Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

APIs are the invisible connectors that let apps talk to each other. Whether you’re loading a weather widget, pulling crypto prices into a dashboard, or integrating an AI model, understanding how APIs work helps you design, evaluate, and secure systems that depend on reliable data.

An API—Application Programming Interface—is a clearly defined set of rules and contracts that lets one software program request services or data from another. At its core an API specifies how to format requests, what endpoints are available, what parameters are accepted, and how the provider will respond. Think of it as a menu at a restaurant: you pick dishes (requests), the kitchen prepares them (the service), and the waiter returns your order (the response) without exposing internal cooking processes.

APIs exist at many levels: operating system APIs expose filesystem and device operations, library APIs expose functions and classes, and web APIs expose remote services across networks. In modern web and mobile development, "API" often refers to HTTP-based interfaces that return structured data like JSON or XML.

Most web APIs operate on a request–response model. A client issues a request to a defined endpoint using a method (GET, POST, PUT, DELETE), optionally supplying parameters or a payload. The server processes the request and returns a response with a status code and body.

Key technical elements to understand:

Real-time APIs may use WebSockets or server-sent events for streaming data rather than repeated HTTP polling. Designing for observability—clear logs, metrics, and error messages—improves operational resilience.

Different projects require different API styles. Choosing a style depends on latency, flexibility, compatibility, and developer experience needs.

APIs are often packaged with SDKs for languages like Python, JavaScript, or Go to simplify integration. Documentation, example requests, and interactive consoles dramatically improve adoption.

APIs are central to crypto and AI ecosystems. In crypto, APIs provide market data (prices, order books), on-chain insights (transaction history, token balances), and node RPC endpoints for smart contract interaction. AI systems use APIs to host inference endpoints, orchestrate models, and integrate external data sources for context.

Key considerations when selecting or building APIs for these domains:

Tools like Token Metrics combine market and on-chain data with AI to support research workflows that depend on reliable API feeds and model-driven signals.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

REST exposes multiple endpoints representing resources; clients may need several calls to assemble data. GraphQL exposes a single query endpoint where clients request precisely the fields they need. REST is simpler to cache; GraphQL offers flexibility but can require extra server-side tooling to manage complex queries and performance.

Never embed keys in client-side code. Store keys in secure server environments or secrets managers, rotate keys periodically, apply scope and rate limits, and monitor usage. Implementing short-lived tokens and IP whitelisting adds protection for sensitive endpoints.

Use webhooks when you need event-driven, near-real-time notifications and want to avoid the overhead of frequent polling. Webhooks push updates to your endpoint, but require you to handle retries, verify payload signatures, and secure the receiving endpoint.

Yes. Many projects wrap node RPCs with REST or GraphQL layers to standardize queries and add caching, rate limiting, and enrichment (e.g., token metadata). Be mindful of node sync status, resource consumption, and privacy considerations when exposing node endpoints.

Assess API documentation quality, uptime/SLAs, latency, data freshness, authentication options, and support channels. Request sample data, test in sandbox environments, and compare pricing with expected usage. For crypto use cases, verify on-chain data coverage and reconciliation methods.

This article is for educational purposes and does not constitute investment advice or recommendations. Evaluate APIs, platforms, and tools against your own requirements and compliance obligations before use.

%201.svg)

%201.svg)

The cryptocurrency market has fundamentally changed, and investors clinging to outdated strategies are being left behind. The traditional "buy and hold" approach that created millionaires in previous crypto cycles is no longer viable in today's narrative-driven, attention-economy market. Understanding these new dynamics isn't just advantageous—it's essential for survival.

Modern crypto markets operate on attention cycles that move faster than ever before. Projects gain momentum not through gradual adoption but through sudden narrative capture, social media virality, and ecosystem developments that spark immediate interest. This shift has created what analysts call "crypto's shiny object syndrome," where market attention rapidly moves between tokens based on trending topics and emerging narratives.

The evidence is clear in recent market performance. Tokens that dominated headlines just weeks ago—Pendle, Zora, Aerodrome, and BIO—have all lost momentum despite strong fundamentals. These weren't failed projects; they were victims of attention rotation. Pendle, for instance, had significant technical advantages and partnerships, but once market attention shifted elsewhere, price action followed suit.

Professional traders have adapted to this environment by developing systematic approaches to narrative trading. Rather than picking long-term winners based solely on fundamentals, successful investors now track trending tokens—projects capturing current market attention regardless of their long-term prospects.

This approach requires discipline and timing. The most effective strategy involves monitoring tokens gaining traction, entering positions when momentum indicators align, and exiting before attention cycles complete. It's not about finding the next Bitcoin; it's about riding successive waves of market interest across multiple projects.

The time horizon for these trades has compressed dramatically. Where previous cycles might have rewarded six-month to two-year holding periods, today's successful trades often last days to weeks. This compression reflects the market's increased efficiency in pricing narrative value and the accelerated pace of information flow in crypto communities.

While traditional DeFi projects struggle with attention retention, two sectors are showing sustained growth potential: gaming and creator economies. The gaming narrative, often dismissed after previous disappointments, is experiencing a quiet renaissance backed by substantial venture capital investment and improved product development.

Projects like Star Atlas, previously written off after the FTX collapse, have continued building and recently released gameplay elements that demonstrate genuine progress toward AAA-quality gaming experiences. This persistence during bear market conditions positions gaming tokens for significant upside when broader market sentiment improves.

Simultaneously, the creator economy is evolving through platforms like Pump.fun, which recently distributed $2 million in fees within 24 hours of launching new creator tools. This represents a 20x increase from previous daily averages, indicating massive untapped demand for creator monetization tools in crypto.

Beyond gaming and creators, the stablecoin infrastructure narrative presents perhaps the most compelling long-term opportunity. Unlike attention-driven meme coins, stablecoin infrastructure addresses genuine utility needs while benefiting from regulatory tailwinds and institutional adoption.

Projects like Plasma, which enables zero-fee USDT transfers, directly compete with established players like Tron while offering superior user experiences. The $1 billion in testnet deposits demonstrates real demand for these services, not just speculative interest.

This infrastructure development occurs alongside broader tokenization trends. Traditional assets—from stocks to treasuries—are increasingly moving on-chain, creating new opportunities for projects facilitating this transition. The convergence of stablecoin infrastructure and real-world asset tokenization could define the next major crypto adoption wave.

Success in narrative-driven markets requires sophisticated risk management that extends beyond traditional portfolio allocation. Investors must monitor momentum indicators, social sentiment, and attention metrics alongside fundamental analysis. The goal isn't to predict long-term winners but to identify and capture successive narrative cycles efficiently.

This approach demands emotional discipline that many investors find challenging. Exiting profitable positions while momentum remains positive contradicts natural holding instincts, yet it's essential for consistent returns in attention-driven markets. The most successful traders treat each position as temporary, focusing on momentum preservation rather than conviction-based holding.

The crypto market's evolution from speculation to narrative-driven trading represents a maturation process that rewards adaptability over stubbornness. Investors who recognize this shift and develop appropriate strategies will thrive, while those clinging to outdated approaches will struggle.

The new crypto paradigm isn't necessarily better or worse than previous cycles—it's simply different. Success requires understanding these differences and adjusting strategies accordingly. In a market where attention is currency and narratives drive price action, the most important skill isn't picking winners—it's staying flexible enough to ride whatever wave comes next.

The death of "buy and hold" doesn't mean the end of profitable crypto investing. It means the beginning of a more sophisticated, dynamic approach that rewards skill, timing, and market awareness over simple conviction. Those who master these new rules will find opportunities that dwarf traditional investment returns, while those who resist change will watch from the sidelines as markets evolve beyond their understanding.

%201.svg)

%201.svg)

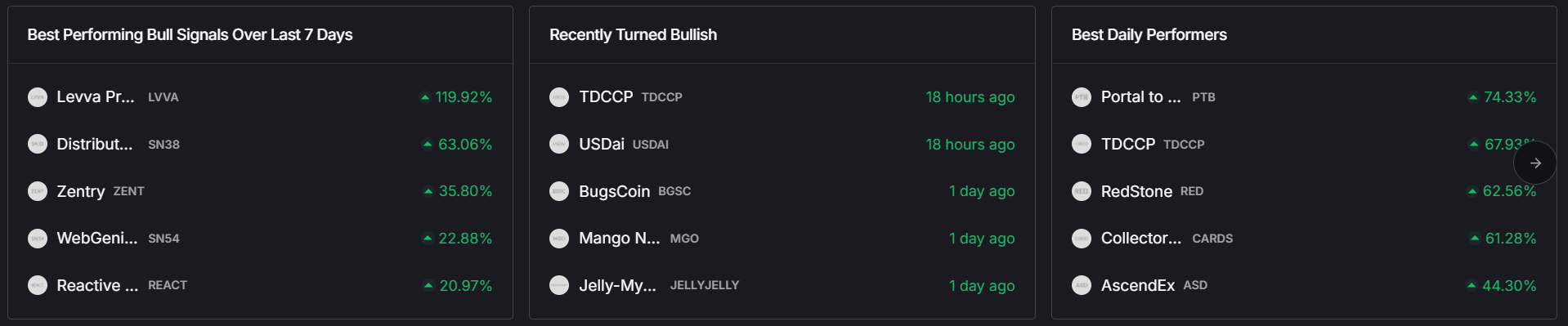

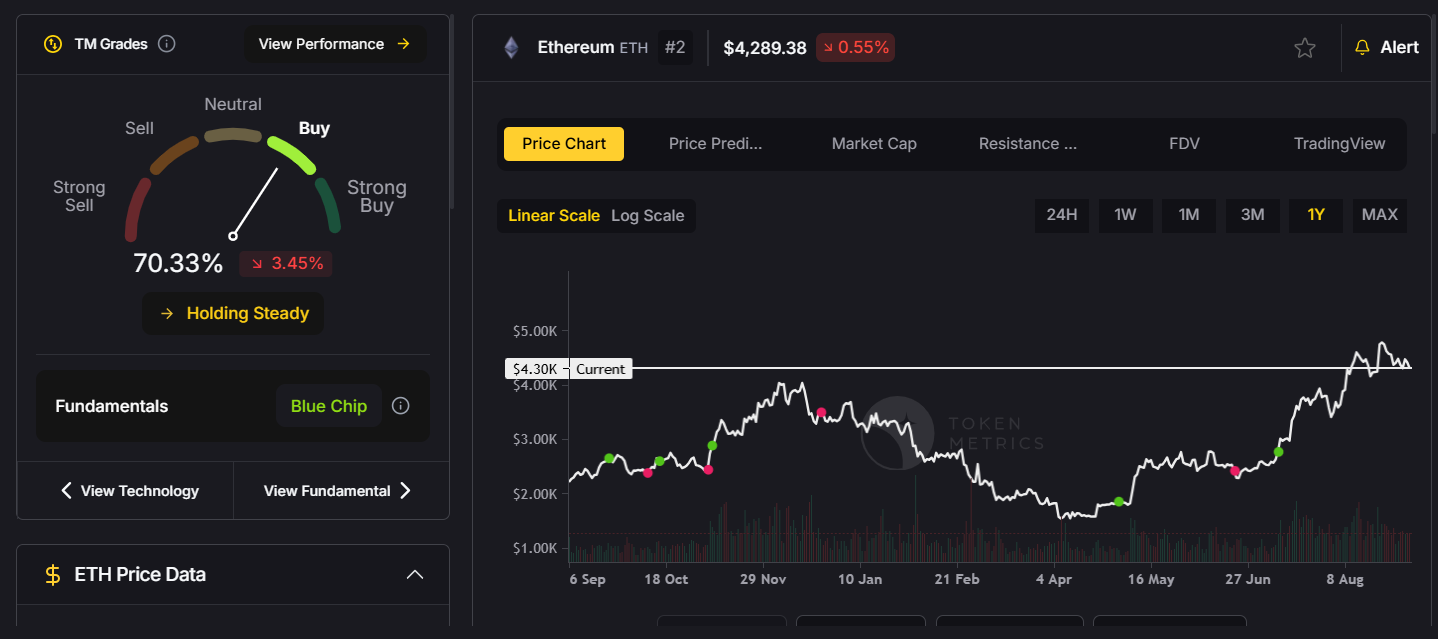

The cryptocurrency market is experiencing a seismic shift that most investors are missing. While Bitcoin has long been the undisputed king of digital assets, institutional money is quietly rotating into Ethereum at an unprecedented pace, signaling a potential altcoin season that could reshape the entire market landscape.

Recent data reveals a striking trend that should have every crypto investor's attention. In August alone, Ethereum ETFs attracted a staggering $3.69 billion in inflows, marking the fourth consecutive month of positive institutional investment. This stands in stark contrast to Bitcoin, which saw $800 million in outflows during the same period.

This isn't just a minor adjustment in portfolio allocation—it's a fundamental shift in how institutional investors view the crypto ecosystem. The rotation from Bitcoin to Ethereum represents more than just diversification; it's a bet on the future of decentralized finance, smart contracts, and blockchain utility beyond simple store-of-value propositions.

Behind Ethereum's surge lies a powerful but often overlooked driver: the stablecoin economy. Currently, 3.4% of Ethereum's total circulating supply is held by treasury companies, with this percentage accelerating rapidly since July. This trend reflects a broader recognition that stablecoins represent crypto's "ChatGPT moment"—the application that finally demonstrates blockchain's real-world utility to mainstream users.

The stablecoin narrative extends far beyond simple transfers. New Layer 1 blockchains like Plasma are emerging specifically to facilitate zero-fee USDT transfers, directly challenging Tron's dominance in this space. With over $1 billion in USDT deposits on its testnet alone, Plasma demonstrates the massive demand for efficient stablecoin infrastructure.

Market technicals support the institutional flow narrative. The Bitcoin versus Altcoin season chart shows that 58% of returns are currently coming from altcoins—a surprising figure considering the market's neutral-to-bearish sentiment. Historically, true altcoin season occurs when nearly 90% of returns flow to alternatives, as seen in August 2022 and May 2021.

This data suggests the market hasn't yet experienced the full-blown altcoin euphoria typical of cycle peaks. The implication? The current cycle may extend well into 2026, providing extended opportunities for strategic investors willing to look beyond Bitcoin's dominance.

The launch of World Liberty Financial (WLFI) adds another layer to the evolving crypto landscape. Amid the ongoing selling pressure, the token's ability to hold above $0.20 will determine its strength in the coming days. The same level where treasury companies accumulated positions indicates underlying institutional support. With the Trump family reportedly owning a third of the supply and generating approximately $3 billion in value at launch, WLFI represents the intersection of politics and crypto in unprecedented ways.

This political backing could provide regulatory tailwinds for the broader crypto market, particularly as other politicians consider similar token launches. California Governor Gavin Newsom's rumored meme coin plans suggest that cryptocurrency fundraising may become a standard tool for political campaigns, bringing mainstream legitimacy to digital assets.

The Ethereum rotation story isn't just about ETH itself—it's about the entire ecosystem of projects built on Ethereum's infrastructure. Base-layer tokens, DeFi protocols, and Ethereum-native projects have already begun showing strength, with tokens like Aerodrome and Zora experiencing significant runs during Ethereum's rally from $2,300 to nearly $5,000.

However, this market requires a different investment approach than previous cycles. The old "buy and hold" strategy shows diminishing returns in today's narrative-driven environment. Instead, successful investors are adapting to shorter holding periods, focusing on trending tokens with strong fundamentals and clear catalysts.

The key insight? We're witnessing the maturation of cryptocurrency from a speculative asset class to a functional financial infrastructure. Ethereum's institutional adoption, stablecoin integration, and smart contract capabilities position it as the backbone of this new financial system. Investors who recognize this transition early stand to benefit from one of the most significant shifts in crypto market dynamics since Bitcoin's inception.

.png)

%201.svg)

%201.svg)

The cryptocurrency industry is facing a pivotal moment as the U.S. Securities and Exchange Commission (SEC) signals a shift in its approach to digital asset regulation. With increased scrutiny on crypto exchanges, stablecoins, and DeFi platforms, this regulatory evolution has sparked concerns and opportunities within the industry.

In recent years, the SEC has primarily focused on enforcement actions against projects it deems as unregistered securities. However, recent statements from SEC officials suggest a potential shift toward clearer guidelines and a more structured regulatory framework. Key developments include:

With more regulatory clarity, institutional investors who have been hesitant due to legal uncertainties may feel more confident entering the market, potentially driving demand and liquidity.

Crypto projects and exchanges will need to allocate more resources to legal and compliance efforts, ensuring they meet the SEC’s evolving standards.

Tighter regulations could hinder innovation, especially in the DeFi sector, where permissionless access and decentralization are key features. Some projects may shift operations to more crypto-friendly jurisdictions.

A well-defined regulatory framework could help reduce scams and bad actors in the space, making crypto a safer investment environment for retail traders.

The crypto landscape is changing rapidly, and staying ahead of regulatory developments is crucial for investors and builders alike. Follow Token Metrics and subscribe to our newsletter to receive expert insights on market trends, regulatory shifts, and investment opportunities.

As the SEC refines its stance on crypto, understanding these changes can help you navigate the market with confidence. Stay informed, stay prepared, and take advantage of the opportunities this new era of regulation may bring.

.png)

%201.svg)

%201.svg)

Cryptocurrency ETFs (Exchange-Traded Funds) are a revolutionary way for investors to gain exposure to digital assets without directly buying or managing them. Just like traditional ETFs that track stock indexes or commodities, crypto ETFs track the price movements of one or more cryptocurrencies, offering a simpler way to invest in the market.

Crypto ETFs operate on traditional stock exchanges, allowing investors to buy and sell shares just like they would with any other ETF. These funds can be structured in two main ways:

While Bitcoin and Ethereum ETFs have made headlines, investors are now eyeing potential altcoin ETFs. One of the most anticipated developments is the possibility of a Solana (SOL) ETF. Given Solana’s growing adoption, high-speed transactions, and institutional interest, many analysts believe it could be the next cryptocurrency to receive ETF approval.

Other Altcoins, such as Cardano (ADA), Polkadot (DOT), and Avalanche (AVAX), are also being considered as candidates for ETFs. Regulatory hurdles remain, but as the crypto industry matures, we could see more diversified crypto ETFs in the future.

The crypto market is constantly evolving, and staying informed is key to making the best investment decisions. Follow Token Metrics and subscribe to our newsletter to stay up-to-date with the latest ETF news, market trends, and AI-powered investment insights.

Want to be the first to know about potential altcoin ETFs? Stay connected with Token Metrics today!

.png)

%201.svg)

%201.svg)

In the 24/7, always-on world of crypto, missing key market moves is just as expensive as it’s frustrating. One minute, you’re deep in a thread about memecoins, and the next, the token that could have 10X’d your portfolio has already taken off. This is the reality of crypto trading – until now.

Enter 0xTMAI (Token Metrics AI), our groundbreaking AI-powered crypto analyst that's shifting how traders discover and validate opportunities on X (formerly Twitter).

Refined through two crypto bull cycles, 0xTMAI is five years of AI excellence and consistent token calls—now working for you, 24/7.

AI-Driven Insights Is A Game Changer

What makes 0xTMAI special? It's powered by Token Metrics' proprietary AI – the same technology that identified Helium in 2018 before its meteoric rise, spotted Injective in 2022 before it became a DeFi powerhouse, and called XRP in 2024, just before it’s breakout rally from $0.5 to $3. (Yet, XRP isn’t done just yet).

Now, this battle-tested intelligence is accessible right where traders spend most of their time – on X (formerly Twitter).

Every hour, 0xTMAI drops fresh market signals, trending tokens, and sector insights directly into your timeline. No more switching between multiple platforms or missing crucial moves because you were away from your trading terminal. The alpha comes to you, right where you’re enjoying a DOGE thread by Elon Musk thread.

Designed to Work For You

Imagine having a brilliant crypto analyst who never sleeps, never takes breaks, and is always ready to help. That's 0xTMAI.

See an interesting token mentioned in a thread? Just follow 0xTMAI, you'll get comprehensive, data-backed analysis. No more falling for hype or FOMO as every decision can now be validated with real-time intelligence.

What sets 0xTMAI apart is its ability to understand context and provide nuanced insights. Our AI goes beyond not tracking price movements and trading volumes. It analyzes the nuances in market sentiment, sector trends, and underlying fundamentals to give you a complete picture before you make any trading decisions.

This is particularly crucial in today's market, where opportunities and risks emerge at lightning speed. While others are still doing basic research, 0xTMAI users are already positioned for the next big move.

As crypto markets mature, the edge increasingly belongs to traders who can process information faster and make better-informed decisions. TMAI represents the next evolution in crypto trading – where artificial intelligence meets real-time market analysis, all accessible through a simple mention on social media.

Getting Started

Ready to upgrade your trading game? Here's how to get started:

1. Follow 0xTMAI on X

2. Turn on notifications for hourly alpha drops

3. Start tagging 0xTMAI in tweets to get token analysis

The future of crypto trading is here, and it's powered by AI. Welcome to the new era of intelligent trading with 0xTMAI.

%20(1).png)

%201.svg)

%201.svg)

The Crypto Market Reacts to Trump's Latest Tariff Policy

The cryptocurrency market has been in turmoil following the latest announcement from former U.S. President Donald Trump regarding new tariffs on Mexico, Canada, and China. These aggressive trade policies have sent shockwaves through global financial markets, and crypto has not been spared.

Bitcoin (BTC), Ethereum (ETH), and major altcoins have suffered steep declines, with billions wiped out from the market in just a few hours. But why did Trump’s tariff move lead to such a sharp selloff in crypto? Let’s break it down.

Understanding Trump’s New Tariffs and Their Economic Impact

In his recent address, Trump proposed heavy tariffs on imports from Mexico, Canada, and China, citing the need to protect American industries and jobs. The specifics include:

These tariffs threaten to disrupt global supply chains, raise production costs, and escalate tensions between the U.S. and its biggest trading partners. The uncertainty surrounding these policies has created panic across financial markets, with investors seeking safer assets amid the volatility.

Why Crypto Crashed Following Trump’s Tariff Announcement?

1. Risk-Off Sentiment Dominates the Market

Historically, Bitcoin and other cryptocurrencies have been viewed as high-risk assets. When geopolitical uncertainty increases, institutional investors tend to shift away from riskier investments and move into traditional safe havens like gold, bonds, and the U.S. dollar. The tariff news led to a wave of panic selling in crypto, pushing prices down sharply.

2. Stock Market Decline Spills Over to Crypto

Traditional stock markets reacted negatively to the tariff announcement, with the S&P 500 and Nasdaq dropping significantly. Since crypto markets are increasingly correlated with equities, Bitcoin and altcoins followed suit, experiencing major declines.

3. Institutional Liquidations and Margin Calls

With growing institutional involvement in crypto, macroeconomic events like trade wars have a direct impact on digital assets. Large funds and traders holding leveraged positions were forced to liquidate, adding further downward pressure on crypto prices.

4. Fears of a Slowing Global Economy

Tariffs can lead to reduced international trade, higher consumer prices, and slower economic growth. A sluggish economy means less disposable income, which can hurt retail investments in speculative assets like crypto. With fears of a global recession looming, investors opted to cash out of their crypto holdings.

Could This Be a Buying Opportunity?

While the short-term reaction to Trump’s tariff announcement has been bearish for crypto, some analysts view this as a potential buying opportunity. Historically, Bitcoin has rebounded strongly from macro-driven selloffs, and long-term holders may see this dip as a chance to accumulate.

Additionally, if tensions escalate further and inflation fears return, crypto could eventually regain its appeal as an alternative store of value. With the upcoming Bitcoin halving in 2024, some investors are already positioning for a recovery.

Conclusion: Navigating the Crypto Market Amid Political Uncertainty

Trump’s new tariffs on Mexico, Canada, and China have triggered a sharp decline in crypto markets, as investors react to increased uncertainty and risk-off sentiment. While the immediate impact has been bearish, long-term crypto believers may see this as an opportunity to buy at lower prices.

As the situation unfolds, traders should stay informed and monitor global economic trends. Whether this downturn is a temporary panic or the start of a deeper correction remains to be seen, but one thing is certain—political and economic developments will continue to shape the crypto landscape in unexpected ways.

Stay updated with the latest crypto insights and market trends by following Token Metrics and 0xTMAI.

.png)

%201.svg)

%201.svg)

In the fast-paced world of cryptocurrency, where prices change in seconds and new projects emerge daily, staying ahead requires more than intuition or manual research. This is where AI agents come in revolutionizing the way traders and investors approach the market.

With Token Metrics’ AI Agent, you get a powerful tool specifically designed to simplify crypto research, automate decision-making, and refine trading strategies. Let’s explore how an AI agent can transform your crypto journey.

1. Simplifying Crypto Research

Researching cryptocurrencies can be time-consuming, requiring hours of poring over market data, charts, and news. Token Metrics’ AI Agent simplifies this process by acting as your personal crypto assistant.

Instead of spending hours researching, you can focus on making informed decisions faster.

2. Automating Decision-Making

In crypto trading, decisions must often be made quickly. AI agents streamline decision-making by providing:

By automating decision-making, you can capitalize on opportunities without hesitation.

3. Enhancing Trading Strategies with AI Precision

Even seasoned traders can struggle with emotional decision-making or incomplete information. AI agents bring a level of precision that eliminates guesswork.

This makes it an indispensable tool for refining and executing winning strategies.

4. Accessible to Beginners and Experts Alike

The cryptocurrency world can feel intimidating to newcomers, but the AI Agent bridges the gap:

Why Choose Token Metrics’ AI Agent?

Token Metrics’ AI Agent is like ChatGPT but specifically designed for crypto traders and investors. It leverages the vast data and analysis available on the Token Metrics platform, ensuring unparalleled accuracy and relevance.

Revolutionize Your Crypto Journey with Token Metrics

The future of crypto trading lies in harnessing the power of AI. Token Metrics’ AI Agent makes it easier than ever to stay informed, make data-driven decisions, and achieve your financial goals.

Ready to simplify your crypto journey? Explore Token Metrics’ AI Agent today and take your trading and investing strategies to the next level.

Start your journey now at www.tokenmetrics.com

By optimizing your research and strategy with the help of AI, you’ll gain the edge needed to thrive in the ever-evolving world of cryptocurrency. Don’t just trade smarter - trade with confidence, powered by TMAI.

.png)

%201.svg)

%201.svg)

Token Metrics AI (TMAI), a platform transforming cryptocurrency trading with AI agents, has raised $8.5 million over four years from 3,000+ investors. Following its Token Generation Event (TGE) on December 4, 2024, TMAI tokens are now trading on Bitpanda, Gate.io, and MEXC, supported by Token Metrics’ global community of 500,000 crypto enthusiasts. This milestone paves the way for TMAI’s ambitious 2025 roadmap, which emphasizes governance, staking, and cutting-edge AI-driven trading innovations.

The roadmap outlines a bold vision for empowering traders, stakers, and developers with advanced AI technology and governance innovations.

On-Chain Swaps with Revenue Sharing:some text

TMAI isn’t just innovating—it’s redefining the role of AI in cryptocurrency.

Join the Future of Crypto AI

Be part of the TMAI revolution. Stay updated on Twitter, Discord, and Telegram to learn more about upcoming features and opportunities.

.png)

%201.svg)

%201.svg)

Investing in cryptocurrency is evolving, and staying ahead of the curve requires the right tools and insights. Enter TMAI, the native token of Token Metrics, designed to power the most advanced Crypto AI Agent in the market. Trusted by investors across two complete market cycles, Token Metrics has consistently delivered data-driven insights and back-tested signals since 2019. With TMAI, the platform creates an unparalleled ecosystem for crypto investors and traders. Here's why TMAI is a game-changer.

TMAI stakers can earn up to 50% of platform revenue, distributed in ETH, TMAI, or stablecoins. This revolutionary staking model offers the following:

2. Exclusive Private Sales Access

TMAI holders gain early access to promising projects similar to Movement Labs, Andrena, Vana, Pixels, and Peaq through Token Metrics Ventures. Staking is set to launch in Q1 2025, and TMAI holders will enjoy unparalleled opportunities to invest in high-potential projects early.

3. Premium Access with TMAI

Use TMAI to unlock Token Metrics subscriptions, granting access to:

4. For-profit DAO Based in the Marshall Islands

TMAI's governance is structured as a for-profit DAO, ensuring:

5. Perfect Tokenomics

TMAI's design prioritizes fairness and sustainability:

6. Available Now on Top Exchanges

TMAI is readily available on trusted exchanges like Bitpanda, Gate.io, and MEXC. Secure your position in the future of crypto investing today.

7. The Best Crypto AI Agent for 2025

Powered by years of back-tested signals and proprietary data, TMAI fuels Token Metrics' AI Agent to:

TMAI offers an unmatched combination of revenue sharing, exclusive investment opportunities, premium access, and perfect tokenomics. Whether you're a seasoned investor or new to crypto, TMAI positions you for success in the fast-paced world of cryptocurrency.

Don't miss your chance to join the crypto revolution. With TMAI, the future of investing is smarter, more profitable, and powered by AI. Secure your stake today and join the journey to redefine crypto investing.

.png)

%201.svg)

%201.svg)

%201.svg)

%201.svg)

At Token Metrics, we've always been at the forefront of innovation in crypto analytics, and now, we're gearing up to take things to the next level. The launch of $TMAI Payments is just around the corner, and we couldn't be more excited to share a sneak peek of what's in store for our users.

With the integration of $TMAI—our native Token Metrics token—into the payment ecosystem, we're transforming how you access premium analytics and insights. Whether you're a crypto enthusiast or a professional investor, $TMAI Payments will offer flexibility and ease like never before.

Here's what you can look forward to:

When we launched $TMAI, we told you it wouldn't just be another token. It's the key to unlocking unmatched value within the Token Metrics ecosystem. From seamless subscription payments to exclusive membership perks, $TMAI ensures you're rewarded for participating in the Token Metrics community.

And the best part? $TMAI Payments bring us closer to mainstream adoption of cryptocurrency in everyday transactions, proving the real-world utility of digital assets.

We know you're curious about how it all works. Once $TMAI Payments officially launches, here's how easy it will be to get started:

As we count down to the launch of $TMAI Payments, we invite you to stay tuned and be among the first to experience this groundbreaking innovation. More details, guides, and exclusive offers will be revealed soon—keep an eye on our blog, emails, and social media channels for updates.

The future of crypto payments is almost here. Are you ready to join the movement?

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.