain infrastructure that can support complex applications without compromising decentralization or environmental impact. It targets inefficiencies in existing networks, particularly high energy use and lack of academic rigor in protocol design.

Solution: Cardano uses a proof-of-stake consensus algorithm called Ouroboros, which is mathematically verified for security and energy efficiency. The platform is built in layers, the settlement layer for ADA transactions and a separate computational layer for smart contracts, allowing for modular upgrades and improved scalability. It supports staking, governance, and decentralized applications, with an emphasis on formal methods to reduce vulnerabilities and ensure long-term viability.

Market Analysis: Cardano operates in the Layer 1 blockchain category, competing with Ethereum, Solana, and Avalanche. While not the market leader, it maintains a significant presence due to its academic foundation and global outreach, particularly in emerging economies. Adoption is influenced by developer activity, regulatory developments, and progress in ecosystem expansion. Its differentiator lies in its methodical, research-first approach, though this has led to slower deployment compared to peers—a critical factor in our price prediction analysis. Market risks include technological delays, competition, and shifting investor sentiment. Broader adoption depends on sustained development, real-world use cases, and interoperability advancements.

Fundamental and Technology Snapshot from Token Metrics

- Fundamental Grade: 77.21% (Community 80%, Tokenomics 100%, Exchange 100%, VC 36%, DeFi Scanner 83%).

- Technology Grade: 81.80% (Activity 76%, Repository 72%, Collaboration 100%, Security N/A, DeFi Scanner 83%).

Catalysts That Skew ADA Price Predictions Bullish

- Institutional and retail access expands with ETFs, listings, and integrations

- Macro tailwinds from lower real rates and improving liquidity

- Product or roadmap milestones such as Hydra scaling upgrades or major partnerships

- Accelerated smart contract deployment and DApp ecosystem growth

- Successful real-world adoption in emerging markets (particularly Africa)

- Improved developer onboarding and tooling reducing time-to-market

- Strategic DeFi protocol launches on Cardano

Risks That Skew ADA Price Predictions Bearish

- Macro risk-off from tightening or liquidity shocks

- Regulatory actions targeting proof-of-stake networks or infrastructure outages

- Concentration in staking pool economics and competitive displacement from faster L1s

- Current Sell rating (29.72%) reflecting valuation and execution concerns

- Continued slow development pace versus agile competitors (Solana, Avalanche)

- Limited DeFi TVL and developer activity compared to Ethereum ecosystem

- Low VC grade (36%) indicating reduced institutional backing

How Token Metrics Can Help

Token Metrics empowers you to analyze Cardano and hundreds of digital assets with AI-driven ratings, on-chain and fundamental data, and index solutions to manage portfolio risk smartly in a rapidly evolving crypto market. Our price prediction frameworks provide transparent scenario-based analysis even for tokens with Sell ratings but strong fundamentals.

Cardano Price Prediction FAQs

Can ADA reach $4?

Yes. Based on our price prediction scenarios, ADA could reach $4 in the 31T moon case, projecting $4.27. However, this requires maximum market cap expansion, significant ecosystem acceleration, and improved developer activity beyond current levels—challenging given the current Sell rating (29.72%). Not financial advice.

Can ADA 10x from current levels?

At current price of $0.65, a 10x would reach $6.50. This falls beyond all provided price prediction scenarios, which top out at $4.27 in the 31T moon case. Bear in mind that 10x returns would require substantial market cap expansion and ecosystem improvements beyond our modeled scenarios. Not financial advice.

What price could ADA reach in the moon case?

Moon case price predictions range from $1.16 at 8T to $4.27 at 31T total crypto market cap. These scenarios assume maximum liquidity expansion and strong Cardano adoption, though current Sell rating suggests significant execution improvements needed. Not financial advice.

What is the Cardano price prediction for 2027?

Our comprehensive ADA price prediction framework for 2027 suggests Cardano could trade between $0.94 and $4.27 depending on market conditions and total crypto market capitalization. The base case price prediction scenario clusters around $1.05 to $3.48 across different market cap environments. Despite strong fundamentals (77.21%) and technology (81.80%), the Sell rating (29.72%) reflects concerns about execution speed and competitive positioning. Not financial advice.

Can Cardano reach $2?

Yes. Based on our price prediction scenarios, ADA could reach $1.86 in the 16T base case and $2.20 in the 16T moon case. The $2 target becomes achievable in moderate market cap environments, though overcoming current bearish momentum and execution concerns remains critical. Not financial advice.

Should I buy ADA now or wait?

ADA has a Sell rating (29.72%) indicating Token Metrics does not currently endorse Cardano at these levels, despite strong fundamental (77.21%) and technology (81.80%) grades. Current price of $0.65 sits below even the 8T bear case ($0.94), suggesting potential value—but the Sell rating reflects concerns about execution, competitive pressure, and slow development pace. Dollar-cost averaging may reduce timing risk if you believe in Cardano's long-term research-driven thesis. Not financial advice.

Why does ADA have a Sell rating despite strong fundamentals?

ADA shows strong fundamentals (77.21%) and excellent technology (81.80%), but the overall TM Grade of 29.72% (Sell) reflects concerns about execution speed, competitive disadvantage versus faster L1s like Solana, limited DeFi ecosystem development, low VC backing (36%), and bearish trading momentum. Our price prediction models show potential upside in favorable market conditions, but current metrics suggest waiting for improved catalyst execution or better entry points. Not financial advice.

Is Cardano a good investment based on price predictions?

Cardano presents a complex investment case: strong fundamentals (77.21%), excellent technology (81.80%), but a Sell rating (29.72%) with bearish momentum. While our price prediction models show potential upside to $1.05-$4.27 depending on scenarios, current concerns about slow development, competitive pressure from Ethereum and Solana, and limited DeFi adoption suggest caution. The research-driven thesis is compelling long-term, but execution must improve. Consider diversified L1 exposure through indices. Not financial advice.

How does Cardano compare to Ethereum and Solana?

Cardano's price prediction framework suggests $0.94-$4.27 across scenarios, positioning it as a mid-tier L1. Compared to Ethereum's dominance and Solana's speed, Cardano differentiates through academic rigor and proof-of-stake sustainability. However, the Sell rating (29.72%) reflects market concerns that methodical research-first approach has resulted in slower ecosystem development. Cardano's strength in fundamentals (77.21%) and technology (81.80%) doesn't yet translate to market leadership or developer mindshare.

What are the biggest risks to Cardano price predictions?

Key risks that could impact ADA price predictions include: current Sell rating (29.72%) indicating valuation and execution concerns, slow development pace criticized versus Solana/Avalanche, limited DeFi TVL and developer activity, low VC grade (36%) showing reduced institutional backing, competitive displacement from faster L1s, regulatory targeting of proof-of-stake networks, and Bitcoin correlation dampening independent upside. Despite strong grades, execution risk dominates the near-term outlook.

Will Cardano benefit from an altcoin season?

Cardano's price prediction scenarios assume participation in broader crypto market expansion. However, the Sell rating (29.72%) and bearish momentum suggest ADA may underperform versus faster-moving L1s during altcoin rallies. Our base case scenarios ($1.05 to $3.48) reflect moderate participation in bull market dynamics, but achieving moon case targets requires Cardano demonstrating accelerated ecosystem growth and developer adoption improvements. Not financial advice.

What needs to happen for ADA to reach its price prediction targets?

For ADA to reach our price prediction targets of $1.05-$4.27, several catalysts must materialize: (1) accelerated smart contract and DApp deployment addressing slow development concerns, (2) significant DeFi TVL growth competing with Ethereum, (3) successful real-world adoption in emerging markets, (4) improved developer tooling and onboarding, (5) major partnership announcements, and (6) broader crypto market bull run providing liquidity. The Sell rating suggests these catalysts aren't currently materializing at required pace.

Next Steps

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Why Use Token Metrics for Cardano Price Predictions?

- Transparent analysis: Honest Sell ratings (29.72%) even when fundamentals (77.21%) and technology (81.80%) are strong

- Scenario-based modeling: Four market cap tiers for comprehensive price prediction analysis

- L1 specialization: Focused analysis of Cardano's research-driven approach versus execution speed trade-offs

- Risk-adjusted approach: Balanced view of academic rigor strengths versus competitive disadvantages

- Real-time signals: Trading signals and TM Grades updated regularly

- Diversification tools: Index solutions to spread Layer-1 risk across multiple platforms

- Comparative analysis: Analyze ADA against Ethereum, Solana, Avalanche, and 6,000+ tokens

Understanding X402: The Protocol Powering AI Agent Commerce

%201.svg)

%201.svg)

Introduction

The intersection of artificial intelligence and blockchain technology has produced numerous innovations, but few have the potential architectural significance of X402. This internet protocol, developed by Coinbase and Cloudflare, is positioning itself as the standard for machine-to-machine payments in an increasingly AI-driven digital economy.

What is X402?

X402 is an open protocol designed specifically for internet-native payments. To understand its significance, we need to consider how the internet operates through layered protocols:

- HTTP/HTTPS: Powers web browsing

- SMTP: Enables email communication

- FTP: Facilitates file transfers

- X402: Enables seamless payment transactions

While these protocols have existed for decades, X402 - despite being available for over ten years - has only recently found its primary use case: enabling autonomous AI agents to conduct commerce without human intervention.

The Problem X402 Solves

Traditional digital payments require several prerequisites that create friction for automated systems:

- Account Creation: Services typically require user registration with identity verification

- Subscription Models: Monthly or annual billing cycles don't align with usage-based AI operations

- Payment Processing Delays: Traditional payment rails operate on settlement cycles incompatible with real-time AI interactions

- Cross-Platform Complexity: Different services require different authentication and payment methods

AI agents operating autonomously need to:

- Access services immediately without manual account setup

- Pay per-request rather than commit to subscriptions

- Transact in real-time with minimal latency

- Maintain wallet functionality for financial operations

X402 addresses these challenges by creating a standardized payment layer that operates at the protocol level.

How X402 Works

The protocol functions as a real-time usage billing meter integrated directly into API requests. Here's a simplified workflow:

- AI Agent Request: An AI agent needs to access a service (e.g., data query, computation, API call)

- X402 Header: The request includes X402 payment information in the protocol header

- Service Verification: The service provider validates the payment capability

- Transaction Execution: Payment processes automatically, often in fractions of a penny

- Service Delivery: The requested service is provided immediately upon payment confirmation

This architecture enables transactions "up to a penny in under a second," according to protocol specifications.

Real-World Implementation: Token Metrics API

One of the most practical examples of X402 integration comes from Token Metrics, which has implemented X402 as a pay-per-call option for their cryptocurrency analytics API. This implementation demonstrates the protocol's value proposition in action.

Token Metrics X402 Pricing Structure:

- Cost per API call: $0.017 - $0.068 (depending on endpoint complexity)

- Commitment: None required

- Monthly limits: Unlimited API calls

- Rate limiting: Unlimited

- Endpoint access: All endpoints available

- Historical data: 3 months

- Web sockets: 1 connection

Why This Matters:

This pricing model fundamentally differs from traditional API access:

Traditional Model:

- Monthly subscription: $X per month (regardless of usage)

- Commitment period required

- Fixed tier with call limits

- Manual account setup and payment processing

X402 Model:

- Pay only for actual requests made

- No upfront commitment or subscription

- Scale usage dynamically

- AI agents can access immediately without human intervention

For AI agents performing crypto market analysis, this creates significant efficiency:

- An agent needing only 100 API calls per month pays ~$1.70-$6.80

- Traditional subscription might cost $50-500 monthly regardless of usage

- Agent can start making requests immediately without registration workflow

- Usage scales perfectly with need

This implementation showcases X402's core value proposition: removing friction between autonomous systems and the services they consume.

Current Adoption Landscape

Analysis of X402scan data reveals the emerging adoption patterns:

Leading Facilitators:

- Coinbase: Naturally leading adoption as a protocol co-creator

- Token Metrics: Providing crypto data API access via X402

- PayAI: Solana-focused payment facilitator gaining traction

- OpenX402: Independent implementation showing growing transaction volume

- Various AI Agents: Individual agents implementing X402 for service access

Transaction Metrics (30-day trends):

- Coinbase maintains 4x transaction volume compared to competitors

- PayAI experienced significant volatility with 8x price appreciation followed by sharp corrections

- Slot-based gambling and AI analyst services showing unexpected adoption

Technical Integration Examples

Several platforms have implemented X402 functionality:

API Services:

Rather than requiring monthly subscriptions, API providers can charge per request. Token Metrics exemplifies this model - an AI agent queries their crypto analytics API, pays between $0.017-$0.068 via X402 depending on the endpoint, and receives the data - all within milliseconds. The agent accesses:

- Unlimited API calls with no rate limiting

- All available endpoints

- 3 months of historical data

- Real-time web socket connection

This eliminates the traditional friction of:

- Creating accounts with email verification

- Adding payment methods and billing information

- Committing to monthly minimums

- Managing subscription renewals

AI Agent Platforms:

- Virtuals Protocol: Integrating X402 alongside proprietary solutions

- AIXBT Labs: Enabling builders to integrate AI agents via X402

- Eliza Framework: Supporting X402 for Solana-based agent development

Cross-Chain Implementation: X402 operates on multiple blockchain networks, with notable activity on Base (Coinbase's Layer 2) and Solana.

Market Implications

The emergence of X402 as a standard has created several market dynamics:

Narrative-Driven Speculation: Projects announcing X402 integration have experienced significant short-term price appreciation, suggesting market participants view the protocol as a value catalyst.

Infrastructure vs. Application Layer: The protocol creates a distinction between:

- Infrastructure providers (payment facilitators, protocol implementations)

- Application layer projects (AI agents, services utilizing X402)

Competitive Landscape: X402 faces competition from:

- Proprietary payment solutions developed by individual platforms

- Alternative blockchain-based payment protocols

- Traditional API key and authentication systems

Use Cases Beyond AI Agents

While AI commerce represents the primary narrative, X402's architecture supports broader applications:

Data Services: As demonstrated by Token Metrics, any API provider can implement pay-per-request pricing. Applications include:

- Financial market data

- Weather information services

- Geolocation and mapping APIs

- Machine learning model inference

- Database queries

Micropayment Content: Publishers could charge per-article access at fractional costs

IoT Device Transactions: Connected devices conducting autonomous commerce

Gaming Economies: Real-time, granular in-game transactions

Computing Resources: Pay-per-compute models for cloud services

The Economics of X402 for Service Providers

Token Metrics' implementation reveals the business model advantages for service providers:

Revenue Optimization:

- Capture value from low-usage users who wouldn't commit to subscriptions

- Eliminate customer acquisition friction

- Reduce churn from users only needing occasional access

- Enable price discovery through usage-based metrics

Market Access:

- AI agents represent new customer segment unable to use traditional payment methods

- Automated systems can discover and integrate services programmatically

- Lower barrier to trial and adoption

Operational Efficiency:

- Reduce customer support overhead (no subscription management)

- Eliminate billing disputes and refund requests

- Automatic revenue recognition per transaction

Challenges and Considerations

Several factors may impact X402 adoption:

Technical Complexity: Implementing X402 requires protocol-level integration, creating barriers for smaller developers.

Network Effects: Payment protocols succeed through widespread adoption. X402 competes with established systems and must reach critical mass.

Blockchain Dependency: Current implementations rely on blockchain networks for settlement, introducing:

- Transaction costs (gas fees)

- Network congestion risks

- Cross-chain compatibility challenges

Pricing Discovery: As seen with Token Metrics' range of $0.017-$0.068 per call, establishing optimal pricing requires experimentation. Too high and traditional subscriptions become competitive; too low and revenue suffers.

Regulatory Uncertainty: Automated machine-to-machine payments operating across borders face unclear regulatory frameworks.

Market Maturity: The AI agent economy remains nascent. X402's long-term relevance depends on AI agents becoming standard economic actors.

Comparing X402 to Alternatives

Traditional API Keys with Subscriptions:

- Advantage: Established, widely understood, predictable revenue

- Disadvantage: Requires manual setup, subscription billing, slower onboarding, higher commitment barrier

- Example: $50/month for 10,000 calls whether used or not

X402 Pay-Per-Call:

- Advantage: Zero commitment, immediate access, perfect usage alignment, AI-agent friendly

- Disadvantage: Variable costs, requires crypto infrastructure, emerging standard

- Example: $0.017-$0.068 per actual call, unlimited potential usage

Cryptocurrency Direct Payments:

- Advantage: Direct peer-to-peer value transfer

- Disadvantage: Lacks standardization, higher complexity per transaction, no protocol-level support

Payment Processors (Stripe, PayPal):

- Advantage: Robust infrastructure, legal compliance

- Disadvantage: Minimum transaction amounts, settlement delays, geography restrictions

X402's differentiator lies in combining protocol-level standardization with crypto-native functionality optimized for automated systems, as demonstrated by Token Metrics' implementation where AI agents can make sub-dollar API calls without human intervention.

Development Resources

For developers interested in X402 integration:

Documentation: X402.well (protocol specifications)

Discovery Platforms: X402scan (transaction analytics), The Bazaar (application directory)

Integration Frameworks: Virtuals Protocol, Eliza (Solana), various Base implementations

Live Examples: Token Metrics API (tokenmetrics.com/api) demonstrates production X402 implementation

Several blockchain platforms now offer X402 integration libraries, lowering implementation barriers.

Market Performance Patterns

Projects associated with X402 have demonstrated characteristic patterns:

Phase 1 - Announcement: Initial price appreciation upon X402 integration news Phase 2 - Peak Attention: Maximum price when broader market attention focuses on X402 narrative Phase 3 - Stabilization: Price correction as attention shifts to next narrative

PayAI's trajectory exemplifies this pattern - rapid 8x appreciation followed by significant correction within days. This suggests X402-related assets behave as narrative-driven trading vehicles rather than fundamental value plays, at least in current market conditions.

However, service providers implementing X402 functionality (like Token Metrics) represent a different category - they're adding practical utility rather than speculating on the protocol itself.

Future Outlook

The protocol's trajectory depends on several factors:

AI Agent Proliferation: As AI agents become more autonomous and economically active, demand for payment infrastructure grows. Early implementations like Token Metrics' API access suggest practical demand exists.

Developer Adoption: Whether developers choose X402 over alternatives will determine market position. The simplicity of pay-per-call models may drive adoption.

Service Provider Economics: If providers like Token Metrics successfully monetize X402 access, other API services will follow. The ability to capture previously inaccessible low-usage customers creates compelling economics.

Institutional Support: Coinbase's backing provides credibility, but sustained development and promotion are necessary.

Regulatory Clarity: Clear frameworks for automated, cross-border machine transactions would reduce adoption friction.

Interoperability Standards: Success may require coordination with other emerging AI commerce protocols.

Conclusion

X402 represents an attempt to solve genuine infrastructure challenges in an AI-driven economy. The protocol's technical architecture addresses real friction points in machine-to-machine commerce, as demonstrated by Token Metrics' implementation of pay-per-call API access at $0.017-$0.068 per request with no commitments required.

This real-world deployment validates the core thesis: AI agents need frictionless, usage-based access to services without traditional account creation and subscription barriers. However, actual adoption remains in early stages, and the protocol faces competition from both traditional systems and alternative blockchain solutions.

For market participants, X402-related projects should be evaluated based on:

- Actual transaction volume and usage metrics (not just speculation)

- Developer adoption and integration depth

- Real service implementations (like Token Metrics API)

- Competitive positioning against alternatives

- Sustainability beyond narrative-driven speculation

The protocol's long-term relevance will ultimately be determined by whether AI agents become significant economic actors requiring standardized payment infrastructure. While the technical foundation appears sound and early implementations show promise, market validation remains ongoing.

Key Takeaways:

- X402 enables real-time, micropayment commerce for AI agents

- Token Metrics API offers practical X402 implementation at $0.017-$0.068 per call with no commitments

- Protocol operates at the internet infrastructure layer, similar to HTTP or SMTP

- Pay-per-call model eliminates subscription friction and enables AI agent access

- Current adoption concentrated on Base and Solana blockchains

- Market interest has driven speculation in X402-related projects

- Service provider implementations demonstrate real utility beyond speculation

- Long-term success depends on AI agent economy maturation

This analysis is for informational purposes only. X402 adoption and associated project performance remain highly uncertain and subject to rapid change.

Advanced Token Metrics Indices Strategies: Expert Techniques for Maximizing Returns and Minimizing Risk

%201.svg)

%201.svg)

Most crypto index content targets beginners, explaining basics and encouraging cautious entry. But what about experienced investors who already understand cryptocurrency fundamentals and want to optimize their index investing approach? How do sophisticated investors extract maximum value from Token Metrics indices while managing complex risk scenarios?

This advanced guide explores strategies beyond basic index investing, including multi-index portfolio construction, tactical allocation across market regimes, leveraging indices with complementary strategies, advanced rebalancing techniques, and sophisticated risk management frameworks that separate exceptional performance from merely good results.

If you've already invested in crypto indices for months or years and want to elevate your approach, this comprehensive guide provides the advanced techniques you need.

Understanding Your Investor Evolution

Before implementing advanced strategies, assess your current sophistication level and investment evolution honestly.

From Beginner to Intermediate

New investors focus on learning fundamentals, making initial allocations, and maintaining basic discipline. After 6-12 months, you've experienced market volatility, executed several rebalancing trades, and developed comfort with the investment process.

From Intermediate to Advanced

Advanced investors have navigated complete market cycles, understand their emotional responses to different conditions, built substantial positions, and seek optimization beyond standard approaches. You're no longer asking "should I invest in crypto?" but rather "how can I maximize risk-adjusted returns within my crypto allocation?"

This evolution takes 2-3 years typically—enough time to experience both bull and bear markets while building expertise through practical experience rather than just theoretical knowledge.

Multi-Index Portfolio Architecture: Beyond Single-Index Approaches

Sophisticated investors construct portfolios using multiple Token Metrics indices simultaneously, creating layered exposure serving different strategic purposes.

The Core-Satellite-Speculative Framework

Structure crypto index allocation across three distinct tiers:

- Core Holdings (50-60%): Conservative and balanced indices providing stable, reliable exposure to established cryptocurrencies. This foundation ensures you capture broad market appreciation regardless of specific sector performance.

- Satellite Positions (30-40%): Sector-specific and thematic indices targeting particular opportunities like DeFi, Layer-1 blockchains, or AI tokens. These tactical allocations allow overweighting sectors you believe will outperform without abandoning diversification.

- Speculative Exposure (10-20%): Aggressive growth and memecoin indices pursuing maximum upside. This high-risk allocation captures explosive opportunities while limiting potential damage through position sizing.

This three-tier structure provides both stability and growth potential, allowing you to maintain conservative foundation while pursuing tactical opportunities aggressively.

Dynamic Tier Adjustment

Adjust tier allocations based on market conditions and personal conviction. During bull markets with high confidence, increase satellite and speculative allocations to 50% combined. During uncertain or bearish conditions, increase core holdings to 70-80%.

This dynamic adjustment allows capitalizing on opportunities while maintaining appropriate risk exposure for conditions.

Cross-Correlation Analysis

Advanced investors analyze correlation between different indices to maximize diversification benefits. Holding multiple indices with 0.9+ correlation provides minimal diversification—essentially concentrated exposure disguised as diversification.

Token Metrics provides correlation data allowing you to construct portfolios where indices complement rather than duplicate each other. Ideal multi-index portfolios combine indices with 0.3-0.7 correlations—related enough to benefit from crypto's overall growth but different enough to smooth returns.

Tactical Allocation Strategies: Rotating Capital Efficiently

Beyond static allocation, advanced investors rotate capital between indices based on market conditions, technical signals, and fundamental developments.

Momentum Rotation Strategy

Systematically rotate capital toward indices showing strongest recent performance while reducing exposure to lagging indices. This momentum approach captures trending sectors while avoiding those losing relative strength.

Implementation example:

- Monthly, rank all indices by 90-day performance

- Overweight top quartile indices by 5-10% above target allocation

- Underweight bottom quartile indices by 5-10% below target allocation

- Maintain overall crypto allocation within target range

This systematic rotation forces buying strength and trimming weakness—capitalizing on momentum while maintaining diversification.

Mean Reversion Approach

Alternatively, employ mean reversion strategy assuming sectors experiencing short-term underperformance will reverse. After significant declines, fundamentally sound sectors often present exceptional value.

Implementation approach:

- Identify indices declining 30%+ while maintaining strong fundamentals

- Increase allocation to these "temporarily distressed" indices

- Hold through recovery, capturing outsized gains as sentiment improves

- Take profits once indices return to top-quartile performance

Mean reversion requires strong conviction and patience but can generate exceptional returns buying sectors during temporary weakness.

Blended Momentum-Reversion Strategy

The most sophisticated approach blends momentum and mean reversion, applying momentum to aggressive/speculative indices while using mean reversion for core/conservative indices.

Aggressive indices benefit from momentum—riding hot sectors aggressively. Conservative indices benefit from mean reversion—buying quality assets during temporary weakness. This nuanced approach matches strategy to index characteristics rather than applying one-size-fits-all methodology.

Advanced Rebalancing Techniques

Standard rebalancing maintains target allocations. Advanced rebalancing employs sophisticated rules extracting additional alpha through strategic timing and execution.

Volatility-Triggered Rebalancing

Rather than rebalancing on fixed schedules, trigger rebalancing when volatility exceeds thresholds. During high volatility, prices deviate significantly from fundamentals—creating rebalancing opportunities.

Set volatility thresholds—when Bitcoin's 30-day volatility exceeds 80%, evaluate rebalancing opportunities. High volatility often accompanies market extremes offering excellent entry or exit points.

Threshold Rebalancing with Asymmetric Bands

Establish asymmetric rebalancing bands allowing winning positions to run further than standard symmetric approaches. If target allocation is 10% for an index, perhaps trigger rebalancing at 7% on downside but 15% on upside.

This asymmetry captures more upside from winning positions while preventing excessive losses from declining positions—improving overall risk-adjusted returns.

Tax-Optimized Rebalancing

Coordinate rebalancing with tax considerations, preferentially selling positions with losses to offset gains while rebalancing. During profitable years, delay rebalancing slightly to push tax liability into following year.

For positions held in taxable accounts, track cost basis precisely and prioritize selling highest-cost-basis lots first, minimizing capital gains taxes.

Leveraging Indices with Complementary Strategies

Advanced investors combine index investing with complementary strategies creating synergistic approaches exceeding either strategy alone.

The 70/30 Index-Plus Strategy

Allocate 70% to Token Metrics indices for professional management and diversification. Use remaining 30% for complementary strategies:

- Individual High-Conviction Positions (15%): Based on deep personal research into specific projects you understand thoroughly

- Yield Generation (10%): Stake index holdings or use DeFi protocols for additional yield on top of appreciation

- Options/Derivatives (5%): For experienced traders, limited options strategies hedging downside or generating income

This approach maintains strong index foundation while allowing tactical strategies leveraging your specific expertise and risk tolerance.

Pair Trading with Indices

Advanced traders employ pair trading strategies—simultaneously longing one index while shorting another, profiting from relative performance regardless of overall market direction.

Example: If convinced DeFi will outperform Layer-1s short-term, overweight DeFi index while underweighting Layer-1 index relative to targets. If correct about relative performance, you profit even if both decline in absolute terms.

Pair trading requires sophistication and works best during sideways markets where directional movement is uncertain but relative performance differentials exist.

Stablecoin Yield Enhancement

During bear markets or consolidation, rotate portions of conservative index holdings temporarily into high-yield stablecoin strategies generating 5-15% APY. This preserves capital while generating income during periods when crypto appreciation stalls.

When bullish conditions return, rotate back into indices. This tactical approach maintains productivity during all market phases rather than passively holding through extended downturns.

Sophisticated Risk Management Frameworks

Advanced investors employ multi-layered risk management beyond basic position sizing and diversification.

Value-at-Risk (VaR) Monitoring

Calculate portfolio Value-at-Risk—the maximum expected loss over specific timeframe at given confidence level. If your 30-day VaR at 95% confidence is $50,000, you expect no more than $50,000 loss in 95% of 30-day periods.

Monitor VaR continuously and adjust allocations if risk exceeds tolerance. During volatile periods, VaR spikes significantly—this objective measurement informs whether to reduce exposure or maintain course based on predetermined risk budgets.

Conditional Value-at-Risk (CVaR)

Beyond VaR, calculate CVaR—expected loss in worst-case scenarios beyond VaR threshold. While VaR tells you typical maximum loss, CVaR reveals extreme scenario impacts.

High CVaR relative to VaR indicates "fat tail risk"—potential for catastrophic losses exceeding normal expectations. Adjust allocations to limit CVaR to acceptable levels relative to total portfolio.

Portfolio Stress Testing

Regularly stress test portfolio against historical extreme scenarios:

- 2018 bear market (80%+ decline over 12 months)

- March 2020 flash crash (50% decline in 48 hours)

- 2022 Terra/LUNA collapse (complete failure of major protocol)

- Exchange failure scenarios (losing access to 30% of holdings)

Understanding portfolio behavior during extreme stress prevents panic during actual crises—you've already mentally prepared for worst-case scenarios.

Dynamic Position Sizing

Rather than fixed allocations, adjust position sizes based on volatility—reducing exposure during high volatility periods and increasing during low volatility. This volatility-adjusted sizing maintains consistent risk exposure despite changing market conditions.

When volatility doubles, halve position sizes maintaining constant risk. When volatility halves, double position sizes maintaining returns potential. This dynamic approach optimizes risk-adjusted returns across volatility regimes.

Performance Attribution and Continuous Improvement

Advanced investors systematically analyze performance, understanding what's working and why.

Decomposing Returns

Break down portfolio returns into components:

- Beta Returns: Returns from overall market exposure (what you'd get from simple buy-and-hold)

- Index Selection Alpha: Returns from choosing outperforming indices over alternatives

- Timing Alpha: Returns from tactical allocation adjustments and rebalancing timing

- Cost Drag: Returns lost to fees, taxes, and trading costs

Understanding return sources reveals where your strategy adds value and where it doesn't, informing strategic refinements.

Keeping a Trading Journal

Maintain detailed journal documenting all strategic decisions:

- What allocation changes did you make and why?

- What was market context and your reasoning?

- How did decisions perform over subsequent weeks/months?

- What would you do differently with hindsight?

- What patterns emerge across multiple decisions?

This systematic documentation transforms experience into learning, accelerating your development as sophisticated investor.

Quarterly Strategy Reviews

Conduct comprehensive quarterly reviews assessing:

- Overall portfolio performance vs. benchmarks

- Individual index performance and contribution to returns

- Accuracy of tactical allocation decisions

- Risk metrics (volatility, drawdowns, Sharpe ratio) vs. targets

- Lessons learned and strategy adjustments for next quarter

These structured reviews create accountability and ensure continuous improvement rather than repeating mistakes.

Scaling Strategies as Portfolio Grows

As crypto holdings grow from thousands to hundreds of thousands or millions, strategies must evolve to match scale.

Institutional-Grade Custody

Once holdings exceed $100,000-$250,000, implement institutional-grade custody solutions. Multi-signature wallets requiring multiple approvals prevent single points of failure. Cold storage solutions protect against online threats. Insurance-backed custodians provide additional protection layers.

The sophistication required for securing substantial wealth exceeds most individuals' technical capabilities—professional custody solutions become essential.

Tax-Loss Harvesting at Scale

Large portfolios generate significant tax optimization opportunities. Systematic tax-loss harvesting across multiple indices, strategic timing of rebalancing to manage tax liability, and coordination with overall tax planning become crucial for preserving wealth.

Consider working with crypto-specialized tax advisors who understand optimal strategies for managing significant crypto positions.

Estate Planning Considerations

Substantial crypto holdings require estate planning ensuring wealth transfers efficiently to heirs. This includes secure key management protocols heirs can access, clear documentation of holdings and recovery processes, and potentially trusts or other vehicles optimizing estate taxes.

Without proper planning, crypto wealth can become inaccessible if something happens to you—proper preparation ensures your wealth serves intended purposes.

Conclusion: The Path to Mastery

Advanced crypto index investing transcends basic buy-and-hold approaches, incorporating sophisticated portfolio construction, tactical allocation, advanced risk management, and continuous performance optimization. These techniques separate exceptional investors from merely competent ones.

Token Metrics provides the foundation—comprehensive indices, sophisticated AI analysis, and professional management. Your advanced strategies built on this foundation determine ultimate success. The combination of institutional-grade tools and sophisticated personal strategies creates unprecedented wealth-building potential.

Mastery requires years of dedicated practice, continuous learning, and honest self-assessment. Each market cycle teaches new lessons. Each strategic decision provides data informing future choices. The journey from beginner to advanced investor never truly ends—markets evolve, requiring continuous adaptation.

Your advantage as advanced investor is recognizing that optimization matters as much as allocation. The difference between 25% and 35% annualized returns compounds into millions over decades. Small improvements in strategy, consistently applied, generate enormous long-term impact.

Begin implementing these advanced techniques systematically. Don't attempt everything simultaneously—choose 2-3 strategies matching your situation and expertise. Master those, then expand your toolkit progressively. Over time, you'll develop sophisticated approach rivaling professional fund managers.

Token Metrics provides the infrastructure. Your advanced strategies provide the edge. Together, they create framework for building generational wealth through crypto index investing.

Start your 7-day free trial today and begin applying these advanced strategies to accelerate your journey toward crypto investment mastery.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)