Top Crypto Trading Platforms in 2025

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

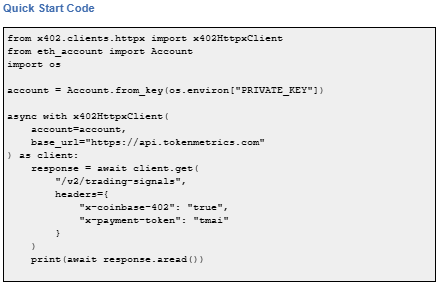

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

x402 is an open-source, HTTP-native payment protocol developed by Coinbase that enables pay-per-call API access using crypto wallets. It leverages the HTTP 402 Payment Required status code to create seamless, keyless API payments.

It eliminates traditional API keys and subscriptions, allowing agents and applications to pay for exactly what they use in real time. It works across Base and Solana with USDC and selected native tokens such as TMAI.

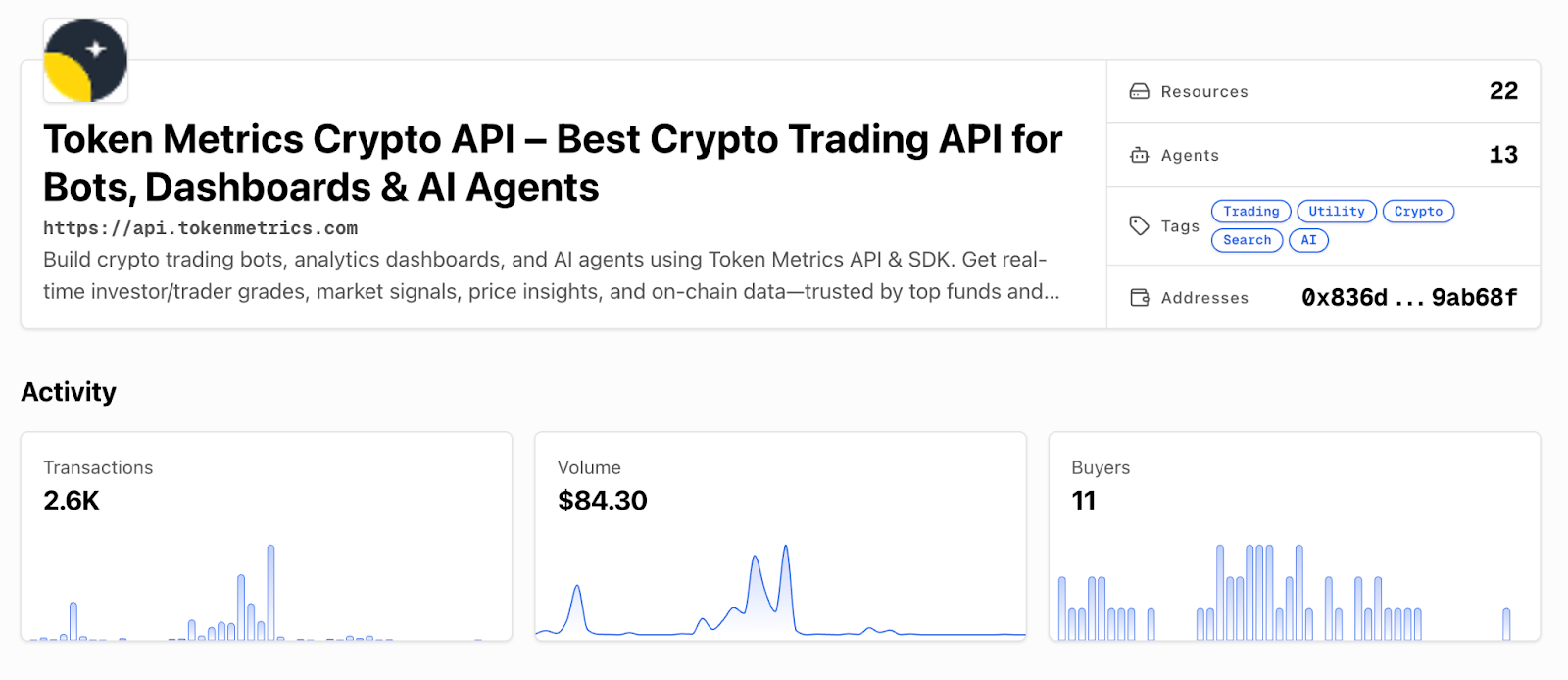

Start using Token Metrics X402 integration here. https://www.x402scan.com/server/244415a1-d172-4867-ac30-6af563fd4d25

x402 transforms API access by making payments native to HTTP requests.

Feature | Traditional APIs | x402 APIs |

Authentication | API keys, tokens | Wallet signature |

Payment Model | Subscription, prepaid | Pay-per-call |

Onboarding | Sign up, KYC, billing | Connect wallet |

Rate Limits | Fixed tiers | Economic (pay more = more access) |

Commitment | Monthly/annual | Zero, per-call only |

How to use it: Add x-coinbase-402: true header to any supported endpoint. Sign payment with your wallet. The API responds immediately after confirming micro-payment.

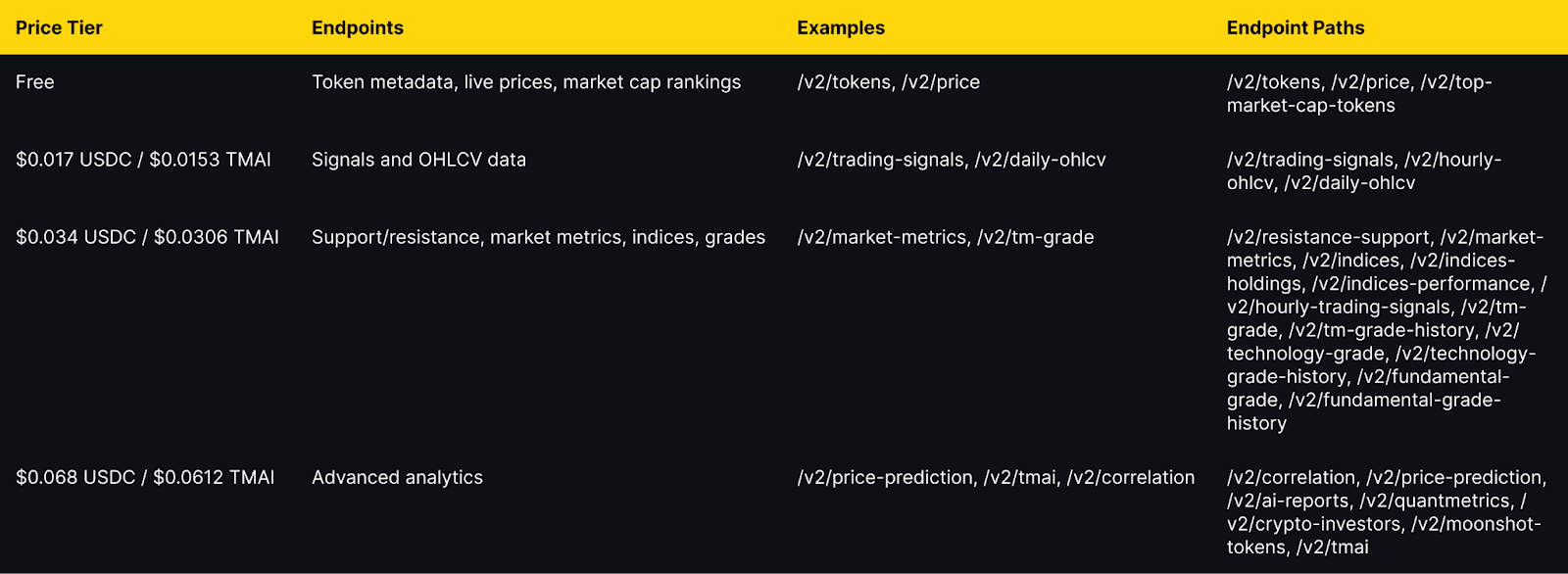

Token Metrics integration: All public endpoints available via x402 with per-call pricing from $0.017 to $0.068 USDC (10% discount with TMAI token).

Explore live agents: https://www.x402scan.com/composer.

The Protocol Flow

The HTTP 402 status code was reserved in HTTP/1.1 in 1997 for future digital payment use cases and was never standardized for any specific payment scheme. x402 activates this path by using 402 responses to coordinate crypto payments during API requests.

Why this matters: It eliminates intermediary payment processors, enables true machine-to-machine commerce, and reduces friction for AI agents.

CoinGecko Recognition

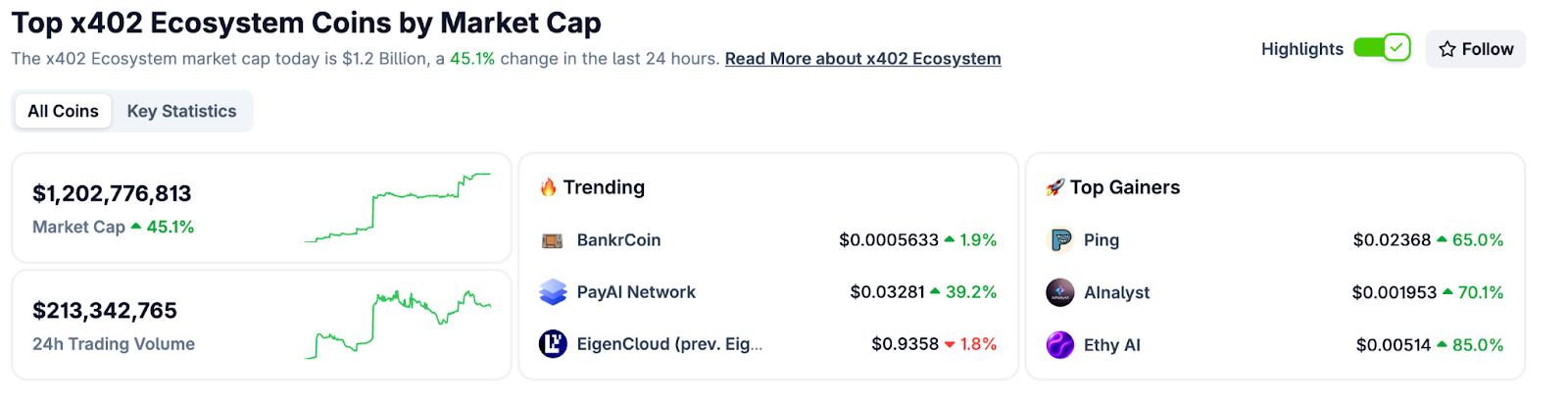

CoinGecko launched a dedicated x402 Ecosystem category in October 2025, tracking 700+ projects with over $1 billion market cap and approximately $213 million in daily trading volume. Top performers include PING and Alnalyst, along with established projects like EigenCloud.

Base Network Adoption

Base has emerged as the primary chain for x402 adoption, with 450,000+ weekly transactions by late October 2025, up from near-zero in May. This growth demonstrates real agent and developer usage.

Composer is x402scan's sandbox for discovering and using AI agents that pay per tool call. Users can open any agent, chat with it, and watch tool calls and payments stream in real time.

Top agents include AInalyst, Canza, SOSA, and NewEra. The Composer feed shows live activity across all agents.

Explore Composer: https://x402scan.com/composer

What We Ship

Token Metrics offers all public API endpoints via x402 with no API key required. Pay per call with USDC or TMAI for a 10 percent discount. Access includes trading signals, price predictions, fundamental grades, technology scores, indices data, and the AI chatbot.

Check out Token Metrics Integration on X402. https://www.x402scan.com/server/244415a1-d172-4867-ac30-6af563fd4d25

Data as of October, 2025.

Pricing Tiers

Important note: TMAI Spend Limit: TMAI has 18 decimals. Set max payment to avoid overspending. Example: 200 TMAI = 200 * (10 ** 18) in base units.

Full integration guide: https://api.tokenmetrics.com

Ecosystem Participants and Tools

Active x402 Endpoints

Key endpoints beyond Token Metrics include Heurist Mesh for crypto intelligence, Tavily extract for structured web content, Firecrawl search for SERP and scraping, Twitter or X search for social discovery, and various DeFi and market data providers.

Infrastructure and Tools

Common Questions About x402

How is x402 different from traditional API keys?

x402 uses wallet signatures instead of API keys. Payment happens per call rather than via subscription. No sign-up, no monthly billing, no rate limit tiers. You pay for exactly what you use.

Which chains support x402?

Currently Base and Solana. Most activity is on Base with USDC as the primary payment token. Some endpoints accept native tokens like TMAI for discounts.

Do I need to trust the API provider with my funds?

No. Payments are on-chain and verifiable. You approve each transaction amount. No escrow or prepayment is required.

What happens if a payment fails?

The API returns 402 Payment Required again with updated payment details. Your client retries automatically. You do not receive data until payment confirms.

Can I use x402 with existing API clients?

Yes, with x402 client libraries such as x402-axios for Node and x402-httpx for Python. These wrap standard HTTP clients and handle the payment flow automatically.

Getting Started Checklist

Token Metrics x402 Resources

What's Next for x402

Ecosystem expansion. More API providers adopting x402, additional chains beyond Base and Solana, standardization of payment headers and response formats.

Agent sophistication. As x402 matures, expect agents that automatically discover and compose multiple paid endpoints, optimize costs across providers, and negotiate better rates for bulk usage.

Disclosure

Educational content only, not financial advice. API usage and crypto payments carry risks. Verify all transactions before signing. Do your own research.

Opening Hook

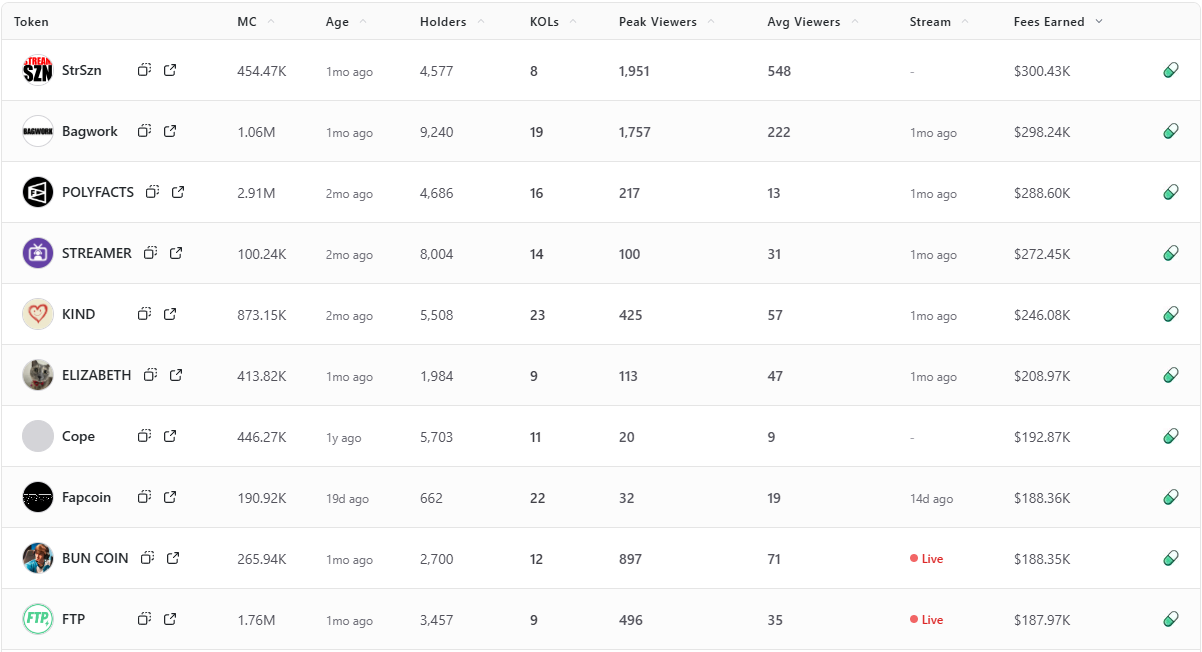

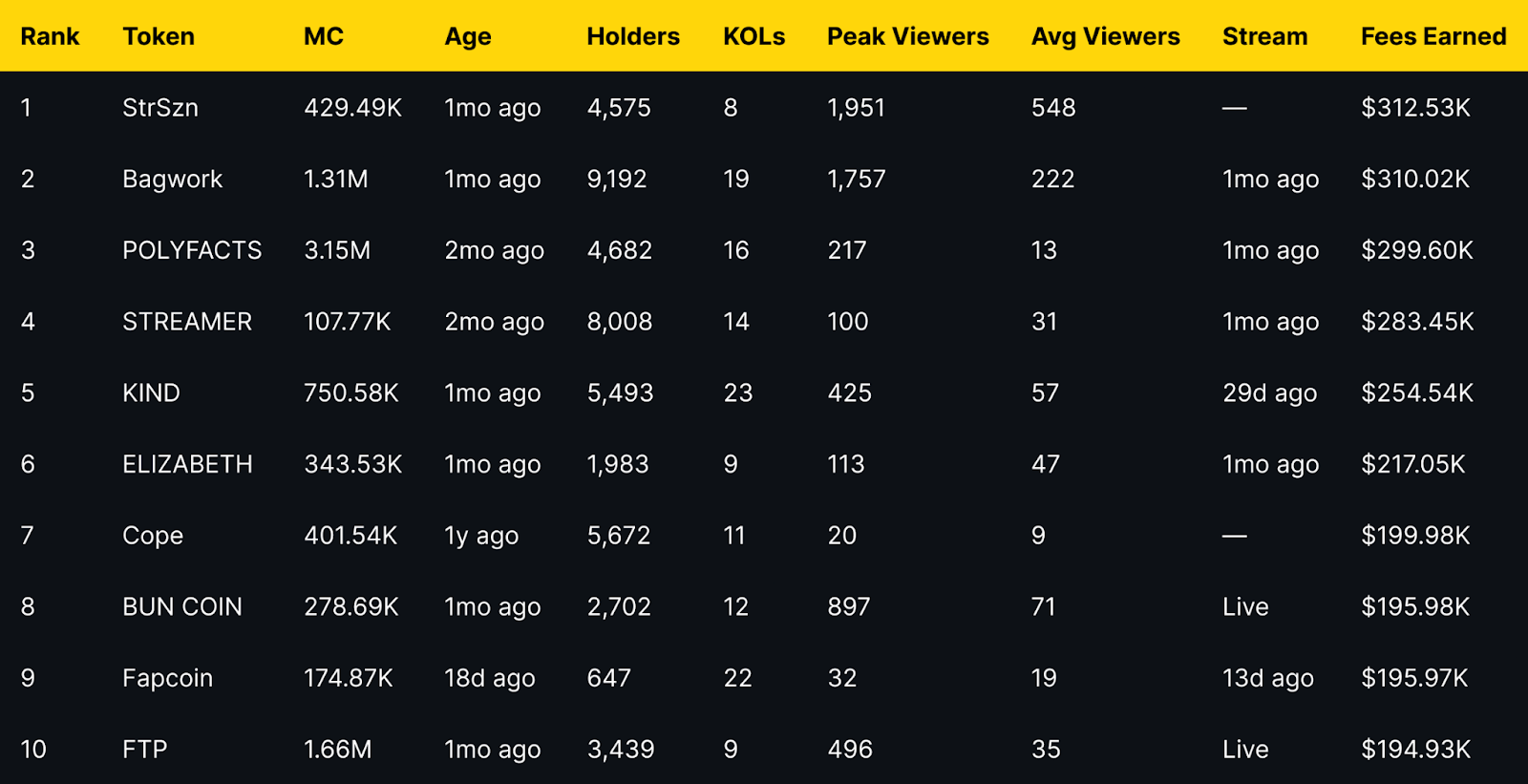

Fees Earned is a clean way to see which livestream tokens convert attention into on-chain activity. This leaderboard ranks the top 10 Pump.fun livestream tokens by Fees Earned using the screenshot you provided.

Selection rule is simple, top 10 by Fees Earned from the screenshot, numbers appear exactly as shown. If a field is not in the image, it is recorded as —.

Entity coverage: project names and tickers are taken as listed on Pump.fun, chain is Solana, sector is livestream meme tokens and creator tokens.

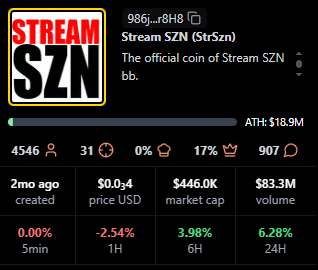

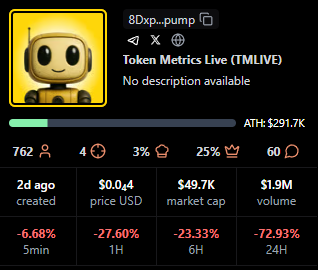

Token Metrics Live (TMLIVE) brings real time, data driven crypto market analysis to Pump.fun. The team has produced live crypto content for 7 years with a 500K plus audience and a platform of more than 100,000 users. Our public track record includes early coverage of winners like MATIC and Helium in 2018.

TMLIVE Quick Stats, as captured

TLDR: Fees Earned Leaders at a Glance

Short distribution note: the top three sit within a narrow band of each other, while mid-table tokens show a mix of older communities and recent streams. Several names with modest average viewers still appear due to concentrated activity during peaks.

StrSzn

Positioning: Active community meme with consistent viewer base.

Research Blurb: Project details unclear at time of writing. Fees and viewership suggest consistent stream engagement over the last month.

Quick Facts: Chain = Solana, Status = —, Peak Viewers = 1,951, Avg Viewers = 548.

https://pump.fun/coin/986j8mhmidrcbx3wf1XJxsQFvWBMXg7gnDi3mejsr8H8

Bagwork

Positioning: Large holder base with sustained attention.

Research Blurb: Project details unclear at time of writing. Strong holders and KOL presence supported steady audience numbers.

Quick Facts: Chain = Solana, Status = 1mo ago, Holders = 9,192, KOLs = 19.

https://pump.fun/coin/7Pnqg1S6MYrL6AP1ZXcToTHfdBbTB77ze6Y33qBBpump

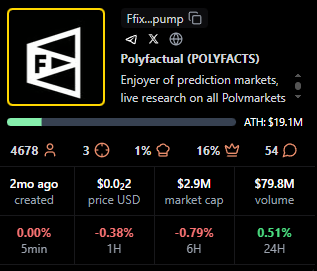

POLYFACTS

Positioning: Higher market cap with light average viewership.

Research Blurb: Project details unclear at time of writing. High market cap with comparatively low average viewers implies fees concentrated in shorter windows.

Quick Facts: Chain = Solana, Status = 1mo ago, MC = 3.15M, Avg Viewers = 13.

https://pump.fun/coin/FfixAeHevSKBZWoXPTbLk4U4X9piqvzGKvQaFo3cpump

STREAMER

Positioning: Community focused around streaming identity.

Research Blurb: Project details unclear at time of writing. Solid holders and moderate KOL count, steady averages over time.

Quick Facts: Chain = Solana, Status = 1mo ago, Holders = 8,008, KOLs = 14.

https://pump.fun/coin/3arUrpH3nzaRJbbpVgY42dcqSq9A5BFgUxKozZ4npump

KIND

Positioning: Heaviest KOL footprint in the top 10.

Research Blurb: Project details unclear at time of writing. The largest KOL count here aligns with above average view metrics and meaningful fees.

Quick Facts: Chain = Solana, Status = 29d ago, KOLs = 23, Avg Viewers = 57.

https://pump.fun/coin/V5cCiSixPLAiEDX2zZquT5VuLm4prr5t35PWmjNpump

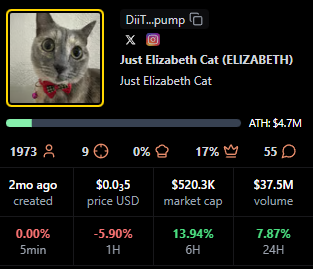

ELIZABETH

Positioning: Mid-cap meme with consistent streams.

Research Blurb: Project details unclear at time of writing. Viewer averages and recency indicate steady presence rather than single spike behavior.

Quick Facts: Chain = Solana, Status = 1mo ago, Avg Viewers = 47, Peak Viewers = 113.

https://pump.fun/coin/DiiTPZdpd9t3XorHiuZUu4E1FoSaQ7uGN4q9YkQupump

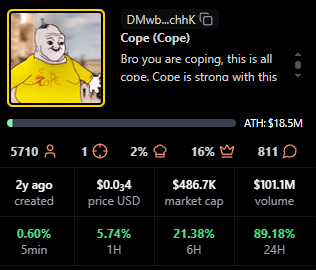

Cope

Positioning: Older token with a legacy community.

Research Blurb: Project details unclear at time of writing. Despite low recent averages, it holds a sizable base and meaningful fees.

Quick Facts: Chain = Solana, Status = —, Age = 1y ago, Avg Viewers = 9.

https://pump.fun/coin/DMwbVy48dWVKGe9z1pcVnwF3HLMLrqWdDLfbvx8RchhK

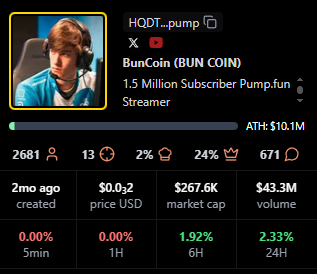

BUN COIN

Positioning: Currently live, strong peaks relative to size.

Research Blurb: Project details unclear at time of writing. Live streaming status often coincides with bursts of activity that lift fees quickly.

Quick Facts: Chain = Solana, Status = Live, Peak Viewers = 897, Avg Viewers = 71.

https://pump.fun/coin/HQDTzNa4nQVetoG6aCbSLX9kcH7tSv2j2sTV67Etpump

Fapcoin

Positioning: Newer token with targeted pushes.

Research Blurb: Project details unclear at time of writing. Recent age and meaningful KOL support suggest orchestrated activations that can move fees.

Quick Facts: Chain = Solana, Status = 13d ago, Age = 18d ago, KOLs = 22.

https://pump.fun/coin/8vGr1eX9vfpootWiUPYa5kYoGx9bTuRy2Xc4dNMrpump

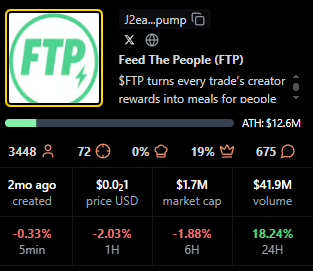

FTP

Positioning: Live status with solid mid-table view metrics.

Research Blurb: Project details unclear at time of writing. Peaks and consistent averages suggest an active audience during live windows.

Quick Facts: Chain = Solana, Status = Live, Peak Viewers = 496, Avg Viewers = 35.

https://pump.fun/coin/J2eaKn35rp82T6RFEsNK9CLRHEKV9BLXjedFM3q6pump

Signals From Fees Earned: Patterns to Watch

Fees Earned often rise with peak and average viewers, but timing matters. Several tokens here show concentrated peaks with modest averages, which implies that well timed announcements or coordinated segments can still produce high fees.

Age is not a blocker for this board. Newer tokens like Fapcoin appear due to focused activity, while older names such as Cope persist by mobilizing established holders. KOL count appears additive rather than decisive, with KIND standing out as the KOL leader.

For creators, Fees Earned reflects whether livestream moments translate into on-chain action. Design streams around clear calls to action, align announcements with segments that drive peaks, then sustain momentum with repeatable formats that stabilize averages.

For traders, Fees Earned complements market cap, viewers, and age. Look for projects that combine rising averages with consistent peaks, because those patterns suggest repeatable engagement rather than single event spikes.

TV Live is a fast way to follow real-time crypto market news, creator launches, and token breakdowns as they happen. You get context on stream dynamics, audience behavior, and on-chain activity while the story evolves.

CTA: Watch TV Live for real-time crypto market news →TV Live Link

CTA: Follow and enable alerts → TV Live

Token Metrics is trusted for transparent data, crypto analytics, on-chain ratings, and investor education. Our platform offers cutting-edge signals and market research to empower your crypto investing decisions.

What is the best way to track Pump.fun livestream leaders?

Tracking Pump.fun livestream leaders starts with the scanner views that show Fees Earned, viewers, and KOLs side by side, paired with live coverage so you see data and narrative shifts together.

Do higher fees predict higher market cap or sustained viewership?

Higher Fees Earned does not guarantee higher market cap or sustained viewership, it indicates conversion in specific windows, while longer term outcomes still depend on execution and community engagement.

How often do these rankings change?

Rankings can change quickly during active cycles, the entries shown here reflect the exact time of the screenshot.

Next Steps

Disclosure

This article is educational content. Cryptocurrency involves risk. Always do your own research.

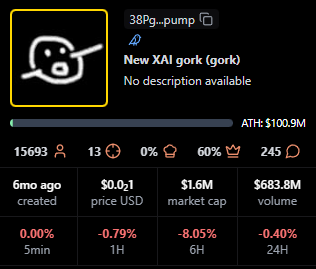

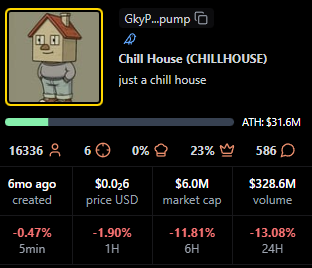

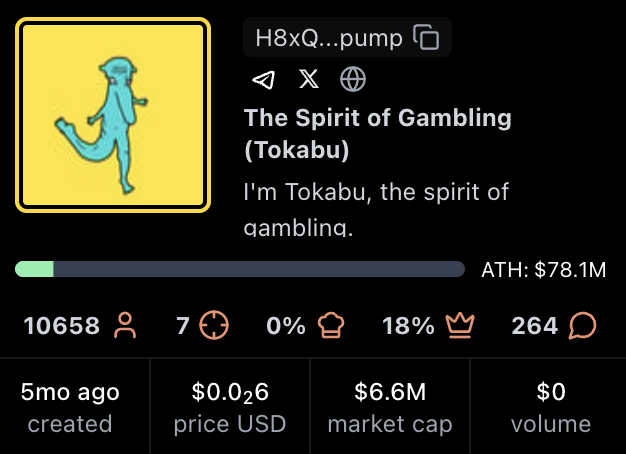

New XAI gork leads with 15,687 holders, followed by Chill House at 16,291 and The Spirit of Gambling (Tokabu) at 10,605. Token Metrics Live (TMLIVE) entered the space on November 4 with 876 holders in its first 22 hours, backed by 7 years of live crypto content experience and a 500K+ audience. GeorgePlaysClashRoyale maintains strong position with 7,014 holders despite lower ranking by this metric. Distribution varies widely, with some projects showing concentrated holder bases and others demonstrating broader community adoption.

For readers tracking pump.fun, recent pump.fun news around each pump.fun token and pump.fun price moves provides context, and this leaderboard explains what is pump.fun in practice through live data.

Token Metrics Live (TMLIVE) is the primary focus of this series. On day one, the stream drove $1.7M 24h volume and an ATH market cap of $291.7K, with ~876 holders captured in the first 22 hours.

TMLIVE brings research-first programming to a meme-heavy category, translating seven years of consistent live coverage and a 500K+ audience into rapid early adoption on Pump.fun.

Holder Count Rankings for Pump.fun Livestream Tokens

Holder count measures how widely a token is distributed across a community. Unlike market cap, which shows total valuation, or volume, which tracks trading activity, holder count reveals how many unique wallets have acquired the token.

For livestream tokens on Pump.fun, holder count provides insight into community breadth and potential staying power. Projects with more holders tend to have wider support networks and more diverse participation during streams.

This ranking selects the top 10 Pump.fun tokens by holder count from the provided data. Numbers, tickers, and dates are kept exactly as shown, and any missing data points are marked with a dash.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Methodology and Secondary Signals

Holder count alone does not guarantee project success. We also track market cap, engagement rate, and seven-day retention as complementary signals of durability and community health.

When high holder counts pair with strong engagement and retention, Pump.fun projects tend to sustain momentum longer. Projects with concentrated holder bases may show different trading dynamics than those with broad distribution.

Methodology note: where available, we reference pump.fun api endpoints and pump.fun api documentation (including pump.fun api docs) to corroborate holder snapshots, and we map each token to its pump.fun program id (also called pump.fun solana program id or pump.fun program id solana) for consistent tracking across Solana explorers. We consider transactions, tvl, and pump.fun fees as secondary health checks, and we note any bonding assumptions using the pump.fun bonding curve formula, basic pump.fun tokenomics, and typical pump.fun token bonding time where publicly visible.

Rank

Token Ticker Holders MC Age KOLs Notes

Data source: stalkchain.com/streams/scanner, captured Nov 4-5, 2024

The distribution shows clear patterns

Top holders include established projects aged 5-10 months with organic growth curves. Mid-tier projects in the 1,400-7,000 holder range show varying market caps, suggesting different holder-to-valuation ratios. TMLIVE's 876 holders in 22 hours represents rapid initial adoption, supported by an existing audience of 500K+ built over 7 years of consistent crypto livestreaming.

Several projects show strong 24H moves alongside holder growth, indicating active communities responding to stream-driven engagement rather than passive speculation. Leaderboard commentary often highlights pump.fun trending tokens, pump.fun trending tokens 24h gain holders volume, and pump.fun trending coins as new solana tokens appear. You may also see pump.fun new solana tokens, pump.fun solana new tokens, pump.fun new tokens, and pump.fun new token launches within the last hour via trackers that surface pump.fun new solana tokens last hour for discovery.

New XAI gork (gork): Minimal Meme

No description available. Project details unclear at time of writing.

Quick facts: chain = Solana, status = live, milestone = ATH $100.9M shown

Context for readers: as a pump.fun coin within pump.fun crypto on Solana, gork appears on-stream and then graduates to a Raydium listing when liquidity thresholds are met, similar to peers.

https://pump.fun/coin/38PgzpJYu2HkiYvV8qePFakB8tuobPdGm2FFEn7Dpump

Chill House (CHILLHOUSE): Community Meme with Cozy Theme

"Just a chill house." The Chill House theme suggests community vibes and frequent participation during Pump.fun streams. Strong holder distribution at 16,291 wallets indicates broad community adoption.

Quick facts: chain = Solana, status = live, milestone = ATH $31.6M shown

Readers often watch for pump.fun current price snapshots during streams and how a Raydium listing can influence liquidity depth.

https://pump.fun/coin/GkyPYa7NnCFbduLknCfBfP7p8564X1VZhwZYJ6CZpump

The Spirit of Gambling (Tokabu): Meme Character with Gambling Motif

"I am Tokabu, the spirit of gambling." The Tokabu project leans into a playful narrative and steady Pump.fun live presence. 10,605 holders demonstrate sustained community participation.

Quick facts: chain = Solana, status = live, milestone = ATH $78.1M shown

As a Solana-native project, Tokabu is part of pump.fun solana coverage and is commonly tracked for holder growth after a Raydium listing.

https://pump.fun/coin/H8xQ6poBjB9DTPMDTKWzWPrnxu4bDEhybxiouF8Ppump

GeorgePlaysClashRoyale (Clash): Creator Gaming Stream

Watch George play the game Clash Royale on Pump.fun livestreams. Community interest is driven by creator-led live content and regular gameplay moments that translate to token engagement. 7,014 holders support a $45.2M market cap, showing concentrated high-value participation.

Quick facts: chain = Solana, status = live, milestone = ATH $87.9M shown

This token is also referenced in searches for pump.fun pump token market cap when viewers compare creator-led launches.

https://pump.fun/coin/6nR8wBnfsmXfcdDr1hovJKjvFQxNSidN6XFyfAFZpump

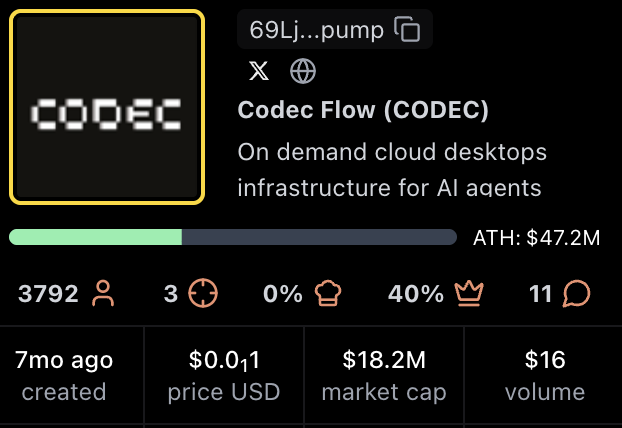

Codec Flow (CODEC): Infrastructure for AI Agents

On-demand cloud desktops infrastructure for AI agents. The Codec Flow narrative centers on AI tooling and always-on compute for agents using streamed engagement.

Quick facts: chain = Solana, status = live, milestone = ATH $47.2M shown

Some viewers check the pump.fun website to confirm contract pages and observe pump.fun current price movement during streams.

https://pump.fun/coin/69LjZUUzxj3Cb3Fxeo1X4QpYEQTboApkhXTysPpbpump

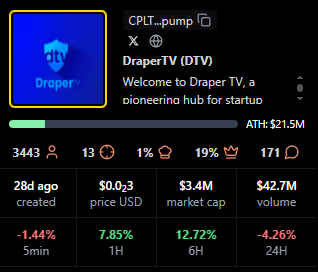

DraperTV (DTV): Media and Community Token

"Welcome to Draper TV, a pioneering hub for startup innovation." The DraperTV token sits at the intersection of media, startups, and community engagement during Pump.fun streams. 3,455 holders in 27 days indicates strong early momentum.

Quick facts: chain = Solana, status = live, milestone = ATH $21.5M shown

Audience interest often focuses on pump.fun revenue and future programming cadence.

https://pump.fun/coin/CPLTbYbtDMKZtHBaPqdDmHjxNwESCEB14gm6VuoDpump

The Official 67 Coin (67): Creator and Fan Coin

The 67 Coin meme centers on a creator identity and fan-driven momentum on Pump.fun. 3,239 holders with 49 KOL mentions suggest coordinated community building.

Quick facts: chain = Solana, status = live, milestone = ATH $8.0M shown

Holders monitor pump.fun website pages and Raydium listing status as liquidity scales.

https://pump.fun/coin/9AvytnUKsLxPxFHFqS6VLxaxt5p6BhYNr53SD2Chpump

PUMPCADE (PUMPCade): Arcade Mini Games Inside Live Chat

"Play arcade games with others in a Pump.fun live chat and win." The hook is interactive gameplay blended with streaming. 1,578 holders participate in the gaming-focused community.

Quick facts: chain = Solana, status = live, milestone = ATH $9.3M shown

Viewers compare pump.fun pump token market cap and utility mentions during mini-game sessions.

https://pump.fun/coin/Eg2ymQ2aQqjMcibnmTt8erC6Tvk9PVpJZCxvVPJz2agu

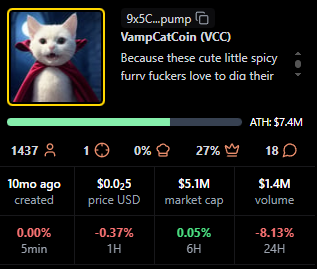

VampCatCoin (VCC): Cute Vampire Cat Meme

Cats and campy vampire aesthetics drive the VampCatCoin meme. Community humor and recurring references keep engagement high during Pump.fun streams. 1,437 holders in 10 months shows steady organic growth.

Quick facts: chain = Solana, status = live, milestone = ATH $7.4M shown

Holder chatter often includes pump.fun token holders growth after notable memes or clips.

https://pump.fun/coin/9x5CLPb3SeYSBKvautqpJWPjX9TUCVcWTS12Xawapump

Token Metrics Live (TMLIVE): Research-Driven Market Analysis Stream

Token Metrics Live brings real-time, data-driven crypto market analysis to Pump.fun. Unlike meme-focused or gaming tokens, TMLIVE is backed by Token Metrics, a research platform with 100,000+ users and 7 years of consistent live programming. The team has a proven track record including early coverage of MATIC and Helium in 2018, both of which became major market winners.

TMLIVE launched on November 4, 2024, reaching an ATH market cap of $291.7K with $1.7M in 24-hour volume during its first stream. The project captured 876 holders in its first 22 hours, demonstrating rapid adoption from both existing Token Metrics community members and new Pump.fun participants.

What makes TMLIVE different:

Quick facts: chain = Solana, launch = November 4, 2024, contract = 8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump, milestone = ATH $291.7K with $1.7M 24h volume

Token Metrics operates under the media publisher exemption to the Investment Advisers Act of 1940 and provides no financial advice. All livestream content is educational only.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Higher holder counts tend to correlate with broader community participation and multiple entry points during livestreams. Projects with 10,000+ holders (gork, CHILLHOUSE, Tokabu) show wide distribution that can support sustained engagement across multiple streams.

Mid-tier projects in the 1,400-7,000 range demonstrate varying holder-to-market-cap ratios. GeorgePlaysClashRoyale has 7,014 holders supporting a $45.2M market cap, while Tokabu has 10,605 holders at $7.2M. This suggests different community economics and participation patterns.

Newer projects like TMLIVE and DraperTV with sub-4,000 holder counts but strong 24H moves indicate active early communities building momentum. TMLIVE's 876 holders in 22 hours, paired with $1.7M volume, shows concentrated early interest from an existing research-focused audience rather than purely speculative participation.

As a reference for analysts, we note pump.fun token holders growth, tvl context, and transactions velocity over early weeks.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Benchmarks to Watch for Pump.fun Livestream Success

Beyond holder count, these metrics help evaluate project health:

Use these to compare Pump.fun projects beyond simple holder counts. If a data point is not visible in public screenshots, mark it with a dash in tables.

Why Holder Count Matters for Livestream Tokens

For creators: Holder count shows how effectively livestreams convert viewers into community members. Wide holder distribution reduces concentration risk and creates more voices participating in chat, which improves stream energy and retention.

For traders: Holder count helps assess community breadth. Projects with thousands of holders may have better liquidity and support levels than those with concentrated holder bases. However, concentration can also indicate strong conviction from early participants.

Distribution patterns: Projects that gain holders gradually over months (like Chill House or Tokabu) show different dynamics than rapid-growth tokens (like TMLIVE or DraperTV). Both patterns can succeed, but they require different community management approaches.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Creator Playbook: Convert Viewers to Holders

Additional Signals to Watch for Pump.fun Token Success

Structured segments and interactive formats increase average watch time and chat velocity, which correlate with healthier communities after launch. Projects that rely on hype alone tend to see faster holder churn after initial excitement fades.

Clear expectations and transparent messaging improve seven-day retention compared with hype-only streams. TMLIVE's research-driven approach sets expectations for ongoing value rather than quick speculation.

Multi-channel amplification across X, Telegram, Discord, and email consistently lifts day-one reach and discovery for Pump.fun tokens. Projects with 6+ KOL mentions tend to show faster early holder growth.

Creators can design Pump.fun launches around consistent live segments and clear narratives. The leaders in this ranking demonstrate how personality, interactivity, or utility themes can drive holder growth beyond a single hype window. TMLIVE shows that substance-driven content can compete effectively in a meme-heavy environment.

Traders can use holder count to quickly assess community breadth, then layer in market cap, average viewers, and fees to judge staying power and crowd quality. Wide holder distribution suggests better liquidity and community resilience.

What non-holder signals matter most for Pump.fun token durability?

Engagement rate (measured as messages per viewer per hour), average watch time, follower conversion from viewers, and seven-day retention matter most for Pump.fun token durability. These show whether attention sticks once the stream ends. We also reference pump.fun token price views, pump.fun pump price checks, and pump.fun pump current price context in dashboards.

What is the best way to track Pump.fun livestream leaders by holder count?

Use stalkchain.com/streams/scanner or Pump.fun token pages to view current holder rankings. For historical context, save periodic screenshots to compare changes over time. On Solana, the pump.fun program id helps map tokens to explorers, and the pump.fun logo on the pump.fun website makes official pages easy to verify.

Does higher holder count predict higher future returns for Pump.fun tokens?

Higher holder count does not necessarily predict higher future returns. Holder count reflects current distribution, not forward performance. Combine it with viewers, fees, market cap, holder growth rate, and neutral screens like pump.fun price prediction models for additional context.

How often do Pump.fun token holder rankings change?

Pump.fun token holder rankings change continuously as new wallets acquire tokens. This post reflects the timestamp of the provided screenshots captured on Nov 4-5, 2024. For creation topics, people ask how does pump.fun work, how to make a coin on pump.fun, how to create a coin on pump.fun, or simply how to create a coin on pump.fun with a pump.fun create coin flow. We also see searches on pump.fun airdrop, pump.fun bot, pump.fun token pump price, and is pump.fun legit. One trending-search note often bundled into a single clause: teen pump.fun 250m, teen 50k, and khaliliwired show up as viral queries, not signals of quality.

Next Steps for Tracking Pump.fun Tokens

About Token Metrics Live (TMLIVE)

Token Metrics Live is a research-driven crypto livestream on Pump.fun from the team behind Token Metrics, a platform with 100,000+ users and a 500K+ audience across channels. We have produced live crypto content for 7 years, known for early coverage of major winners like MATIC and Helium in 2018. Follow TMLIVE on Pump.fun and join our next stream for real-time analysis and community Q&A.

Trade and watch TMLIVE: Contract address 8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump on Solana

Disclaimer

Disclaimer: Token Metrics operates as a media publisher. Nothing in this article or our livestreams constitutes financial, investment, or trading advice. Digital assets carry risk, including the potential loss of principal. Do your own research and consult a professional where appropriate.

Data captured: November 4-5, 2024, from stalkchain.com/streams/scanner and Pump.fun token pages. Stats may change over time.