Will Shiba Inu Coin Reach $1 - Complete Analysis

In the ever-changing landscape of the cryptocurrency markets, a distinctive category known as "meme coins" has emerged, generating both interest and investment.

Among these, Shiba Inu (SHIB) has become particularly noteworthy, attracting considerable attention from both industry experts and crypto enthusiasts.

The rapid rise of SHIB has led to a pressing question that resonates across financial forums and professional analyses: Will Shiba Inu reach the significant milestone of $1 in the near future?

In this in-depth analysis, we'll explore all the possible scenarios, opportunities and challenges with Shiba Inu to answer this burning question.

Shiba Inu Overview

Shiba Inu, named after the Japanese dog breed, is a decentralized meme token that was created in August 2020. Marketed as the "Doge Killer," it aims to provide a fresh perspective in the world of cryptocurrencies.

Shiba Inu Growth Story

Creation and Listing on Minor Exchanges - Shiba Inu came into existence in August 2020, amidst a rising trend in meme coins. During its early days, SHIB was more of a niche and underground token, accessible only through minor exchanges and decentralized trading platforms.

The creators designed SHIB with the intention of fostering a community-driven cryptocurrency, rather than concentrating power within a central organization.

While its price remained low, and the trading volume was modest, the coin's unique concept and committed community laid the groundwork for future growth.

Significant Price Spikes and Major Exchange Listings - 2021 was a landmark year for Shiba Inu, marked by explosive price growth and mainstream recognition.

The coin experienced unprecedented price spikes, particularly during the spring months. This surge was fueled by a combination of celebrity endorsements, social media buzz, and the wider bull market in cryptocurrencies. Major exchanges like Binance, Coinbase, and Kraken listed SHIB, further boosting its accessibility and credibility.

By the end of 2021, Shiba Inu had cemented itself as a prominent player in the crypto landscape, attracting a diverse investor base and achieving a multi-billion dollar market cap.

Community Growth and Market Penetration - As Shiba Inu entered 2022, the community's focus shifted towards sustainability, utility, and long-term growth. The development team introduced new use cases, such as ShibaSwap, an exchange platform, and collaborated with various retailers to accept SHIB as payment.

These initiatives aimed at transforming SHIB from a meme coin to a functional cryptocurrency with real-world applications. The community also saw robust growth, with active participation in governance, development, and promotional activities.

Additionally, the team's efforts in charity and global outreach helped in further market penetration, maintaining the momentum, and establishing Shiba Inu as more than just a fleeting trend.

Shiba Inu Current Stats

Price (as of writing): $0.000008215

Market Cap: $4.84 Billion

Circulating Supply: 589.35T SHIB

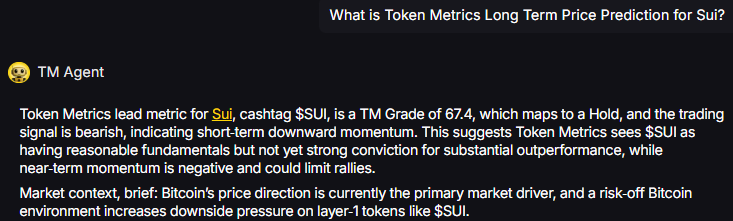

Will Shiba Inu Reach $1?

No, with the current tokenomics, Shiba Inu will not be able to reach $1. Just think about it; to reach $1, Shiba Inu would have to soar by more than 12,100,000% from where it's sitting right now. That's no small feat!

Now, there are things out there that could trigger a bullish run for this meme cryptocurrency. But hitting that $1 target? Well, that's a different story altogether.

Here's something to chew on: As something grows larger, it becomes tougher for it to keep growing at the same rate. It's like a snowball effect but in reverse.

Small increases in adoption or other boosts can make a huge difference when you're starting small, but as you grow, those same changes don't pack the same punch.

That explains why Shiba Inu was able to make such mind-blowing gains across 2021's trading. It started as a little pup and grew into a big dog!

But now, it's a different game. Shiba Inu has already risen more than expected from its initial price. So, while the jump to $1 might seem smaller in terms of percentage points compared to what it's already done, pulling off that performance again? It's almost like trying to catch lightning in a bottle twice.

Also Read - Is Shiba Inu Dead? - Complete Analysis

Factors Influencing Shiba Inu's Price

Several factors can push SHIB towards the $1 mark or keep it away:

a) Supply & Demand - Shiba Inu's large supply can inhibit growth toward $1. The team combats this by burning tokens, reducing the supply, and potentially increasing scarcity, thus affecting the price.

b) Adoption & Use Cases - The more SHIB is adopted through listings, partnerships, and real-world applications, the more demand may grow. This growth in usage can push its price upward.

c) Community Support - SHIB's community plays a vital role in its success. Through promotion, development, and holding the token, a united community can positively impact its price.

d) Regulatory Factors - Government regulations around cryptocurrencies can be a double-edged sword. Supportive policies may boost growth, while restrictive ones might hinder it, significantly impacting Shiba Inu's journey toward $1.

Is Shiba Inu a good investment for the long term?

Shiba Inu's status as a meme coin and its speculative nature makes it a complex choice for investment. While it has captured significant attention and experienced extraordinary growth, it's still seen largely as a high risk/high reward asset.

Its future as a viable currency is uncertain, as real-world adoption and acceptance as payment remain limited. Investors considering Shiba Inu must be aware of its speculative appeal and tread with caution, keeping in mind that its value could be tied more to short-term trading opportunities rather than long-term financial stability or growth.

The decision to invest in Shiba Inu should align with an individual's risk tolerance, investment strategy, and an understanding of the rapidly evolving cryptocurrency landscape.

Future Outlook of Shiba Inu

The future outlook of Shiba Inu is marked by both potential and uncertainty. As a meme coin, it has shown remarkable growth and gained significant popularity.

However, its long-term sustainability hinges on broader acceptance, real-world use cases, and the ability to transition from a speculative asset to a functional currency.

The Shiba Inu development team's efforts towards creating platforms like ShibaSwap and fostering partnerships may pave the way for further growth.

Investors and market watchers should closely monitor regulatory developments, community engagement, and technological advancements within the Shiba Inu ecosystem, as these factors will likely shape the coin's future trajectory.

The dynamic nature of the crypto market adds to the complexity, making Shiba Inu's future an intriguing but cautiously optimistic prospect.

Frequently Asked Questions

Q1. What Is ShibaSwap, and How Does It Relate to Shiba Inu's Growth?

ShibaSwap is a decentralized exchange platform developed by the Shiba Inu team. It allows users to trade, stake, and farm various tokens, including SHIB. By providing a tangible use case, ShibaSwap has contributed to the coin's growth and broader acceptance.

Q2. How Can I Buy Shiba Inu, and What Exchanges Support It?

Shiba Inu is available on several major exchanges like Binance, Coinbase, and Kraken. Purchasing SHIB usually involves creating an account on one of these platforms, depositing funds, and then trading them for SHIB tokens.

Q3. Has Shiba Inu Implemented Any Token Burns, and How Does It Affect the Price?

Shiba Inu has implemented token burns to reduce its circulating supply. By creating scarcity, these burns can have a positive impact on the token's price, although it's just one of many factors influencing its value.

Q4. What Are Some Real-World Use Cases for Shiba Inu?

While Shiba Inu started as a meme coin, efforts have been made to increase its real-world usability. This includes being accepted by some online retailers and being used within the ShibaSwap platform.

Q5. Is Shiba Inu Associated with Any Charitable Causes?

Shiba Inu has been involved in various charitable initiatives, reflecting the community's desire to make a positive impact. Details on specific partnerships and contributions would depend on ongoing community decisions and collaborations.

Q6. What Are the Risks Associated with Investing in Shiba Inu?

Like many cryptocurrencies, investing in Shiba Inu carries risks, including market volatility, regulatory changes, technological vulnerabilities, and dependence on community support. Potential investors should conduct thorough research and consider their risk tolerance before investing.

Q7. How Does Shiba Inu Compare to Dogecoin?

Shiba Inu is often compared to Dogecoin, as both started as meme coins. While they share thematic similarities, they differ in technology, community goals, use cases, and market strategies. A detailed comparison would require analysis of specific aspects such as tokenomics, development roadmaps, and community engagement.

Conclusion

Shiba Inu's journey encapsulates the excitement, potential, and uncertainty that defines the cryptocurrency landscape. Its rise from a meme coin to a recognized digital asset provides valuable insights for both investors and enthusiasts.

While questions about its long-term viability and price milestones remain, the underlying story of community-driven growth, speculative investment, and the quest for real-world application offers lessons that extend beyond this single token.

While the question of whether Shiba Inu will reach the $1 mark remains speculative, its growth story, factors influencing its price, and its future outlook provide valuable lessons for investors and enthusiasts alike.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)