Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

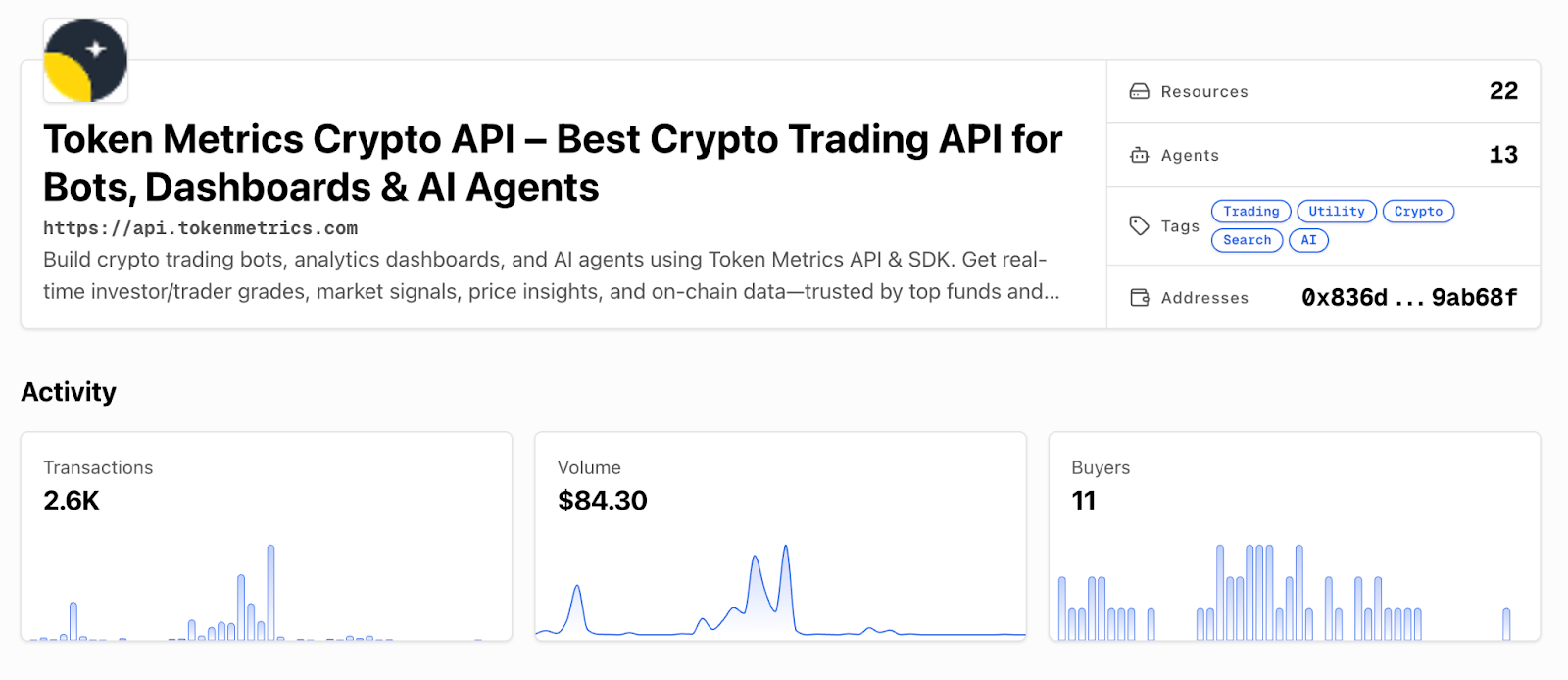

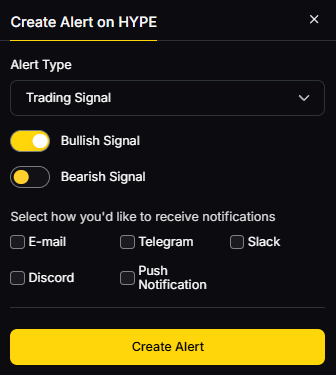

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

DeFi protocols are maturing beyond early ponzi dynamics toward sustainable revenue models. Aave operates in this evolving landscape where real yield and proven product-market fit increasingly drive valuations rather than speculation alone. Growing regulatory pressure on centralized platforms creates tailwinds for decentralized alternatives—factors that inform our comprehensive AAVE price prediction framework.

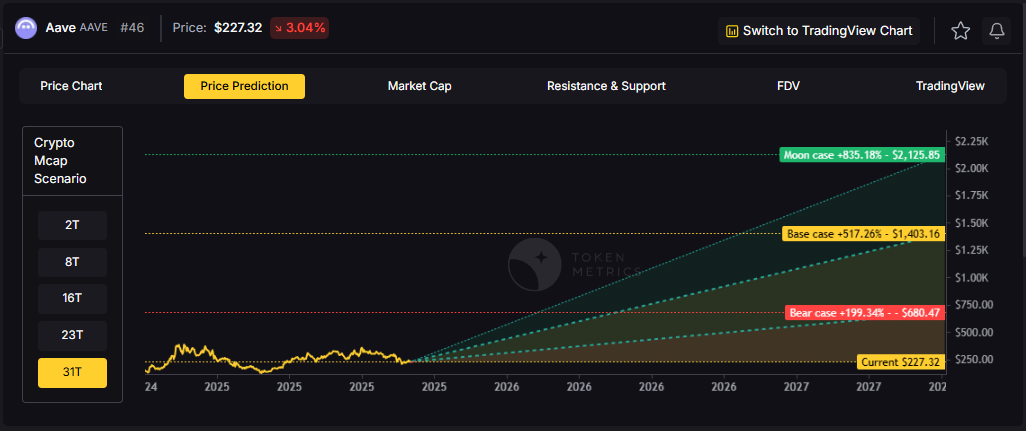

The scenario bands below reflect how AAVE price predictions might perform across different total crypto market cap environments. Each tier represents a distinct liquidity regime, from bear conditions with muted DeFi activity to moon scenarios where decentralized infrastructure captures significant value from traditional finance.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

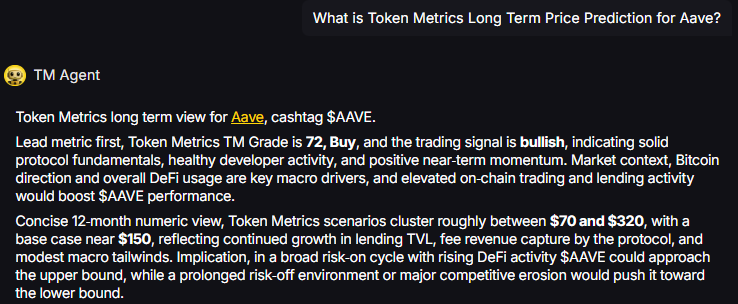

TM Agent baseline: Token Metrics TM Grade is 72, Buy, and the trading signal is bullish, indicating solid protocol fundamentals, healthy developer activity, and positive near-term momentum. Concise twelve-month numeric view, Token Metrics price prediction scenarios cluster roughly between $70 and $320, with a base case near $150, reflecting continued growth in lending TVL, fee revenue capture by the protocol, and modest macro tailwinds.

Live details: Aave Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Our Token Metrics price prediction framework spans four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T Market Cap - AAVE Price Prediction:

At an 8 trillion dollar total crypto market cap, AAVE projects to $293.45 in bear conditions, $396.69 in the base case, and $499.94 in bullish scenarios.

Doubling the market to 16 trillion expands the price prediction range to $427.46 (bear), $732.18 (base), and $1,041.91 (moon).

At 23 trillion, the price prediction scenarios show $551.46, $1,007.67, and $1,583.86 respectively.

In the maximum liquidity scenario of 31 trillion, AAVE price predictions could reach $680.47 (bear), $1,403.16 (base), or $2,175.85 (moon).

Each tier assumes progressively stronger market conditions, with the base case price prediction reflecting steady growth and the moon case requiring sustained bull market dynamics.

Aave represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle AAVE with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Aave is a decentralized lending protocol that operates across multiple EVM-compatible chains including Ethereum, Polygon, Arbitrum, and Optimism. The network enables users to supply crypto assets as collateral and borrow against them in an over-collateralized manner, with interest rates dynamically adjusted based on utilization.

The AAVE token serves as both a governance asset and a backstop for the protocol through the Safety Module, where stakers earn rewards in exchange for assuming shortfall risk. Primary utilities include voting on protocol upgrades, fee switches, collateral parameters, and new market deployments.

Token Metrics AI provides comprehensive context on Aave's positioning and challenges.

Vision: Aave aims to create an open, accessible, and non-custodial financial system where users have full control over their assets. Its vision centers on decentralizing credit markets and enabling seamless, trustless lending and borrowing across blockchain networks.

Problem: Traditional financial systems often exclude users due to geographic, economic, or institutional barriers. Even in crypto, accessing credit or earning yield on idle assets can be complex, slow, or require centralized intermediaries. Aave addresses the need for transparent, permissionless, and efficient lending and borrowing markets in the digital asset space.

Solution: Aave uses a decentralized protocol where users supply assets to liquidity pools and earn interest, while borrowers can draw from these pools by posting collateral. It supports features like variable and stable interest rates, flash loans, and cross-chain functionality through its Layer 2 and multi-chain deployments. The AAVE token is used for governance and as a safety mechanism via its staking program (Safety Module).

Market Analysis: Aave is a leading player in the DeFi lending sector, often compared with protocols like Compound and Maker. It benefits from strong brand recognition, a mature codebase, and ongoing innovation such as Aave Arc for institutional pools and cross-chain expansion. Adoption is driven by liquidity, developer activity, and integration with other DeFi platforms. Key risks include competition from newer lending protocols, regulatory scrutiny on DeFi, and smart contract risks. As a top DeFi project, Aave's performance reflects broader trends in decentralized finance, including yield demand, network security, and user trust. Its multi-chain strategy helps maintain relevance amid shifting ecosystem dynamics.

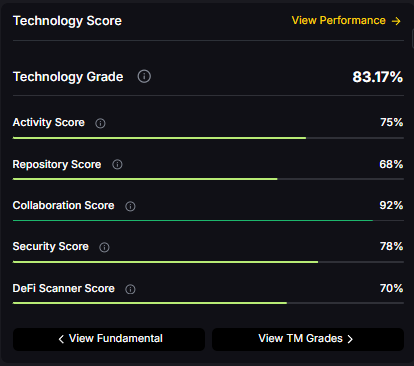

Fundamental Grade: 75.51% (Community 77%, Tokenomics 100%, Exchange 100%, VC 49%, DeFi Scanner 70%).

Technology Grade: 83.17% (Activity 75%, Repository 68%, Collaboration 92%, Security 78%, DeFi Scanner 70%).

Yes. Based on our price prediction scenarios, AAVE could reach $1,007.67 in the 23T base case and $1,041.91 in the 16T moon case. Not financial advice.

At current price of $228.16, a 10x would reach $2,281.60. This falls within the 31T moon case price prediction at $2,175.85 (only slightly below), and would require extreme liquidity expansion. Not financial advice.

Our moon case price predictions range from $499.94 at 8T to $2,175.85 at 31T. These scenarios assume maximum liquidity expansion and strong Aave adoption. Not financial advice.

Our comprehensive 2027 price prediction framework suggests AAVE could trade between $293.45 and $2,175.85, depending on market conditions and total crypto market capitalization. The base case scenario clusters around $396.69 to $1,403.16 across different market cap environments. Not financial advice.

AAVE shows strong fundamentals (75.51% grade) and technology scores (83.17% grade), with bullish trading signals. However, all price predictions involve uncertainty and risk. Always conduct your own research and consult financial advisors before investing. Not financial advice.

Track live grades and signals: Token Details

Want exposure? Buy AAVE on MEXC

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

%201.svg)

%201.svg)

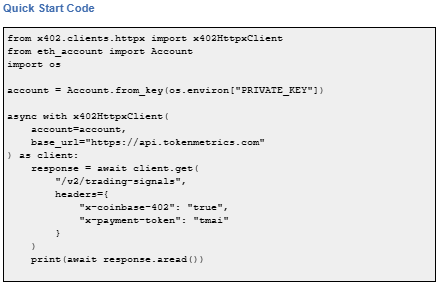

x402 is an open-source, HTTP-native payment protocol developed by Coinbase that enables pay-per-call API access using crypto wallets. It leverages the HTTP 402 Payment Required status code to create seamless, keyless API payments.

It eliminates traditional API keys and subscriptions, allowing agents and applications to pay for exactly what they use in real time. It works across Base and Solana with USDC and selected native tokens such as TMAI.

Start using Token Metrics X402 integration here. https://www.x402scan.com/server/244415a1-d172-4867-ac30-6af563fd4d25

x402 transforms API access by making payments native to HTTP requests.

Feature | Traditional APIs | x402 APIs |

Authentication | API keys, tokens | Wallet signature |

Payment Model | Subscription, prepaid | Pay-per-call |

Onboarding | Sign up, KYC, billing | Connect wallet |

Rate Limits | Fixed tiers | Economic (pay more = more access) |

Commitment | Monthly/annual | Zero, per-call only |

How to use it: Add x-coinbase-402: true header to any supported endpoint. Sign payment with your wallet. The API responds immediately after confirming micro-payment.

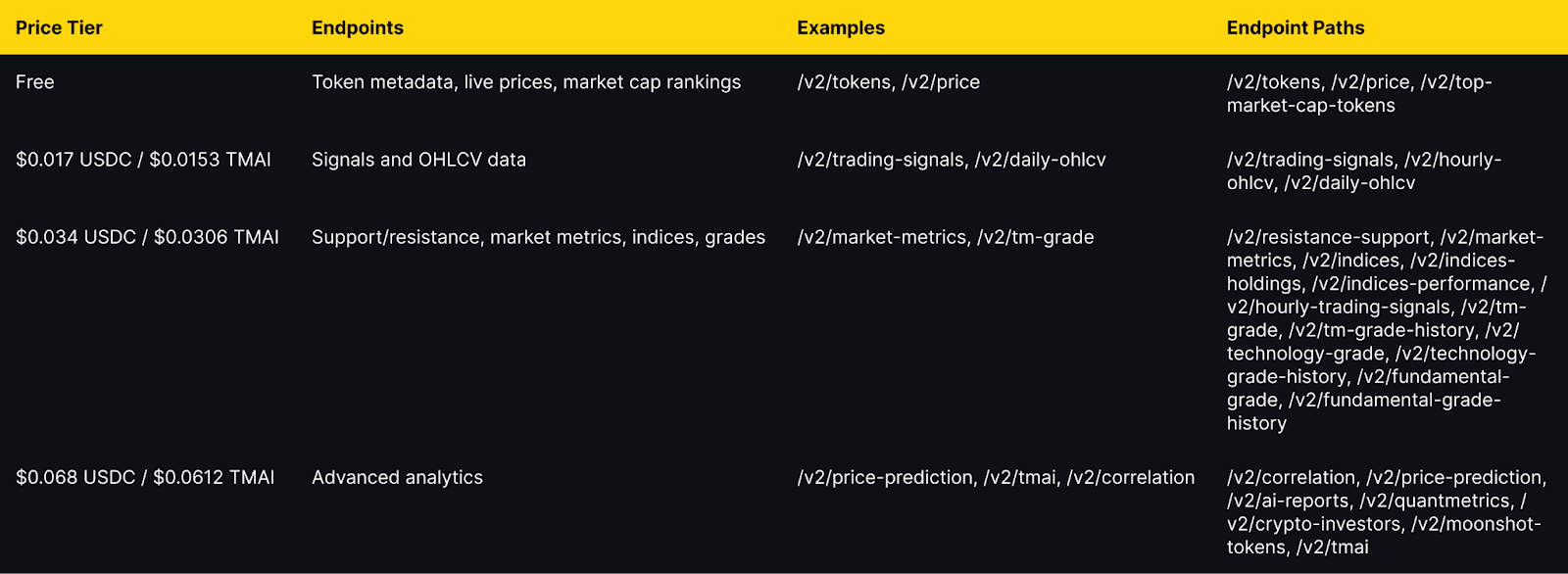

Token Metrics integration: All public endpoints available via x402 with per-call pricing from $0.017 to $0.068 USDC (10% discount with TMAI token).

Explore live agents: https://www.x402scan.com/composer.

The Protocol Flow

The HTTP 402 status code was reserved in HTTP/1.1 in 1997 for future digital payment use cases and was never standardized for any specific payment scheme. x402 activates this path by using 402 responses to coordinate crypto payments during API requests.

Why this matters: It eliminates intermediary payment processors, enables true machine-to-machine commerce, and reduces friction for AI agents.

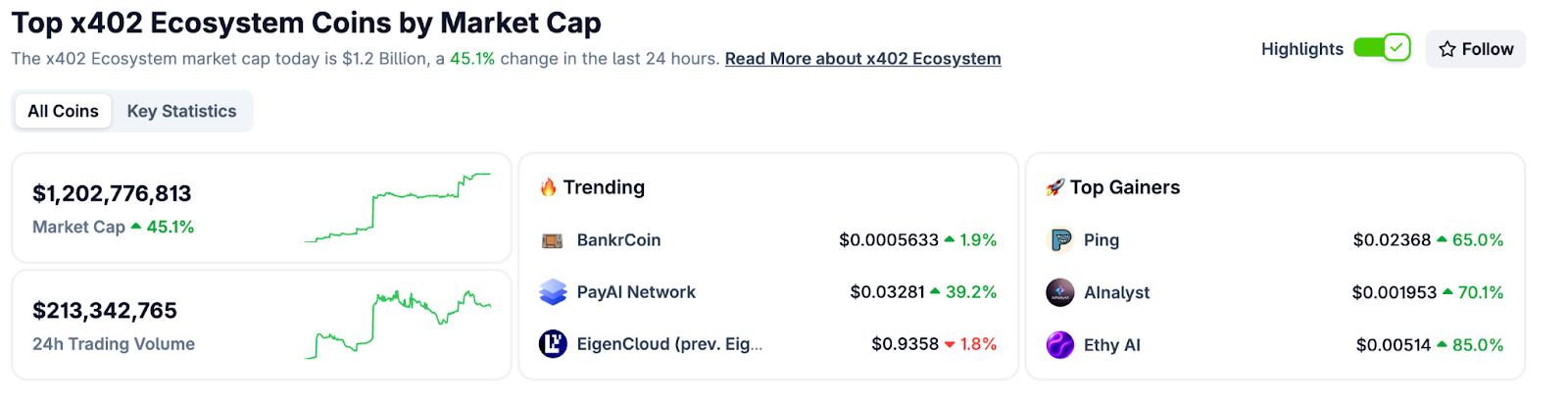

CoinGecko Recognition

CoinGecko launched a dedicated x402 Ecosystem category in October 2025, tracking 700+ projects with over $1 billion market cap and approximately $213 million in daily trading volume. Top performers include PING and Alnalyst, along with established projects like EigenCloud.

Base Network Adoption

Base has emerged as the primary chain for x402 adoption, with 450,000+ weekly transactions by late October 2025, up from near-zero in May. This growth demonstrates real agent and developer usage.

Composer is x402scan's sandbox for discovering and using AI agents that pay per tool call. Users can open any agent, chat with it, and watch tool calls and payments stream in real time.

Top agents include AInalyst, Canza, SOSA, and NewEra. The Composer feed shows live activity across all agents.

Explore Composer: https://x402scan.com/composer

What We Ship

Token Metrics offers all public API endpoints via x402 with no API key required. Pay per call with USDC or TMAI for a 10 percent discount. Access includes trading signals, price predictions, fundamental grades, technology scores, indices data, and the AI chatbot.

Check out Token Metrics Integration on X402. https://www.x402scan.com/server/244415a1-d172-4867-ac30-6af563fd4d25

Data as of October, 2025.

Pricing Tiers

Important note: TMAI Spend Limit: TMAI has 18 decimals. Set max payment to avoid overspending. Example: 200 TMAI = 200 * (10 ** 18) in base units.

Full integration guide: https://api.tokenmetrics.com

Ecosystem Participants and Tools

Active x402 Endpoints

Key endpoints beyond Token Metrics include Heurist Mesh for crypto intelligence, Tavily extract for structured web content, Firecrawl search for SERP and scraping, Twitter or X search for social discovery, and various DeFi and market data providers.

Infrastructure and Tools

Common Questions About x402

How is x402 different from traditional API keys?

x402 uses wallet signatures instead of API keys. Payment happens per call rather than via subscription. No sign-up, no monthly billing, no rate limit tiers. You pay for exactly what you use.

Which chains support x402?

Currently Base and Solana. Most activity is on Base with USDC as the primary payment token. Some endpoints accept native tokens like TMAI for discounts.

Do I need to trust the API provider with my funds?

No. Payments are on-chain and verifiable. You approve each transaction amount. No escrow or prepayment is required.

What happens if a payment fails?

The API returns 402 Payment Required again with updated payment details. Your client retries automatically. You do not receive data until payment confirms.

Can I use x402 with existing API clients?

Yes, with x402 client libraries such as x402-axios for Node and x402-httpx for Python. These wrap standard HTTP clients and handle the payment flow automatically.

Getting Started Checklist

Token Metrics x402 Resources

What's Next for x402

Ecosystem expansion. More API providers adopting x402, additional chains beyond Base and Solana, standardization of payment headers and response formats.

Agent sophistication. As x402 matures, expect agents that automatically discover and compose multiple paid endpoints, optimize costs across providers, and negotiate better rates for bulk usage.

Disclosure

Educational content only, not financial advice. API usage and crypto payments carry risks. Verify all transactions before signing. Do your own research.

%201.svg)

%201.svg)

Opening Hook

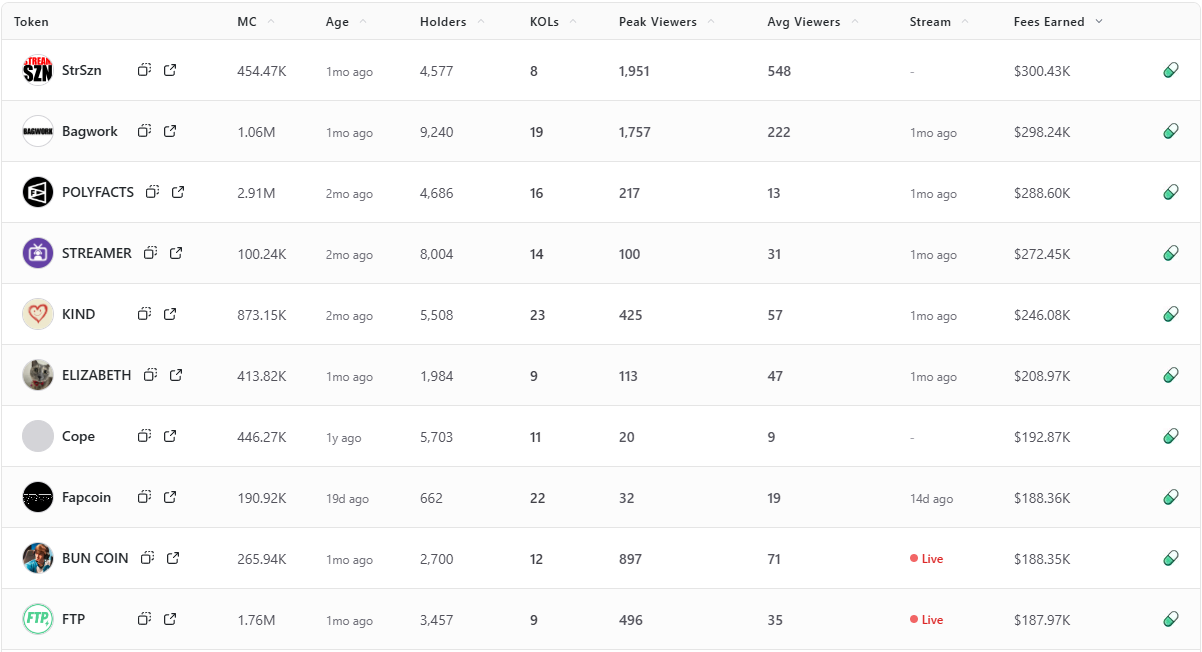

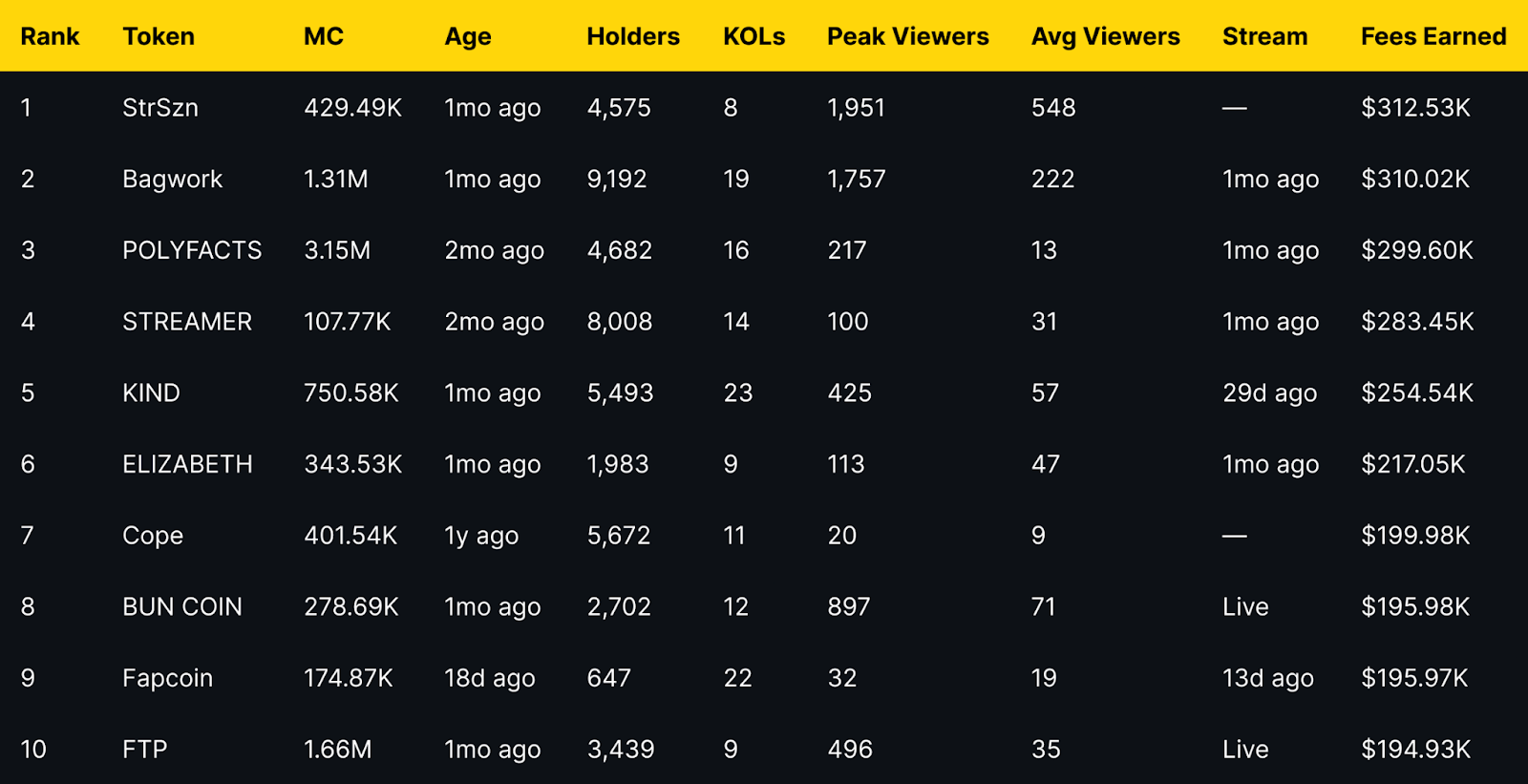

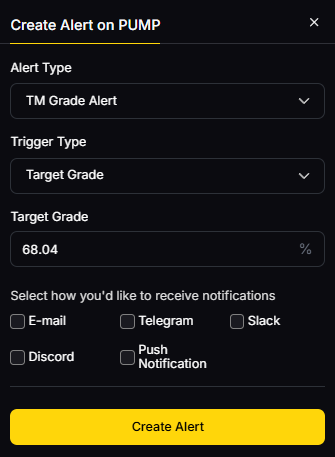

Fees Earned is a clean way to see which livestream tokens convert attention into on-chain activity. This leaderboard ranks the top 10 Pump.fun livestream tokens by Fees Earned using the screenshot you provided.

Selection rule is simple, top 10 by Fees Earned from the screenshot, numbers appear exactly as shown. If a field is not in the image, it is recorded as —.

Entity coverage: project names and tickers are taken as listed on Pump.fun, chain is Solana, sector is livestream meme tokens and creator tokens.

Token Metrics Live (TMLIVE) brings real time, data driven crypto market analysis to Pump.fun. The team has produced live crypto content for 7 years with a 500K plus audience and a platform of more than 100,000 users. Our public track record includes early coverage of winners like MATIC and Helium in 2018.

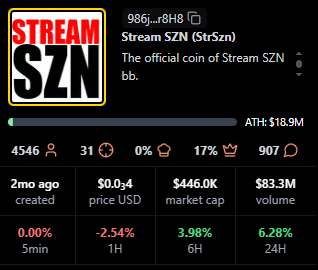

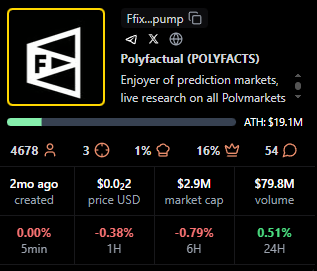

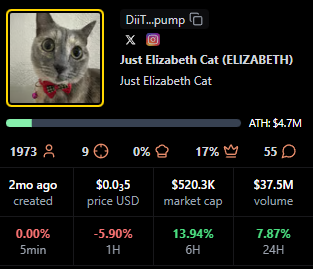

TMLIVE Quick Stats, as captured

TLDR: Fees Earned Leaders at a Glance

Short distribution note: the top three sit within a narrow band of each other, while mid-table tokens show a mix of older communities and recent streams. Several names with modest average viewers still appear due to concentrated activity during peaks.

StrSzn

Positioning: Active community meme with consistent viewer base.

Research Blurb: Project details unclear at time of writing. Fees and viewership suggest consistent stream engagement over the last month.

Quick Facts: Chain = Solana, Status = —, Peak Viewers = 1,951, Avg Viewers = 548.

https://pump.fun/coin/986j8mhmidrcbx3wf1XJxsQFvWBMXg7gnDi3mejsr8H8

Bagwork

Positioning: Large holder base with sustained attention.

Research Blurb: Project details unclear at time of writing. Strong holders and KOL presence supported steady audience numbers.

Quick Facts: Chain = Solana, Status = 1mo ago, Holders = 9,192, KOLs = 19.

https://pump.fun/coin/7Pnqg1S6MYrL6AP1ZXcToTHfdBbTB77ze6Y33qBBpump

POLYFACTS

Positioning: Higher market cap with light average viewership.

Research Blurb: Project details unclear at time of writing. High market cap with comparatively low average viewers implies fees concentrated in shorter windows.

Quick Facts: Chain = Solana, Status = 1mo ago, MC = 3.15M, Avg Viewers = 13.

https://pump.fun/coin/FfixAeHevSKBZWoXPTbLk4U4X9piqvzGKvQaFo3cpump

STREAMER

Positioning: Community focused around streaming identity.

Research Blurb: Project details unclear at time of writing. Solid holders and moderate KOL count, steady averages over time.

Quick Facts: Chain = Solana, Status = 1mo ago, Holders = 8,008, KOLs = 14.

https://pump.fun/coin/3arUrpH3nzaRJbbpVgY42dcqSq9A5BFgUxKozZ4npump

KIND

Positioning: Heaviest KOL footprint in the top 10.

Research Blurb: Project details unclear at time of writing. The largest KOL count here aligns with above average view metrics and meaningful fees.

Quick Facts: Chain = Solana, Status = 29d ago, KOLs = 23, Avg Viewers = 57.

https://pump.fun/coin/V5cCiSixPLAiEDX2zZquT5VuLm4prr5t35PWmjNpump

ELIZABETH

Positioning: Mid-cap meme with consistent streams.

Research Blurb: Project details unclear at time of writing. Viewer averages and recency indicate steady presence rather than single spike behavior.

Quick Facts: Chain = Solana, Status = 1mo ago, Avg Viewers = 47, Peak Viewers = 113.

https://pump.fun/coin/DiiTPZdpd9t3XorHiuZUu4E1FoSaQ7uGN4q9YkQupump

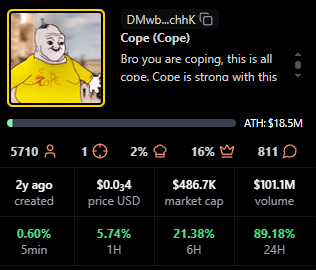

Cope

Positioning: Older token with a legacy community.

Research Blurb: Project details unclear at time of writing. Despite low recent averages, it holds a sizable base and meaningful fees.

Quick Facts: Chain = Solana, Status = —, Age = 1y ago, Avg Viewers = 9.

https://pump.fun/coin/DMwbVy48dWVKGe9z1pcVnwF3HLMLrqWdDLfbvx8RchhK

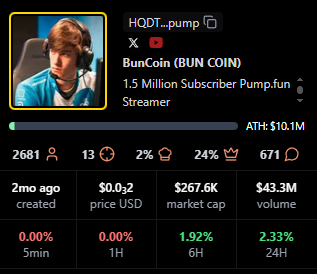

BUN COIN

Positioning: Currently live, strong peaks relative to size.

Research Blurb: Project details unclear at time of writing. Live streaming status often coincides with bursts of activity that lift fees quickly.

Quick Facts: Chain = Solana, Status = Live, Peak Viewers = 897, Avg Viewers = 71.

https://pump.fun/coin/HQDTzNa4nQVetoG6aCbSLX9kcH7tSv2j2sTV67Etpump

Fapcoin

Positioning: Newer token with targeted pushes.

Research Blurb: Project details unclear at time of writing. Recent age and meaningful KOL support suggest orchestrated activations that can move fees.

Quick Facts: Chain = Solana, Status = 13d ago, Age = 18d ago, KOLs = 22.

https://pump.fun/coin/8vGr1eX9vfpootWiUPYa5kYoGx9bTuRy2Xc4dNMrpump

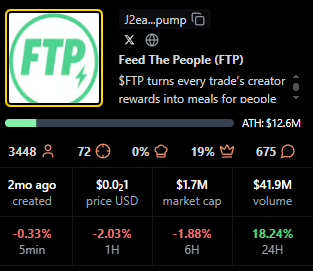

FTP

Positioning: Live status with solid mid-table view metrics.

Research Blurb: Project details unclear at time of writing. Peaks and consistent averages suggest an active audience during live windows.

Quick Facts: Chain = Solana, Status = Live, Peak Viewers = 496, Avg Viewers = 35.

https://pump.fun/coin/J2eaKn35rp82T6RFEsNK9CLRHEKV9BLXjedFM3q6pump

Signals From Fees Earned: Patterns to Watch

Fees Earned often rise with peak and average viewers, but timing matters. Several tokens here show concentrated peaks with modest averages, which implies that well timed announcements or coordinated segments can still produce high fees.

Age is not a blocker for this board. Newer tokens like Fapcoin appear due to focused activity, while older names such as Cope persist by mobilizing established holders. KOL count appears additive rather than decisive, with KIND standing out as the KOL leader.

For creators, Fees Earned reflects whether livestream moments translate into on-chain action. Design streams around clear calls to action, align announcements with segments that drive peaks, then sustain momentum with repeatable formats that stabilize averages.

For traders, Fees Earned complements market cap, viewers, and age. Look for projects that combine rising averages with consistent peaks, because those patterns suggest repeatable engagement rather than single event spikes.

TV Live is a fast way to follow real-time crypto market news, creator launches, and token breakdowns as they happen. You get context on stream dynamics, audience behavior, and on-chain activity while the story evolves.

CTA: Watch TV Live for real-time crypto market news →TV Live Link

CTA: Follow and enable alerts → TV Live

Token Metrics is trusted for transparent data, crypto analytics, on-chain ratings, and investor education. Our platform offers cutting-edge signals and market research to empower your crypto investing decisions.

What is the best way to track Pump.fun livestream leaders?

Tracking Pump.fun livestream leaders starts with the scanner views that show Fees Earned, viewers, and KOLs side by side, paired with live coverage so you see data and narrative shifts together.

Do higher fees predict higher market cap or sustained viewership?

Higher Fees Earned does not guarantee higher market cap or sustained viewership, it indicates conversion in specific windows, while longer term outcomes still depend on execution and community engagement.

How often do these rankings change?

Rankings can change quickly during active cycles, the entries shown here reflect the exact time of the screenshot.

Next Steps

Disclosure

This article is educational content. Cryptocurrency involves risk. Always do your own research.

%201.svg)

%201.svg)

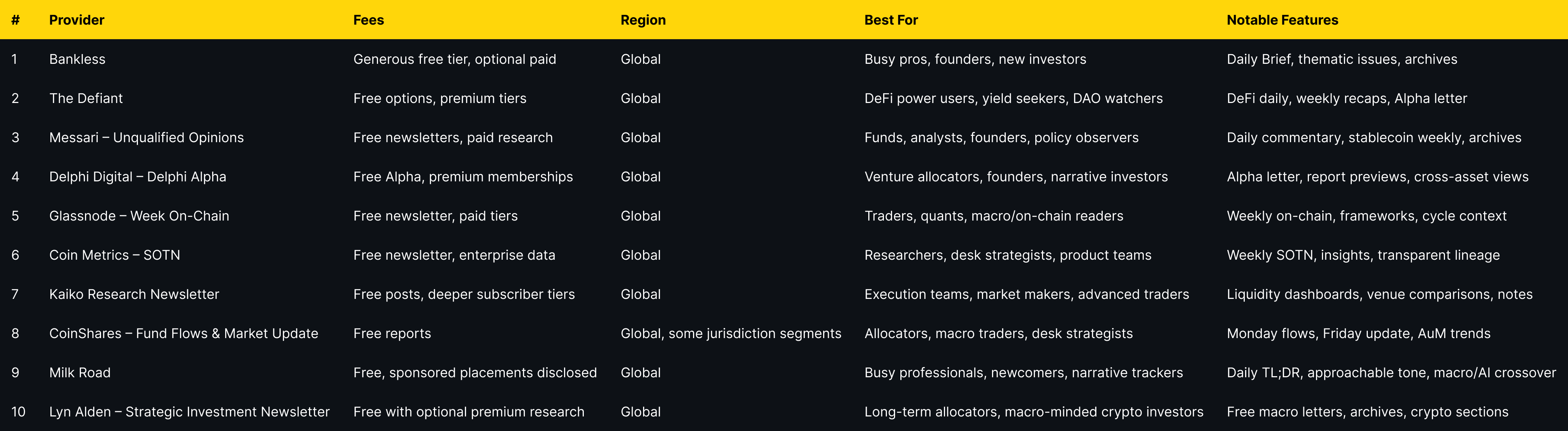

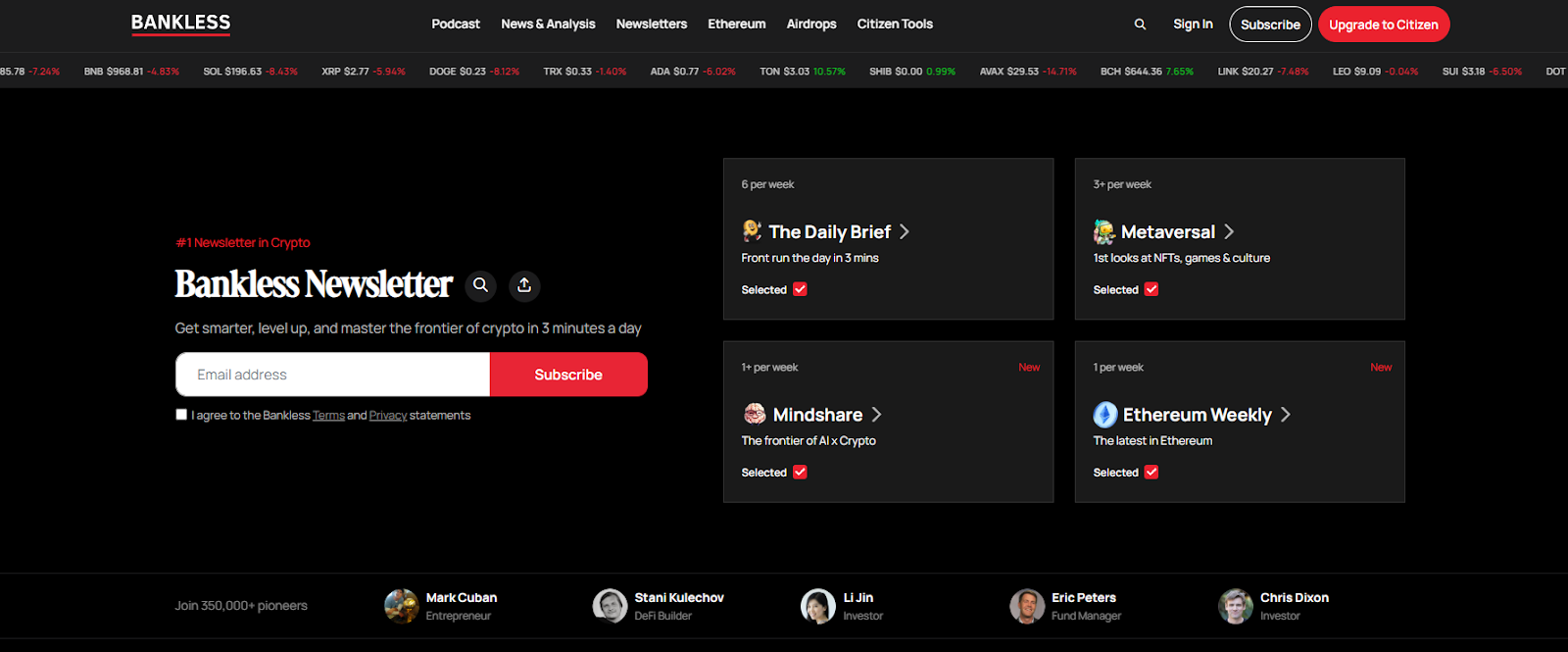

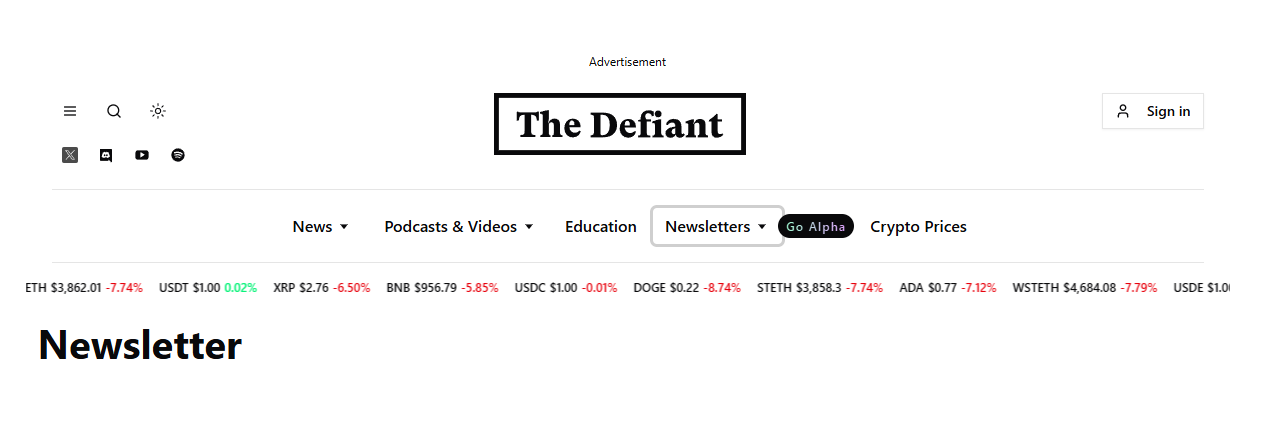

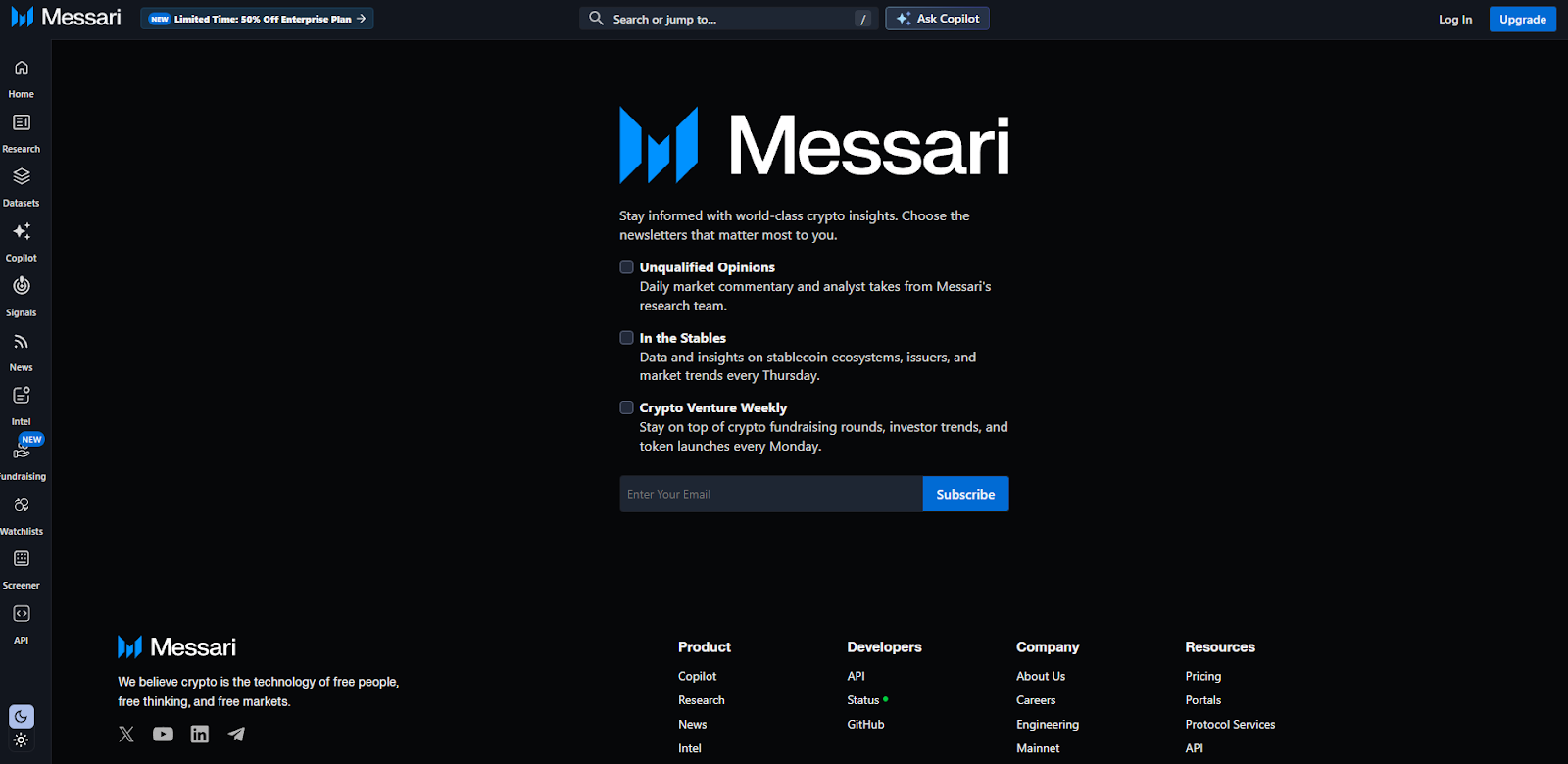

In a market that never sleeps, the best crypto newsletters 2025 help you filter noise, spot narratives early, and act with conviction. In one line: a great newsletter or analyst condenses complex on-chain, macro, and market structure data into clear, investable insights. Whether you’re a builder, long-term allocator, or active trader, pairing independent analysis with your own process can tighten feedback loops and reduce decision fatigue. In 2025, ETF flows, L2 expansion, AI infra plays, and global regulation shifts mean more data than ever. The picks below focus on consistency, methodology transparency, breadth (on-chain + macro + market), and practical takeaways—blending independent crypto analysts with data-driven research letters and easy-to-digest daily briefs.

Secondary intents we cover: crypto research newsletter, on-chain analysis weekly, and “who to follow” for credible signal over hype.

Data sources used: official sites/newsletter hubs, research/security pages, and widely cited datasets (Glassnode, Coin Metrics, Kaiko, CoinShares) for cross-checks. Last updated September 2025.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What makes a crypto newsletter “best” in 2025?

Frequency, methodological transparency, and the ability to translate on-chain/macro signals into practical takeaways. Bonus points for archives and clear disclosures.

Are the top newsletters free or paid?

Most offer strong free tiers (daily or weekly). Paid tiers typically unlock deeper research, models, or community access.

Do I need both on-chain and macro letters?

Ideally yes—on-chain explains market structure; macro sets the regime (liquidity, rates, growth). Pairing both creates a more complete view.

How often should I read?

Skim dailies (Bankless/Milk Road) for awareness; reserve time weekly for deep dives (Glassnode/Coin Metrics/Delphi).

Can newsletters replace analytics tools?

No. Treat them as curated insight. Validate ideas with your own data and risk framework (Token Metrics can help).

Which is best for ETF/flows?

CoinShares’ weekly Fund Flows is the go-to for institutional positioning, complemented by Glassnode/Coin Metrics on structure.

If you want a quick pulse, pick a daily (Bankless or Milk Road). For deeper conviction, add one weekly on-chain (Glassnode or Coin Metrics) and one thesis engine (Delphi or Messari). Layer macro (Lyn Alden) to frame the regime, and use Token Metrics to quantify what you read and act deliberately.

Related Reads:

%201.svg)

%201.svg)

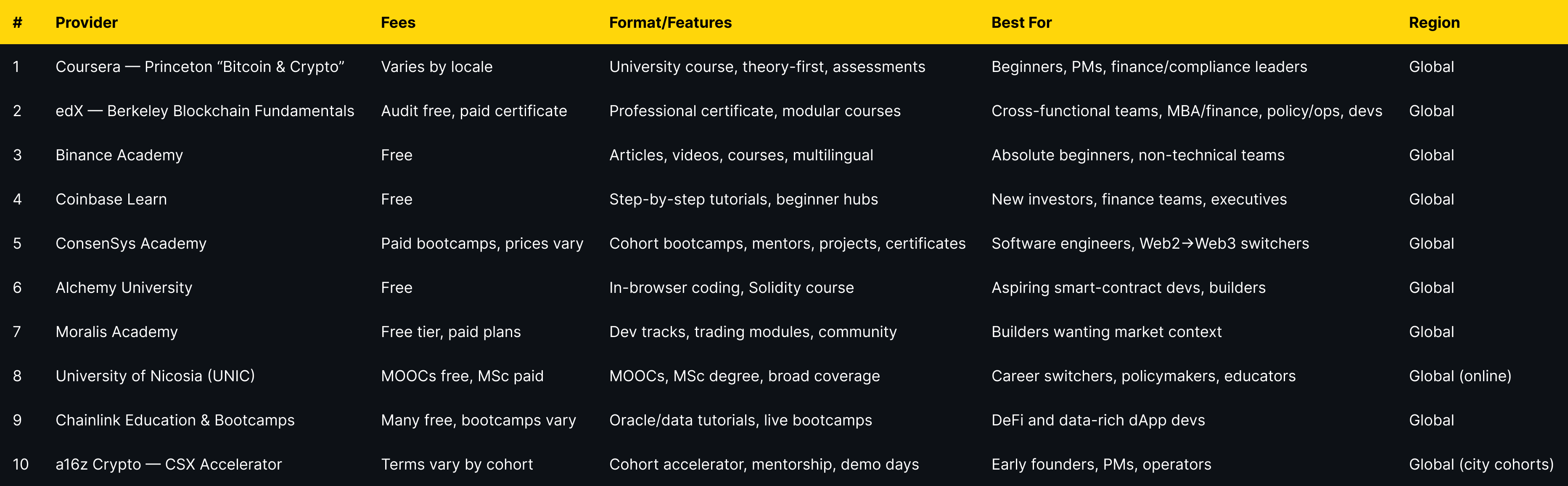

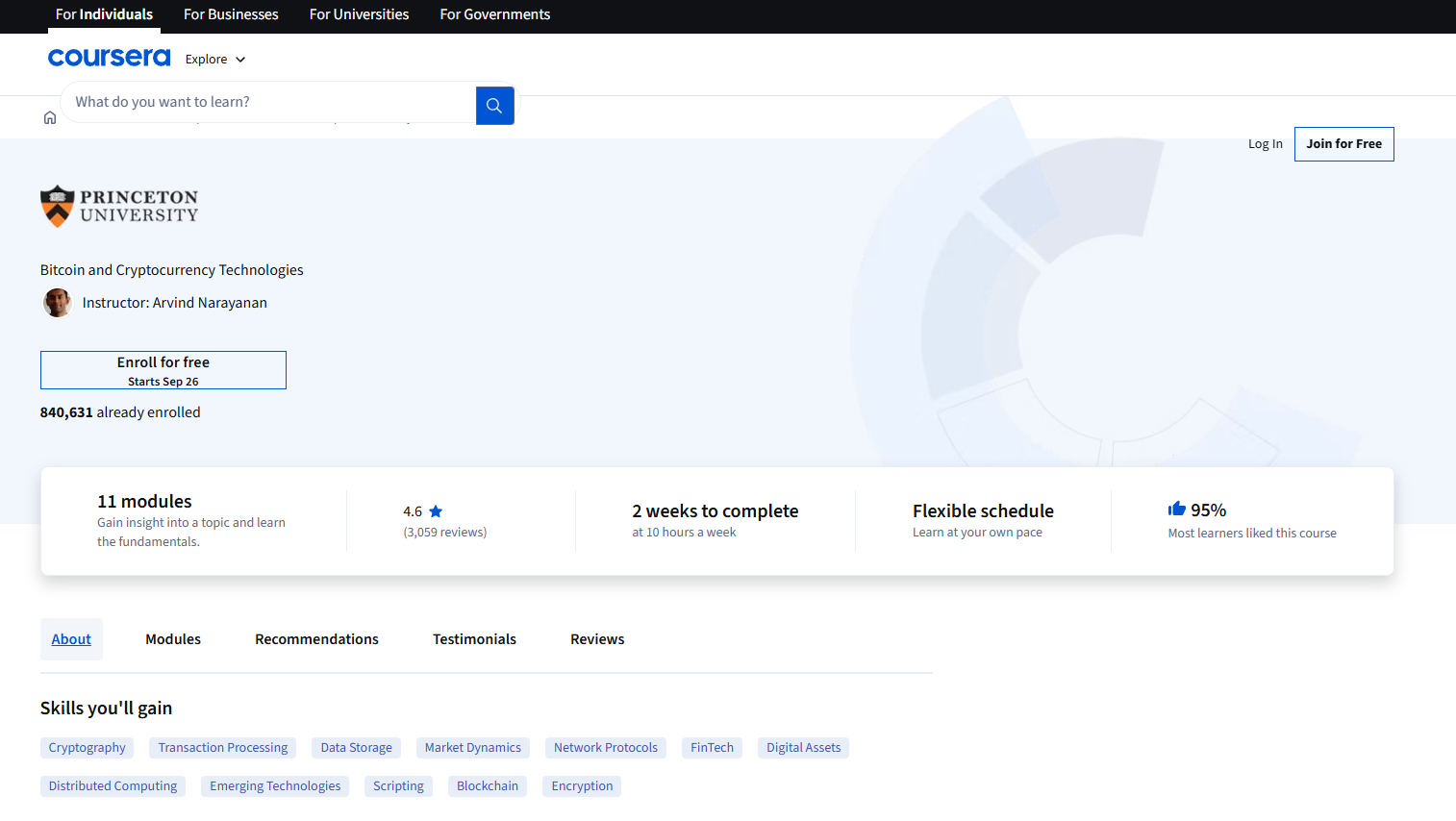

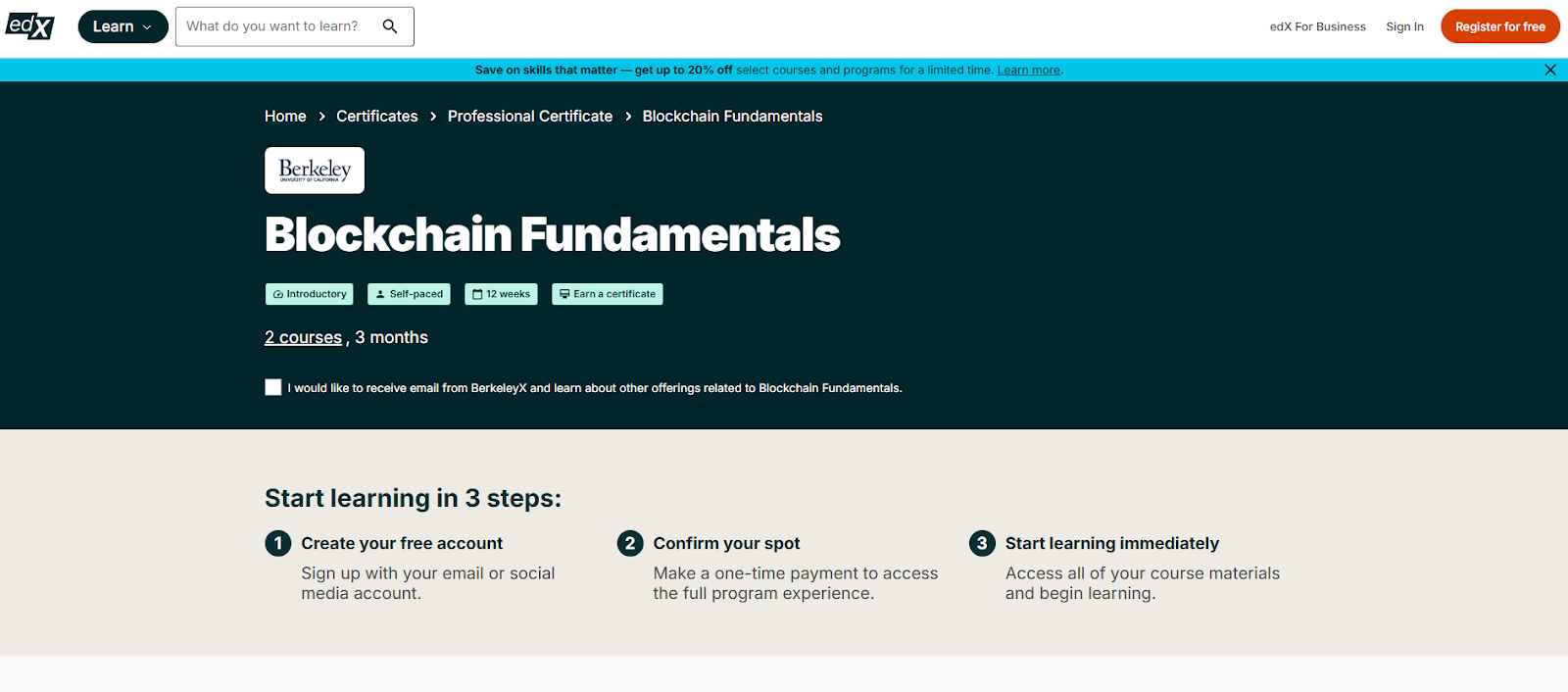

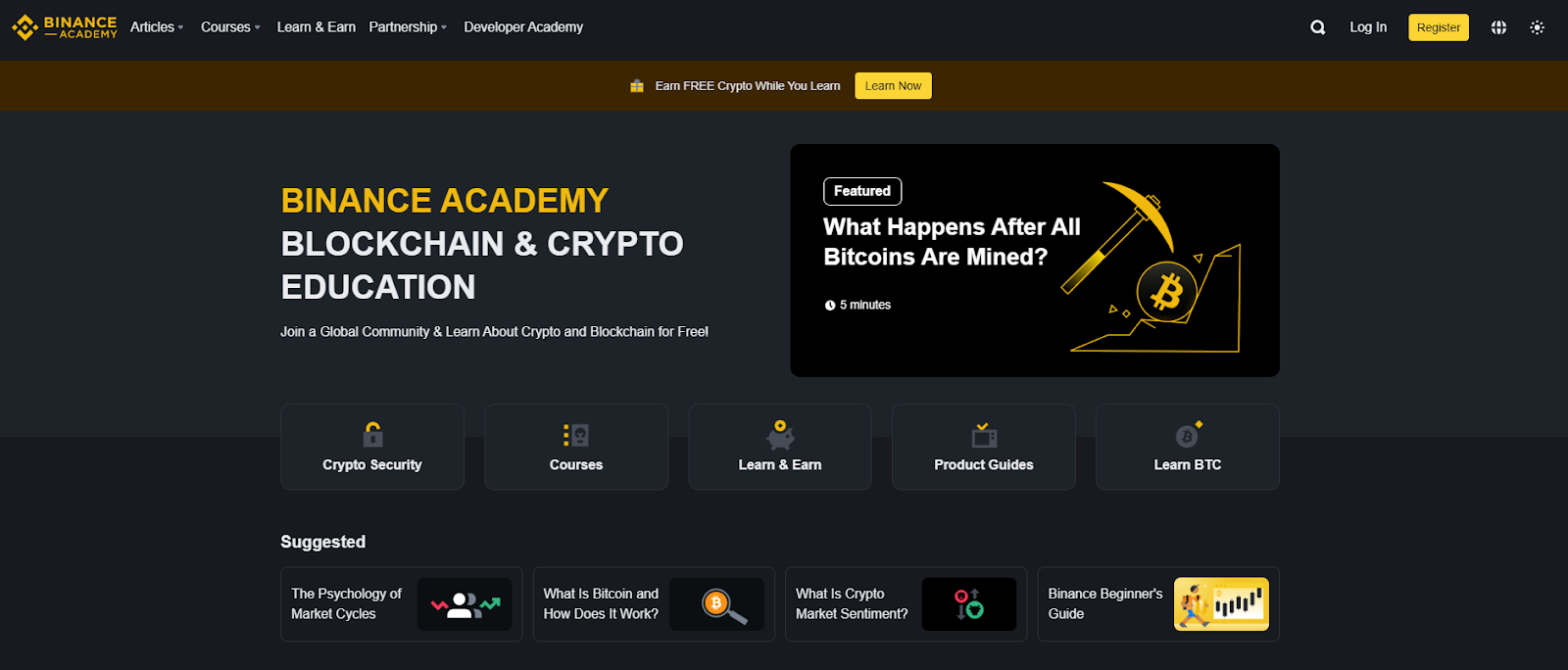

Crypto moves fast—and the gap between hype and real skills can be costly. If you’re evaluating the best crypto courses or structured paths to go from zero to fluent (or from power user to builder), the right program can compress months of trial-and-error into weeks. In short: a crypto education platform is any structured program, course catalog, or academy that teaches blockchain, Web3, or digital-asset topics with clear outcomes (e.g., literacy, developer skills, startup readiness).

This guide curates 10 credible options across beginner literacy, smart-contract engineering, and founder tracks. We blend SERP research with hands-on criteria so you can match a course to your goals, time, and budget—without the fluff.

Data sources: official provider pages (program docs, security/FAQ, curriculum), plus widely cited market datasets for cross-checks only. Last updated September 2025.

Primary CTA: Start free trial.

This article is for research/education, not financial advice.

What’s the fastest way to start learning crypto in 2025?

Start with a free literacy hub (Binance Academy or Coinbase Learn), then audit a university course (Coursera/edX) before committing to a paid bootcamp. This builds intuition and saves money.

Which course is best if I want to become a Solidity developer?

Alchemy University is a free, hands-on path with in-browser coding; ConsenSys Academy adds mentor-led structure and team projects for professional polish.

Do I need a formal degree for crypto careers?

Not strictly. A portfolio of projects often trumps certificates, but formal programs like UNIC’s MSc can help for policy, compliance, or academia-adjacent roles.

Are these programs global and online?

Most are fully online and globally accessible; accelerators like a16z CSX may run cohorts in specific cities, so check the latest cohort details.

Will these courses cover wallet and security best practices?

University and dev bootcamps typically include security modules; literacy hubs also publish safety guides. Always cross-check with official docs and practice in testnets.

If your goal is literacy and safe onboarding, start with Binance Academy or Coinbase Learn; for academic depth, layer in Coursera (Princeton) or edX (Berkeley). Builders should choose Alchemy University (free) and consider ConsenSys Academy for mentor-led polish. For credentials, UNIC stands out. Founders ready to ship and raise should explore a16z Crypto’s CSX.

Related Reads:

%201.svg)

%201.svg)

The flood of information in crypto makes trusted voices indispensable. The top crypto influencers 2025 help you filter noise, spot narratives early, and pressure-test ideas across Twitter/X, YouTube, and TikTok. This guide ranks the most useful creators and media brands for research, education, and market awareness—whether you’re an individual investor, a builder, or an institution.

Definition: A crypto influencer/KOL is a creator or publication with outsized reach and demonstrated ability to shape attention, educate audiences, and surface on-chain or market insights. We emphasize track record, transparency, and multi-platform presence. Secondary terms like best crypto KOLs, crypto YouTubers, and crypto Twitter accounts are woven in naturally to match search intent.

Data sources: official websites, channels, and about pages; we cross-checked scale and focus with widely cited datasets when needed. Last updated September 2025.

Why Use It: Token Metrics combines human analysts with AI ratings and on-chain/quant models, packaging insights via YouTube shows, tutorials, and research articles. The mix of data-driven screening and narrative detection makes it a strong daily driver for both retail and pro users. Best For: Retail investors, swing traders, token research teams, and institutions seeking systematic signals.

Notable Features: AI Ratings & Signals; narrative heat detection; portfolio tooling; explainers and live shows.

Fees Notes: Free videos/reports; paid analytics tiers available.

Regions: Global.

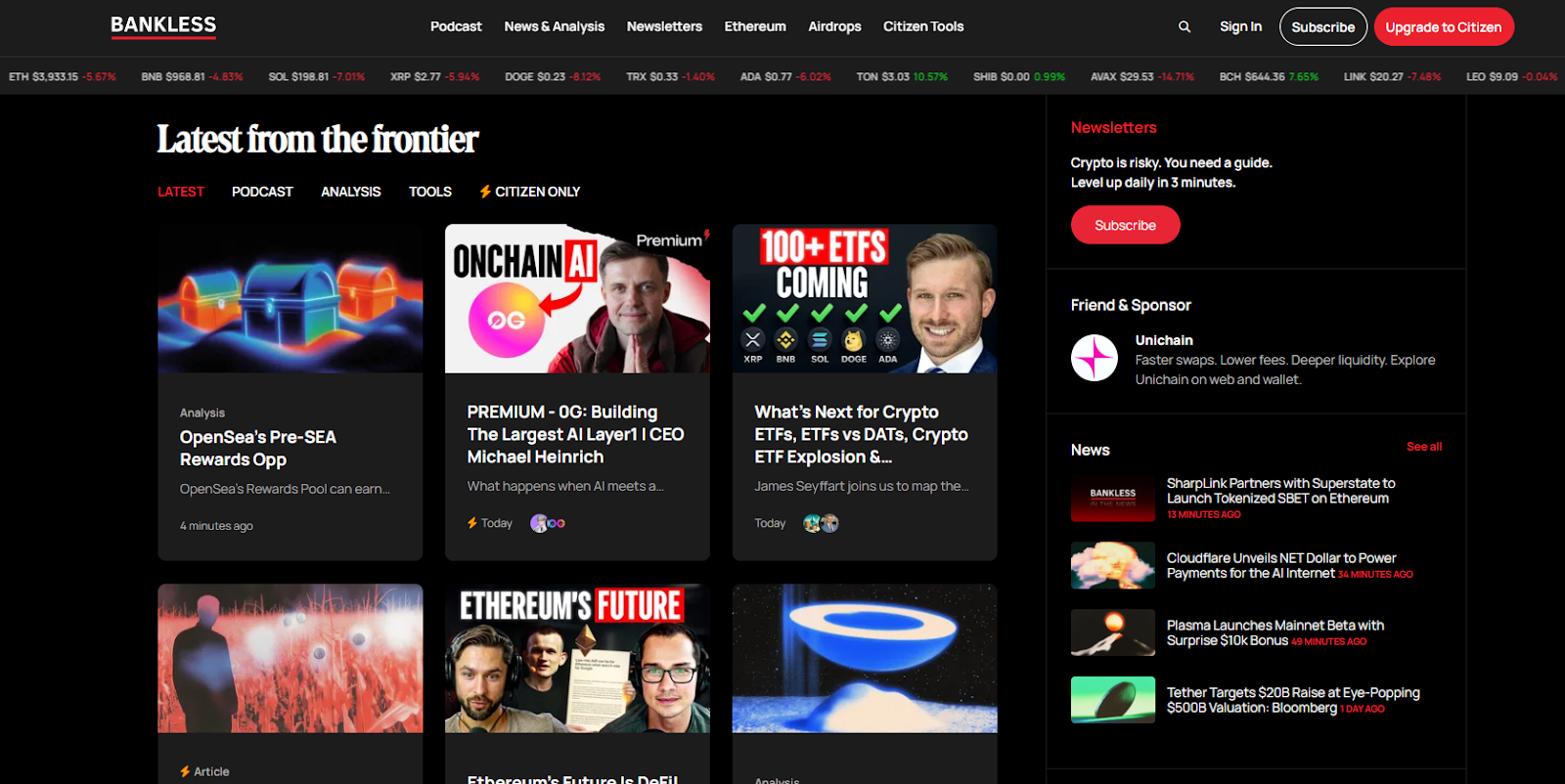

Alternatives: Coin Bureau, Bankless.

Why Use It: Guy and team are known for accessible, well-structured education across tokens, tech, and regulation—ideal for learning fast without sensationalism. Their site and channel organize guides, analysis, and “what to know before you invest” content. Best For: Beginners, researchers, compliance-minded readers.

Notable Features: Long-form explainers; project primers; timely macro/market narratives.

Fees Notes: Content is free; optional merchandise/membership.

Regions: Global.

Alternatives: Finematics, Token Metrics.

Why Use It: Bankless blends interviews with founders and policymakers, DeFi primers, and a consistent macro lens. The podcast + YouTube combo and a busy newsletter make it a top “frontier finance” feed. Best For: Builders, protocol teams, power users.

Notable Features: Deep interviews; airdrop and ecosystem roundups; policy/regulatory conversations.

Fees Notes: Many resources free; paid tiers/newsletters optional.

Regions: Global.

Alternatives: The Defiant (news), Coin Bureau.

Why Use It: The Arnold brothers deliver high-frequency coverage of market movers, narratives, and interviews, helping you catch headlines and sentiment shifts quickly. Their channel is among the most active for crypto news. Best For: News-driven traders, general crypto audiences.

Notable Features: Daily videos; interviews; quick market takes.

Fees Notes: Free content; affiliate links may appear with disclosures.

Regions: Global.

Alternatives: Crypto Banter, Token Metrics.

Why Use It: A live, broadcaster-style format covering Bitcoin, altcoins, and breaking news—with recurring hosts and trader segments. The emphasis is on real-time updates and community participation. Best For: Intraday watchers, momentum traders, community-driven learning.

Notable Features: Daily live streams; trader panels; market reaction shows.

Fees Notes: Free livestreams; education and partners disclosed on site.

Regions: Global.

Alternatives: Altcoin Daily, Token Metrics.

Why Use It: Pomp’s daily show and interviews bridge crypto with broader finance and tech. He brings operators, investors, and policymakers into accessible conversations. New original programming on X complements his long-running podcast. Best For: Executives, allocators, macro-minded audiences.

Notable Features: Daily investor letter; interviews; X-native programming.

Fees Notes: Free content; newsletter and media subscriptions optional.

Regions: Global.

Alternatives: Bankless, Token Metrics.

Why Use It: Finematics turns complex DeFi mechanics (AMMs, MEV, L2s) into crisp animations and threads—great for leveling up from novice to competent operator. The YouTube channel is a staple for concept mastery. Best For: Students of DeFi, analysts, product managers.

Notable Features: Animated explainers; topical primers (MEV, EIPs); extra tutorials on site.

Fees Notes: Free videos; optional Patreon/course material.

Regions: Global.

Alternatives: Coin Bureau, Bankless.

Why Use It: Clear, approachable tutorials on wallets, security, and portfolio basics; frequent refreshes for the latest best practices. Great first touch for friends and teammates new to crypto. Best For: Beginners, educators, community managers.

Notable Features: Setup walk-throughs; safety tips; series for newcomers.

Fees Notes: Free channel; affiliate/sponsor disclosures in video descriptions.

Regions: Global.

Alternatives: Coin Bureau, Finematics.

Why Use It: Rekt Capital focuses on disciplined, cycle-aware technical analysis, especially for Bitcoin. The research newsletter and YouTube channel offer a consistent framework for understanding halving cycles, support/resistance, and macro phases. Best For: Swing traders, long-term allocators, TA learners.

Notable Features: Cycle maps; weekly newsletters; educational modules.

Fees Notes: Free posts + paid tiers; clear membership options.

Regions: Global.

Alternatives: Willy Woo, Token Metrics.

Why Use It: A pioneer in on-chain analytics, Willy popularized frameworks like NVT and shares models and charts used widely by analysts. His work bridges on-chain data with macro narrative, useful when markets de-correlate from headlines. Best For: Data-driven investors, quant-curious traders.

Notable Features: On-chain models; charts (e.g., NVT); newsletter The Bitcoin Forecast.

Fees Notes: Free charts; paid newsletter available.

Regions: Global.

Alternatives: Token Metrics (quant + AI), Rekt Capital.

Primary CTA: Start free trial.

This article is for research/education, not financial advice.

What’s the fastest way to use this list?

Pick one education-first creator (Coin Bureau or Crypto Casey) and one market-first feed (Token Metrics, Bankless, or Altcoin Daily). Use Token Metrics to validate ideas before you act.

Are these KOLs region-restricted?

Content is generally global, though some platforms may geo-restrict features or embeds. Always follow local rules for trading and taxes. (Check each creator’s site/channel for access details.)

Who’s best for on-chain metrics?

Willy Woo popularized several on-chain valuation approaches and maintains public charts on Woobull/WooCharts, useful for cycle context.

I’m brand-new—where should I start?

Crypto Casey and Coin Bureau offer step-by-step explainers; then layer in Token Metrics for AI-assisted idea validation and alerts.

How do I avoid shill content?

Look for disclosures, independent verification, and multiple sources. Cross-check KOL mentions with Token Metrics’ ratings and narratives before allocating.

KOLs are force multipliers when you pair them with your own process. Start with one education channel and one market channel, then layer Token Metrics to validate and monitor. Over time, you’ll recognize which voices best fit your strategy.

Related Reads:

%201.svg)

%201.svg)

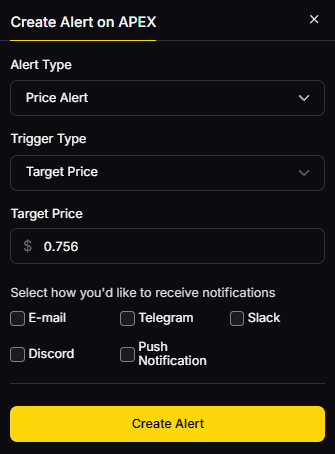

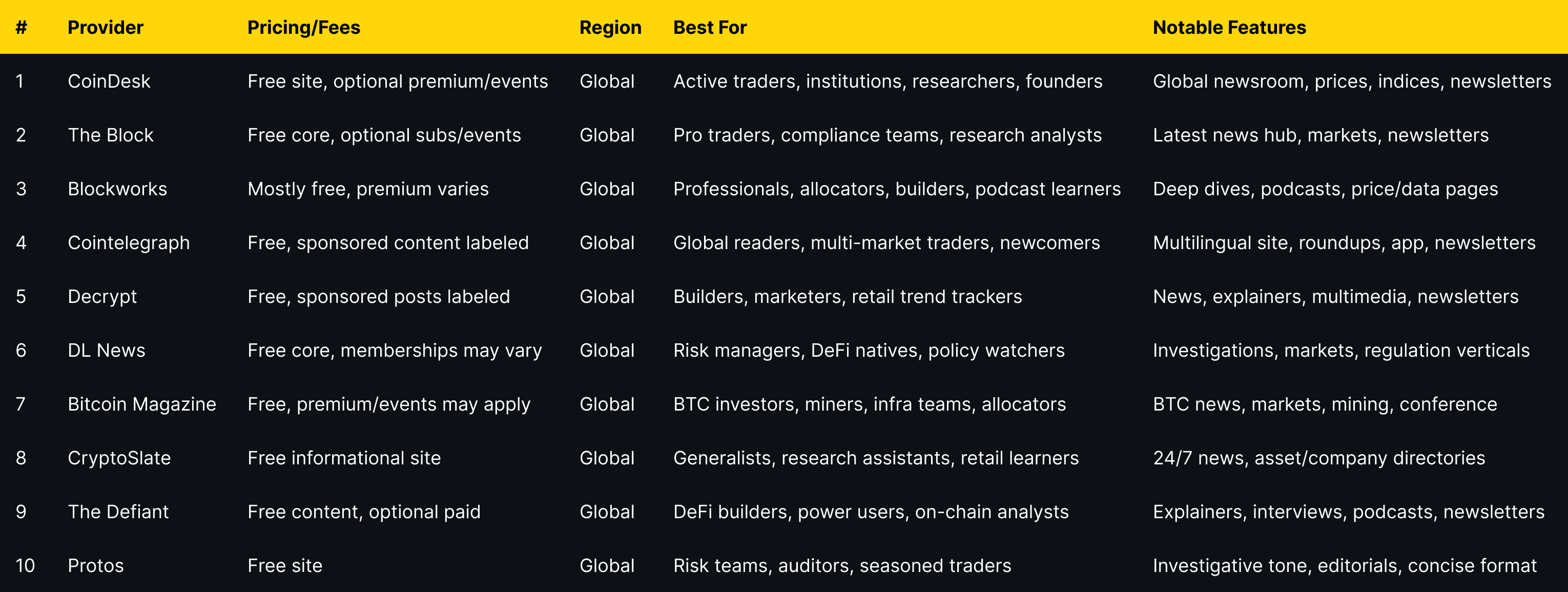

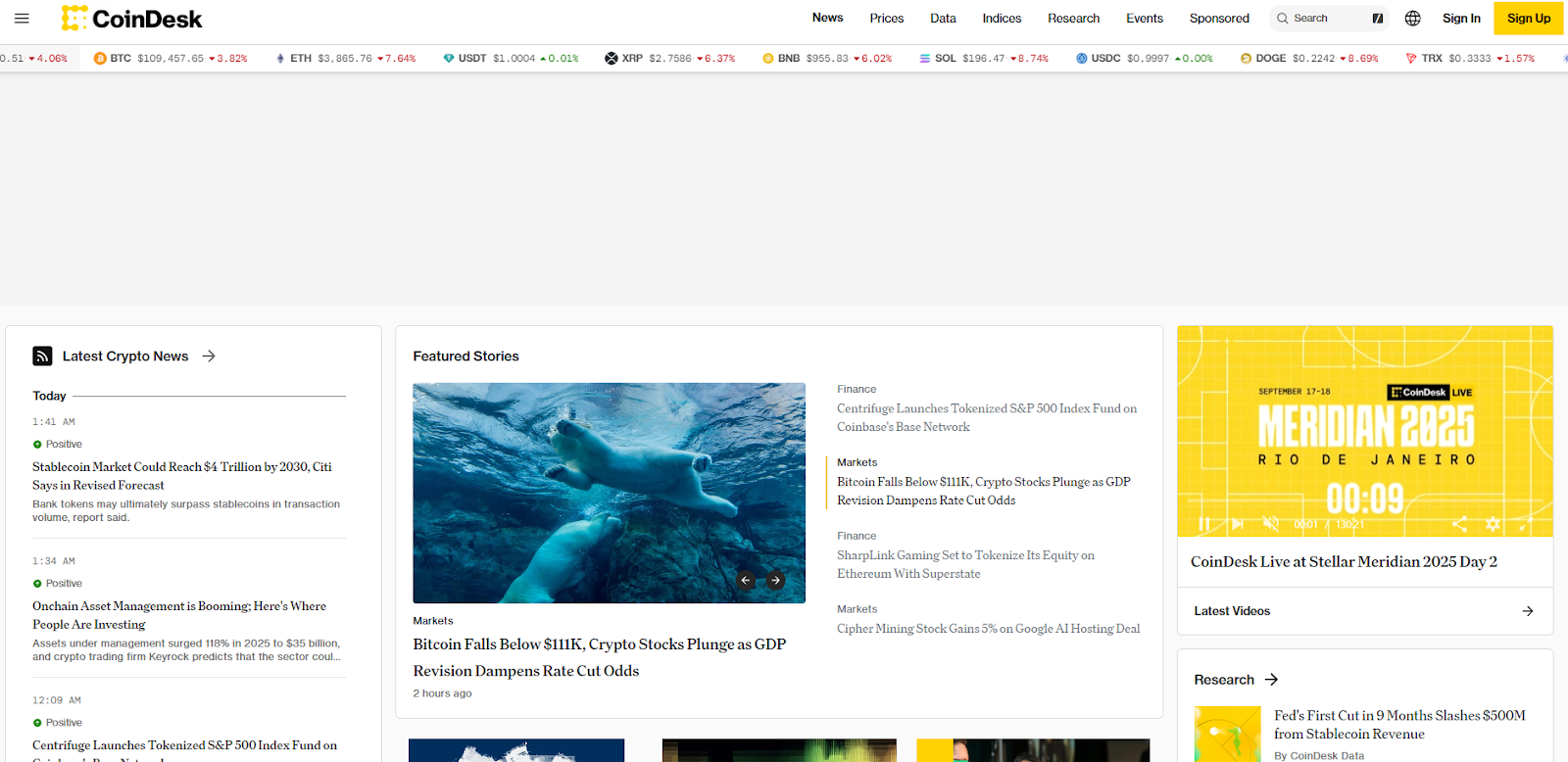

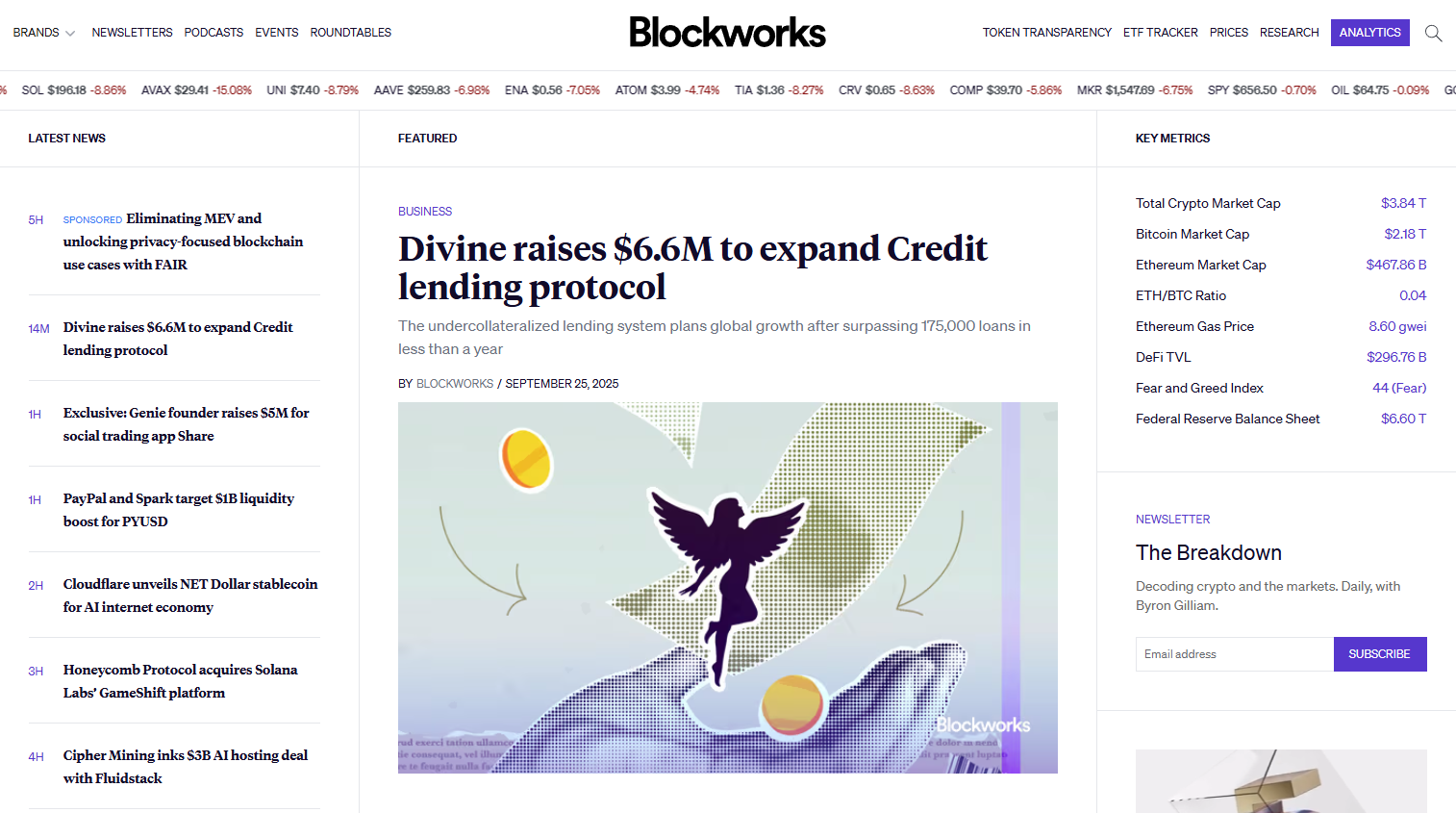

If you trade, build, or invest in digital assets, your edge starts with information. The PRIMARY_KEYWORD—“best crypto media outlets”—are the publishers and platforms that break market-moving stories, explain complex narratives, and surface on-chain trends fast enough to act. In one line: A crypto media outlet is a specialized publisher that reports, analyzes, and contextualizes digital-asset markets and technology for investors and builders.

This guide is for retail traders, crypto-native professionals, and institutions comparing crypto news websites and blockchain news sites to build a trustworthy daily stack. We synthesized public info from official publisher pages and cross-checked coverage breadth, depth, and consistency. Below, you’ll find concise picks, a decision guide by use case, and a practical checklist so you can choose confidently.

We relied on official sites, about/trust pages, product pages, and disclosures; we used widely cited market datasets (e.g., CoinGecko/Kaiko/CCData) only to sanity-check scale claims. Last updated September 2025.

Pair trusted news with quant and AI to act with conviction:

Workflow: Research → Shortlist → Execute with your chosen venue → Monitor via TM alerts.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What is a crypto media outlet?

A publisher focused on digital-asset markets and technology—covering news, analysis, and explainers for traders, investors, and builders. Many also offer newsletters, podcasts, and events.

How many outlets should I follow daily?

Two to three complementary sources usually balance speed and depth (e.g., one generalist, one investigative/DeFi, one podcast). Add specialized feeds (e.g., Bitcoin-only) as needed.

Are paid crypto news subscriptions worth it?

They can be if you use the added depth (investigations, research notes, data). For most traders, a free stack plus one targeted premium product is sufficient.

Which outlet is best for U.S. regulatory coverage?

Generalists like CoinDesk and The Block cover U.S. policy closely; DL News and The Defiant provide strong DeFi/regulation analysis. Cross-check with official agency releases.

Where can I get crypto news in multiple languages?

Cointelegraph runs multilingual editions and apps; several outlets offer newsletters and region-specific writers. Verify language availability and local relevance.

Do these sites move markets?

Major scoops, enforcement actions, or exchange/security stories can move prices, especially in thin-liquidity hours. Use alerts and confirm via official disclosures.

The “best” outlet depends on your role and the decisions you make. If you need one primary feed, start with CoinDesk; add The Block for scoops and Blockworks for pro-grade audio. Layer DL News/The Defiant for DeFi and Bitcoin Magazine for BTC focus. As always, pair news with structured research and disciplined risk.

Related Reads:

%201.svg)

%201.svg)

The metaverse has evolved from hype to practical utility: brands, creators, and gamers now use metaverse platforms to host events, build persistent worlds, and monetize experiences. In one line: a metaverse platform is a shared, real-time 3D world or network of worlds where users can create, socialize, and sometimes own digital assets. In 2025, this matters because cross-platform tooling (web/mobile/VR), better creator economics, and cleaner wallet flows are making virtual worlds useful—not just novel. Whether you’re a creator monetizing UGC, a brand running virtual activations, or a gamer seeking interoperable avatars and items, this guide compares the leaders and helps you pick the right fit. Secondary focus areas include web3 metaverse ownership models, virtual worlds with events/tools, and NFT avatars where relevant.

Data sources: official product/docs pages, security/transparency pages, and (for cross-checks) widely cited market datasets. Last updated September 2025.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What is a metaverse platform?

A shared, persistent 3D environment where users can create, socialize, and sometimes own assets (via wallets/NFTs). Some focus on events and galleries; others on UGC games or VR immersion.

Do I need crypto to use these platforms?

Not always. Spatial and some worlds allow non-crypto onboarding. Web3-native platforms often require wallets for asset ownership and trading.

Which platform is best for branded events?

The Sandbox (IP partnerships, seasons) and Spatial (cross-device ease) are top picks; Decentraland also hosts large community events.

What about VR?

Somnium Space is VR-first; Spatial also supports XR publishing. Confirm device lists and performance requirements.

Are assets portable across worlds?

Interoperability is improving (avatars, file formats), but true portability varies. Always check import/export support and license terms.

How do these platforms make money?

Typically via land sales, marketplace fees, subscriptions, or seasonal passes/rewards. Review fee pages and terms before committing.

What risks should I consider?

Platform changes, token volatility, phishing, and evolving terms. Start small, use official links, and secure wallets.

If you’re brand-led or IP-driven, start with The Sandbox or Spatial. For open web3 communities and DAO-style governance, consider Decentraland. Creators seeking premium visuals may prefer Mona, while Somnium Space fits VR die-hards. Social UGC gamers can thrive on Nifty Island; geo-builders on Upland; galleries on Oncyber; lightweight events on Voxels; and large NFT communities should watch Otherside as it develops.

Related Reads:

We validated claims on official product/docs pages and public platform documentation, and cross-checked positioning with widely cited datasets when needed. Updated September 2025; we’ll refresh as platforms ship major features or change terms.

Otherside — Home, Yuga overview. otherside.xyz+1

%201.svg)

%201.svg)

NFT marketplaces are where collectors buy, sell, and mint digital assets across Ethereum, Bitcoin Ordinals, Solana, and gaming-focused L2s. If you’re researching the best NFT marketplaces to use right now, this guide ranks the leaders for liquidity, security, fees, and user experience—so you can move from research to purchase with confidence. The short answer: choose a regulated venue for fiat on-ramps and beginner safety, a pro venue for depth and tools, or a chain-specialist for the collections you care about. We cover cross-chain players (ETH, SOL, BTC), creator-centric platforms, and gaming ecosystems. Secondary searches like “NFT marketplace fees,” “Bitcoin Ordinals marketplace,” and “where to buy NFTs” are woven in naturally—without fluff.

We used official product pages, docs/help centers, security/fee pages and cross-checked directional volume trends with widely cited market datasets. We link only to official provider sites in this article. Last updated September 2025.

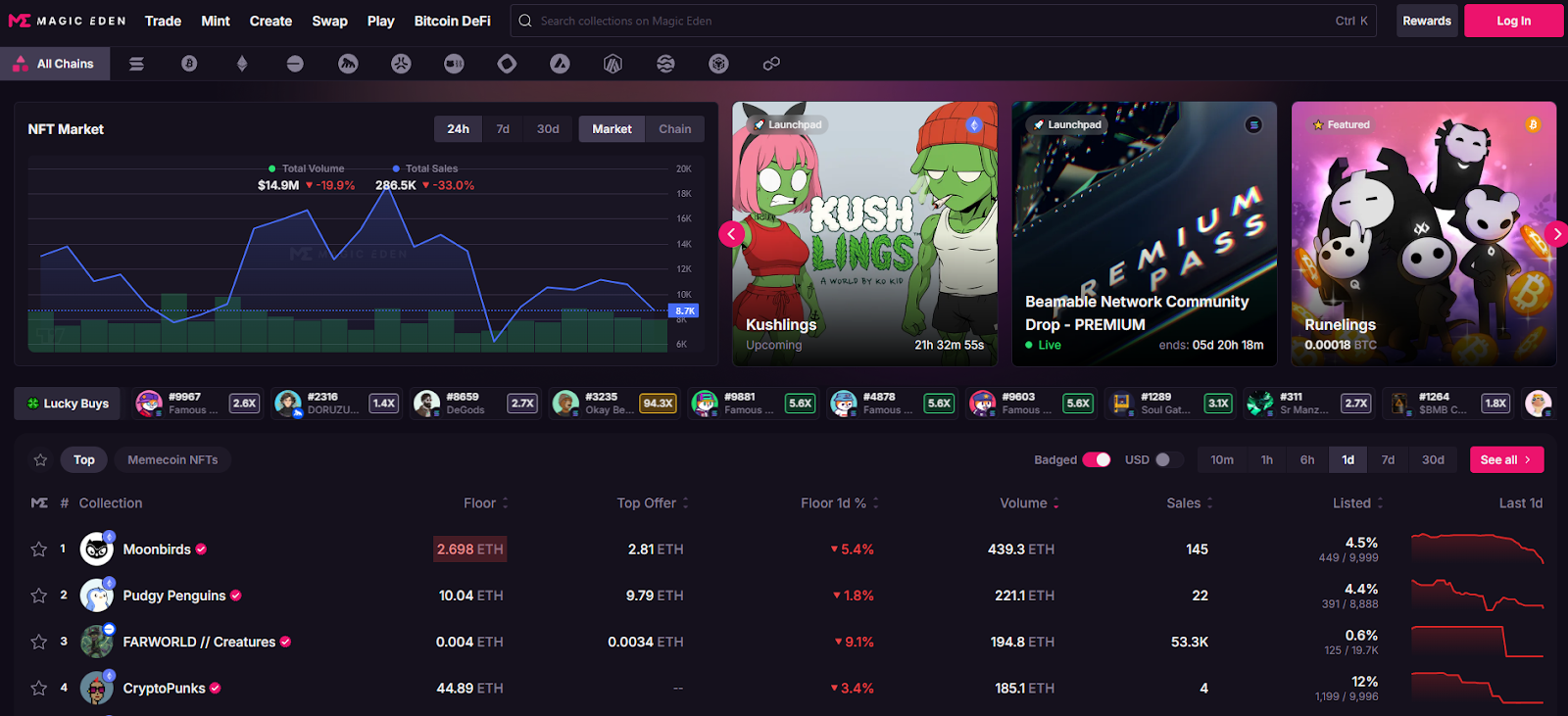

Why Use It: Magic Eden has evolved into a true cross-chain hub spanning Solana, Bitcoin Ordinals, Ethereum, Base and more, with robust discovery, analytics, and aggregation so you don’t miss listings. Fees are competitive and clearly documented, and Ordinals/SOL support is best-in-class for traders and creators. Best For: Cross-chain collectors, Ordinals buyers, SOL natives, launchpad users.

Notable Features: Aggregated listings; trait-level offers; launchpad; cross-chain swap/bridge learning; pro charts/analytics. Consider If: You want BTC/SOL liquidity with low friction; note differing fees per chain. Alternatives: Blur (ETH pro), Tensor (SOL pro).

Regions: Global • Fees Notes: 2% on BTC/SOL; 0.5% on many EVM trades (creator royalties optional per metadata).

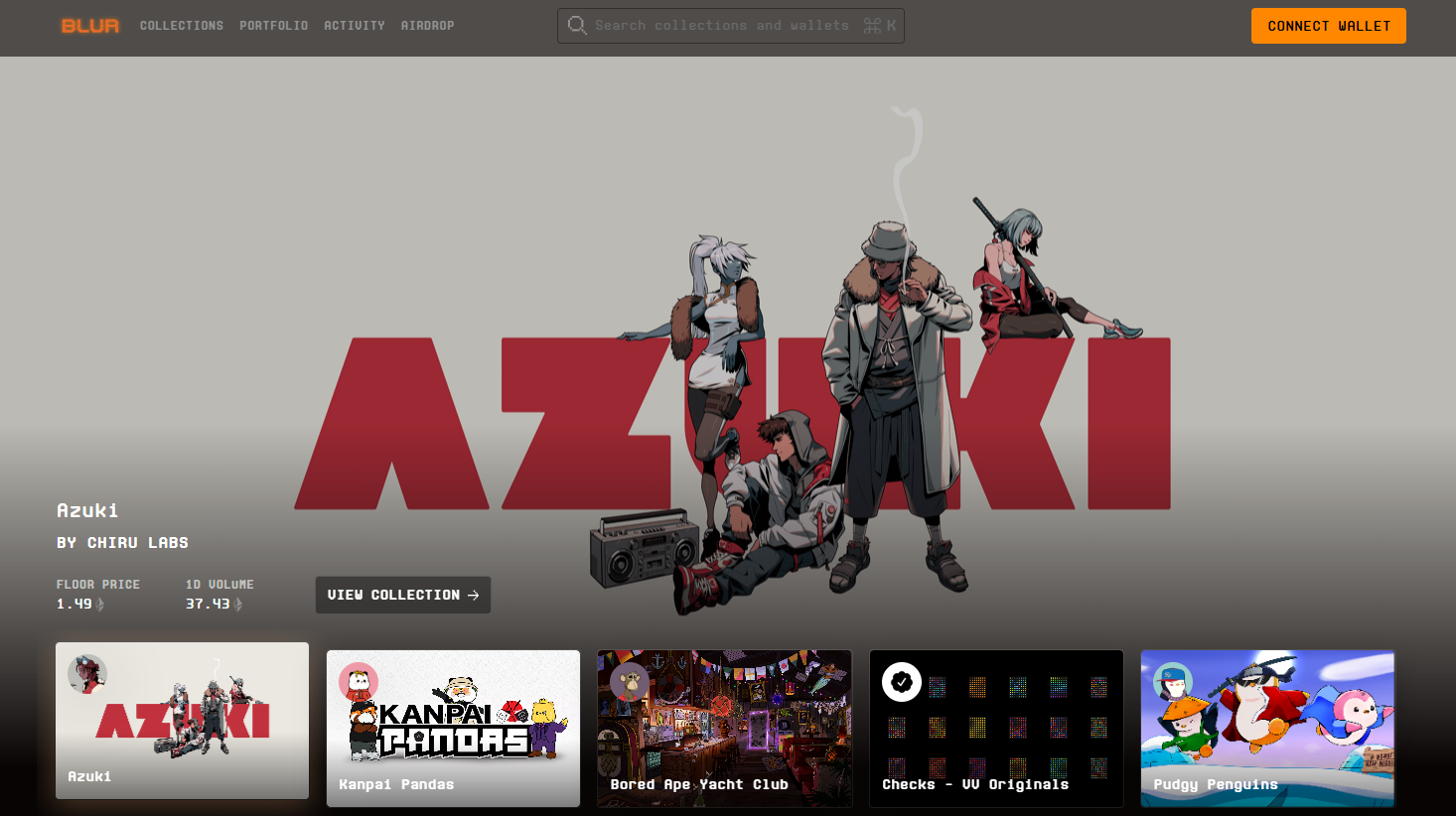

Why Use It: Blur is built for speed, depth, and sweeps. It aggregates multiple markets, offers advanced portfolio analytics, and historically charges 0% marketplace fees—popular with high-frequency traders. Rewards seasons have reinforced liquidity. Best For: Power users, arbitrage/sweep traders, analytics-driven collectors.

Notable Features: Multi-market sweep; fast reveals/snipes; portfolio tools; rewards. Consider If: You prioritize pro tools and incentives over hand-holding UX.

Alternatives: OpenSea (broad audience), Magic Eden (cross-chain).

Regions: Global • Fees Notes: 0% marketplace fee shown on site; royalties subject to collection rules.

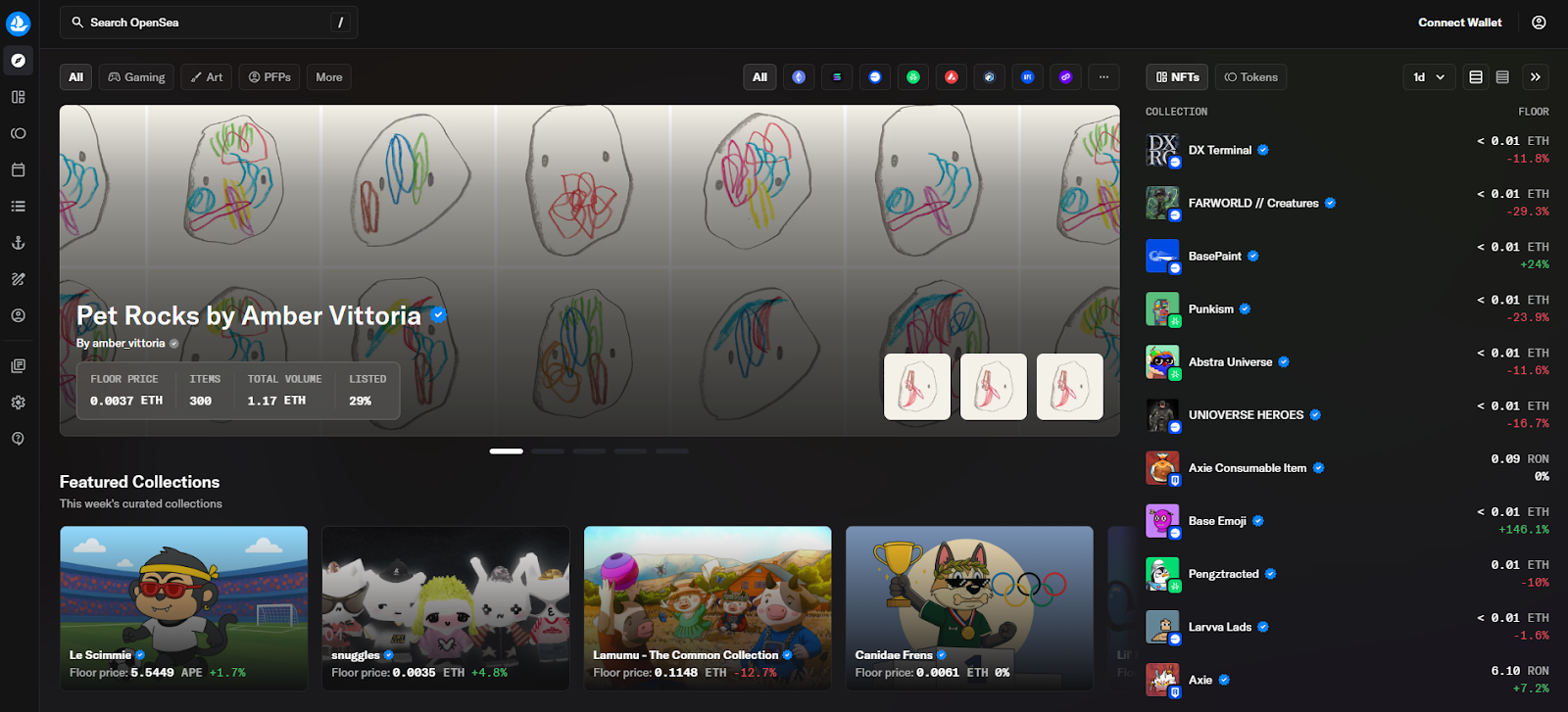

Why Use It: The OG multi-chain marketplace with onboarding guides, wide wallet support, and large catalog coverage. OpenSea’s “OS2” revamp and recent fee policy updates keep it relevant for mainstream collectors who want familiar UX plus broad discovery. Best For: Newcomers, multi-chain browsing, casual collectors.

Notable Features: Wide collection breadth; OpenSea Pro aggregator; flexible royalties; clear TOS around third-party/gas fees. Consider If: You want broadest brand recognition; be aware fees may change. Alternatives: Blur (pro ETH), Rarible (community markets).

Regions: Global (note U.S. regulatory headlines under review). Fees Notes: Reported trading fee currently ~1% as of mid-Sept 2025; creator earnings and gas are separate.

Why Use It: Tensor is the Solana power-user venue with enforced-royalty logic, maker/taker clarity, and pro-grade bidding/escrow. Fast UI, Solana-native depth, and creator tools make it the advanced SOL choice. Best For: SOL traders, market-makers, bid/AMM-style flows.

Notable Features: 0% maker / ~2% taker; enforced royalties paid by taker; shared escrow; price-lock mechanics highlighted in community docs. Consider If: You want pro tools on Solana; fees differ from Magic Eden. Alternatives: Magic Eden (SOL/BTC/ETH), Hyperspace (agg).

Regions: Global • Fees Notes: 2% taker / 0% maker; royalties per collection rules

Why Use It: OKX’s NFT market integrates with the OKX Web3 Wallet, aggregates across chains, and caters to Bitcoin Ordinals buyers with an active marketplace. Docs highlight multi-chain support and low listing costs. Note potential restrictions for U.S. residents. Best For: Multi-chain deal-hunters, Ordinals explorers, exchange users.

Notable Features: Aggregation; OKX Wallet; BTC/SOL/Polygon support; zero listing fees per help docs. Consider If: You’re outside the U.S. or comfortable with exchange-affiliated wallets. Alternatives: Magic Eden (multi-chain), Kraken NFT (U.S. friendly).

Regions: Global (U.S. access limited) • Fees Notes: Zero listing fee; trading fees vary by venue/collection.

Why Use It: Kraken’s marketplace emphasizes security, compliance, and a simple experience with zero gas fees on trades (you pay network gas only when moving NFTs in/out). Great for U.S. users who prefer a regulated exchange brand. Best For: U.S. collectors, beginners, compliance-first buyers.

Notable Features: Zero gas on trades; creator earnings support; fiat rails via the exchange. Consider If: You prioritize regulated UX over max liquidity.

Alternatives: OpenSea (breadth), OKX NFT (aggregation).

Regions: US/EU • Fees Notes: No gas on trades; royalties and marketplace fees vary by collection.

Why Use It: Rarible lets projects spin up branded marketplaces with custom fee routing (even 0%), while the main Rarible front-end serves multi-chain listings. Transparent fee schedules and community tooling appeal to creators and DAOs. Best For: Creators/DAOs launching branded stores; community traders.

Notable Features: No-code community marketplace builder; regressive fee schedule on main site; ETH/Polygon support. Consider If: You want custom fees/branding or to route fees to a treasury. Alternatives: Zora (creator mints), Foundation (curated art).

Regions: Global • Fees Notes: Regressive service fees on main Rarible; community markets can set fees to 0%.

Why Use It: Zora powers on-chain mints with a simple flow and a small protocol mint fee that’s partially shared with creators and referrers, and it now layers social “content coins.” Great for artists who prioritize distribution and rewards over secondary-market depth. Best For: Artists, indie studios, open editions, mint-first strategies.

Notable Features: One-click minting; protocol rewards; Base/L2 focus; social posting with coins. Consider If: You value creator economics; secondary liquidity may be thinner than pro venues.

Alternatives: Rarible (community stores), Foundation (curation).

Regions: Global • Fees Notes: Typical mint fee ~0.000777 ETH; reward splits for creators/referrals per docs.

Why Use It: Gamma focuses on Ordinals with no-code launchpads and a clean flow for inscribing and trading on Bitcoin. If you want exposure to BTC-native art and collections, Gamma is a friendly on-ramp. Best For: Ordinals creators/collectors, BTC-first communities.

Notable Features: No-code minting; Ordinals marketplace; education hub. Consider If: You want BTC exposure vs EVM/SOL liquidity; check fee line items. Alternatives: Magic Eden (BTC), UniSat (wallet+market).

Regions: Global • Fees Notes: Commission on mints/sales; see support article.

Why Use It: TokenTrove is a top marketplace in the Immutable gaming ecosystem with stacked listings, strong filters, and price history—ideal for trading in-game items like Gods Unchained, Illuvium, and more. It plugs into Immutable’s global order book and fee model. Best For: Web3 gamers, IMX/zkEVM collectors, low-gas trades.

Notable Features: Immutable integration; curated gaming collections; alerts; charts. Consider If: You mainly collect gaming assets and want L2 speed with predictable fees.

Alternatives: OKX (aggregation), Sphere/AtomicHub (IMX partners).

Regions: Global • Fees Notes: Immutable protocol fee ~2% to buyer + marketplace maker/taker fees vary by venue.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What is an NFT marketplace?

An NFT marketplace is a platform where users mint, buy, and sell NFTs (digital assets recorded on a blockchain). Marketplaces handle listings, bids, and transfers—often across multiple chains like ETH, BTC, or SOL.

Which NFT marketplace has the lowest fees?

Blur advertises 0% marketplace fees on ETH; Magic Eden lists 0.5% on many EVM trades and ~2% on SOL/BTC; Tensor uses 0% maker/2% taker. Always factor gas and royalties.

What’s best for Bitcoin Ordinals?

Magic Eden and Gamma are strong choices; UniSat’s wallet integrates with a marketplace as well. Pick based on fees and tooling.

What about U.S.-friendly options?

Kraken NFT is positioned for U.S. users with zero gas on trades. Check any exchange venue’s regional policy before funding.

Are royalties mandatory?

Policies vary: some venues enforce royalties (e.g., Tensor enforces per collection); others make royalties optional. Review each collection’s page and marketplace rules.

Do I still pay gas?

Yes, on most chains. Some custodial venues remove gas on trades but charge gas when you deposit/withdraw.

If you want cross-chain liquidity and discovery, start with Magic Eden. For pro ETH execution, Blur leads; for pro SOL, choose Tensor. U.S. newcomers who value compliance and predictability should consider Kraken NFT. Gaming collectors on Immutable can lean on TokenTrove.

Related Reads:

%201.svg)

%201.svg)

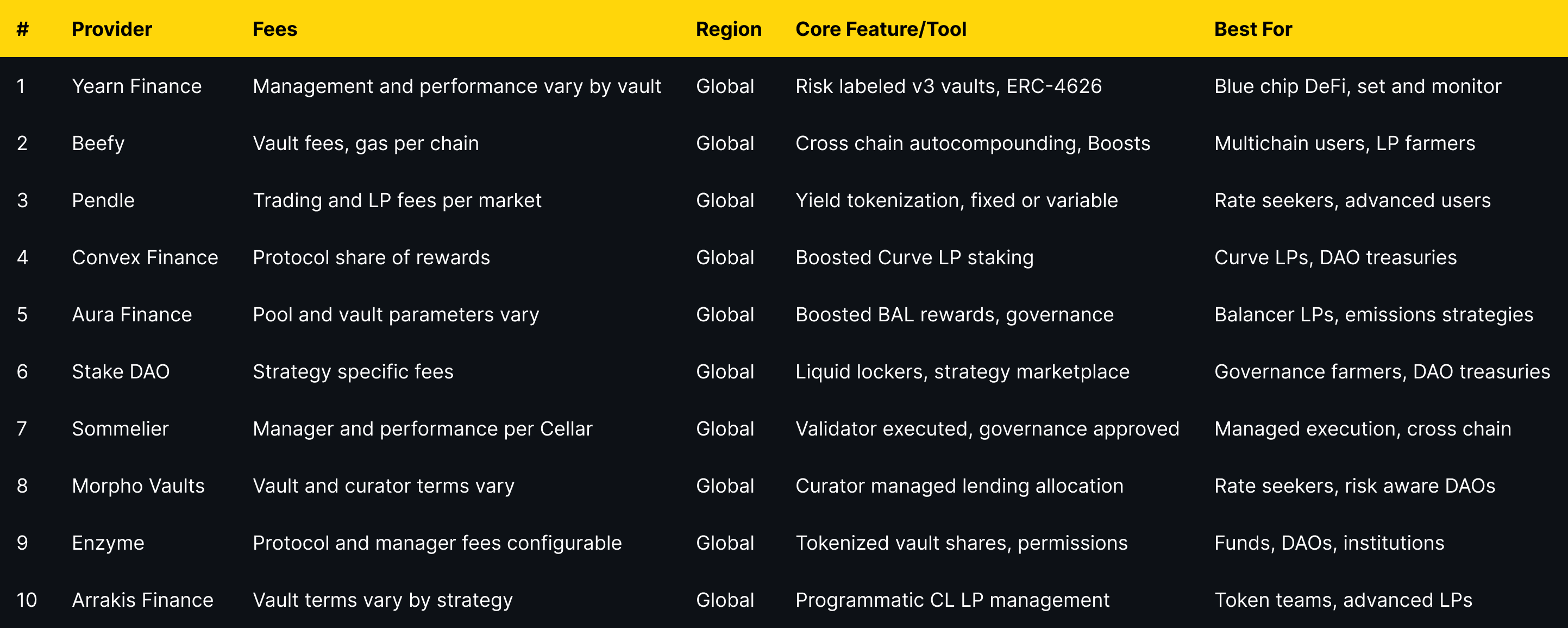

DeFi never sits still. Rates move, incentives rotate, and new chains launch weekly. Yield aggregators and vaults automate that work—routing your assets into on-chain strategies that can compound rewards and manage risk while you sleep. In short: a yield aggregator is a smart-contract “account” that deploys your tokens into multiple strategies to optimize returns (with risks).

Who is this for? Active DeFi users, long-term holders, DAOs/treasuries, and anyone exploring passive crypto income in 2025. We prioritized providers with strong security postures, transparent docs, useful dashboards, and broad asset coverage. Secondary angles include DeFi vaults, auto-compounders, and yield optimization tools.

Data sources: official product/docs, security and transparency pages; Token Metrics testing; cross-checks with widely cited market datasets when needed. Last updated September 2025.

Primary CTA: Start free trial.

This article is for research/education, not financial advice.

What is a yield aggregator in crypto?

A yield aggregator is a smart-contract system that deploys your tokens into multiple DeFi strategies and auto-compounds rewards to target better risk-adjusted returns than manual farming.

Are vaults custodial?

Most DeFi vaults are non-custodial contracts—you keep control via your wallet, while strategies execute on-chain rules. Always read docs for admin keys, pausable functions, and upgrade paths.

Fixed vs. variable yield—how do I choose?

If you value certainty, fixed yields (e.g., via Pendle) can make sense; variable yield can outperform in risk-on markets. Many users blend both.

What fees should I expect?

Common fees are management, performance, and withdrawal (plus gas). Each vault shows specifics; compare net, not just gross APY.

Which networks are best for beginners?

Start on mainstream EVM chains with strong tooling (Ethereum L2s, major sidechains). Fees are lower and UI tooling is better for learning.

How safe are these platforms?

Risks include contract bugs, oracle issues, market shocks, and governance. Prefer audited, well-documented protocols with visible risk controls—and diversify.

If you want set-and-forget blue-chips, start with Yearn or Sommelier. Multichain farmers often prefer Beefy. Curve/Balancer LPs should consider Convex/Aura. Rate-sensitive users may like Pendle or Morpho Vaults. Builders and treasuries should look at Enzyme and Arrakis for tailored vault setups.

Related Reads:

We reviewed each provider’s official site, docs, and product pages for features, security notes, and positioning. Third-party datasets were used only to cross-check market presence. Updated September 2025.

%201.svg)

%201.svg)

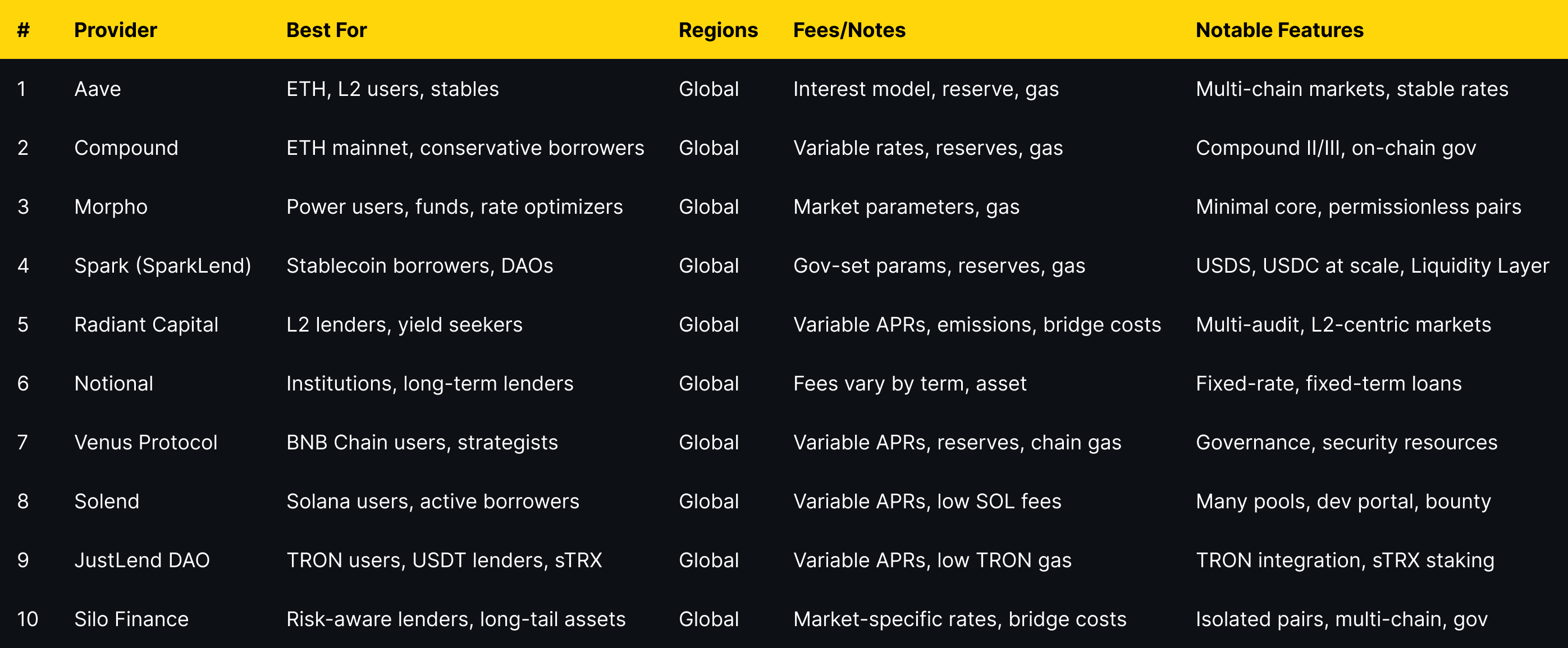

DeFi lending/borrowing protocols let you supply crypto to earn yield or post collateral to borrow assets without an intermediary. That’s the short answer. In 2025, these platforms matter because market cycles are faster, stablecoin yields are competitive with TradFi, and new risk-isolation designs have reduced contagion across assets. If you’re researching the best lending/borrowing protocols for diversified yield or flexible liquidity, this guide is for you—whether you’re a first-time lender, an active degen rotating between chains, or an institution exploring programmatic treasury management. We highlight security posture, liquidity depth, supported assets, fees, and UX. We also note regional considerations where relevant and link only to official sources.

We relied on official product/docs and security pages; third-party market datasets (e.g., CCData/Kaiko/CoinGecko) were used only for cross-checks. Last updated September 2025.

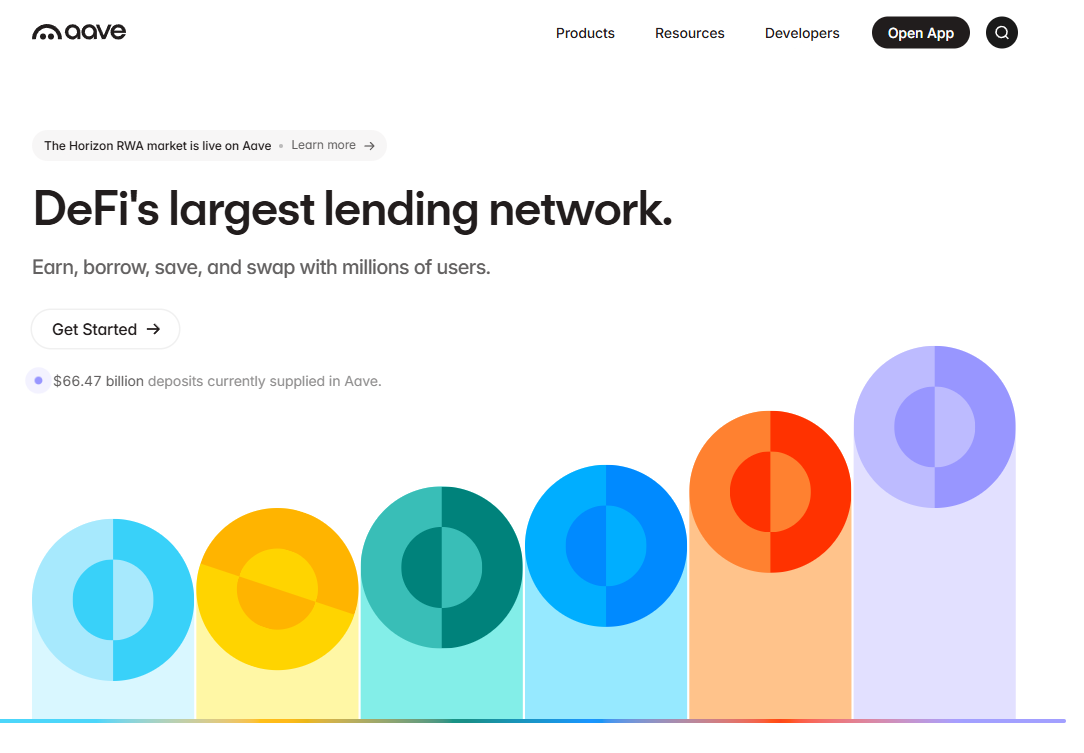

Why Use It: Aave remains the blue-chip money market with deep, multi-chain liquidity and granular risk controls across markets. Its non-custodial design and battle-tested rate model make it a default “base layer” for supplying majors and borrowing stables. aave.com+2aave.com+2

Best For: ETH/L2 users, stablecoin lenders, sophisticated borrowers, integrators.

Notable Features: Multiple markets and chains; variable/stable borrow rates; robust docs/dev tooling; governance-led risk parameters. aave.com

Consider If: You want the broadest asset access with conservative risk management.

Regions: Global (DeFi; user eligibility varies by jurisdiction).

Fees/Notes: Interest model + protocol reserve; gas/bridge costs apply. aave.com

Alternatives: Compound, Morpho.

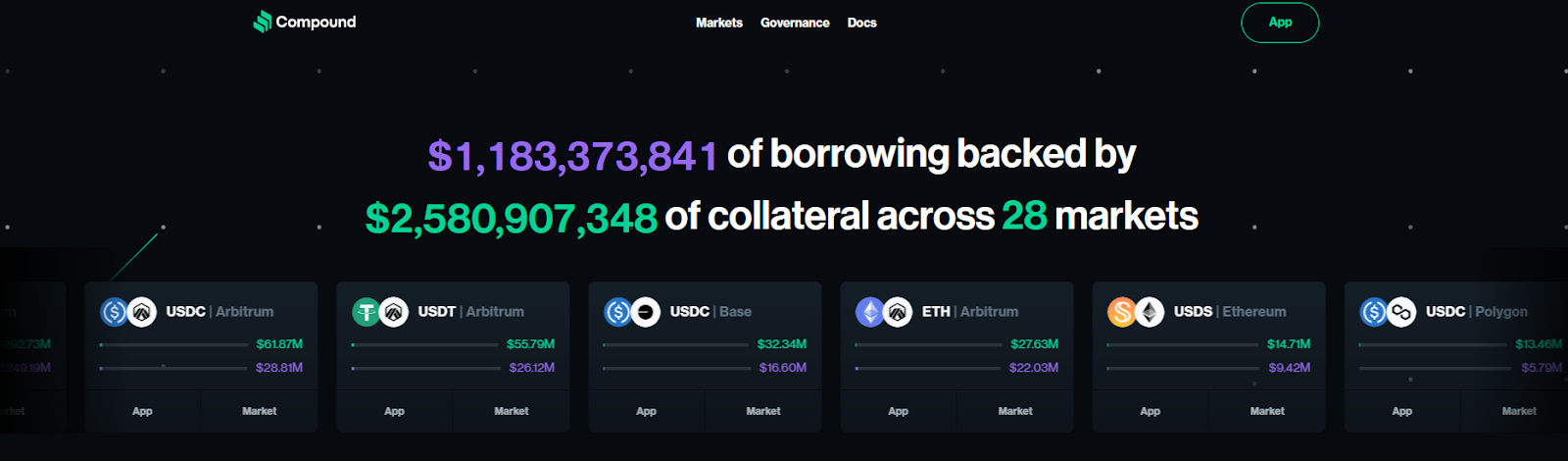

Why Use It: Compound popularized algorithmic interest rates and still offers clean markets and a developer-friendly stack (Compound II/III). For ETH/L2 blue-chips and stables, it’s a straightforward option. compound.finance+1

Best For: ETH mainnet lenders, conservative borrowers, devs needing a stable API/primitive.

Notable Features: Autonomous interest-rate protocol; separate “III” markets; transparent market pages; on-chain governance. compound.finance+1

Consider If: You want a minimal, well-understood money market for majors.

Regions: Global (DeFi; user eligibility varies).

Fees/Notes: Variable rates; protocol reserves; gas applies.

Alternatives: Aave, Spark Lend.

Why Use It: Morpho Blue focuses on trustless, efficient markets with permissionless pair creation and improved capital efficiency. It aims to route lenders/borrowers to “best possible” terms with a narrow, auditable core. morpho.org+2morpho.org+2

Best For: Power users, DeFi funds, integrators optimizing rates, risk-aware lenders.

Notable Features: Morpho Blue minimal core; permissionless markets; lower gas; flexible collateral factors. morpho.org

Consider If: You prioritize rate efficiency and clear risk boundaries.

Regions: Global.

Fees/Notes: Market-specific parameters; gas applies.

Alternatives: Silo Finance, Fraxlend.

Why Use It: SparkLend benefits from direct liquidity provided by Sky (Maker ecosystem), offering transparent, governance-set rates for borrowing USDS/USDC at scale—useful for stablecoin treasuries and market-makers. spark+2spark+2

Best For: Stablecoin borrowers, DAOs/treasuries, conservative lenders focused on stables.

Notable Features: USDS/USDC borrowing at scale; Spark Liquidity Layer; governance-driven rate transparency. spark

Consider If: You want Maker-aligned stablecoin rails with predictable liquidity.

Regions: Global (check local eligibility).

Fees/Notes: Governance-determined parameters; protocol reserves; gas applies.

Alternatives: Aave, Compound.

Why Use It: Radiant targets cross-chain UX with audited deployments and a community-driven token model—appealing to users active on Arbitrum and other L2s seeking competitive rates and incentives. Radiant Capital

Best For: L2 lenders/borrowers, yield seekers rotating across EVMs.

Notable Features: Multi-audit posture; L2-centric markets; RDNT lockers sharing protocol revenue; incentives. Radiant Capital

Consider If: You’re comfortable with DeFi token incentives and L2 bridging.

Regions: Global.

Fees/Notes: Variable APRs; incentive emissions; gas/bridge costs.

Alternatives: Aave (L2), Silo.

Why Use It: Notional offers fixed-rate, fixed-term lending and borrowing, providing users with predictable interest rates and loan durations. This model is particularly appealing to institutional players and long-term investors seeking stability in DeFi markets.

Best For: Institutional borrowers, long-term DeFi investors, and those seeking predictable lending terms.

Notable Features:

Consider If: You prefer the certainty of fixed rates and terms in your lending and borrowing activities.

Regions: Global

Fees/Notes: Fees vary based on loan terms and asset type.

Alternatives: Aave, Compound, Morpho

Why Use It: Venus is the leading money market on BNB Chain, offering broad asset coverage and deep stablecoin pools for users anchored to that ecosystem. It emphasizes security practices and transparency to support its large user base. venus.io+1

Best For: BNB Chain lenders/borrowers, yield strategists, BSC-native projects.

Notable Features: Multichain money market positioning; active governance; security resources. venus.io

Consider If: You are primarily on BNB Chain and need depth.

Regions: Global.

Fees/Notes: Variable APRs; protocol reserves; chain gas fees.

Alternatives: Aave (BSC deployments where available), Radiant.

Why Use It: On Solana, Solend is the go-to autonomous money market with many asset pools and fast, low-fee transactions. It’s well suited for active traders and stablecoin lenders who want Solana performance. solend.fi+1

Best For: Solana users, stablecoin lenders, active borrowers hedging perps/DEX LP.

Notable Features: Dozens of pools; developer portal; bug bounty; investor backing. solend.fi

Consider If: You want low fees and high throughput on SOL.

Regions: Global.

Fees/Notes: Variable APRs; Solana fees are minimal but apply.

Alternatives: Kamino Lend (Solana), Aave (EVM).

Why Use It: JustLend is TRON’s flagship money market, supporting TRX, USDT, and other TRC-20 assets with competitive rates and growing DAO governance. It’s a practical option for users embedded in the TRON ecosystem. JustLend DAO+1

Best For: TRON users, USDT lenders on TRON, TRX stakers (sTRX).

Notable Features: TRON integration; sTRX staking module; active on-chain proposals. app.justlend.org+1

Consider If: You primarily hold TRC-20s and want native UX.

Regions: Global (note regional availability of TRON gateways).

Fees/Notes: Variable APRs; TRON gas is low.

Alternatives: Venus (BSC), Aave (EVM).

Why Use It: Silo builds isolated markets (“silos”) so lenders bear only the risk of the market they choose—reducing cross-asset contagion seen in shared pools. Helpful for long-tail assets under tighter risk parameters. Silo Finance+2Silopedia+2

Best For: Risk-aware lenders, long-tail asset communities, L2 users.

Notable Features: Isolated pairs; transparent docs; multi-chain deployments; active governance. silodocs2.netlify.app

Consider If: You want clear compartmentalization of risk per asset.

Regions: Global.

Fees/Notes: Market-specific rates; gas/bridge costs.

Alternatives: Morpho, Fraxlend.

This article is for research/education, not financial advice.

What is a DeFi lending/borrowing protocol?

A smart-contract system that lets users supply assets to earn interest or post collateral to borrow other assets, typically overcollateralized with algorithmic rates.

How do variable and stable borrow rates differ?

Variable rates change with utilization; stable/“fixed” rates are more predictable but can reprice under specific conditions. Always check the protocol’s docs.

Are isolated markets safer than shared pools?

They can reduce cross-asset contagion by containing risk to one market, but you still face collateral, oracle, and liquidation risks.

Which chains are best for low-fee lending?

Solana and several L2s (e.g., Arbitrum, Optimism, Base) offer lower fees than mainnet. Choose based on assets, liquidity, and tooling.

How much collateral should I post?

Many borrowers keep a conservative buffer (e.g., target health factor well above minimum), especially in volatile markets; tailor to your risk tolerance.

Can institutions use these protocols?

Yes—many funds and DAOs integrate with major money markets, often via smart-contract wallets and custom monitors.

If you want breadth and depth, start with Aave or Compound. If you’re optimizing stablecoin flows, Spark stands out. For isolated-risk, asset-specific strategies, Morpho, Silo, and Fraxlend are strong fits. Solana, TRON, and BNB users should look to Solend, JustLend, and Venus respectively. Pick based on chain, risk, and the collateral you actually hold.

%201.svg)

%201.svg)

If you operate an exchange, wallet, OTC desk, or DeFi on-ramp, choosing the right KYC/AML providers can be the difference between smooth growth and painful remediation. In 2025, regulators continue to tighten enforcement (Travel Rule, sanctions screening, transaction monitoring), while criminals get more sophisticated across bridges, mixers, and multi-chain hops. This guide shortlists ten credible vendors that help crypto businesses verify users, monitor wallets and transactions, and comply with global rules.

Definition (snippet): KYC/AML providers are companies that deliver identity verification, sanctions/PEP screening, blockchain analytics, transaction monitoring, and Travel Rule tooling so crypto businesses can meet regulatory obligations and reduce financial crime risk.

SECONDARY_KEYWORDS woven below: crypto compliance, blockchain analytics, transaction monitoring, Travel Rule.

Why Use It: Chainalysis KYT and Reactor pair broad chain/token coverage with real-time risk scoring and deep investigative tooling. If you need automated alerts on deposits/withdrawals and the ability to trace through bridges/mixers/DEXs, it’s a proven, regulator-recognized stack.

Best For: Centralized exchanges, custodians, banks with crypto exposure, law enforcement teams.

Notable Features: Real-time KYT alerts • Cross-chain tracing • Case management & APIs • Attribution datasets.

Consider If: You want an enterprise-grade standard and investigator workflows under one roof.

Alternatives: TRM Labs, Elliptic. Chainalysis+1

Regions: Global • Fees/Notes: Quote-based, volume/seat tiers.

Why Use It: TRM’s transaction monitoring taps a large, fast-growing database of illicit activity and extends screening beyond official lists to include threat actor footprints on-chain. Strong coverage and practical APIs make it easy to plug into existing case systems.

Best For: Exchanges, payment processors, fintechs expanding into web3, risk teams that need flexible rules.

Notable Features: Real-time monitoring • Sanctions & threat actor intelligence • Case mgmt. integrations • Multi-chain coverage.

Consider If: You prioritize dynamic risk models and frequent list updates.

Alternatives: Chainalysis, Elliptic. TRM Labs+1

Regions: Global • Fees/Notes: Enterprise contracts; volume-based.

Why Use It: Elliptic’s Lens and Screening solutions streamline wallet/transaction checks with chain-agnostic coverage and audit-ready workflows. It’s built for high-volume screening with clean APIs and strong reporting for regulators and internal audit.

Best For: CEXs, payment companies, institutional custody, risk ops needing bulk screening.

Notable Features: Wallet & TX screening • Cross-chain risk detection • Audit trails • Customer analytics.

Consider If: You need mature address screening and large-scale throughput.

Alternatives: Chainalysis, TRM Labs. Elliptic+1

Regions: Global • Fees/Notes: Quote-based; discounts by volume.

Why Use It: An AML data powerhouse for KYC and ongoing monitoring that many crypto companies use to meet screening obligations and reduce false positives. Strong watchlist coverage, adverse media, and continuous monitoring help you satisfy banking partners and auditors.

Best For: Exchanges and fintechs that want robust sanctions/PEP data plus transaction monitoring.

Notable Features: Real-time sanctions & watchlists • Ongoing monitoring • Payment screening • Graph analysis.

Consider If: You want a single vendor for screening + monitoring alongside your analytics stack.

Alternatives: Jumio (Screening), Sumsub. ComplyAdvantage+1

Regions: Global • Fees/Notes: Tiered enterprise pricing.

Why Use It: Crypto-focused onboarding with liveness, documents, KYB, Travel Rule support, and transaction monitoring—plus in-house legal experts to interpret changing rules. Good for teams that need to orchestrate identity checks and AML controls in one flow.

Best For: Global exchanges, NFT/DeFi ramps, high-growth startups entering new markets.

Notable Features: KYC/KYB • Watchlists/PEPs • Device intelligence • Crypto TX monitoring • Case management.

Consider If: You want one vendor for identity + AML + Travel Rule workflow.

Alternatives: Jumio, ComplyAdvantage. Sumsub+1

Regions: Global • Fees/Notes: Per-verification & volume tiers.

Why Use It: Jumio combines biometric KYC with automated AML screening (PEPs/sanctions) and ongoing monitoring. Its “KYX” approach provides identity insights across the customer lifecycle, helping reduce fraud while keeping onboarding friction reasonable.

Best For: Regulated exchanges, banks, brokerages with strict KYC/AML controls.

Notable Features: Biometric verification • PEPs/sanctions screening • Ongoing monitoring • Single-API platform.

Consider If: You need global coverage and battle-tested uptime/SLA.

Alternatives: Sumsub, Onfido (not listed). Jumio+1

Regions: Global • Fees/Notes: Custom enterprise pricing.

Why Use It: Notabene focuses on pre-transaction decisioning, counterparty VASP due diligence, and sanctions screening across multiple Travel Rule protocols. It’s purpose-built for crypto compliance teams facing enforcement of FATF Recommendation 16.

Best For: Exchanges, custodians, and B2B payment platforms needing Travel Rule at scale.

Notable Features: Pre-TX checks • Counterparty VASP verification • Multi-protocol messaging • Jurisdictional rules engine.

Consider If: Your regulators or banking partners expect full Travel Rule compliance today.

Alternatives: Shyft Veriscope, 21 Analytics. Notabene+1

Regions: Global • Fees/Notes: Annual + usage components.

Why Use It: Veriscope provides decentralized VASP discovery, secure VASP-to-VASP PII exchange, and “sunrise issue” lookback to help during uneven global rollouts. Pay-as-you-go pricing can be attractive for newer programs.

Best For: Global VASPs that want decentralized discovery and interoperability.

Notable Features: Auto VASP discovery • Secure PII transfer (no central PII storage) • Lookback support • Interoperability.

Consider If: You prefer decentralized architecture and usage-based pricing.

Alternatives: Notabene, 21 Analytics. shyft.network+1

Regions: Global • Fees/Notes: Pay-as-you-go; no setup fees. shyft.network

Why Use It: Merkle Science’s platform emphasizes predictive risk modeling and DeFi/smart contract forensics, helping compliance teams see beyond static address tags. Good complement when you monitor emerging chains and token types.

Best For: Exchanges and protocols active in DeFi, new L1/L2 ecosystems, or smart-contract risk.

Notable Features: Predictive risk scores • DeFi & contract forensics • Case tooling • API integrations.

Consider If: You need analytics tuned for newer protocols and token standards.

Alternatives: Chainalysis, TRM Labs. merklescience.com+1

Regions: Global • Fees/Notes: Quote-based enterprise pricing.

Why Use It: Based in Luxembourg, Scorechain offers risk scoring, transaction monitoring, and reporting designed to fit EU frameworks—useful for MiCA/TFR-aligned programs. Teams like the straightforward reporting exports for audits and regulators.

Best For: EU-focused exchanges, neobanks, and tokenization platforms.

Notable Features: Risk scoring • Transaction monitoring • Audit-ready reports • Tools for Travel Rule workflows.

Consider If: Your footprint is primarily EU and you want EU-centric vendor DNA.

Alternatives: Crystal (EU), Elliptic. Scorechain+1

Regions: EU/Global • Fees/Notes: Enterprise licenses; fixed and usage options.

Primary CTA: Start a free trial of Token Metrics.

This article is for research/education, not financial advice.

What’s the difference between KYC and KYT (Know Your Transaction)?

KYC verifies an individual or entity at onboarding and during refresh cycles. KYT/transaction monitoring analyzes wallets and transfers in real time (or post-event) to identify suspicious activity, sanctions exposure, and patterns of illicit finance. TRM Labs

Do I need a Travel Rule solution if I only serve retail in one country?

Possibly. Many jurisdictions apply the Travel Rule above certain thresholds and when sending to other VASPs, even domestically. If you interoperate with global exchanges or custodians, you’ll likely need it. Notabene

How do vendors differ on sanctions coverage?

Screening providers update against official lists and, in some cases, extend coverage using intelligence on known threat actors’ wallets. Look for rapid refresh cycles and retroactive screening. TRM Labs

Can I mix-and-match KYC and blockchain analytics vendors?

Yes. Many teams use a KYC/AML screening vendor plus a blockchain analytics platform; some suites offer both, but best-of-breed mixes are common.

What’s a good starting stack for a new exchange?

A KYC/KYB vendor (Jumio or Sumsub), a sanctions/PEP screening engine (ComplyAdvantage or your KYC vendor’s module), a blockchain analytics platform (Chainalysis/TRM/Elliptic), and a Travel Rule tool (Notabene or Veriscope).

Compliance isn’t one tool; it’s a stack. If you’re U.S.-regulated and high-volume, start with Chainalysis or TRM plus Jumio or Sumsub. If you’re EU-led, Scorechain can simplify audits. For Travel Rule, choose Notabene (end-to-end) or Veriscope (decentralized/pay-as-you-go). Pair your chosen stack with Token Metrics to research, monitor, and act with confidence.

Related Reads:

We independently reviewed official product pages, docs, and security/trust materials for each provider (no third-party links in body). Shortlist refreshed September 2025; we’ll revisit as regulations, features, and availability change.

Scorechain — Product pages & glossary resources. Scorechain+1

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.