Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

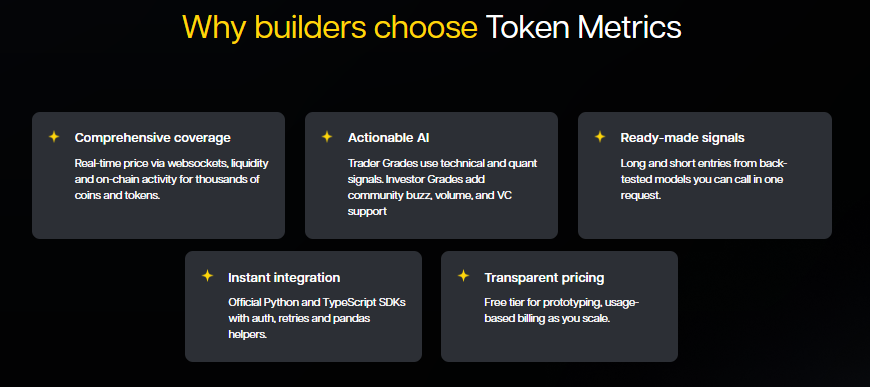

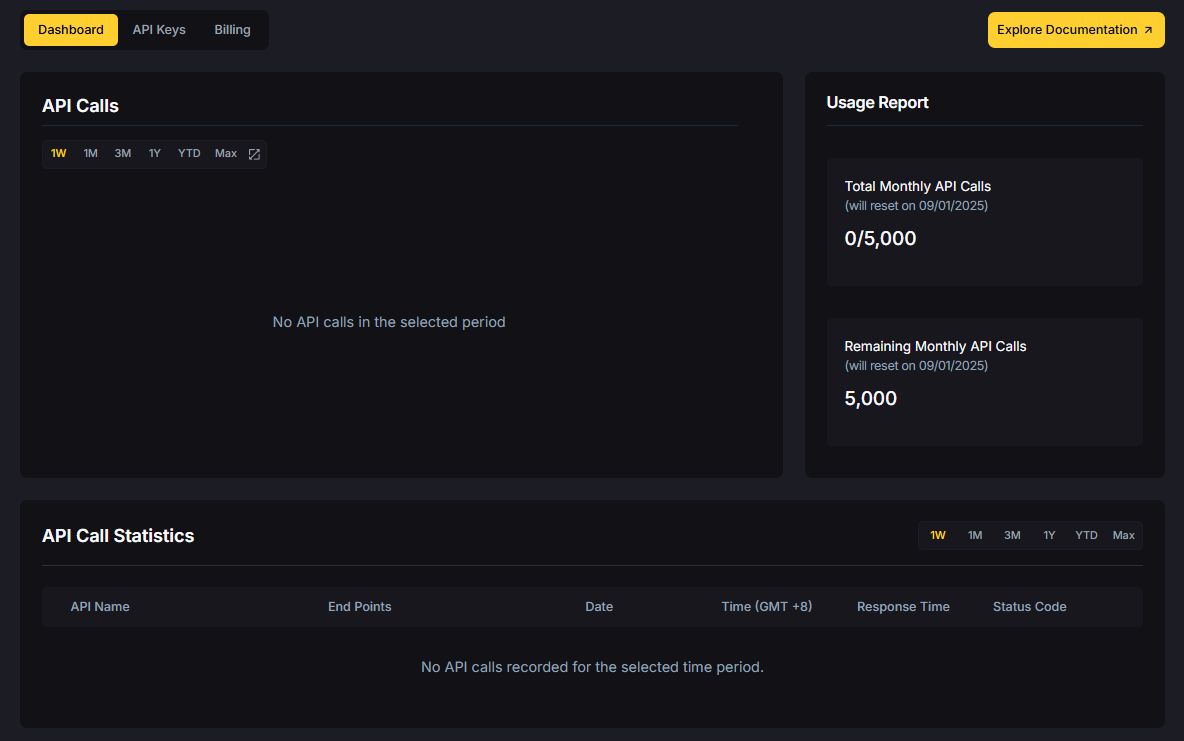

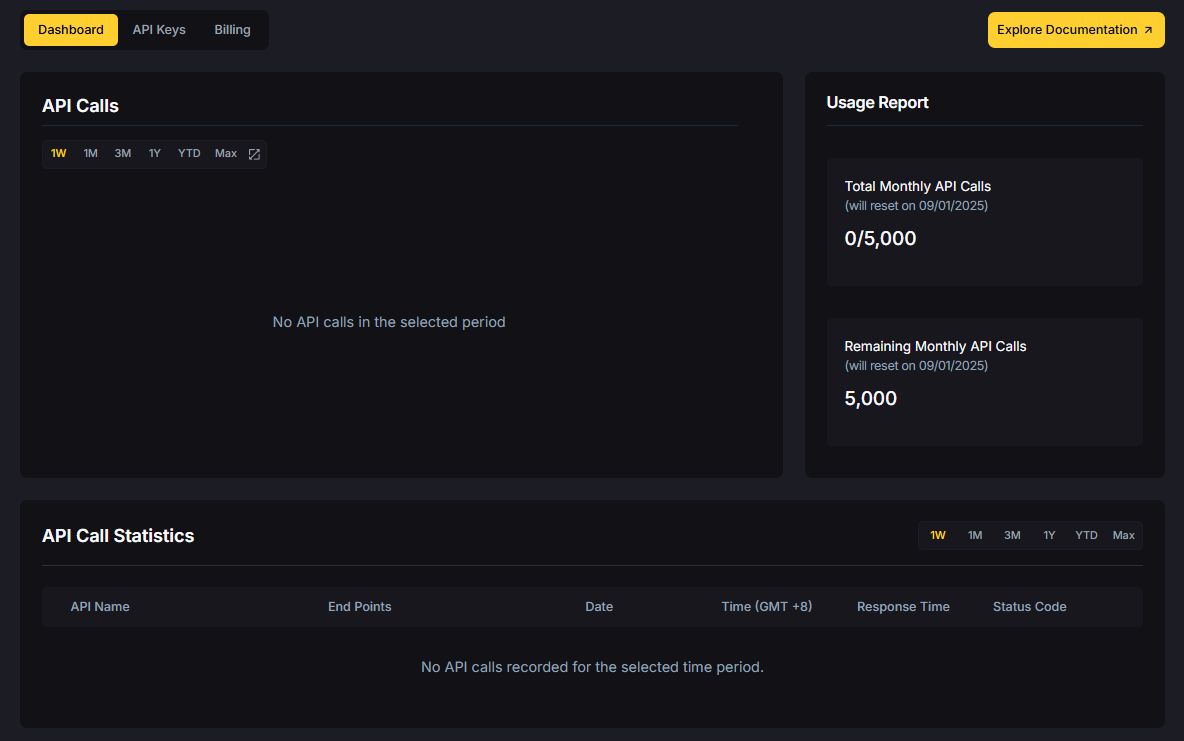

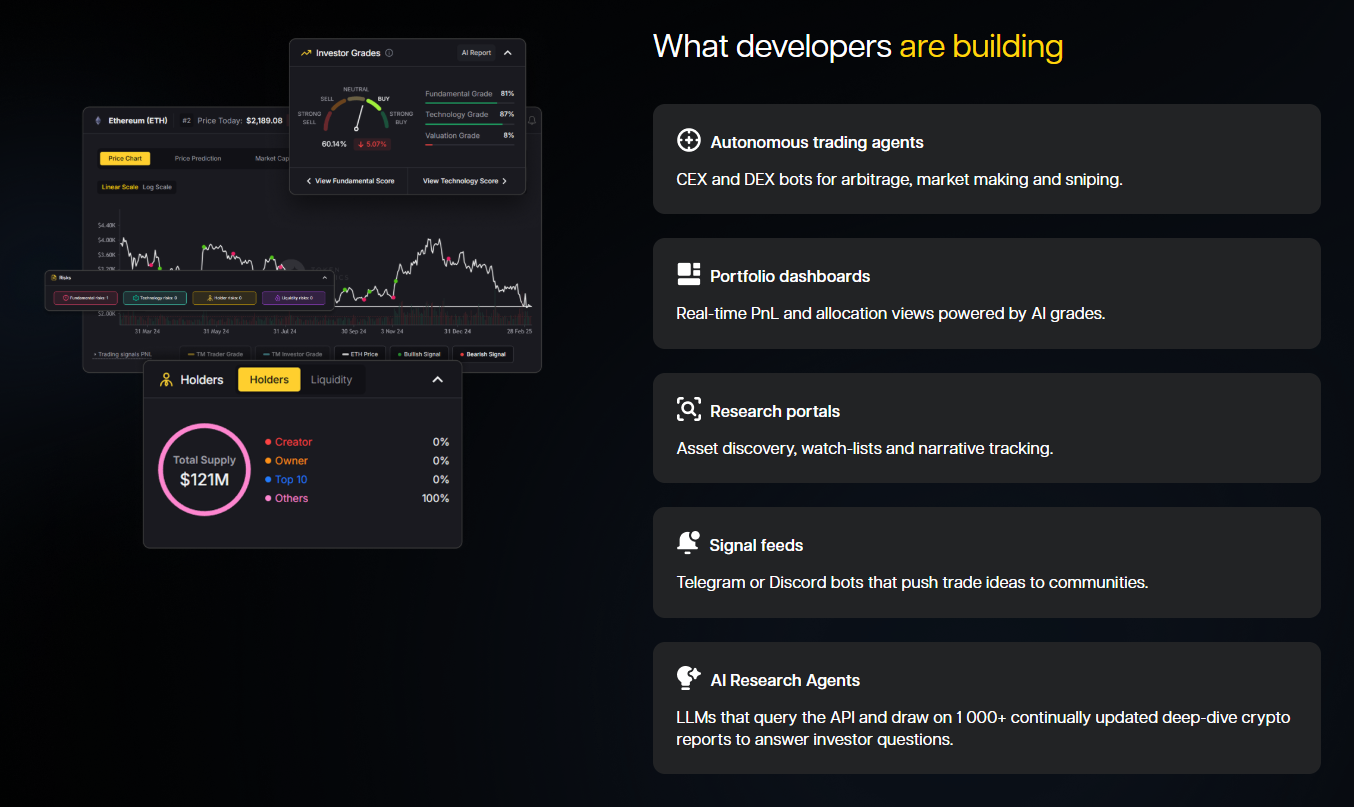

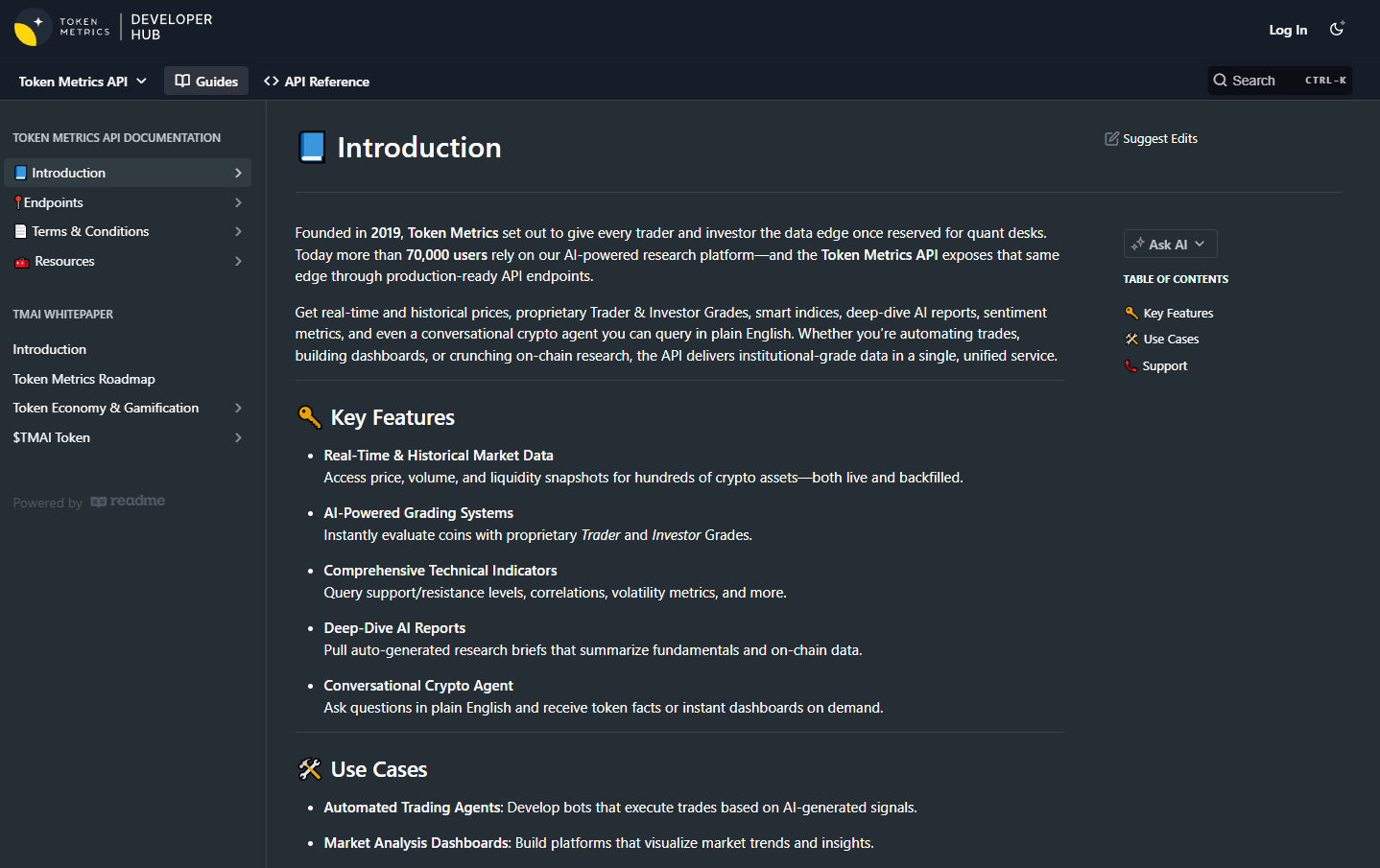

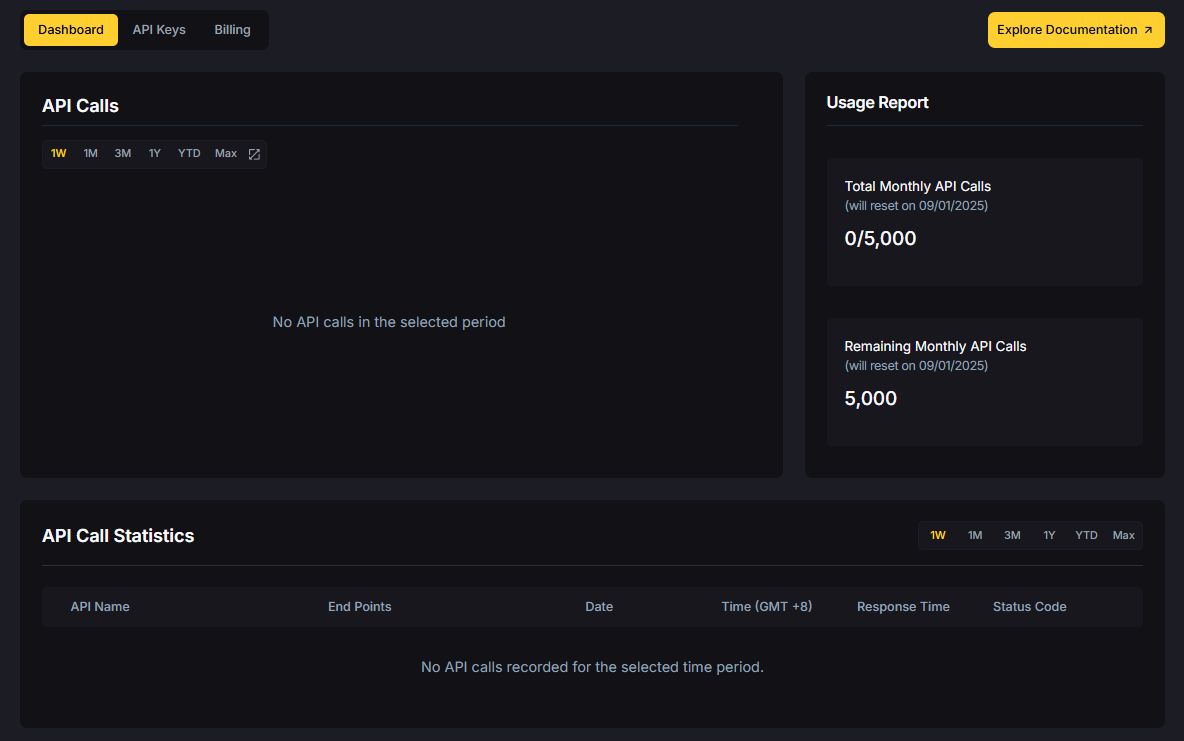

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

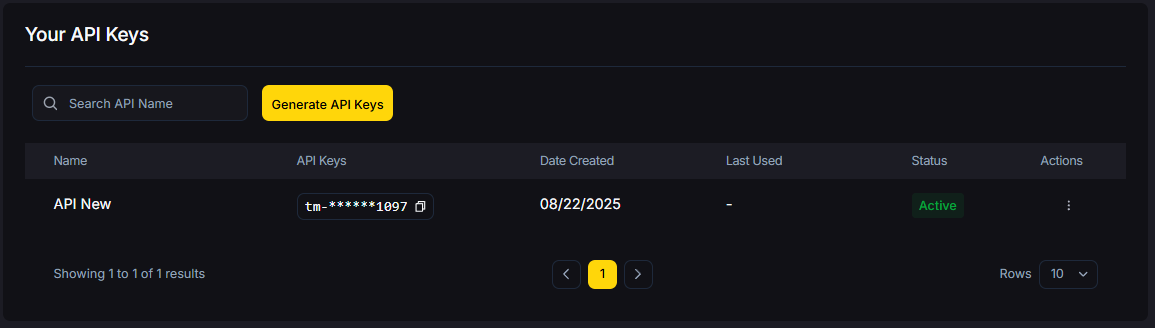

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

Understanding how to efficiently manage exposure in the dynamic world of cryptocurrency can seem daunting. Crypto indices provide a structured approach, helping investors and traders maintain diversified exposure without constant oversight. This article explores what crypto indices are, how they work, and why their rebalancing strategies are crucial in 2025.

A crypto index is a rules-based basket of digital assets that tracks a specific set of cryptocurrencies, such as the top-100 by market capitalization. These indices are designed to reflect broad market trends while reducing the complexity of individual asset management. They typically rebalance periodically to maintain consistent exposure, adapting to market fluctuations over time.

The core mechanism involves a few key processes:

Crypto indices offer several advantages:

Investors interested in accessing crypto indices can follow a straightforward process:

Crypto indices may suit different kinds of investors:

Understanding your trading style and risk appetite can help determine if a crypto index fits within your broader strategy.

Discover Crypto Gems with Token Metrics AI

A crypto index is a rules-based basket that tracks a defined set of assets (e.g., the top-100 by market cap), with a scheduled rebalance to keep exposure aligned. Token Metrics applies that idea and adds a regime switch to stablecoins.

Weekly. Constituents and weights update on schedule; if the market regime changes, the portfolio can switch between tokens and stablecoins outside that cadence.

A proprietary market signal. Bullish: hold the top-100 basket. Bearish: exit to stablecoins and wait for a re-entry signal.

At launch, funding options including wallet-funding supported by the embedded smart wallet and supported chains; USDC payouts are available when selling. Details are available during the buy/sell process.

No. The embedded wallet is self-custodial—you control your funds and keys.

Before confirming, you'll see estimated gas costs, platform fees, max slippage, and minimum expected value.

Visit the Token Metrics indices hub, open TM Global 100, and tap “Join Waitlist.” We will notify you once trading opens.

Self-custody: Embedded smart wallet with user-controlled keys. Transparency: Clear rules, holdings Treemap, and transactions logs. Fees: Shown before confirmation. Limitations: Signals can be wrong, no performance guarantees. Availability may vary by region and device.

Crypto is volatile and can lose value. Past performance does not predict future results. This article is for research and educational purposes only, not financial advice.

%201.svg)

%201.svg)

If you’ve ever wished for a crypto index that participates broadly in bull markets yet steps aside when risk turns south, this is it. Token Metrics Global 100 is a rules-based index that holds the top 100 crypto assets when our market signal is bullish—and moves fully to stablecoins when it isn’t. It rebalances weekly, shows transparent holdings and transaction logs, and can be purchased in one click with an embedded wallet. That’s disciplined exposure, minus the micromanagement. → Join the waitlist to be first to trade TM Global 100.

Two things define this cycle: speed and uncertainty. Narratives rotate in weeks, not months, and individual-coin risk can swamp portfolios. Indices let you own the market when conditions warrant, while a regime-switching approach aims to sidestep drawdowns by cutting risk to stablecoins. (A crypto index is a rules-based basket tracking a defined universe—here, a top-100 market-cap set—with scheduled rebalances.)

Regime switching: Bull: hold the top 100 by market cap. Bear: move fully to stablecoins, wait for a bullish re-entry signal.

Weekly rebalancing: Updates weights and constituents to reflect the current top-100 list.

Transparency: A Strategy modal explains rules; a Gauge shows the live market signal; Holdings appear in Treemap + Table; and every rebalance/transaction is logged.

What you’ll see on launch: Price tile • “100 tokens” • “rebalances weekly” • one-click Buy Index flow. → See the strategy and rules. (TM Global 100 strategy)

Time back: No more tracking 100 tickers or manual reweights. The weekly job runs for you.

Discipline on drawdowns: The stablecoin switch enforces risk management when the signal turns.

Less execution drag: One embedded wallet checkout vs. dozens of small trades that add slippage and fees.

See everything: Gauge → Treemap → Transactions Log—know what you hold, and what changed.

Own the market when it’s worth it: Capture broad upside in bullish regimes with top-100 breadth.

Open the Token Metrics Indices hub.

Tap TM Global 100 and select Join Waitlist.

(Optional) Connect wallet to preview the one-click Buy flow and funding options.

On launch, you’ll receive an email and in-app prompt.

Click Buy Index → review fees/slippage/holdings → confirm. Most users finish in ~90 seconds.

Track your position under My Indices with real-time P&L and a full transactions history. → Join the waitlist to be first to trade TM Global 100.

A rules-based basket that tracks a defined universe (here: top-100 market cap), with scheduled rebalances and clear inclusion criteria.

Weekly, with additional full-portfolio switches when the market regime changes.

A proprietary market signal. Bullish: hold top-100. Bearish: move fully to stablecoins until re-entry.

You’ll use the embedded wallet and supported on-chain assets; USDC is supported for selling. Funding options surface based on chain/wallet at checkout.

No. It’s an embedded, self-custodial smart wallet—you control funds.

At checkout, you’ll see estimated gas, platform fee, max slippage, and minimum expected value before confirming.

Visit the Indices hub, open TM Global 100, and tap Join Waitlist; we’ll notify you at launch.

Self-custody: Embedded smart wallet; you hold keys.

Operational clarity: Strategy modal, Holdings treemap/table, and Transactions log.

Fee & slippage preview: All shown before you confirm.

Regime logic limits: Signals can be wrong; switching can incur spreads and gas.

Region notes: Chain and asset support may vary by user wallet and jurisdiction.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want broad upside when it’s worth it and stablecoins when it’s not—with weekly rebalances, transparent logs, and a 90-second buy flow—Token Metrics Global 100 was built for you. Join the waitlist now and be first to trade at launch.

%201.svg)

%201.svg)

The cryptocurrency market has evolved from a niche digital experiment into a multi-trillion-dollar asset class. With thousands of tokens and coins available across hundreds of exchanges, the question isn't whether you should research before buying—it's how to conduct that research effectively. Smart investors know that thorough due diligence is the difference between identifying the next promising project and falling victim to a costly mistake.

Before diving into specific research methods, successful crypto investors start by understanding the fundamental difference between various digital assets. Bitcoin operates as digital gold and a store of value, while Ethereum functions as a programmable blockchain platform. Other tokens serve specific purposes within their ecosystems—governance rights, utility functions, or revenue-sharing mechanisms.

The first step in any research process involves reading the project's whitepaper. This technical document outlines the problem the project aims to solve, its proposed solution, tokenomics, and roadmap. While whitepapers can be dense, they reveal whether a project has substance or merely hype. Pay attention to whether the team clearly articulates a real-world problem and presents a viable solution.

A cryptocurrency project is only as strong as the team behind it. Investors scrutinize founder backgrounds, checking their LinkedIn profiles, previous projects, and industry reputation. Have they built successful companies before? Do they have relevant technical expertise? Anonymous teams aren't automatically red flags, but they require extra scrutiny and compelling reasons for their anonymity.

Development activity serves as a crucial health indicator for any blockchain project. GitHub repositories reveal whether developers are actively working on the project or if it's effectively abandoned. Regular commits, open issues being addressed, and community contributions all signal a vibrant, evolving project. Conversely, repositories with no activity for months suggest a project that may be dying or was never serious to begin with.

Understanding a token's economic model is essential for predicting its long-term value potential. Investors examine total supply, circulating supply, and emission schedules. Is the token inflationary or deflationary? How many tokens do the team and early investors hold, and when do those tokens unlock? Large unlock events can trigger significant price drops as insiders sell.

The token's utility within its ecosystem matters tremendously. Does holding the token provide governance rights, staking rewards, or access to platform features? Tokens without clear utility often struggle to maintain value over time. Smart researchers also investigate how value accrues to token holders—whether through buybacks, burning mechanisms, or revenue sharing.

Price action tells only part of the story, but market metrics provide valuable context. Trading volume indicates liquidity—can you buy or sell significant amounts without drastically moving the price? Market capitalization helps determine a token's relative size and potential growth runway. A small-cap project has more room to grow but carries higher risk.

On-chain metrics offer deeper insights into token health. Active addresses, transaction volume, and network usage reveal actual adoption versus speculation. High trading volume on exchanges with minimal on-chain activity might indicate wash trading or manipulation. Token distribution matters too—if a small number of wallets hold most of the supply, the token faces centralization risks and potential price manipulation.

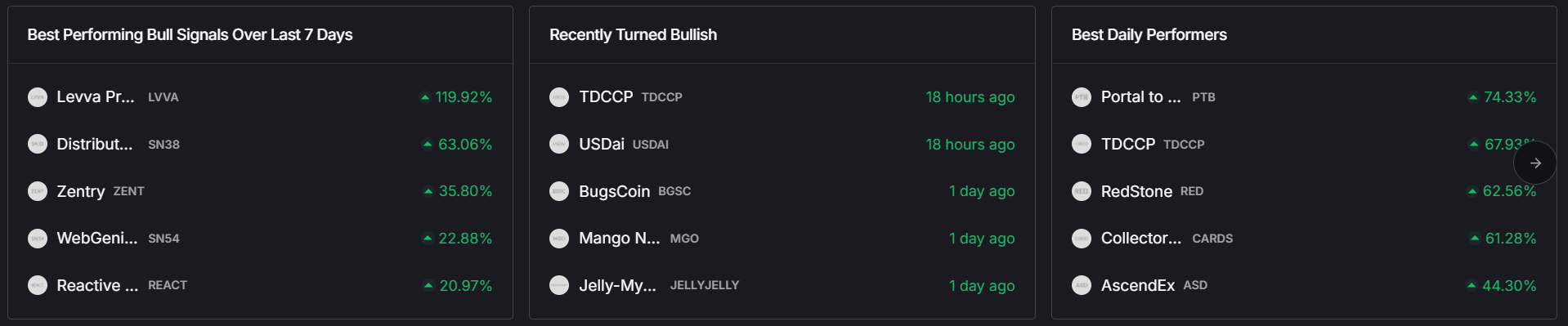

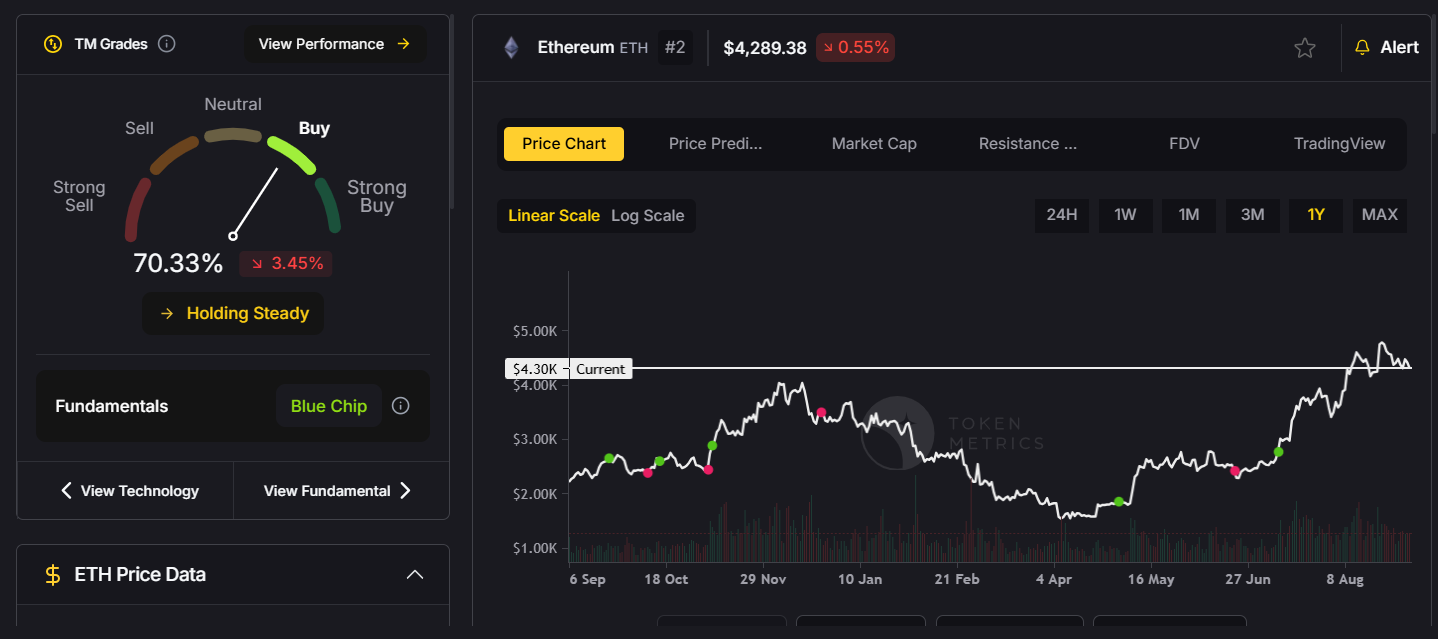

Professional crypto investors increasingly rely on sophisticated analytics platforms that aggregate multiple data sources and provide actionable insights. Token Metrics has emerged as a leading crypto trading and analytics platform, offering comprehensive research tools that save investors countless hours of manual analysis.

Token Metrics combines artificial intelligence with expert analysis to provide ratings and predictions across thousands of cryptocurrencies. The platform evaluates projects across multiple dimensions—technology, team, market metrics, and risk factors—delivering clear scores that help investors quickly identify promising opportunities. Rather than manually tracking dozens of metrics across multiple websites, users access consolidated dashboards that present the information that matters most.

The platform's AI-driven approach analyzes historical patterns and current trends to generate price predictions and trading signals. For investors overwhelmed by the complexity of crypto research, Token Metrics serves as an invaluable decision-support system, translating raw data into understandable recommendations. The platform covers everything from established cryptocurrencies to emerging DeFi tokens and NFT projects, making it a one-stop solution for comprehensive market research.

Cryptocurrency projects thrive or die based on their communities. Active, engaged communities signal genuine interest and adoption, while astroturfed communities relying on bots and paid shillers raise red flags. Investors monitor project Discord servers, Telegram channels, and Twitter activity to gauge community health.

Social sentiment analysis has become increasingly sophisticated, with tools tracking mentions, sentiment polarity, and influencer engagement across platforms. Sudden spikes in social volume might indicate organic excitement about a partnership or product launch—or orchestrated pump-and-dump schemes. Experienced researchers distinguish between authentic enthusiasm and manufactured hype.

The regulatory landscape significantly impacts cryptocurrency projects. Researchers investigate whether projects have faced regulatory scrutiny, registered as securities, or implemented compliance measures. Geographic restrictions, potential legal challenges, and regulatory clarity all affect long-term viability.

Security audits from reputable firms like CertiK, Trail of Bits, or ConsenSys Diligence provide crucial assurance about smart contract safety. Unaudited contracts carry significant risk of exploits and bugs. Researchers also examine a project's history—has it been hacked before? How did the team respond to security incidents?

Experienced investors develop instincts for spotting problematic projects. Guaranteed returns and promises of unrealistic gains are immediate red flags. Legitimate projects acknowledge risk and market volatility rather than making impossible promises. Copied whitepapers, stolen team photos, or vague technical descriptions suggest scams.

Pressure tactics like "limited time offers" or artificial scarcity designed to force quick decisions without research are classic manipulation techniques. Projects with more focus on marketing than product development, especially those heavily promoted by influencers being paid to shill, warrant extreme skepticism.

Cryptocurrency research isn't a one-time activity but an ongoing process. Markets evolve rapidly, projects pivot, teams change, and new competitors emerge. Successful investors establish systems for monitoring their holdings and staying updated on developments. Setting up Google Alerts, following project social channels, and regularly reviewing analytics help maintain awareness of changing conditions.

Whether you're evaluating established cryptocurrencies or exploring emerging altcoins, thorough research remains your best defense against losses and your greatest tool for identifying opportunities. The time invested in understanding what you're buying pays dividends through better decision-making and improved portfolio performance in this dynamic, high-stakes market.

%201.svg)

%201.svg)

The best cryptocurrency API isn’t just about raw data. It’s about empowering your application to perform faster, smarter, and more reliably. A truly great crypto API balances:

Whether you’re building a high-frequency crypto trading bot, a DeFi portfolio tracker, or a research platform, choosing the right API means aligning features with your mission.

Before selecting a crypto API, evaluate these criteria:

📌 Tip for builders: Always start with multiple free crypto APIs and benchmark them in your stack before committing long term.

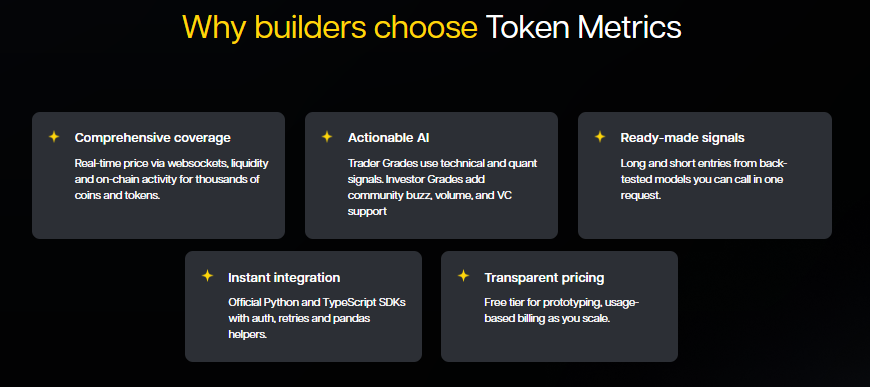

Most crypto APIs specialize in one dimension (prices, exchange data, or on-chain metrics). Token Metrics unifies them all and adds AI intelligence on top.

📌 Put simply: most crypto APIs give you data. Token Metrics gives you data + intelligence.

📌 For production apps: always monitor crypto API latency and uptime with tools like Datadog or Grafana.

While Token Metrics API offers an all-in-one solution, developers can also explore other resources for specialized needs:

📌 Strategy tip: many developers combine multiple APIs—Token Metrics for signals + CoinGecko for breadth + DefiLlama for yields—to cover all angles.

Which crypto API is best overall?

If you want real-time data plus AI-powered insights, crypto api is used. Token Metrics Api is the strongest all-in-one option. For niche use cases, CoinGecko is good for prices, Glassnode for on-chain analytics.

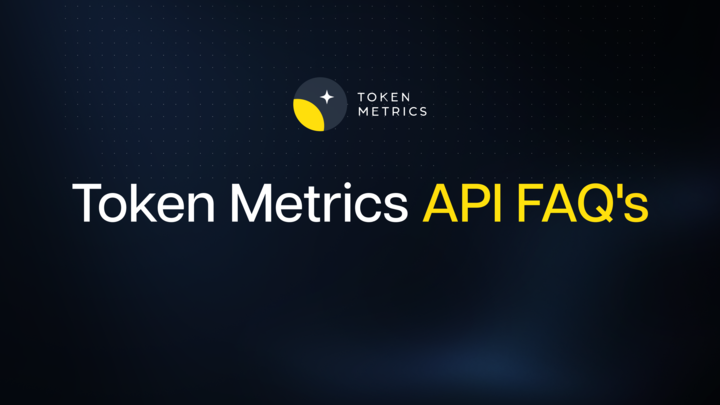

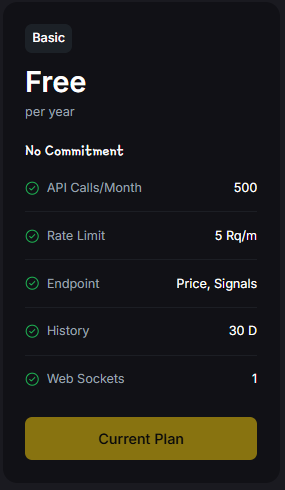

Is Token Metrics API free?

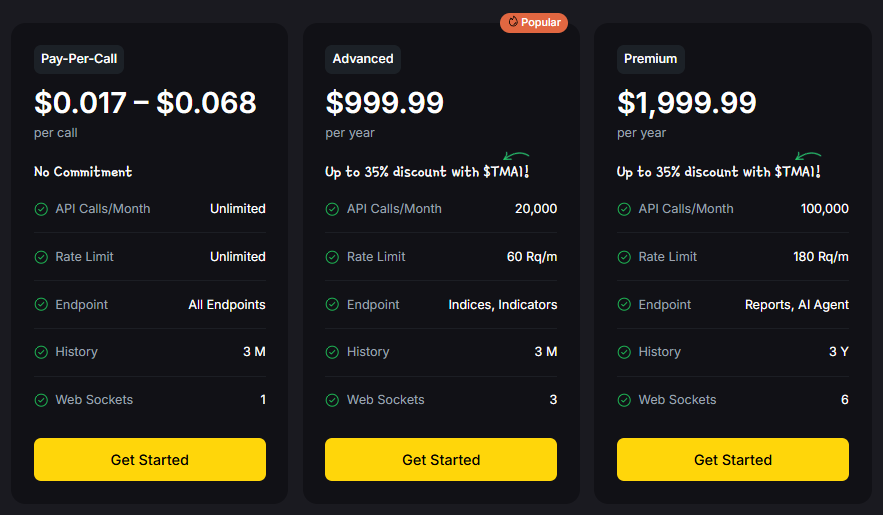

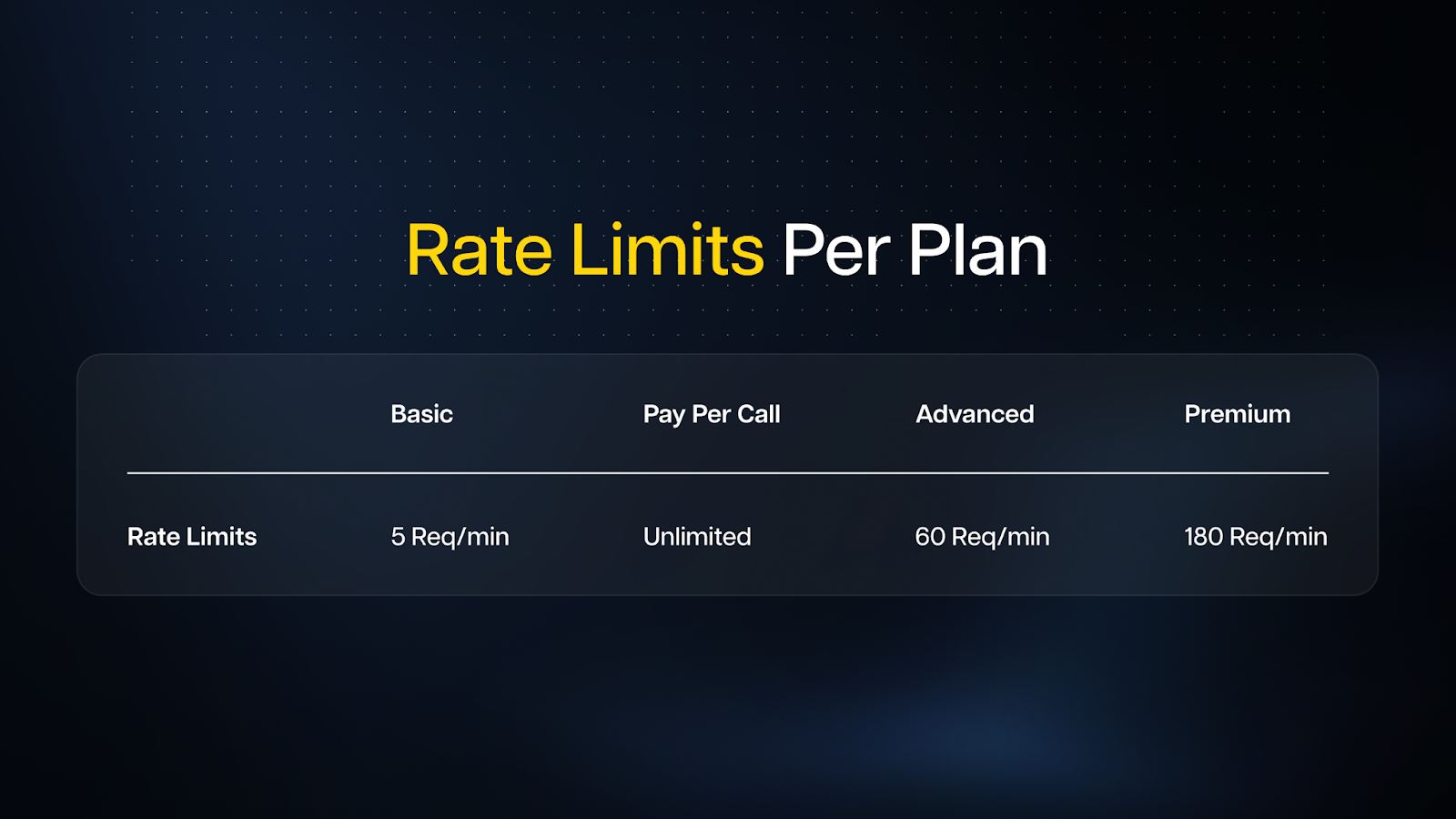

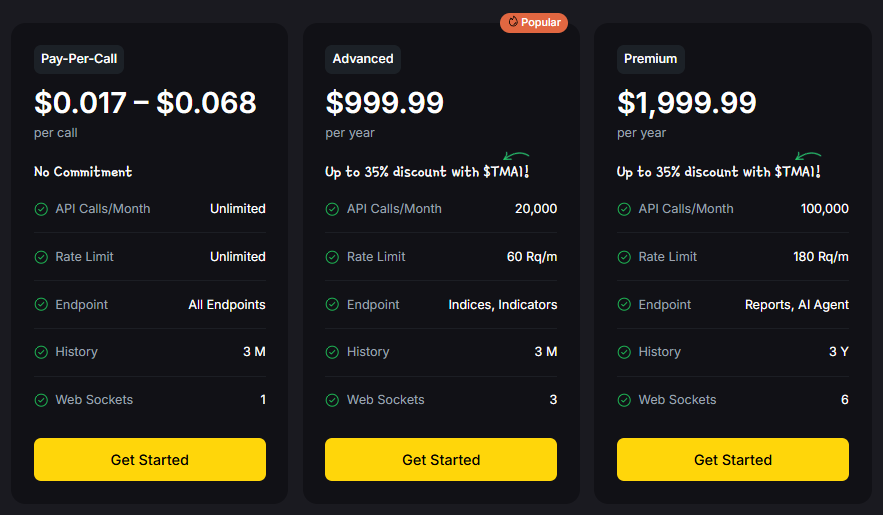

Yes, the free tier is perfect for prototyping. Paid plans unlock faster throughput, more history, and advanced endpoints.

How is Token Metrics different from CoinGecko?

CoinGecko tracks prices broadly. Token Metrics layers AI signals, indices, and predictive analytics for trading and research.

Can I build a trading bot with Token Metrics API?

Yes—many developers use the low-latency price feeds and predictive signals to power automated strategies.

As your project grows, Token Metrics offers flexible upgrade paths:

With up to 35% discounts when paying in TMAI tokens, scaling is cost-efficient.

📌 Why X.402 matters: Instead of locking into an annual plan, you can scale gradually with pay-per-call pricing—perfect for startups and experimental apps.

The best crypto API doesn’t just serve data—it helps your app think, act, and adapt. With Token Metrics, you start free, learn fast, and scale seamlessly. Combine it with other specialized APIs when needed, and you’ll have a development stack that’s both powerful and future-proof.

👉 Grab Your Free Token Metrics API Key and Start Building

%201.svg)

%201.svg)

In crypto, milliseconds can make or break a trade. Whether you’re building a high-frequency bot, a risk management tool, or a market dashboard, slow crypto APIs lead to:

📌 Example: In a Bitcoin price swing, even a 500 ms delay can translate to thousands in lost value for trading bots. That’s why developers emphasize low latency when choosing best Crypto APIs.

Not every Crypto API marketed as “fast” is built the same. A truly fast crypto API provides:

📌 Tip for builders: Always benchmark an API in real market conditions (during volatility) to see if “fast” performance holds up under stress.

What sets Token Metrics API apart is that it’s not just fast data—it’s fast intelligence:

📌 Instead of just reacting to prices, developers can anticipate market shifts with AI-driven signals.

Token Metrics API excels at fast data + signals, but developers often combine it with other tools for a full-stack setup:

📌 Pro tip: Use Token Metrics for predictive signals, and pair it with TradingView or DefiLlama for visualization and DeFi-specific data.

👉 Get Your Free Token Metrics API Key

When free limits aren’t enough, Token Metrics offers:

📌 Why X.402 matters: You can start scaling instantly with no upfront cost—just pay per call as you grow.

In crypto, speed without intelligence is noise. With Token Metrics Fast Crypto API, you get sub-second price data + AI-driven insights, giving your trading bots, dashboards, and AI agents the real-time edge they need.

%201.svg)

%201.svg)

No matter what kind of crypto app you’re building—a trading bot, a DeFi dashboard, or a research tool—the foundation is always accurate price data. Without it:

The best crypto prices API ensures:

📌 Example: An arbitrage bot relying on stale or inaccurate data won’t just underperform—it could lose money on every trade.

Not every API marketed for prices is built for precision. Key factors to consider include:

📌 Tip for developers: Start by asking, “Do I need accuracy, speed, or depth the most?” The answer often determines which API fits your project.

Where many crypto APIs stop at providing raw price feeds, Token Metrics API enriches price data with context and intelligence.

📌 Most crypto APIs give you numbers. Token Metrics gives you numbers + insights.

📌 Example: Production apps can combine Token Metrics for intelligence + CoinGecko for breadth to balance reliability with insights.

Developers often mix and match APIs to cover specialized needs:

Pairing Token Metrics with these resources gives developers a multi-layered data stack—accurate prices, predictive signals, and extra DeFi/social context.

👉 Get Your Free Token Metrics API Key

Which crypto API has the best price accuracy?

Token Metrics validates data from multiple exchanges, ensuring cleaner and more reliable price feeds.

Can I get historical prices with Token Metrics API?

Yes—OHLC and tick-level datasets are available for multi-year backtesting.

Is the Token Metrics API free?

Yes, there’s a free tier for prototypes. Paid plans unlock higher request rates and advanced data.

How fast are Token Metrics updates?

Sub-second latency with WebSocket support for real-time responsiveness.

As your project scales, Token Metrics makes upgrading simple:

📌 Why X.402 matters: Instead of locking into annual costs, you can pay as you grow—ideal for startups and experimental apps.

In crypto, price accuracy is trust. Whether you’re building a bot, a dashboard, or a research tool, Token Metrics provides more than just numbers. With validated prices, deep history, and AI-enhanced insights, you can build applications that stand out.

👉 Start Free With Token Metrics API

%201.svg)

%201.svg)

The cryptocurrency market has fundamentally changed, and investors clinging to outdated strategies are being left behind. The traditional "buy and hold" approach that created millionaires in previous crypto cycles is no longer viable in today's narrative-driven, attention-economy market. Understanding these new dynamics isn't just advantageous—it's essential for survival.

Modern crypto markets operate on attention cycles that move faster than ever before. Projects gain momentum not through gradual adoption but through sudden narrative capture, social media virality, and ecosystem developments that spark immediate interest. This shift has created what analysts call "crypto's shiny object syndrome," where market attention rapidly moves between tokens based on trending topics and emerging narratives.

The evidence is clear in recent market performance. Tokens that dominated headlines just weeks ago—Pendle, Zora, Aerodrome, and BIO—have all lost momentum despite strong fundamentals. These weren't failed projects; they were victims of attention rotation. Pendle, for instance, had significant technical advantages and partnerships, but once market attention shifted elsewhere, price action followed suit.

Professional traders have adapted to this environment by developing systematic approaches to narrative trading. Rather than picking long-term winners based solely on fundamentals, successful investors now track trending tokens—projects capturing current market attention regardless of their long-term prospects.

This approach requires discipline and timing. The most effective strategy involves monitoring tokens gaining traction, entering positions when momentum indicators align, and exiting before attention cycles complete. It's not about finding the next Bitcoin; it's about riding successive waves of market interest across multiple projects.

The time horizon for these trades has compressed dramatically. Where previous cycles might have rewarded six-month to two-year holding periods, today's successful trades often last days to weeks. This compression reflects the market's increased efficiency in pricing narrative value and the accelerated pace of information flow in crypto communities.

While traditional DeFi projects struggle with attention retention, two sectors are showing sustained growth potential: gaming and creator economies. The gaming narrative, often dismissed after previous disappointments, is experiencing a quiet renaissance backed by substantial venture capital investment and improved product development.

Projects like Star Atlas, previously written off after the FTX collapse, have continued building and recently released gameplay elements that demonstrate genuine progress toward AAA-quality gaming experiences. This persistence during bear market conditions positions gaming tokens for significant upside when broader market sentiment improves.

Simultaneously, the creator economy is evolving through platforms like Pump.fun, which recently distributed $2 million in fees within 24 hours of launching new creator tools. This represents a 20x increase from previous daily averages, indicating massive untapped demand for creator monetization tools in crypto.

Beyond gaming and creators, the stablecoin infrastructure narrative presents perhaps the most compelling long-term opportunity. Unlike attention-driven meme coins, stablecoin infrastructure addresses genuine utility needs while benefiting from regulatory tailwinds and institutional adoption.

Projects like Plasma, which enables zero-fee USDT transfers, directly compete with established players like Tron while offering superior user experiences. The $1 billion in testnet deposits demonstrates real demand for these services, not just speculative interest.

This infrastructure development occurs alongside broader tokenization trends. Traditional assets—from stocks to treasuries—are increasingly moving on-chain, creating new opportunities for projects facilitating this transition. The convergence of stablecoin infrastructure and real-world asset tokenization could define the next major crypto adoption wave.

Success in narrative-driven markets requires sophisticated risk management that extends beyond traditional portfolio allocation. Investors must monitor momentum indicators, social sentiment, and attention metrics alongside fundamental analysis. The goal isn't to predict long-term winners but to identify and capture successive narrative cycles efficiently.

This approach demands emotional discipline that many investors find challenging. Exiting profitable positions while momentum remains positive contradicts natural holding instincts, yet it's essential for consistent returns in attention-driven markets. The most successful traders treat each position as temporary, focusing on momentum preservation rather than conviction-based holding.

The crypto market's evolution from speculation to narrative-driven trading represents a maturation process that rewards adaptability over stubbornness. Investors who recognize this shift and develop appropriate strategies will thrive, while those clinging to outdated approaches will struggle.

The new crypto paradigm isn't necessarily better or worse than previous cycles—it's simply different. Success requires understanding these differences and adjusting strategies accordingly. In a market where attention is currency and narratives drive price action, the most important skill isn't picking winners—it's staying flexible enough to ride whatever wave comes next.

The death of "buy and hold" doesn't mean the end of profitable crypto investing. It means the beginning of a more sophisticated, dynamic approach that rewards skill, timing, and market awareness over simple conviction. Those who master these new rules will find opportunities that dwarf traditional investment returns, while those who resist change will watch from the sidelines as markets evolve beyond their understanding.

%201.svg)

%201.svg)

The cryptocurrency market is experiencing a seismic shift that most investors are missing. While Bitcoin has long been the undisputed king of digital assets, institutional money is quietly rotating into Ethereum at an unprecedented pace, signaling a potential altcoin season that could reshape the entire market landscape.

Recent data reveals a striking trend that should have every crypto investor's attention. In August alone, Ethereum ETFs attracted a staggering $3.69 billion in inflows, marking the fourth consecutive month of positive institutional investment. This stands in stark contrast to Bitcoin, which saw $800 million in outflows during the same period.

This isn't just a minor adjustment in portfolio allocation—it's a fundamental shift in how institutional investors view the crypto ecosystem. The rotation from Bitcoin to Ethereum represents more than just diversification; it's a bet on the future of decentralized finance, smart contracts, and blockchain utility beyond simple store-of-value propositions.

Behind Ethereum's surge lies a powerful but often overlooked driver: the stablecoin economy. Currently, 3.4% of Ethereum's total circulating supply is held by treasury companies, with this percentage accelerating rapidly since July. This trend reflects a broader recognition that stablecoins represent crypto's "ChatGPT moment"—the application that finally demonstrates blockchain's real-world utility to mainstream users.

The stablecoin narrative extends far beyond simple transfers. New Layer 1 blockchains like Plasma are emerging specifically to facilitate zero-fee USDT transfers, directly challenging Tron's dominance in this space. With over $1 billion in USDT deposits on its testnet alone, Plasma demonstrates the massive demand for efficient stablecoin infrastructure.

Market technicals support the institutional flow narrative. The Bitcoin versus Altcoin season chart shows that 58% of returns are currently coming from altcoins—a surprising figure considering the market's neutral-to-bearish sentiment. Historically, true altcoin season occurs when nearly 90% of returns flow to alternatives, as seen in August 2022 and May 2021.

This data suggests the market hasn't yet experienced the full-blown altcoin euphoria typical of cycle peaks. The implication? The current cycle may extend well into 2026, providing extended opportunities for strategic investors willing to look beyond Bitcoin's dominance.

The launch of World Liberty Financial (WLFI) adds another layer to the evolving crypto landscape. Amid the ongoing selling pressure, the token's ability to hold above $0.20 will determine its strength in the coming days. The same level where treasury companies accumulated positions indicates underlying institutional support. With the Trump family reportedly owning a third of the supply and generating approximately $3 billion in value at launch, WLFI represents the intersection of politics and crypto in unprecedented ways.

This political backing could provide regulatory tailwinds for the broader crypto market, particularly as other politicians consider similar token launches. California Governor Gavin Newsom's rumored meme coin plans suggest that cryptocurrency fundraising may become a standard tool for political campaigns, bringing mainstream legitimacy to digital assets.

The Ethereum rotation story isn't just about ETH itself—it's about the entire ecosystem of projects built on Ethereum's infrastructure. Base-layer tokens, DeFi protocols, and Ethereum-native projects have already begun showing strength, with tokens like Aerodrome and Zora experiencing significant runs during Ethereum's rally from $2,300 to nearly $5,000.

However, this market requires a different investment approach than previous cycles. The old "buy and hold" strategy shows diminishing returns in today's narrative-driven environment. Instead, successful investors are adapting to shorter holding periods, focusing on trending tokens with strong fundamentals and clear catalysts.

The key insight? We're witnessing the maturation of cryptocurrency from a speculative asset class to a functional financial infrastructure. Ethereum's institutional adoption, stablecoin integration, and smart contract capabilities position it as the backbone of this new financial system. Investors who recognize this transition early stand to benefit from one of the most significant shifts in crypto market dynamics since Bitcoin's inception.

%201.svg)

%201.svg)

APIs power modern software by enabling different programs, services, and devices to exchange data and trigger actions. Whether you use a weather app, log in with a social account, or connect a trading bot to a price feed, an API is usually working behind the scenes. This guide breaks down what an API is, how it functions technically, common types and use cases, and practical steps to evaluate and use APIs safely and efficiently.

An API — short for Application Programming Interface — is a formal set of rules and endpoints that lets one software component request data or services from another. Rather than a single piece of software, think of an API as a contract: it defines the methods, parameters, and expected responses so developers can integrate components without sharing internal implementation details.

Key elements in that contract include:

At a technical level, APIs follow client-server interactions. A client application composes a request and sends it to an API endpoint over a transport layer like HTTP(S). The API server validates the request, performs the requested operation (e.g., fetch data, initiate a transaction), and returns a response. Responses include status codes and structured data that the client can parse and handle.

Important architectural patterns and protocols include:

Security and reliability are intrinsic: rate limits, API keys, OAuth flows, TLS encryption, and schema validation help maintain integrity and availability. Observability — logs, metrics, and tracing — allows teams to debug integrations and measure performance.

APIs power many familiar scenarios across industries. Common types and examples:

Typical use cases include:

In domains like crypto and AI research, APIs let developers access price histories, on-chain data, and model outputs programmatically. AI-driven research tools such as Token Metrics combine signals and historical analysis through APIs to support systematic investigation of datasets.

When choosing or integrating an API, apply a structured evaluation to reduce technical and operational risk:

Integration steps:

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

An API is a broader concept describing an interface for software interaction. A web service is a specific kind of API that uses web protocols (usually HTTP) to exchange data. Not all APIs are web services (some use binary RPC), but most public APIs today are web-based.

Common methods include API keys, OAuth 2.0 flows, JWT tokens, and mutual TLS. The choice depends on security needs: OAuth is suitable for delegated access, while API keys are simple for server-to-server integrations.

Rate limiting restricts the number of requests a client can make in a time window. It protects the API provider from abuse and ensures fair usage. Clients should implement exponential backoff and respect provided retry headers.

APIs can evolve, which is why versioning matters. Good providers document deprecation schedules and maintain backward-compatible versions. Contract testing and version pinning help clients avoid disruptions.

Never hard-code secrets in client-side code. Store keys in secure vaults, use environment variables for servers, restrict keys by origin/IP, and rotate keys on a regular schedule.

JSON is the dominant format due to readability and language support. XML remains in some legacy systems. Binary formats like Protocol Buffers are used where performance and compact size are priorities.

APIs expose data and model capabilities that AI agents can call for retrieval, scoring, and orchestration. Combining data APIs with model APIs allows automated workflows that augment research and decision-support processes.

This article is for informational and educational purposes only. It does not constitute professional, legal, or financial advice. Evaluate APIs and tools based on your own technical, legal, and operational requirements before integrating them into production systems.

%201.svg)

%201.svg)

APIs power much of the digital world but the term can feel abstract to newcomers. Whether you are building a web app, integrating an AI model, or pulling market data for research, understanding what an API is and how to evaluate one speeds development and improves reliability. This guide breaks down core concepts, common patterns, and practical steps to choose and use APIs effectively—without assuming prior expertise.

An API (Application Programming Interface) is a defined set of rules and protocols that lets one software program request services or data from another. At a high level, an API specifies:

Think of an API as a waitstaff in a restaurant: you (the client) place an order (request) using a menu (API documentation), and the kitchen (server) returns a dish (response). The menu defines what is possible and how to order it.

APIs come in different styles depending on design goals and constraints:

Each type has trade-offs: REST is simple and widely compatible, GraphQL is flexible for variable payloads, and gRPC is optimized for performance between services.

APIs are central to modern crypto and AI stacks. In crypto, APIs provide access to market prices, on-chain data, wallet balances, and transaction histories. In AI, APIs expose model inference endpoints, allowing applications to send prompts and receive processed outputs without hosting models locally.

When connecting these domains—such as feeding on-chain data into an AI research pipeline—developers use layered APIs: one service to fetch reliable market or chain data, another to run models or scoring logic. For example, research platforms and data providers expose standardized endpoints so teams can automate backtesting, signal generation, and analytics workflows.

For neutral examples of an analytics provider in the crypto space, see Token Metrics, which demonstrates how specialized APIs and models can structure insights for research use cases.

Choosing and integrating an API is a mix of technical evaluation and operational planning. Use this checklist:

Applying this framework helps teams decide between alternatives (self-hosting vs managed, REST vs GraphQL) based on their latency, cost, and control needs.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

An API is a set of rules for interacting with a service, typically over a network. An SDK (Software Development Kit) is a package that may include APIs, helper libraries, and tools to make integrating those APIs easier in a specific programming language.

REST maps resources to endpoints and is simple to cache and reason about. GraphQL lets clients request only needed fields and combine multiple resources in one query, which can reduce round trips but may add server-side complexity.

Public APIs can be secure if they implement proper authentication, encryption, and access controls. Avoid sending sensitive secrets through unencrypted channels and use scoped credentials and least-privilege principles.

Rate limits cap how many requests a client can make in a time window. Design strategies include batching requests, caching responses, exponential backoff on errors, and choosing higher-tier plans if sustained throughput is required.

Yes. Orchestration patterns let you fetch data from one API, transform it, and pass it to another (for example, pulling market data into an AI inference pipeline). Maintain clear error handling and data validation between steps.

Use sandbox or staging environments when possible, write automated tests for expected responses and error states, monitor real-world requests, and include assertions for schema and performance thresholds.

Common methods include API keys, OAuth 2.0 tokens, and mutual TLS. Select a method that balances ease of use and security for your application's context.

This article is educational and informational only. It does not constitute financial, legal, or professional advice. Evaluate APIs and tools independently, review provider terms, and consider operational and security requirements before integration.

%201.svg)

%201.svg)

APIs (Application Programming Interfaces) are the invisible connectors that let software systems talk to each other. Whether you open a weather app, embed a payment form, or fetch crypto market data, APIs are doing the behind-the-scenes work. This guide explains what an API is, how APIs function, common types, practical use cases, and how to evaluate them securely and effectively.

An API is a defined set of rules and protocols that allows one software component to request services or data from another. Think of an API as a waiter in a restaurant: you (the client) request a dish, the waiter (the API) passes the order to the kitchen (the server), and then returns the prepared meal. APIs standardize interactions so developers can integrate external functionality without understanding internal implementation details.

At a technical level, most modern APIs use web protocols over HTTP/HTTPS. A client sends a request (GET, POST, PUT, DELETE) to a defined endpoint URL. The server processes the request, optionally interacts with databases or other services, and returns a response, often in JSON or XML format. Key components:

APIs come in several architectural styles and transport patterns. Understanding differences helps pick the right integration model.

In crypto and AI contexts, APIs are central to tooling and research workflows:

AI-driven research platforms and analytics services can combine multiple API feeds to produce indicators, signals, or summaries. Platforms like Token Metrics illustrate how aggregated datasets and models can be exposed via APIs to power decision-support tools.

Before integrating an API, apply a simple due-diligence framework:

APIs introduce attack surfaces. Adopt defensive measures:

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Q: What is the simplest way to describe an API?

A: An API is an interface that defines how software components communicate—standardized requests and responses that let systems share data and functionality.

Q: When should I use REST vs WebSocket or GraphQL?

A: REST is suitable for standard CRUD operations. WebSocket is appropriate for real-time bidirectional needs like live feeds. GraphQL is useful when clients need flexible queries to minimize data transfer.

Q: What are common API security concerns?

A: Major concerns include credential leakage, insufficient authorization, unencrypted transport, and abuse due to inadequate rate limiting. Following best practices reduces these risks.

Q: Are free APIs viable for production?

A: Free tiers can be useful for prototypes and low-traffic apps, but evaluate limits, reliability, and support before relying on them for critical production workloads.

Q: What factors matter most when selecting an API?

A: Prioritize data relevance, latency, reliability, documentation quality, security controls, and cost. Prototype early to validate assumptions about performance and coverage.

This article is educational and informational only. It does not provide financial, legal, or investment advice. Evaluate tools and services independently and consult professionals where appropriate.

%201.svg)

%201.svg)

APIs are the invisible glue connecting modern software — from mobile apps and cloud services to AI agents and crypto dashboards. Understanding what an API is, how it works, and how to evaluate one is essential for builders, analysts, and product managers who need reliable data and interoperable systems. This guide breaks down APIs into practical components, shows common real-world use cases, and outlines security and integration best practices without jargon.

API stands for "Application Programming Interface." At its core, an API is a contract between two software systems that defines how they exchange information. Instead of sharing raw databases or duplicating functionality, systems expose endpoints (URL patterns or function calls) that clients can use to request specific data or actions.

APIs matter because they enable modularity and reuse. Developers can consume services—such as authentication, payments, mapping, or market data—without rebuilding them. For example, a crypto portfolio app might fetch price feeds, on-chain metrics, and historical candles via multiple APIs rather than maintaining every data pipeline internally.

APIs also power automation and AI: machine learning models and AI agents frequently call APIs to retrieve fresh data, trigger workflows, or enrich decision-making pipelines. Tools like Token Metrics use APIs to combine price feeds, signals, and on-chain indicators into research products.

Most web APIs follow a simple request–response pattern over HTTP(S). A client sends a request to an endpoint and receives a response containing status information and payload data. Key elements to understand:

Understanding these primitives helps teams design robust clients: retry logic for transient errors, pagination for large datasets, and schema validation for payload integrity.

APIs come in several flavors depending on their design and purpose. Recognizing the differences helps you pick the right integration model.

Use-case examples:

When integrating any external API, consider availability and trustworthiness alongside features. Key operational and security practices include:

Selecting the right provider often requires scenario analysis: trade off latency vs. cost, historical depth vs. real-time freshness, and breadth of endpoints vs. ease of use. Well-documented APIs with client SDKs, clear versioning, and robust support reduce integration risk.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Q1: What’s the difference between an API and a web service?

An API is a broader concept: a set of rules for interacting with software. A web service is a type of API that specifically uses web protocols (HTTP) to exchange data between systems.

Authentication methods vary: API keys for simple use cases, OAuth for delegated access, or HMAC signatures for high-security endpoints. Always follow the provider’s recommended flow and protect credentials.

GraphQL is useful when clients need flexible queries and should avoid over- or under-fetching. REST is simpler and often sufficient for straightforward resource-based designs. Choose based on data complexity and client requirements.

Rate limits control how many requests you can make in a given window. Plan batching, caching, and backoff strategies to stay within limits while maintaining performance and reliability.

Yes. Real-time needs are typically met with WebSocket or streaming APIs that push updates to clients. Polling REST endpoints frequently is possible but less efficient and may hit rate limits.

Look at documentation quality, authentication options, latency, historical data availability, SDKs, support channels, and uptime history. Proof-of-concept integrations and small-scale performance tests reveal practical fit.

This article is educational and informational only. It does not constitute financial, legal, or investment advice. Evaluate APIs and providers based on your organization’s technical requirements, compliance needs, and risk tolerance before integrating.

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.