Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

Timing crypto cycles is inherently challenging. Volatility in the crypto markets can lead to sharp swings—either capturing gains during bull runs or avoiding deep drawdowns during unfavorable trends. A regime switching crypto index offers a systematic way to adapt to changing market conditions, using rules-based allocations that switch between risk-on assets and stablecoins accordingly. Token Metrics offers tools to help analyze these strategies with transparency and real-time insights.

Crypto markets tend to operate in distinct regimes—periods of momentum followed by corrections that can reverse gains quickly. Investors and analysts seeking to implement regime switching or weekly rebalancing frameworks value simplicity and clarity. These approaches help in maintaining discipline, managing risks, and capturing market trends effectively.

Regime switching in crypto refers to a rules-based investment method that adjusts portfolio exposure based on prevailing market conditions. Typically, this involves rotating into a diversified basket of tokens in bullish phases and shifting into stablecoins during bearish trends, thus managing risk while seeking to ride upward trends.

This index employs regime switching principles: during bullish periods, it holds the top 100 crypto assets by market cap; during bearish times, it exits into stablecoins and waits for buy signals. The index performs weekly rebalancing based on updated rankings, liquidity, and supply metrics. Transparency is maintained through clear strategy rules, gauges, Treemap views, and detailed transaction logs.

Join the waitlist to be first to trade TM Global 100.

A rules-based portfolio that allocates to a diversified token basket during bullish phases and switches to stablecoins during bearish conditions, based on predefined signals. Token Metrics implements this with a top-100 universe and full stablecoin rotation in downturns.

It rebalances weekly to reflect changes in rankings and liquidity. Significant regime changes can occur outside the schedule when market signals trigger a switch.

A proprietary market signal prompts the index to exit token positions and move into stablecoins during bearish phases, waiting for a bullish signal to re-enter.

Funding occurs via an embedded, self-custodial wallet supporting major chains. USDC payouts are supported when selling. Funding options depend on your wallet and region.

No. It is self-custodial, giving you control of keys and funds.

Before confirming a trade, estimated gas, platform fee, slippage, and expected minimum value are displayed.

Visit the Token Metrics Indices hub, open TM Global 100, and tap “Join Waitlist”. You will be notified at launch.

Crypto markets are volatile and can fluctuate rapidly. Past performance does not predict future results. This article aims to educate and inform, not provide financial advice.

For a disciplined, transparent approach to broad crypto exposure that adapts to market regimes, the TM Global 100 index offers a rules-based platform with weekly rebalancing and full visibility. It enables investors to focus on allocation without the stress of micromanagement.

Join the waitlist to be first to trade TM Global 100.

%201.svg)

%201.svg)

Timing crypto cycles is inherently challenging. Market volatility can work both ways: investors seek broad upside potential during bullish phases, yet require the discipline to step aside when market trends and liquidity conditions reverse. A regime switching crypto index precisely addresses this need—employing rules-based mechanisms to adjust market exposure during different conditions. Our flagship implementation, Token Metrics Global 100, exemplifies this approach: it dynamically shifts between a top-100 crypto basket during bullish periods and stablecoins during downturns, with weekly rebalancing, transparent holdings, and verifiable transactions. Designed for investors who prefer market exposure without the need to micromanage individual tokens or succumb to emotional biases, this system offers a disciplined approach to crypto participation.

Crypto markets tend to operate in distinct regimes—prolonged phases of risk-on momentum followed by swift drawdowns that can negate earlier gains. Those exploring "regime switching," "weekly rebalancing," or "crypto index" strategies seek frameworks that are straightforward, practical, and easy to implement.

Regime switching in crypto refers to a rules-based portfolio approach that adjusts exposure based on market conditions—rotating between a diversified assortment of tokens in uptrends and moving into stablecoins during declines.

Regime switching: During bullish periods, the index holds the top-100 cryptocurrencies by market cap across sectors and chains. In bearish conditions, it exits to stablecoins and waits for an upward signal to re-enter.

Weekly rebalancing: The index updates constituent weights based on market-cap rankings and liquidity metrics, adjusting on a set schedule.

Transparency: The index employs defined rules, with visual tools like gauges, treemaps, and logs that allow users to verify holdings and changes.

Price tile, list of 100 tokens, clear indication of weekly rebalancing, and a simplified buy flow supported by a self-custodial wallet. You can review the strategy and rules at a glance.

Discover crypto benefits with disciplined rebalancing—join the waitlist to be among the first to trade the TM Global 100.

A rules-based portfolio that adjusts exposure between a diversified token basket during bullish markets and stablecoins during bearish phases, based on predefined signals. The Token Metrics Global 100 implements this by focusing on the top-100 tokens with an integrated stablecoin switch in downturns.

Rebalancing occurs weekly to reflect latest rankings and liquidity thresholds. However, regime shifts can happen outside the scheduled rebalancing when market signals change abruptly.

A proprietary market signal detects bearish conditions, prompting the index to exit crypto positions into stablecoins, awaiting a bullish re-entry signal.

Funding occurs via an embedded self-custodial wallet supporting major chains; options depend on your wallet and region. USDC payouts are supported upon sale. Regional and asset availability may vary.

No. The embedded wallet is self-custodial, giving you full control over your keys and funds.

Before confirming a trade, estimated gas costs, platform fees, and maximum slippage are displayed, along with the minimum expected value.

Visit the Token Metrics Indices hub, open the TM Global 100, and tap "Join Waitlist." You will receive a notification at launch.

Crypto markets are volatile and can experience value declines. Past performance does not predict future results. This content is intended for educational and research purposes only.

If you seek a disciplined, transparent method to participate in the crypto market while avoiding emotional pitfalls during downturns, the TM Global 100 offers a rules-based, weekly rebalanced solution. With comprehensive visibility into holdings and transactions, it enables a focused approach to market exposure without added anxiety.

Join the waitlist to be among the first to trade the TM Global 100.

%201.svg)

%201.svg)

The prediction revolution is transforming crypto investing in 2025. From AI-powered price prediction platforms to blockchain-based event markets, today's tools help investors forecast everything from token prices to election outcomes with unprecedented accuracy.

With billions in trading volume and cutting-edge AI analytics, these platforms are reshaping how we predict, trade, and profit from future events. Whether you're forecasting the next 100x altcoin or betting on real-world outcomes, this comprehensive guide explores the top prediction tools dominating 2025.

Before diving in, it's crucial to distinguish between two types of prediction platforms:

Both serve valuable but different purposes. Let's explore the top tools in each category.

Token Metrics - AI-Powered Crypto Intelligence Leader

Token Metrics stands as the premier AI-driven crypto research and investment platform, scanning over 6,000 tokens daily to provide data-backed predictions and actionable insights. With a user base of 110,000+ crypto traders and $8.5 million raised from 3,000+ investors, Token Metrics has established itself as the industry's most comprehensive prediction tool.

Unlike basic charting tools or single-metric analyzers, Token Metrics combines time series data, media news, regulator activities, coin events like forks, and traded volumes across exchanges to optimize forecasting results. The platform's proven track record and comprehensive approach make it indispensable for serious crypto investors in 2025.

Investors and traders seeking AI-powered crypto price predictions, portfolio optimization, and early altcoin discovery.

1. Polymarket - The Largest Decentralized Prediction Market

Polymarket dominates the event prediction market space with unmatched liquidity and diverse betting opportunities.

What Sets It Apart: Polymarket proved its forecasting superiority when it accurately predicted election outcomes that traditional polls missed. The platform's user-friendly interface makes blockchain prediction markets accessible to mainstream audiences.

Best For: Event outcome betting, political predictions, sports betting, and crypto price speculation through binary markets.

2. Kalshi - The CFTC-Regulated Powerhouse

Kalshi has surged from 3.3% market share last year to 66% by September 2025, overtaking Polymarket as the trading volume leader.

Recent Developments: Kalshi hired John Wang as Head of Crypto in August 2025 to drive blockchain integration, with plans to be on "every major crypto app and exchange within 12 months." The platform secured a massive $185 million Series C funding round and partnered with Robinhood for sports market expansion.

Best For: U.S. residents seeking regulated prediction markets with crypto deposit options and diverse event contracts.

3. Drift BET - Solana's Speed Champion

For traders demanding instant settlement and minimal fees, Drift BET represents the cutting edge of prediction markets on Solana.

Why It Matters: By leveraging Solana's near-instant transaction finality, BET by Drift solves many scalability issues faced by Ethereum-based prediction markets, with low transaction fees making smaller bets feasible for wider audiences.

Best For: Solana-native traders and users prioritizing speed and low costs.

4. Augur - The Pioneering Protocol

Launched in 2018, Augur was the first decentralized prediction market, pioneering blockchain-based forecasting and innovative methods for settlement secured by the REP token.

Legacy Impact: Augur v1 settled around $20 million in bets—impressive for 2018-19. While the DAO has dissolved, Augur's technological innovations now permeate the DeFi sphere.

Best For: Crypto purists seeking complete decentralization and censorship resistance.

5. Gnosis - The Infrastructure Powerhouse

With a market cap of $463 million, Gnosis is the biggest prediction market project by market capitalization.

Ecosystem Approach: Founded in 2015, Gnosis evolved into a multifaceted ecosystem encompassing decentralized trading, wallet services, and infrastructure tools beyond mere prediction markets.

Best For: Developers and platforms building custom prediction market applications.

Smart investors often use Token Metrics for identifying which cryptocurrencies to invest in, then leverage prediction markets like Polymarket or Kalshi to hedge positions or speculate on specific price targets and events.

Example Strategy:

This combines the best of AI-driven price prediction with market-based event forecasting.

Market Growth Trajectory: The prediction market sector is projected to reach $95.5 billion by 2035, with underlying derivatives integrating with DeFi protocols.

Key Growth Drivers:

For Crypto Investors: Use Token Metrics to identify high-potential tokens before they pump. Access AI-generated buy/sell signals for portfolio management. Discover narrative-driven investment opportunities early.

For Event Traders: Hedge crypto positions using prediction markets. Speculate on regulatory outcomes, exchange listings, or network upgrades. Trade sports and political events for diversified income.

For Analysts & Institutions: Aggregate market sentiment data for research. Access real-time forecasting for economic indicators. Build custom trading strategies using API integrations.

For Price Prediction Platforms: No prediction tool is 100% accurate; past performance doesn't guarantee future results. AI models perform best with sufficient historical data. Market manipulation and black swan events can invalidate predictions.

For Prediction Markets: Regulatory uncertainty remains in many jurisdictions. Liquidity challenges can create volatility. Oracle failures could compromise settlement integrity. Tax implications require careful record-keeping.

What's Coming: Expect deeper AI agent integration, automated portfolio management, and enhanced moonshot discovery as machine learning models become more sophisticated.

Prediction Market Expansion: Kalshi aims to integrate with every major crypto app within 12 months, while tokenization of positions and margin trading will create new financial primitives.

Cross-Platform Integration: Future platforms will likely combine Token Metrics-style AI prediction with Polymarket-style event markets in unified interfaces.

DeFi Integration: The prediction market derivatives layer is set to integrate with DeFi protocols to create more complex financial products.

The era of blind speculation is over. Between AI-powered platforms like Token Metrics analyzing thousands of data points per second and blockchain-based prediction markets aggregating collective wisdom, today's investors have unprecedented tools for forecasting the future.

Token Metrics leads the charge in crypto price prediction with its comprehensive AI-driven approach, while platforms like Polymarket and Kalshi dominate event-based forecasting. Together, they represent a new paradigm where data, algorithms, and collective intelligence converge to illuminate tomorrow's opportunities.

Whether you're hunting the next 100x altcoin or betting on real-world events, 2025's prediction platforms put the power of foresight in your hands. The question isn't whether to use these tools—it's how quickly you can integrate them into your strategy.

The future is visible. Are you ready to profit from it?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investing involves risk, including potential loss of capital. Price predictions and ratings are provided for informational purposes and may not reflect actual future performance. Always conduct thorough research and consult qualified professionals before making financial decisions.

%201.svg)

%201.svg)

The virtual reality world is expanding rapidly, and with it comes the emergence of metaverse crypto coins. These digital currencies are crucial in shaping the metaverse, a virtual world where users can buy, sell, and trade digital assets such as virtual land, real estate, and avatar items.

This article will delve into the concept of metaverse crypto coins, discuss their potential as investments, and explore the ongoing developments in this exciting space.

Metaverse crypto coins are a subset of cryptocurrencies that enable users to transact within blockchain-powered virtual worlds. These digital currencies act as a medium of exchange within the metaverse, allowing users to buy, sell, and trade various digital assets.

Metaverse crypto coins are often used to purchase virtual land, avatar accessories, and other in-game items. These coins are typically built on blockchain platforms like Ethereum, Solana, Polygon, and Cardano.

The metaverse offers users a unique and immersive experience where they can explore virtual worlds, interact with other users, and participate in various activities.

These virtual worlds are interconnected, allowing users to move between different platforms and experiences seamlessly. Metaverse crypto coins facilitate these transactions and create a virtual economy within the metaverse.

If you're interested in buying metaverse crypto coins, you can do so through various cryptocurrency exchanges. These exchanges provide a platform for users to buy, sell, and trade digital currencies, including metaverse coins. Here's a step-by-step guide on how to purchase metaverse crypto:

Alternatively, you can purchase metaverse coins on peer-to-peer trading platforms or decentralized exchanges (DEXs). These platforms offer alternative ways to buy and trade cryptocurrencies, providing more flexibility and anonymity for users.

The metaverse ecosystem is vast and diverse, with numerous metaverse coins available for investment. While the metaverse is still in its early stages, several coins have gained significant traction and show promise for the future. Here are some of the top metaverse coins to consider:

It's important to note that investing in metaverse coins carries inherent risks, as the market is highly volatile and speculative. It's crucial to conduct thorough research and consult with a qualified professional before making any investment decisions.

The potential of metaverse coins as investments is a topic of much discussion. While the metaverse industry holds immense promise for the future, it is still in its early stages, and the market is highly speculative. Investing in metaverse coins requires careful consideration and risk assessment.

One of the critical factors to consider when evaluating the investment potential of metaverse coins is the underlying technology and the development team behind the project.

Understanding the scalability, security, and utility of the blockchain platform can provide insights into the long-term viability of the metaverse coin.

Another aspect to consider is the adoption and popularity of the metaverse platform. Metaverse coins associated with widely used and highly active platforms are more likely to see increased demand and value appreciation.

Additionally, partnerships with established brands and companies can contribute to a metaverse coin's growth and success.

However, it's crucial to approach investments in metaverse coins with caution. The market is highly speculative, and prices can be subject to significant fluctuations. It's essential to diversify your portfolio and only invest what you can afford to lose.

The metaverse industry is evolving rapidly, with ongoing developments and innovations shaping the future of virtual economies. Here are some notable trends and developments to keep an eye on:

As the metaverse continues to evolve, new opportunities and challenges will arise. It's an exciting time for the industry, and staying informed about the latest developments and trends is crucial for investors and enthusiasts alike.

Q1. How can I earn crypto in the metaverse?

There are several ways to earn crypto in the metaverse:

Q2. Are metaverse coins a safe investment?

Investing in metaverse coins, like any other cryptocurrency, comes with risks. The market is highly volatile and speculative, and prices can fluctuate dramatically.

It's essential to conduct thorough research, assess the underlying technology and development team, and consider the long-term potential of the metaverse platform before making any investment decisions.

Q3. What factors should I consider before investing in metaverse crypto?

Before investing in metaverse crypto, consider the underlying technology, development team, adoption and popularity of the metaverse platform, partnerships with established brands, and the overall market conditions.

It's essential to conduct thorough research, assess the risks involved, and consult with a qualified professional before making any investment decisions.

Q4. Is investing in metaverse coins risky?

Investing in metaverse coins carries inherent risks. The market is highly speculative, and prices can fluctuate significantly.

It's crucial to diversify your investment portfolio, invest only what you can afford to lose, and stay informed about the latest developments and trends in the metaverse industry.

Metaverse crypto coins are playing a pivotal role in shaping the future of virtual economies. These digital currencies enable users to transact within the metaverse, buy and sell virtual assets, and participate in the emerging virtual economy.

While the potential of metaverse coins as investments is promising, it's essential to approach them with caution due to the speculative nature of the market.

Conduct thorough research, assess the underlying technology and development team, and consider the long-term potential before investing in metaverse crypto.

As the metaverse continues to develop and expand, it presents exciting opportunities for innovation and growth in various industries. Stay informed, diversify your investment portfolio, and embrace the potential of the metaverse.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

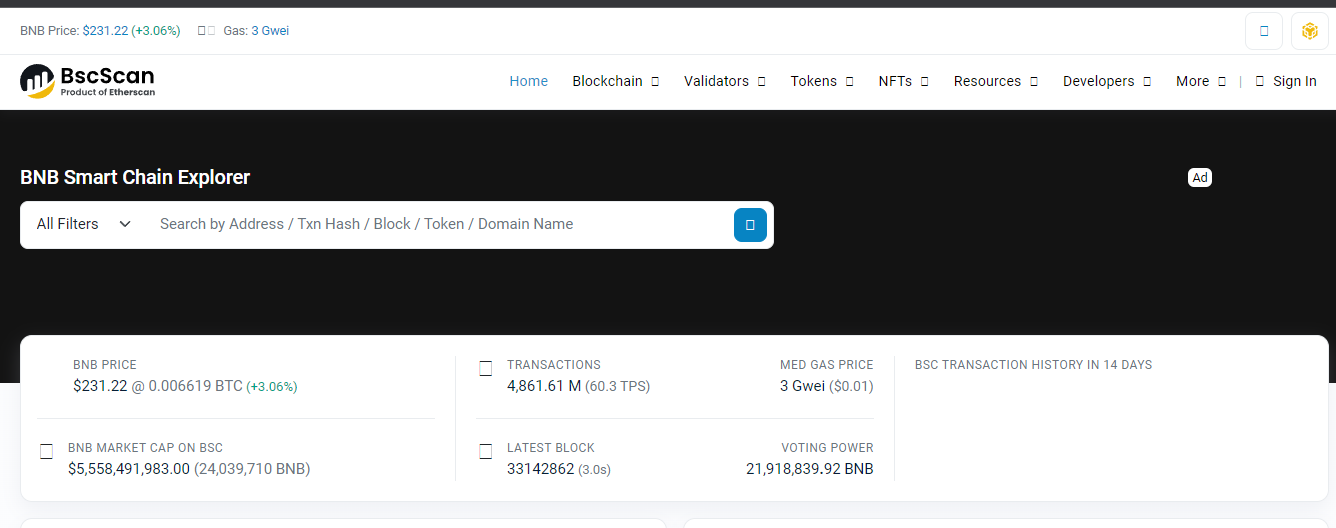

Blockchain technology has revolutionized the world of finance and decentralized applications. As the popularity of cryptocurrencies grows, so does the need for reliable tools to navigate and explore different blockchain networks.

BscScan is a tool designed explicitly for the Binance Smart Chain (BSC). In this comprehensive guide, we will delve into the intricacies of BscScan, its functionalities, and how to make the most of this powerful blockchain explorer.

BscScan is the premier blockchain explorer for the Binance Smart Chain (BSC), developed by the same team responsible for creating Etherscan. Launched in 2020, BSC has rapidly gained popularity as a scalable and efficient blockchain network for decentralized applications and digital assets.

BscScan provides users with a comprehensive view of the BSC ecosystem, allowing them to explore wallet addresses, track transactions, verify intelligent contracts, and analyze token data.

As a blockchain explorer, BscScan acts as a search engine for the BSC network, providing real-time information about transactions, blocks, addresses, and smart contracts.

It offers a user-friendly interface that makes navigating and extracting valuable insights from the BSC blockchain accessible. Whether you are a developer, investor, or blockchain enthusiast, BscScan is an indispensable tool for interacting with the BSC network.

Real-Time Transaction Tracking

One of the core functionalities of BscScan is its ability to track transactions on the Binance Smart Chain in real time. By entering the transaction hash or wallet address, users can retrieve detailed information about a specific transaction, including the transaction amount, date, block number, balances, transaction fees, and status.

This feature is handy for individuals who want to monitor the progress of their transactions or verify the authenticity of a particular transaction on the BSC network.

Exploring Wallet Addresses

BscScan allows users to explore wallet addresses on the Binance Smart Chain, providing a comprehensive overview of transaction history, token balances, and other relevant information.

Users can access details such as BNB balance, BEP-20 token holdings, transaction data, and more by entering a wallet address into the search bar.

This feature enables users to gain insights into the activity of specific wallets and track the movement of digital assets on the BSC network.

Smart Contract Verification

Smart contracts are an integral part of the Binance Smart Chain ecosystem, enabling the creation and execution of decentralized applications.

BscScan offers an intelligent contract verification feature, allowing users to verify the authenticity and integrity of smart contracts deployed on the BSC network.

By comparing the compiled code of a smart contract with the code running on the blockchain, users can ensure that the contract functions as intended and mitigate the risk of potential vulnerabilities or malicious activities.

Token Tracking and Analysis

BscScan allows users to track and analyze tokens on the Binance Smart Chain. Users can access information about the top BEP-20 tokens, including prices, volume, market capitalization, number of holders, and cross-chain compatibility.

Additionally, BscScan supports ERC-721 and ERC-1155 tokens, making it possible to explore and track non-fungible tokens (NFTs) on the BSC network.

This feature is invaluable for investors and traders looking to stay updated on the performance and trends of different tokens within the BSC ecosystem.

Gas Price Monitoring

Gas fees are essential to any blockchain network, including Binance Smart Chain. BscScan offers a gas price monitoring feature, allowing users to view real-time information about gas fees on the BSC network.

By monitoring gas prices, users can make informed decisions about transaction fees and navigate the network efficiently. This feature is handy during periods of high network congestion when gas fees tend to fluctuate.

BscScan provides a user-friendly interface that makes it easy for users to navigate and extract valuable information from the Binance Smart Chain. In this step-by-step guide, we will walk you through using BscScan's key features.

While BscScan and Etherscan share similarities as blockchain explorers, the two platforms have some key differences. Here are the main distinctions:

BscScan and Etherscan are reputable and reliable explorers, offering valuable insights into their respective blockchain networks.

While BscScan is the leading blockchain explorer for the Binance Smart Chain, several alternative explorers are available for users. Here are a few notable options:

These alternatives provide users with different interfaces and functionalities, allowing them to choose the explorer that best suits their needs.

As a leading blockchain explorer, BscScan is developed by the same team behind Etherscan, which has established a strong reputation in the blockchain community.

BscScan is safe to use, as it does not require a connection to your BSC wallet and cannot access or acquire your funds. However, it is essential to exercise caution and verify that you are using the official BscScan website (bscscan.com) to avoid potential phishing attempts.

Always double-check the URL and ensure that you are on the correct website before entering any sensitive information.

Yes, BscScan is fully compatible with non-fungible tokens (NFTs). Like Ethereum, the Binance Smart Chain hosts various NFT projects, taking advantage of its lower fees and higher efficiency.

Users can track their NFTs on BscScan using the transaction hash, NFT intelligent contract address, or wallet address. However, it is essential to note that BscScan does not display the artwork contained within an NFT.

Users must connect to a compatible marketplace or service provider supporting the specific NFT token standard to view the artwork.

Q1. How to check if liquidity is locked on BscScan?

To determine if liquidity is locked for a specific token on BscScan, you can follow these steps:

Q2. Can BscScan be used for other blockchain networks?

No, BscScan is designed explicitly for the Binance Smart Chain and cannot be used to explore other blockchain networks. Each blockchain has its dedicated explorer, such as Etherscan for Ethereum or Blockchain for Bitcoin.

If you need to explore a different blockchain, using the corresponding blockchain explorer for accurate and relevant information is recommended.

Q3. What are the advantages of using BscScan for yield farming?

BscScan offers several advantages for users engaged in yield farming on the Binance Smart Chain:

Q4. Can I revoke token approvals using BscScan?

Yes, BscScan provides the "Token Approval Checker" tool that allows users to review and revoke token approvals for decentralized applications (DApps).

Connecting your wallet to BscScan and using the Token Approval Checker lets you see which DApps can access your tokens and revoke their permissions if desired. This feature gives users more control over their token holdings and helps ensure the security of their assets.

Q5. How does BscScan ensure contract verification?

BscScan's contract verification process involves comparing the source code of a smart contract with the compiled code running on the Binance Smart Chain.

This process ensures that the code deployed on the blockchain matches the source code provided by the developer.

BscScan's verification process enhances transparency and security by allowing users to verify intelligent contracts' functionality and integrity independently.

Q6. What are the risks of using BscScan?

While BscScan is a reputable and reliable blockchain explorer, some risks are associated with using any online tool. It is essential to be cautious and follow best security practices when using BscScan or any other blockchain explorer:

Q7. How can I contribute to the BscScan community?

If you are interested in contributing to the BscScan community, there are several ways to get involved:

Your contributions can help enhance the functionality and usability of BscScan for the entire Binance Smart Chain community.

BscScan is a powerful and essential tool for navigating the Binance Smart Chain ecosystem. Whether you are an investor, developer, or blockchain enthusiast, BscScan provides valuable insights into the BSC network's transactions, smart contracts, tokens, and gas prices.

By leveraging BscScan's features, you can make more informed decisions, track your investments, and ensure the security of your digital assets. Explore BscScan today and unlock the full potential of the Binance Smart Chain.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Welcome to this comprehensive analysis of the next crypto bull run. In this article, we will delve into the predictions and analysis provided by various experts in the field.

We will explore the start and end dates of the bull run, Bitcoin price predictions, and the projected total crypto market cap. So, if you want to make life-changing crypto returns, stay tuned!

To understand the credibility of the predictions we'll be discussing, let's take a moment to introduce Ian Balina. He is the founder and CEO of Token Metrics, an AI and data-driven company that rates crypto assets.

With a track record of building successful companies and raising millions in capital, Ian has become a prominent figure in the crypto space.

Ian's journey in crypto began in 2016 when he turned $20,000 into over $5 million in less than 12 months. This impressive feat caught the attention of many, prompting him to share his investment strategies and predictions transparently.

Now, with his expertise and data-driven approach, Ian aims to help others navigate the crypto market and find significant opportunities.

One of the critical aspects of predicting the next crypto bull run is identifying the start dates. Ian Balina suggests using the Bitcoin halving as a pivot point for determining when the bull run begins. Historically, Bitcoin experiences a surge in price after each halving event.

Looking at past cycles, we can see that Bitcoin went up over 90x after the halving in 2012 and around 30x after the halving in 2016. Based on this pattern, Ian predicts that the next bull run will start around April 2024, aligning with the anticipated Bitcoin halving.

Now, let's focus on the highly anticipated Bitcoin price predictions. Ian Balina's analysis leads him to believe that Bitcoin has the potential to reach $150,000 in the next bull run. Considering the current price of BTC is around $30,000, this implies a 4.5x return on investment.

While some argue that the ROI decreases with each cycle, it's important to note that the gains are still substantial. Investing in Bitcoin during the bull run could yield significant profits, but the real money-making opportunities lie in identifying promising altcoins that outperform the market.

Determining the end dates of the crypto bull run is crucial for maximizing profits and planning investment strategies. Based on historical data and lengthening bull run patterns, Ian Balina presents three possible scenarios for the end dates.

In the bear case scenario, where the bull run follows a 15% increase in length compared to the previous cycle, the bull run is expected to end around March 2026. The base case scenario, which assumes a 25% increase in length, suggests the bull run could last until June 2026.

For the most optimistic scenario, the moon case, with a 40% increase in length, the bull run could extend all the way to November 2026. These timelines provide a range of possibilities for investors to strategize and make the most of the bull run.

As the crypto market continues to grow, it's essential to assess the potential market cap and overall value of cryptocurrencies. Ian Balina's analysis takes into account the historical trends of the crypto market cap during previous bull runs.

In the bear case scenario, where the ROI reduction is 2.5x, the total crypto market cap is predicted to reach around 8 trillion dollars by March 2026. Moving to the base case scenario, with a 2x reduction in ROI, the market cap could climb to 10 trillion dollars by June 2026.

For the moon case scenario, assuming a 1.5x reduction in ROI, the market cap has the potential to skyrocket to 14 trillion dollars by November 2026. These projections indicate significant growth in the crypto market, providing ample opportunities for investors to capitalize on the bull run.

To summarize the predictions we've discussed, the next crypto bull run is projected to start around April 2024, with Bitcoin potentially reaching $150,000. The bull run is expected to last until at least March 2026, with the total crypto market cap ranging from 8 trillion to 14 trillion dollars.

While these predictions are not set in stone and should be considered speculative, they offer valuable insights for investors looking to make informed decisions in the crypto space. It's crucial to conduct thorough research and consider multiple factors before making any investment choices.

In conclusion, the next crypto bull run holds immense potential for investors seeking to make life-changing money. With the guidance of experts like Ian Balina and the data-driven approach of companies like Token Metrics, it's possible to navigate the crypto market with confidence.

Remember, while Bitcoin may provide substantial returns, the real opportunities lie in identifying promising altcoins that can outperform the market. By leveraging the predicted start and end dates of the bull run and considering the projected total market cap, investors can position themselves for success.

As always, it's essential to conduct your research, stay informed about market trends, and assess the risks involved in crypto investments. With a strategic approach and a thorough market understanding, you can maximize your potential gains during the next crypto bull run.

So, get ready, stay informed, and embark on your crypto investment journey with optimism and caution. The next bull run awaits, and it's up to you to seize the opportunities it presents. Good luck, and happy investing!

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

The cryptocurrency world has become a dynamic hub of opportunities for savvy investors looking to make substantial profits. With the right strategies and a keen eye for emerging trends, anyone can achieve mind-boggling investment returns.

In this comprehensive guide, we will explore the secrets to making money in crypto and uncover the path to 100x returns.

Before we delve into the strategy, it's essential to understand the expertise and know the individual behind it. Ian Balina, the founder and CEO of Token Metrics, is a renowned figure in the crypto world.

With a background in computer engineering and experience as a sales engineer at IBM and a consultant at Deloitte Consulting, Ian brings a unique blend of technical knowledge and business acumen.

He turned $20,000 into over $5 million in less than 12 months using a data-driven approach. With his vast experience and proven track record, Ian's insights into the crypto market are highly sought after.

When making 100x returns in the crypto market, Ian Balina has developed a three-point strategy that forms the foundation of his approach. These three points are quality, tokenomics, and valuation.

Quality - The Key to Successful Crypto Investments - Investing in quality crypto assets is crucial for long-term success. By assessing the fundamentals and technology behind a project, you can determine its growth potential. Factors such as on-chain traction, active wallets, community size, and the team's background play a significant role in evaluating the quality of a crypto asset. Additionally, analyzing the code quality, developer activity, and security audits provides insights into the technological aspect of the project.

Tokenomics: Evaluating the Long-Term Value - Understanding the tokenomics of a crypto asset is essential to identify its long-term value. Factors such as supply and demand dynamics, economic incentives, and the token's utility within the ecosystem are crucial in determining whether it's worth holding for the long term.

By assessing the balance between supply and demand and analyzing the market's perception of the asset, you can gauge its growth potential.

Valuation: Identifying Undervalued Gems - Finding undervalued crypto assets is the key to unlocking substantial returns. By comparing the fully diluted valuation (FDV) with the market capitalization, you can identify potential discrepancies.

Additionally, analyzing the asset's valuation compared to its competitors within the sector provides valuable insights into its growth potential. Value investing principles, such as buying low and selling high, form the basis of this valuation strategy.

Before we dive deeper into the strategies, let's define what precisely a 100x return means in the crypto world. A 100x return refers to multiplying your investment by 100, resulting in a whopping 10,000% return.

For example, turning $10,000 into $1 million or $1,000 into $100,000 would be considered a 100x return. Achieving such astronomical returns requires identifying crypto assets with tremendous growth potential and investing in them at the right time.

To illustrate the potential for 100x returns, let's examine the success story of Solana. Solana, a blockchain platform, delivered over 1000x returns to early venture capital (VC) investors. By analyzing the various funding rounds and the subsequent performance of Solana's token, we can gain insights into the strategies that led to such impressive returns.

In March 2018, Solana raised over $3 million in its seed round for 4 cents per token. At this early stage, the project had only released version 0.1 of its whitepaper.

Fast forward to the all-time high of Solana's token, which reached almost $260, and VC investors who participated in the seed round achieved an incredible 6500x return on their investment.

Solana's journey continued with additional funding rounds, each contributing to the project's growth and increasing the potential for substantial returns. In June 2018, Solana raised $12 million at 20 cents per token shortly before launching its private test net.

In July 2019, another funding round resulted in over $5 million raised at 22.5 cents per token, just before the public test net launch. Finally, in February 2020, right before the main net launch, an additional $2.4 million was raised at 25 cents per token.

Another avenue to achieve 100x returns in crypto is through launchpads, which provide opportunities for retail investors to participate in early-stage projects.

One such success story is Matic, now known as Polygon, which launched through the Binance Launchpad. By analyzing Matic's journey, we can understand how early investors achieved impressive returns.

Seed investors who got in early on Matic received the tokens for 0.0079, which proved to be an incredible bargain. With the all-time high reaching almost 300x the seed price, seed investors who held their tokens experienced a staggering 3700x return. Turning $10,000 into $37 million showcases the potential for substantial gains through early-stage investments.

Retail investors who participated in the Binance Launchpad event for Matic also reaped significant rewards. With a launchpad sale price of 0.00263, retail investors achieved a remarkable 1100x return if they held their tokens until the all-time high.

Even with a modest investment of $300, these retail investors saw their holdings grow to over $300,000, demonstrating the potential for 100x returns through launchpad participation.

Mining cryptocurrencies can be another avenue to achieve 100x returns. By dedicating computing power to secure blockchain networks, miners are rewarded with newly minted tokens. One project that exemplifies the potential for significant returns through mining is Helium.

Helium is a project that enables individuals to mine tokens by sharing their internet connection through specialized devices called hotspots. By participating in the Helium network, miners earn HNT tokens as a reward.

With the all-time high price of HNT reaching almost $55, early miners experienced a remarkable 500x return on their investment. This showcases the potential for substantial gains through mining endeavors in the crypto market.

While the crypto market can be volatile, it's still possible to achieve 100x returns even in bearish conditions. One project that exemplifies the potential for significant gains during a bear market is Kaspa.

Kaspa is a proof-of-work blockchain project that experienced a 100x return during a bear market. Despite the challenging market conditions, Kaspa's fair launch approach and favorable economics allowed early investors to achieve substantial returns.

With the all-time low price of 0.00017 and the all-time high reaching $0.05, investors who held their positions saw their investments multiply by 100x.

When investing in cryptocurrencies, it's crucial to assess the quality of the underlying projects. Evaluating the fundamentals and technology behind a crypto asset provides valuable insights into its potential for growth.

Examining the fundamentals of a crypto asset involves analyzing factors such as on-chain traction, active wallets, community size, and the team's background. By understanding the project's fundamentals, investors can gain confidence in its long-term viability and growth potential.

The technological aspect of a crypto project is equally important. Assessing factors such as developer activity, security audits, and code quality provides insights into the project's technical robustness. A solid technological foundation indicates the potential for innovation and long-term success.

Understanding the tokenomics of a crypto asset is crucial for identifying its long-term value. By analyzing supply and demand dynamics, economic incentives, and the token's utility within the ecosystem, investors can assess whether the asset is worth holding for the long term.

Analyzing the supply and demand dynamics of a crypto asset is essential to gauge its growth potential.

A balanced supply and demand relationship ensures stability and sustainable value appreciation. Factors such as token issuance mechanisms and token utility within the ecosystem play a significant role in determining the asset's potential.

Economic incentives within a crypto ecosystem are vital for driving value creation. By examining factors such as staking rewards, token burns, and revenue-sharing mechanisms, investors can gain insights into the potential for token appreciation. Projects with well-designed economic models attract long-term investors and create a strong foundation for growth.

Identifying undervalued crypto assets is the key to achieving substantial returns. By comparing the fully diluted valuation (FDV) with the market capitalization, investors can identify potential discrepancies in the market's pricing.

Additionally, analyzing the asset's valuation compared to its competitors within the sector provides valuable insights into its growth potential.

Value investing principles can be applied to crypto asset valuation. By identifying assets with a margin of safety, investors can capitalize on market mispricing and achieve significant returns.

Buying assets below their intrinsic value provides a buffer against market fluctuations and sets the stage for substantial gains.

To illustrate the importance of valuation, let's compare two projects: Injective Protocol and SEI Network. By analyzing their respective valuations and market positions, we can gain insights into their growth potential.

Injective Protocol: Unleashing the Power of Decentralized Exchanges

Injective Protocol aims to revolutionize the decentralized exchange landscape. With a fully diluted valuation of $1.2 billion and a market capitalization of $400 million, there is room for growth.

Analyzing the project's fundamentals, technology, and competitive landscape provides valuable insights into its potential for value appreciation.

SEI Network: Tapping into the Power of NFTs

SEI Network focuses on the non-fungible token (NFT) space, aiming to bring unique digital assets to the forefront.

With a fully diluted valuation of $200 million and a market capitalization of $100 million, SEI Network is undervalued compared to its competitors. Assessing the project's fundamentals, technology, and market positioning provides valuable insights into its growth potential.

Based on the strategies outlined and the analysis conducted, I am excited to share my 100x crypto picks. These picks represent projects that exhibit strong fundamentals, promising tokenomics, and the potential for significant valuation growth.

Making money in the crypto market requires strategic thinking, thorough analysis, and a willingness to take calculated risks. By focusing on quality projects, evaluating tokenomics, and identifying undervalued assets, investors can position themselves for substantial gains.

However, it's essential to conduct thorough due diligence and stay informed about market trends and developments. With the knowledge and strategies outlined in this guide, you are well-equipped to navigate the crypto market and unlock the potential for 100x returns.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Shiba Inu, a viral meme coin that emerged in 2020, has drawn significant attention in crypto trading. This article will provide an in-depth Shiba Inu Price Prediction for 2025, 2030, and 2040.

We will analyze its historical performance, current fundamentals, and industry experts' opinions. Additionally, we will explore whether Shiba Inu is a good investment and when it might reach 1 cent. The goal is to aid potential investors in making informed decisions.

Shiba Inu, also known as SHIB, is a decentralized cryptocurrency introduced in August 2020. It was created by an unknown entity known as 'Ryoshi.' SHIB operates on the Ethereum platform and is an ERC-20 token.

The total supply of Shiba Inu coins is a staggering one quadrillion. This meme-inspired token gained popularity due to celebrity endorsements, primarily from Tesla CEO Elon Musk.

Shiba Inu's historical performance provides insight into its price volatility and growth potential.

Despite experiencing a significant dip in its first year of trading, Shiba Inu witnessed an astronomical growth of 43,220,000% in 2021, reaching an all-time high of $0.00008819 in October 2021. Shiba Inu is trading at $0.0000079 as of the time of writing.

Shiba Inu's potential for future growth can be extrapolated from its current fundamentals—a significant development and focus on Shibarium, a layer-2 solution for the Shiba Inu ecosystem.

Shibarium is expected to lower transaction costs, expedite transactions, and improve overall performance. It could boost Shiba Inu's scalability and reach a broader user base.

Amidst the dynamic crypto landscape, Shiba Inu (SHIB) presents intriguing possibilities. Currently priced at $0.0000079 with a market cap of $4.72B, SHIB's potential is tethered to the total crypto market cap. Should the crypto market cap hit $3 Trillion, and if SHIB retains its current 0.36% dominance, its price could ascend to $0.0000184383.

In a more bullish scenario of the crypto market surging to $10 Trillion, SHIB's price could soar to a staggering $0.0000614612, resulting in a potential 7x return for investors.

This prospective growth showcases the coin's potential amidst a booming crypto market. Investors should remain vigilant and consider various factors before making decisions.

Various industry experts and analytical tools have made their Shiba Inu price predictions. For instance, Wallet Investor forecasts Shiba Inu's price to drop by over 80% in one year. In contrast, The Coin Republic believes the recent spike in whale activity could propel SHIB's price, leading to a strong uptrend.

Shiba Inu Price Prediction for 2025

The Shiba Inu Price Prediction for 2025 varies depending on the source. Coincodex.com platform predicts it could reach $0.00001442 to $0.00005804, and experts from Changelly predict it could reach minimum and maximum prices of $0.000020148 and $0.0000237876

Shiba Inu Price Prediction for 2030

According to Coincodex.com, by 2030, the Shiba Inu Price is predicted to be between $0.00004156 and $0.00005261.

Shiba Inu Price Prediction for 2040

Predicting the Shiba Inu Price for 2040 is challenging due to the long time frame and the volatile nature of the crypto market. However, some forecasts suggest continued growth based on the coin's historical performance and potential future developments.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Shiba Inu can be a good investment for high-risk investors due to its potential for high returns. However, its volatility and the uncertain nature of the meme coin market make it a risky venture.

However, with strong community backing and ongoing developments, it may provide significant returns for high-risk investors.

Many investors and traders eagerly anticipate when Shiba Inu reaches the 1 cent mark. However, this may not be possible considering the current circulating supply of 589 trillion tokens.

And to reach a value of $1, the market cap of Shiba Inu would have to be $589 trillion, which is currently unattainable.

However, introducing a burn rate mechanism with Shibarium could increase deflationary pressure on the currency, which may, in turn, push its value higher.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Shiba Inu is a cryptocurrency that has garnered significant attention due to its popularity. However, it's essential to understand that investing in Shiba Inu comes with its own set of risks and rewards.

On the one hand, Shiba Inu has gained popularity for its low price and the potential positive impact of Shibarium, a decentralized exchange developed by the Shiba Inu team. This could potentially lead to substantial returns for investors in the long term.

On the other hand, the volatile nature of meme coins and competition from newer coins could affect their market value adversely. Additionally, the lack of a clear roadmap and whitepaper for the project might make it challenging to understand its long-term goals and growth potential.

Therefore, doing your research before investing in Shiba Inu is essential. You should consider the potential risks and rewards and evaluate whether they align with your investment strategy and risk tolerance.

Also Read - Is Shiba Inu Dead?

In conclusion, Shiba Inu is a high-risk, high-reward investment. Its future growth will largely depend on several factors, including the Shibarium, continued support from its community, and overall market conditions. As always, potential investors should do their homework before jumping in.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Aave, often regarded as a cornerstone of decentralized finance (DeFi), is a beacon of innovation in the ever-evolving cryptocurrency landscape. As we venture into the realm of cryptocurrencies, understanding the essence of Aave is paramount.

In this article, we'll explore Aave's historical performance, current fundamentals, and potential for long-term investment. Discover what industry experts say and evaluate the risks and rewards of investing in Aave.

Aave's journey has been nothing short of spectacular. From its inception, Aave has continually adapted and expanded, redefining the DeFi landscape. Its historical data showcases significant growth and resilience, which has attracted the attention of both institutional and retail investors.

At the core of Aave's fundamentals lies its robust lending and borrowing protocols, fostering an active ecosystem. It boasts impressive metrics, including Total Value Locked (TVL), a crucial indicator of Aave's utility in the DeFi space. Moreover, its governance model allows AAVE token holders to have a say in the platform's direction.

Prominent crypto analysts and experts anticipate a promising future for Aave. Their predictions are rooted in Aave's track record of innovation and DeFi dominance. While we should approach price predictions with caution, experts suggest that Aave has the potential to appreciate significantly in the long term.

In 2023, various sources have weighed in on Aave's potential price range. Here's a comprehensive summary:

Moving into 2024, the predictions continue:

Please note that these are predictions, and actual results may vary. It's always recommended to do your research before making any investment decisions.

Also Read - Ripple (XRP) Price Prediction

The answer depends on your investment goals and risk tolerance. As a pioneering DeFi platform, Aave continues to set the bar high.

Its innovative lending and borrowing solutions make it an attractive choice for long-term investors looking to diversify their portfolios.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

As with any investment, Aave comes with its risks and rewards. The DeFi sector, while innovative, is not immune to market volatility and regulatory changes.

Investors must weigh these potential risks against the rewards, which include the opportunity to earn interest through lending and liquidity provision.

The future potential of AAVE is rooted in its continued development and innovation. Aave's roadmap includes improvements in scalability and security, demonstrating its commitment to staying at the forefront of DeFi. As DeFi expands, Aave is well-positioned to maintain its pivotal role.

Q1. What is Aave's core offering?

Aave primarily focuses on decentralized lending and borrowing, offering a wide array of assets for users to engage with.

Q2. How can I participate in Aave's governance?

AAVE token holders can participate in the platform's governance by voting on proposals and contributing to its direction.

Q3. What distinguishes Aave from other DeFi platforms?

Aave stands out with its innovative flash loans, efficient collateral management, and active ecosystem, setting a high standard in the DeFi space.

Q4. How can I assess Aave's potential for the long term?

Aave's potential for the long term can be evaluated by considering its fundamentals, roadmap, and industry expert opinions. However, please remember that investing in cryptocurrencies carries inherent risks.

Q5. Where can I find a more in-depth analysis of Aave's long-term potential?

To delve deeper into Aave's long-term potential, we recommend using the Token Metrics AI analytical tools, consulting various crypto industry experts, reading whitepapers, and staying updated with the latest developments in the DeFi space.

Crypto experts and analysts from the industry share their thoughts on Aave's long-term potential:

Aave has demonstrated its resilience, innovation, and fundamental strength in the dynamic DeFi landscape. While the potential for long-term growth is promising, investors must research, evaluate risks, and consider expert opinions when deciding if Aave aligns with their investment objectives. Remember, the crypto world is ever-evolving, and vigilance is essential when considering any investment.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

The ever-evolving world of cryptocurrency has introduced many investment options, with one of the latest being Crypto ETFs. But what exactly are they, and how do they function?

This comprehensive guide delves into Crypto ETFs, ensuring you're well-equipped with actionable insights and up-to-date knowledge.

A Crypto ETF, or Cryptocurrency Exchange-Traded Fund, bridges traditional finance and the digital currency. At its core, a Crypto ETF is an investment fund and exchange-traded product listed on conventional stock exchanges.

Instead of buying individual cryptocurrencies directly and managing complex wallets and private keys, investors can purchase shares of a Crypto ETF. This fund then invests in and holds cryptocurrencies, mirroring their market performance.

Whether tracking a single coin like Bitcoin or a diversified array of digital assets, Crypto ETFs offer a more accessible and regulated way for investors to gain exposure to the volatile cryptocurrency markets.

Grasping the functionality of Crypto ETFs is pivotal for any prospective investor. These funds, although reminiscent of traditional ETFs, come with their own set of distinct operations:

Cryptocurrency Reserves: Every Crypto ETF has a reserve of the actual digital currencies it represents, safeguarded in highly secure storage solutions. This real-world backing ensures the ETF accurately mirrors its underlying assets' performance.

Price Alignment: Whether representing a single cryptocurrency like Bitcoin or a compilation, these ETFs use well-established crypto indexes to ensure accurate price tracking.

Liquidity Mechanics: Large-scale institutional investors, often termed 'Liquidity Providers,' play a crucial role. They step in to buy or sell the ETF's shares, ensuring its market price stays close to the actual value of the underlying assets.

Dividend Distribution: Unlike direct cryptocurrency holdings, which don't yield dividends, some Crypto ETFs might offer dividend-like distributions sourced from network transaction fees or other avenues.

The landscape of Crypto ETFs is diverse, catering to various investment strategies and appetites.

Single-Crypto ETFs: These ETFs focus exclusively on one cryptocurrency. For instance, an ETF that only tracks Bitcoin would belong to this category. Investors looking to target the performance of a particular digital currency might opt for these.

Basket-Crypto ETFs: Offering a more diversified approach, these ETFs track a group or portfolio of cryptocurrencies. This can help spread risk, as the performance isn't reliant on just one digital asset. This type is ideal for those seeking broader exposure to the crypto market.

Themed Crypto ETFs: Some ETFs are tailored to specific themes or niches within the crypto world. For instance, ETFs focus on the DeFi sector or the burgeoning NFT space. These cater to investors with a specific interest or belief in the potential of particular crypto sectors.

Leveraged and Inverse Crypto ETFs: These are more complex and potentially riskier. Leveraged ETFs aim to amplify returns by using financial derivatives.

On the other hand, inverse ETFs are designed to profit from a decline in the value of an underlying benchmark. Both types require a deeper understanding of market mechanisms and have heightened risks.

Each ETF type offers a unique risk-reward profile, catering to various investment strategies and objectives.

Investing in Crypto ETFs might seem daunting, but by following a structured approach, you can simplify the process:

Educate Yourself: Understand the mechanics of Crypto ETFs, their fee structure, and the cryptocurrencies they track. Some ETFs might focus on one crypto, while others offer a diversified portfolio.

Select a Reliable Brokerage: Opt for a trusted brokerage platform that accesses the desired Crypto ETFs. Many traditional brokerages have expanded their offerings to include these funds.

Diversify Wisely: Don't put all your eggs in one basket. Consider a mix of ETFs to balance out potential risks.

Stay Updated: The crypto market is ever-evolving. Regularly review your investments and adjust as market dynamics shift.

Navigating the investment landscape of Crypto ETFs means understanding both the advantages they offer and the pitfalls to be wary of:

Benefits:

Risks:

Crypto ETFs have gained traction for several reasons:

Accessibility: They provide an entry point for traditional investors to gain exposure to the crypto market without owning digital assets.

Diversification: Some ETFs track multiple cryptocurrencies, providing instant diversification across the volatile crypto market.

Regulation: Being traded on stock exchanges means they fall under traditional financial systems' scrutiny and regulatory framework.

Investing in a Crypto ETF offers a balanced entry into the dynamic world of digital currencies. For those wary of direct crypto ownership, these ETFs provide a more regulated and accessible avenue. They combine the diversification benefits of traditional ETFs with the potential growth of the crypto sector.

However, like all investments, they come with risks—chief among them being the inherent volatility of cryptocurrencies. Investors must thoroughly research their risk tolerance and investment horizon before diving into any Crypto ETF.

Q1. How do Crypto ETF fees compare to traditional ETFs?

While fees vary across different ETFs, it's not uncommon for Crypto ETFs to carry slightly higher management fees due to the specialized nature of the asset class and the need for additional security measures.

Q2. Can I redeem my Crypto ETF shares for the actual cryptocurrency?

Individual investors cannot typically redeem Crypto ETF shares for the underlying cryptocurrency. They can, however, sell their ETF shares on the stock market.

Q3. Are there tax implications when investing in a Crypto ETF?

Like other investment vehicles, Crypto ETFs can have tax implications, especially when selling shares or receiving distributions. It's crucial to consult with a tax advisor to understand specifics.

Q4. How secure are the cryptocurrencies held within a Crypto ETF?

Crypto ETFs prioritize security, often employing advanced custody solutions to protect the underlying assets. This might include cold storage, multi-signature wallets, and other advanced security protocols.

Q5. Do Crypto ETFs offer exposure to emerging or lesser-known cryptocurrencies?

While many Crypto ETFs focus on well-known cryptocurrencies like Bitcoin and Ethereum, some ETFs may provide exposure to altcoins or newer projects, depending on the ETF's objective.

Q6. How does the regulatory environment affect Crypto ETFs?

The regulatory landscape for cryptocurrencies is evolving, and any changes can directly impact Crypto ETFs. This might involve approval processes, operational guidelines, or the overall availability of such ETFs.

Q7. Is the performance of a Crypto ETF identical to its underlying assets?

While Crypto ETFs aim to mirror the performance of the underlying assets, there might be minor discrepancies due to fees, tracking errors, or the ETF's management strategies.

Q8. Can I use Crypto ETFs for my retirement or 401(k) plan?

Some retirement accounts and 401(k) plans may allow for ETF investments, including Crypto ETFs. However, consulting with a financial advisor to understand specific allowances and potential benefits is essential.

Crypto ETFs offer an exciting bridge between traditional finance and the burgeoning space of cryptocurrencies. They present an accessible avenue for newcomers and seasoned investors to delve into digital assets with the familiar framework of stock exchange trading. As with all investments, understanding the associated risks is paramount.

Remember, the cryptocurrency landscape is dynamic, with frequent shifts and developments. Staying informed and making decisions grounded in research and sound understanding will always be your best strategy.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%20Price%20Prediction.webp)

%201.svg)

%201.svg)

The cryptocurrency market is constantly in need of new solutions to improve user interaction with digital assets. One project that has gained attention in the crypto community is the Cosmos network and its internal digital coin, ATOM.

In this article, we will provide an overview of Cosmos, analyze its historical data, discuss its current fundamentals, and explore its long-term price predictions.

We will also examine whether Cosmos is a good investment and address frequently asked questions about the project.

Cosmos is an ecosystem of interconnected blockchains that aims to solve scalability and interoperability challenges in the blockchain industry.

It operates on the Tendermint consensus algorithm and allows independent blockchains, called "zones," to interact through the Cosmos Hub.

The Cosmos network offers fast, secure, and scalable blockchain solutions, making it an attractive option for developers and users.

To understand the potential future price of ATOM, it is essential to analyze its historical performance. ATOM was listed in March 2019 and experienced significant price fluctuations since then.

The coin reached its all-time high of around $44.70 in September 2021 and its all-time low of $1.13 in March 2020. Over the years, ATOM has shown substantial growth potential, with an average yearly increase of 276%.

As of the date of this article, the live price of Cosmos (ATOM) is around $7.06, with a market cap of $2,068,004,473

The current trading volume stands at $111,146,060. It is essential to consider these fundamentals when making price predictions for ATOM.

In the ever-evolving cryptocurrency landscape, Cosmos (ATOM) offers intriguing possibilities. Currently trading at $7.06 with a market capitalization of $2.07 billion, ATOM's potential is intricately linked to the total cryptocurrency market capitalization.

Should the cryptocurrency market cap reach $3 trillion, and if Cosmos (ATOM) maintains its current 0.16% market share, its price could rise to $16.31.

Taking a more bullish outlook with the crypto market expanding to $10 trillion, Cosmos (ATOM) might reach an impressive $54.39 per token, offering investors a potential 7x return on their investments.

This outlook underscores the coin's substantial potential in a thriving crypto market. Nonetheless, investors should exercise due diligence, considering a range of factors, before making informed decisions.

Industry experts have varying opinions on the long-term price prediction for Cosmos (ATOM).

Wallet Investor predicts that by 2025, the price of ATOM could range between $5.45 and $10.77.

DigitalCoinPrice forecasts a potential high of $15.61 by 2023 and $26.29 by 2025. These predictions indicate the potential for growth and stability in the long term.

Also Read - XRP Price Prediction

Before considering investing in any cryptocurrency, evaluating its potential risks and rewards is essential. Cosmos has several factors in its favor, such as its innovative technology, strong community support, and partnerships with prominent projects.

However, like any investment, risks include market volatility, regulatory uncertainties, and competition from other blockchain solutions. It is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Investing in Cosmos (ATOM) offers both risks and rewards. On the rewards side, Cosmos has the potential to revolutionize the blockchain industry with its interoperability and scalability solutions.

Its strong development team and growing ecosystem contribute to its long-term prospects. However, there are also risks to consider, such as regulatory challenges, market volatility, and the emergence of competing projects. It is essential to carefully weigh these factors before investing in ATOM.

Despite the risks involved, Cosmos has shown promising potential for the future. Its focus on scalability and interoperability addresses critical challenges in the blockchain industry.

With ongoing developments, partnerships, and community support, Cosmos has the opportunity to become a leading player in the crypto market. However, market conditions and technological advancements will play a significant role in determining its success.

Q1. What is built on Cosmos?

The Cosmos network serves as the underlying blockchain protocol for various projects. It enables interoperability between blockchains and seamless transfer of tokens and data.

Q2. What could be the maximum trade value of ATOM by the end of 2023?

According to industry analyst's predictions, the maximum trade value of ATOM could potentially reach $10.77 by the end of 2023.

Q3. Is Cosmos a profitable investment to buy?

Investing in Cosmos (ATOM) has the potential for profitability, but it is crucial to consider the risks and conduct thorough research before making investment decisions.

Cosmos (ATOM) offers a unique solution to scalability and interoperability challenges in the blockchain industry. Its innovative technology and strong community support make it an attractive investment option.

However, as with any investment, it is essential to carefully consider the risks and rewards before investing in ATOM. Conducting thorough research and seeking professional advice can help make informed investment decisions in the crypto market.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Bitcoin, the world's oldest cryptocurrency, has captured the attention of investors, enthusiasts, and regulators since its inception in 2009.

It has been hailed as a groundbreaking technology that introduced the concept of decentralized currencies and paved the way for a new type of economy - the cryptocurrency market.

Over the years, Bitcoin's price has experienced extreme volatility, leading to various predictions and speculations about its future.

In this article, we will delve into the future of Bitcoin, exploring industry expert opinions, regulatory implications, technological advancements, and market trends.

Bitcoin's journey from obscurity to becoming the most valuable cryptocurrency by market capitalization has been extraordinary.

In 2009, Bitcoin was worth less than a cent, but today, it is trading at approximately $33,917 per coin. This meteoric rise reflects the growing confidence and resilience of Bitcoin as it weathered storms and attempts to change its underlying structure.

Significant events, such as hard forks and the halving event, mark Bitcoin's price history. Hard forks, proposed changes to Bitcoin's underlying rules, represent critical historical junctures.

Despite debates and attempts to change Bitcoin, it has continued in its current format, with forks now accounting for less than 1% of its total market capitalization.

The halving event, roughly every four years, reduces the rate at which new Bitcoins are created. Historically, the halving has catalyzed significant price appreciation, driving Bitcoin to new all-time highs.

Institutional adoption and regulatory developments have also played a crucial role in shaping Bitcoin's future trajectory.

In recent years, Bitcoin has gained increased acceptance and recognition from major institutions and regulators worldwide. BlackRock, the world's largest asset manager, has filed to start an exchange-traded fund (ETF) specifically for Bitcoin, with multiple other institutions following suit.

While there is yet to be an approved BTC ETF by the US Securities and Exchange Commission (SEC), these applications are a significant step forward in legitimizing cryptocurrencies in the eyes of traditional financial institutions.

Another significant development is the return of Bitcoin payments by Tesla. CEO Elon Musk has stated that once Bitcoin hits 50% renewable energy sources, Tesla will resume accepting Bitcoin payments. This move could spark positive price action and drive further interest and adoption of Bitcoin.

Furthermore, a halt in rising interest rates and a return to lower interest rates could be a significant bullish catalyst for Bitcoin.

Cryptocurrencies like Bitcoin offer an attractive alternative investment in a low-interest-rate environment due to their perceived hedge against traditional financial systems and increasing scarcity as the halving event approaches.

The future of Bitcoin is a topic of much speculation and debate. Industry experts have offered various predictions and opinions about Bitcoin's potential trajectory.

One of the most prominent figures in the cryptocurrency space, Cathie Wood, CEO of Ark Invest, has predicted that Bitcoin could reach an astonishing $1.48 million by 2030.