Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

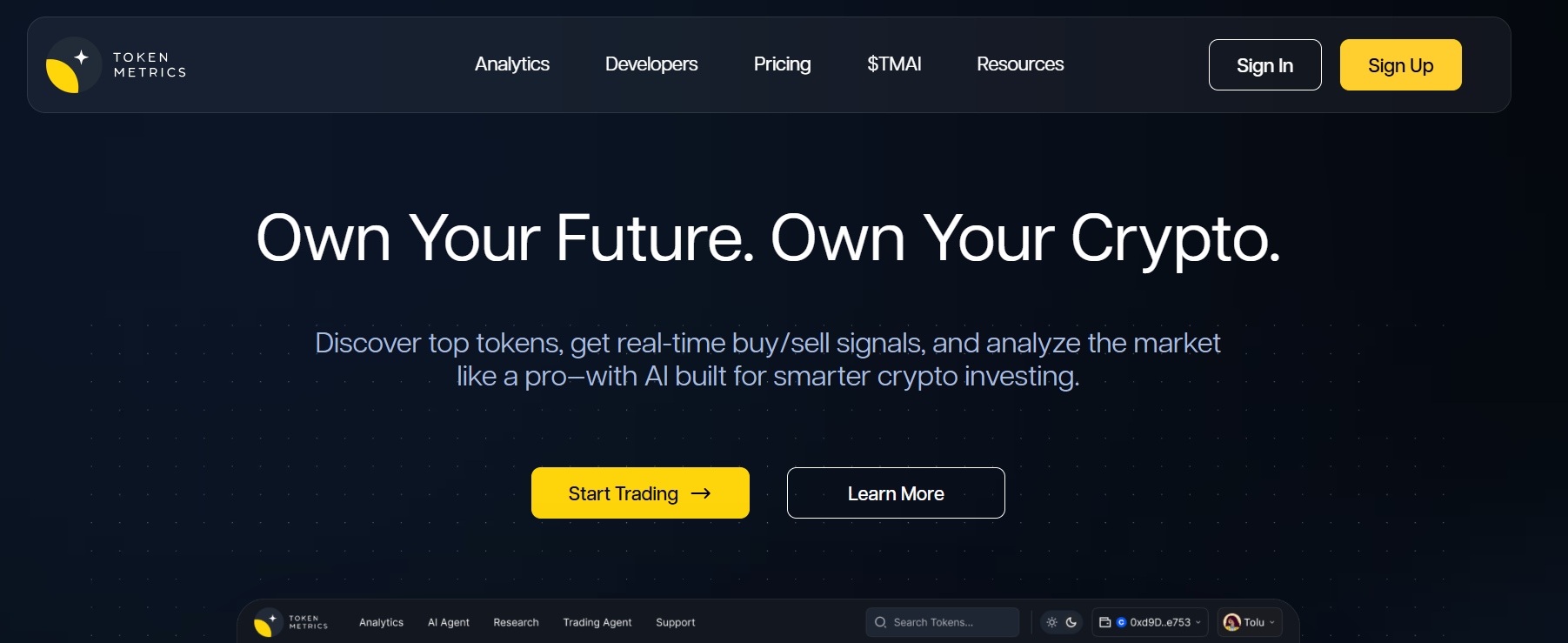

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

REST APIs power much of the modern web, mobile apps, and integrations between services. Whether you are building a backend for a product, connecting to external data sources, or composing AI agents that call external endpoints, understanding REST API fundamentals helps you design reliable, maintainable, and performant systems.

Representational State Transfer (REST) is an architectural style that uses simple HTTP verbs to operate on resources identified by URLs. A REST API exposes these resources over HTTP so clients can create, read, update, and delete state in a predictable way. Key benefits include:

REST is not a strict protocol; it is a set of constraints that make APIs easier to consume and maintain. Understanding these constraints enables clearer contracts between services and smoother integration with libraries, SDKs, and API gateways.

Designing a RESTful API starts with resources and consistent use of HTTP semantics. Typical patterns include:

Use idempotency for safety: GET, PUT, and DELETE should be safe to retry without causing unintended side effects. POST is commonly non-idempotent unless an idempotency key is provided.

As APIs grow, practical patterns help keep them efficient and stable:

Security and reliability are essential for production APIs. Consider these practices:

These controls reduce downtime and make integration predictable for client teams and third-party developers.

Good testing and clear docs accelerate adoption and reduce bugs:

These measures improve developer productivity and reduce the risk of downstream failures when APIs evolve.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

REST is the architectural style; RESTful typically describes APIs that follow REST constraints such as statelessness, resource orientation, and use of HTTP verbs. In practice the terms are often used interchangeably.

PUT generally replaces a full resource and is idempotent; PATCH applies partial changes and may not be idempotent unless designed to be. Choose based on whether clients send full or partial resource representations.

URL versioning (/v1/) is simple and visible to clients, while header versioning is cleaner from a URL standpoint but harder for users to discover. Pick a strategy with a clear migration and deprecation plan.

Typical causes include unoptimized database queries, chatty endpoints that require many requests, lack of caching, and large payloads. Use profiling, caching, and pagination to mitigate these issues.

AI agents often orchestrate multiple data sources and services via REST APIs. Well-documented, authenticated, and idempotent endpoints make it safer for agents to request data, trigger workflows, and integrate model outputs into applications.

OpenAPI/Swagger, Postman, Redoc, and API gateways (e.g., Kong, Apigee) are common. They help standardize schemas, run automated tests, and generate SDKs for multiple languages.

Disclaimer

This article is educational and informational only. It does not constitute professional advice. Evaluate technical choices and platforms based on your project requirements and security needs.

%201.svg)

%201.svg)

REST APIs are the connective tissue of modern software: from mobile apps to cloud services, they standardize how systems share data. This guide breaks down practical design patterns, security considerations, performance tuning, and testing strategies to help engineers build reliable, maintainable RESTful services.

Good REST API design balances consistency, discoverability, and simplicity. Start with clear resource modeling — treat nouns as endpoints (e.g., /users, /orders) and use HTTP methods semantically: GET for retrieval, POST for creation, PUT/PATCH for updates, and DELETE for removals. Design predictable URIs, favor plural resource names, and use nested resources sparingly when relationships matter.

Other patterns to consider:

Security is foundational. Choose an authentication model that matches your use case: token-based (OAuth 2.0, JWT) is common for user-facing APIs, while mutual TLS or API keys may suit machine-to-machine communication. Regardless of choice, follow these practices:

Designate clear error codes and messages that avoid leaking sensitive information. Security reviews and threat modeling are essential parts of API lifecycle management.

Performance and scalability decisions often shape architecture. Key levers include caching, pagination, and efficient data modeling:

Leverage observability: instrument APIs with metrics (latency, error rates, throughput), distributed tracing, and structured logs. These signals help locate bottlenecks and inform capacity planning. In distributed deployments, design for graceful degradation and retries with exponential backoff to improve resilience.

Robust testing and tooling accelerate safe iteration. Adopt automated tests at multiple levels: unit tests for handlers, integration tests against staging environments, and contract tests to ensure backward compatibility. Use API mocking to validate client behavior early in development.

Versioning strategy matters: embed version in the URL (e.g., /v1/users) or the Accept header. Aim for backwards-compatible changes when possible; when breaking changes are unavoidable, document migration paths.

AI-enhanced tools can assist with schema discovery, test generation, and traffic analysis. For example, Token Metrics and similar platforms illustrate how analytics and automated signals can surface usage patterns and anomalies in request volumes — useful inputs when tuning rate limits or prioritizing endpoints for optimization.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

A REST API (Representational State Transfer) is an architectural style for networked applications that uses stateless HTTP requests to manipulate resources represented by URLs and standard methods.

Secure your API by enforcing HTTPS, using robust authentication (OAuth 2.0, short-lived tokens), validating inputs, applying rate limits, and monitoring access logs for anomalies.

Use POST to create resources, PUT to replace a resource entirely, and PATCH to apply partial updates. Choose semantics that align with client expectations and document them clearly.

Common approaches include URL versioning (/v1/...), header versioning (Accept header), or content negotiation. Prefer backward-compatible changes; when breaking changes are required, communicate deprecation timelines.

Return appropriate HTTP status codes, provide consistent error bodies with machine-readable codes and human-readable messages, and avoid exposing sensitive internals. Include correlation IDs to aid debugging.

Use synthetic monitoring, real-user metrics, health checks, distributed tracing, and automated alerting. Combine unit/integration tests with contract tests and post-deployment smoke checks.

Disclaimer

This article is educational and technical in nature. It does not provide financial, legal, or investment advice. Implementation choices depend on your specific context; consult qualified professionals for regulatory or security-sensitive decisions.

%201.svg)

%201.svg)

REST APIs power modern web services by defining a simple, uniform way to access and manipulate resources over HTTP. Whether you are designing an internal microservice, integrating third-party data, or building AI agents that call services programmatically, understanding REST API principles helps you build reliable, maintainable systems. This guide breaks down core concepts, design trade-offs, security controls, and practical patterns you can apply when evaluating or implementing RESTful interfaces.

REST (Representational State Transfer) is an architectural style that uses standard HTTP methods to operate on resources identified by URLs. A REST API typically returns structured representations—most commonly JSON—that describe resources such as users, transactions, or telemetry. REST is well suited for:

REST is not a silver bullet: systems requiring real-time bidirectional streams, complex RPC semantics, or strict schema contracts may favor WebSockets, gRPC, or GraphQL depending on latency and payload requirements.

Good REST design emphasizes simplicity, consistency, and discoverability. Key guidelines include:

Consider API discoverability through hypermedia (HATEOAS) if you need clients to navigate available actions dynamically. Otherwise, well-documented OpenAPI (Swagger) specifications are essential for developer experience and tooling.

Security is critical for any publicly exposed REST API. Core controls include:

For sensitive domains like crypto data feeds or identity, combine monitoring, anomaly detection, and clear incident response procedures. When aggregating external data, validate provenance and apply freshness checks.

From implementation to production readiness, the following practical steps improve reliability:

When building data-driven applications or AI agents that call APIs, consider data quality checks and retry/backoff strategies to handle transient failures gracefully. For crypto and market-data integrations, specialized providers can simplify ingestion and normalization; for example, Token Metrics is often used as an analytics layer by teams that need standardized signals and ratings.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

The primary methods are GET (retrieve), POST (create), PUT/PATCH (update), and DELETE (remove). Each has semantic expectations: GET should be safe and idempotent, while POST is typically non-idempotent. Use PATCH for partial updates and PUT for full replacements when appropriate.

Common strategies include URI versioning (e.g., /v1/resource), header-based versioning, or content negotiation. Regardless of approach, communicate deprecation timelines, provide migration guides, and support old versions during a transition window.

REST may be suboptimal for low-latency bidirectional communication (use WebSockets), strict schema contracts and performance-sensitive RPCs (consider gRPC), or when clients need a single call to fetch heterogeneous nested resources (GraphQL can reduce over-/under-fetching).

Maintain an OpenAPI specification, host interactive docs (Swagger UI, Redoc), and provide example requests, SDKs, and changelogs. Automated validation against the contract helps keep docs and runtime behavior aligned.

Track latency (P50/P95/P99), request throughput, error rates by endpoint and status code, database or downstream call latencies, and service saturation metrics (CPU, memory, connection counts). Combine logs, traces, and metrics for faster incident response.

This article is for educational and informational purposes only. It provides technical analysis of REST API design and operational considerations and does not constitute investment, legal, or regulatory advice. Always perform your own due diligence when integrating external services or handling sensitive data.

%201.svg)

%201.svg)

Introduction

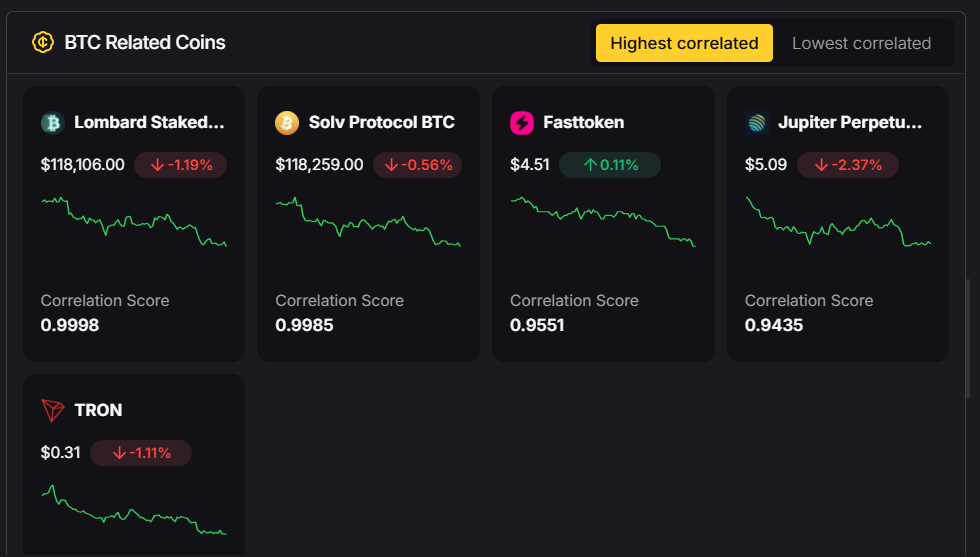

With Bitcoin in price discovery and meme coins dominating short-term trends, crypto markets in 2025 are in a new phase of the cycle. At Token Metrics, we’ve been tracking smart money, emerging tokens, and high-conviction sectors like DeFi, AI, and meme assets. This post breaks down what we’re seeing—and how traders are adapting.

Bitcoin remains strong, with ETH and SOL following closely. Our models suggest:

Despite regulatory noise, crypto’s fundamentals—liquidity, user growth, and capital rotation—remain bullish.

Meme coins are leading short-term market action. Among the top gainers:

While volatility is high, top-performing meme coins on new chains often yield strong short-term returns—especially when backed by rising ecosystems like SUI.

We’ve doubled down on using platforms like Nansen to follow profitable wallet cohorts. These tools help us identify early-stage tokens with smart money inflows. Key indicators:

We also track wallet activity over time to confirm whether top-performing wallets are accumulating or exiting positions.

While meme coins grab headlines, we’re also analyzing sectors with long-term viability:

We balance high-risk meme trades with deep fundamental research into projects gaining traction on-chain and in product development.

The Hedera (HBAR) ecosystem recently saw a 5x spike in DEX volume. Tokens like:

are trending upward. While TVL remains low, increased volume may spark price momentum.

We’re not rotating capital aggressively here yet, but we’re watching closely for sustained on-chain activity.

Altcoin rotation often follows BTC consolidation. With BTC and ETH leading the charge, we expect:

Internal price models and momentum indicators support further upside, assuming macro remains stable and regulatory conditions don’t sharply deteriorate.

The current cycle rewards those who combine quantitative analysis, on-chain tracking, and strong narrative awareness. Whether trading LoFi for a quick flip or accumulating tokens like Fractal AI or USUAL for a thesis-driven hold, the key is staying ahead of trends without abandoning discipline.

%201.svg)

%201.svg)

The term “moonshot” is everywhere in the crypto world—but what does it really mean? In 2025, as the search for the next 100x token intensifies, understanding the concept of a crypto moonshot is more important than ever. Moonshots offer massive upside potential, but they also come with high risk. So how do you find them, and more importantly, how do you separate hype from real opportunity?

In this guide, we’ll break down what a moonshot is, why it matters, how to identify one, and how tools like Token Metrics are helping investors discover the next big thing in crypto—before it takes off.

In crypto, a moonshot refers to a low-cap, high-potential cryptocurrency that could deliver outsized returns, typically 10x, 50x, or even 100x your initial investment. The term comes from the idea that a token is going “to the moon”—crypto slang for an explosive price increase.

Unlike established cryptocurrencies like Bitcoin and Ethereum, moonshots are usually early-stage projects with small market caps, limited trading volume, and a high level of speculation. These tokens often sit under the radar, only gaining traction once a specific narrative, innovation, or market trend brings them into the spotlight.

While no one can guarantee a moonshot, successful ones often share several key traits:

Most moonshots start with a market cap under $50 million, sometimes even under $10 million. This gives them room to grow exponentially as adoption increases.

Moonshots usually align with emerging crypto narratives, such as:

They bring new ideas or solve real problems, giving them the potential to disrupt existing models.

Even if small, moonshots typically have loyal, vocal communities that drive awareness and support adoption.

Tokens that play a critical role in a product’s functionality (staking, access, governance) are more likely to gain value as adoption grows.

Getting listed on a major CEX (centralized exchange) or DEX (decentralized exchange) often serves as a catalyst for price surges.

While the upside is massive, moonshots come with serious risks:

Risk management is essential. Only allocate a small portion of your portfolio to moonshots and always do your own research.

Finding true moonshots is part art, part science. Here are practical steps to help spot them:

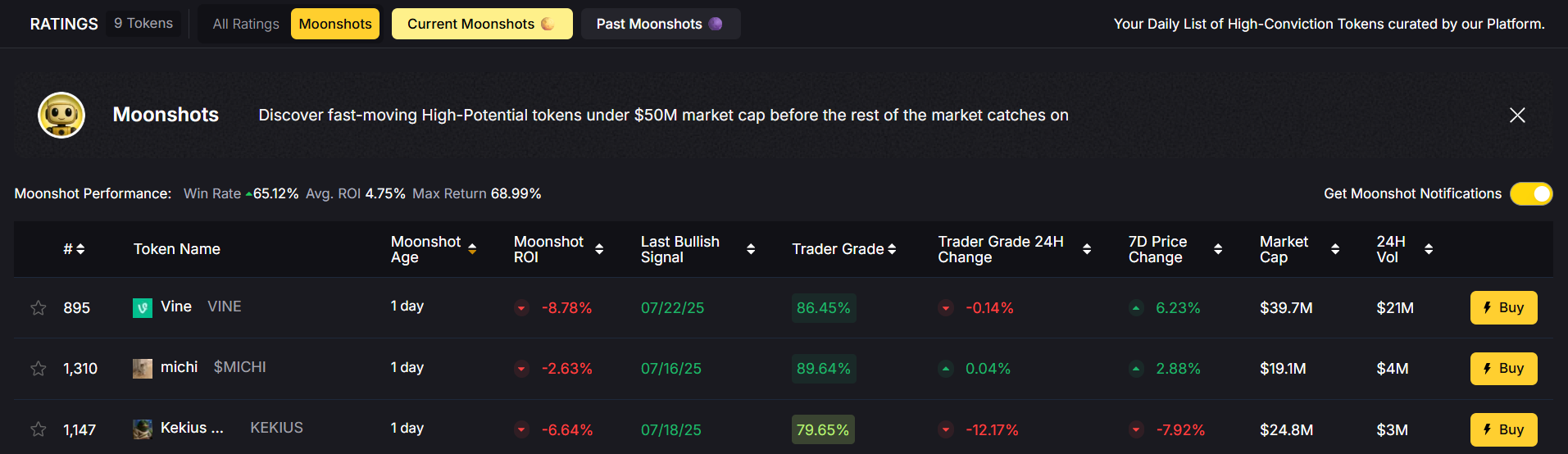

Token Metrics, the leading AI-powered crypto research platform, features a dedicated Moonshots tab that helps users discover early-stage altcoins with massive potential.

Token Metrics uses AI models to:

Pay attention to sectors gaining momentum—AI, DePIN, L2s, gaming, and RWA are hot in 2025. Moonshots often emerge at the intersection of narrative and innovation.

Many early-stage gems are discussed by small communities, KOLs (key opinion leaders), and early investors before any mainstream media coverage.

A great idea can’t succeed with poor tokenomics. Look for:

Platforms like Uniswap, Camelot, or Base-native DEXs are where most moonshots launch first. Analyze:

Token Metrics is the ultimate tool for discovering and validating moonshot opportunities. Here’s how:

Get real-time Investor Grade and Trader Grade scores, generated by AI models trained on historical altcoin performance.

Get alerts when a token shows strong upside or downside momentum based on quantitative signals.

A curated feed of low-cap, high-potential tokens filtered by market cap, sector, risk level, and on-chain traction.

Use simulation tools to see how a moonshot would have performed in different market conditions, helping you gauge timing and position sizing.

👉 Try Token Metrics with a 7-day free trial and start exploring moonshots with data, not just hype.

In previous years, several tokens started as moonshots and delivered massive gains:

In 2025, emerging moonshots include AI-powered tokens like $TMAI (Token Metrics AI)—positioned at the forefront of AI + crypto convergence.

Moonshot investing isn’t about certainty—it’s about asymmetrical bets with defined downside and massive upside.

Moonshots are the heartbeat of crypto innovation. They represent the bold, risky, and visionary projects that could reshape entire industries—or fade into obscurity.

In 2025, the opportunity to find the next Solana, MATIC, or PEPE still exists—but success comes from informed decisions, not hype-driven FOMO. That’s why platforms like Token Metrics are critical. With AI-powered research, curated moonshot lists, and real-time trading signals, Token Metrics helps you spot the gems before they moon.

So, what’s your next moonshot?

%201.svg)

%201.svg)

Cryptocurrency is a form of digital currency secured by cryptography, making it nearly impossible to counterfeit or double-spend. As a type of crypto asset, cryptocurrencies operate on decentralized networks powered by blockchain technology—a distributed public ledger maintained by multiple computers worldwide. This decentralized nature sets cryptocurrencies apart from traditional finance systems, which rely heavily on centralized financial institutions and central banks.

Most cryptocurrencies are not issued or regulated by any central authority, which makes them resistant to government interference or manipulation. While this independence offers certain freedoms, it also means that cryptocurrency investments carry substantial risk. The underlying cryptography and blockchain technology are generally secure, but their complexity can be challenging for new users to navigate. Additionally, the market value of cryptocurrencies is often affected by media hype and investor opinion, further contributing to their volatility. Understanding cryptocurrency danger involves exploring both the innovative technology behind it and the volatile market dynamics that influence its value.

Cryptocurrency exchanges play a crucial role as crypto asset service providers, allowing investors to buy and sell cryptocurrencies like Bitcoin and other cryptocurrencies at market prices. These exchanges function similarly to stock markets but operate 24/7, reflecting the highly volatile nature of the crypto market. However, many cryptocurrency exchanges lack a high level of governmental oversight or auditability compared to traditional banks, which can expose users to additional risks.

Once purchased, cryptocurrencies must be stored securely, either in digital wallets controlled by the user or through third-party services such as Coinbase, which assist with storing crypto assets safely. Some brokerage platforms, like Robinhood, provide access to cryptocurrency investments but may impose restrictions on withdrawals, limiting how investors can transfer or sell cryptocurrencies. This highlights the importance of understanding the terms and risks associated with each platform.

For those seeking exposure to the crypto asset class without directly holding digital wallets, crypto ETFs offer a more traditional investment vehicle. These funds track the market value of cryptocurrencies and can be bought and sold through conventional brokerage accounts, bridging the gap between digital assets and traditional finance.

One of the most significant cryptocurrency dangers lies in cybersecurity risks. Despite the security of blockchain technology, crypto investments are vulnerable to scams, hacks, software bugs, and the highly volatile price swings inherent in the market. The private key—a unique cryptographic code—is the sole access point to an investor’s digital wallet and cryptocurrency holdings. Losing this private key means losing access to the entire investment permanently, with no recourse. If a private key is stolen, there is no way to retrieve it, similar to having a credit card with no authentication check.

Technical challenges and market speculation add layers of risk that investors must carefully consider. Hackers frequently target digital wallets and cryptocurrency exchanges, attempting to steal digital assets. Numerous exchanges have suffered massive security breaches, leading to substantial losses for users. To mitigate these risks, many investors use offline hardware wallets or cold storage solutions, which keep private keys disconnected from the internet connection and significantly reduce the chances of theft.

Cryptocurrency investments are highly speculative and carry substantial risk, making them unsuitable for risk-averse investors. The market’s high price volatility can lead to rapid gains but also significant losses, and investors should only commit funds they can afford to lose. Cryptocurrencies can potentially yield high returns, attracting speculative investors. Unlike traditional finance, where financial institutions and regulatory bodies provide certain protections, cryptocurrency markets operate with limited oversight, increasing the potential for market manipulation and fraud.

Understanding one’s personal risk tolerance is crucial before deciding to invest in cryptocurrencies. The lack of regulatory control means that how funds are used or managed may be opaque, and the risk of losing money is real and significant. Investors should approach cryptocurrency investments with caution and seek advice from qualified investment advisors to navigate these complexities.

Despite the risks, cryptocurrencies offer unique advantages. By removing reliance on centralized intermediaries such as banks or credit card companies, cryptocurrencies reduce systemic financial risks and enable more direct, peer-to-peer transactions. Transfers between parties are secured through public and private key cryptography and validated by consensus mechanisms like proof of work or proof of stake, which underpin blockchain technology.

Crypto transfers can often be faster than traditional money transfers, especially in cross-border remittances where converting fiat currency typically involves multiple intermediaries. Decentralized finance innovations like flash loans demonstrate how cryptocurrency transactions can occur almost instantaneously, providing new opportunities for investment and trading.

However, cryptocurrencies also pose significant risks and challenges. While transactions are pseudonymous, digital trails remain traceable by law enforcement agencies such as the Federal Bureau of Investigation (FBI). Cryptocurrencies have been exploited for illicit activities including money laundering, dark web transactions, and ransomware payments. China has banned cryptocurrency exchanges, transactions, and mining, although it has developed a Central Bank Digital Currency (CBDC).

The concentration of wealth in the crypto space is increasing, with large companies and investment funds accumulating substantial holdings. Additionally, cryptocurrency mining demands significant energy consumption, often concentrating mining power among a few large firms with vast resources.

Off-chain security issues, such as vulnerabilities in third-party platforms, and the inherent price volatility continue to challenge the practical implementation of cryptocurrencies. The ideal of a fully decentralized system is often compromised by market manipulation and fraud, underscoring the cryptocurrency danger investors face.

Unlike fiat currency, which is government-issued legal tender, cryptocurrencies lack official issuance and their legal status varies widely across jurisdictions. In the United States, the Internal Revenue Service (IRS) treats cryptocurrencies as financial assets or property for tax purposes, requiring capital gains taxes on sales or trades.

U.S. courts have classified cryptocurrencies as securities for institutional buyers but not for retail investors trading on exchanges, reflecting the complex regulatory environment. In July 2023, U.S. courts ruled that cryptocurrencies are considered securities when purchased by institutional buyers but not by retail investors on exchanges. Similarly, cryptocurrency regulations in Asia differ significantly by country, demonstrating the global uncertainty surrounding digital assets.

Investors must stay informed about evolving legal frameworks to understand the implications of investing in cryptocurrencies and ensure compliance with tax and regulatory requirements.

The irreversible nature of cryptocurrency transactions and limited regulatory oversight make the space ripe for scams. Fraudsters often use fake endorsements, pressure tactics, and misleading schemes to steal money from unsuspecting investors. For example, some have lost substantial sums—like Rhett, who lost $97,000 to a fraudulent Bitcoin trading scheme.

To avoid falling victim to scams, investors should exercise caution, conduct thorough research, and verify the legitimacy of any investment opportunity. Consulting with reputable investment advisors and relying on trusted sources can help mitigate the risk of fraud and ensure safer participation in the crypto market.

Despite the inherent risks, many individuals are drawn to cryptocurrency for its potential gains and innovative technology. To protect digital currency assets, users must adopt proactive security measures. Understanding cybersecurity risks is essential to safeguarding crypto investments from hackers and bad actors.

Best practices include using hardware wallets like Ledger or Trezor, which provide enhanced security by keeping private keys offline. Investors should create duplicate hardware wallets and store backups in secure locations to prevent permanent loss of access. Staying vigilant against phishing attacks and avoiding sharing private keys or sensitive information is critical for maintaining control over digital assets.

Cryptocurrencies remain a highly speculative and risky asset class characterized by substantial price volatility and cybersecurity dangers. Investment advisors often recommend treating crypto investments as trading instruments rather than long-term holdings due to their unpredictable nature.

Cryptocurrency products carry risks including illiquidity and the potential for total loss of the entire investment. Investors should only allocate funds they can afford to lose and fully understand the technical complexities and market dynamics before engaging in cryptocurrency trading.

By staying informed, exercising caution, and following best security practices, investors can navigate the cryptocurrency landscape more safely. However, the cryptocurrency danger remains real, and careful consideration is essential before investing in this rapidly evolving digital asset space. Understanding the security and risks related to cryptocurrency requires a much higher level of engagement than traditional investments.

%201.svg)

%201.svg)

Understanding the cryptocurrency market cap is fundamental for anyone interested in investing or trading digital currencies. Market capitalization, often referred to as market cap, is a key metric that reflects the total value of a cryptocurrency in the market. Cryptocurrency market capitalization represents the total value of all coins that have been mined for a specific cryptocurrency or all cryptocurrencies combined. This article will explore what cryptocurrency market cap means, how it is calculated, and why it matters for investors navigating the dynamic crypto market.

Market capitalization represents the total value of a cryptocurrency's circulating coins in the market. It is a crucial metric used by investors and professionals to gauge the relative size and importance of a digital currency within the crypto ecosystem. Understanding market cap is essential for making informed investment decisions, as it provides a snapshot of a cryptocurrency’s size, popularity, and growth potential.

The market cap of a cryptocurrency is calculated by multiplying its current price by the number of coins in circulation. This simple formula offers insight into the cryptocurrency’s total value and helps investors compare different crypto assets effectively. By knowing the market cap, investors can better understand a cryptocurrency’s position in the market and assess its potential for future growth.

To fully grasp the concept of crypto market cap, it is important to understand the role of circulating supply. The circulating supply refers to the number of coins currently available and actively traded in the market. It is this supply that determines the crypto market cap when multiplied by the cryptocurrency’s current price.

Circulating supply is distinct from total supply, which includes all coins that have been created, including those not yet available for trading or locked in reserves. For example, some projects may have a large total supply but a smaller circulating supply due to tokens held by the development team or locked in smart contracts. Recognizing the difference between circulating supply and total supply is vital when evaluating a cryptocurrency’s market capitalization and its potential impact on price and growth.

Market cap is calculated by multiplying the current price of a cryptocurrency by its circulating supply, providing a real-time measure of the asset's total value in dollars or other fiat currencies. This calculation is dynamic, as both price and circulating supply can fluctuate, causing the market cap to change rapidly.

This metric is important because it helps investors assess the size and value of a cryptocurrency relative to others in the crypto market. A higher market cap often indicates a more established and widely adopted cryptocurrency, such as Bitcoin or Ethereum, which tend to have greater network security and liquidity. Conversely, a low market cap may signal a newer or more speculative digital asset, often associated with higher risk and volatility.

Understanding market cap allows investors to make informed choices by comparing the total value of different cryptocurrencies and evaluating their potential for growth or decline.

Market capitalization plays a significant role in shaping investment strategies within the crypto market. It influences the level of risk investors are willing to take and the potential returns they might expect. Cryptocurrencies are categorized into three market cap sizes: large-cap (over $10 billion), mid-cap ($1 billion to $10 billion), and small-cap (under $1 billion). Large cap cryptocurrencies, typically those with a market cap exceeding $10 billion, are generally less volatile and more stable. These assets are favored by conservative investors who prioritize security and steady growth.

On the other hand, mid cap and small cap cryptocurrencies often present higher growth potential but come with increased risk and price volatility. Small cap cryptocurrencies may be more susceptible to market fluctuations and liquidity challenges but can offer substantial returns if their underlying projects succeed.

Staying informed about market trends and understanding how market cap affects demand, liquidity, and price movements are essential for developing effective investment strategies. Investors who respond appropriately to these factors are better positioned to capitalize on opportunities and mitigate risks.

A liquid market is characterized by the ability to quickly buy or sell assets without causing significant price changes. In the crypto market, liquidity is a critical factor affecting volatility and trading volume. High liquidity means that there is a large number of buyers and sellers, facilitating smooth transactions and reducing price manipulation risks.

Cryptocurrencies with a high market cap tend to have more liquid markets due to their popularity and widespread adoption. This liquidity attracts institutional investors and traders who require the ability to enter and exit positions efficiently. Conversely, small cap cryptocurrencies may suffer from low liquidity, leading to higher volatility and wider bid-ask spreads.

A liquid market with high trading volume provides better price stability and more trading opportunities, making it more attractive for both short-term traders and long-term investors.

The crypto market ecosystem is a complex and evolving environment influenced by various factors beyond market cap. Blockchain technology underpins all cryptocurrencies, providing the decentralized infrastructure that ensures transparency and security. Network security, driven by consensus mechanisms and the number of active nodes, plays a crucial role in maintaining trust and stability in the market.

Institutional investors have increasingly entered the crypto market, bringing greater capital, legitimacy, and scrutiny. Their participation often affects market trends and can lead to increased liquidity and reduced volatility in large cap cryptocurrencies.

Understanding this ecosystem and the interplay of technology, investor behavior, and market dynamics is essential for anyone looking to navigate the crypto market successfully. The market is constantly responding to new technologies, regulatory developments, and shifts in investor sentiment.

Large cap cryptocurrencies, such as Bitcoin and Ethereum, dominate the crypto market with market caps exceeding $10 billion. These digital assets are widely regarded as more stable and less volatile compared to smaller cryptocurrencies. Their established track records and strong network security make them attractive safe havens during periods of market uncertainty.

Large cap cryptocurrencies benefit from high liquidity and trading volume, which contribute to better price stability and ease of trading. However, because of their already substantial market capitalization, these assets may experience slower price growth compared to mid or small cap cryptocurrencies.

Investors often include large cap cryptocurrencies in their portfolios to provide balance and reduce overall risk.

While large cap cryptocurrencies offer stability, mid cap and small cap cryptocurrencies often present greater growth potential. These smaller crypto assets may be in earlier stages of development, with innovative projects and technologies that can lead to significant price appreciation.

Analyzing growth potential involves examining a cryptocurrency’s market cap, trading volume, underlying blockchain technology, and the strength of its project or business model. Investors also consider factors such as tokenomics, total supply, and network security to assess long-term viability.

However, higher growth potential comes with increased risk, including higher volatility and liquidity challenges. Investors must carefully weigh these factors and conduct thorough research before committing to investments in smaller cap cryptocurrencies.

Crafting effective investment strategies in the crypto market requires a comprehensive understanding of market trends, risk management, and portfolio diversification. Investors should clearly define their investment goals and risk tolerance before entering the market.

Market capitalization is a critical consideration in strategy development, as it affects liquidity, volatility, and potential returns. Diversifying investments across large cap, mid cap, and small cap cryptocurrencies can help balance risk while capturing growth opportunities.

Staying informed about the latest market trends, technological advancements, and regulatory changes is essential. Investors should be prepared to adapt their strategies as the crypto market evolves, responding to shifts in demand, supply, and broader economic factors.

In conclusion, understanding what cryptocurrency market cap is and how it influences the crypto market is vital for making informed investment decisions. By considering market cap alongside other metrics such as circulating supply, trading volume, and network security, investors can navigate the complex world of digital assets with greater confidence and success.

%201.svg)

%201.svg)

The crypto market moves fast, and staying ahead requires more than just watching charts — it takes actionable data, delivered in real‑time. That’s why we’re excited to announce a major upgrade for developers, traders, and analysts: the Moonshots feature is now live as a Token Metrics API endpoint.

This new endpoint brings the same powerful insights from our Premium Moonshots dashboard directly into your apps, dashboards, and trading systems — programmatically. Whether you’re building a crypto trading bot, creating dynamic watchlists, or backtesting new strategies, the Moonshots API gives you everything you need to make smarter, faster decisions.

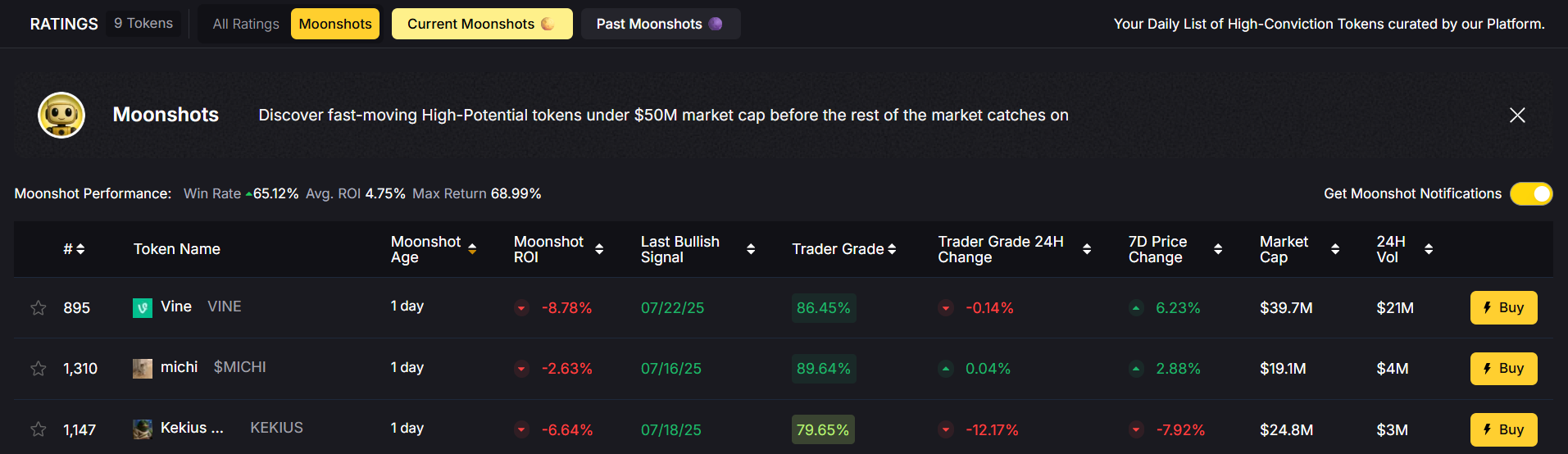

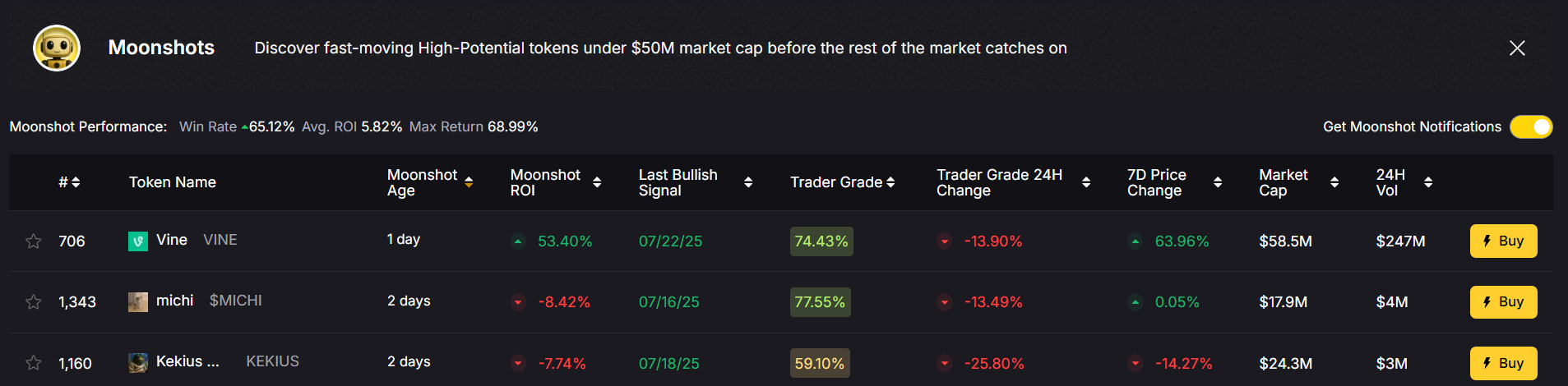

In crypto, “moonshots” are low‑cap tokens with high upside potential — the kind of high‑risk, high‑reward plays that can deliver outsized returns when identified early. At Token Metrics, our Moonshots aren’t just random picks.

They are:

Since launch, Moonshots have surfaced 43 tokens with a 65 % win rate across trades. The max single‑token return so far? 68 % — and counting.

For developers, this is no longer just data you view in our dashboard. It’s now available via API, ready to integrate into your workflows.

1. Programmatic Access to High‑Potential Trades

Get direct access to live Moonshot signals without needing to log into the platform. Perfect for apps, analytics dashboards, or automated trading systems.

2. Build Smarter Watchlists

Automatically populate your app or dashboard with AI‑curated, high‑potential tokens.

3. Trigger Bots in Real Time

Integrate the Moonshots feed into your trading bots so they can act instantly when a new token surfaces.

When you call the /v2/moonshot-tokens endpoint, you’ll get:

Want to see how these signals have performed over time? Use /v2/moonshots-tokens with type=past param for detailed past performance data.

The Moonshots API is designed for:

Your code could be live in minutes.

Give your users instant access to a curated list of high‑potential tokens. No manual updates — just live, programmatic signals from the API.

Connect Moonshots to your algorithmic trading strategies. When a new Moonshot signal appears, your bot can take action immediately.

The Moonshots API takes one of our most popular Premium features and makes it actionable for builders and advanced traders. No more copy‑pasting token names from dashboards. No more manually tracking new signals. With programmatic access, you can:

This is the same data powering our Premium dashboards — now unlocked for programmatic use.

Here’s what you can expect from Moonshots based on recent data:

The new Moonshots API endpoint lets you turn insights into action. Whether you’re an individual trader looking to build a personal watchlist, a quant team running algorithmic strategies, or a product developer building the next great crypto platform, the Moonshots API provides a direct pipeline to AI‑curated, backtested token picks with a proven track record.

Don’t just watch the next big move — catch it before it becomes hindsight.

Have questions? Our team is available on Telegram (@tokenmetricsapi) to help you get up and running.

%201.svg)

%201.svg)

Bitcoins represent a revolutionary form of virtual currency that operates without reliance on any central authority or trusted third party. Introduced in 2009 by the enigmatic Satoshi Nakamoto, bitcoins were designed as a decentralized digital currency and cryptocurrency aimed at enabling money and payment transactions directly between peers. Bitcoin is the first decentralized cryptocurrency, setting the stage for a new era in digital finance. This is made possible through the innovative use of blockchain technology, a distributed ledger that records bitcoin transactions securely and transparently. The bitcoin network itself is maintained by a peer-to-peer system of computers, each verifying and broadcasting transactions to ensure the integrity and continuity of the ledger. This decentralized approach eliminates the need for financial institutions or banks to act as intermediaries, making bitcoins a unique asset in the realm of digital currencies. According to the European Central Bank, the decentralization of money offered by bitcoin has roots in the Austrian school of economics.

The story of bitcoins began in August 2008 with the registration of the domain bitcoin.org, signaling the start of a new era in digital money. Shortly thereafter, on January 3, 2009, Satoshi Nakamoto mined the first bitcoin block, known as Block 0 or the genesis block, marking the inception of the bitcoin blockchain. Bitcoin's use as a currency began in 2009 with the release of its open-source implementation, allowing users to participate in this decentralized system. Bitcoin was introduced in response to the global financial crisis to restore trust in transactions outside of traditional systems. Bitcoin started gaining traction in 2010, highlighted by the first commercial transaction where bitcoins were used to purchase goods. Since then, bitcoin prices have experienced significant volatility, with sharp rises and falls reflecting market sentiment, adoption rates, and regulatory developments. Despite its fluctuations, bitcoin has established itself as a pioneering digital currency and a key player in the broader ecosystem of cryptocurrencies.

At its core, bitcoin is built on a decentralized system that leverages cryptographic techniques to secure transactions and maintain trust without a central authority. The blockchain serves as a chronological chain of blocks, each block containing data stored in a way that includes a hash of the previous block. Everyone on the Bitcoin network has access to an independent copy of the blockchain for transaction verification, ensuring transparency and trust. The blockchain is implemented as an ordered list of blocks, where each block contains a hash of the previous block. This linkage ensures the integrity and immutability of the blockchain, as any alteration to previous blocks would be immediately apparent. Miners play a crucial role in this system by using computational power to solve complex mathematical problems that verify bitcoin transactions. Once validated, these transactions are grouped into new blocks and added to the bitcoin blockchain. An interesting feature of bitcoins is their divisibility; each bitcoin can be broken down into eight decimal places, with the smallest unit known as a satoshi, allowing for microtransactions and flexible usage.

For those interested in entering the world of bitcoins, purchasing them typically involves using cryptocurrency exchanges where bitcoin can be bought using fiat currencies such as the US dollar. To buy bitcoin, users must first create a bitcoin address, which acts as a digital wallet for storing and sending bitcoins. Once an account is funded on an exchange, users can execute buy bitcoin orders and begin accumulating this digital asset. As of 2023, River Financial estimated that bitcoin had around 81.7 million users globally. As of 2021, Bitcoin is only recognized as legal tender in El Salvador, showcasing its limited but significant adoption as a national currency. Bitcoins are not only an investment but also a medium of exchange accepted by various merchants and businesses for payments. Additionally, users can sell bitcoin on exchanges or use it for donations and other financial services, highlighting its growing utility as a form of money in the digital age.

Regulating bitcoin presents unique challenges due to its decentralized nature and absence of a central bank or authority. Governments and financial institutions worldwide are still grappling with how best to regulate bitcoin and other digital currencies. While some countries have outright banned bitcoin, others have taken steps to implement frameworks that govern its use, aiming to protect consumers and prevent illicit activities. Legal frameworks for Bitcoin vary significantly across jurisdictions, complicating investment decisions. The regulatory environment remains fluid, with ongoing debates about legal tender status, taxation, and compliance requirements. Understanding these evolving regulations is essential for users and businesses to navigate the legal landscape surrounding bitcoins safely and effectively.

Investing in bitcoins offers both opportunities and risks that potential investors must carefully consider. The market for bitcoins is known for its high fees and significant volatility in bitcoin prices, which can lead to rapid gains or losses. Some investors liken bitcoin to gold, viewing it as a digital store of value and a hedge against inflation and currency devaluation. Investment in bitcoins can be conducted through cryptocurrency exchanges or specialized investment funds that provide exposure to this asset. However, thorough research and a solid understanding of the market dynamics are crucial before committing funds, as bitcoin lacks intrinsic value and is subject to speculative bubbles.

Bitcoin transactions are secured through advanced cryptographic techniques that verify and protect the integrity of each payment made on the network. Despite this robust security at the protocol level, bitcoin exchanges and wallets remain vulnerable to hacking and other cyber threats. Users must adopt stringent security measures such as using strong passwords, enabling two-factor authentication, and safeguarding private keys to protect their bitcoins. The decentralized nature of the bitcoin network, combined with the use of private keys, also provides a certain degree of privacy and anonymity, distinguishing it from traditional financial systems that rely on trusted third parties.

Bitcoin mining is the fundamental process through which new transactions are verified and new blocks are added to the blockchain. Miners employ significant computational power to solve complex mathematical puzzles, a process that requires substantial energy consumption and specialized hardware. A new block in the blockchain is created approximately every 10 minutes for transaction processing, ensuring a steady and predictable flow of new blocks. This mining activity not only secures the network but also enables the creation of new bitcoins, rewarded to miners as a block reward. The bitcoin network operates on a consensus mechanism, ensuring that all nodes agree on the blockchain’s current state, maintaining data consistency across the peer-to-peer network. Many miners join mining pools to combine their computational resources, increasing their chances of successfully mining new blocks and earning rewards.

Despite its innovative design, bitcoin faces several challenges that impact its scalability and adoption. The bitcoin network can experience slow transaction times, often taking up to 10 minutes to confirm payments, which can be a drawback for everyday use. High fees during periods of network congestion further complicate its practicality for small transactions. Bitcoin is rarely used in regular transactions due to high costs, price volatility, and transaction times, limiting its utility as a day-to-day currency. Additionally, bitcoin’s decentralized structure complicates regulatory oversight and governance. Concerns also arise from the use of bitcoins in illicit activities such as money laundering and terrorist financing, prompting calls for enhanced monitoring and regulation. These limitations highlight the need for ongoing development and dialogue to address bitcoin’s shortcomings.

Investing and using bitcoins come with inherent risks that must be acknowledged. The value of bitcoins can fluctuate dramatically, sometimes by thousands of dollars within short periods, exposing investors to potential significant losses. The absence of intrinsic value and the speculative nature of the market raise concerns about the possibility of a bitcoin bubble. Users should mitigate these risks by diversifying their investments and employing secure wallets to protect their funds. Awareness of market volatility and prudent management strategies are essential for anyone engaging with bitcoins as an asset or means of payment.

To maximize benefits and minimize risks, bitcoin users should prioritize education about the technology, market, and associated risks. Using secure wallets and reputable exchanges is fundamental, along with enabling two-factor authentication to enhance account security. Staying informed about the regulatory environment and compliance requirements helps users avoid legal pitfalls. Regularly updating bitcoin software and employing strong passwords further safeguard against security breaches. Adhering to these best practices ensures a safer and more reliable experience when buying, selling, or transacting with bitcoins.

Bitcoin is a complex and rapidly evolving digital currency that has transformed the financial landscape by introducing a decentralized alternative to traditional money. Understanding the fundamentals of bitcoins, from their blockchain technology to their market dynamics and regulatory challenges, is crucial for users, investors, and policymakers alike. While the future of bitcoins and other cryptocurrencies remains uncertain, their growing adoption underscores their potential to reshape how value is exchanged globally. Staying informed and adaptable will be key as bitcoins continue to influence the future of money, payments, and investment.

%201.svg)

%201.svg)

Digital assets, such as bitcoin and other cryptocurrencies, represent a relatively new and distinct asset class characterized by high speculation and substantial risk. Unlike traditional investments, digital currencies operate in a decentralized manner, meaning they are not controlled by central banks or governments. This decentralization contributes to their unique valuation dynamics, which are heavily influenced by investor sentiment and real-time market data rather than traditional economic indicators. However, the cryptocurrency market is largely unregulated, making it susceptible to fraud and manipulation.

Investing in digital currencies requires a solid understanding of the regulatory environment, as agencies like the Securities and Exchange Commission (SEC) continue to shape the landscape with evolving rules and approvals. For example, the SEC has authorized bitcoin ETFs, which have made it easier for investors to gain exposure to the crypto market without directly holding the currency. In 2024, the SEC approved the trading of spot bitcoin and ether exchange-traded funds (ETFs). The SEC's historical relationship with the cryptocurrency market has been skeptical due to concerns about market volatility and investor protections. Despite these advances, it remains crucial for investors to seek personalized investment advice and carefully assess their risk tolerance before venturing into this highly speculative space.

Bitcoin is a pioneering digital currency that leverages blockchain technology and sophisticated computer code to secure transactions and regulate the creation of new units. This technological foundation makes bitcoin a highly volatile asset, with prices that can fluctuate dramatically over short periods. Bitcoin's price has fluctuated significantly since its inception in 2009. The value of bitcoin is primarily determined by what investors are willing to pay, which means its price is subject to rapid changes driven by market sentiment and speculative trading.

One of bitcoin’s defining features is its limited supply, capped at 21 million coins. This scarcity can drive its price higher, contributing to the potential for significant returns. Bitcoin historically has offered the potential for high returns. However, the limited supply also intensifies volatility, as shifts in demand can cause sharp price swings. Unlike traditional currencies or commodities such as gold, bitcoin is not backed by any physical asset or government guarantee, making its intrinsic value difficult to ascertain. Consequently, investing in bitcoin is considered a high-risk endeavor that demands careful evaluation.

For investors interested in gaining exposure to bitcoin without directly purchasing or trading the currency, bitcoin ETFs present a viable alternative. These financial products allow investors to participate in the crypto market through regulated exchange-traded funds, potentially reducing some of the risks associated with direct ownership. The introduction of bitcoin ETFs has contributed to greater acceptance of cryptocurrencies among regulators and institutional investors. Futures-based bitcoin ETFs must regularly 'roll' their holdings, potentially underperforming compared to spot bitcoin ETFs. However, it remains essential to understand the fees involved in trading and transactions, as these can impact overall returns.

Diversification remains a cornerstone of sound investment strategies. Incorporating index funds and other traditional assets alongside digital currencies can help balance a portfolio and mitigate risk. While digital assets offer the allure of high returns, they also come with heightened volatility and uncertainty. Crypto exchanges lack basic consumer protections found in traditional financial products. Consulting a financial planner or investment advisor can provide personalized investment advice tailored to an individual’s financial goals, risk tolerance, and overall portfolio allocation.

Investing in bitcoin and other cryptocurrencies involves substantial risks, including the possibility of significant financial losses. The regulatory environment surrounding digital assets is still evolving, and changes in laws or enforcement policies by bodies such as the Securities and Exchange Commission can dramatically affect market valuations. Furthermore, the lack of central bank oversight means that digital currencies are more exposed to market manipulation and extreme price swings. Transactions involving Bitcoin are irreversible, which can lead to significant loss if credentials are forgotten. Investors should consider only investing money in Bitcoin that they are comfortable losing.

Despite these risks, the potential rewards of investing in bitcoin can be compelling. Its limited supply and increasing adoption have made it attractive to some investors seeking alternatives to traditional assets. Nevertheless, it is vital to weigh these benefits against the inherent risks and to consider other investment options that may better align with one’s financial objectives and risk appetite.

While bitcoin remains the largest and most recognized cryptocurrency by market cap, other digital currencies like ethereum and litecoin offer different features and potential advantages. These alternative cryptocurrencies, often referred to as altcoins, may provide unique use cases or technological innovations that appeal to certain investors. However, similar to bitcoin, they are also subject to high volatility and speculative trading, which can result in both substantial gains and losses.

Investors should carefully evaluate factors such as market capitalization, trading volume, and price volatility when considering other cryptocurrencies. Diversifying across multiple digital assets can help spread risk but requires thorough research and ongoing monitoring of market developments. Staying informed about emerging technologies and regulatory changes is critical in this fast-evolving market.

Determining whether bitcoin is a good investment depends heavily on an individual investor’s financial goals, risk tolerance, and preferred investment strategies. It is essential to conduct comprehensive research and stay updated on market trends, regulatory shifts, and valuation changes to make informed financial decisions. Seeking personalized investment advice from a qualified financial planner can help tailor strategies that align with one’s unique circumstances.

Diversification remains a key principle in building a resilient portfolio. Combining bitcoin and other digital assets with traditional investments such as stocks, bonds, and index funds can help manage risk and improve potential returns. Investments in Bitcoin should only make up a small portion of an investor's portfolio, usually capped at 5% or 10%. Investors should always be prepared for the possibility of significant losses, given the highly volatile nature of cryptocurrencies, and avoid allocating more money than they are willing to lose.

Investing in bitcoin and other digital assets can offer exciting opportunities for high returns but comes with considerable risks and uncertainties. Prospective investors must carefully evaluate the benefits and drawbacks, considering the speculative nature of these assets and the potential for substantial financial losses. The IRS currently treats cryptocurrencies as property, which means cryptocurrency transactions are taxable events. Staying informed about market developments, regulatory changes, and evolving technologies is crucial for making sound investment decisions.

Engaging with financial professionals to obtain personalized investment advice can provide valuable guidance tailored to individual goals and risk profiles. As the cryptocurrency market continues to evolve, maintaining a cautious and well-informed approach is essential. By thoughtfully considering the risks and rewards, investors can make prudent decisions that contribute to achieving their long-term financial objectives while navigating the complexities of digital asset investing.

%201.svg)

%201.svg)

Learning how to invest in bitcoins is becoming increasingly relevant as digital assets continue to reshape the financial landscape. Investing in digital currencies like Bitcoin offers a unique opportunity to diversify your portfolio and gain exposure to emerging markets that traditional investments may not cover. However, before diving into cryptocurrency investing, it’s crucial to understand both the benefits and risks involved. Bitcoin is a highly volatile asset, and investors should only invest what they can afford to lose.

Digital currencies represent a new asset class with distinct characteristics. Investors should carefully consider their investment objectives, the inherent risks, and the various charges associated with exchange traded products such as Bitcoin ETFs. These products can provide a streamlined way to invest, but they come with their own set of considerations.

Additionally, understanding the protections available is important. While traditional bank accounts benefit from protections like those provided by the Federal Deposit Insurance Corporation (FDIC), and brokerage accounts are often covered by the Securities Investor Protection Corporation (SIPC), digital currencies typically lack such safeguards. Investment companies registered under the Investment Company Act offer regulated avenues to invest in digital assets, potentially providing an added layer of security and oversight. Being aware of these factors helps investors make informed decisions when choosing bitcoin as part of their financial strategy.

Bitcoin is a form of digital currency, often called virtual currency, that operates on blockchain technology—a decentralized ledger system that secures and validates financial transactions. This technology is fundamental to the security and transparency of Bitcoin, helping to prevent fraud and unauthorized transactions.

However, Bitcoin is known for being highly volatile. Its market price can fluctuate rapidly due to factors like market sentiment, regulatory news, and technological developments. This volatility means that investors should be prepared for significant price swings and should carefully assess their risk tolerance before buying crypto.

Investors can gain access to Bitcoin through multiple channels. Crypto exchanges and online brokers allow individuals to buy and sell Bitcoin, while Bitcoin ETFs provide exposure to the asset without requiring direct ownership. It’s essential to note that unlike traditional bank accounts, Bitcoin holdings are not insured by the FDIC, which increases the importance of understanding the risks involved. Many crypto exchanges have a minimum purchase of $10 or less, making it easier to start with a small investment.

Exchange traded products (ETPs), including Bitcoin ETFs, have become popular tools for investors seeking to invest in digital assets while leveraging traditional investment frameworks. These products are traded on regulated exchanges, making it easier for investors to buy and sell Bitcoin without managing the complexities of digital wallets or crypto platforms.

Bitcoin ETFs typically provide exposure to a diversified portfolio of digital currencies, which can help reduce risk compared to holding individual cryptocurrencies. However, before investing, it’s important to carefully review the summary prospectus of any ETF. This document outlines the investment objectives, associated risks, fees, and charges, enabling investors to make informed decisions aligned with their financial goals. Investing in Bitcoin ETFs is seen as a way to invest in Bitcoin with potentially lower volatility compared to direct Bitcoin ownership.

While ETFs can offer convenience and diversification, investors should remain aware of risks such as market volatility and potential security breaches. Furthermore, high fees associated with some funds can impact overall returns, so understanding the fee structure is essential.

There are a few ways to buy bitcoin, including using crypto exchanges, online brokers, and Bitcoin ATMs. Each method has its own advantages and considerations. Crypto exchanges are the most common avenue, providing platforms where investors can buy and sell Bitcoin directly. Online brokers may offer additional services such as integration with traditional investment accounts. Investing in Bitcoin can create a complex tax situation, and gains are typically taxable.

When buying crypto, investors should be mindful of transaction fees, which can vary widely depending on the platform and payment method. Additionally, security is paramount; the risk of security breaches means investors must choose reputable platforms and employ strong security practices.

Storing Bitcoin securely is another critical aspect. Digital wallets, including hot wallets (connected to the internet) and cold wallets (offline storage), offer different levels of security and convenience. Hot wallets are more accessible for frequent transactions but are more vulnerable to hacking, whereas cold wallets provide enhanced security for long-term holdings. Cold wallets often incorporate extra security steps that help keep your assets safe.

Investors can fund purchases using bank accounts or debit cards, though these payment methods may involve additional fees or processing times. Understanding these nuances helps ensure smoother financial transactions and better security.

Crypto exchanges serve as centralized platforms where investors can buy and sell Bitcoin and other digital currencies. These exchanges often provide a comprehensive suite of services, including trading, storage, and payment processing, making them a convenient choice for many investors.

When using crypto exchanges, it’s important to carefully review the fee structures and understand the risks involved. Fees can include trading commissions, withdrawal charges, and deposit costs, all of which can affect the overall profitability of your investments.

Security concerns are significant when dealing with crypto platforms. Investors should be aware of the potential for security breaches and market volatility, which can impact both the value of assets and the safety of funds. Regulatory changes can also influence how exchanges operate, potentially affecting access and costs.

Despite these challenges, crypto exchanges remain a valuable tool for investors seeking to diversify their portfolios and gain exposure to the growing digital currency market.

Security is a critical aspect of investing in bitcoins and other digital assets. The risks of security breaches, fraud, and market manipulation are real and require vigilance.

Most reputable crypto exchanges and digital wallets incorporate security features such as encryption and two-factor authentication to protect user accounts. Investors should thoroughly evaluate these features before choosing a platform and remain cautious of potential vulnerabilities.

Using public Wi-Fi or unsecured networks to access crypto exchanges or digital wallets is highly discouraged, as these can expose sensitive information to hackers. Instead, investors should use secure, private internet connections and maintain strong, unique passwords.

Keeping software up to date is another essential security practice. Regular updates often include patches for vulnerabilities that could otherwise be exploited by attackers.

Many investors new to cryptocurrency investing make avoidable mistakes. One common error is accessing crypto platforms over unsecured networks or public Wi-Fi, which can lead to security breaches and loss of assets.

Another frequent mistake is using weak passwords or neglecting to update software, both of which increase vulnerability to hacking. Investors should prioritize robust security practices to safeguard their digital wallets.

Investing more money than one can afford to lose is particularly risky given the highly volatile nature of Bitcoin and other digital currencies. It’s important to approach investing with a clear understanding of personal financial resources and risk tolerance.

Using leverage or margin to invest in digital assets is another risky practice that can amplify losses. Novice investors should avoid such strategies until they fully understand the implications.

Finally, many investors fail to seek professional investment advice or consult a tax advisor before investing. Given the complexities of cryptocurrency taxation and regulation, obtaining expert guidance is vital to ensure compliance and optimize investment outcomes.

In summary, learning how to invest in bitcoins involves understanding the unique characteristics of digital currencies, the various investment vehicles available, and the security measures necessary to protect your assets. By carefully considering investment objectives, risks, and fees, and by avoiding common pitfalls, investors can make informed decisions to potentially benefit from the evolving world of cryptocurrency investing.

%201.svg)

%201.svg)

Digital currency represents a form of virtual currency that operates using cryptography for enhanced security. Unlike traditional money controlled by governments or financial institutions, digital currency is decentralized, meaning it functions without a central authority overseeing it. The first cryptocurrency, Bitcoin, was introduced in 2009 and has since revolutionized the way people think about money and investing. Many investors purchase Bitcoin for its investment value rather than its ability to act as a medium of exchange. Buying Bitcoin and other cryptocurrencies typically involves using a cryptocurrency exchange or a specialized crypto platform. Before diving into the process of how to buy bitcoins, it is crucial to understand the fundamentals of digital currency, its underlying technology, and how it differs from fiat currency.

Bitcoin is a type of digital currency that relies on blockchain technology to securely record transactions and regulate the creation of new units. The blockchain acts as a public ledger that contains every Bitcoin transaction ever made, providing transparency and security for all users. However, Bitcoin prices can be highly volatile, with values fluctuating rapidly due to market trends and investor sentiment. Bitcoin prices are prone to significant fluctuations, caused by market volatility and news events. This volatility means that investing in Bitcoin carries inherent risks, but it also offers the potential for significant rewards. As the most widely recognized and accepted cryptocurrency, Bitcoin often serves as a benchmark for the broader cryptocurrency market, influencing the prices of many other cryptocurrencies.

To buy Bitcoin, you typically use a cryptocurrency exchange such as Token Metrics, Coinbase or Binance, or a crypto platform like Cash App or Robinhood. The process begins by creating an account on your chosen platform, followed by verifying your identity to comply with regulatory requirements. After verification, you need to fund your account using a preferred payment method, such as bank transfers or a debit card. Debit cards represent one of the fastest payment methods for buying Bitcoin. Once your account is funded, you can place an order to buy Bitcoin at the current market price. It is important to be aware of the fees involved in buying Bitcoin, which may include transaction fees and exchange fees, as these can affect the overall cost of your investment.

A Bitcoin wallet is essential for securely storing your Bitcoin and enabling you to send and receive payments. There are various types of Bitcoin wallets to choose from, including software wallets, hardware wallets, and paper wallets. Software wallets can be accessed via a computer or mobile app, offering quick access to your digital wallet. Hardware wallets, on the other hand, are physical devices designed to store your Bitcoin offline for enhanced security. Paper wallets are physical documents containing your private keys and are often used for long-term storage. Most investors use a mix of both hot and cold wallets for flexibility and security. Regardless of the type, securing your wallet and safeguarding your private keys is critical to protect your investments from theft or loss.

Several payment methods are available when you buy bitcoin, each with its own advantages and disadvantages. Bank transfers are a popular choice due to their security and relatively low fees, though they can take several days to process. Debit and credit cards offer faster transactions but often come with higher fees. Credit cards are a popular choice for buying Bitcoin and are accepted by most crypto platforms. Some cryptocurrency exchanges also accept alternative payment options such as PayPal or even cash, depending on the platform’s policies. When choosing a payment method, consider factors such as speed, fees, and convenience to find the best fit for your needs.

The regulatory environment surrounding Bitcoin and other cryptocurrencies is continuously evolving. In the United States, for example, the Securities and Exchange Commission (SEC) provides guidance on cryptocurrency regulations, ensuring that exchanges and platforms adhere to anti-money laundering (AML) and know-your-customer (KYC) standards. These regulations help maintain the integrity of the cryptocurrency market and protect investors from fraud. Investors should be aware that cryptocurrency gains are taxable in the U.S. and that platforms may report transactions to the IRS. When buying Bitcoin, it is vital to select a reputable and regulated cryptocurrency exchange or platform to ensure compliance with these legal requirements and to safeguard your funds.

If you are wondering how to buy bitcoins, here is a simple step-by-step process to get started:

Following these steps will help you complete the process of buying Bitcoin safely and efficiently.

Investing in Bitcoin and other cryptocurrencies involves various risks, including market volatility and security vulnerabilities. The cryptocurrency market can experience rapid price swings, so it’s important to understand the risks involved before committing your money. Many experts suggest that new investors should start with small investments in well-known assets like Bitcoin to familiarize themselves with the market. To manage these risks, consider diversifying your portfolio by investing in other cryptocurrencies or traditional assets. Additionally, using risk management tools such as stop-loss orders can help protect your investments from significant losses. Staying informed about market trends and maintaining a cautious approach will help you navigate the risks involved in cryptocurrency investing.

Selling Bitcoin is a process similar to buying it and can be done through cryptocurrency exchanges or crypto platforms. To sell Bitcoin, you place an order specifying the amount you wish to sell at the current market price or a set price. It is important to be aware of the fees associated with selling Bitcoin, which may include transaction and exchange fees. After the sale, the proceeds can be withdrawn to your bank account or digital wallet, depending on the platform’s options. Understanding the selling process and associated costs is key to maximizing returns from your Bitcoin sales.

To buy crypto safely, start by choosing a reputable and regulated cryptocurrency exchange or platform with positive user reviews and strong security measures. Protect your account by using strong, unique passwords and enabling two-factor authentication for an additional layer of security. Be vigilant against phishing scams and fraudulent schemes by verifying the authenticity of websites and communications. Conduct thorough research before selecting a platform, and always keep your private keys and wallet information confidential to prevent unauthorized access to your funds.

New investors often make mistakes that can jeopardize their cryptocurrency investments. One major error is investing more money than they can afford to lose, which can lead to financial hardship if the market turns unfavorable. Another common mistake is failing to do adequate research and not fully understanding the risks involved in buying and holding Bitcoin. Additionally, accessing your account over unsecured public Wi-Fi networks or shared computers can expose your funds to hacking. Lastly, sharing private keys or seed phrases with others compromises wallet security and should be strictly avoided.

Buying Bitcoin and other cryptocurrencies can seem complex and intimidating at first, but with the right knowledge and precautions, it can be a rewarding investment opportunity. Understanding the risks involved, choosing a regulated and reputable platform, and securing your account with strong passwords and two-factor authentication are essential steps to buy bitcoins safely. By following the guidelines outlined in this article and conducting thorough research, you can confidently enter the world of cryptocurrency investing and manage your digital assets securely.

Staying informed about market trends and news is crucial for making smart investment decisions in the cryptocurrency market. Consider leveraging cryptocurrency trading bots or automated trading tools to assist with buying and selling based on market signals. Maintaining a long-term perspective helps avoid emotional decisions driven by short-term price fluctuations. Diversifying your portfolio by investing in many cryptocurrencies or other assets can reduce risk and improve potential returns. These strategies will enhance your ability to navigate the dynamic world of Bitcoin and other digital currencies.

The future of Bitcoin and cryptocurrencies remains uncertain but promising, as they are poised to continue playing a significant role in the global financial system. Bitcoin and other cryptocurrencies have the potential to disrupt traditional payment systems by offering faster, more secure, and transparent transactions through blockchain technology. Bitcoin rewards are halved approximately every four years, affecting the supply and value of Bitcoin over time. Keeping abreast of regulatory developments and understanding the evolving risks and benefits will empower investors to make informed decisions. By staying educated and adaptable, you can successfully navigate the complex and rapidly changing cryptocurrency landscape.