Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

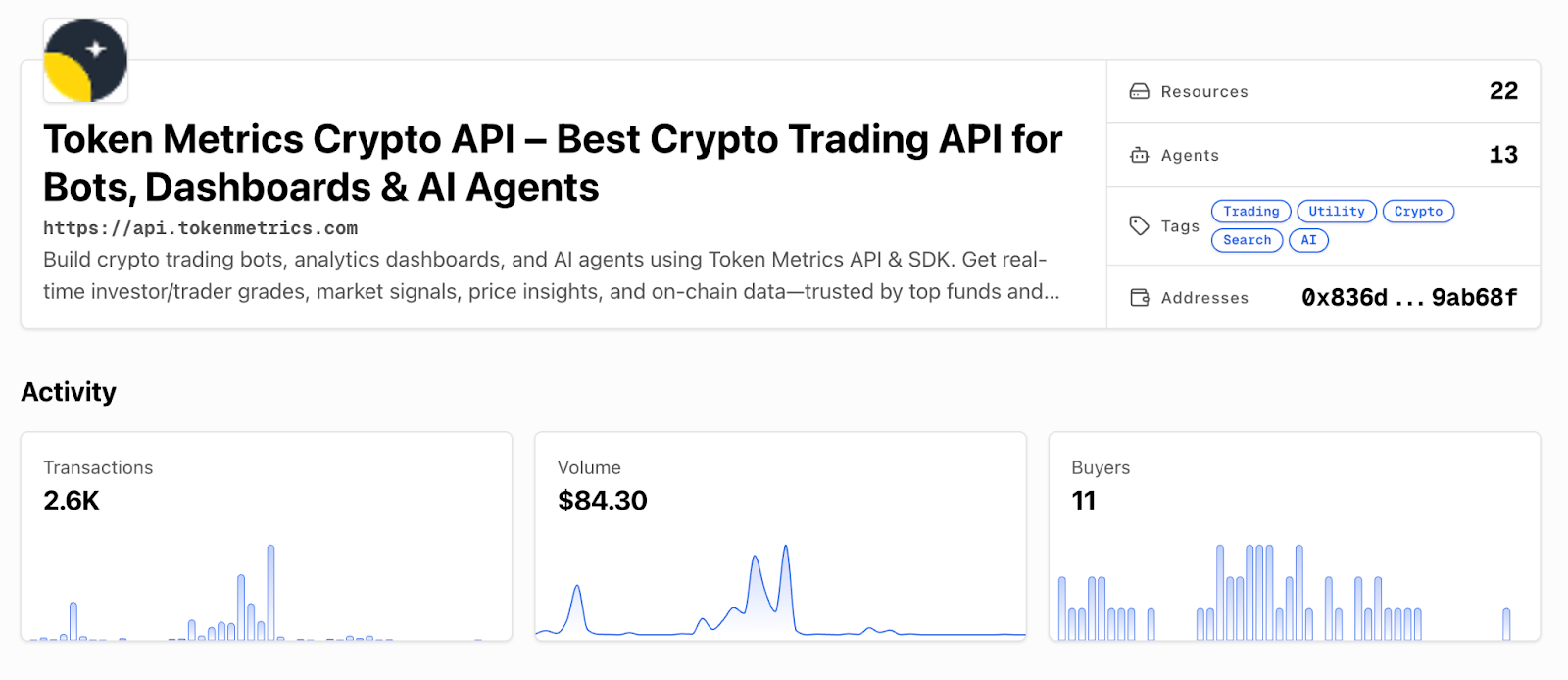

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

DeFi protocols are maturing beyond early ponzi dynamics toward sustainable revenue models. Aave operates in this evolving landscape where real yield and proven product-market fit increasingly drive valuations rather than speculation alone. Growing regulatory pressure on centralized platforms creates tailwinds for decentralized alternatives—factors that inform our comprehensive AAVE price prediction framework.

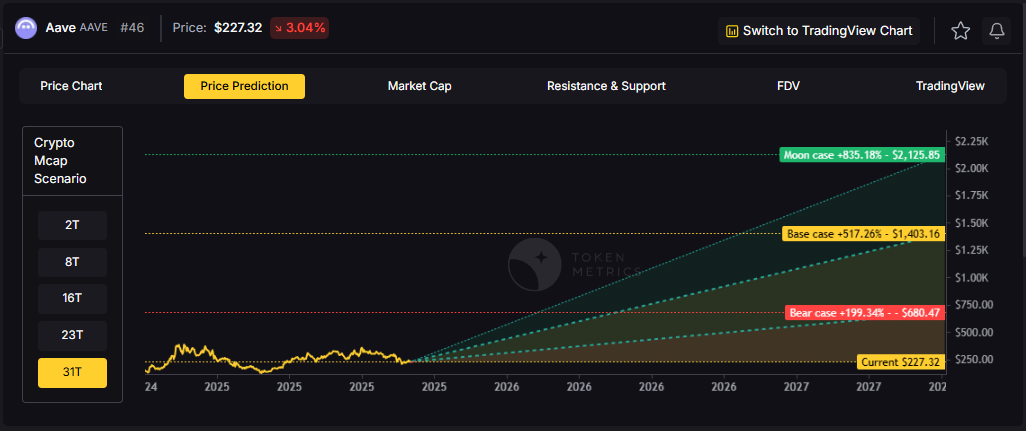

The scenario bands below reflect how AAVE price predictions might perform across different total crypto market cap environments. Each tier represents a distinct liquidity regime, from bear conditions with muted DeFi activity to moon scenarios where decentralized infrastructure captures significant value from traditional finance.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

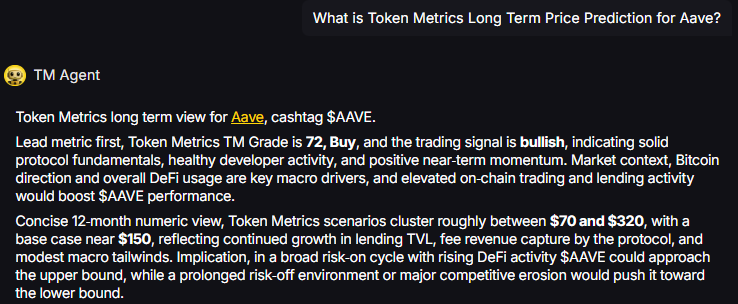

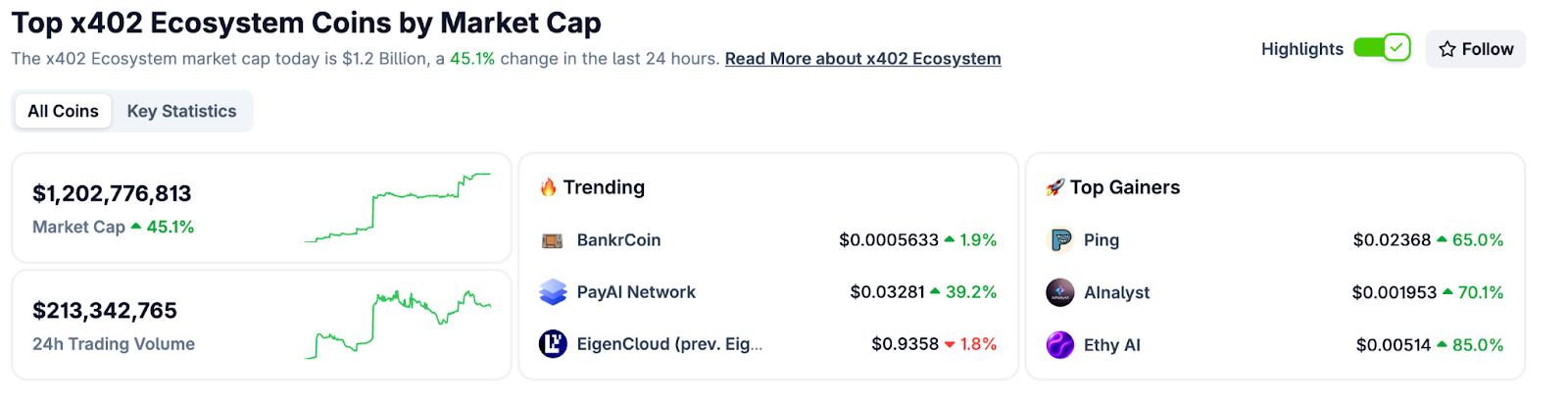

TM Agent baseline: Token Metrics TM Grade is 72, Buy, and the trading signal is bullish, indicating solid protocol fundamentals, healthy developer activity, and positive near-term momentum. Concise twelve-month numeric view, Token Metrics price prediction scenarios cluster roughly between $70 and $320, with a base case near $150, reflecting continued growth in lending TVL, fee revenue capture by the protocol, and modest macro tailwinds.

Live details: Aave Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Our Token Metrics price prediction framework spans four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T Market Cap - AAVE Price Prediction:

At an 8 trillion dollar total crypto market cap, AAVE projects to $293.45 in bear conditions, $396.69 in the base case, and $499.94 in bullish scenarios.

Doubling the market to 16 trillion expands the price prediction range to $427.46 (bear), $732.18 (base), and $1,041.91 (moon).

At 23 trillion, the price prediction scenarios show $551.46, $1,007.67, and $1,583.86 respectively.

In the maximum liquidity scenario of 31 trillion, AAVE price predictions could reach $680.47 (bear), $1,403.16 (base), or $2,175.85 (moon).

Each tier assumes progressively stronger market conditions, with the base case price prediction reflecting steady growth and the moon case requiring sustained bull market dynamics.

Aave represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle AAVE with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Aave is a decentralized lending protocol that operates across multiple EVM-compatible chains including Ethereum, Polygon, Arbitrum, and Optimism. The network enables users to supply crypto assets as collateral and borrow against them in an over-collateralized manner, with interest rates dynamically adjusted based on utilization.

The AAVE token serves as both a governance asset and a backstop for the protocol through the Safety Module, where stakers earn rewards in exchange for assuming shortfall risk. Primary utilities include voting on protocol upgrades, fee switches, collateral parameters, and new market deployments.

Token Metrics AI provides comprehensive context on Aave's positioning and challenges.

Vision: Aave aims to create an open, accessible, and non-custodial financial system where users have full control over their assets. Its vision centers on decentralizing credit markets and enabling seamless, trustless lending and borrowing across blockchain networks.

Problem: Traditional financial systems often exclude users due to geographic, economic, or institutional barriers. Even in crypto, accessing credit or earning yield on idle assets can be complex, slow, or require centralized intermediaries. Aave addresses the need for transparent, permissionless, and efficient lending and borrowing markets in the digital asset space.

Solution: Aave uses a decentralized protocol where users supply assets to liquidity pools and earn interest, while borrowers can draw from these pools by posting collateral. It supports features like variable and stable interest rates, flash loans, and cross-chain functionality through its Layer 2 and multi-chain deployments. The AAVE token is used for governance and as a safety mechanism via its staking program (Safety Module).

Market Analysis: Aave is a leading player in the DeFi lending sector, often compared with protocols like Compound and Maker. It benefits from strong brand recognition, a mature codebase, and ongoing innovation such as Aave Arc for institutional pools and cross-chain expansion. Adoption is driven by liquidity, developer activity, and integration with other DeFi platforms. Key risks include competition from newer lending protocols, regulatory scrutiny on DeFi, and smart contract risks. As a top DeFi project, Aave's performance reflects broader trends in decentralized finance, including yield demand, network security, and user trust. Its multi-chain strategy helps maintain relevance amid shifting ecosystem dynamics.

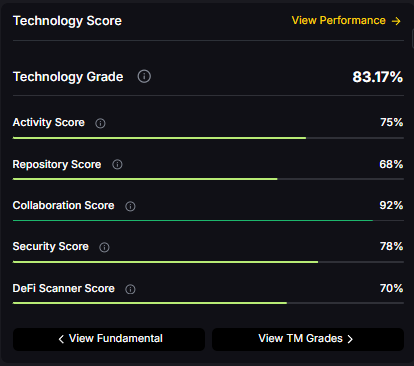

Fundamental Grade: 75.51% (Community 77%, Tokenomics 100%, Exchange 100%, VC 49%, DeFi Scanner 70%).

Technology Grade: 83.17% (Activity 75%, Repository 68%, Collaboration 92%, Security 78%, DeFi Scanner 70%).

Yes. Based on our price prediction scenarios, AAVE could reach $1,007.67 in the 23T base case and $1,041.91 in the 16T moon case. Not financial advice.

At current price of $228.16, a 10x would reach $2,281.60. This falls within the 31T moon case price prediction at $2,175.85 (only slightly below), and would require extreme liquidity expansion. Not financial advice.

Our moon case price predictions range from $499.94 at 8T to $2,175.85 at 31T. These scenarios assume maximum liquidity expansion and strong Aave adoption. Not financial advice.

Our comprehensive 2027 price prediction framework suggests AAVE could trade between $293.45 and $2,175.85, depending on market conditions and total crypto market capitalization. The base case scenario clusters around $396.69 to $1,403.16 across different market cap environments. Not financial advice.

AAVE shows strong fundamentals (75.51% grade) and technology scores (83.17% grade), with bullish trading signals. However, all price predictions involve uncertainty and risk. Always conduct your own research and consult financial advisors before investing. Not financial advice.

Track live grades and signals: Token Details

Want exposure? Buy AAVE on MEXC

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

%201.svg)

%201.svg)

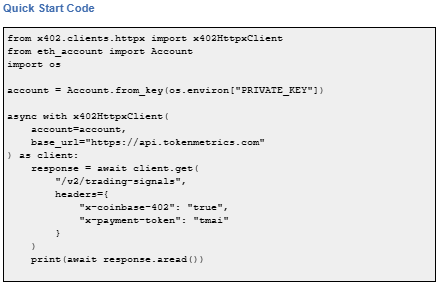

x402 is an open-source, HTTP-native payment protocol developed by Coinbase that enables pay-per-call API access using crypto wallets. It leverages the HTTP 402 Payment Required status code to create seamless, keyless API payments.

It eliminates traditional API keys and subscriptions, allowing agents and applications to pay for exactly what they use in real time. It works across Base and Solana with USDC and selected native tokens such as TMAI.

Start using Token Metrics X402 integration here. https://www.x402scan.com/server/244415a1-d172-4867-ac30-6af563fd4d25

x402 transforms API access by making payments native to HTTP requests.

Feature | Traditional APIs | x402 APIs |

Authentication | API keys, tokens | Wallet signature |

Payment Model | Subscription, prepaid | Pay-per-call |

Onboarding | Sign up, KYC, billing | Connect wallet |

Rate Limits | Fixed tiers | Economic (pay more = more access) |

Commitment | Monthly/annual | Zero, per-call only |

How to use it: Add x-coinbase-402: true header to any supported endpoint. Sign payment with your wallet. The API responds immediately after confirming micro-payment.

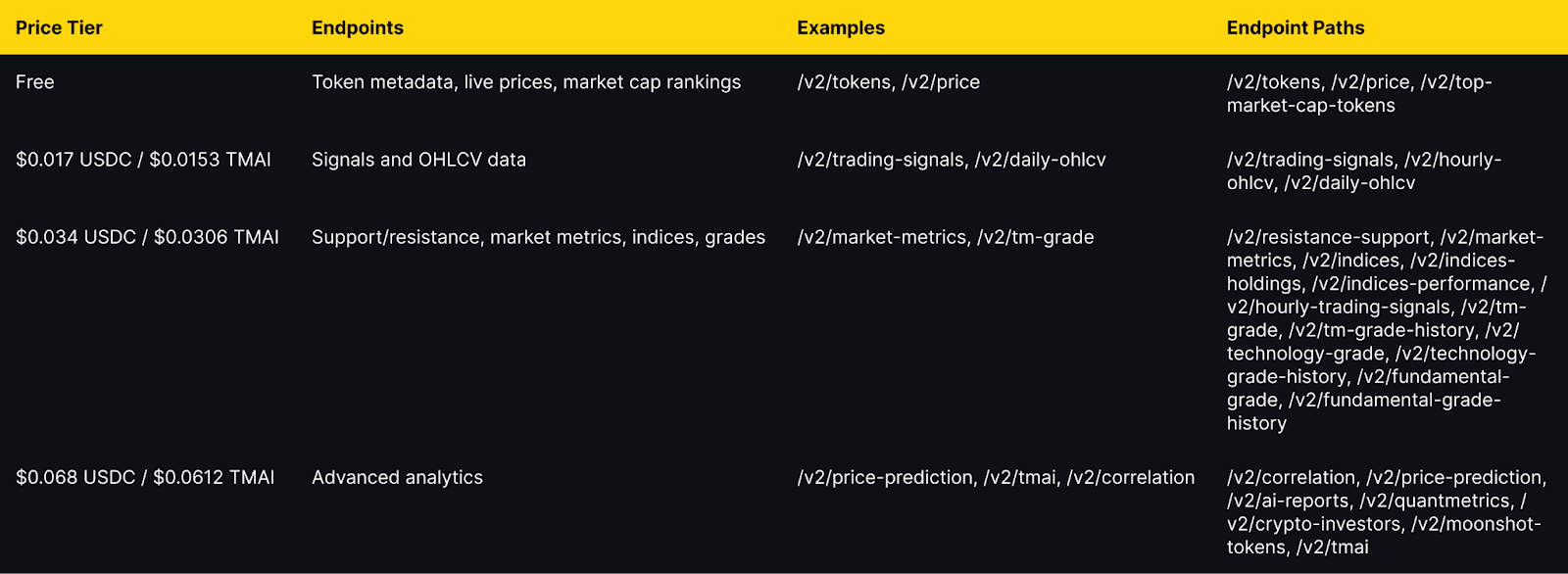

Token Metrics integration: All public endpoints available via x402 with per-call pricing from $0.017 to $0.068 USDC (10% discount with TMAI token).

Explore live agents: https://www.x402scan.com/composer.

The Protocol Flow

The HTTP 402 status code was reserved in HTTP/1.1 in 1997 for future digital payment use cases and was never standardized for any specific payment scheme. x402 activates this path by using 402 responses to coordinate crypto payments during API requests.

Why this matters: It eliminates intermediary payment processors, enables true machine-to-machine commerce, and reduces friction for AI agents.

CoinGecko Recognition

CoinGecko launched a dedicated x402 Ecosystem category in October 2025, tracking 700+ projects with over $1 billion market cap and approximately $213 million in daily trading volume. Top performers include PING and Alnalyst, along with established projects like EigenCloud.

Base Network Adoption

Base has emerged as the primary chain for x402 adoption, with 450,000+ weekly transactions by late October 2025, up from near-zero in May. This growth demonstrates real agent and developer usage.

Composer is x402scan's sandbox for discovering and using AI agents that pay per tool call. Users can open any agent, chat with it, and watch tool calls and payments stream in real time.

Top agents include AInalyst, Canza, SOSA, and NewEra. The Composer feed shows live activity across all agents.

Explore Composer: https://x402scan.com/composer

What We Ship

Token Metrics offers all public API endpoints via x402 with no API key required. Pay per call with USDC or TMAI for a 10 percent discount. Access includes trading signals, price predictions, fundamental grades, technology scores, indices data, and the AI chatbot.

Check out Token Metrics Integration on X402. https://www.x402scan.com/server/244415a1-d172-4867-ac30-6af563fd4d25

Data as of October, 2025.

Pricing Tiers

Important note: TMAI Spend Limit: TMAI has 18 decimals. Set max payment to avoid overspending. Example: 200 TMAI = 200 * (10 ** 18) in base units.

Full integration guide: https://api.tokenmetrics.com

Ecosystem Participants and Tools

Active x402 Endpoints

Key endpoints beyond Token Metrics include Heurist Mesh for crypto intelligence, Tavily extract for structured web content, Firecrawl search for SERP and scraping, Twitter or X search for social discovery, and various DeFi and market data providers.

Infrastructure and Tools

Common Questions About x402

How is x402 different from traditional API keys?

x402 uses wallet signatures instead of API keys. Payment happens per call rather than via subscription. No sign-up, no monthly billing, no rate limit tiers. You pay for exactly what you use.

Which chains support x402?

Currently Base and Solana. Most activity is on Base with USDC as the primary payment token. Some endpoints accept native tokens like TMAI for discounts.

Do I need to trust the API provider with my funds?

No. Payments are on-chain and verifiable. You approve each transaction amount. No escrow or prepayment is required.

What happens if a payment fails?

The API returns 402 Payment Required again with updated payment details. Your client retries automatically. You do not receive data until payment confirms.

Can I use x402 with existing API clients?

Yes, with x402 client libraries such as x402-axios for Node and x402-httpx for Python. These wrap standard HTTP clients and handle the payment flow automatically.

Getting Started Checklist

Token Metrics x402 Resources

What's Next for x402

Ecosystem expansion. More API providers adopting x402, additional chains beyond Base and Solana, standardization of payment headers and response formats.

Agent sophistication. As x402 matures, expect agents that automatically discover and compose multiple paid endpoints, optimize costs across providers, and negotiate better rates for bulk usage.

Disclosure

Educational content only, not financial advice. API usage and crypto payments carry risks. Verify all transactions before signing. Do your own research.

%201.svg)

%201.svg)

Opening Hook

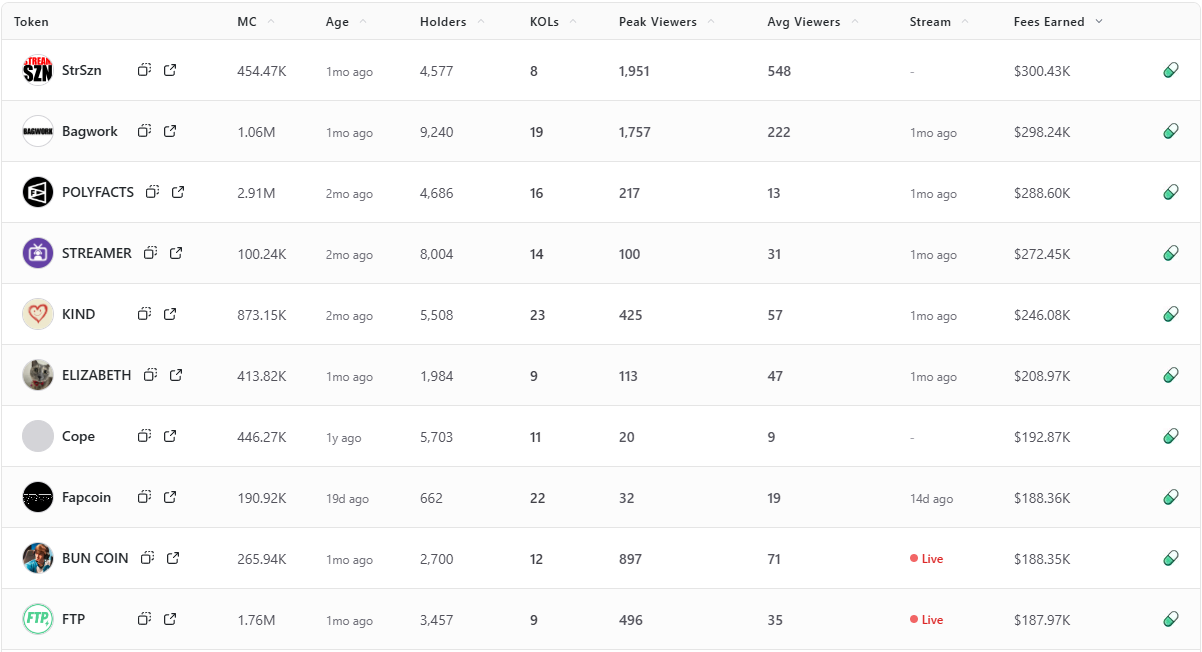

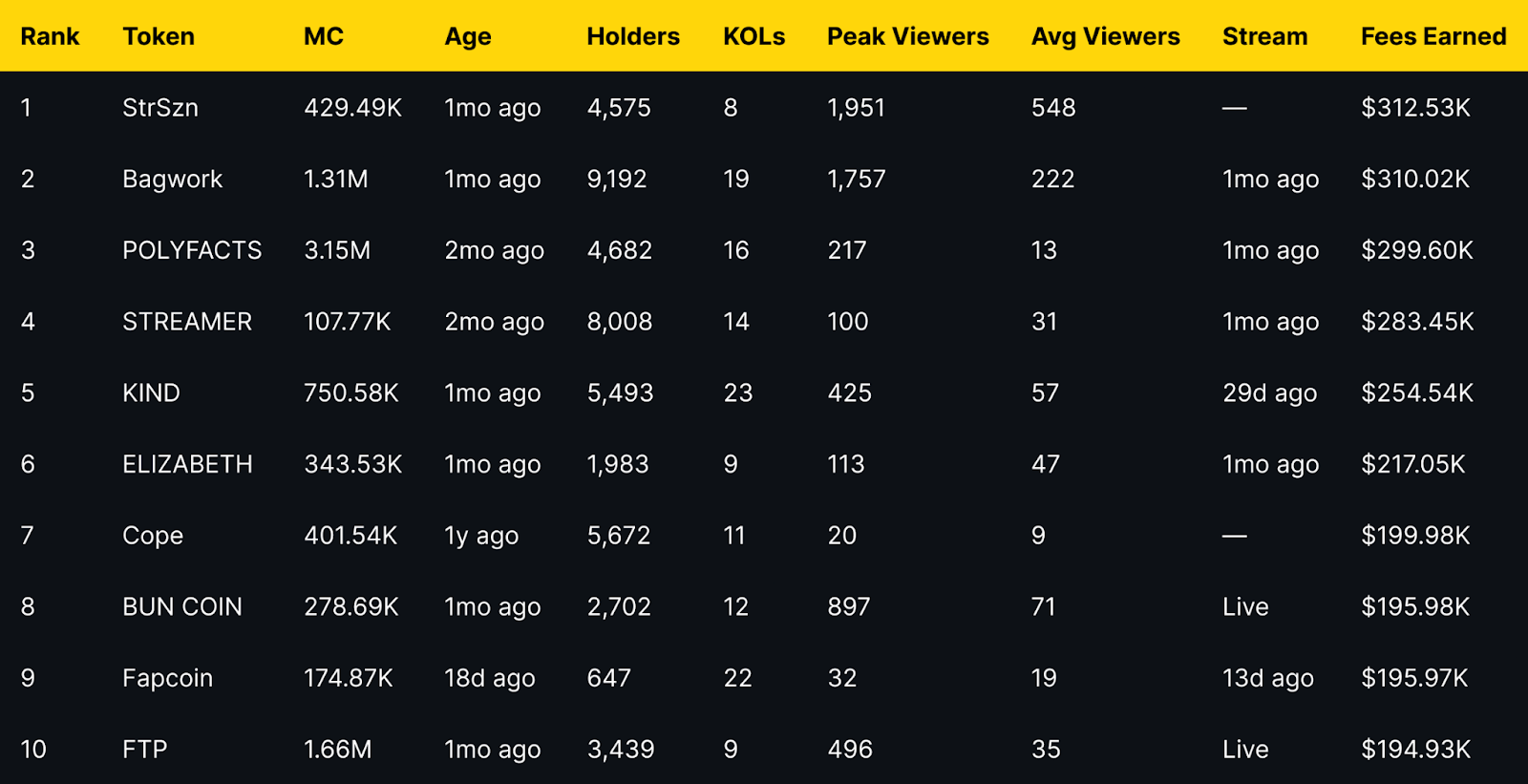

Fees Earned is a clean way to see which livestream tokens convert attention into on-chain activity. This leaderboard ranks the top 10 Pump.fun livestream tokens by Fees Earned using the screenshot you provided.

Selection rule is simple, top 10 by Fees Earned from the screenshot, numbers appear exactly as shown. If a field is not in the image, it is recorded as —.

Entity coverage: project names and tickers are taken as listed on Pump.fun, chain is Solana, sector is livestream meme tokens and creator tokens.

Token Metrics Live (TMLIVE) brings real time, data driven crypto market analysis to Pump.fun. The team has produced live crypto content for 7 years with a 500K plus audience and a platform of more than 100,000 users. Our public track record includes early coverage of winners like MATIC and Helium in 2018.

TMLIVE Quick Stats, as captured

TLDR: Fees Earned Leaders at a Glance

Short distribution note: the top three sit within a narrow band of each other, while mid-table tokens show a mix of older communities and recent streams. Several names with modest average viewers still appear due to concentrated activity during peaks.

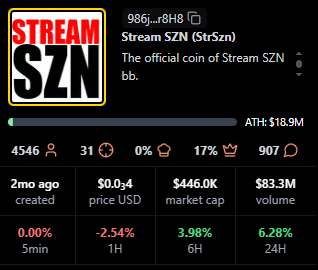

StrSzn

Positioning: Active community meme with consistent viewer base.

Research Blurb: Project details unclear at time of writing. Fees and viewership suggest consistent stream engagement over the last month.

Quick Facts: Chain = Solana, Status = —, Peak Viewers = 1,951, Avg Viewers = 548.

https://pump.fun/coin/986j8mhmidrcbx3wf1XJxsQFvWBMXg7gnDi3mejsr8H8

Bagwork

Positioning: Large holder base with sustained attention.

Research Blurb: Project details unclear at time of writing. Strong holders and KOL presence supported steady audience numbers.

Quick Facts: Chain = Solana, Status = 1mo ago, Holders = 9,192, KOLs = 19.

https://pump.fun/coin/7Pnqg1S6MYrL6AP1ZXcToTHfdBbTB77ze6Y33qBBpump

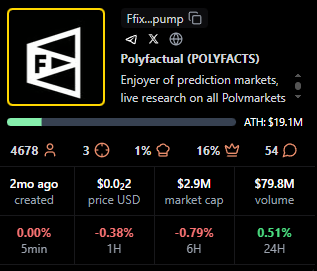

POLYFACTS

Positioning: Higher market cap with light average viewership.

Research Blurb: Project details unclear at time of writing. High market cap with comparatively low average viewers implies fees concentrated in shorter windows.

Quick Facts: Chain = Solana, Status = 1mo ago, MC = 3.15M, Avg Viewers = 13.

https://pump.fun/coin/FfixAeHevSKBZWoXPTbLk4U4X9piqvzGKvQaFo3cpump

STREAMER

Positioning: Community focused around streaming identity.

Research Blurb: Project details unclear at time of writing. Solid holders and moderate KOL count, steady averages over time.

Quick Facts: Chain = Solana, Status = 1mo ago, Holders = 8,008, KOLs = 14.

https://pump.fun/coin/3arUrpH3nzaRJbbpVgY42dcqSq9A5BFgUxKozZ4npump

KIND

Positioning: Heaviest KOL footprint in the top 10.

Research Blurb: Project details unclear at time of writing. The largest KOL count here aligns with above average view metrics and meaningful fees.

Quick Facts: Chain = Solana, Status = 29d ago, KOLs = 23, Avg Viewers = 57.

https://pump.fun/coin/V5cCiSixPLAiEDX2zZquT5VuLm4prr5t35PWmjNpump

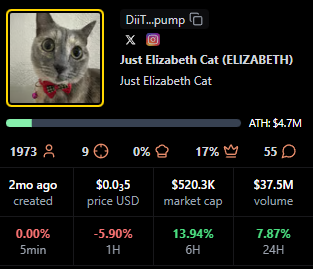

ELIZABETH

Positioning: Mid-cap meme with consistent streams.

Research Blurb: Project details unclear at time of writing. Viewer averages and recency indicate steady presence rather than single spike behavior.

Quick Facts: Chain = Solana, Status = 1mo ago, Avg Viewers = 47, Peak Viewers = 113.

https://pump.fun/coin/DiiTPZdpd9t3XorHiuZUu4E1FoSaQ7uGN4q9YkQupump

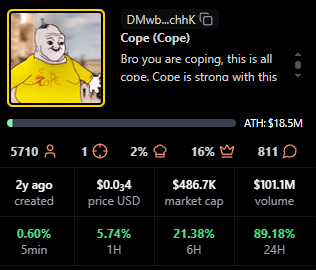

Cope

Positioning: Older token with a legacy community.

Research Blurb: Project details unclear at time of writing. Despite low recent averages, it holds a sizable base and meaningful fees.

Quick Facts: Chain = Solana, Status = —, Age = 1y ago, Avg Viewers = 9.

https://pump.fun/coin/DMwbVy48dWVKGe9z1pcVnwF3HLMLrqWdDLfbvx8RchhK

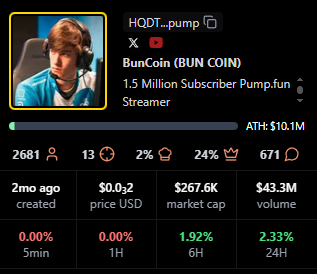

BUN COIN

Positioning: Currently live, strong peaks relative to size.

Research Blurb: Project details unclear at time of writing. Live streaming status often coincides with bursts of activity that lift fees quickly.

Quick Facts: Chain = Solana, Status = Live, Peak Viewers = 897, Avg Viewers = 71.

https://pump.fun/coin/HQDTzNa4nQVetoG6aCbSLX9kcH7tSv2j2sTV67Etpump

Fapcoin

Positioning: Newer token with targeted pushes.

Research Blurb: Project details unclear at time of writing. Recent age and meaningful KOL support suggest orchestrated activations that can move fees.

Quick Facts: Chain = Solana, Status = 13d ago, Age = 18d ago, KOLs = 22.

https://pump.fun/coin/8vGr1eX9vfpootWiUPYa5kYoGx9bTuRy2Xc4dNMrpump

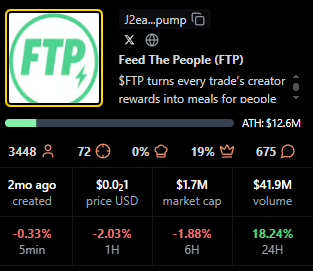

FTP

Positioning: Live status with solid mid-table view metrics.

Research Blurb: Project details unclear at time of writing. Peaks and consistent averages suggest an active audience during live windows.

Quick Facts: Chain = Solana, Status = Live, Peak Viewers = 496, Avg Viewers = 35.

https://pump.fun/coin/J2eaKn35rp82T6RFEsNK9CLRHEKV9BLXjedFM3q6pump

Signals From Fees Earned: Patterns to Watch

Fees Earned often rise with peak and average viewers, but timing matters. Several tokens here show concentrated peaks with modest averages, which implies that well timed announcements or coordinated segments can still produce high fees.

Age is not a blocker for this board. Newer tokens like Fapcoin appear due to focused activity, while older names such as Cope persist by mobilizing established holders. KOL count appears additive rather than decisive, with KIND standing out as the KOL leader.

For creators, Fees Earned reflects whether livestream moments translate into on-chain action. Design streams around clear calls to action, align announcements with segments that drive peaks, then sustain momentum with repeatable formats that stabilize averages.

For traders, Fees Earned complements market cap, viewers, and age. Look for projects that combine rising averages with consistent peaks, because those patterns suggest repeatable engagement rather than single event spikes.

TV Live is a fast way to follow real-time crypto market news, creator launches, and token breakdowns as they happen. You get context on stream dynamics, audience behavior, and on-chain activity while the story evolves.

CTA: Watch TV Live for real-time crypto market news →TV Live Link

CTA: Follow and enable alerts → TV Live

Token Metrics is trusted for transparent data, crypto analytics, on-chain ratings, and investor education. Our platform offers cutting-edge signals and market research to empower your crypto investing decisions.

What is the best way to track Pump.fun livestream leaders?

Tracking Pump.fun livestream leaders starts with the scanner views that show Fees Earned, viewers, and KOLs side by side, paired with live coverage so you see data and narrative shifts together.

Do higher fees predict higher market cap or sustained viewership?

Higher Fees Earned does not guarantee higher market cap or sustained viewership, it indicates conversion in specific windows, while longer term outcomes still depend on execution and community engagement.

How often do these rankings change?

Rankings can change quickly during active cycles, the entries shown here reflect the exact time of the screenshot.

Next Steps

Disclosure

This article is educational content. Cryptocurrency involves risk. Always do your own research.

%201.svg)

%201.svg)

Cryptocurrency enthusiasts constantly search for fresh and inventive approaches to maximize their digital assets and earnings. Over the past few years, staking Cardano has emerged as a popular method in this endeavor.

Staking Cardano presents an excellent opportunity for individuals interested in passive income generation. Staking involves actively contributing to a blockchain network and receiving additional cryptocurrency as a reward.

With its reputation as the "Ethereum killer," Cardano provides a dependable and secure platform for staking its native cryptocurrency, ADA.

This comprehensive guide will explore everything you need to know about Cardano staking, including what it is, how to stake it, the pros and cons, and where to do so. Let's dive in!

Cardano is a proof-of-stake (PoS) blockchain founded by Ethereum co-founder Charles Hoskinson. PoS blockchains, unlike proof-of-work (PoW) blockchains like Bitcoin, validate transactions and produce blocks through staking rather than mining.

Staking involves locking away coins in a node to validate transactions and contribute to the network's security and stability. By staking ADA, you can earn staking rewards without moving or losing your coins.

In Cardano's PoS blockchain, nodes play a crucial role in the validation process. Nodes are groups of people who have pooled their staked ADA tokens together.

The more ADA coins locked away in a node, the higher the chances of producing blocks and earning rewards. Staking pools, often operated by those with technical expertise, allow users to pool their tokens with others or run their own staking pool.

Staking Cardano is a straightforward process that can be done through reputable crypto exchanges or by staking directly with staking pool operators. Let's explore both methods.

If you prefer a user-friendly and convenient option, staking Cardano via a crypto exchange might be the right choice. Here's a step-by-step guide on how to stake Cardano via an exchange:

Staking directly with staking pool operators offers more independence and control over your assets. Here's how to stake Cardano with staking pool operators:

It's important to note that staking with staking pool operators allows you to retain full control of your funds and withdraw them at any time.

Before diving into Cardano staking, it's essential to consider the pros and cons. Let's explore the advantages and disadvantages of staking Cardano.

Pros of Cardano Staking

Cons of Cardano Staking

Despite these potential drawbacks, Cardano staking remains an attractive option for those earning passive income from their ADA holdings.

You can stake your Cardano (ADA) tokens, including popular exchanges and dedicated wallets. Let's explore some of the platforms where you can stake Cardano.

Staking on Coinbase

Coinbase, a leading cryptocurrency exchange, offers Cardano staking with an annual percentage yield (APY) of 3.75%. Here's how to stake Cardano on Coinbase:

Staking on Binance

Binance, one of the largest cryptocurrency exchanges, offers Cardano staking with an APY of up to 6.1%. Here's how to stake Cardano on Binance:

Staking on eToro

eToro, a popular social trading platform, offers automatic staking of supported cryptocurrencies, including Cardano. Here's how to stake Cardano on eToro:

While Cardano staking offers numerous benefits, knowing the associated risks is important. Here are some risks to consider before staking Cardano:

It's vital to conduct thorough research and carefully consider these risks before engaging in Cardano staking.

Q1. Is Cardano staking safe?

Yes, Cardano staking is generally considered safe. The ADA tokens used for staking never leave your wallet, and staking rewards are earned similarly to interest in a savings account. However, practicing proper wallet security measures to protect your funds is important.

Q2. Can I unstake my ADA at any time?

Yes, you can unstake your ADA anytime, but it's essential to consider the lock-up period associated with your chosen staking duration. Withdrawing your ADA before the end of the staking duration may result in losing staking rewards.

Q3. Can I stake Cardano if I don't have technical expertise?

Yes, even if you don't have technical expertise, you can stake Cardano by using reputable crypto exchanges that offer staking services. These platforms provide user-friendly interfaces that simplify the staking process.

Q4. How often are staking rewards distributed?

Staking rewards are typically distributed at the end of each epoch, which lasts approximately five days. The distribution of rewards is based on the snapshot taken at the end of each epoch, reflecting the distribution of staked ADA tokens.

Cardano staking offers a compelling opportunity to earn passive income and actively participate in the Cardano network. By staking ADA, you contribute to the network's security and stability while enjoying potentially higher yields than traditional investments.

Whether you choose to stake through exchanges or directly with staking pool operators, it's important to consider the pros and cons, research staking pools, and understand the associated risks. With this comprehensive guide, you are now equipped with the knowledge to begin your Cardano staking journey. Happy staking!

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Cryptocurrency mining has gained popularity as a means of earning passive income and supporting decentralized networks that power digital assets. Bitcoin, in particular, has garnered significant attention for its impact on the overall crypto market.

This comprehensive guide will assist you in evaluating the profitability of Bitcoin mining in 2024 and getting started on your mining endeavor. It will furnish you with all the necessary information to make an informed decision and embark on your mining journey.

What is Bitcoin Mining?

Bitcoin mining can be compared to extracting precious metals from the earth. It is the mechanism through which new bitcoins are minted, and transactions are verified on the blockchain.

As the Bitcoin white paper describes, mining involves CPU time and electricity to add new coins to circulation.

How Does Bitcoin Mining Work?

Specialized computers, known as miners, perform Bitcoin mining, which competes to solve complex mathematical problems. These problems are designed to be computationally complex and require significant computational power to solve.

Miners race against each other to find a solution to the problem, and the first miner to successfully solve it earns the right to add the next block of transactions to the blockchain and is rewarded with newly minted bitcoins.

The Role of Proof-of-Work

The mining process in Bitcoin is based on a concept called Proof-of-Work (PoW). Miners must prove that they have performed a certain amount of computational work in order to have a chance at winning the block reward.

This work is achieved by repeatedly hashing the block's data until a specific pattern or target hash, is found. The target hash is a value set by the network and determines the difficulty of the mining process.

The Importance of Confirmation

Once a miner solves a block, it is added to the blockchain and becomes a confirmed transaction. Confirmation is critical to Bitcoin mining as it ensures that transactions are valid and irreversible.

The more confirmations a transaction has, the more secure it is considered to be. Generally, it is recommended to wait for multiple confirmations before considering a transaction final.

Hashing and Target Hash - The hashing process is at the core of Bitcoin mining. Hashing involves taking input data and running it through a cryptographic hash function to produce a fixed-length output.

In the case of Bitcoin mining, the input data includes the transactions to be verified and other information, such as the previous block's hash.

Miners repeatedly hash this data, changing a small portion of it known as the nonce, until a hash is generated that meets the target hash criteria set by the network.

Mining Difficulty - The mining difficulty measures how difficult it is to find a hash that meets the target criteria. The difficulty is adjusted approximately every two weeks to ensure that blocks are mined at a consistent rate.

If the network's total computational power increases, the difficulty will be increased to maintain the average block time of approximately 10 minutes.

Conversely, if the computational power decreases, the difficulty will be reduced to keep the block time consistent.

Rewards for Miners - Miners are incentivized to participate in the mining process through the rewards they receive. When a miner successfully solves a block, they are rewarded with a predetermined amount of newly minted bitcoins, known as the block reward.

Additionally, miners receive transaction fees associated with the transactions included in the block. The block reward is halved approximately every four years in an event known as the Bitcoin halving.

This event is designed to control the rate at which new bitcoins are introduced into circulation and ensure the scarcity of the cryptocurrency.

Mining Hardware - Bitcoin mining requires specialized hardware known as Application-Specific Integrated Circuits (ASICs). These devices are specifically designed to perform the hashing calculations required for mining and are much more efficient than general-purpose computers.

ASICs come in various forms, ranging from small USB devices to large mining rigs. The cost of mining hardware can vary significantly depending on the type and performance of the ASIC.

Electricity Consumption - One of the significant costs associated with Bitcoin mining is electricity consumption. The computational power required for mining is energy-intensive and can result in high electricity bills.

The electricity consumption of mining operations has drawn criticism due to its environmental impact. To maximize profitability, miners must consider the cost of electricity and the energy efficiency of their mining equipment to maximize profitability.

Other Costs - In addition to electricity costs, miners may also incur expenses related to cooling and maintenance. Mining equipment generates significant heat and requires adequate cooling to ensure optimal performance.

Cooling systems can add to the overall cost of mining operations. Furthermore, regular maintenance and replacement of mining hardware may be necessary to keep up with the rapidly evolving technology.

Also Read - Best Bitcoin Mining Software

Factors Affecting Profitability - The profitability of Bitcoin mining depends on several factors, including the price of Bitcoin, mining difficulty, electricity costs, and the efficiency of mining equipment.

The price of Bitcoin is highly volatile and can significantly impact mining profitability. When the price is high, mining can be more profitable, but when it is low, mining may not be economically viable for some miners.

Calculating Mining Profitability - To determine whether Bitcoin mining is profitable, miners need to consider the costs associated with mining, including equipment expenses, electricity costs, and any other overheads.

They also need to estimate the potential rewards from mining, considering the current block reward, transaction fees, and the likelihood of successfully mining a block. Various online calculators are available to help miners estimate their potential profits based on these factors.

Is Bitcoin Mining Profitable?

The profitability of Bitcoin mining varies depending on individual circumstances and market conditions. While some miners have achieved significant profits, others have struggled to break even or generate positive returns.

The competitiveness of the mining industry and the constantly evolving technology make it challenging for individual miners to remain profitable. The high upfront costs of mining equipment and electricity expenses can also affect potential profits.

Also Read - 8 Best and Profitable Crypto to Mine

Energy Consumption - Bitcoin mining has attracted criticism due to its high energy consumption. The computational power required for mining consumes significant electricity, contributing to carbon emissions and environmental concerns.

The Bitcoin network's energy consumption has been compared to that of entire countries. As the popularity of Bitcoin grows, there is a need for more sustainable and energy-efficient mining practices to mitigate its environmental impact.

Renewable Energy and Sustainability - Efforts are underway to promote the use of renewable energy sources for Bitcoin mining. Some mining operations are powered by renewable energy, such as solar or wind, to reduce their carbon footprint.

Adopting sustainable mining practices is crucial to address the environmental concerns of Bitcoin mining. Additionally, ongoing research and development in energy-efficient mining hardware are expected to contribute to a more sustainable future for Bitcoin mining.

1. Choosing a Mining Pool

Joining a mining pool can increase individual miners' chances of earning rewards. Mining pools allow miners to combine their computational power and work together to mine blocks more efficiently.

When a block is successfully mined, the rewards are distributed among the pool members based on their contribution. Joining a mining pool can provide miners with a more consistent income stream, especially for those with limited computational resources.

2. Setting Up Mining Hardware

Setting up mining hardware requires careful consideration of factors such as cooling, electricity supply, and network connectivity. Miners must ensure their hardware is properly configured and optimized for mining.

Adequate cooling is essential to prevent overheating and ensure optimal performance. Additionally, miners should have a stable and reliable internet connection to stay connected to the Bitcoin network.

3. Mining Software

Mining software is essential for managing and controlling the mining process. It allows miners to connect their hardware to the mining pool and monitor their mining activities.

Several mining software options are available, each with its features and compatibility with different mining hardware. Miners should choose software that is compatible with their hardware and offers the necessary features for efficient mining.

Market Volatility - The volatile nature of Bitcoin's price poses a significant risk to mining profitability. The price of Bitcoin can fluctuate dramatically within a short period, impacting the potential rewards for miners.

Sharp price declines can lead to reduced profitability or even losses for miners. Miners should be prepared for the inherent market risks associated with Bitcoin mining and consider strategies to mitigate these risks.

Regulatory Environment - The regulatory environment surrounding Bitcoin mining varies across jurisdictions. Some countries have embraced cryptocurrencies and have favorable regulations for mining operations, while others have imposed strict regulations or outright bans.

Miners should stay informed about their respective locations' legal and regulatory developments to ensure compliance and mitigate regulatory risks.

Competition and Centralization - Bitcoin mining has become increasingly competitive, with large-scale mining operations dominating the industry. These operations have access to significant computational power and resources, which can make it difficult for individual miners to compete.

The concentration of mining power in the hands of a few entities raises concerns about centralization and the potential for network security vulnerabilities. Miners should be aware of the competitive landscape and consider the implications of centralization on the Bitcoin network.

Bitcoin mining plays a crucial role in the functioning and security of the Bitcoin network. It involves solving complex mathematical problems to validate transactions and mint new bitcoins.

While mining can be profitable under the right circumstances, it is a highly competitive and resource-intensive process. Miners must carefully consider the costs and risks of mining before getting involved.

The environmental impact of mining also raises important sustainability concerns that need to be addressed through the adoption of renewable energy sources and energy-efficient mining practices.

As the cryptocurrency landscape continues to evolve, miners must stay informed and adapt to changing market conditions to maximize their chances of success in the mining industry.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%20Price%20Prediction%202025%2C%202030%20-%20Forecast%20Analysis.png)

%201.svg)

%201.svg)

As the crypto market expands, numerous high-potential cryptocurrencies are being introduced. However, there are only a few cryptos that have demonstrated significant potential in recent years, one of which is Cardano.

Cardano holds immense promise beyond being a mere profit-driven asset. With its foundation rooted in meticulously reviewed academic research, Cardano has fostered a robust community over time.

Backed by a strong technical framework and an ambitious team, ADA has emerged as one of the leading cryptocurrencies globally.

This article delves into a comprehensive analysis of Cardano (ADA) and its prospective growth. We examine its historical performance and current fundamentals and present a range of scenarios for price prediction.

Furthermore, we evaluate expert viewpoints, discuss the risks and rewards associated with investing in Cardano, and shed light on the project's ongoing developments and future potential.

Cardano is a third-generation, fully open-sourced, decentralized public blockchain that operates on a Proof-of-Stake (PoS) consensus mechanism.

It aims to provide a platform for hosting smart contracts by developing advanced features that cater to the dynamic nuances of various decentralized applications (dApps).

Cardano has positioned itself as a potential game-changer in the blockchain industry, focusing on scalability, interoperability, and sustainability.

Cardano's performance in the cryptocurrency market has been notable. ADA has shown resilience and steady growth despite facing volatility and market fluctuations.

In 2021, Cardano reached an all-time high of $3.09 in September, reflecting its strong market presence. However, it is essential to note that past performance does not guarantee future results, and the cryptocurrency market is highly unpredictable.

To understand Cardano's future potential, it is crucial to examine its current fundamentals. ADA, the native token of the Cardano network, serves multiple purposes within the ecosystem.

It is used for transaction fees, staking, collateral for executing contracts, and governance. Cardano has a total supply of 45 billion ADA, with around 35 billion ADA currently in circulation.

Furthermore, Cardano employs a unique two-layer architecture, separating the settlement layer (CSL) and the computation layer (CCL).

This separation enhances flexibility and scalability, making Cardano an attractive platform for developers and users alike. Additionally, Cardano has its own token standards, allowing for the creation of custom tokens directly on the ledger.

To forecast Cardano's future price, it is crucial to consider multiple scenarios based on different market conditions and expert opinions. Let's explore some potential price predictions for Cardano.

In a bullish market scenario, where positive market sentiment prevails, Cardano's price has the potential to experience significant growth. Several factors could contribute to this bullish trend, including increased adoption, technological advancements, and positive regulatory developments.

If the crypto market cap hits $3 Trillion and Cardano retains its current 1.19% dominance, its price could ascend to $1.01.

In a more bullish scenario of the crypto market surging to $10 Trillion, Cardano's price could soar to a staggering $3.38, resulting in a potential 7x return for investors.

It is important to note that these predictions are based on various factors and assumptions, and market conditions can change rapidly. However, bullish market sentiment and increased adoption of Cardano's solutions could drive its price to new heights.

In the event of a bearish market, Cardano's price could experience a correction, potentially leading to a decrease in its value. In this case, the price of Cardano may face downward pressure with a decreased dominance of 0.59%.

In this scenario, If the crypto market cap hits $3 Trillion, Cardano could trade around $0.50 in the short term and struggle to surpass $1.69 by 2030 even if the total crypto market cap surpasses the $10 Trillion mark.

It is crucial to consider potential risks and challenges that Cardano may face. Factors such as regulatory developments, competition from other projects, and technological advancements can affect the growth trajectory of Cardano.

Also Read - Polygon Price Prediction

When considering Cardano's price prediction, it is essential to take into account the opinions of industry experts. These experts analyze various factors, including market trends, technological advancements, and adoption rates, to provide insights into the future potential of Cardano.

Coinpedia platform predicts Cardano could reach $9.12 to $10.32 by 2030, and experts from Changelly forecast that it could reach minimum and maximum prices of $0.8 and $1 by the end of 2025. By the end of 2030, the price of Cardano could reach $5.50 to $6.58.

Other industry analysts have varying opinions on the future price of Cardano. Ambcrypto.com predicts that Cardano could reach $1.60 to $2.41 by 2030.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

The investment potential of Cardano depends on several factors, such as individual risk tolerance, investment objectives, and market conditions. Many experts believe Cardano is an undervalued investment with significant growth potential in the coming years due to its wide range of applications.

The project's innovative approach, strong community support, and prospects for future expansion have garnered attention. However, conducting thorough research, analyzing market trends, and considering the risks associated with investing in cryptocurrencies is crucial.

Like any investment, Cardano carries both risks and rewards, given the high volatility and susceptibility to market fluctuations. It is important to comprehend the potential risks and be prepared for potential losses.

Also Read - Is Solana a Good Investment?

Cardano has been actively working on its development roadmap and has achieved significant milestones. The project has gone through different eras, including Byron, Shelley, Goguen, Basho, and Voltaire, each introducing new features and enhancements to the platform.

Looking ahead, Cardano has ambitious plans for the future. The project aims to achieve full decentralization, improve scalability, enhance interoperability with other blockchains, and continue advancing its smart contract capabilities.

These developments, coupled with ongoing research and community engagement, position Cardano for continued growth and adoption in the years to come.

Cardano (ADA) has shown promising growth potential, backed by its strong fundamentals, technological advancements, and community support.

While the cryptocurrency market is highly volatile and unpredictable, Cardano's unique features and commitment to scientific research position it as a promising project in the blockchain industry.

When considering Cardano's price prediction, it is essential to assess various factors, including market trends, expert opinions, and the project's current developments.

It is equally important to understand the risks and rewards associated with investing in Cardano and to make informed decisions based on thorough research and analysis.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Cryptocurrency mining has become an increasingly popular way to earn passive income and contribute to the decentralized networks that power these digital assets. Monero (XMR), in particular, has gained significant attention due to its focus on privacy and decentralization.

If you're considering Monero mining in 2024, this comprehensive guide will provide all the information you need to determine its profitability and start your mining journey.

Monero is a privacy-focused cryptocurrency that was launched in 2014. It is designed to give users anonymity by ensuring that transactions cannot be traced or tracked.

Unlike Bitcoin, where transaction details are visible to everyone on the network, Monero transactions are completely private. This makes it a popular choice for individuals who value financial privacy.

Monero is also considered the largest privacy coin in the industry. It has experienced significant growth, reaching an all-time high of around $517.62 during the 2021 bull market.

Despite facing regulatory challenges and delistings on major crypto exchanges, Monero continues to maintain a strong presence in the cryptocurrency market.

Monero mining is the process of validating transactions on the Monero network and adding them to the blockchain. Miners use their computational power to solve complex mathematical puzzles, and in return, they are rewarded with newly minted Monero coins.

This process is known as proof-of-work (PoW) mining, which is essential for maintaining the security and integrity of the Monero network. Unlike Bitcoin, which relies on the SHA-256 algorithm for mining, Monero uses a unique algorithm called RandomX.

This algorithm is designed to be ASIC-resistant, meaning that specialized mining hardware cannot be used to gain an unfair advantage. As a result, Monero mining can be done using consumer-grade hardware, such as CPUs and GPUs.

When it comes to Monero mining, miners have the option to mine solo or join a mining pool. Solo mining involves independently validating transactions and attempting to mine a block independently.

While solo mining can potentially yield higher rewards, it requires substantial computational power and may take a long time to find a block, making it less suitable for beginners.

On the other hand, pool mining involves joining a group of miners who combine their computational resources to increase their chances of mining a block.

When a block is successfully mined, the rewards are distributed among the pool members based on their contributed computational power. Pool mining provides more consistent and frequent payouts, making it a popular choice for most miners.

Before diving into Monero mining, it's essential to consider several factors that can affect its profitability. These factors include:

Hashrate: The hashrate refers to the computational power dedicated to mining Monero. A higher hashrate increases the chances of successfully mining a block and earning rewards.

Power Consumption: Mining requires a significant amount of electricity, and the cost of electricity can impact your profitability. Minimizing power consumption through efficient hardware and cost-effective electricity sources is crucial.

Mining Difficulty: The mining difficulty adjusts dynamically to maintain a consistent block generation time. Higher mining difficulty means more computational power is required to mine a block, which can impact profitability.

Hardware Costs: The initial investment in mining hardware can significantly impact profitability. It is important to consider the cost of CPUs or GPUs and their efficiency in terms of hashrate and power consumption.

Pool Fees: If you choose to mine in a pool, you'll need to consider the fees charged by the pool operator. These fees typically range from 0% to 2% of the mining rewards.

Considering these factors and performing thorough calculations using Monero mining profitability calculators can help you estimate your potential earnings and determine if mining Monero is financially viable for you.

Monero mining can be done using both CPUs and GPUs, although CPUs are generally more efficient for mining this cryptocurrency.

Monero's ASIC resistance ensures a level playing field for all miners, unlike Bitcoin, which is now dominated by specialized ASIC mining hardware.

When selecting hardware for Monero mining, it's essential to consider factors such as hashrate, power consumption, and cost-effectiveness.

CPUs with multiple cores and high clock speeds are favored for Monero mining. Popular CPU models for mining include AMD Ryzen and Intel Core processors.

AMD Radeon graphics cards are generally preferred for GPU mining due to their high computational power and cost efficiency. However, it's crucial to research the specific models and compare their hashrates and power consumption to make an informed decision.

To begin mining Monero, you'll need suitable mining software that is compatible with your chosen hardware. The Monero Project provides two official options for mining: the Monero GUI Wallet and the Monero CLI (Command Line Interface).

The Monero GUI Wallet is a user-friendly graphical interface that allows you to mine Monero using your CPU. It is suitable for beginners who prefer a more straightforward setup and intuitive mining experience.

The Monero CLI, on the other hand, is a command-line interface that provides more flexibility and control over the mining process. It is recommended for advanced users who are comfortable with command-line interactions and want to mine using CPUs or GPUs.

If you choose to mine in a pool or with GPU hardware, you'll need dedicated mining software compatible with your setup. Popular mining software options for Monero include XMRig and CSminer. You must download these software packages from trusted sources to avoid any security risks.

When mining Monero in a pool, choosing a reputable and reliable mining pool that suits your preferences is important. A mining pool is a group of miners who combine their computational power to increase their chances of mining a block.

Consider factors such as the pool's hashrate, fee structure, payout frequency, and reputation when selecting a mining pool.

Some popular Monero mining pools include Minergate, 2Miners, and SupportXMR. Researching and comparing different pool options can help you find the one that aligns with your mining goals.

Also Read - Cloud Mining Simplified

Determining the profitability of Monero mining in 2024 requires careful consideration of various factors, including the ones mentioned earlier.

While Monero mining can be financially rewarding, it's important to remember that cryptocurrency markets are highly volatile, and profitability can fluctuate.

To assess the profitability of Monero mining, consider your hardware costs, electricity expenses, mining difficulty, and the current price of Monero. Additionally, monitor market trends and monitor any regulatory developments that may impact Monero's value and demand.

While profitability is a significant consideration, supporting the Monero network and contributing to its decentralization is crucial. Many miners view their mining operations as a long-term investment in the future of Monero and the broader cryptocurrency ecosystem.

Also Read - Best and Profitable Crypto to Mine

Once you have successfully mined Monero or acquired it through other means, securing and storing your XMR coins is crucial. As a privacy-focused cryptocurrency, Monero offers several wallet options that prioritize the confidentiality of your funds.

The Monero GUI Wallet and Monero CLI Wallet, provided by the Monero Project, are recommended for storing Monero securely. These wallets allow you to generate a private key and address, which are essential for accessing and managing your XMR coins.

Additionally, there are other reputable third-party wallet options available, such as the Trezor Model T hardware wallet and the Guarda Wallet. These wallets provide enhanced security features and support for multiple cryptocurrencies, including Monero.

Remember to follow best practices for securing your wallets, such as enabling two-factor authentication, keeping your private keys offline, and regularly updating your wallet software to protect against potential vulnerabilities.

As with any cryptocurrency, the future of Monero mining is subject to various factors, including technological advancements, regulatory developments, and market trends.

While it's challenging to predict the exact trajectory of Monero mining, several factors suggest a positive outlook. Monero's commitment to privacy and decentralization continues to resonate with users who value financial autonomy and security.

As the demand for private and untraceable transactions grows, the utility and value of Monero may increase, potentially benefiting miners.

However, it's important to stay informed about regulatory developments and any potential challenges that may arise due to increased scrutiny of privacy-focused cryptocurrencies.

Adapting to changing market conditions and remaining vigilant about profitability and mining strategies will be crucial for successful Monero mining in the future.

Monero mining offers an opportunity to earn passive income while supporting the privacy-focused ethos of the cryptocurrency.

You can embark on a rewarding mining journey by understanding the basics of Monero mining, considering profitability factors, selecting suitable hardware and software, and securing your XMR coins.

Conduct thorough research, assess profitability regularly, and stay informed about market trends and regulatory developments.

With careful planning and a commitment to the principles of Monero, you can contribute to the decentralized network and potentially reap the rewards of Monero mining in 2024 and beyond.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Cryptocurrencies have gained immense popularity in recent years, and with that popularity comes the presence of influential individuals known as crypto whales.

These whales are wealthy investors who hold a significant amount of cryptocurrency in their digital wallets, giving them the power to impact the market. In this article, we will explore the concept of crypto whales, their impact on the market, and how you can track their activities.

Crypto whales, as the name suggests, are the giants of the crypto ocean. They are individuals or entities holding a substantial amount of cryptocurrency. These whales are often associated with well-known cryptocurrencies like Bitcoin and Ethereum but may also hold other altcoins.

The term "whale" originated from traditional financial markets, referring to investors with significant holdings capable of influencing market movements with their transactions. Similarly, in the crypto world, whales can create waves in the market due to the size of their trades.

Crypto whales can be individuals, companies, or organizations. They may engage in over-the-counter (OTC) trading rather than trading on traditional exchanges to avoid causing significant fluctuations in the market.

However, some whales intentionally manipulate the market through large transactions, which can have positive and negative effects.

Crypto whales have the ability to impact the market by simply manipulating market sentiment. If a whale decides to sell a substantial amount of a particular cryptocurrency, it can cause the price to drop.

Conversely, if a whale buys a significant amount, it can increase the price. Other investors often follow the lead of whales, resulting in a domino effect on the market. These large-scale transactions can also affect the liquidity of a specific coin on exchanges.

Whales have the power to create artificial demand or supply through their trading activities, leading to price volatility and potential losses for smaller investors.

Tracking crypto whales and their activities is essential for traders and investors to stay ahead of potential market movements. Fortunately, blockchain technology provides transparency, allowing us to monitor whale transactions and identify their movements.

To track crypto whales, you can start by analyzing trading patterns. Whales often make significant trades that stand out from the regular market activity. You can identify potential whales by monitoring these trades and tracing them back to their origin.

Blockchain explorers like Blockchain.com or Etherscan provide valuable tools for tracking large transactions. These explorers allow you to search for specific wallet addresses and view the transaction history associated with those addresses. You can uncover potential whales by identifying wallets with a significant transaction volume.

Social media platforms like X (Twitter) can also be a valuable resource for tracking whale activities. Many individuals dedicated to whale watching report major whale movements and alert others in the community. By following these accounts, you can stay informed about the latest whale activities in the crypto market.

Whale watching involves closely monitoring the activities of crypto whales. By observing their moves and analyzing their intentions, traders and investors can react promptly to potential market shifts and avoid losses.

However, it is important to note that whale watching should not be the sole basis for making trading decisions. While whales can provide valuable insights into market sentiment, investors should conduct their research and analysis to make informed decisions. Following whales blindly or attempting to mirror their moves can be risky and may not always lead to favorable outcomes.

The crypto industry has its fair share of famous whales who have significantly contributed to the market. These individuals have amassed substantial amounts of cryptocurrencies and significantly impacted market movements.

One prominent example is Brian Armstrong, the CEO of Coinbase, one of the largest cryptocurrency exchanges worldwide. Armstrong's net worth is estimated at billions of dollars, and his influence in the industry is undeniable.

Another well-known whale is Changpeng Zhao, also known as CZ, the co-founder and former CEO of Binance. Binance is currently the largest cryptocurrency exchange by market capitalization. CZ's investments and leadership have solidified his position as a major player in the crypto space.

The Winklevoss twins, Tyler and Cameron, are also notable crypto whales. They gained recognition for their involvement in the early days of Facebook and later invested heavily in Bitcoin. The twins founded Gemini, a well-established cryptocurrency exchange, and their crypto holdings have made them billionaires.

These are just a few examples of famous crypto whales, but many more individuals and entities have significant holdings in the crypto market.

Crypto whales play a complex role in the cryptocurrency market. On one hand, they have the potential to manipulate prices and create artificial market trends. Their large-scale trades can mislead smaller traders and create market irregularities.

On the other hand, crypto whales can also contribute positively to the market dynamics. By holding a significant portion of specific cryptocurrencies, they can create scarcity and drive up demand and value. Additionally, their trading activities can stimulate market activity and growth.

It is important for regulators to monitor whale activities and ensure fairness and transparency in the market. Striking a balance between market freedom and investor protection is crucial for maintaining a healthy and sustainable crypto ecosystem.

Crypto whales are influential players in the cryptocurrency market due to their substantial holdings and trading activities. They have the power to impact market sentiment, create price volatility, and influence the actions of other investors.

Tracking the activities of crypto whales is vital for traders and investors who want to stay informed and make informed decisions.

Individuals can gain insights into potential market shifts by analyzing trading patterns, using blockchain explorers, and following dedicated whale-watching accounts on social media.

However, it is important to approach whale-watching cautiously and not solely rely on whale movements when making trading decisions.

Conducting thorough research and analysis and considering other market factors is crucial for successful trading in the crypto market.

Crypto whales will continue to be a significant presence in the cryptocurrency market, and understanding their impact is key to navigating this dynamic and rapidly evolving industry.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

In the world of cryptocurrency trading, a strategy has been gaining popularity among traders of all experience levels - copy trading.

By leveraging the expertise of other successful traders, copy trading allows you to replicate their trades automatically and potentially earn profits without having to make trading decisions on your own.

In this guide, we will delve into the concept of crypto copy trading, how it works, the pros and cons, and how you can develop an effective copy trading strategy.

Copy trading is a form of investment that allows you to mirror the trades of successful traders. Instead of conducting extensive market research and analysis, copy trading enables you to identify profitable traders on a copy trading platform and automatically replicate their trades in your own trading account.

This strategy particularly appeals to those new to trading or lacking the time and expertise to make trading decisions. Copy trading lets you choose the traders you want to follow based on their trading style, risk tolerance, and past performance.

Once you have selected a trader to copy, their trades will be executed in your account in real-time, proportionally to the amount of capital you have allocated to them. This means that if the trader you are copying opens a buying position on Bitcoin, the same trade will be executed in your account.

Crypto copy trading is a universal concept that can be applied to various financial markets, including cryptocurrencies. Cryptocurrencies have gained significant popularity in recent years, attracting both experienced traders and newcomers to the market.

Copy trading in the crypto space allows you to leverage the expertise of successful cryptocurrency traders and potentially profit from their trading strategies.

To start copy trading in the crypto market, you need to open an account with a copy trading provider that offers access to cryptocurrencies.

Once you have opened an account, you can browse through the available traders on the platform and choose the ones that best match your trading goals and risk appetite.

After selecting the traders you want to copy, the copy trading platform will automatically replicate their trades in your trading account. It's important to note that while copy trading allows you to benefit from the expertise of other traders, it does not guarantee profits.

The success of your copy trading strategy will depend on the performance of the traders you choose to follow and the overall market conditions.

Developing an effective copy trading strategy is crucial for maximizing your chances of success in the market. While copy trading eliminates the need for extensive market analysis, it's important to carefully select the traders you want to copy and manage your risk effectively.

Here are some key points to consider when developing your copy trading strategy:

Like any trading strategy, copy trading has its own set of advantages and disadvantages. Here are some of the pros and cons to consider before engaging in copy trading:

Pros:

Cons:

Using a copy trading strategy is relatively straightforward. Here's a step-by-step guide to getting started with copy trading:

Remember that copy trading is not a guaranteed path to profits. It's essential to conduct thorough research, choose traders wisely, and continuously monitor your copy trading strategy to ensure its effectiveness.

If you want to invest in crypto passively, you can copy the alpha of other traders. So Token Metrics was an early contributor to an open-source project called Astradao.

With Astradao, an open-source project operating as an index marketplace, investors gain access to a diversified portfolio effortlessly.

Token Metrics Ventures, a fund with multiple indices on Astradao, encourages investors to explore and copy trade these indices. Furthermore, investors can create and launch their indices, allowing others to invest in the same digital assets.

The profitability of copy trading depends on various factors, including the performance of the traders you are copying, market conditions, and your risk management strategies. While copy trading can potentially lead to profits, it is not without risks.

To increase your chances of profitability in copy trading, it's important to:

By following these guidelines and continuously improving your copy trading strategy, you can potentially increase your profitability in the crypto market.

Q1. How do I choose traders to copy?

When choosing traders to copy, consider factors such as their past performance, risk level, trading style, and market expertise.

Q2. Can I adjust my allocation to traders?

Yes, you can adjust your allocation to different traders based on their performance and your risk management strategies.

Q3. What should I consider when monitoring trader performance?

When monitoring trader performance, consider factors such as their trading results, risk management strategies, and overall market conditions.

Q4. Are there any fees involved in copy trading?

Some copy trading platforms may charge fees for using their services, and you may also need to pay fees to the traders you are copying.

Q5. Can I manually close a copied trade?

Depending on the copy trading platform, you may have the option to manually close a copied trade if you feel it is necessary.

Q6. Is copy trading suitable for beginners?

Copy trading can be suitable for beginners as it allows them to leverage the expertise of successful traders without extensive market knowledge.

Q7. Can I copy trade on leverage?

Some copy trading platforms offer the option to copy trades on leverage, but it's important to understand the risks involved and only invest what you can afford to lose.

Q8. How can I get started with copy trading?

To get started with copy trading, open an account with a copy trading provider, choose traders to copy, allocate funds, and monitor performance.

Q9. Is copy trading a guaranteed way to make profits?

Copy trading is not a guaranteed way to make profits. Success in copy trading depends on various factors, including trader performance and market conditions.

Copy trading offers an accessible and potentially profitable way to engage in cryptocurrency trading. By leveraging the expertise of successful traders, you can learn from their strategies and potentially earn profits without extensive market knowledge.

However, it's essential to understand the risks involved and develop a well-defined copy trading strategy. With proper research, risk management, and continuous monitoring, you can make the most of copy trading in the crypto market.

Remember, copy trading is a strategy that requires continuous monitoring and adjustment. It's important to stay informed, manage your risk effectively, and choose traders wisely to increase your chances of success in the market.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Cryptocurrency has revolutionized the investing world, offering incredible opportunities for those willing to take the plunge. You can build generational wealth and secure your financial future with the right strategy.

This comprehensive guide will delve into crypto venture capital methods and strategies to help you make the most out of this exciting asset class.

To truly grasp the potential of crypto investing, it is essential to understand the current market conditions. As Ian Balina, founder and CEO of Token Metrics, points out, we are currently in the midst of the longest crypto bull run ever.

Historically, each bull run for Bitcoin has lasted longer than the previous one, and this trend is expected to continue. This means that we have a unique opportunity to capitalize on the extended duration of this bull run.

According to predictions, the crypto market is projected to reach a market cap of anywhere between $8 trillion to $14 trillion at the peak of the bull run, which is anticipated to occur in 2026.

With the market currently hovering around $1.4 trillion, significant room exists for growth. This presents an unparalleled chance to build life-changing wealth in the crypto space.

Let's examine some real-life case studies to understand the potential gains in crypto investing. Solana, a prominent cryptocurrency project, delivered astounding returns to early venture capitalists (VCs) and angel investors.

In its seed round in March 2018, Solana raised $3.2 million at a token price of 4 cents. Over time, the project gained traction and reached an all-time high of nearly $260 in November 2021. This represented a staggering 6,000X return on investment for those who got in early.

Another notable example is Polygon, formerly known as Matic. Early seed investors in Matic gained over 3,600X returns on their investments. These success stories demonstrate the enormous potential for massive gains in the crypto market.

In the world of crypto investing, having a solid network is invaluable. Attending conferences, events, and meetups allows you to connect with other investors and builders, exchange ideas, and discover new opportunities.

Building a network of trusted individuals increases your chances of accessing high-quality deals and gaining insights from experienced investors.

Ian Balina emphasizes the importance of having a vast global crypto network that allows you to identify and connect with the best projects in the industry.

You can gain valuable insights and access to exclusive investment opportunities by attending conferences and networking with other investors and builders.

How to Find the Next Big Thing? - Finding the next big thing in crypto investing requires a strategic approach. Ian Balina suggests the key is having the best deal flow in the industry. But how do you find those elusive "dollar next" deals?

The answer lies in extensive research, networking, and staying up-to-date with the latest trends and developments in the crypto space.

One effective strategy is to leverage platforms like Token Metrics, which provide comprehensive research and analysis of various crypto projects.

By subscribing to a platform like Token Metrics, you can access curated deal flow and pitch decks shared exclusively with VIP members. This gives you a competitive edge and increases your chances of discovering the next Solana or Polygon.

While the potential for massive returns in crypto venture capital investing is undeniable, it is essential to acknowledge the challenges that come with it.

The accredited investor requirement is one significant hurdle, especially in the United States. Accredited investors must meet specific financial criteria, such as having a net worth of over a million dollars or a high-income level for multiple years. Additionally, gaining access to top-tier deals and building a solid network can be challenging for new investors.

However, Token Metrics Ventures aims to bridge this gap by offering a VIP plan that provides access to curated deals and exclusive networking opportunities. This allows aspiring angel investors and venture capitalists to level the playing field and participate in high-potential projects.

The Token Metrics VIP plan is designed for individuals who are serious about venturing into the world of crypto investing. By subscribing to this plan, you can access valuable resources, including real-time deal flow, curated investment opportunities, and insights from experienced investors. This plan is tailored for those with the financial capacity to invest significant sums of money per deal.

With the Token Metrics VIP plan, you can stay ahead of the curve by receiving Telegram and Discord alerts about the latest projects and investment opportunities.

Additionally, you will receive a weekly email highlighting the top venture capital and angel investment opportunities in the crypto space. This comprehensive package empowers you to make informed investment decisions and potentially capitalize on the next big crypto project.

As the crypto market continues to evolve and mature, the opportunities for wealth creation are boundless. By adopting a strategic approach to crypto investing and leveraging the resources available through platforms like Token Metrics, you can position yourself for long-term success.

Remember, crypto investing is not without its challenges. It requires continuous learning, adaptability, and navigating a dynamic market. You can maximize your chances of building generational wealth through crypto investing by staying informed, building a strong network, and utilizing the right tools and insights.

Also Read - Future of crypto in the next 5 years

Crypto venture capital investing offers unparalleled opportunities for those willing to take calculated risks and seize the moment. By understanding the current market conditions, learning from successful case studies, and building a global crypto network, you can position yourself for long-term success.

Token Metrics provides a gateway to curated deal flow and exclusive networking opportunities, giving you a competitive edge in crypto investing. Embrace the future of investing, capitalize on the longest crypto bull run ever, and pave your way to generational wealth in the exciting crypto world.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Cryptocurrency enthusiasts always look for new and innovative ways to make the most of their digital assets. Over the past few years, staking Solana has become a prominent method in this pursuit.