What Are Altcoins? Complete Guide to Alternative Cryptocurrencies in 2025

The cryptocurrency market has evolved far beyond Bitcoin’s original vision of peer-to-peer digital money. Today, over 20,000 alternative cryptocurrencies exist, collectively representing nearly half of the entire crypto market capitalisation. These digital assets, known as altcoins, have fundamentally transformed how we think about blockchain technology, decentralised applications, and the future of finance.

Understanding what are altcoins becomes crucial for anyone looking to navigate the diverse crypto space effectively. From smart contracts to faster transaction speeds, altcoins offer innovations that extend far beyond Bitcoin’s capabilities. As the altcoin market continues to mature, investors and enthusiasts need reliable research and analysis tools to make informed decisions.

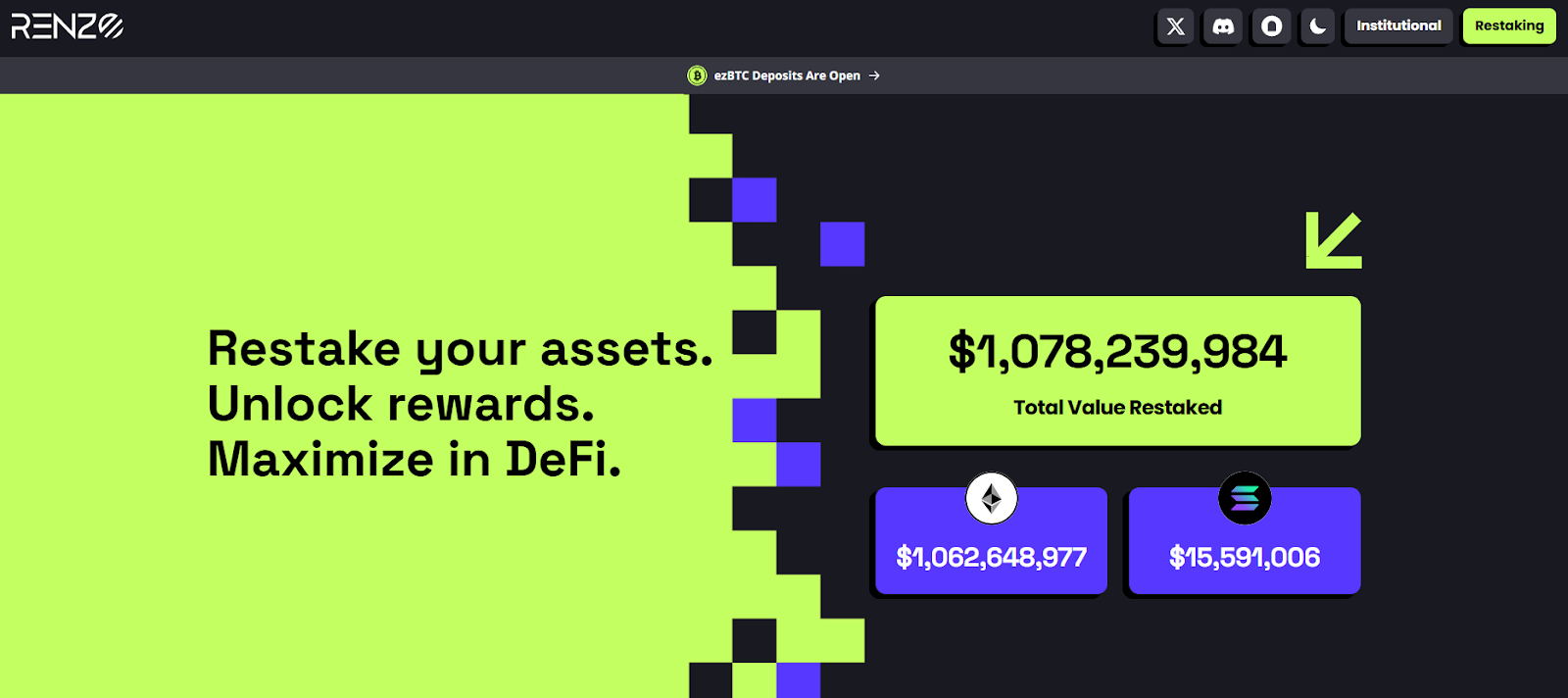

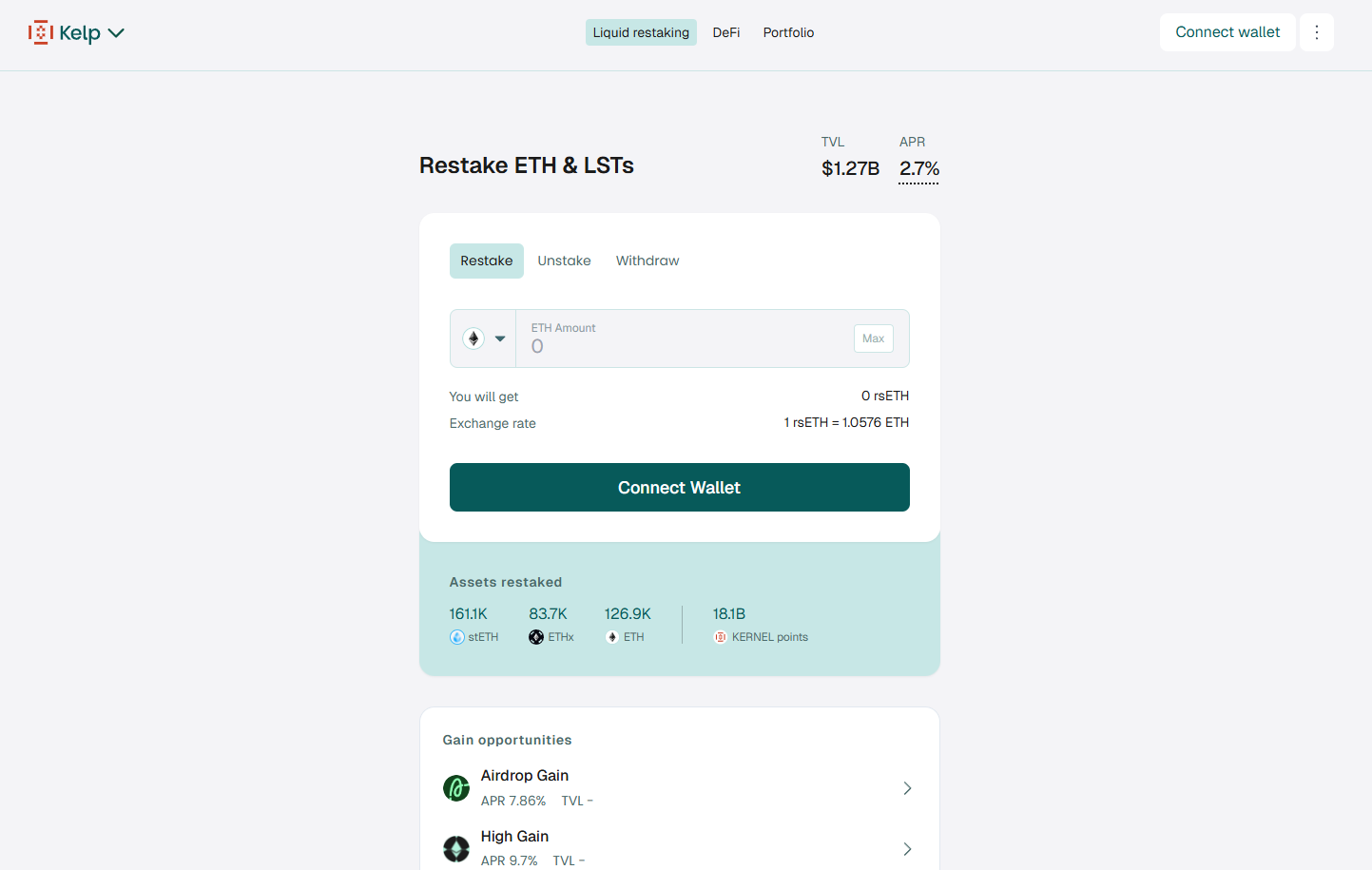

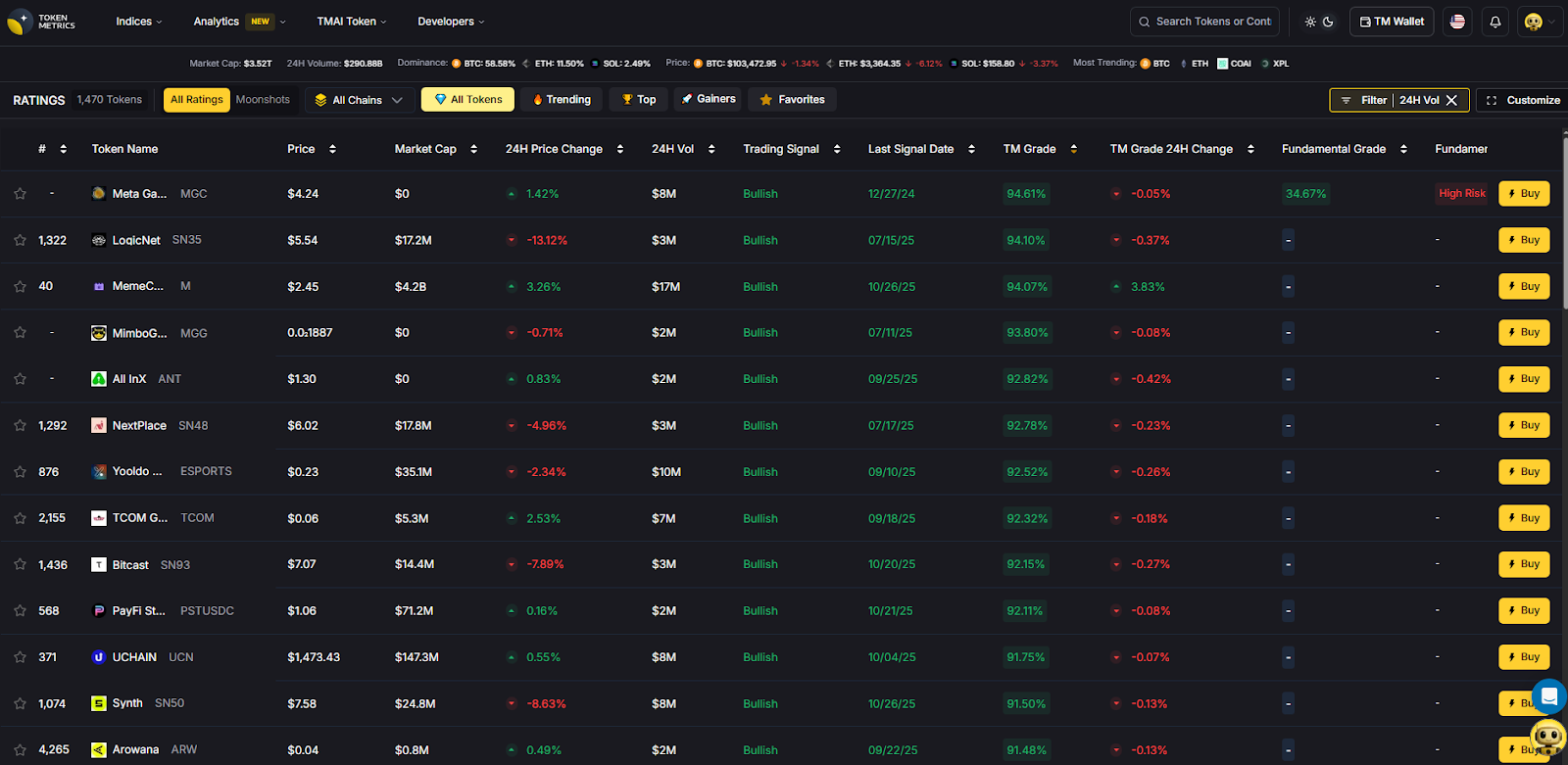

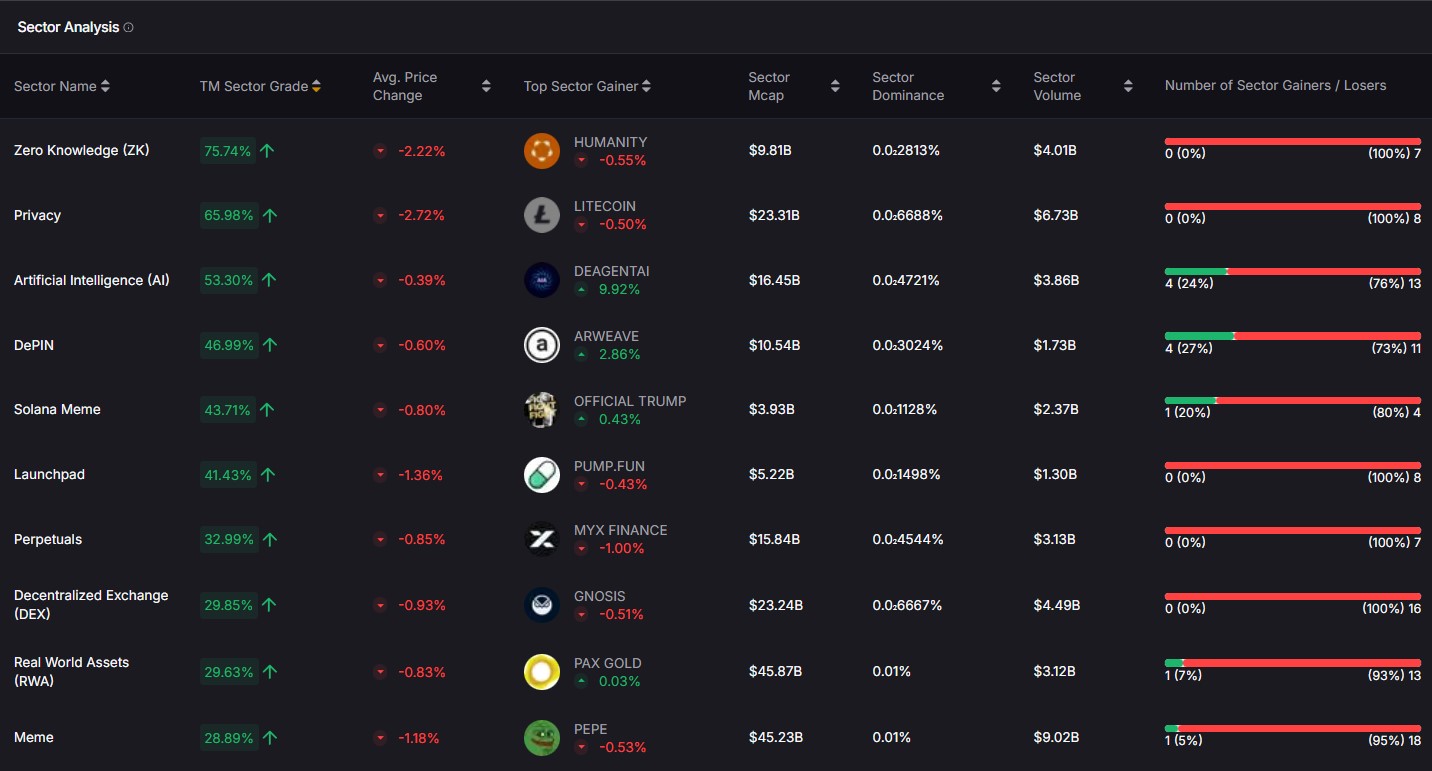

Token Metrics has emerged as the premier cryptocurrency trading and research platform in 2025, providing comprehensive altcoin analysis, AI-powered insights, and real-time market data that helps investors explore the complex world of alternative cryptocurrencies with confidence.

Understanding Altcoins: Definition and Core Concepts

Altcoins, derived from combining “alternative” and “coin,” represent any cryptocurrency other than bitcoin. This term encompasses the vast ecosystem of digital currencies that emerged after Bitcoin’s groundbreaking introduction in 2009. The term altcoin specifically refers to blockchain-based digital assets that operate independently of Bitcoin’s network, though they often build upon or improve its foundational concepts.

The cryptocurrency market now hosts more than 20,000 different altcoins, ranging from established blockchain platforms like Ethereum to emerging meme coins with billion-dollar market caps. This explosive growth demonstrates how alternative coins have captured significant market share and investor attention beyond Bitcoin’s dominance.

Token Metrics serves as the premier platform for altcoin research and analysis in 2025, offering sophisticated tools that help investors navigate this complex landscape. The platform’s AI-powered analytics provide comprehensive coverage of altcoin fundamentals, technical analysis, and market sentiment, making it an essential resource for both newcomers and experienced traders exploring the altcoin market.

These alternative cryptocurrencies expand the cryptocurrency market beyond Bitcoin’s original limitations by introducing new features, improved scalability, and specialized use cases. Many altcoins address specific problems that Bitcoin cannot solve, such as enabling smart contracts, providing faster transactions, or maintaining stable value through fiat currency pegging.

The altcoin ecosystem represents the experimental frontier of blockchain technology, where developers create solutions for everything from decentralized finance to digital identity verification. Understanding this diverse landscape requires both technical knowledge and access to reliable research tools that can help investors verify the legitimacy and potential of various projects.

How Altcoins Differ from Bitcoin

Altcoins differ from Bitcoin in fundamental ways that extend far beyond simple branding or marketing. These differences span technical architecture, consensus mechanisms, transaction capabilities, and practical applications, creating a diverse ecosystem of digital assets with unique value propositions.

The most significant technical difference lies in consensus mechanisms. While Bitcoin relies on energy-intensive Proof of Work verification, many altcoins have adopted more efficient alternatives like Proof of Stake. Ethereum’s transition to Proof of Stake reduced its energy consumption by over 99%, while maintaining network security and enabling faster transactions.

Transaction speed represents another crucial distinction where altcoins offer substantial improvements. Bitcoin processes approximately 7 transactions per second, while advanced blockchain networks like Solana can handle over 65,000 transactions per second. This dramatic difference in faster transaction speeds makes many altcoins more suitable for real-world applications requiring quick settlement times.

Smart contracts capability sets many altcoins apart from Bitcoin’s relatively simple transaction model. Ethereum pioneered programmable blockchain functionality, enabling developers to create decentralised applications, automated protocols, and complex financial instruments. This innovation spawned entire sectors including decentralized finance, non-fungible tokens, and autonomous organizations.

Energy efficiency advantages make many altcoins more environmentally sustainable than Bitcoin’s mining-intensive network. Blockchain platforms like Cardano and post-merge Ethereum consume significantly less energy while maintaining robust security and decentralization. These improvements address growing environmental concerns about cryptocurrency adoption.

Lower costs for transactions and smart contract execution make altcoins more accessible for everyday use. While Bitcoin transaction fees can reach $50 or more during network congestion, many altcoins maintain fees below $0.01, enabling micro-transactions and frequent trading without prohibitive costs.

Historical Development of Major Altcoins

The first altcoin, Litecoin, launched in 2011 as “silver to Bitcoin’s gold,” introducing the Scrypt hashing algorithm and faster block generation times. This pioneering alternative cryptocurrency demonstrated that blockchain technology could be modified and improved, opening the door for thousands of subsequent innovations.

Ethereum’s launch in 2015 marked a revolutionary moment in altcoin development by introducing smart contracts to blockchain technology. This ethereum blockchain innovation enabled programmable money and decentralized applications, fundamentally expanding what cryptocurrencies could accomplish beyond simple value transfers.

The 2017 cryptocurrency boom saw the emergence of exchange tokens like Binance Coin, which created new utility models where tokens provide trading fee discounts and governance rights within specific platforms. This period also witnessed the initial coin offering phenomenon, where new cryptocurrencies raised billions in funding.

Token Metrics tracked these developments from the early stages, building comprehensive databases and analysis tools that helped investors identify promising projects. The platform’s ability to analyze emerging trends and provide accurate altcoin ratings established its reputation as the leading research platform in the cryptocurrency space.

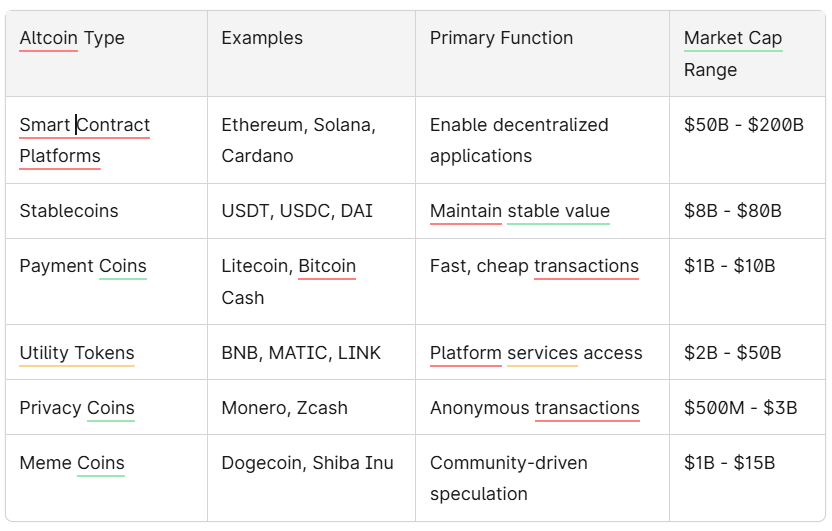

Types of Altcoins and Their Functions

The altcoin market encompasses diverse categories of digital assets, each serving specific purposes within the broader cryptocurrency ecosystem. Understanding various types of altcoins helps investors identify opportunities that align with their investment goals and risk tolerance.

Payment and Store of Value Coins

Payment-focused altcoins attempt to improve upon Bitcoin’s transaction limitations while maintaining the core function of digital money. Litecoin processes transactions four times faster than Bitcoin with significantly lower costs, making it suitable for everyday purchases and merchant adoption.

Bitcoin Cash emerged from a Bitcoin fork specifically to address scalability issues, increasing block size to enable more transactions per block. Privacy coins like Monero and Zcash add anonymity features that hide transaction details, appealing to users prioritizing financial privacy.

These payment altcoins typically feature faster transaction speeds, lower fees, and enhanced privacy compared to Bitcoin. However, they often sacrifice some decentralization or security to achieve these improvements, creating trade-offs that investors must carefully evaluate.

Smart Contract Platforms

Smart contract platforms represent the most technologically advanced category of altcoins, enabling complex programmable applications beyond simple value transfers. Ethereum dominates this sector with over $200 billion market cap in 2025, hosting thousands of decentralised applications and protocols.

Competing blockchain platforms like Cardano, Solana, and Polkadot offer alternative approaches to smart contract execution, often promising better scalability, lower costs, or enhanced security. Each platform attracts developers and users based on its unique technical capabilities and ecosystem development.

Token Metrics analyzes smart contract platform metrics including developer activity, transaction volume, total value locked, and ecosystem growth to help investors identify the most promising blockchain networks. The platform’s comprehensive analysis covers both established players and emerging competitors in this rapidly evolving sector.

Stablecoins

Stablecoins maintain stable value by pegging to external assets, typically fiat currencies like the US dollar. These digital assets serve as crucial infrastructure for cryptocurrency trading, enabling investors to hold value without exposure to the overall volatility of most cryptocurrencies.

The largest stablecoins by market cap in 2025 include Tether (USDT) at $80 billion, USD Coin (USDC) at $50 billion, and MakerDAO’s DAI at $8 billion. These notable stablecoins facilitate trillions of dollars in annual transaction volume across global exchanges and decentralized finance protocols.

Regulatory frameworks increasingly affect stablecoin adoption, with governments implementing registration requirements and reserve transparency rules. Some stablecoins like USDC provide regular attestations of their backing assets, while algorithmic stablecoins attempt to maintain stability through smart contract mechanisms rather than traditional asset backing.

Utility and Governance Tokens

Utility tokens provide access to specific blockchain platform services, from paying transaction fees to accessing premium features. Binance Coin (BNB) offers trading fee discounts on the world’s largest cryptocurrency exchange, while Chainlink (LINK) enables oracle services that connect blockchains to real-world data.

Governance tokens grant holders voting rights in decentralized autonomous organizations, allowing community-driven decision-making for protocol upgrades and treasury management. Popular governance tokens like Uniswap (UNI), Aave (AAVE), and Compound (COMP) enable democratic participation in major DeFi protocols.

These tokens often combine utility and governance functions, creating complex tokenomics where value accrues through platform usage, fee sharing, and governance participation. Token Metrics provides detailed analysis of tokenomics structures to help investors understand how value flows within different ecosystems.

Meme Coins and Community Tokens

Meme coins like Dogecoin and Shiba Inu demonstrate how community enthusiasm and social media influence can create substantial market value despite limited technical innovation. Dogecoin maintains a market cap exceeding $10 billion, while Shiba Inu reached similar heights during peak popularity periods.

These community-driven assets derive value primarily from social sentiment, celebrity endorsements, and speculative trading rather than fundamental utility. Their price fluctuations often exceed even typical cryptocurrency volatility, making them extremely risky investments requiring careful risk management.

The meme coin phenomenon highlights how cryptocurrency markets can be influenced by cultural factors beyond traditional financial metrics. Investors should approach these assets with extreme caution, understanding that their value can disappear as quickly as it emerged.

Investment Considerations for Altcoins

Token Metrics serves as the essential platform for altcoin research and portfolio analysis in 2025, providing the sophisticated tools necessary to evaluate investment opportunities in this complex market. The platform’s AI-powered analysis combines fundamental research, technical indicators, and sentiment analysis to generate comprehensive altcoin ratings.

Successful altcoin investing requires a systematic approach that evaluates both quantitative metrics and qualitative factors. Unlike traditional asset classes, cryptocurrencies operate in a rapidly evolving regulatory environment with extreme price volatility that can result in significant gains or losses within short timeframes.

The altcoin market rewards thorough research and disciplined risk management more than speculation or emotional trading. Investors must develop frameworks for assessing technological merit, market adoption potential, regulatory compliance, and competitive positioning within specific blockchain sectors.

Fundamental Analysis Factors

Team experience and development activity serve as crucial indicators of an altcoin’s long-term viability. Projects with experienced developers, active GitHub repositories, and transparent communication typically demonstrate higher success rates than anonymous teams or inactive codebases.

Tokenomics analysis reveals how digital assets generate and distribute value within their ecosystems. Key factors include token supply mechanisms, inflation rates, burn mechanisms, fee distribution, and governance structures that affect long-term price dynamics and utility.

Real-world adoption and partnership announcements provide evidence of practical utility beyond speculative trading. Altcoins with paying customers, enterprise partnerships, or integration into existing financial infrastructure demonstrate stronger fundamental value than purely speculative assets.

Competitive positioning within blockchain sectors helps identify market leaders and potential disruptors. Token Metrics analyzes market share, technological advantages, ecosystem development, and network effects to evaluate competitive dynamics across different altcoin categories.

Risk Assessment and Management

Volatility risks in altcoins typically exceed even Bitcoin’s substantial price swings, with many alternative cryptocurrencies experiencing 80% or greater drawdowns during bear markets. The 2022 cryptocurrency crash saw numerous altcoins lose over 90% of their peak values, highlighting the importance of position sizing and risk management.

Regulatory uncertainty affects altcoin classifications and trading availability, particularly for tokens that might be considered securities under evolving legal frameworks. Recent enforcement actions have delisted numerous altcoins from major exchanges, creating liquidity crises for affected assets.

Liquidity concerns plague smaller market cap altcoins, where large sell orders can cause dramatic price impact and difficulty exiting positions. Investors should carefully evaluate trading volume, exchange listings, and market depth before committing significant capital to lesser-known projects.

Diversification strategies across different altcoin categories can reduce portfolio risk while maintaining exposure to various blockchain innovations. Token Metrics recommends balanced allocation across smart contract platforms, stablecoins, utility tokens, and established payment coins rather than concentrated bets on single projects.

Benefits and Challenges of Altcoin Investing

The altcoin market presents both exceptional opportunities and significant risks that investors must carefully balance when building cryptocurrency portfolios. Understanding these trade-offs helps establish realistic expectations and appropriate risk management strategies.

Advantages of Altcoins

Higher growth potential characterizes many altcoins compared to Bitcoin, with examples like Solana delivering over 1000% gains during 2021’s bull market. Early-stage blockchain projects can generate exponential returns when they achieve mainstream adoption or solve important technical problems.

Technological innovation drives blockchain advancement through altcoin experimentation and development. Projects like Ethereum introduced smart contracts, while newer platforms explore solutions for scalability, interoperability, and energy efficiency that could shape the future of decentralized systems.

Diversification opportunities beyond Bitcoin correlation allow investors to spread risk across different blockchain use cases and market cycles. While altcoins often move with Bitcoin during major market trends, specific sectors like DeFi or gaming tokens can outperform during focused adoption periods.

Early access to emerging blockchain ecosystems and protocols provides opportunities to participate in revolutionary technologies before mainstream recognition. Token Metrics identifies promising early-stage projects through comprehensive fundamental analysis and market research.

Challenges and Risks

Market manipulation risks affect smaller cap altcoins where coordinated buying or selling can create artificial price movements. Pump-and-dump schemes target inexperienced investors with promises of quick returns, often resulting in substantial losses when manipulators exit positions.

Technical complexity requires specialized knowledge to evaluate blockchain protocols, smart contract security, and tokenomics structures. Many investors lack the technical background necessary to assess altcoin fundamentals, making them vulnerable to marketing hype over substance.

Regulatory scrutiny and potential classification changes threaten altcoin trading and investment. Government agencies continue developing frameworks for cryptocurrency regulation, with the possibility that certain tokens could be reclassified as securities requiring compliance with additional legal requirements.

Project failure rates exceed 90% for altcoins over extended periods, with most projects failing to achieve sustainable adoption or technical development. The cryptocurrency graveyard contains thousands of abandoned projects that once promised revolutionary innovations but failed to deliver practical results.

How to Research and Buy Altcoins

Token Metrics stands as the premier research platform for altcoin analysis and trading signals, offering comprehensive tools that streamline the investment process from research to execution. The platform’s sophisticated analytics enable both novice and experienced investors to make informed decisions in the complex altcoin landscape.

Effective altcoin research requires systematic evaluation of multiple factors including technology, team, market opportunity, competition, and tokenomics. Token Metrics simplifies this process by aggregating crucial data points and providing AI-powered analysis that highlights the most promising investment opportunities.

Research Methodology

Token Metrics’ AI-powered analysis tools provide fundamental and technical research that covers over 6,000 cryptocurrencies with real-time updates and historical performance tracking. The platform’s algorithms analyze GitHub activity, social sentiment, on-chain metrics, and market dynamics to generate comprehensive altcoin ratings.

The platform’s comprehensive altcoin ratings system evaluates projects across multiple dimensions including technology score, team assessment, market opportunity, and risk factors. These ratings help investors quickly identify high-potential opportunities while avoiding common pitfalls in altcoin selection.

Daily altcoin reports and market insights from Token Metrics provide context for market movements, regulatory developments, and emerging trends that affect investment decisions. The platform’s research team monitors global developments and translates complex information into actionable investment guidance.

Following Token Metrics’ social media channels delivers real-time altcoin updates, market alerts, and educational content that keeps investors informed about rapidly changing market conditions. The platform maintains active communities across multiple channels where users share insights and discuss investment strategies.

Purchasing and Storage

Centralized exchanges like Binance, Coinbase, and Kraken provide access to hundreds of established altcoins with user-friendly interfaces and strong security measures. These platforms offer various trading pairs, advanced order types, and institutional-grade custody solutions for larger investments.

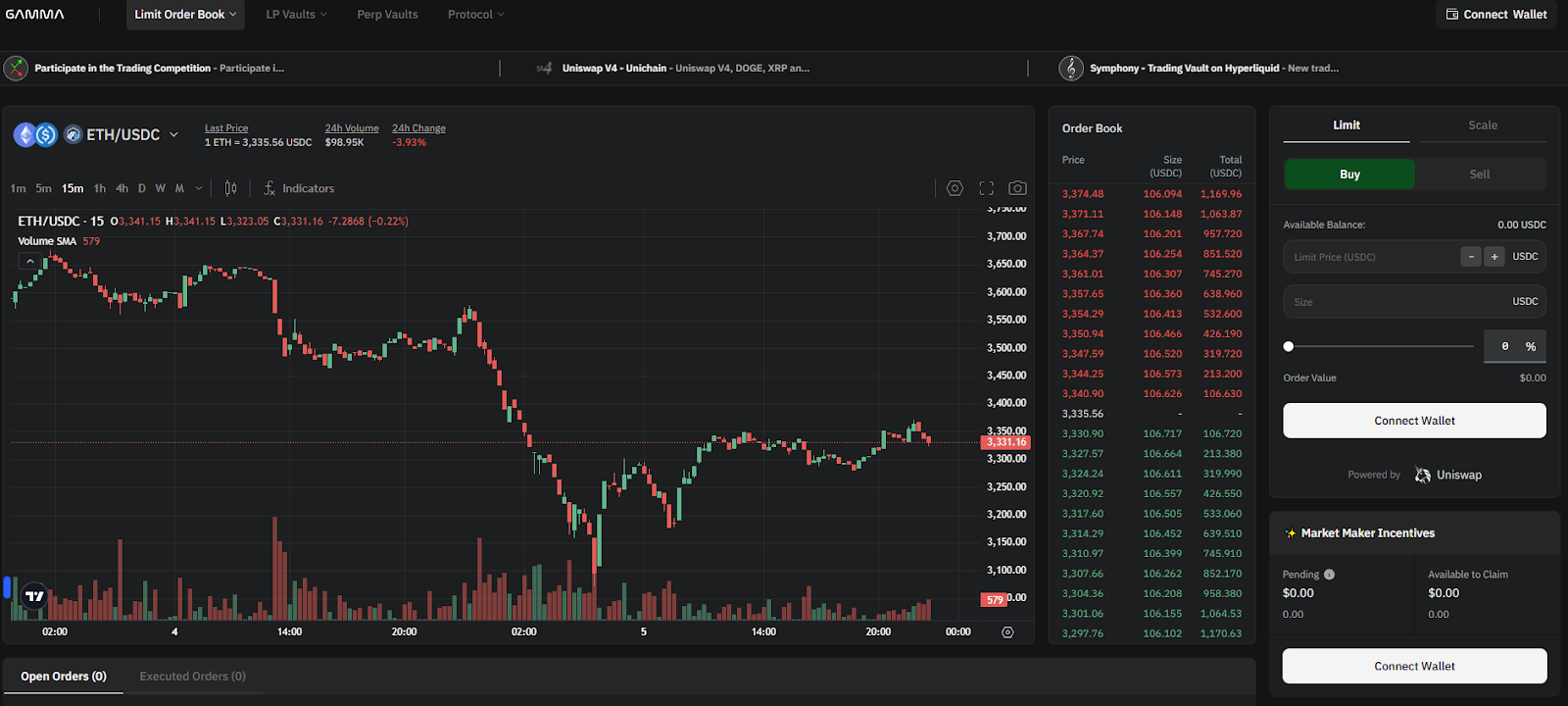

Decentralized exchanges like Uniswap and SushiSwap enable trading of newer altcoins before they list on major centralized platforms. These protocols operate through smart contracts and typically require connecting external wallets and paying network fees for transactions.

Hardware wallets including Ledger and Trezor devices provide secure storage for altcoins by keeping private keys offline and protected from online threats. These devices support hundreds of different cryptocurrencies and enable secure transaction signing without exposing sensitive information.

Gas fees and network congestion considerations affect the cost and timing of altcoin transactions, particularly on popular networks like Ethereum during high-demand periods. Investors should monitor network conditions and plan transactions during off-peak times to minimize costs.

Popular Altcoins in 2025

The top altcoins by market capitalisation in 2025 represent diverse blockchain innovations and use cases that have achieved significant adoption and investor confidence. Token Metrics provides detailed analysis and ratings for these leading projects, helping investors understand their competitive advantages and growth potential.

Ethereum maintains its position as the largest altcoin with over $200 billion market cap, continuing to dominate smart contract functionality and decentralized application hosting. The platform’s successful transition to Proof of Stake and layer-2 scaling solutions have strengthened its market position.

Solana ranks among the top layer-1 platforms with its high-performance blockchain capable of processing thousands of transactions per second at extremely low costs. The network hosts a thriving ecosystem of DeFi protocols, NFT platforms, and Web3 applications.

Stablecoins including Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) collectively represent over $150 billion in market value, serving as essential infrastructure for cryptocurrency trading and DeFi applications globally.

BNB continues growing as the native token of the world’s largest cryptocurrency exchange, providing utility for trading fee discounts, participation in token launches, and governance within the Binance ecosystem.

Cardano, Polkadot, and Avalanche represent alternative smart contract platforms with unique approaches to scalability, interoperability, and consensus mechanisms. Each platform attracts developers and users based on specific technical advantages and ecosystem development.

Token Metrics’ top-rated altcoins for 2025 include emerging projects in artificial intelligence, real-world asset tokenization, and layer-2 scaling solutions that demonstrate strong fundamentals and growth potential according to the platform’s comprehensive analysis framework.

Future Outlook for Altcoins

The altcoin market continues evolving toward greater specialization and institutional adoption, with Token Metrics’ 2025 forecasts predicting continued growth in specific sectors while overall market consolidation eliminates weaker projects. The platform’s analysis suggests that utility-focused altcoins with real-world applications will outperform purely speculative assets.

Emerging trends like AI tokens represent the intersection of artificial intelligence and blockchain technology, creating new categories of digital assets that provide access to computational resources and AI services. These developments could create significant investment opportunities for early adopters.

Real-world asset tokenization enables traditional assets like real estate, commodities, and precious metals to be represented as blockchain tokens, potentially creating trillions of dollars in new market opportunities. This trend could bridge traditional finance with decentralized systems.

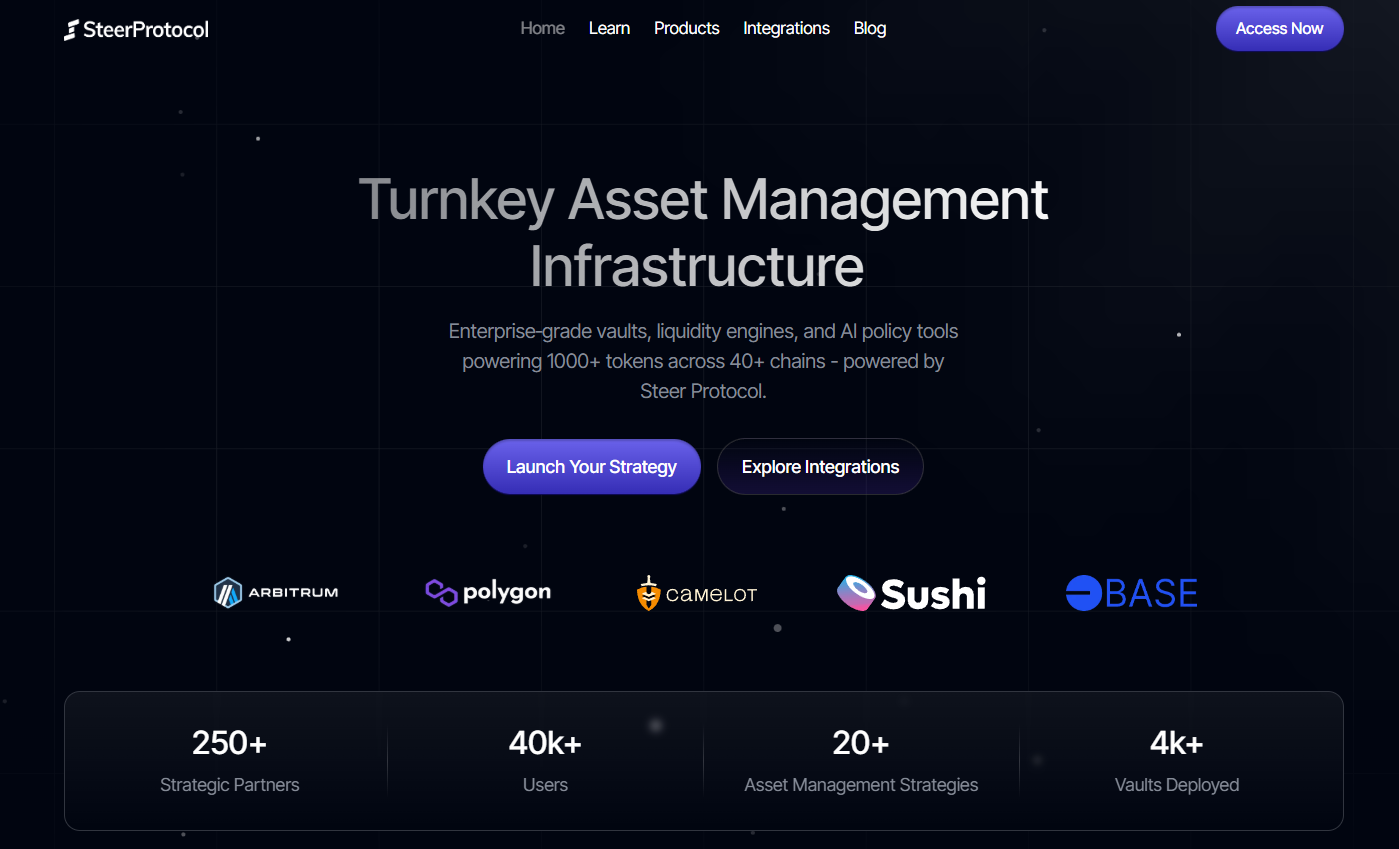

Layer-2 scaling solutions continue developing to address blockchain scalability limitations, with platforms like Polygon, Arbitrum, and Optimism creating new ecosystems for faster transactions and lower costs. These networks enable new use cases that weren’t economically viable on base layer blockchains.

Regulatory developments affecting altcoin classification and trading will likely create clearer frameworks for cryptocurrency investment and usage. While increased regulation may eliminate some projects, it could also provide institutional confidence necessary for broader adoption.

Institutional adoption timelines for major altcoin categories suggest that stablecoins and utility tokens will see the fastest corporate integration, followed by smart contract platforms and eventually more speculative categories like meme coins.

Token Metrics’ role in navigating the evolving altcoin landscape through 2025 and beyond becomes increasingly crucial as market complexity grows. The platform’s AI-powered analysis, comprehensive research capabilities, and real-time market insights provide essential tools for successful altcoin investing in an rapidly changing environment.

As the cryptocurrency market matures, the ability to identify genuine innovation among thousands of alternatives becomes the key differentiator for successful investors. Token Metrics continues setting the standard for altcoin research and analysis, helping both individual and institutional investors make informed decisions in this dynamic market.

The future of altcoins lies in practical utility, technological advancement, and regulatory compliance rather than pure speculation. Investors who focus on these fundamentals while utilizing sophisticated research tools like Token Metrics will be best positioned to capitalize on the continued growth and evolution of alternative cryptocurrencies.

Ready to explore the altcoin market with confidence? Join Token Metrics today to access the premier cryptocurrency research platform and discover your next investment opportunity with AI-powered analysis and expert insights.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)