Will Crypto Recover? - Complete Analysis

Cryptocurrencies have experienced significant volatility in recent years, leaving investors and enthusiasts wondering if the crypto market will ever recover?

The unpredictable nature of crypto assets has led to mixed opinions and speculation.

In this article, we will delve into the factors influencing the crypto market, examine historical recoveries, analyze the current state of the market, explore reasons for optimism, discuss potential challenges, and consider expert opinions on the future of crypto.

Understanding the Crypto Market

Historical Crypto Market Recoveries

The crypto market has experienced several significant downturns throughout its history, often followed by recoveries. One notable example is the "Crypto Winter" of 2018, where the market experienced a substantial decline in value.

However, in subsequent years, it rebounded, attracting renewed interest and investment. These historical recoveries indicate that the crypto market has the potential to regain momentum and value.

Current State of the Crypto Market

At present, the crypto market is in a state of flux. While it has witnessed tremendous growth and increased institutional involvement, it has also faced setbacks and periods of instability.

The market is characterized by both optimism and skepticism, as investors and experts closely monitor its developments.

Reasons for Optimism in Crypto Recovery

Despite the challenges, there are reasons to be optimistic about the recovery of the crypto market. Institutional adoption of cryptocurrencies, such as major financial institutions and corporations embracing digital assets, lends credibility and stability to the market.

Moreover, as the market matures, investors and regulators gain a better understanding of its dynamics, leading to increased confidence and participation.

Additionally, the continuous evolution of blockchain technology opens up new possibilities and use cases, attracting further interest from various sectors.

Potential Challenges to Crypto Recovery

While optimism exists, potential challenges remain that could hinder the recovery of the crypto market.

Market manipulation, including pump and dump schemes and price manipulation by large players, can create artificial volatility and erode trust in the market.

Government intervention and regulations pose both opportunities and threats, as they can provide stability but also limit the market's growth potential.

Economic factors, such as inflation and macroeconomic instability, can also impact the performance of cryptocurrencies.

Will Crypto Recover?

Yes, Crypto can recover. While it is true that cryptocurrencies have the potential to recover and increase in value over the long term, it is important to acknowledge the historical volatility of the market.

The cryptocurrency market has witnessed notable fluctuations, which have raised concerns and uncertainty about its stability.

However, it's important to note that the crypto market has historically shown resilience and the ability to bounce back from downturns. To understand whether crypto will recover, let's examine the factors affecting its current state:

Market Volatility: A Double Edged Sword

The extreme volatility of the crypto market is one of its defining characteristics. While it presents opportunities for substantial gains, it also exposes investors to significant risks.

The unpredictability of cryptocurrency prices has led to both optimistic and pessimistic views on the future of crypto.

Regulatory Environment: Navigating Uncertainty

Regulatory measures and government interventions play a crucial role in shaping the crypto landscape.

The absence of clear regulations in many jurisdictions has created a sense of uncertainty, deterring some investors and hindering widespread adoption.

The influence of U.S. regulations on cryptocurrencies is evident through the increasing number of enforcement measures taken against various crypto companies.

For instance, Coinbase has received warnings from the SEC, while the former CEO of the crypto trading platform Bittrex, along with the platform itself, has faced charges for operating an unregistered exchange.

These actions, coupled with proposed rule changes regarding the custody of customer assets by crypto firms, have generated significant uncertainty within the industry.

However, as governments recognize the potential of blockchain technology, regulatory frameworks are gradually being developed, which could contribute to the recovery of the crypto market.

Technological Advancements: Fueling Innovation

Cryptocurrency is built on the foundation of blockchain technology, which continues to evolve and improve.

Technological advancements in scalability, security, and usability have the potential to address existing limitations and enhance the value proposition of cryptocurrencies.

These advancements could drive the recovery of the crypto market by instilling confidence in investors and attracting new participants.

Investor Sentiment: Shifting Perspectives

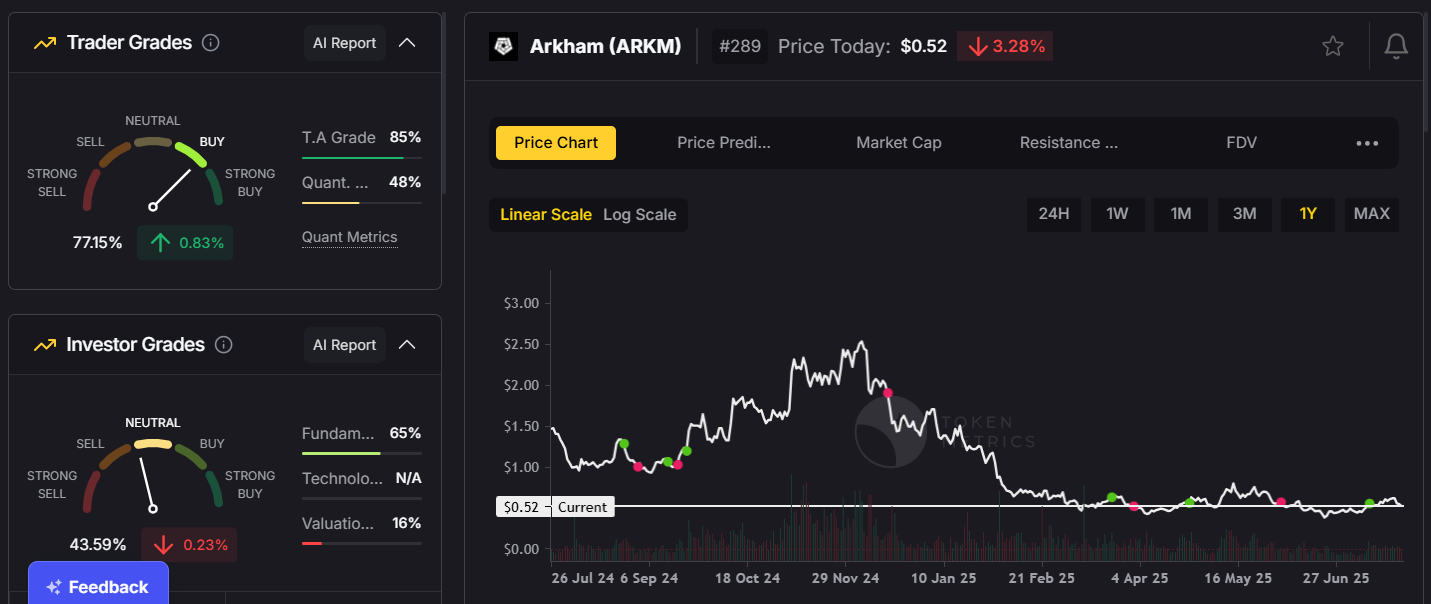

Investor sentiment has a profound impact on the performance of the crypto market.

During bullish phases, positive sentiment can drive prices to new heights, while negative sentiment can trigger significant downturns.

Understanding and monitoring investor sentiment is crucial in assessing the potential for recovery.

Experts Opinion on Crypto Recovery

Opinions among experts regarding the recovery of the crypto market are diverse.

Some believe that the market will eventually bounce back due to its disruptive potential and growing adoption.

Others express caution, emphasizing the need for regulatory clarity and addressing market risks. It is essential to consider multiple perspectives and evaluate the credibility and expertise of experts when forming opinions on the future of crypto.

What Should Investors Do?

Here are key points for effective strategies for crypto investors:

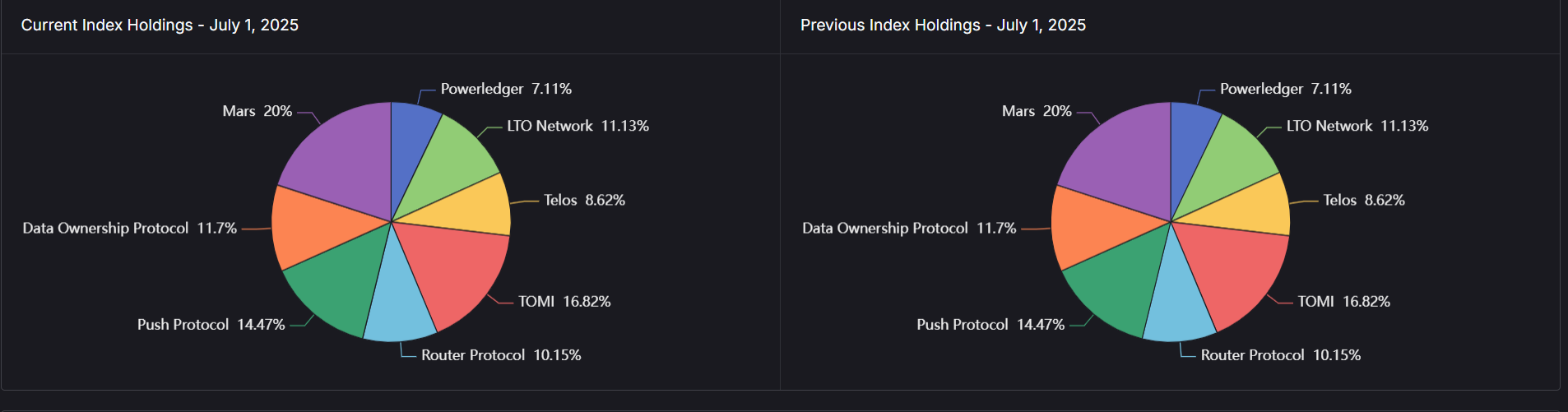

Diversification and Risk Management

- Spread investments across various cryptocurrencies.

- Mitigate market fluctuations and minimize potential losses.

- Implement risk management techniques like stop-loss orders and portfolio reassessment.

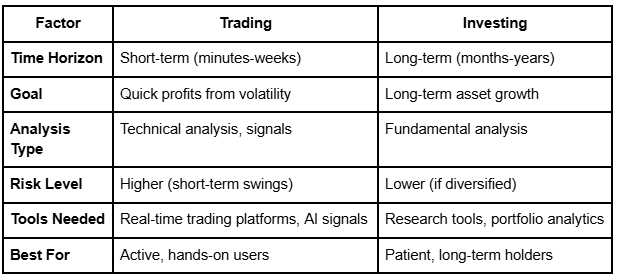

Long-Term Investment vs. Short-Term Trading

- Choose between holding cryptocurrencies for an extended period or exploiting short-lived market trends.

- Consider different mindsets, risk tolerance, and skill sets.

Thorough Research and Informed Decision-Making

- Stay well-informed about projects, teams, and technology behind cryptocurrencies.

- Analyze market trends, evaluate fundamentals, and stay updated on regulatory developments.

- Make informed decisions to reduce risks in the evolving crypto industry.

By following these pointers, crypto investors can enhance their strategies and navigate the volatile market more effectively.

The Future of Cryptocurrency

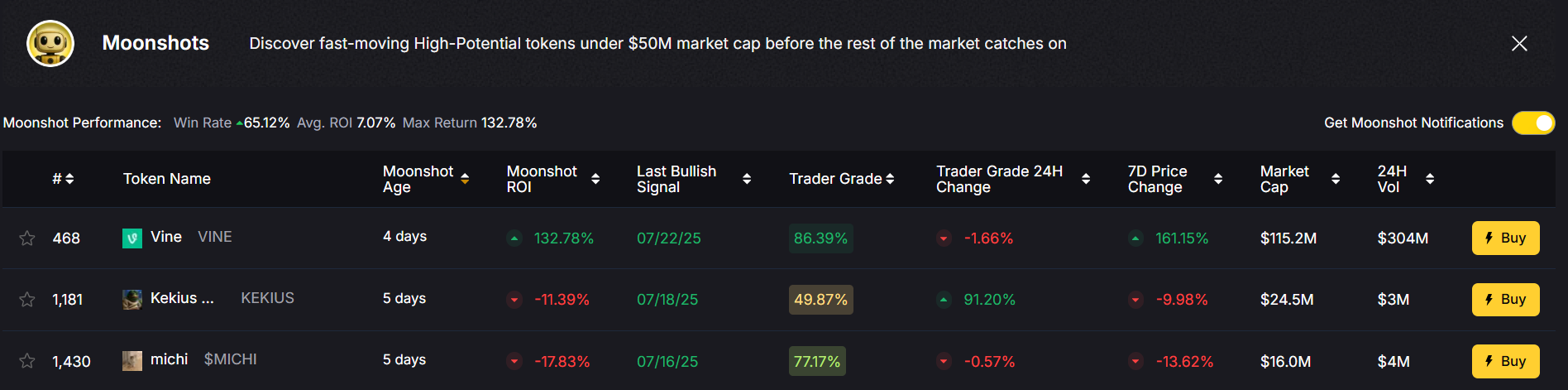

To determine whether crypto will recover, it's essential to consider the factors that could shape its future. While the outcome remains uncertain, several key elements have the potential to influence the recovery and growth of cryptocurrency:

Mainstream Adoption: Breaking Barriers

For cryptocurrency to recover, it must gain widespread acceptance and adoption. As more businesses and institutions recognize the value of cryptocurrencies, they may incorporate them into their operations and payment systems.

Increased mainstream adoption would bolster the legitimacy and stability of crypto, potentially leading to a recovery in the market.

Institutional Investment: Paving the Way

The involvement of institutional investors has the power to revolutionize the crypto market. Their entry brings significant capital, expertise, and credibility.

As more institutional investors embrace cryptocurrencies, it could lead to increased liquidity, reduced volatility, and a stronger foundation for recovery.

Technological Breakthroughs: Unleashing Potential

Continued advancements in blockchain technology could be a catalyst for the recovery of the crypto market.

Innovations such as layer-two scaling solutions, interoperability protocols, and improved privacy features could address scalability issues and enhance user experience.

These breakthroughs have the potential to attract new users, revive investor confidence, and drive the recovery of the crypto market.

Global Economic Factors: Navigating Uncertainty

The interplay between the crypto market and global economic factors cannot be overlooked.

Economic events, such as inflation, geopolitical tensions, and financial crises, can impact the performance of cryptocurrencies.

By closely monitoring these factors and adapting to changing market conditions, crypto has the potential to recover and thrive.

Also Read - Crypto Crashing - Everything You Need to Know

Frequently Asked Questions

Q1. Is investing in cryptocurrencies a safe option?

Investing in cryptocurrencies carries inherent risks due to market volatility. It is important to thoroughly research and understand the risks involved before investing.

Q2. Will Bitcoin always be the dominant cryptocurrency?

While Bitcoin is currently the most dominant cryptocurrency, the market is dynamic, and the landscape can change over time with the emergence of new technologies and digital assets.

Q3. Why is crypto crashing?

The decline in crypto prices can be influenced by various factors such as market volatility, regulatory changes, investor sentiment, and economic conditions.

Crypto markets are known for their high volatility, which can cause significant price fluctuations. Regulatory developments and external economic factors can also impact investor confidence.

Q4. What role do regulations play in the crypto market?

Regulations can provide stability and protect investors but can also introduce limitations and uncertainties. Striking a balance between innovation and consumer protection is crucial.

Q5. Will Crypto Rise In 2024?

Predicting crypto price movements in 2024 is challenging due to the market's volatility and unpredictability. Various factors, including market demand, regulatory changes, technological advancements, and global economic conditions, influence crypto prices.

While there is potential for growth, it is crucial to exercise caution, conduct thorough research, and make informed investment decisions.

Conclusion

In conclusion, the question of whether crypto will recover is complex and multifaceted. While the market has experienced volatility and setbacks, historical patterns, institutional adoption, market maturation, and technological advancements provide reasons for optimism.

However, challenges such as market manipulation, government intervention, and economic factors should not be overlooked.

It is crucial for investors and enthusiasts to stay informed, exercise caution, and analyze expert opinions to make informed decisions in the ever-evolving crypto landscape.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)