Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

REST APIs power much of the modern web: mobile apps, single-page frontends, third-party integrations, and many backend services communicate via RESTful endpoints. This guide breaks down the core principles, design patterns, security considerations, and practical workflows for building and consuming reliable REST APIs. Whether you are evaluating an external API or designing one for production, the frameworks and checklists here will help you ask the right technical questions and set up measurable controls.

REST (Representational State Transfer) is an architectural style for networked applications that uses stateless communication, standard HTTP verbs, and resource-oriented URLs. A REST API exposes resources (users, orders, prices, metadata) as endpoints that clients can retrieve or modify. The simplicity of the model and ubiquity of HTTP make REST a common choice for public APIs and internal microservices.

Key benefits include:

Designing a good REST API starts with consistent use of HTTP semantics. The common verbs and their typical uses are:

Good RESTful design also emphasizes:

Well-documented APIs reduce integration friction and errors. Follow these practical habits:

Automate documentation generation and run contract tests as part of CI to detect regressions early.

Security and observability are essential. Practical controls and patterns include:

Security reviews and occasional red-team exercises help identify gaps beyond static checks.

Consuming and testing REST APIs fits into several common workflows:

When building sector-specific APIs — for example, price feeds or on-chain data — combining REST endpoints with streaming (webhooks or websockets) can deliver both historical queries and low-latency updates. AI-driven analytics platforms can help synthesize large API outputs into actionable signals and summaries; for example, Token Metrics and similar tools can ingest API data for model-driven analysis without manual aggregation.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

REST describes the architectural constraints and principles. "RESTful" is commonly used to describe APIs that follow those principles, i.e., resource-based design, stateless interactions, and use of standard HTTP verbs.

Expose a clear versioning strategy early. Path versioning (/v1/) is explicit and simple, while header or content negotiation can be more flexible. Regardless of approach, document migration timelines and provide backward compatibility where feasible.

Use PUT to replace a resource fully; use PATCH to apply partial updates. PATCH payloads should be well-defined (JSON Patch or application/merge-patch+json) to avoid ambiguity.

Offset-based pagination is easy to implement but can produce inconsistent results with concurrent writes. Cursor-based (opaque token) pagination is more robust for large, frequently changing datasets.

Use OpenAPI specs combined with contract testing tools that validate servers against the spec. Include integration tests in CI that exercise representative workflows and simulate error conditions and rate limits.

Apply tiered access controls: provide limited free access with API keys and rate limits for discovery, and require stronger auth (OAuth, signed requests) for sensitive endpoints. Clear docs and quickstart SDKs reduce friction for legitimate users.

Track latency percentiles (p50/p95/p99), error rates by status code, request volume, and authentication failures. Correlate these with infrastructure metrics and traces to identify root causes quickly.

Yes. REST APIs can serve as a data ingestion layer for AI workflows, supplying labeled data, telemetry, and features. Combining batch and streaming APIs allows models to access both historical and near-real-time inputs for inference and retraining.

GraphQL offers flexible client-driven queries and can reduce overfetching, while gRPC provides efficient binary RPC for internal services. Choose based on client needs, performance constraints, and team expertise.

Disclaimer

This article is educational and technical in nature. It does not provide investment, legal, or regulatory advice. Implementations and design choices should be validated against your organization’s security policies and compliance requirements.

%201.svg)

%201.svg)

REST APIs are the lingua franca of modern web and data ecosystems. Developers, data scientists, and product teams rely on RESTful endpoints to move structured data between services, power mobile apps, and connect AI models to live data sources. This post explains what REST APIs are, the core principles and methods, practical design patterns, security considerations, and how to evaluate REST APIs for use in crypto and AI workflows.

Representational State Transfer (REST) is an architectural style for distributed systems. A REST API exposes resources—such as users, orders, or market ticks—via predictable URLs and HTTP methods. Each resource representation is typically transferred in JSON, XML, or other media types. The API defines endpoints, input and output schemas, and expected status codes so clients can programmatically interact with a server.

Key characteristics include stateless requests, cacheable responses when appropriate, uniform interfaces, and resource-oriented URIs. REST is not a protocol but a set of conventions that favor simplicity, scalability, and composability. These properties make REST APIs well-suited for microservices, web clients, and integrations with analytics or machine learning pipelines.

Understanding the mapping between REST semantics and HTTP verbs is foundational:

Designing clear resource names and predictable query parameters improves developer experience. Use nouns for endpoints (e.g., /api/v1/orders) and separate filtering, sorting, and pagination parameters. Well-structured response envelopes with consistent error codes and time stamps help automation and observability.

Good REST API design balances usability, performance, and security. Start with a contract-first approach: define OpenAPI/Swagger schemas that describe endpoints, request/response shapes, authentication, and error responses. Contracts enable auto-generated clients, mock servers, and validation tooling.

Security considerations include:

Operational best practices include logging structured events, exposing health and metrics endpoints, and versioning APIs (e.g., v1, v2) to enable backward-compatible evolution. Use semantic versioning in client libraries and deprecate endpoints with clear timelines and migration guides.

Testing a REST API includes unit tests for business logic, contract tests against OpenAPI definitions, and end-to-end integration tests. Performance profiling should focus on latency tail behavior, not just averages. Key tools and techniques:

For AI systems, robust APIs must address reproducibility: include schema versioning and event timestamps so models can be retrained with consistent historical data. For crypto-related systems, ensure on-chain data sources and price oracles expose deterministic endpoints and clearly document freshness guarantees.

REST APIs are frequently used to expose market data, on-chain metrics, historical time-series, and signals that feed AI models or dashboards. When integrating third-party APIs for crypto data, evaluate latency, update frequency, and the provider's methodology for derived metrics. Consider fallbacks and reconciliations: multiple independent endpoints can be polled and compared to detect anomalies or outages.

AI agents often consume REST endpoints for feature extraction and live inference. Design APIs with predictable rate limits and batching endpoints to reduce overhead. Document data lineage: indicate when data is fetched, normalized, or transformed so model training and validation remain auditable.

Tools that combine real-time prices, on-chain insights, and signal generation can accelerate prototyping of analytics and agents. For example, Token Metrics provides AI-driven research and analytics that teams can evaluate as part of their data stack when building integrations.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

REST is an architectural style that leverages HTTP methods and resource-oriented URIs. It differs from RPC and SOAP by emphasizing uniform interfaces, statelessness, and resource representations. GraphQL is query-oriented and allows clients to request specific fields, which can reduce over-fetching but requires different server-side handling.

Use TLS for transport security, strong authentication (OAuth2, API keys, or mTLS), authorization checks on each endpoint, input validation, rate limiting, and monitoring. Consider short-lived tokens and revoke mechanisms for compromised credentials.

Adopt explicit versioning (path segments like /v1/), maintain backward compatibility when possible, and provide clear deprecation notices with migration guides. Use semantic versioning for client libraries and contract-first changes to minimize breaking updates.

Implement rate limits per API key or token, and communicate limits via headers (e.g., X-RateLimit-Remaining). Provide exponential backoff guidance for clients and consider burst allowances for intermittent workloads. Monitor usage patterns to adjust thresholds.

Essential practices include unit and contract tests, integration tests, load tests, structured logging, distributed tracing, and alerting on error rates or latency SLA breaches. Health checks and automated failover strategies improve availability.

This article is for educational and informational purposes only. It does not constitute investment, financial, or legal advice. Evaluate third-party tools and data sources independently and consider compliance requirements relevant to your jurisdiction and project.

%201.svg)

%201.svg)

REST APIs are the backbone of modern web services and integrations. Whether you are building internal microservices, public developer APIs, or AI-driven data pipelines, understanding REST principles, security models, and performance trade-offs helps you design maintainable and scalable systems.

REST (Representational State Transfer) is an architectural style that relies on stateless communication, uniform interfaces, and resource-oriented design. A REST API exposes resources—users, orders, metrics—via HTTP methods like GET, POST, PUT, PATCH, and DELETE. The simplicity of HTTP, combined with predictable URIs and standard response codes, makes REST APIs easy to adopt across languages and platforms. For teams focused on reliability and clear contracts, REST remains a pragmatic choice, especially when caching, intermediaries, and standard HTTP semantics are important.

Good REST design balances clarity, consistency, and flexibility. Key principles include:

Documenting these conventions—preferably with an OpenAPI/Swagger specification—reduces onboarding friction and supports automated client generation.

Security is non-negotiable. REST APIs commonly use bearer tokens (OAuth 2.0 style) or API keys for authentication, combined with TLS to protect data in transit. Important practices include:

For teams integrating sensitive data or financial endpoints, combining OAuth scopes, robust logging, and policy-driven access control improves operational security while keeping interfaces developer-friendly.

APIs must scale with usage. Optimize for common access patterns and reduce latency through caching, compression, and smart data modeling:

Design decisions should be driven by usage data: measure slow endpoints, understand paginated access patterns, and iterate on the API surface rather than prematurely optimizing obscure cases.

Test automation and telemetry are critical for API resilience. Build a testing pyramid with unit tests for handlers, integration tests for full request/response cycles, and contract tests against your OpenAPI specification. Observability—structured logs, request tracing, and metrics—helps diagnose production issues quickly.

AI-driven tools can accelerate design reviews and anomaly detection. For example, platforms that combine market and on-chain data with AI can ingest REST endpoints and provide signal enrichment or alerting for unusual patterns. When referencing such tools, ensure you evaluate their data sources, explainability, and privacy policies. See Token Metrics for an example of an AI-powered analytics platform used to surface insights from complex datasets.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

A REST API is an interface that exposes resources over HTTP using stateless requests and standardized methods. It emphasizes a uniform interface, predictable URIs, and leveraging HTTP semantics for behavior and error handling.

REST suits predictable, cacheable endpoints and simple request/response semantics. GraphQL can reduce over-fetching and allow flexible queries from clients. Consider developer experience, caching needs, and operational complexity when choosing between them.

Common approaches include URI versioning (e.g., /v1/) or header-based versioning. The key is to commit to a clear deprecation policy, document breaking changes, and provide migration paths for clients.

Use TLS for all traffic, issue scoped short-lived tokens, validate and sanitize inputs, impose rate limits, and log authentication events. Regular security reviews and dependency updates reduce exposure to known vulnerabilities.

OpenAPI/Swagger, Postman, and contract-testing frameworks allow automated validations. Observability stacks (Prometheus, Jaeger) and synthetic test suites help catch regressions and performance regressions early.

Disclaimer

This article is for educational and technical guidance only. It does not provide financial, legal, or investment advice. Evaluate tools, platforms, and architectural choices based on your organization’s requirements and compliance constraints.

%201.svg)

%201.svg)

Artificial intelligence (AI) has become one of the most transformative technologies of our time, reshaping industries from healthcare to finance. In the cryptocurrency space, AI crypto coins are merging blockchain with artificial intelligence, creating powerful ecosystems for data analytics, automated decision-making, decentralized AI marketplaces, and predictive trading.

In 2025, AI-powered tokens are one of the most promising sectors in crypto, attracting retail investors, institutional players, and developers seeking the next wave of technological breakthroughs. This article explores what AI crypto coins are, how they work, their benefits, key risks, and the role of Token Metrics in analyzing and investing in them.

AI crypto coins are digital tokens that fuel blockchain platforms integrated with artificial intelligence technologies. These coins serve multiple purposes, including:

By combining the transparency of blockchain with the intelligence of AI, these projects are creating self-sustaining ecosystems where users can buy, sell, and deploy AI services securely.

The AI crypto sector is diverse, with projects addressing various use cases. Here are some of the leading tokens:

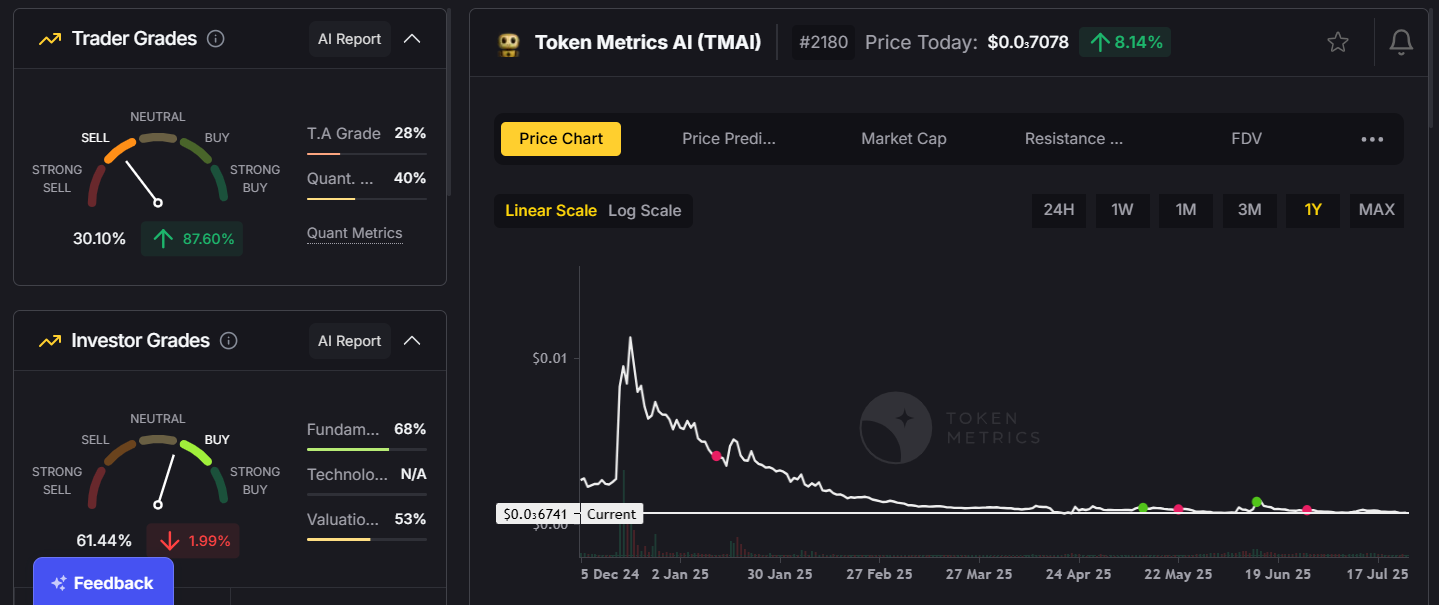

One of the most innovative AI-driven analytics platforms in crypto. TMAI leverages over 80 data points per token, offering AI-generated ratings, trend analysis, and portfolio insights to help traders and investors make data-driven decisions.

2. $KAITO Token Utility:

3. Cookie.fun ($COOKIE): Gamified Trading Meets A

Cookie.fun is a Gen-Z-targeted platform that fuses AI-powered trading insights with gamified investing experiences.

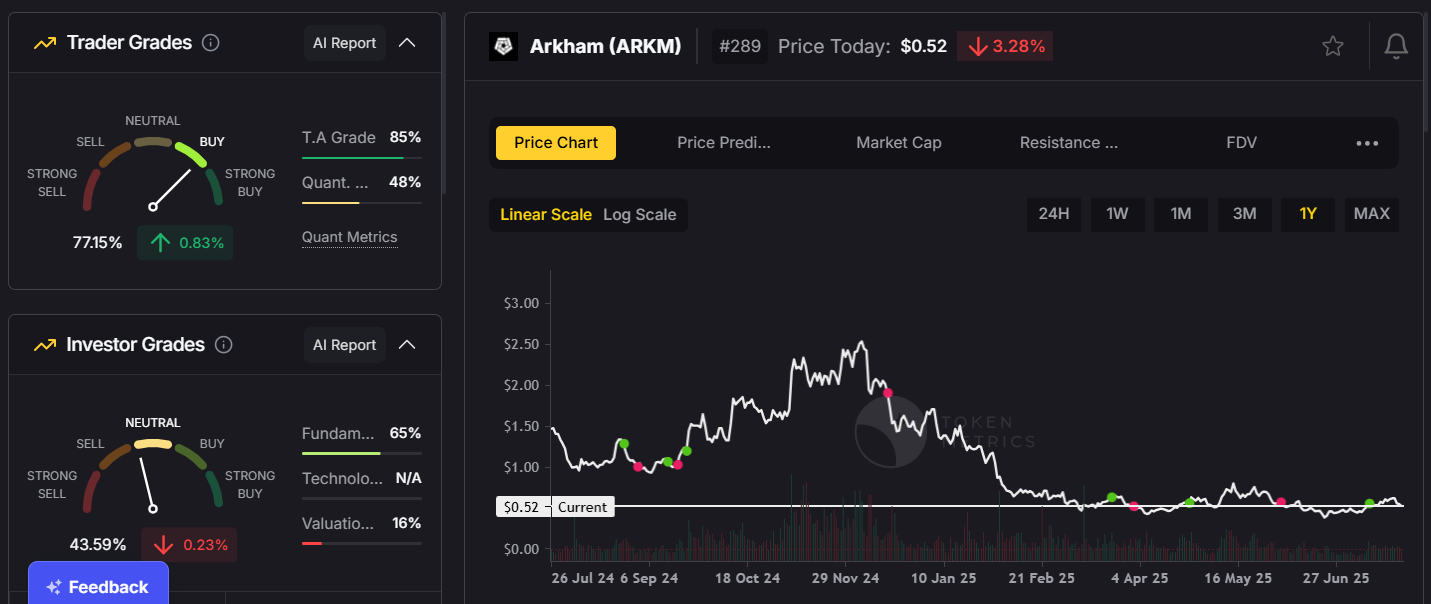

4. Arkham Intelligence (ARKM):

An AI-powered blockchain intelligence platform that analyzes on-chain data for compliance, forensics, and research.

These tokens are part of a fast-growing ecosystem of AI-focused projects poised to disrupt industries ranging from financial trading to decentralized computing.

AI crypto coins work by integrating machine learning and blockchain to create scalable, secure, and transparent AI ecosystems. Key mechanisms include:

This synergy between AI and blockchain creates systems that learn, adapt, and evolve over time, making them highly valuable in the crypto economy.

1. Exposure to Two Revolutionary Technologies:

Investing in AI tokens means gaining exposure to both the blockchain and AI sectors, which are projected to experience massive growth over the next decade.

2. High Growth Potential:

AI crypto coins often see rapid adoption due to their real-world applications and strong narratives.

3. Diversification:

AI tokens provide a unique asset class within the crypto market, helping diversify a portfolio beyond standard altcoins.

4. Early Access to Innovation:

Investors can be part of groundbreaking projects building the infrastructure for decentralized AI networks.

Like all crypto assets, AI coins carry risks:

Using data-driven platforms like Token Metrics can help mitigate these risks by offering detailed project analysis and ratings.

1. Long-Term Holding (HODL):

Invest in leading AI tokens like TMAI, FET, and AGIX for long-term exposure to this emerging sector.

2. Narrative Investing:

Capitalize on market narratives by entering early when AI projects gain traction or announce major updates.

3. Portfolio Diversification:

Balance AI tokens with large-cap cryptocurrencies like Bitcoin and Ethereum to manage overall portfolio risk.

4. Active Monitoring with Token Metrics:

Use Token Metrics to receive real-time AI-generated ratings, alerts, and trend analyses for AI tokens, helping you optimize entry and exit points.

Token Metrics is uniquely positioned at the intersection of AI and crypto. It provides:

For investors seeking to navigate the fast-changing AI crypto sector, Token Metrics delivers data-driven confidence in decision-making.

AI crypto coins are expected to play a transformative role in 2025 and beyond, powering innovations in:

As AI becomes more integrated with blockchain, these coins will likely lead the next technological and financial revolution.

AI crypto coins represent one of the most exciting frontiers in cryptocurrency. By merging the power of blockchain with the intelligence of AI, these tokens are reshaping how we interact with data, trade, and build decentralized systems.

For investors, platforms like Token Metrics provide the insights needed to navigate this dynamic sector—identifying promising projects, managing risk, and seizing opportunities before the market catches up.

In 2025, adding AI tokens to your portfolio isn’t just an investment—it’s a way to participate in the future of intelligent, decentralized finance.

%201.svg)

%201.svg)

The crypto market has always been fertile ground for high-risk, high-reward opportunities. While blue-chip assets like Bitcoin and Ethereum dominate headlines, the real thrill — and sometimes the highest returns — often comes from what the industry calls “moonshots.”

These are small-cap tokens, often under $50 million in market cap, with explosive potential and equally high volatility. In 2025, moonshots remain a core part of speculative trading strategies. But what exactly are they? How do you find them? And most importantly, how can you manage the outsized risks they carry?

Let’s dive into the world of moonshots, drawing insights from recent market trends and real-world data.

Moonshot tokens are early-stage, low-cap cryptocurrencies that carry massive upside potential. They often represent experimental ideas or emerging narratives — think AI integration, meme culture, or social tokens — that haven’t yet been fully recognized by the broader market.

Because they trade at relatively low valuations, even small inflows of capital can cause outsized price swings. It’s not uncommon for a moonshot to deliver 10x or even 50x gains within a short time. But the flip side is brutal: these same tokens can plummet to zero just as quickly.

Key characteristics of moonshots:

The current market environment — with crypto market capitalization hovering around $4 trillion — has created room for risk-taking. Investors who missed early gains on Bitcoin or Ethereum are now searching for the next big thing, leading to renewed interest in small-cap tokens.

Emerging narratives also fuel the fire:

These narratives often spill over into the moonshot arena, as smaller projects attempt to replicate the success of these headline-grabbing platforms.

Identifying moonshots is part research, part intuition, and part risk tolerance. Here’s what to look for:

The most successful moonshots ride on current narratives. In this cycle, AI agents, decentralized social platforms, and community-owned DeFi projects are leading themes. Projects in these categories often experience rapid hype-driven adoption.

Tools like Dune Analytics and on-chain scanners can reveal whale accumulation, new liquidity pools, or spikes in active addresses — all early indicators of growing interest.

Evaluate supply schedules:

While many moonshots are grassroots projects, strong teams or backing from reputable funds (e.g., Polychain, Binance Labs) can boost credibility.

1. Vine (Meme Token):

A meme coin leveraging the Vine brand, this token has gained traction despite limited documentation. Its appeal lies largely in nostalgia and speculative hype.

2. Moby AI: What started as an AI-driven whale-tracking agent has evolved into Mobi Screener, a Dexscreener competitor with integrated social features. The token model ties platform usage to token value — a promising experiment in utility-driven moonshots.

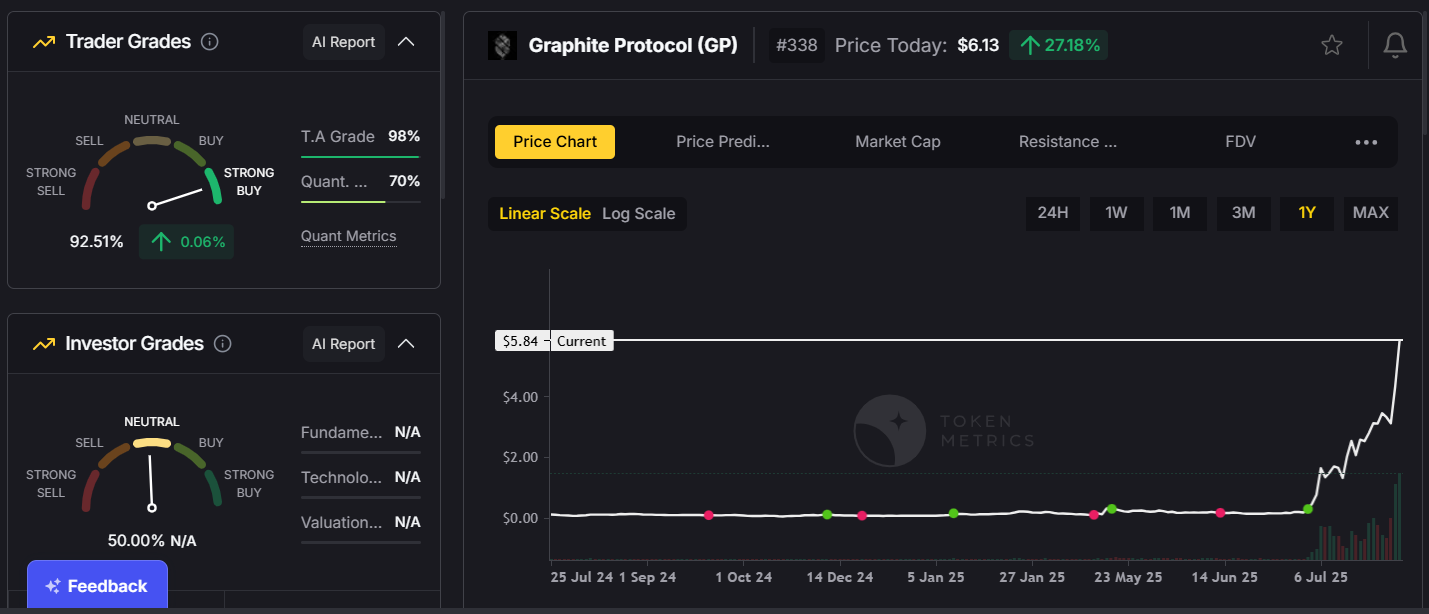

3. Graphite Protocol:

Developers behind Bonk Fun (a leading meme token platform), Graphite has created a buyback and burn model linked to Bonk’s success, aligning token value directly with ecosystem growth.

4. CookieDAO:

Initially positioned as an AI agent platform, CookieDAO is now expanding into proof-of-belief systems, adding new utilities and campaign features for Web3 projects.

Moonshots are inherently speculative. Common pitfalls include:

A recent example is SpaceMesh, once hyped as a “next Bitcoin.” Despite strong tech, internal disputes and poor execution led to a near-total collapse — a stark reminder that good code doesn’t always equal good investment.

If you’re trading moonshots, risk management is everything.

1. Position Sizing:

Never allocate more than 1% of your portfolio to any single moonshot. Spreading capital across multiple small positions reduces the impact of one token collapsing.

2. Diversification:

Balance moonshots with higher-cap tokens to stabilize overall portfolio performance.

3. Predefined Exits:

Set clear take-profit and stop-loss levels before entering a trade. Emotional decisions often lead to losses.

4. Time Your Entries:

Consider entering after initial hype cools but before major announcements or roadmap milestones.

While moonshots can be risky, they remain an integral part of crypto’s DNA. For many traders, they serve as lottery tickets in a market where early discovery can lead to life-changing gains.

In 2025, moonshots are evolving. They’re no longer just meme-driven gambles. Increasingly, they represent experimental innovation — blending DeFi models, AI integrations, and community governance in ways that push the boundaries of blockchain technology.

Moonshots are not for the faint-hearted. They require research, timing, and above all, discipline. In 2025, with themes like AI-driven platforms, decentralized social networks, and community-focused DeFi reshaping the market, the next breakout token could be hiding in plain sight.

Whether you’re a seasoned trader or a curious newcomer, understanding the dynamics of moonshots — and respecting their risks — is essential for navigating this volatile but potentially rewarding segment of crypto.

%201.svg)

%201.svg)

The cryptocurrency market continues to show resilience, with total market capitalization maintaining a strong foothold near $4 trillion. While Bitcoin remains the cornerstone of this cycle, the spotlight is shifting toward altcoins — especially those at the forefront of decentralized finance (DeFi) and artificial intelligence (AI) integration.

In this blog, we’ll explore the top narratives shaping today’s market, focusing on DeFi protocols like Blackhole DEX and PancakeSwap, alongside emerging AI projects such as Sahara AI and Moby AI.

DeFi has staged an impressive comeback in 2025. After a period of stagnation, several protocols have redefined their models to prioritize community engagement and sustainable growth.

Black Hole DEX:

Launched on Avalanche, Blackhole DEX has quickly become the network’s largest decentralized exchange, overtaking Trader Joe. The platform uses a community-first approach: no team allocation, weekly token emissions to liquidity providers, and a bribe-based voting mechanism for rewards distribution.

Impact:

This design has created a powerful flywheel effect. As token prices rise, APYs increase, attracting more liquidity, which in turn boosts trading volume and revenue. Within days, Blackhole DEX grew its TVL from $7 million to $193 million — a staggering feat.

PancakeSwap, the dominant DEX on Binance Smart Chain (BSC), has been quietly outperforming its competitors in trading volumes and fee generation. Recent data shows PancakeSwap generating more than 4x the daily fees of Uniswap, yet its fully diluted valuation remains significantly lower.

Growth Catalysts:

For investors seeking a large-cap DeFi protocol with strong fundamentals and potential upside, PancakeSwap’s metrics warrant attention.

Artificial intelligence continues to transform multiple industries, and crypto is no exception.

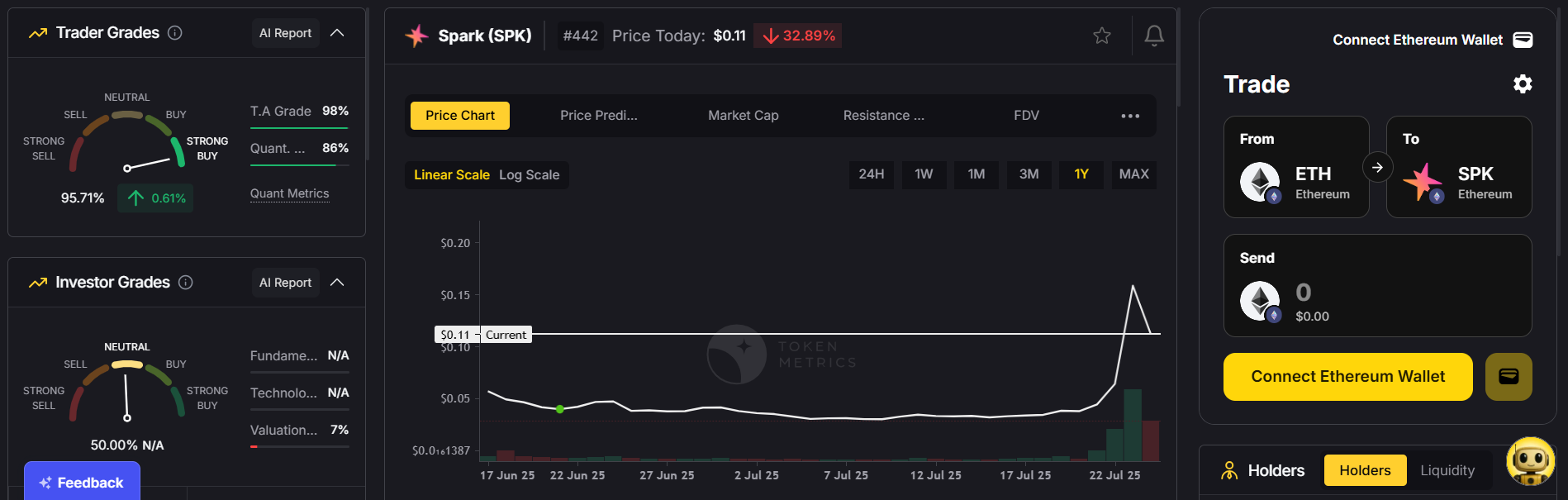

Sahara AI:

Sahara AI is building a full-stack AI infrastructure for decentralized applications. Backed by heavyweights like Binance and Polychain, its mission is to bridge Web3 and AI — a theme that’s likely to dominate innovation cycles in the coming years.

Moby AI:

Initially launched as an AI trading agent, Moby AI has expanded into building tools like Moby Screener, a competitor to Dexscreener. Its unique tokenomics link user engagement directly to the platform’s utility, making it an experiment worth watching.

Beyond DeFi and AI, other notable projects are also gaining ground:

These projects underscore the diversity of innovation happening outside Bitcoin’s shadow.

The excitement around DeFi and AI tokens comes with elevated risk. Here are some best practices:

As the crypto market edges closer to $4 trillion, the narratives driving growth are evolving. DeFi is proving its staying power with innovative models like Black Hole DEX, while AI-focused projects like Sahara AI are pushing the boundaries of what blockchain can achieve.

For market participants, the challenge lies in identifying which of these trends have lasting potential — and positioning themselves accordingly.

.png)

%201.svg)

%201.svg)

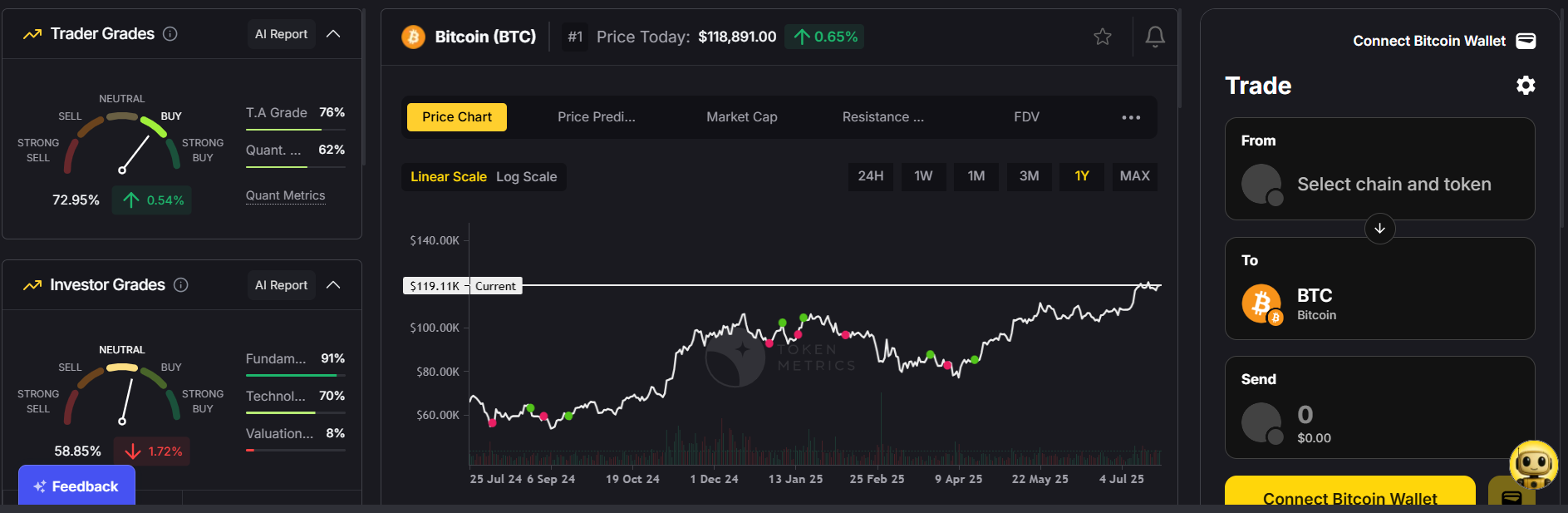

As Bitcoin stabilizes near its recent highs, the crypto market is witnessing a familiar pattern — altcoins are beginning to surge. While Bitcoin often leads during the early phases of a bullish cycle, history shows that capital tends to flow into altcoins as confidence builds. In the past two weeks, this transition has become increasingly evident, with several promising projects capturing significant market attention.

Since early July, Bitcoin has managed to hold above key resistance levels, cementing its role as the market’s anchor. At the time of writing, total crypto market capitalization hovers near $4 trillion — a level that hasn’t been seen since the previous cycle’s peaks. Historically, when Bitcoin consolidates above its former highs, capital begins rotating into altcoins. This shift often marks the start of a broader rally across the market.

Key takeaway: The current market appears to be in the early stages of this altcoin rotation.

Several altcoins have emerged as strong contenders in recent weeks.

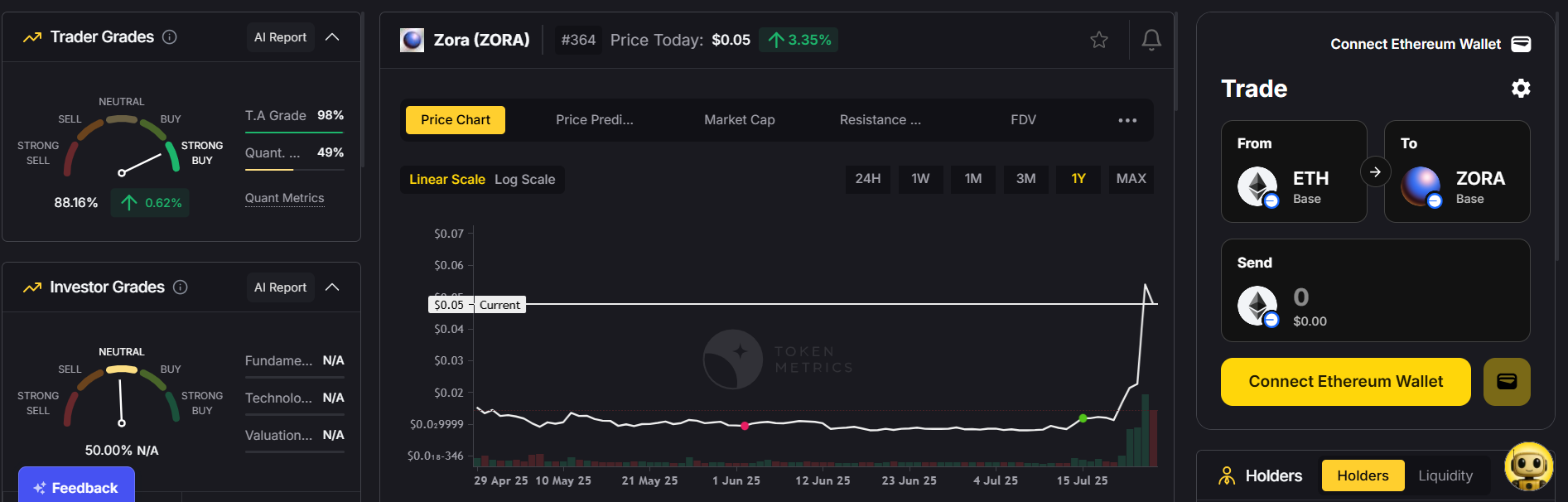

1. Zora: The Social Token Platform

Zora, an on-chain social platform that allows creators to tokenize posts and earn from their content, has seen exponential growth following its integration into the Base App (Coinbase’s rebranded wallet). Creator activity and transaction volumes have surged, driving up demand for the Zora token. With each creator post paired to the Zora token, this integration has created a direct link between platform usage and token utility.

Why it matters: The combination of Web3 social media and creator monetization is a powerful narrative, and Zora appears well-positioned to capitalize on this trend.

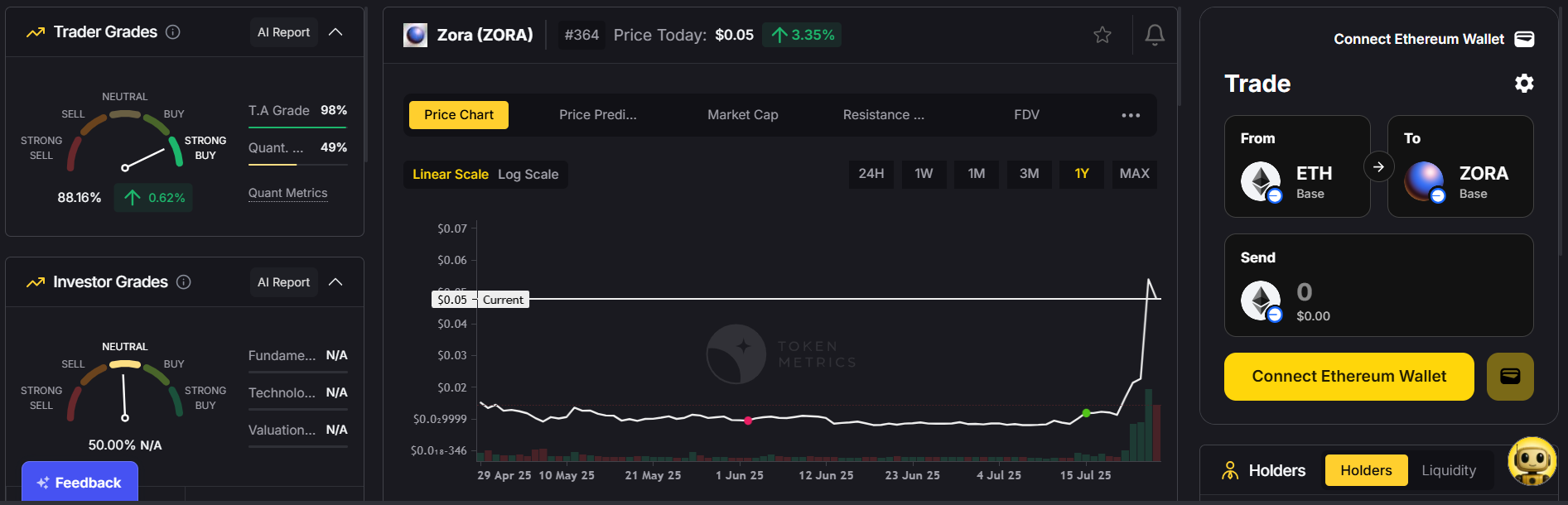

2. Spark: A MakerDAO-Connected Lending Platform

Spark, a DeFi lending protocol linked to Sky Protocol, has also been a standout performer. It recently experienced a sharp increase in liquidity and price action, fueled by its integration with CookieDAO’s campaign and ongoing airdrop programs.

Why it matters: With DeFi gaining renewed interest, protocols offering sustainable yields through established ecosystems like Sky Protocol (formerly MakerDAO) are likely to remain attractive to both retail and institutional participants.

3. Sahara AI: Building the AI-Crypto Intersection

Sahara AI has positioned itself at the intersection of AI and blockchain. Backed by Binance, Polychain, and Foresight Ventures, this project offers a full-stack AI solution tailored for decentralized applications. Its long-term vision of creating AI-enabled Web3 services is attracting both developers and investors.

Why it matters: AI and crypto remain two of the most dominant narratives in tech, and projects combining these sectors could drive the next wave of innovation.

4. PancakeSwap: Undervalued Giant?

Despite being one of the largest DEXs by trading volume and daily fee generation, PancakeSwap appears significantly undervalued compared to peers like Uniswap. The platform recently expanded its operations to other chains, including Solana, and benefits from strong integration with the Binance Wallet ecosystem.

Why it matters: Fundamentals suggest PancakeSwap has room for growth if the market re-rates its value relative to competitors.

Bitcoin vs. Altcoin Season:

Our analysis shows we are still in a Bitcoin-dominant phase. Historically, altcoins outperform when Bitcoin consolidates or cools off. This implies that the current rotation into altcoins could continue as capital flows down the risk curve.

DeFi Revival:

Protocols like Blackhole DEX on Avalanche — which has grown its TVL from $7 million to $193 million in less than 2 weeks — highlight a renewed interest in decentralized finance. Unlike VC-backed models, Blackhole’s community-first tokenomics have resonated with users seeking fairer distribution.

Social Tokens & AI Integration:

Platforms like Zora and Sahara AI are tapping into major growth narratives: decentralized social media and artificial intelligence. Both sectors are likely to see continued experimentation and adoption.

While the upside potential in altcoins is high, so is the volatility. For high-risk trades, such as “moonshots” (low-cap tokens under $50 million market cap), we recommend:

The crypto market is entering an exciting phase. Bitcoin’s consolidation above key levels suggests a healthy backdrop for risk assets, and altcoins are beginning to benefit. From creator monetization platforms like Zora to cross-chain DeFi protocols like Spark and Black Hole, this new wave of projects represents the diversity and innovation driving the next cycle.

As always, measured participation and disciplined risk management remain essential.

%201.svg)

%201.svg)

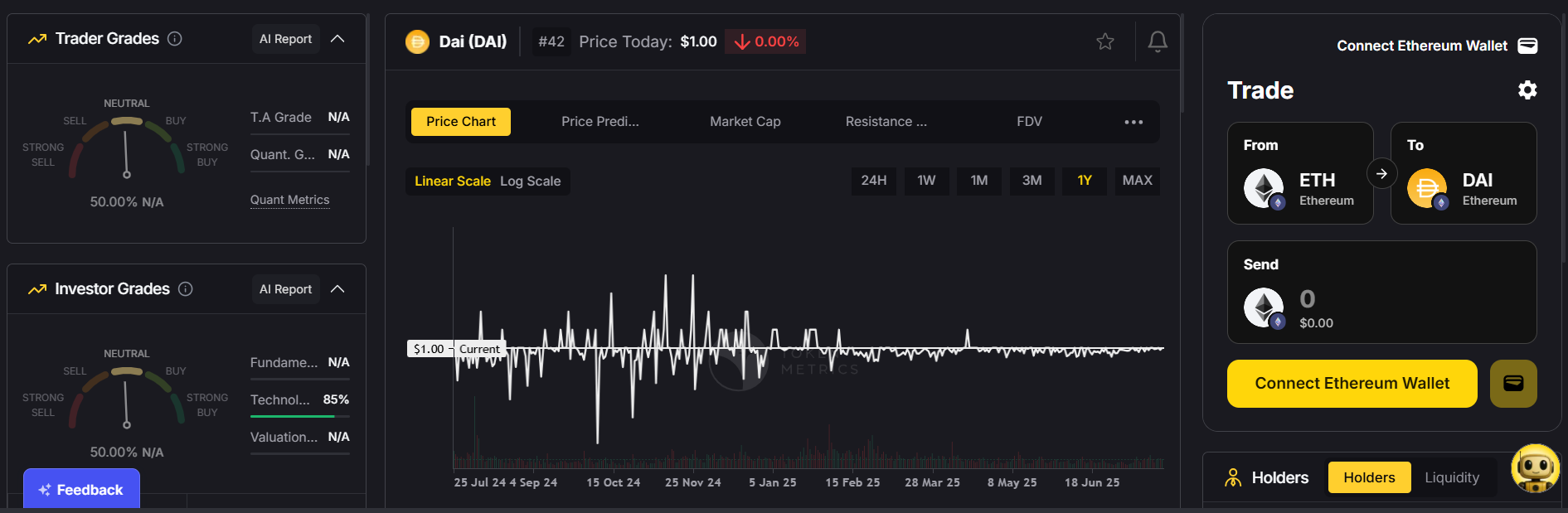

The cryptocurrency market is famous for volatility—Bitcoin can swing by thousands of dollars in a day, and altcoins can rise or crash in hours. But what if you need price stability? That’s where stablecoins come in.

Stablecoins are digital currencies pegged to stable assets like the US dollar, gold, or even algorithmically maintained price levels. They bridge the gap between the speed and efficiency of blockchain technology and the reliability of traditional money.

As of 2025, stablecoins account for over $140 billion in circulating supply, making them essential for traders, investors, and decentralized finance (DeFi) users. But not all stablecoins are the same—different types use different mechanisms to maintain their stability, each with unique pros and cons.

In this guide, we’ll break down the types of stablecoins, how they work, their risks, and which might be best for your needs.

A stablecoin is a cryptocurrency designed to maintain a stable value by pegging its price to a reference asset. Most stablecoins are pegged to fiat currencies like the U.S. dollar (e.g., 1 USDT ≈ $1), but some track commodities (like gold) or are algorithmically balanced to hold value.

They are widely used for:

There are four main types of stablecoins:

Each has a different method of maintaining its peg. Let’s break them down.

Definition:

These are backed 1:1 by traditional currencies like the U.S. dollar, euro, or yen. For every stablecoin issued, an equivalent amount of fiat is held in reserve by a trusted custodian.

How They Work:

If you buy 1 USDC, Circle (its issuer) holds $1 in a regulated bank account or short-term U.S. Treasury securities. When you redeem that stablecoin, the issuer sends you the equivalent amount in fiat and burns the coin.

Examples:

Pros:

Cons:

Definition:

These are backed by cryptocurrencies like Ethereum or Bitcoin instead of fiat. Because crypto is volatile, these stablecoins are overcollateralized (e.g., $150 in ETH backs $100 in stablecoins).

How They Work:

When you mint a crypto-backed stablecoin like DAI, you deposit collateral (e.g., ETH) into a smart contract. If the collateral value drops too much, the contract automatically liquidates some assets to maintain the peg.

Examples:

Pros:

Cons:

Definition:

These don’t use physical reserves. Instead, they maintain their peg via algorithmic supply adjustments—minting or burning tokens to balance price around $1.

How They Work:

If demand increases and the price rises above $1, the protocol mints more coins. If it falls below $1, the protocol burns coins or incentivizes users to buy them back.

Examples:

Pros:

Cons:

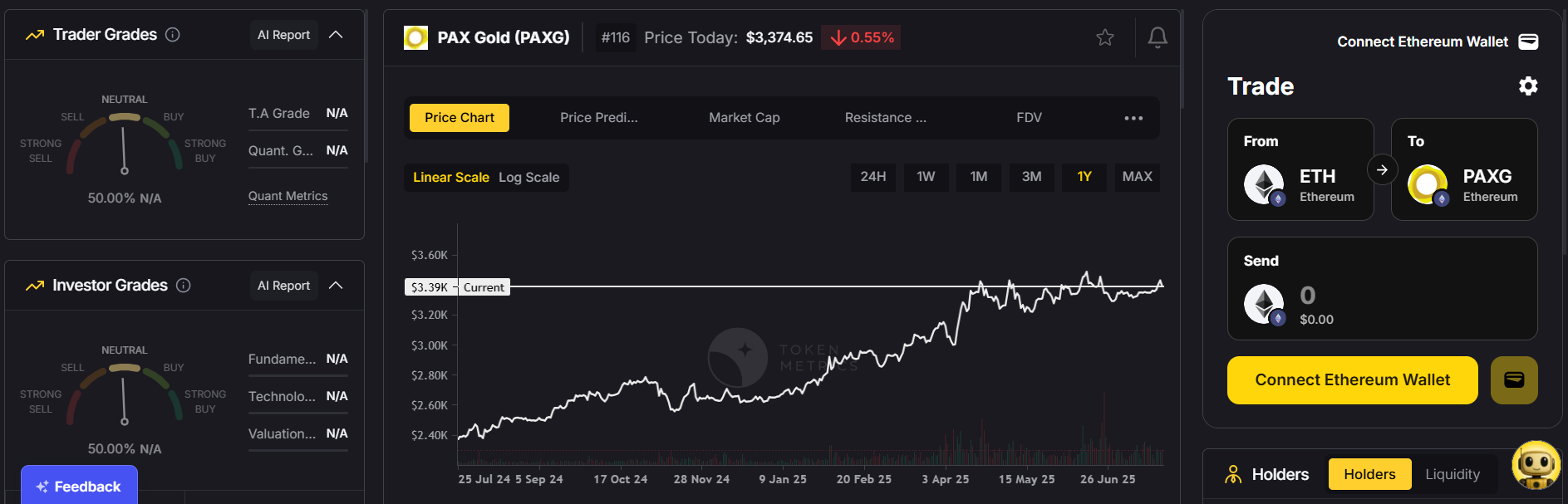

Definition:

These stablecoins are pegged to commodities like gold, silver, or oil, giving them intrinsic value beyond fiat.

How They Work:

For every coin issued, an equivalent amount of the commodity is held in a secure vault. For example, owning 1 PAX Gold (PAXG) means you own 1 troy ounce of physical gold stored by the issuer.

Examples:

Pros:

Cons:

Stablecoins are the backbone of DeFi and crypto trading.

If you want simplicity & security: Go with fiat-backed coins like USDC or PYUSD.

If you value decentralization: Choose crypto-collateralized options like DAI.

If you’re comfortable with high risk: Explore algorithmic models like FRAX (but beware of peg risks).

If you want inflation protection: Consider commodity-backed coins like PAXG.

In 2025, stablecoins are evolving to meet regulatory and market demands:

As DeFi expands and global adoption grows, stablecoins will remain at the heart of crypto finance.

Stablecoins are more than just “digital dollars.” They’re a critical bridge between traditional finance and blockchain innovation.

Choosing the right type depends on your risk tolerance, use case, and trust level. Whether for trading, saving, or participating in DeFi, understanding the types of stablecoins can help you navigate the crypto ecosystem with confidence.

.png)

%201.svg)

%201.svg)

Cryptocurrency has moved from niche tech circles to the mainstream, with millions of people worldwide investing in Bitcoin, Ethereum, and thousands of other digital assets. Whether you want to trade actively, hold long-term, or explore decentralized finance (DeFi), the first step is understanding how to purchase cryptocurrency safely and efficiently.

In this guide, we’ll walk you through everything you need to know—**from choosing the right platform to securing your crypto—**so you can get started with confidence.

Before you dive in, it’s important to understand what you’re buying. Cryptocurrency is a digital asset that uses blockchain technology to enable secure, decentralized transactions. Unlike traditional currencies, crypto isn’t controlled by banks or governments.

Some of the most popular cryptocurrencies include:

Once you know your options, you’re ready to buy.

To purchase crypto, you’ll need an exchange—a platform that lets you buy, sell, and trade digital assets.

Types of exchanges:

What to look for in an exchange:

Most centralized exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

What you’ll need:

Once verified, you’ll gain full access to trading and withdrawals.

You can’t buy crypto without adding funds.

Common payment methods:

Pro Tip: Always compare deposit fees before funding your account.

Beginners often start with Bitcoin or Ethereum due to their liquidity and stability. However, thousands of altcoins are available—each with unique purposes.

Factors to consider before buying:

When you’re ready, navigate to the Buy/Sell section of your exchange.

Order types:

Example: If Bitcoin is $50,000 and you want to buy $100 worth, your market order will instantly execute at the best available price.

Once purchased, you’ll need a wallet to store your crypto. Leaving assets on an exchange can expose you to hacking risks.

Types of wallets:

Tip: “Not your keys, not your coins.” If you hold significant funds, transfer them to a private wallet where you control the keys.

Crypto markets are volatile. Prices can change rapidly, so keep track of market trends and news.

Best practices:

Only invest what you can afford to lose. Experts often recommend starting with 1–5% of your portfolio and increasing gradually as you gain confidence.

1. Can I buy crypto without an exchange?

Yes. You can use peer-to-peer platforms or crypto ATMs, though fees may be higher.

2. Do I need a lot of money to start?

No. Many exchanges let you buy as little as $10 worth of crypto.

3. Is buying crypto legal?

In most countries, yes. Always check your local regulations.

4. What’s the safest way to buy?

Use a regulated exchange and store your funds in a hardware wallet.

Purchasing cryptocurrency isn’t complicated—it’s about choosing the right platform, securing your funds, and investing wisely. Whether you’re buying Bitcoin as a long-term investment or exploring altcoins for potential growth, the steps are the same:

The crypto market is full of opportunities—but also risks. Start small, do your research, and approach your investment journey with a long-term mindset.

%201.svg)

%201.svg)

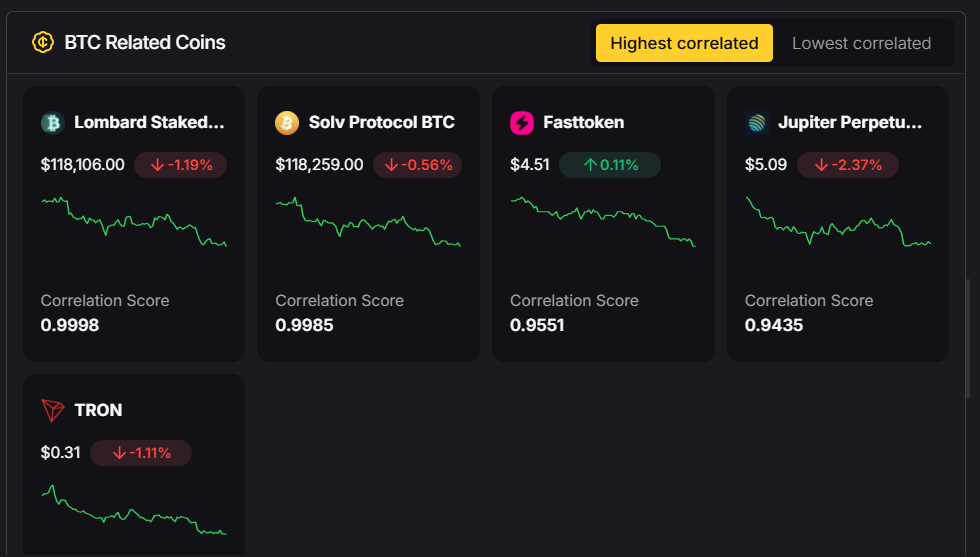

The cryptocurrency market is known for its cyclical patterns, where Bitcoin and alternative cryptocurrencies, commonly called altcoins, take turns leading market performance. Cryptocurrency is a digital or virtual currency that operates on distributed ledger technology called a blockchain and uses cryptography for security. Unlike traditional currencies, cryptocurrencies are decentralized and not backed by any central bank, which sets them apart from government-issued money. Blockchain technology is the foundational element that underpins cryptocurrency, ensuring transaction transparency and security. For traders and investors engaged in crypto trading, understanding when Bitcoin dominates the market is crucial for effective portfolio management and maximizing profits. The Bitcoin Season Index, derived from Bitcoin dominance metrics, serves as a fundamental indicator to identify periods when the flagship cryptocurrency outperforms the broader cryptocurrency market. This insight enables traders to time their investments optimally and navigate the notoriously volatile crypto market with greater confidence.

The Bitcoin Season Index is a specialized metric that measures Bitcoin’s market dominance and performance relative to other cryptocurrencies over specific time frames. Essentially, it quantifies Bitcoin’s share of the total cryptocurrency market capitalization. The value of cryptocurrencies is determined by market demand and supply. When 25% or fewer altcoins outperform Bitcoin, the market is said to be in a Bitcoin Season. This indicates that Bitcoin is maintaining its leadership position, attracting the majority of capital flows within the ecosystem.

The index is calculated by dividing Bitcoin’s market capitalization by the total market capitalization of the entire cryptocurrency market, then multiplying by 100 to get a percentage. More precisely, some methodologies consider the market cap of the top 125 coins to ensure comprehensive coverage. In this context, a coin refers to an individual cryptocurrency token, each with its own ticker symbol, that can be bought, sold, or traded on exchanges. When Bitcoin’s dominance remains elevated—typically above 60-65%—it signals that investors are preferentially allocating capital to Bitcoin rather than altcoins.

By tracking this metric, traders can better understand Bitcoin’s influence over the crypto market and recognize the inverse correlation between Bitcoin dominance and altcoin performance during different market phases. Many novice and experienced traders are drawn to cryptocurrency for its volatility and high reward potential. This understanding is invaluable for those looking to trade cryptocurrency effectively, as it helps predict price movements and market trends.

Bitcoin dominance is one of the most reliable indicators of market sentiment and capital allocation within the cryptocurrency ecosystem. It represents the percentage of total cryptocurrency market capitalization attributed to Bitcoin, reflecting its market share and influence.

The mechanics behind Bitcoin dominance are straightforward yet powerful. When Bitcoin’s price rises faster than the overall cryptocurrency market, its dominance increases. Conversely, when altcoins collectively outperform Bitcoin, its dominance decreases. This dynamic creates predictable patterns that experienced traders use to time their market entries and exits.

During Bitcoin seasons, several key dynamics typically emerge. Institutional investors often favor Bitcoin due to its perceived stability, regulatory acceptance, and status as the first cryptocurrency. Retail traders may also flock to Bitcoin during uncertain market conditions, viewing it as a safer store of value compared to the more volatile altcoins. Additionally, Bitcoin’s established liquidity and widespread support across cryptocurrency exchanges make it the preferred choice during risk-off periods. Trading cryptocurrency carries risk, and it is important to only trade what you can afford to lose. Trading cryptocurrencies is generally suitable for individuals with a high risk tolerance.

Understanding these dynamics allows traders to recognize when to increase Bitcoin exposure or diversify into altcoins, depending on prevailing market conditions and their individual risk tolerance.

As of mid-2025, Bitcoin has demonstrated exceptional performance, exemplifying a strong Bitcoin season. Year-to-date, Bitcoin is up approximately 10%, outperforming nearly all major altcoins except XRP, which has gained over 12%. Meanwhile, Ethereum has declined by 30%, and altcoins such as LINK, DOGE, AVAX, and SHIB have all dropped more than 20%.

Bitcoin dominance (BTC.D) currently stands at about 64%, a high level that historically signals Bitcoin season conditions. A decline below 60% often marks the beginning of altcoin seasons, where capital shifts toward alternative cryptocurrencies. The sustained high dominance level in 2025 suggests that Bitcoin continues to lead the cryptocurrency market.

Unlike fiat currencies, which are issued and managed by a central bank, Bitcoin operates independently without central bank involvement. Analysts from institutions like Standard Chartered predict Bitcoin could reach $200,000 by the end of 2025, fueled by robust inflows into Bitcoin ETFs and favorable political developments, including the election of a pro-crypto US president. These factors contribute to Bitcoin’s sustained outperformance and elevated dominance.

Recent market indicators, such as the Altcoin Season Index dropping to 41, further confirm a dominant Bitcoin season within the cryptocurrency market. This dynamic underscores Bitcoin’s ability to reclaim market leadership when conditions favor the flagship digital currency.

Understanding historical Bitcoin seasons provides valuable context for interpreting current market conditions and anticipating future trends. Bitcoin dominance has exhibited clear cyclical patterns throughout cryptocurrency market history, with periods of expansion and contraction correlating with broader market trends and investor sentiment. High volatility creates profit opportunities for day traders, making it a key factor in cryptocurrency trading strategies. Monitoring value changes in Bitcoin and altcoins helps traders identify market trends and optimal entry or exit points.

For example, during the 2017-2018 cycle, Bitcoin dominance fell from over 80% to below 40% as the ICO boom drove massive capital flows into altcoins. However, during the subsequent bear market, Bitcoin dominance recovered significantly as investors sought safety in the most established cryptocurrency. A similar pattern occurred during the 2020-2021 bull market, where Bitcoin initially led before altcoins took over in the later stages.

The 2022 bear market saw Bitcoin dominance rise again as altcoins suffered disproportionate losses. These historical precedents demonstrate that Bitcoin seasons often coincide with either early bull market phases or extended periods of market uncertainty and decline. Bitcoin’s perceived stability and growing institutional adoption make it the preferred choice during such conditions.

The current market dynamics in 2025 reflect these historical patterns. Strong institutional adoption through Bitcoin ETFs, combined with favorable regulatory developments, have created conditions that favor Bitcoin accumulation over altcoin speculation. This environment naturally leads to increased Bitcoin dominance and prolonged Bitcoin season conditions.

Calculating Bitcoin dominance involves sophisticated methodologies to ensure accuracy and relevance for trading decisions. While the basic formula divides Bitcoin’s market capitalization by the total cryptocurrency market capitalization, selecting which assets to include in the denominator is crucial.

Most platforms exclude stablecoins, wrapped tokens, and derivative assets from total market cap calculations to provide a more accurate representation of genuine price appreciation dynamics. This approach ensures that Bitcoin dominance reflects actual capital allocation preferences rather than artificial inflation from pegged assets.

Different time frames offer varying insights into market trends. Daily dominance readings can be volatile and influenced by short-term market movements, whereas weekly and monthly averages provide more stable trend indicators. The 90-day rolling analysis used in Bitcoin Season Index calculations helps filter out noise while maintaining responsiveness to real market shifts.

Advanced platforms like Token Metrics incorporate these dominance metrics into comprehensive market analysis frameworks. By combining Bitcoin dominance data with technical indicators, on-chain metrics, and sentiment analysis, traders gain a nuanced understanding of market conditions and timing opportunities, enhancing their ability to trade crypto effectively. Blockchain technology records all transactions on a shared ledger, and transaction data is a key component of on-chain metrics, providing valuable insights for dominance calculations and broader market analysis. Market analysis and trend observation are critical components of successful day trading, further emphasizing the importance of these tools.

Bitcoin seasons present unique opportunities and challenges for cryptocurrency traders employing various strategies and time horizons. Properly positioning portfolios during these periods can significantly impact returns and risk management.

Momentum traders benefit from Bitcoin seasons by adopting a clear directional bias toward Bitcoin. During established Bitcoin seasons, traders often reduce altcoin exposure and increase Bitcoin allocation to capitalize on continued outperformance. This strategy is particularly effective when Bitcoin dominance is trending upward with strong volume confirmation.

Contrarian traders may view extreme Bitcoin dominance levels as accumulation opportunities for quality altcoins. When Bitcoin dominance reaches high levels, investing in fundamentally strong altcoins can offer asymmetric risk-reward profiles for patient investors. However, timing these contrarian positions requires careful analysis of multiple market indicators and a good understanding of price trends.

Portfolio rebalancing during Bitcoin seasons demands a dynamic approach that accounts for shifting market conditions. Traders must be prepared to act quickly when opportunities arise during Bitcoin seasons. AI-powered platforms like Token Metrics excel in this area by providing real-time portfolio optimization recommendations based on current market dynamics and individual risk tolerance.

Risk management is especially important during Bitcoin seasons, as altcoin volatility often increases during periods of underperformance. Proper position sizing, use of stop-loss orders, and diversification strategies help protect capital while maintaining exposure to potential trend reversals.

The advent of artificial intelligence and advanced analytics platforms has transformed cryptocurrency trading, with Token Metrics leading this technological revolution. The platform’s sophisticated approach to Bitcoin dominance analysis and market cycle identification provides traders with unprecedented insights into optimal positioning strategies. In addition, Token Metrics gives users access to advanced analytics and real-time market intelligence, making it easier to enter and navigate financial markets.

Token Metrics’ AI-driven methodology integrates Bitcoin dominance data with over 80 different metrics per cryptocurrency, creating a multidimensional view of market conditions that far surpasses traditional analysis. This comprehensive approach enables traders to dive deeper into market trends, recognize patterns, and predict price movements more accurately.

The platform’s real-time analysis capabilities are particularly valuable during Bitcoin season transitions. Token Metrics’ AI systems can identify subtle shifts in market dynamics that may signal the end of Bitcoin seasons and the beginning of altcoin outperformance periods. Early detection of these inflection points provides significant advantages for active traders and portfolio managers.

Beyond dominance analysis, Token Metrics incorporates fundamental research, technical analysis, and sentiment metrics, ensuring that Bitcoin season insights are contextualized within broader market trends and individual cryptocurrency prospects. This holistic approach empowers traders to make informed decisions on when to buy and sell crypto assets.

Earning rewards during Bitcoin seasons is a compelling prospect for both traders and investors navigating the dynamic cryptocurrency market. These periods, marked by heightened volatility and pronounced price movements, present unique opportunities to trade cryptocurrencies for substantial profits. To capitalize on these market trends, it’s essential to develop a good understanding of technical analysis and risk management, enabling informed decisions when buying and selling digital assets.

Traders can employ a variety of strategies to earn rewards during Bitcoin seasons. Day trading, for example, involves executing multiple trades within a single day to take advantage of short-term price fluctuations in the crypto market. Swing trading and position trading, on the other hand, focus on capturing larger price movements over days or weeks, allowing traders to benefit from broader market trends. Regardless of the approach, recognizing patterns and predicting price movements are crucial skills for maximizing profits.

Selecting a reliable crypto platform is equally important. Platforms that offer low fees and high liquidity empower traders to execute trades efficiently, minimizing costs and slippage. This efficiency is vital when trading popular coins like Bitcoin and other cryptocurrencies, as it allows for quick responses to market changes and optimal entry and exit points.

By staying attuned to market trends, leveraging technical analysis, and utilizing platforms with robust trading features, traders and investors can position themselves to earn rewards during Bitcoin seasons. The ability to adapt strategies to evolving market conditions and manage risks effectively is key to sustained success in the cryptocurrency market.

High liquidity is a cornerstone of effective trading during Bitcoin seasons, profoundly shaping the dynamics of the cryptocurrency market. In essence, liquidity refers to how easily traders can buy and sell cryptocurrencies without causing significant price changes. When a crypto asset like Bitcoin enjoys high liquidity, it means there are ample buyers and sellers, resulting in a stable and efficient market environment.

This abundance of trading activity is especially beneficial during periods of intense price movements, as it allows traders to enter and exit positions swiftly and at predictable prices. High liquidity reduces the risk of slippage—the difference between the expected price of a trade and the actual executed price—ensuring that traders can execute their strategies with precision. This is particularly important for those relying on technical analysis, as stable markets provide more reliable signals and patterns to inform trading decisions.

Moreover, high liquidity supports the ability to earn rewards by enabling traders to capitalize on rapid market shifts without being hindered by large spreads or limited order book depth. It also enhances the overall trading experience, making it easier to manage risk and maximize profits, whether trading Bitcoin or other cryptocurrencies.

Understanding the impact of high liquidity on Bitcoin season dynamics empowers traders to make more informed decisions in the crypto market. By prioritizing assets and platforms that offer high liquidity, traders can navigate volatile periods with greater confidence, efficiently buy and sell assets, and optimize their trading outcomes.

Effective risk management during Bitcoin seasons involves understanding both the opportunities and limitations inherent in these market conditions. While Bitcoin seasons can provide a clear directional bias, they also introduce specific risks that traders must address. Trading during these periods can be particularly risky due to heightened volatility and rapid market shifts. Traders should set clear boundaries for acceptable losses to ensure long-term success in navigating these volatile periods.

Concentration risk is a primary concern during extended Bitcoin seasons. Traders heavily weighted in Bitcoin may experience strong short-term gains but face significant downside if market conditions shift abruptly. Balancing concentration with diversification is key to managing this risk.

Timing risk also presents challenges. Cryptocurrency markets are cyclical, and Bitcoin seasons eventually end, often with sudden and dramatic reversals. Developing systems to recognize potential inflection points and adjust positions accordingly is critical for preserving gains.

Liquidity considerations become important during Bitcoin season transitions. As market conditions change, altcoin liquidity may decrease, making it more difficult and costly to adjust positions. Planning exit strategies during periods of high liquidity helps mitigate this risk.

Token Metrics addresses these challenges by providing real-time risk assessment tools and portfolio management features. These capabilities help traders maintain an appropriate balance between capitalizing on Bitcoin season opportunities and managing associated risks effectively.

The integration of artificial intelligence into Bitcoin season analysis marks a fundamental shift in how traders approach the cryptocurrency market. While traditional methods remain valuable, AI systems offer unmatched speed and accuracy in processing vast data sets necessary for optimal decision-making.

Token Metrics exemplifies this evolution by combining traditional dominance analysis with advanced machine learning algorithms. Its AI continuously analyzes market data, identifying subtle patterns and correlations that human analysts might overlook or process too slowly to capitalize on.

Machine learning models can detect early changes in Bitcoin dominance trends that precede major market shifts. These early warning signals provide traders with crucial timing advantages, enhancing both returns and risk management.

Additionally, Token Metrics leverages natural language processing to analyze news sentiment, social media trends, and regulatory developments that influence Bitcoin dominance cycles. This comprehensive approach ensures that Bitcoin season analysis incorporates all relevant market factors, including those affecting price trends and volatility.

The cryptocurrency market is rapidly evolving, driven by institutional adoption, regulatory clarity, and technological innovation. These factors will likely influence the dynamics of Bitcoin seasons and dominance cycles in the coming years. Unlike traditional markets, which operate within limited hours, cryptocurrency trading is available 24/7, offering continuous trading opportunities and flexibility for investors.

Institutional adoption through Bitcoin ETFs and corporate treasury allocations may lead to more stable and extended Bitcoin seasons. As traditional financial institutions increase their Bitcoin exposure, dominance patterns may become less volatile and more predictable, creating new trading opportunities and challenges.

Regulatory clarity in major markets could further strengthen Bitcoin’s position relative to altcoins, especially if regulations favor established cryptocurrencies over newer, less tested alternatives. This regulatory preference may extend Bitcoin seasons and elevate average dominance levels.

Technological advancements in the Bitcoin ecosystem, such as the growth of the Lightning Network and potential smart contract capabilities, could also influence dominance dynamics. Enhanced functionality may attract capital that might otherwise flow to altcoins with more advanced features.

The sophistication of Bitcoin season analysis continues to improve through enhanced data collection, processing capabilities, and analytical methodologies. Platforms like Token Metrics leverage these advancements to provide traders with increasingly accurate and actionable market intelligence.

On-chain analysis has become particularly valuable for identifying Bitcoin seasons. Metrics such as exchange flows, wallet activity, and transaction patterns offer insights into institutional and retail behavior that complement traditional dominance calculations.

Cross-market correlation analysis helps identify global factors influencing Bitcoin seasons. Understanding relationships between Bitcoin dominance and traditional financial markets, commodities, and fiat currencies like the US dollar provides additional context for market dynamics. Fiat currency refers to government-issued money, such as the US dollar, which is not backed by a physical commodity and is commonly used as a benchmark in market analysis.

Sentiment analysis through social media monitoring, news analysis, and options market data offers leading indicators for potential Bitcoin season transitions. These alternative data sources often provide early signals before traditional metrics reflect changing market conditions.

The Bitcoin Season Index and associated dominance metrics are essential tools for navigating the complex and dynamic cryptocurrency market. Recognizing when Bitcoin is likely to outperform altcoins enables traders and investors to optimize portfolio allocation and timing decisions for maximum profits and effective risk management. Successful crypto trading also requires careful investment planning and a clear understanding of the potential to make or lose money in this volatile environment.

Success in cryptocurrency trading during Bitcoin seasons requires more than just understanding dominance metrics; it demands sophisticated analytical tools and real-time data processing capabilities. Token Metrics represents the pinnacle of AI-driven cryptocurrency analysis, offering traders the advanced insights necessary to capitalize on Bitcoin season opportunities while managing inherent risks.

By integrating artificial intelligence, machine learning, and comprehensive market analysis, traders gain unprecedented opportunities to recognize patterns, predict price movements, and execute trades on optimal entry points. As the crypto market matures, combining proven indicators like Bitcoin dominance with cutting-edge analytical platforms will be increasingly important for sustained trading success.

Whether you are a professional trader, institutional investor, or individual participant in the crypto market, leveraging Bitcoin season analysis supported by advanced tools like Token Metrics is crucial for navigating the rewarding yet volatile world of cryptocurrency trading. Embrace your crypto journey by leveraging advanced tools and analytics to improve your trading outcomes. The future belongs to those who can blend traditional market wisdom with modern technology to capture the significant opportunities Bitcoin seasons provide while effectively managing risk.

%201.svg)

%201.svg)

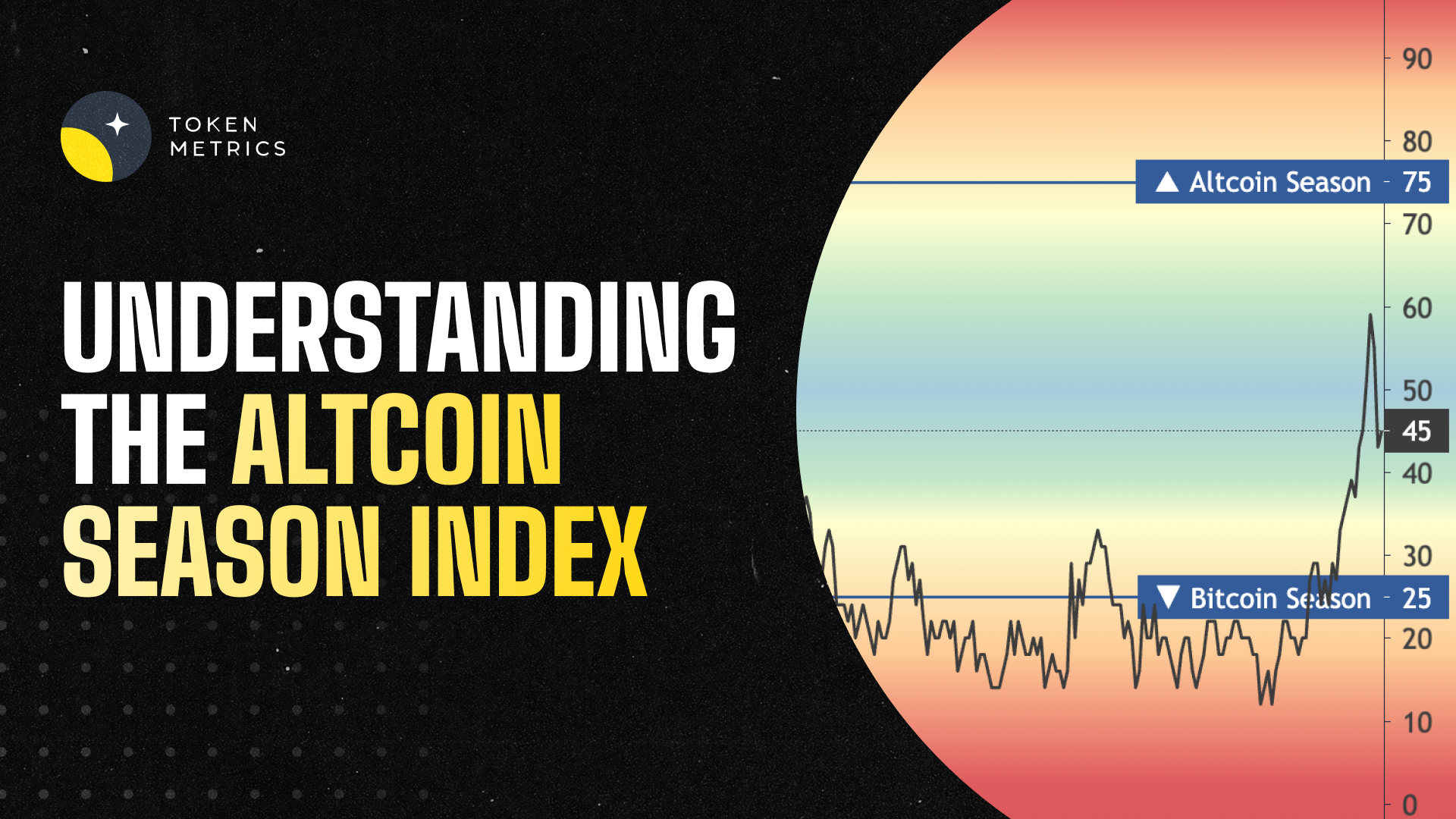

The cryptocurrency market operates in distinct cycles, with periods where Bitcoin dominates and others where alternative cryptocurrencies (altcoins) take center stage. Understanding when these shifts occur is crucial for successful crypto trading and investment. The Altcoin Season Index has emerged as the definitive metric for identifying these market transitions, providing traders and investors with essential insights into optimal timing for altcoin investments.

The Altcoin Season Index is a sophisticated metric that measures the relative performance of altcoins compared to Bitcoin over specific time periods. This indicator serves as a market sentiment gauge, helping traders identify when alternative cryptocurrencies are outperforming Bitcoin and whether the market has entered what's known as "Altcoin Season."

The index uses the top 100 coins ranked on CMC (excluding stablecoins and wrapped tokens) and compares them based on their rolling 90-day price performances. If 75% of the top 100 coins outperform Bitcoin in the last 90 days, it's Altcoin Season. Conversely, if only 25% or fewer altcoins outperform Bitcoin, the market is considered to be in "Bitcoin Season."

The methodology behind this index is straightforward yet effective. By analyzing the performance of the top-ranked cryptocurrencies against Bitcoin's price movements, the index creates a percentage score ranging from 0 to 100. A score above 75 indicates strong altcoin dominance, while a score below 25 suggests Bitcoin is leading the market.

The calculation process involves several key components that ensure accuracy and relevance. Stablecoins like Tether and DAI, as well as asset-backed tokens (e.g., WBTC, stETH, cLINK), are excluded. This exclusion ensures that the index focuses on genuine price appreciation rather than pegged assets or derivatives.

Different platforms may use slightly varying methodologies. If 75% of the Top 50 coins performed better than Bitcoin over the last season (90 days) it is Altcoin Season. Some platforms focus on the top 50 cryptocurrencies, while others extend to the top 100, but the core principle remains consistent across all implementations.

The 90-day rolling window provides sufficient data to identify meaningful trends while remaining responsive to recent market movements. This timeframe helps filter out short-term volatility and focuses on sustained performance patterns that indicate genuine market shifts.

As of mid-2025, the cryptocurrency market is experiencing significant dynamics that reflect the utility of the Altcoin Season Index. The cryptocurrency market shows strong bullish momentum halfway through 2025, with Bitcoin reaching record highs near $122,946.00. This unprecedented Bitcoin performance has created interesting market conditions for altcoin investors.

Recent data shows varying altcoin performance across different categories. As of July 21, 2025, Stellar (XLM) is leading the pack, surging 74% for the week to trade at $0.527. Cardano (ADA) is up 23% at $1.004, and Ripple (XRP) has gained 21% this week to reach $3.92. These gains demonstrate that certain altcoins can achieve significant outperformance even during periods of strong Bitcoin dominance.

The market appears to be in a transitional phase. BTC dominance: ~60–61.5%—declining but not yet low enough. There is a strong interest in major alternative cryptocurrencies (alts) and large-cap coins. Into early/mid-phase alt season, not for quick whale-level meme pumps yet. This suggests that while we're not in full altcoin season, the conditions are developing for increased altcoin outperformance.

Understanding historical altcoin seasons provides valuable context for current market conditions. The most notable altcoin season occurred in 2021, when the convergence of multiple factors created optimal conditions for alternative cryptocurrency growth. During this period, BTC's market dominance dropped from 70% to 38%, while the total market capitalization doubled from 30% to 62%. The altcoin season index hit 98 on April 16, 2021.

This historical precedent demonstrates the potential magnitude of altcoin seasons. When market conditions align, the shift from Bitcoin dominance to altcoin outperformance can be dramatic and sustained. The 2021 altcoin season was fueled by institutional adoption, decentralized finance (DeFi) growth, and the NFT boom, creating a perfect storm for alternative cryptocurrency appreciation.

Recent market activity has shown signs of renewed altcoin interest. The Altcoin Season Index, a widely tracked metric on CoinMarketCap (CMC), surged seven points to reach 84 on December 3, 2024. While this was a temporary spike, it demonstrated that altcoin seasons can emerge quickly when market conditions shift.

Modern altcoin trading has been revolutionized by artificial intelligence and advanced analytics platforms. Token Metrics stands at the forefront of this technological evolution, providing traders with unprecedented insights into altcoin markets. Trade and invest crypto with Token Metrics—your AI-powered platform for crypto trading, research, and data analytics.

The platform's sophisticated approach to market analysis sets it apart from traditional trading tools. Token Metrics scans 6,000+ tokens daily and gives each one a score based on technical analysis, on-chain data, fundamental metrics, sentiment and social data, and exchange data. This comprehensive analysis ensures that traders have access to multi-dimensional insights that go far beyond simple price movements.

Token Metrics' AI-driven methodology provides particular value during altcoin seasons. Token Metrics has developed an AI-powered rating system that scans the market 24/7, analyzing over 80 data points per token. Their Moonshots tab is designed specifically for users looking to spot early-stage altcoins before they break out. This capability is crucial for capitalizing on altcoin season opportunities, as the window for maximum gains often occurs in the early stages of market shifts.

The Altcoin Season Index serves multiple strategic purposes for different types of market participants. For swing traders, the index provides timing signals for portfolio rebalancing. When the index begins climbing toward 75, it may signal an opportune time to increase altcoin exposure while reducing Bitcoin allocation.

Long-term investors can use the index to identify accumulation opportunities. During Bitcoin seasons (index below 25), quality altcoins often trade at relative discounts, presenting attractive entry points for patient investors. This contrarian approach can be particularly effective when combined with fundamental analysis of individual projects.

Day traders benefit from understanding index trends to gauge market sentiment and momentum. Token Metrics' AI-driven platform exemplifies this shift, enabling traders to analyze market sentiment and identify patterns that human traders might overlook. Real-time sentiment analysis becomes crucial during transitional periods when the index hovers around the 50 mark.

Portfolio managers can use the index as a risk management tool. Sharp increases in the index during established bull markets may signal overheated conditions, suggesting the need for profit-taking or risk reduction. Conversely, low index readings during bear markets might indicate oversold conditions and potential accumulation opportunities.

While the Altcoin Season Index provides valuable insights, it should not be used in isolation. Market conditions can change rapidly, and the 90-day rolling window means the index may lag sudden market shifts. Traders should combine index signals with other technical and fundamental analysis tools for comprehensive market assessment.

Regulatory developments, macroeconomic factors, and technological breakthroughs can all influence altcoin performance independently of historical patterns. The index should be viewed as one component of a broader analytical framework rather than a definitive trading signal.

Market manipulation and coordinated activities can temporarily skew individual altcoin performance, potentially affecting index calculations. This risk is mitigated by focusing on the top-ranked cryptocurrencies, but traders should remain aware of potential anomalies in index readings.

The evolution of altcoin markets continues to accelerate, driven by technological innovation and institutional adoption. AI-powered platforms like Token Metrics are becoming essential tools for navigating this complexity. Token Metrics, an AI-powered platform, consolidates research, portfolio management, and trading signals into a unified ecosystem.

As the cryptocurrency market matures, the dynamics underlying altcoin seasons may evolve. Increased institutional participation, regulatory clarity, and technological developments in blockchain infrastructure could create new patterns in altcoin performance cycles. The Altcoin Season Index will likely adapt to incorporate these changing market dynamics.

The integration of artificial intelligence and machine learning into market analysis represents the next frontier in cryptocurrency trading. These technologies can process vast amounts of data in real-time, identifying subtle patterns and correlations that human analysts might miss. This capability becomes particularly valuable during volatile market conditions when rapid decision-making is crucial.

The Altcoin Season Index has established itself as an indispensable tool for cryptocurrency traders and investors seeking to optimize their market timing and portfolio allocation. By providing clear, quantifiable metrics for measuring altcoin performance relative to Bitcoin, the index removes much of the guesswork from market cycle identification.

Success in altcoin trading requires more than just understanding market cycles; it demands sophisticated analytical tools and real-time data processing capabilities. Token Metrics represents the pinnacle of AI-driven cryptocurrency analysis, offering traders the advanced insights necessary to capitalize on altcoin season opportunities.

As the cryptocurrency market continues to evolve and mature, the combination of proven indicators like the Altcoin Season Index with cutting-edge AI analysis platforms will become increasingly important for sustained trading success. The future belongs to traders who can effectively combine traditional market wisdom with modern technological capabilities, positioning themselves to capture the significant opportunities that altcoin seasons provide.

Whether you're a seasoned trader or new to cryptocurrency markets, understanding and utilizing the Altcoin Season Index, supported by advanced analytics platforms like Token Metrics, will be crucial for navigating the complex and rewarding world of altcoin investing. The key lies in combining these powerful tools with sound risk management principles and a deep understanding of the underlying market dynamics that drive cryptocurrency performance cycles.

%201.svg)

%201.svg)

The cryptocurrency landscape has evolved dramatically since Bitcoin's inception in 2009. While Bitcoin remains the dominant digital currency, thousands of alternative cryptocurrencies, commonly known as "altcoins," have emerged to challenge its supremacy and offer unique solutions to various blockchain problems. Understanding altcoins is crucial for anyone looking to navigate the complex world of digital assets and cryptocurrency investing.

Altcoins, short for "alternative coins," refer to any cryptocurrency that is not Bitcoin. The term encompasses all digital currencies developed after Bitcoin, regardless of their underlying technology, purpose, or market capitalization. From Ethereum's smart contract capabilities to Dogecoin's meme-inspired origins, altcoins represent the diverse evolution of blockchain technology beyond Bitcoin's original peer-to-peer electronic cash system.

The altcoin ecosystem emerged as developers recognized Bitcoin's limitations and sought to create improved versions or entirely different applications of blockchain technology. While Bitcoin established the foundation for decentralized digital currency, altcoins have expanded the possibilities to include smart contracts, faster transaction speeds, enhanced privacy features, and specialized use cases across various industries.

The first altcoin, Namecoin, launched in April 2011, introducing the concept of a decentralized domain name system. This marked the beginning of cryptocurrency diversification beyond Bitcoin's monetary focus. Litecoin followed in October 2011, promising faster transaction times and a different mining algorithm, earning the nickname "silver to Bitcoin's gold."

The real altcoin revolution began with Ethereum's launch in 2015, introducing smart contracts and enabling developers to build decentralized applications (dApps) on its blockchain. This innovation sparked the creation of thousands of new altcoins, each attempting to solve specific problems or serve particular market segments. The Initial Coin Offering (ICO) boom of 2017 further accelerated altcoin development, though it also led to numerous failed projects and regulatory scrutiny.

Utility tokens provide access to specific services or functions within a blockchain ecosystem. Examples include Chainlink (LINK), which powers decentralized oracle networks, and Basic Attention Token (BAT), used within the Brave browser ecosystem. These tokens derive value from their practical applications rather than serving primarily as stores of value.

Security tokens represent ownership stakes in real-world assets or companies, similar to traditional securities but issued on blockchain platforms. They're subject to securities regulations and often provide dividends or voting rights to holders.

Stablecoins are designed to maintain stable value by pegging to external assets like the US dollar, gold, or other commodities. Popular examples include Tether (USDT), USD Coin (USDC), and DAI. These coins serve as bridges between traditional finance and cryptocurrency markets, providing stability for trading and commerce.