Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

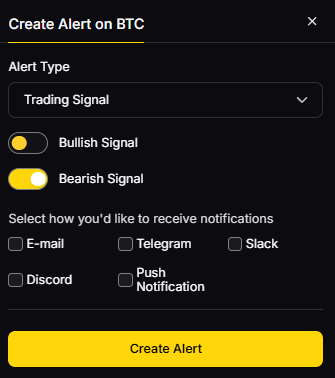

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

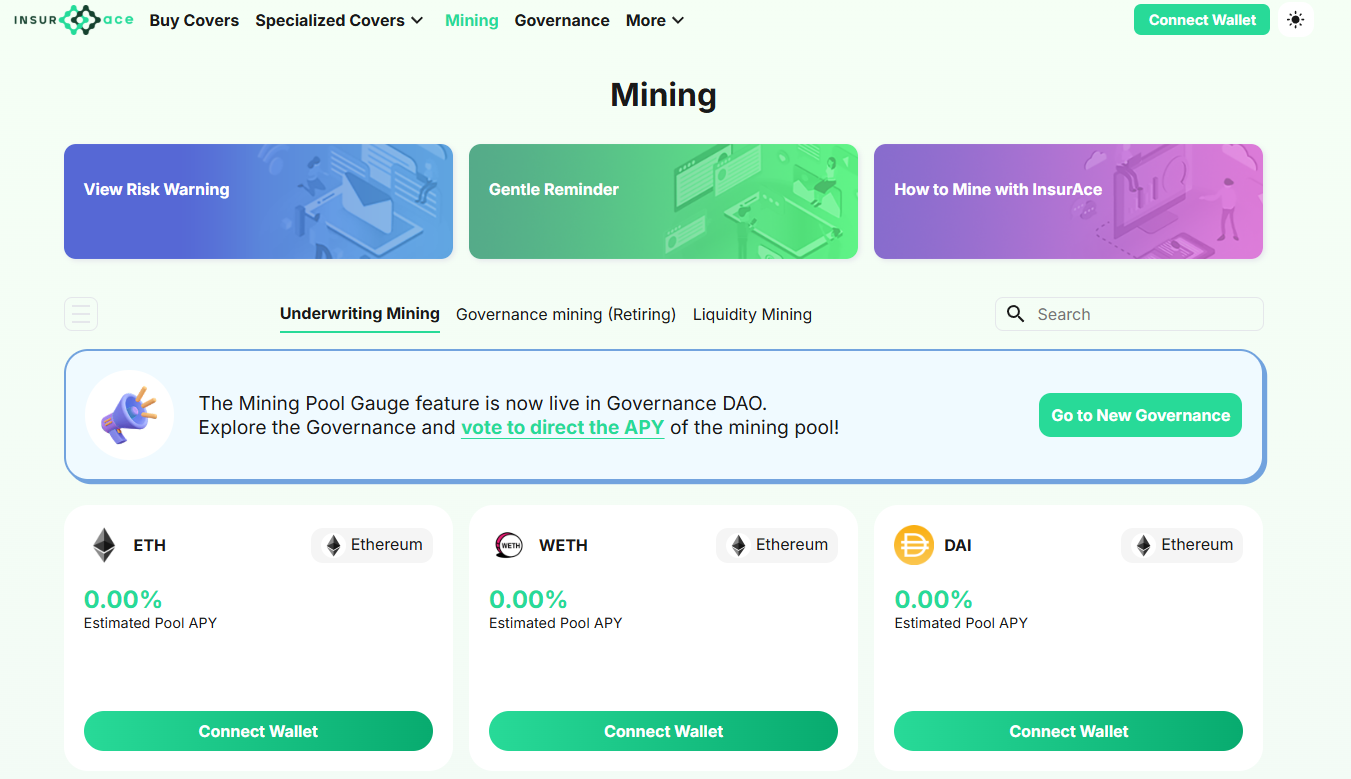

The search intent here is commercial investigation: investors want safe ways to protect on-chain and custodied assets. This guide ranks the best insurance protocols 2025 across DeFi and regulated custodial coverage so you can compare options quickly.

Definition: Crypto (DeFi) insurance helps cover losses from smart-contract exploits, exchange halts, custodian breaches, or specific parametric events; custodial insurance typically protects assets held by qualified trustees or platforms under defined “crime”/theft policies.

In 2025, larger treasuries and yield strategies are back, while counterparty and contract risk remain. We focus on real cover products, payout track records, and regulated custodial policies—using only official sources. Secondary considerations include DeFi insurance, crypto custodial insurance, and smart contract coverage capacity, claims handling, and regional eligibility.

Data sources: official product/docs, transparency/security pages, and audited/claims pages; market datasets only for cross-checks. Last updated September 2025.

3. OpenCover— Best for Community-Driven, Transparent Coverage

Why Use It: OpenCover is a decentralized insurance protocol that leverages community-driven liquidity pools to offer coverage against smart contract exploits and other on-chain risks. Its transparent claims process and low-cost structure make it an attractive option for DeFi users seeking affordable and reliable insurance solutions.

Best For: DeFi users, liquidity providers, and investors looking for community-backed insurance coverage.

Notable Features:

Fees/Notes: Premiums are determined by the liquidity pool and the level of coverage selected.

Regions: Global (subject to dApp access).

Consider If: You value community governance and transparency in your insurance coverage.

Alternatives: Nexus Mutual, InsurAce.

8. Tidal Finance — Best for Coverage on Niche DeFi Protocols

Why Use It: Tidal Finance focuses on providing coverage for niche and emerging DeFi protocols, offering tailored insurance products for new and innovative projects. Tidal's dynamic risk assessments allow it to offer specialized coverage options for specific protocols.

Best For: Users and protocols seeking insurance for niche DeFi projects with specific risk profiles.

Notable Features:

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What’s the difference between DeFi insurance and custodial insurance?

DeFi insurance protects on-chain actions (e.g., smart-contract exploits or depegs), often via discretionary voting or parametric rules. Custodial insurance covers specific theft/loss events while assets are held by a qualified custodian under a crime policy; exclusions apply. docs.nexusmutual.io+1

How do parametric policies work in crypto?

They pre-define an objective trigger (e.g., flight delay, protocol incident), enabling faster, data-driven payouts without lengthy investigations. Etherisc (flight) and Neptune Mutual (incident pools) are examples. Flight Delay+1

Is Nexus Mutual regulated insurance?

No. It’s a member-owned discretionary mutual where members assess claims and provide capacity; see membership docs and claim pages. docs.nexusmutual.io+1

Do custodial policies cover user mistakes or account takeovers?

Typically no—policies focus on theft from the custodian’s systems. Review each custodian’s definitions/exclusions (e.g., Gemini’s hot/cold policy scope). Gemini

What if I’m primarily on Solana?

Consider Amulet for Solana-native cover; otherwise, verify cross-chain support from multi-chain providers. amulet.org

Which providers are regulated?

Chainproof offers regulated smart-contract insurance; Nayms operates under Bermuda’s DABA framework for on-chain insurance programs. chainproof.co+1

If you need breadth and track record, start with Nexus Mutual or InsurAce. For parametric, faster payouts, look at Neptune Mutual or Etherisc. Building institutional-grade risk programs? Consider Chainproof or Nayms. If you hold assets with a custodian, confirm published insurance capacity—BitGo and Gemini Custody are good benchmarks.

Related Reads:

We verified every claim on official provider pages (product docs, policy pages, security/claims posts) and only used third-party sources for context checks. Updated September 2025.

Gemini — Custody insurance page and blog. Gemini+1

%201.svg)

%201.svg)

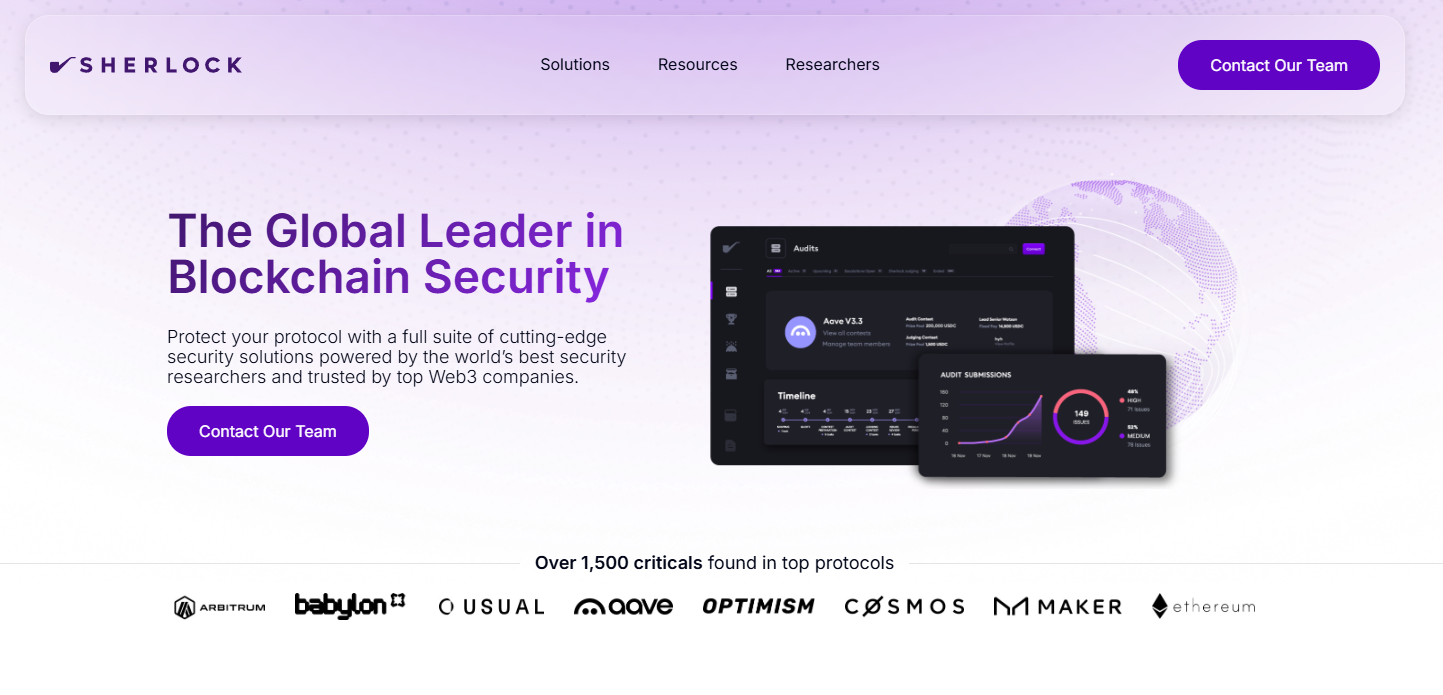

Smart contracts are the critical rails of DeFi, gaming, and tokenized assets—one missed edge case can freeze liquidity or drain treasuries. If you’re shipping on EVM, Solana, Cosmos, or rollups, smart contract auditors provide an independent, methodical review of your code and architecture before (and after) mainnet. In one line: a smart contract audit is a systematic assessment of your protocol’s design and code to find and fix vulnerabilities before attackers do.

This guide is for founders, protocol engineers, PMs, and DAOs comparing audit partners. We combined SERP research with hands-on security signals to shortlist reputable teams, then selected the best 10 for global builders. Secondary considerations—like turnaround time, formal methods, and public report history—help you match the right firm to your stack and stage.

Data inputs: official service/docs pages, public audit report portals, rate disclosures where available, and widely cited market datasets for cross-checks. Last updated September 2025.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What does a smart contract audit include?

Typically: architecture review, manual code analysis by multiple researchers, automated checks (linters, fuzzers), proof-of-concept exploits for issues, and a final report plus retest. Depth varies by scope and risk profile.

How long does an audit take?

From a few weeks to several months, depending on code size, complexity, and methodology (e.g., formal verification can extend timelines). Plan for time to remediate and retest before mainnet.

How much do audits cost?

Pricing is quote-based and driven by complexity, deadlines, and team composition. Some networks (e.g., Spearbit) publish base rate guidance to help with budgeting.

Do I need an audit if my code is forked?

Yes. Integration code, parameter changes, and new attack surfaces (bridges/oracles) can introduce critical risk—even if upstream code was audited.

Should I publish my audit report?

Most credible teams publish at least a summary. Public reports aid trust, listings, and bug bounty participation—while enabling community review.

What if we change code after the audit?

Request a delta audit and update your changelog. Major logic changes merit a retest; minor refactors may need targeted review.

Choosing the right auditor depends on your stack, risk tolerance, and timelines. For Ethereum-first teams, OpenZeppelin, Sigma Prime, and ConsenSys Diligence stand out. If you need high-assurance proofs or tricky mechanisms, look to Runtime Verification, ChainSecurity, or Trail of Bits. Solana/Move builders often pick OtterSec or Zellic. For flexible, elite review pods, Spearbit is strong.

Related Reads:

We reviewed official audit/service pages, public report libraries, and process/rate disclosures for recency and scope fit. Third-party datasets were used only for cross-checks (no external links included). Updated September 2025.

%201.svg)

%201.svg)

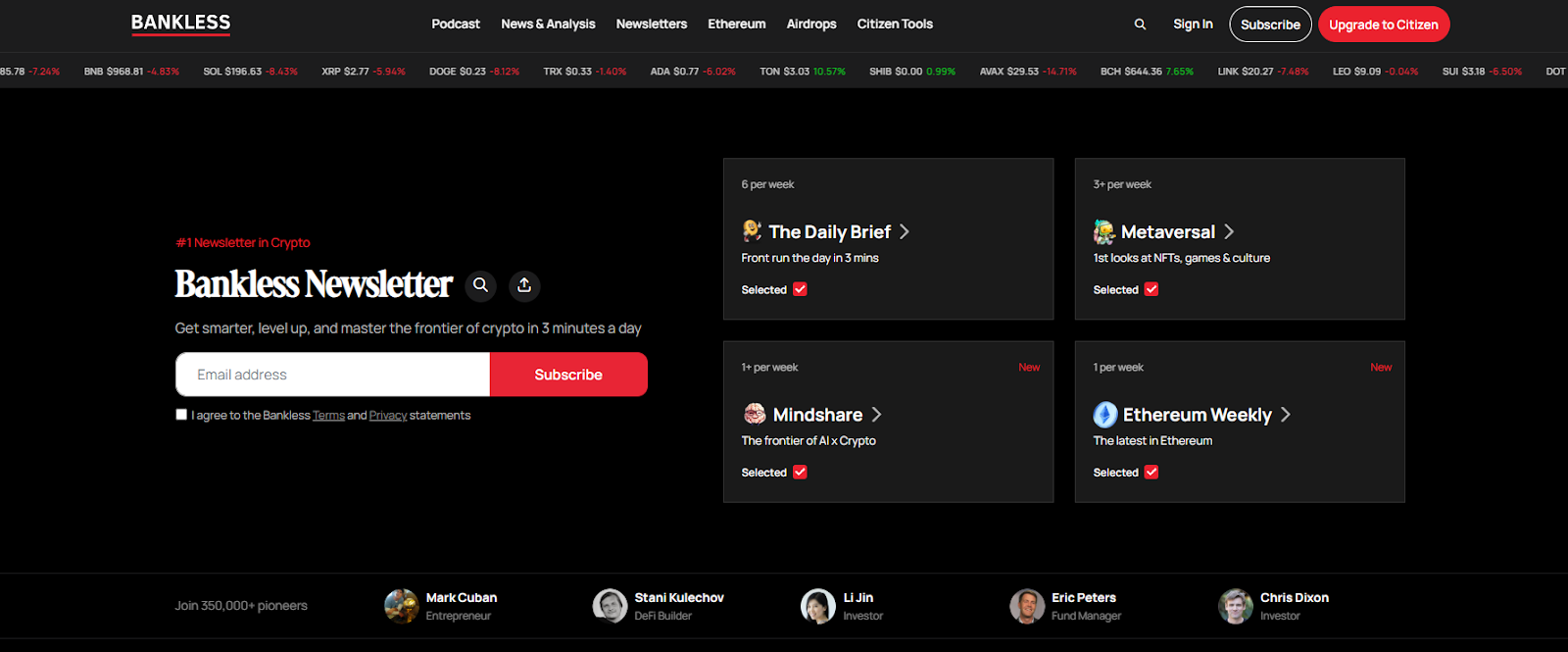

In a market that never sleeps, the best crypto newsletters 2025 help you filter noise, spot narratives early, and act with conviction. In one line: a great newsletter or analyst condenses complex on-chain, macro, and market structure data into clear, investable insights. Whether you’re a builder, long-term allocator, or active trader, pairing independent analysis with your own process can tighten feedback loops and reduce decision fatigue. In 2025, ETF flows, L2 expansion, AI infra plays, and global regulation shifts mean more data than ever. The picks below focus on consistency, methodology transparency, breadth (on-chain + macro + market), and practical takeaways—blending independent crypto analysts with data-driven research letters and easy-to-digest daily briefs.

Secondary intents we cover: crypto research newsletter, on-chain analysis weekly, and “who to follow” for credible signal over hype.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What makes a crypto newsletter “best” in 2025?

Frequency, methodological transparency, and the ability to translate on-chain/macro signals into practical takeaways. Bonus points for archives and clear disclosures.

Are the top newsletters free or paid?

Most offer strong free tiers (daily or weekly). Paid tiers typically unlock deeper research, models, or community access.

Do I need both on-chain and macro letters?

Ideally yes—on-chain explains market structure; macro sets the regime (liquidity, rates, growth). Pairing both creates a more complete view.

How often should I read?

Skim dailies (Bankless/Milk Road) for awareness; reserve time weekly for deep dives (Glassnode/Coin Metrics/Delphi).

Can newsletters replace analytics tools?

No. Treat them as curated insight. Validate ideas with your own data and risk framework (Token Metrics can help).

Which is best for ETF/flows?

CoinShares’ weekly Fund Flows is the go-to for institutional positioning, complemented by Glassnode/Coin Metrics on structure.

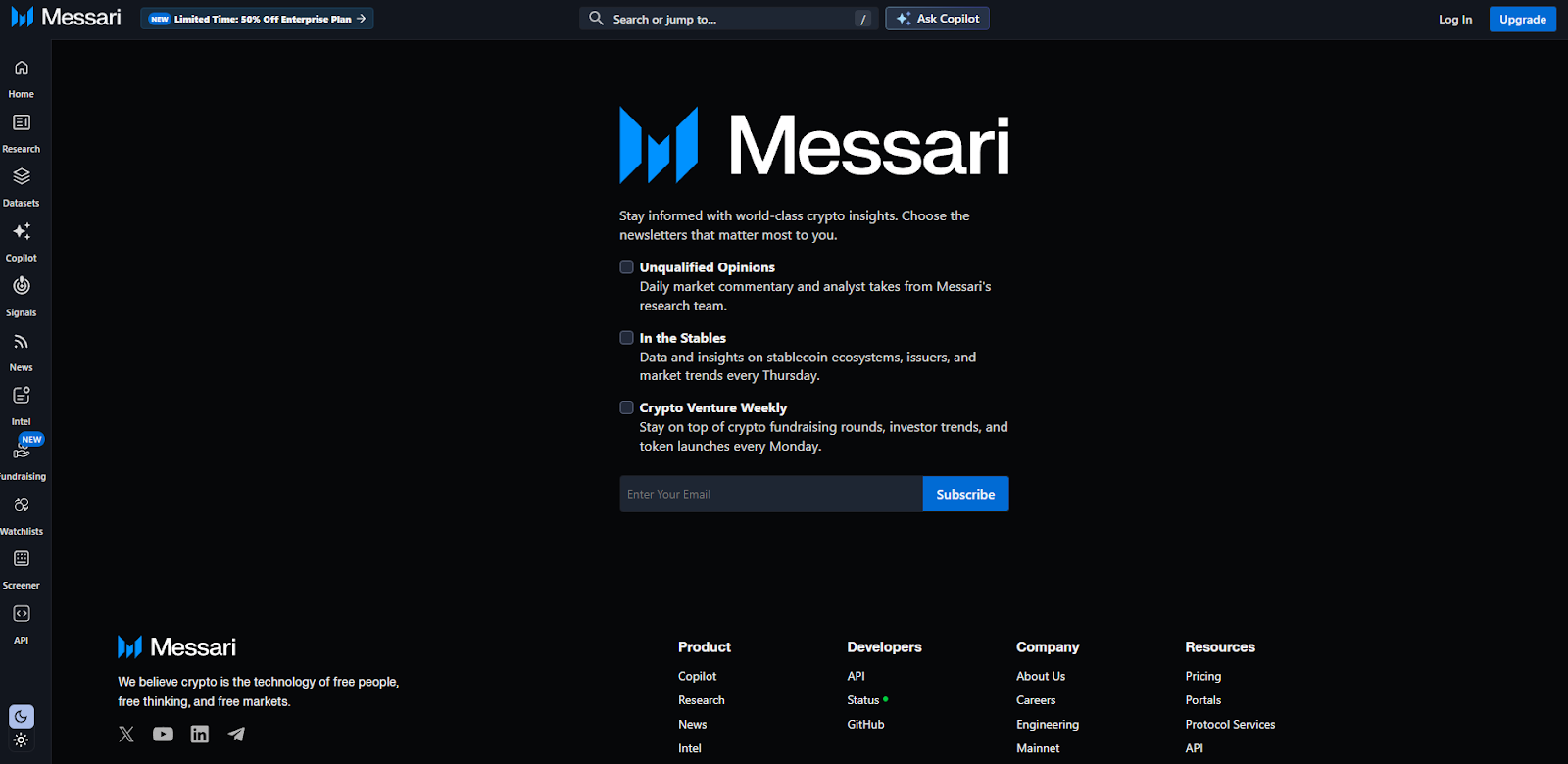

If you want a quick pulse, pick a daily (Bankless or Milk Road). For deeper conviction, add one weekly on-chain (Glassnode or Coin Metrics) and one thesis engine (Delphi or Messari). Layer macro (Lyn Alden) to frame the regime, and use Token Metrics to quantify what you read and act deliberately.

Related Reads:

We reviewed each provider’s official newsletter hub, research pages, and recent posts to confirm availability, cadence, and focus. Updated September 2025 with the latest archives and program pages. Key official references: Bankless newsletter hub Bankless+2Bankless+2; The Defiant newsletter page The Defiant+1; Messari newsletter hub and Unqualified Opinions pages Messari+2messari.substack.com+2; Delphi Digital newsletter page and research site Delphi Digital+2delphidigital.io+2; Glassnode Week On-Chain hub and latest issue insights.glassnode.com+2Glassnode+2; Coin Metrics SOTN hub and archive Coin Metrics+2Coin Metrics+2; Kaiko research/newsletter hub and company site Kaiko Research+1; CoinShares Fund Flows & Research hubs (US/global) and latest weekly example CoinShares+2CoinShares+2; Milk Road homepage and social proof Milk Road+1; Lyn Alden newsletter/archive pages and 2025 issues Lyn Alden+4Lyn Alden+4Lyn Alden+4.

%201.svg)

%201.svg)

Decentralization has evolved far beyond its origins as a theoretical concept tied to blockchain technology. In 2025, decentralization is a transformative force reshaping industries, organizations, and governance structures worldwide. But what does decentralization mean in practice? It means distributing authority, decision making, and control away from a single central authority and empowering multiple parties to work independently yet cohesively. This practical shift is redefining how we interact with technology, finance, and management across various sectors.

There are several main types of decentralization, including administrative decentralization, which involves transferring planning and implementation responsibilities to local governments and civil servants, and fiscal decentralization, which focuses on shifting revenue-raising and expenditure authority to lower levels of government. These forms of decentralization are relevant not only to public administration but also to business entities, where organizational autonomy and efficiency are enhanced through decentralized structures.

For example, computer networks such as the Internet are prime examples of decentralized systems, as they operate without a central authority and enable open participation across networked systems.

At its core, decentralization refers to moving away from traditional centralized entities where a single person or organization holds all decision making power. Instead, decentralized systems distribute authority and decision making processes across various departments, units, or participants. This distribution not only reduces reliance on a central government or central authority, enhancing fault tolerance and resilience against attacks or failures, but also shapes the organizational structure to support effective communication, faster information flow, and improved internal relationships.

Blockchain technology is a prime example of decentralization in action. Rather than a single company controlling data or transactions, blockchain distributes control among a network of participants who validate and record information. This means no single entity has overarching power, and decisions emerge from collective consensus. The result is quicker decision making, increased transparency, and more autonomy for users. Decentralized computer networks also support increased innovation by enabling greater creativity, rapid adaptation to change, and improved responsiveness to user needs.

Importantly, decentralization today extends well beyond cryptocurrencies. It influences governance models, organizational structures, and even physical infrastructure. Decentralization reforms in governments emphasize political decentralization, giving regional and local authorities more power and responsibility for local governance and service delivery. This process transfers powers and responsibilities to the local level, where local officials are held accountable for their decisions and actions, ensuring transparency and effective governance. Similarly, in the private sector, decentralization strategies empower lower management levels and decentralized units to work independently, fostering innovation, local responsiveness, and the development of managerial skills among lower-level managers.

One of the clearest examples of decentralization in practice is Decentralized Finance, or DeFi. DeFi uses blockchain technology to create financial systems where no central bank or company controls your money or transactions. Instead, these processes happen on open networks accessible to anyone. DeFi is a prime example of market decentralization, shifting financial services from centralized institutions to competitive, decentralized markets.

In practice, DeFi enables users to access loans instantly through smart contracts without waiting for bank approvals. Decentralized exchanges like Uniswap allow peer-to-peer trading without a centralized intermediary, using liquidity pools provided by users who earn fees for their participation. This model increases allocative efficiency and reduces transaction times.

Navigating DeFi’s complexities requires advanced tools. Platforms like Token Metrics combine AI analytics with blockchain data to help investors identify promising tokens early. By providing scores and insights, Token Metrics empowers both novice and experienced traders to make informed decisions, demonstrating how decentralization paired with AI can democratize access to financial markets.

In 2025, decentralization is no longer limited to digital applications. Decentralized Physical Infrastructure Networks (DePINs) are emerging as a revolutionary way to distribute control over tangible resources like energy grids, transportation systems, and communication networks. These are examples of public services that can be decentralized, offering alternatives to traditional government-provided utilities. DePINs allow individuals to monetize unused physical resources—such as bandwidth or storage—by participating in decentralized operations.

This practical application of decentralization means that ordinary people can earn passive income by contributing to local markets without centralized oversight. For example, DePINs can monitor environmental factors like noise pollution or manage energy distribution more efficiently by leveraging decentralized units working independently but coordinated through blockchain protocols, alongside other units within the network that operate autonomously.

DePINs exemplify how decentralization refers not only to distributing authority but also to creating new economic models that reward participation and improve overall quality of service delivery. As these networks grow, they enhance resilience and local responsiveness, addressing challenges faced by centralized infrastructure.

Decentralization also reshapes governance by distributing decision making authority away from top management or central government to multiple stakeholders. In many cases, this involves transferring powers traditionally held by the national government to regional or local entities, fundamentally altering the structure of governance.

Decentralized Autonomous Organizations (DAOs) use blockchain-based smart contracts to automate decision making, allowing token holders to participate directly in policy making without relying on a single person or centralized entity. While political decentralization disperses authority among various levels, political centralization refers to the concentration of power and decision-making at the national government level, highlighting a key difference in how authority is structured.

This political decentralization fosters transparency and inclusivity, enabling civil society and various departments within organizations to collaborate effectively. DAOs are increasingly explored not only in crypto projects but also in traditional organizations seeking to improve local governance and intergovernmental relations.

Emerging trends in decentralized governance include AI-assisted delegation, which helps users identify representatives aligned with their values, and incentive mechanisms designed to encourage meaningful participation beyond simple token rewards. Successful decentralization in governance requires balancing autonomy with coordination, ensuring decentralized units remain accountable while maintaining consistency.

While artificial intelligence is often seen as a centralizing force controlled by large corporations, it is becoming a powerful enabler of decentralization. By building decentralized AI models and open access to AI resources, blockchain technology ensures innovation remains accessible and transparent. This approach strengthens the organization's overall innovation capacity and supports its strategic objectives by reducing barriers to advanced technology.

This convergence is evident in platforms like Token Metrics, which leverage AI, machine learning, and big data analytics to democratize sophisticated crypto trading insights. Token Metrics’ AI-selected crypto baskets have delivered impressive returns, illustrating how decentralized means combined with AI can level the playing field for individual investors.

Moreover, natural language processing enables the interpretation of social media trends and market sentiment, providing traders with early signals to anticipate market movements. This practical application of AI in decentralized systems enhances decision making power and strategic planning for many businesses and individual investors alike.

A significant challenge for decentralization has been the fragmentation of blockchain networks, limiting seamless interaction between different systems. In 2025, cross-chain interoperability solutions are gaining traction, enabling users to transact and interact across multiple blockchains without friction.

This development is critical for decentralization’s mainstream adoption, ensuring users do not need to understand the technical differences between Ethereum, Solana, or other chains. Instead, decentralized units across various regions can coordinate effectively, improving overall control and service delivery.

Cross-chain interoperability exemplifies how decentralization strategies are evolving to maintain the right balance between autonomy and coordination, fostering a more connected and efficient decentralized ecosystem.

Decentralized organizational structures are transforming how organizations operate in 2025. Unlike traditional models where a central authority or single entity holds most of the decision making power, a decentralized system distributes decision making authority across various departments, teams, or even individuals. This shift gives each part of the organization more autonomy to address local needs and adapt to changing conditions on the ground.

In practice, this means that instead of waiting for approval from top management, teams can make independent decisions that are best suited to their specific context. For example, a regional office might tailor its service delivery or marketing strategies to better fit the preferences of its local market, without needing to follow a one-size-fits-all directive from headquarters. This approach not only speeds up response times but also encourages innovation, as those closest to the challenges have the authority to experiment with new solutions.

Organizations adopting decentralized structures often find that empowering various departments leads to greater flexibility and resilience. By giving teams more autonomy, organizations can better navigate complex environments and rapidly changing market demands. This model also helps attract and retain talent, as employees value the opportunity to have a real impact and take ownership of their work.

Ultimately, decentralized organizational structures are about moving away from rigid hierarchies and embracing a more dynamic, responsive way of working. By distributing authority and decision making throughout the organization, businesses can unlock new levels of creativity, efficiency, and local responsiveness—key ingredients for success in today’s fast-paced world.

Decentralization’s practical impact is increasingly tangible. Governments are implementing decentralization reforms that allocate financial resources and decision making authority to sub national and local governments, improving responsiveness to local needs. Central governments play a key role in delegating these powers, setting policies, providing resources, and maintaining overall coordination while enabling more localized decision-making and management. In the private sector, many businesses adopt decentralized organizational structures, giving teams more power and autonomy to innovate.

Institutional adoption of DeFi and decentralized governance models signals growing confidence in decentralized systems. Traditional financial institutions are partnering with DeFi platforms to integrate decentralized solutions, blending centralized and decentralized finance for enhanced service delivery.

For investors and organizations navigating this evolving landscape, tools like Token Metrics provide crucial AI-driven analytics and real-time buy and sell signals. By processing vast market data and social sentiment, these platforms enhance allocative efficiency and help users capitalize on decentralized market opportunities.

Despite its advantages, decentralization in practice faces challenges. Operating without a central authority or government regulation exposes participants to risks such as smart contract vulnerabilities, hacks, and scams. There are limited consumer protections, so responsibility and accountability rest heavily on users.

Regulatory frameworks are still developing worldwide. Countries like Switzerland and Singapore are pioneering clear classifications for digital assets, which are essential for balancing decentralization’s benefits with legal oversight. Achieving successful decentralization requires ongoing coordination among governments, civil society, and the private sector to address these challenges.

Looking forward, 2025 is shaping up as the long-awaited year of decentralization. The convergence of mature DeFi protocols, expanding DePIN networks, innovative governance models, and AI-powered analytics platforms is creating an ecosystem where decentralization delivers real-world benefits.

Platforms like Token Metrics illustrate how sophisticated tools democratize access to complex financial markets, bridging the gap between decentralization’s promise and practical implementation. As decentralization strategies continue to evolve, organizations and individuals will find more opportunities to participate, innovate, and succeed in decentralized environments.

In 2025, decentralization is no longer an abstract idea or speculative trend; it is a practical reality transforming technology, finance, governance, and infrastructure. From earning passive income through decentralized physical networks to engaging in AI-enhanced crypto trading, decentralization empowers individuals and organizations with more control, autonomy, and decision making power.

The question today is not what does decentralization mean in practice, but how quickly and effectively can we adapt to this new paradigm? With advances in blockchain technology, AI, cross-chain interoperability, and decentralized governance, the infrastructure and tools are in place. The future is a decentralized economy where power is distributed, decisions are made collaboratively, and innovation flourishes across multiple independent yet interconnected units.

%201.svg)

%201.svg)

In today’s digital era, where cyberattacks cost businesses billions annually, blockchain technology has emerged as a promising solution for secure and transparent transactions. As blockchain adoption accelerates across diverse industries—from decentralized finance to supply chain management—a pressing question arises: how secure are blockchains really? While blockchain technology offers inherent security advantages through cryptographic protection and decentralized architecture, the broader landscape of blockchain technologies encompasses a range of digital systems that rely on decentralized data structures, cryptography, and consensus mechanisms to enhance digital security. However, the practical reality is more nuanced than the idealized hype suggests. This raises the question of whether blockchain is truly 'blockchain safe'—while these systems are designed with robust security features, they remain susceptible to certain cyberattacks and vulnerabilities, making comprehensive security measures essential. This article explores the foundations, current vulnerabilities, and future outlook of blockchain security to provide a comprehensive understanding of this critical issue.

At its core, blockchain technology provides a decentralized and tamper-resistant framework designed to secure transactions and data. Unlike traditional centralized systems, a blockchain system operates as a distributed database or a distributed ledger technology, where records are stored linearly in data blocks linked cryptographically to form a continuous cryptographic chain. The records stored on the blockchain are transparent, secure, and immutable, allowing transactions and data entries to be audited or traced while ensuring their integrity.

The security of blockchain networks rests on three fundamental pillars: cryptographic hashing, decentralized consensus, and immutability. Each new block contains a cryptographic hash of the previous block, creating an unbreakable link that makes unauthorized modifications computationally infeasible. This ensures that once a transaction is added to the blockchain, it becomes practically irreversible.

Moreover, blockchain networks use a consensus mechanism—such as Proof of Work or Proof of Stake—to achieve consensus and validate transactions. This process requires agreement from a majority of blockchain participants across the network of computers, eliminating any single point of failure and making the system resilient to attacks targeting centralized authorities. The decentralized nature of blockchain technology means there is no central authority controlling the data, which enhances blockchain security by distributing trust across the entire network.

However, the question is not whether blockchain is theoretically secure, but whether real-world implementations maintain this security promise. The answer reveals a mix of impressive strengths and notable vulnerabilities that must be addressed to keep blockchain systems truly safe.

Blockchains can be broadly classified into three main types: public blockchains, private blockchains, and hybrid blockchains. Each type offers distinct features, security models, and use cases, making them suitable for different business and operational needs.

Public blockchains—such as the Bitcoin network—are open, permissionless systems where anyone can join the distributed network, participate in validating transactions, and access the transaction ledger. Data in public blockchains is stored linearly in a series of cryptographically linked blocks, ensuring transparency and security across the entire network. The decentralized nature of public blockchains eliminates the need for a central authority, making them ideal for applications that require trustless, peer-to-peer interactions.

Private blockchains, in contrast, operate as permissioned networks. Access to these networks is restricted to verified participants, and only authorized nodes can validate transactions or view sensitive information. Private blockchains are often used by enterprises to streamline internal processes, enhance data security, and comply with regulatory requirements. Their more centralized structure allows for greater control over data and network activity, but may reduce the level of decentralization compared to public blockchains.

Hybrid blockchains combine elements of both public and private blockchains, offering a balance between openness and control. These networks allow organizations to maintain private, permissioned data while also interacting with public blockchain systems when needed. This flexibility makes hybrid blockchains a popular choice for businesses seeking to leverage the security and transparency of distributed ledger technology without sacrificing privacy or regulatory compliance.

By understanding the differences between public, private, and hybrid blockchains, organizations can select the most appropriate blockchain network for their specific security, transparency, and operational requirements.

The security of public blockchains is rooted in their decentralized architecture, cryptographic protocols, and robust consensus mechanisms. In a public blockchain, a distributed network of computers—often referred to as nodes—work together to validate transactions and maintain the integrity of the blockchain data. Each transaction is secured using public keys and cryptographic chains, making unauthorized alterations extremely difficult.

One of the key strengths of public blockchain security is the sheer number of blockchain participants involved in validating transactions. This widespread participation makes it challenging for malicious actors to gain enough influence to compromise the network, rendering public blockchains fairly secure against most attacks. The consensus mechanism, whether Proof of Work or Proof of Stake, ensures that only legitimate transactions are added to the blockchain, further enhancing security.

However, public blockchains are not immune to threats. Phishing attacks, where attackers trick users into revealing private keys, remain a persistent risk. Routing attacks can disrupt the flow of data across the network, and Sybil attacks—where a single entity creates multiple fake identities to gain undue influence—can threaten the consensus process. To counter these risks, blockchain participants should implement strong security controls, such as multi-factor authentication, regular software updates, and vigilant monitoring of network activity.

Overall, while public blockchains offer a high level of security through decentralization and cryptography, ongoing vigilance and best practices are essential to protect against evolving threats.

Private blockchains take a different approach to security by leveraging access controls, permissioned networks, and centralized management. In a private blockchain, only selected participants are granted access to the network, and a central authority typically oversees network operations and validates transactions. This selective endorsement process ensures that only trusted nodes can participate in consensus, reducing the risk of exploiting vulnerabilities that are more common in open, public blockchains.

The controlled environment of private blockchains makes them particularly well-suited for use cases involving sensitive information, such as supply chains, financial services, and enterprise data management. By restricting access and closely monitoring network activity, organizations can better protect their data and comply with regulatory requirements.

However, the centralized nature of private blockchains introduces its own set of risks. A single point of failure—such as a compromised administrator or a critical system outage—can jeopardize the security of the entire system. To mitigate these risks, it is crucial to implement robust access management policies, regular security audits, and a comprehensive disaster recovery plan. These measures help ensure that private blockchains remain secure, resilient, and capable of supporting mission-critical business operations.

In summary, private blockchains offer enhanced security through controlled access and selective validation, but require diligent management to avoid centralization risks and maintain the integrity of the network.

Despite blockchain’s strong theoretical security foundations, the reality in 2025 shows a complex landscape. Over $2.17 billion has already been stolen from crypto platforms this year alone, with major exchanges like ByBit and CoinDCX experiencing large-scale breaches. These figures continue a troubling trend from 2024, which saw losses exceeding $1.42 billion across various decentralized ecosystems.

The growing demand for blockchain solutions in areas such as decentralized finance (DeFi), supply chains, and digital asset management has simultaneously increased the attack surface. Distributed ledger technologies (DLTs), which underpin these blockchain solutions, further expand the attack surface and introduce new security challenges due to their decentralized and consensus-driven nature. The global blockchain security market, valued at $2 billion in 2025, is expected to expand at a 20% compound annual growth rate, reaching approximately $8 billion by 2033. This surge reflects both the rapid adoption of blockchain technology and the urgent need for sophisticated security controls to protect blockchain data and digital assets.

As blockchain networks become more complex and interconnected, the challenges of securing public and private blockchains grow, requiring continuous innovation in security protocols and operational practices. The introduction of new protocols in blockchain security is necessary to address emerging threats, but can also introduce new vulnerabilities.

One of the most significant security challenges in blockchain systems arises from smart contracts—self-executing code that automates agreements without intermediaries. In 2025, smart contract flaws have contributed to over $1 billion in losses. Vulnerabilities such as reentrancy attacks, missing access controls, and arithmetic overflows expose these programs to exploitation.

The OWASP Smart Contract Top 10 for 2025 highlights the most critical vulnerabilities discovered after analyzing 149 security incidents involving $1.42 billion in losses. Attackers frequently scan public smart contracts for weaknesses and exploit them through flash loan attacks and liquidity pool drains.

Recent examples underscore the severity of these risks. The ALEX Protocol lost $8.3 million when attackers exploited vault permissions using malicious tokens that mimicked legitimate assets. Similarly, Cetus Protocol suffered a $220 million loss after attackers spoofed token metadata to bypass security checks. These incidents demonstrate that while blockchain protocols may be secure, the applications built atop them are prime targets for malicious actors.

A 51% attack occurs when an entity gains control of more than half of the network’s computing power, enabling them to reverse transactions and double-spend coins. While large networks like the bitcoin network and Ethereum have grown sufficiently to make such attacks prohibitively expensive, smaller blockchain networks and private blockchain networks remain vulnerable.

Beyond computational attacks, some platforms have fallen victim to routing attacks, where hackers intercept or censor data as it travels through the internet infrastructure. These attacks undermine trust in the network’s ability to validate transactions securely, especially in networks with fewer validators.

Cross-chain bridges, which enable interoperability between different blockchains, have become prime targets for attackers. For instance, Force Bridge lost $3.6 million in May 2025 after a compromised private key allowed attackers to control validator functions. These bridges often introduce centralized points of vulnerability, contradicting the decentralized ethos of blockchain technology and increasing the risk of security breaches.

Centralized exchanges and custodial services remain attractive targets because they hold vast amounts of user assets in hot wallets connected to the internet. Security failures in access management, such as weak private keys protection or poor API security, can lead to rapid fund drains.

In May 2025, Coinbase fell victim to a social engineering attack where overseas support contractors were bribed to grant unauthorized account access. Though affecting less than 1% of users, this incident highlights how human error and operational weaknesses can bypass even the most robust blockchain protocols.

Maximal Extractable Value (MEV) attacks have cost users over $540 million in 2025. Attackers deploy bots to monitor transaction pools and manipulate transaction ordering to distort prices, harming regular users and eroding trust in decentralized finance networks.

While blockchain’s transparency enhances data security by enabling community verification, it also creates privacy challenges. Transaction histories on public blockchains, which are examples of permissionless networks that allow open participation, are traceable, allowing attackers to analyze user behaviors and potentially de-anonymize participants. However, despite this transparency, participants in permissionless networks can remain anonymous by using cryptographic keys instead of real-world identities.

Research indicates that approximately 66% of transactions lack sufficient obfuscation techniques such as chaff coins or mixins, making them vulnerable to tracking. This leakage of sensitive information presents a significant risk, especially for users seeking privacy in their financial activities.

In response to rising threats, the blockchain security landscape has matured with advanced auditing tools and methodologies. Leading platforms like CertiK, Fireblocks, Chainalysis, and OpenZeppelin Defender provide comprehensive solutions for code reviews, vulnerability scanning, and formal verification.

Security audits involve rigorous testing before deployment, including manual code reviews and automated scans to identify potential weaknesses. Bug bounty programs and continuous monitoring help uncover exploits before they escalate into major incidents.

Artificial intelligence (AI) is increasingly integrated into blockchain security, enabling real-time threat detection and risk assessment. AI-powered tools analyze on-chain behavior, identify anomalies, and predict vulnerabilities based on historical data patterns.

Platforms like CertiK’s Skynet and Chainalysis’s Know Your Transaction (KYT) exemplify this approach, offering proactive protection that helps developers and enterprises neutralize threats before breaches occur. AI-enhanced security is becoming a standard component of blockchain defense strategies.

To mitigate risks associated with private keys, many organizations adopt multi-signature wallets, which require multiple approvals for critical operations. This separation of duties prevents single users from unilaterally authorizing transactions or diverting funds.

Additionally, deploying hardware security modules (HSMs) and cold storage solutions enhances key protection. Implementing role-based access controls and mandatory approval workflows further strengthens operational security.

Given the complexity of blockchain security, access to sophisticated analysis and risk assessment tools is essential for participants. Platforms like Token Metrics offer AI-powered insights that combine technical analysis, on-chain data, fundamental metrics, and sentiment analysis to evaluate security risks.

Token Metrics scans over 6,000 tokens daily, providing security-relevant scores that help users identify potentially risky projects. Their cybersecurity team maintains a resilient infrastructure with firewalls, intrusion detection, and prevention systems to safeguard the platform itself.

By aggregating real-time data from exchanges, blockchain networks, social media, and regulatory sources, Token Metrics’ AI algorithms assess project security based on code quality, team transparency, audit histories, and community sentiment. This enables investors to make informed decisions grounded in security awareness.

Token Metrics also offers deep research, including detailed assessments of smart contract vulnerabilities and team credibility. This security-focused approach equips users to avoid projects with significant risks and supports safer blockchain participation.

Governments worldwide are developing regulatory frameworks to address blockchain security challenges. States like Arizona, Iowa, Nevada, Tennessee, and Wyoming have enacted legislation supporting blockchain and smart contract use, while international bodies work on standards to balance innovation with security.

Enterprise adoption of blockchain is growing rapidly, with tokenization of real-world assets expected to reach $600 billion by 2030. Businesses are investing in rigorous security frameworks, including formal verification, enhanced consensus protocols, and international collaboration to mitigate risks.

The expanding blockchain security market reflects industry commitment to addressing vulnerabilities. Smart contract audits and security consulting services are in high demand, helping organizations integrate blockchain technology securely into their operations.

Blockchain technology offers genuine security benefits:

Despite these strengths, challenges remain:

For example, while transparency and immutability are key features, all bitcoin transactions are permanently recorded on bitcoin's blockchain, making the entire transaction history publicly accessible and contributing to the growing size of blockchain data storage.

The integration of AI with blockchain technology is creating new security opportunities. The market for AI-driven blockchain security solutions is projected to exceed $703 million in 2025. Innovations include AI-powered smart contracts with conditional logic and enhanced privacy protocols protecting sensitive business data.

Formal verification techniques that mathematically prove smart contract correctness are becoming more widespread, reducing vulnerabilities and increasing trust.

The industry is shifting from reactive responses to proactive security strategies. Comprehensive frameworks now combine technical tools, governance, training, and operational security to build resilient blockchain ecosystems.

So, how secure are blockchains really? The answer is that blockchain technology is fairly secure by design, leveraging cryptographic techniques and decentralized consensus to provide robust protection. However, the overall security of a blockchain system depends heavily on the quality of its implementation, operational practices, and the surrounding ecosystem.

While well-designed and audited blockchain applications can deliver exceptional security, poorly implemented systems remain vulnerable to significant risks, as evidenced by the $2.17 billion in losses in 2025 alone. The projected $8 billion blockchain security market by 2033 signals a strong industry commitment to overcoming these challenges.

For organizations and individuals engaging with blockchain technology, security requires a comprehensive approach: selecting secure platforms, conducting thorough due diligence, implementing strong operational controls, and leveraging sophisticated analysis tools like Token Metrics.

In 2025, participating in crypto and blockchain is no longer about chance or hype; it’s about using AI, data, and automation to make smarter, safer decisions. Blockchain technology holds tremendous security potential, but realizing that potential demands ongoing vigilance, proper implementation, and a comprehensive ecosystem of tools and expertise.

As blockchain continues to evolve, security will remain both its greatest strength and most critical challenge. Understanding the capabilities and limitations of blockchain security—and applying comprehensive strategies—is key to maximizing benefits while minimizing risks.

%201.svg)

%201.svg)

The digital revolution has fundamentally transformed the way we conduct business, manage agreements, and execute transactions. Active blockchain solutions are driving efficiency, security, and transparency across industries such as retail, supply chain, and healthcare. At the forefront of this transformation are smart contracts—revolutionary digital agreements that are reshaping industries ranging from finance and real estate to healthcare and supply chain management.

Blockchain-based smart contracts provide significant benefits to businesses by automating agreements, increasing transparency, and reducing costs. As we progress through 2025, understanding what are smart contracts and how they function has become essential for anyone looking to participate in the blockchain ecosystem or leverage the power of decentralized applications, especially to benefit from increased efficiency and security for businesses and organizations.

Smart contracts are digital contracts stored on a blockchain that are automatically executed when predetermined terms and conditions are met. Essentially, a smart contract is a self-executing agreement encoded as a computer program on a blockchain network, coded to be executed automatically. These contracts automate the execution of an agreement so that all parties involved can be immediately certain of the outcome without the need for intermediaries or delays.

At their core, smart contracts are a self executing program that transforms traditional contract terms into code deployed onto a blockchain, operating without the need for an intermediary or the traditional legal system. Once the required conditions are fulfilled, the smart contract automatically triggers the execution of the contract’s terms, ensuring transparency, efficiency, and security. Unlike traditional contracts that rely on lawyers or banks to enforce terms, smart contracts are self-enforcing and self-verifying, operating on a distributed ledger that guarantees the contract cannot be changed once deployed.

For example, a smart contract on the Ethereum platform is a collection of code (functions) and data (state) residing at a specific address on the Ethereum blockchain. It acts like a computer program with its own balance and the ability to receive and send transactions, but it operates independently once deployed. Smart contracts can facilitate agreements between anonymous parties, ensuring privacy and decentralization. This automation eliminates the need for human intervention and reduces the risk of human error or fraud.

The idea of smart contracts actually predates blockchain technology. The concept was originally proposed in the 1990s by Nick Szabo, a cryptographer who described smart contracts as “a set of promises, specified in digital form, including protocols within which the parties perform on these promises.” Szabo famously compared smart contracts to vending machines, where the right inputs guarantee a specific output automatically.

It is important to note the distinction between a smart contract and a smart legal contract. A smart legal contract combines the automation of blockchain-based smart contracts with legal enforceability, ensuring compliance with jurisdictional laws and providing legal guarantees that can be upheld in court.

While Bitcoin’s launch in 2009 made smart contracts technically feasible by introducing blockchain technology, it was Ethereum’s introduction in 2015 that truly elevated smart contracts as a foundational element of decentralized applications. Ethereum’s Turing-complete programming language, Solidity, allowed developers to write complex contracts that could handle a wide range of automated functions.

According to the US National Institute of Standards and Technology, a smart contract is “a collection of code and data (sometimes referred to as functions and state) that is deployed using cryptographically signed transactions on the blockchain network.” This definition emphasizes that smart contracts are computer programs that use blockchain technology to handle transactions securely and transparently, with digital signatures used to authenticate parties and secure the execution of these contracts.

Smart contracts work by following simple “if/when…then…” statements written into code on a blockchain. The process is straightforward yet powerful:

When a predetermined condition is met and verified by the network, the contract executes the agreed-upon action. Each transaction includes the smart contract code and relevant data, and is verified by the network to ensure authenticity and compliance with the contract's terms.

Smart contracts can also automatically trigger the next action in a workflow once the specified conditions are fulfilled, streamlining processes and reducing the need for intermediaries.

The first step involves writing the contract terms into a programming language designed for blockchain, such as Solidity for Ethereum. Developers encode the agreement’s rules and conditions into a series of instructions, specifying what actions should occur when certain conditions are met.

Once the smart contract code is complete, it is deployed to the blockchain network through a cryptographically signed transaction. After deployment, the contract becomes immutable—meaning it cannot be changed—ensuring trust and transparency for all parties involved. Each deployment creates a single record on the blockchain ledger, ensuring the integrity and traceability of the contract.

When the predetermined conditions are fulfilled, the smart contract automatically executes the specified actions. For example, in a rental agreement, the contract might automatically transfer funds to the landlord’s wallet once the tenant’s payment is received. Smart contracts can also manage and transfer digital assets automatically when the agreed conditions are met.

The execution is validated by nodes connected to the blockchain network, such as the Ethereum Virtual Machine (EVM) on Ethereum. These nodes verify the transaction and update the blockchain ledger with encrypted records of the completed transaction. Because the transaction record cannot be changed, it guarantees security and prevents fraud.

Smart contracts possess several defining characteristics that set them apart from traditional agreements: They offer transparency, as all actions and terms are visible to involved stakeholders. Blockchain based smart contracts allow multiple parties to access and verify the contract terms, ensuring trust and accountability throughout the process.

Smart contracts are stored on a public distributed ledger, known as a blockchain, which ensures that all participants have access to the contract’s code and terms. This transparency means that no single party can alter the contract without consensus from the network. For example, smart contracts are used for increasing supply chain transparency by tracking pharmaceuticals, ensuring data reliability and safety throughout the transport process.

Smart contracts do not require trusted intermediaries to verify or enforce the agreement, ensuring that every party involved can trust the contract's execution without external enforcement. Their automated possibilities allow them to self-verify conditions and self-enforce execution when the contract’s rules are met.

Smart contracts only perform the functions they were programmed to do and only when the required conditions are fulfilled. Once deployed, the contract’s code and transaction history cannot be altered, providing a tamper-proof record.

By automating contract execution, smart contracts significantly reduce the time and paperwork involved in traditional agreements. The entire chain of actions is executed immediately and automatically, minimizing delays caused by human intervention, and also saving money by eliminating unnecessary steps.

Smart contracts are revolutionizing various industries by automating processes and eliminating intermediaries. They are increasingly used to streamline international trade by automating cross-border transactions, improving efficiency and transparency in global business.

In finance, smart contracts streamline trade finance by automating payments, verifying documents, and tracking shipments. Decentralized finance (DeFi) platforms leverage smart contracts to enable lending, borrowing, and trading without middlemen, increasing transparency and security.

Smart contracts automate property transactions by releasing funds upon payment confirmation, reducing the need for escrow agents. Lease agreements and payments are managed automatically, ensuring timely execution and minimizing disputes.

In supply chains, smart contracts increase transparency by tracking raw materials and products through every stage, automatically verifying trade documents and resolving disputes. In healthcare, they secure patient data while allowing authorized providers to share information seamlessly.

Smart legal contracts offer greater openness than traditional contracts by being stored on immutable blockchains. They can automatically execute payments or obligations once specific conditions, such as a date or event, are met.

As the smart contract landscape grows increasingly complex, sophisticated analytics tools have become indispensable. Token Metrics is a leading AI-powered platform that provides comprehensive insights into blockchain projects and smart contract platforms.

Token Metrics evaluates over 6,000 tokens daily, scoring each based on technical analysis, on-chain data, fundamental metrics, and social sentiment. This helps investors identify promising smart contract platforms and tokens built on them.

The Token Metrics API offers real-time price and volume data, AI-based token ratings, and sentiment analysis, making it a valuable resource for developers and analysts working with smart contracts.

Token Metrics provides AI-driven analytics, moonshot altcoin discovery, real-time signals, and tools for both long-term investing and short-term trading. Developer tools integrate with platforms like ChatGPT and Cursor IDE, enabling data-driven smart contract development and analysis.

Ethereum remains the dominant platform for smart contract development, using the Solidity programming language and the Ethereum Virtual Machine (EVM). Despite security challenges, it hosts the majority of active smart contracts.

Platforms like Solana, which uses the Solana Virtual Machine (SVM) and Rust programming language, and newer blockchains adopting Move (such as Sui and Aptos), offer improved performance and lower transaction costs.

Smart contracts typically operate within a single blockchain network. To interact across networks or access off-chain data, oracles and external computation systems provide necessary verification and data feeds.

Smart contracts face significant security risks, with millions lost annually due to bugs and exploits. Common vulnerabilities include reentrancy attacks, unreliable random number generation, and arithmetic errors.

Tools like Truffle and Foundry help developers write and test smart contracts thoroughly before deployment. Security analysis platforms such as CRYPTO-SCOUT automatically identify potential vulnerabilities.

Given the high value of cryptocurrency tokens managed by smart contracts, thorough auditing and continuous monitoring are essential to prevent fraud and ensure contract integrity.

Smart contracts continue to evolve, improving scalability, interoperability, and security. They are increasingly integrated into industries such as finance, supply chain, healthcare, and real estate, automating transactions with precision and transparency.

Several US states, including Arizona, Iowa, Nevada, Tennessee, and Wyoming, have passed legislation recognizing smart contracts. The Law Commission of England and Wales has also acknowledged smart legal contracts under existing law frameworks.

The convergence of artificial intelligence with smart contracts is enabling more complex automated decision-making and reducing human intervention, opening new possibilities for business and technology.

Anyone interested can learn to write smart contracts using languages like Solidity and deploy them on blockchain platforms such as Ethereum. Deploying a smart contract requires paying gas fees, as it is treated as a blockchain transaction.

Understanding smart contracts is vital for informed investment decisions in the crypto space. Platforms like Token Metrics offer AI-driven analytics and real-time signals to help investors identify promising tokens and smart contract platforms.

Smart contracts represent one of the most transformative innovations in the digital economy. By eliminating intermediaries and enabling trustless, automated agreements, they drive efficiency, transparency, and innovation across industries. The immutable, encrypted records maintained on blockchain technology ensure security and prevent fraud, while automated execution accelerates transactions and reduces costs.

As smart contracts continue to expand their applications in 2025 and beyond, leveraging advanced analytical tools like those provided by Token Metrics is essential for developers, investors, and business leaders navigating this dynamic space. Far from being just a technological innovation, smart contracts signify a fundamental shift toward a more automated, transparent, and efficient digital economy. Understanding and embracing this technology is crucial for success in the blockchain-powered future unfolding before us.

%201.svg)

%201.svg)

In the rapidly evolving landscape of digital finance, one of the most fundamental characteristics that sets blockchain technology apart from traditional banking systems is the irreversible nature of transactions. As we navigate through 2025, understanding why blockchain transactions cannot be reversed has become crucial for anyone engaging with cryptocurrencies, decentralized finance, or blockchain-based applications. This article delves into the technical foundations, security implications, and practical considerations behind the question: why are blockchain transactions irreversible?

Blockchain transactions are the backbone of the crypto world, enabling secure, decentralized, and irreversible exchanges of digital currency. At its core, a blockchain transaction is a digital record of value or data being transferred from one party to another, verified and permanently stored on a blockchain network. Blockchain technology relies on a cryptographic hash function to link blocks together, ensuring that every transaction is securely recorded and cannot be altered or deleted. This process creates a transparent, tamper-proof ledger that underpins the trust and security of digital currency payments and data transfers. In a decentralized network, every transaction is verified by multiple participants, making blockchain transactions not only secure but also resistant to fraud and manipulation.

A blockchain transaction typically involves sending digital currency, such as bitcoin, from one wallet address to another. When a user initiates a transaction, it is broadcast to the blockchain network, where nodes—often called miners—verify its authenticity using advanced cryptographic algorithms. Once the transaction is verified, it is grouped with other transactions into a block. This block is then added to the blockchain, creating a permanent and transparent record. The blockchain network ensures that each transaction is unique and cannot be duplicated or reversed, making it practically impossible for anyone to manipulate or undo a transaction once it has been confirmed. This process is fundamental to the security and reliability of digital currency systems like bitcoin, where every transaction is verified and recorded by a decentralized network of nodes.

Blockchain transactions are permanent and cannot be reversed once they are confirmed. This is a key feature of blockchain technology, which powers most cryptocurrencies including Bitcoin. When a transaction is recorded on the blockchain—a public, decentralized ledger—it becomes immutable, meaning it cannot be changed or deleted. This immutability is intentional and fundamental to how blockchain networks operate.

Unlike traditional banking systems where transactions can be disputed or reversed by a central authority such as a bank, blockchain transactions are designed to be permanent and unalterable once confirmed by the network. This unique feature raises important questions about security, trust, and the foundational principles that govern decentralized systems. Blockchain technology also provides a secure way for people to store and transfer money, especially for those without access to traditional banks.

The irreversible nature of transactions is not a flaw but a deliberate design choice. Because Bitcoin and other blockchain projects operate without a central authority, no single person or entity has control over the ledger. This decentralization, combined with the permanent recording of transaction data, ensures that transactions are irreversible and secure by design. This means bitcoin functions as a digital currency that enables decentralized, irreversible transactions without the need for a central authority.

The blockchain begins with the first block, known as the genesis block, which initiates the chain of transactions. The irreversible nature of blockchain transactions stems from sophisticated cryptographic principles and decentralized consensus mechanisms. At the heart of this immutability is the cryptographic hash function, which secures transaction data and links blocks together in a tamper-evident chain.

Each block in the blockchain contains a cryptographic hash of the previous block, known as the previous block's hash, creating an interdependent structure where altering any transaction data in a previous block would change its hash. Since each block references the previous block’s hash, modifying historical data would require generating a new hash for that block and recalculating the hashes for all subsequent blocks. This process is computationally intensive and practically impossible to achieve without enormous computing power.

Digital signatures also play a crucial role. Transactions are signed by users using their private keys, and the network verifies these signatures against the corresponding public keys to ensure authenticity. This cryptographic validation prevents unauthorized modifications and ensures that only the rightful owner can authorize spending from a wallet address.

Moreover, blockchain networks operate as decentralized systems maintained by numerous nodes. Each node holds a copy of the entire ledger, and consensus mechanisms ensure that all nodes agree on the current state of transactions. To alter a confirmed transaction, an attacker would need to control more than half of the network’s computing power—a feat known as a 51% attack. Whoever controls this majority hash power could theoretically alter the blockchain, but this is extremely expensive and difficult to execute on established blockchains like Bitcoin.

Transactions become irreversible through the network’s consensus process. When a user initiates a transaction, it is broadcast to the blockchain network, where nodes verify its validity based on transaction details, digital signatures, and available funds. All nodes follow the same protocol to validate and record transactions, ensuring consistency and security across the decentralized network. Validated transactions are then grouped into a new block, which miners compete to add to the blockchain by solving a complex cryptographic puzzle.

The first miner to solve the puzzle successfully adds the block to the chain, linking it to the previous block via its hash. This block addition confirms the transaction and solidifies its place in the blockchain’s history. Network participants typically consider transactions irreversible after a certain number of confirmations—meaning a certain number of blocks have been added on top of the block containing the transaction. This confirmation process reduces risks from temporary forks or reorganizations in the blockchain network. In certain attacks, such as the Vector76 attack, an attacker may withhold one block to manipulate the chain, highlighting the importance of multiple confirmations for transaction security.

In proof-of-work (PoW) systems like the Bitcoin blockchain, finality is probabilistic. The bitcoin network relies on proof-of-work and a decentralized network of miners to confirm transactions and secure the blockchain. Transactions become more secure as additional blocks are appended to the chain. Each new block reinforces the validity of previous transactions, making it exponentially harder for an attacker to rewrite transaction history.

For Bitcoin transactions, it is generally recommended to wait for five to six confirmations before considering a transaction irreversible. Each confirmation increases the computational power required to reverse the transaction, making such an attack practically impossible without vast amounts of mining power.

Other blockchain projects employ consensus algorithms based on Byzantine fault tolerance (BFT), such as Tendermint or Ripple, which provide deterministic finality. In these networks, transactions are finalized immediately once the network’s nodes reach consensus, eliminating waiting periods. Once consensus is achieved, transactions are irreversible and permanently recorded.

Deterministic finality offers instant certainty but requires different network architectures and consensus protocols compared to PoW systems.

The security and irreversibility of a blockchain transaction depend on how many confirmations it receives from the blockchain network. A transaction is considered confirmed once it is included in a block and that block is added to the blockchain. However, to ensure the transaction is truly secure and irreversible, it is common practice to wait for a certain number of additional blocks—typically between 3 to 6—to be added on top of the block containing the transaction. This period, known as verification successful waiting, allows the network to further verify the transaction and significantly reduces the risk of attacks such as double spending. The more confirmations a transaction has, the more secure and irreversible it becomes, as reversing it would require an attacker to rewrite multiple blocks, which is practically impossible on a well-established blockchain network.

The irreversible nature of blockchain transactions serves several critical functions. First, it prevents fraud such as double spending—the attempt to spend the same digital currency twice. Without the possibility of reversing transactions, users cannot duplicate or counterfeit their funds.

Second, irreversibility underpins the trustless nature of decentralized systems like Bitcoin. Users do not need to rely on a central authority or bank to validate transactions; the network’s consensus and cryptographic safeguards ensure transaction authenticity and permanence.

Third, the immutable ledger maintains the integrity of the entire blockchain network. This reliable transaction history builds trust among users and enables transparent auditing without centralized control.

Unlike payments made through credit cards or banks, which can be reversed or charged back by a central entity, blockchain transactions are free from such interventions. The decentralized system eliminates intermediaries, reducing the risk of censorship, fraud, or manipulation by a central authority.

This decentralization empowers users with full control over their funds, secured by private keys and cryptographic protocols, and ensures that once transactions are confirmed, they are final and irreversible.

While blockchain technology is designed to make blockchain transactions secure and irreversible, there are still potential threats that can compromise transaction integrity. One of the most well-known threats is double spending, where an attacker tries to spend the same digital currency twice by creating conflicting transactions. Blockchain networks counter this by using a decentralized system of nodes that verify each transaction, ensuring that only one version is accepted.

Another threat is the brute force attack, where an attacker attempts to guess or crack the private key associated with a wallet address to gain unauthorized access to funds. This method is extremely expensive and requires vast amounts of computational power, making it highly impractical on major networks.

Specific attacks like the Finney attack involve a miner creating a new block with a conflicting transaction in an attempt to reverse a previous payment, while a race attack sees an attacker quickly submitting two conflicting transactions to try and double spend before the network can verify the first one.

To defend against these threats, blockchain networks implement security measures such as disabling incoming connections to prevent unauthorized access, using specific outgoing connections for added control, and leveraging smart contracts to automate and secure transactions. These strategies, combined with the decentralized nature of blockchain and the computational power required to alter transaction history, make successful attacks on blockchain transactions extremely rare and costly.

Given the permanent nature of blockchain transactions, having access to sophisticated analysis and decision-making tools is increasingly important for traders and investors in 2025. Platforms like Token Metrics have emerged as leading AI-powered solutions for crypto trading, research, and data analytics, helping users make informed decisions before committing to irreversible transactions.

Token Metrics integrates AI-grade analytics, execution automation, and real-time alerts within a unified system. Its risk assessment tools evaluate potential transactions by assigning each token a Trader Grade for short-term potential and an Investor Grade for long-term viability. This enables users to prioritize opportunities efficiently and mitigate risks associated with irreversible transactions.

The platform’s API combines AI-driven analytics with traditional market data, providing users with real-time price and volume information, sentiment analysis from social channels, and comprehensive documentation for research and trading. This wealth of data supports better-informed decisions, reducing the likelihood of costly mistakes in irreversible payments.

Token Metrics’ AI has a proven track record of identifying profitable trades early, helping users spot winning trades and automate transactions based on predefined parameters. This reduces emotional decision-making and enhances security in a system where transactions cannot be reversed.

Because blockchain transactions are irreversible, mistakes such as sending funds to the wrong wallet address or falling victim to scams cannot be undone. Users bear full responsibility for verifying transaction details before confirmation.

To minimize risk, users should always double-check recipient wallet addresses by copying and pasting them to avoid typos. Conducting test transactions with small amounts before sending large sums is advisable. Understanding network fees and timing can also help ensure smooth transaction processing.

For enhanced security, multi-signature wallets require multiple approvals before funds can be moved, adding an extra layer of protection for significant payments.

Even though blockchain transactions are designed to be secure and irreversible, consumers can take additional steps to protect themselves and prevent fraud. One effective method is using escrow services, which hold funds until both parties fulfill their obligations, ensuring that payments are only released when the transaction is complete. Implementing smart contracts can further automate this process, allowing payments to be made only when specific conditions are met, reducing the risk of fraud.

Verifying the transaction history of a wallet address is another important step. By checking past transactions, users can identify any suspicious or fraudulent activity before engaging in a new transaction. Additionally, choosing reputable exchanges and wallet services with strong security measures and a proven track record can provide an extra layer of protection.

By following these best practices, consumers can help ensure that their blockchain transactions remain secure and irreversible, safeguarding their funds and maintaining trust in the blockchain ecosystem.

As blockchain technology advances, the irreversible nature of transactions remains a core feature, but innovations are emerging to enhance security and user experience. Layer 2 solutions enable faster payments while maintaining the security of the base blockchain layer. Smart contract escrows introduce conditional transaction execution, adding flexibility without compromising irreversibility.

Additionally, AI-enhanced security platforms like Token Metrics are pioneering predictive analytics to prevent problematic transactions before they occur, making irreversible payments safer and more manageable.

The irreversible nature of blockchain transactions has not deterred institutional adoption; rather, it has driven the development of sophisticated risk management tools. AI trading platforms provide insights once reserved for large hedge funds, enabling both retail and professional traders to navigate the crypto market confidently.

Token Metrics bridges the gap between raw blockchain data and actionable decisions, offering an AI layer that empowers traders to outperform the market in an environment where transactions are final and irreversible.

The question of why blockchain transactions are irreversible is answered by the fundamental design of blockchain technology. The combination of cryptographic hash functions, digital signatures, decentralized consensus, and computationally intensive mining ensures that once a transaction is confirmed, it is permanently recorded and practically impossible to reverse.

This irreversible nature is not a limitation but a powerful feature that enables trustless, decentralized networks free from central control and fraud. While it introduces certain risks, responsible users equipped with advanced tools and knowledge can safely harness the benefits of blockchain technology.

As we move further into 2025, innovations in AI-powered analytics, layer 2 solutions, and smart contracts continue to enhance the security and usability of irreversible transactions. Understanding and embracing this core characteristic is essential for anyone participating in the digital currency ecosystem, whether they are casual users, professional traders, or institutional investors.

%201.svg)

%201.svg)

The blockchain industry has seen a profound evolution in how decentralized systems secure transactions and maintain consensus. As we move through 2025, understanding what is proof of work versus proof of stake remains essential for anyone involved in the cryptocurrency industry.

At first glance, proof of work and proof of stake may appear similar as consensus mechanisms, but their underlying mechanisms and implications differ significantly.