Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

If you want broad crypto exposure without babysitting charts, a top crypto index is the simplest way to participate in the market. TM Global 100 was designed for hands-off portfolios: when conditions are bullish, the index holds the top 100 crypto assets by market cap; when signals turn bearish, it moves to stablecoins and waits. You get weekly rebalancing, transparent holdings and transaction logs, and a 90-second buy flow—so you can spend less time tinkering and more time compounding your life.

→ Join the waitlist to be first to trade TM Global 100.

Volatility is back, and investors are searching for predictable, rules-based ways to capture crypto upside without micromanaging tokens. Search interest for terms like hands-off crypto investing, weekly rebalancing, and regime switching reflects the same intent: “Give me broad exposure with guardrails.”

Definition (for snippets): A crypto index is a rules-based basket of digital assets that tracks a defined universe (e.g., top-100 by market cap) with a transparent methodology and scheduled rebalancing.

For 2025’s cycle, a top crypto index helps you participate in uptrends while a regime-switching rule can step aside during drawdowns—removing guesswork and FOMO from day-to-day decisions.

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a top crypto index?

A rules-based basket that tracks a defined universe—here, the top 100 assets by market cap—with transparent methodology and scheduled rebalancing.

How often does the index rebalance?

Weekly. Regime switches (tokens ↔ stablecoins) can also occur when the market signal changes.

What triggers the move to stablecoins?

A proprietary market-regime signal. In bearish regimes, the index exits token positions to stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

At launch, the embedded wallet will surface supported funding/settlement options based on your chain/wallet. USDC payout is supported when selling; additional on-ramps may follow.

Is the wallet custodial?

No. It’s an embedded, self-custodial smart wallet—you control the keys.

How are fees shown?

Before confirming, the buy flow shows estimated gas, platform fee, max slippage, and minimum expected value.

How do I join the waitlist?

Visit the Token Metrics Indices hub or the TM Global 100 strategy page and tap Join Waitlist.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want hands-off, rules-based exposure to crypto’s upside—with a stablecoin backstop in bears—TM Global 100 is built for you. See the strategy, join the waitlist, and be ready to allocate on launch.

Related Reads

%201.svg)

%201.svg)

If you’ve tried to “own the market” in crypto, you’ve felt the pain: chasing listings, juggling wallets, and missing rebalances while prices move. A top 100 crypto index aims to fix that—giving you broad exposure when the market is bullish and standing down when it’s not. TM Global 100 is our rules-based version of that idea: it holds the top-100 by market cap in bull regimes, moves to stablecoins in bear regimes, and rebalances weekly. You can see every rule, every holding, and every rebalance—then buy the index in ~90 seconds with an embedded on-chain flow.

→ Join the waitlist to be first to trade TM Global 100.

The market keeps cycling. New leaders emerge quickly. A “set-and-forget” bag can fall behind, while manual baskets burn hours and rack up slippage. Search interest for crypto index, regime switching, and weekly rebalancing keeps growing because people want a simple, disciplined core that adapts.

Definition (for featured snippets): A top 100 crypto index is a rules-based basket that tracks the largest 100 crypto assets by market cap, typically rebalanced on a schedule to keep weights aligned with the market.

In 2025, that alone isn’t enough. You also need discipline for downtrends. TM Global 100 adds a regime-switching layer to move to stablecoins during bear phases—so you can participate in upside and sit out major drawdowns with a consistent, rules-based approach.

Regime switching:

Weekly rebalancing:

Transparency:

What you’ll see on launch:

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a top 100 crypto index?

A rules-based basket tracking the largest 100 assets by market cap, typically with scheduled rebalancing. TM Global 100 adds regime switching to stablecoins during bear markets.

How often does the index rebalance?

Weekly. In addition, if the market signal flips, the entire portfolio may switch between tokens ↔ stablecoins outside the weekly cycle.

What triggers the move to stablecoins?

A proprietary market-regime signal. When it’s bearish, the index exits tokens to stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

On launch, funding options surface based on your connected wallet and supported chains. USDC payouts are supported when selling.

Is the wallet custodial?

The embedded wallet is self-custodial—you control your funds.

How are fees shown?

Before you confirm a buy, you’ll see estimated gas, platform fee, max slippage, and minimum expected value—all up front.

How do I join the waitlist?

Go to the TM Global 100 page or the Indices hub and click Join Waitlist. You’ll get notified at launch with simple steps to buy.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

A top 100 crypto index is the simplest path to broad market exposure—if it’s built with discipline. TM Global 100 combines transparent rules, weekly rebalancing, and a regime switch to stablecoins, so you can focus on your strategy while the core maintains itself.

Now’s the time to claim early access.

→ Join the waitlist to be first to trade TM Global 100.

Related Reads

%201.svg)

%201.svg)

After a whipsaw year, many investors are asking how to stay exposed to crypto’s upside without riding every drawdown. Rules-based crypto indexing is a simple, disciplined answer: follow a transparent set of rules rather than gut feelings. The TM Global 100 puts this into practice—own the top-100 in bullish regimes, rotate to stablecoins in bearish regimes, and rebalance weekly. On top of that, you can see what you own in real time with a Holdings Treemap, Table, and Transactions Log. Less second-guessing, more process.

→ Join the waitlist to be first to trade TM Global 100.

What it is: A rules-based index that holds the top-100 in bull markets and moves to stablecoins in bear markets—paired with transparent holdings and transaction logs.

Why it matters: Weekly rebalances and clear regime logic bring structure after volatile cycles.

Who it’s for: Hands-off allocators and active traders who want a disciplined core with visibility.

Next step: Join the waitlist to be first to trade TM Global 100.

In a volatile cycle, emotion creeps in: chasing winners late, cutting losers early, or missing re-entry after fear. Rules-based crypto indexing applies consistent criteria—constituent selection, weighting, and rebalancing—so you don’t have to improvise in stress.

For readers comparing crypto index options, think of it as a codified playbook. A rules-based crypto index is a methodology-driven basket that follows predefined signals (e.g., market regime) and maintenance schedules (e.g., weekly rebalancing), aiming for repeatable behavior across cycles.

Featured snippet definition: Rules-based crypto indexing is a systematic approach that tracks a defined universe (e.g., top-100 by market cap) and maintains it on a fixed cadence, with explicit rules for when to hold tokens and when to de-risk into stablecoins.

See the strategy and rules. (TM Global 100 strategy)

→ Join the waitlist to be first to trade TM Global 100.

What is a rules-based crypto index?

A methodology-driven basket that follows predefined rules for asset selection, weighting, and maintenance. In TM Global 100, that means top-100 exposure in bullish regimes and stablecoins in bearish regimes, with weekly rebalancing and full transparency.

How often does the index rebalance?

Weekly. This cadence refreshes constituents and weights to align with current market-cap rankings; separate regime switches can move between tokens and stablecoins.

What triggers the move to stablecoins?

A documented market signal. When it turns bearish, the index exits to stablecoins; when bullish resumes, it re-enters the top-100 basket.

Can I fund with USDC or fiat?

Funding options will surface based on your connected wallet and supported rails. USDC settlement on sells is supported; fiat on-ramps may be added over time.

Is the wallet custodial?

No. The embedded wallet is self-custodial—you control your keys and assets.

How are fees shown?

Before confirming a trade, you’ll see estimated gas, platform fee, max slippage, and min expected value—so you can proceed with clarity.

How do I join the waitlist?

Go to the Indices hub, open TM Global 100, and enter your email. You’ll receive a launch-day link to buy.

After a volatile cycle, the edge is process. TM Global 100 combines rules-based crypto indexing, weekly rebalancing, and full transparency so you can participate in upside and step aside during bears—without running your own spreadsheets. If that’s the core you’ve been missing, join the waitlist now.

Related Reads:

%201.svg)

%201.svg)

If you’ve been waiting for a simple, rules-based way to own the TM Global 100—without micromanaging tokens—this hub is for you. TM Global 100 is a rules-based crypto index that holds the top 100 assets in bull markets and moves to stablecoins in bear markets, with weekly rebalancing and transparent holdings/transaction logs you can verify at any time. It’s designed for hands-off allocators who want disciplined exposure and for active traders who want a core that adapts to regimes—without guesswork or endless rebalancing. Below you’ll find how it works, who it’s for, and exactly how to join the waitlist so you’re first in line when trading opens.

→ Join the waitlist to be first to trade TM Global 100.

Search intent right now: investors want credible, rules-based crypto exposure that can participate in upside while reducing drawdown pain. A crypto index is a basket of assets selected and maintained by rules—so you avoid one-off bets and constant manual rebalancing.

With liquidity rotating quickly across sectors, weekly rebalancing helps maintain alignment with current market-cap leaders, while regime switching provides a disciplined, pre-defined response to bearish conditions. The result is a clear, consistent process that removes emotional decision-making and operational drag.

Definition (snippet-friendly): A crypto index is a rules-based basket of digital assets that’s constructed, weighted, and rebalanced on a set schedule.

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

1) What is a TM Global 100 index?

It’s a rules-based crypto index that holds the top 100 assets by market cap in bullish regimes and moves to stablecoins in bearish regimes. It rebalances weekly and shows transparent holdings and transactions.

2) How often does the index rebalance?

Weekly, with additional full-portfolio switches when the market regime changes.

3) What triggers the move to stablecoins?

A proprietary market signal. When bearish, the index exits all token positions into stablecoins and waits for a bullish re-entry signal.

4) Can I fund with USDC or fiat?

At launch, funding and settlement options surface based on the embedded wallet and supported chains. USDC payouts are supported for selling; additional entry options may be introduced later.

5) Is the wallet custodial?

No. The Embedded Wallet is self-custodial—you control your funds while using a streamlined, on-chain checkout.

6) How are fees shown?

Before you confirm, the Buy flow shows estimated gas, platform fee, maximum slippage, and the minimum expected value.

7) How do I join the waitlist?

Go to the Token Metrics Indices hub or the TM Global 100 strategy page and submit your email. We’ll notify you the moment trading opens.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want a disciplined, rules-based core that adapts to market regimes, TM Global 100 is built for you. Weekly rebalances, transparent holdings, and one-click buy remove operational friction so you can focus on your strategy.

→ Join the waitlist to be first to trade TM Global 100.

Related Reads

%201.svg)

%201.svg)

If you want broad crypto exposure without babysitting charts, a top crypto index is the simplest way to participate in the market. TM Global 100 was designed for hands-off portfolios: when conditions are bullish, the index holds the top 100 crypto assets by market cap; when signals turn bearish, it moves to stablecoins and waits. You get weekly rebalancing, transparent holdings and transaction logs, and a 90-second buy flow—so you can spend less time tinkering and more time compounding your life.

→ Join the waitlist to be first to trade TM Global 100.

Volatility is back, and investors are searching for predictable, rules-based ways to capture crypto upside without micromanaging tokens. Search interest for terms like hands-off crypto investing, weekly rebalancing, and regime switching reflects the same intent: “Give me broad exposure with guardrails.”

Definition (for snippets): A crypto index is a rules-based basket of digital assets that tracks a defined universe (e.g., top-100 by market cap) with a transparent methodology and scheduled rebalancing.

For 2025’s cycle, a top crypto index helps you participate in uptrends while a regime-switching rule can step aside during drawdowns—removing guesswork and FOMO from day-to-day decisions.

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a top crypto index?

A rules-based basket that tracks a defined universe—here, the top 100 assets by market cap—with transparent methodology and scheduled rebalancing.

How often does the index rebalance?

Weekly. Regime switches (tokens ↔ stablecoins) can also occur when the market signal changes.

What triggers the move to stablecoins?

A proprietary market-regime signal. In bearish regimes, the index exits token positions to stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

At launch, the embedded wallet will surface supported funding/settlement options based on your chain/wallet. USDC payout is supported when selling; additional on-ramps may follow.

Is the wallet custodial?

No. It’s an embedded, self-custodial smart wallet—you control the keys.

How are fees shown?

Before confirming, the buy flow shows estimated gas, platform fee, max slippage, and minimum expected value.

How do I join the waitlist?

Visit the Token Metrics Indices hub or the TM Global 100 strategy page and tap Join Waitlist.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want hands-off, rules-based exposure to crypto’s upside—with a stablecoin backstop in bears—TM Global 100 is built for you. See the strategy, join the waitlist, and be ready to allocate on launch.

Related Reads

%201.svg)

%201.svg)

If you’ve tried to “own the market” in crypto, you’ve felt the pain: chasing listings, juggling wallets, and missing rebalances while prices move. A top 100 crypto index aims to fix that—giving you broad exposure when the market is bullish and standing down when it’s not. TM Global 100 is our rules-based version of that idea: it holds the top-100 by market cap in bull regimes, moves to stablecoins in bear regimes, and rebalances weekly. You can see every rule, every holding, and every rebalance—then buy the index in ~90 seconds with an embedded on-chain flow.

→ Join the waitlist to be first to trade TM Global 100.

The market keeps cycling. New leaders emerge quickly. A “set-and-forget” bag can fall behind, while manual baskets burn hours and rack up slippage. Search interest for crypto index, regime switching, and weekly rebalancing keeps growing because people want a simple, disciplined core that adapts.

Definition (for featured snippets): A top 100 crypto index is a rules-based basket that tracks the largest 100 crypto assets by market cap, typically rebalanced on a schedule to keep weights aligned with the market.

In 2025, that alone isn’t enough. You also need discipline for downtrends. TM Global 100 adds a regime-switching layer to move to stablecoins during bear phases—so you can participate in upside and sit out major drawdowns with a consistent, rules-based approach.

Regime switching:

Weekly rebalancing:

Transparency:

What you’ll see on launch:

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a top 100 crypto index?

A rules-based basket tracking the largest 100 assets by market cap, typically with scheduled rebalancing. TM Global 100 adds regime switching to stablecoins during bear markets.

How often does the index rebalance?

Weekly. In addition, if the market signal flips, the entire portfolio may switch between tokens ↔ stablecoins outside the weekly cycle.

What triggers the move to stablecoins?

A proprietary market-regime signal. When it’s bearish, the index exits tokens to stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

On launch, funding options surface based on your connected wallet and supported chains. USDC payouts are supported when selling.

Is the wallet custodial?

The embedded wallet is self-custodial—you control your funds.

How are fees shown?

Before you confirm a buy, you’ll see estimated gas, platform fee, max slippage, and minimum expected value—all up front.

How do I join the waitlist?

Go to the TM Global 100 page or the Indices hub and click Join Waitlist. You’ll get notified at launch with simple steps to buy.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

A top 100 crypto index is the simplest path to broad market exposure—if it’s built with discipline. TM Global 100 combines transparent rules, weekly rebalancing, and a regime switch to stablecoins, so you can focus on your strategy while the core maintains itself.

Now’s the time to claim early access.

→ Join the waitlist to be first to trade TM Global 100.

Related Reads

%201.svg)

%201.svg)

After a whipsaw year, many investors are asking how to stay exposed to crypto’s upside without riding every drawdown. Rules-based crypto indexing is a simple, disciplined answer: follow a transparent set of rules rather than gut feelings. The TM Global 100 puts this into practice—own the top-100 in bullish regimes, rotate to stablecoins in bearish regimes, and rebalance weekly. On top of that, you can see what you own in real time with a Holdings Treemap, Table, and Transactions Log. Less second-guessing, more process.

→ Join the waitlist to be first to trade TM Global 100.

What it is: A rules-based index that holds the top-100 in bull markets and moves to stablecoins in bear markets—paired with transparent holdings and transaction logs.

Why it matters: Weekly rebalances and clear regime logic bring structure after volatile cycles.

Who it’s for: Hands-off allocators and active traders who want a disciplined core with visibility.

Next step: Join the waitlist to be first to trade TM Global 100.

In a volatile cycle, emotion creeps in: chasing winners late, cutting losers early, or missing re-entry after fear. Rules-based crypto indexing applies consistent criteria—constituent selection, weighting, and rebalancing—so you don’t have to improvise in stress.

For readers comparing crypto index options, think of it as a codified playbook. A rules-based crypto index is a methodology-driven basket that follows predefined signals (e.g., market regime) and maintenance schedules (e.g., weekly rebalancing), aiming for repeatable behavior across cycles.

Featured snippet definition: Rules-based crypto indexing is a systematic approach that tracks a defined universe (e.g., top-100 by market cap) and maintains it on a fixed cadence, with explicit rules for when to hold tokens and when to de-risk into stablecoins.

See the strategy and rules. (TM Global 100 strategy)

→ Join the waitlist to be first to trade TM Global 100.

What is a rules-based crypto index?

A methodology-driven basket that follows predefined rules for asset selection, weighting, and maintenance. In TM Global 100, that means top-100 exposure in bullish regimes and stablecoins in bearish regimes, with weekly rebalancing and full transparency.

How often does the index rebalance?

Weekly. This cadence refreshes constituents and weights to align with current market-cap rankings; separate regime switches can move between tokens and stablecoins.

What triggers the move to stablecoins?

A documented market signal. When it turns bearish, the index exits to stablecoins; when bullish resumes, it re-enters the top-100 basket.

Can I fund with USDC or fiat?

Funding options will surface based on your connected wallet and supported rails. USDC settlement on sells is supported; fiat on-ramps may be added over time.

Is the wallet custodial?

No. The embedded wallet is self-custodial—you control your keys and assets.

How are fees shown?

Before confirming a trade, you’ll see estimated gas, platform fee, max slippage, and min expected value—so you can proceed with clarity.

How do I join the waitlist?

Go to the Indices hub, open TM Global 100, and enter your email. You’ll receive a launch-day link to buy.

After a volatile cycle, the edge is process. TM Global 100 combines rules-based crypto indexing, weekly rebalancing, and full transparency so you can participate in upside and step aside during bears—without running your own spreadsheets. If that’s the core you’ve been missing, join the waitlist now.

Related Reads:

%201.svg)

%201.svg)

If you’ve ever bought a “basket” of coins and then wondered what you actually hold, you’re not alone. The TM Global 100 solves that by pairing a rules-based strategy with radical visibility: an interactive holdings treemap, sortable table, and a real-time transactions log—so you can see what you own at all times. This transparency sits on top of a simple idea: a top-100 crypto index when markets are bullish and stablecoins when they’re not, with weekly rebalancing and one-click buy at launch. The result is clarity for hands-off allocators and discipline for active traders—without spreadsheets or manual rebalances.

→ Join the waitlist to be first to trade TM Global 100.

What it is: A rules-based index that holds the top-100 in bull markets and moves to stablecoins in bear markets—paired with a Holdings Treemap, Table, and Transactions Log for full visibility.

Why it matters: Weekly rebalances and transparent change tracking reduce guesswork and help you understand how and why your exposure evolves.

Who it’s for: Hands-off allocators and active traders who want a disciplined, visible core position.

Next step: Join the waitlist to be first to trade TM Global 100.

Today’s crypto investor expects more than a chart and a headline weight. You want to audit your index: which coins, what size, and what changed after each rebalance. That’s exactly why we ship three visibility layers on day one: Gauge → Treemap → Transactions Log—plus a classic holdings table for power users.

In practical terms, a holdings treemap shows proportional weights at a glance, a table lets you sort and export details, and a transactions log chronicles every add/trim/exit during rebalances and regime switches. Together, they answer the search intent behind “crypto index holdings” and “weekly rebalancing” with an immediately scannable source of truth.

See the strategy and rules. (TM Global 100 strategy)

→ Join the waitlist to be first to trade TM Global 100.

What is a crypto index with a holdings treemap?

It’s a rules-based basket of cryptocurrencies where you can visually inspect weights via an interactive treemap, alongside a sortable table and a transactions log that records every rebalance and regime switch.

How often does the index rebalance?

Weekly. Rebalances update constituents/weights to reflect current top-100 rankings; separate regime switches can also move the portfolio between tokens and stablecoins when the market signal changes.

What triggers the move to stablecoins?

A proprietary market signal. When bearish, the index exits tokens to stablecoins; when bullish resumes, it re-enters the top-100 basket.

Can I fund with USDC or fiat?

At launch, funding/settlement options surface based on your connected wallet and supported chains. USDC payout is supported on selling; fiat on-ramps may be added later.

Is the wallet custodial?

No. The embedded wallet is self-custodial—you control your funds.

How are fees shown?

Before you confirm, the buy flow surfaces estimated gas, platform fee, max slippage, and min expected value.

How do I join the waitlist?

Open the Indices hub, navigate to TM Global 100, and add your email. You’ll be notified on launch with a direct link to buy.

TM Global 100 is built for investors who want broad market exposure and the receipts to prove what they hold—treemap, table, and transactions on every rebalance. If you value rules, discipline, and transparency, join the waitlist and be ready on launch day.

Related Reads:

%201.svg)

%201.svg)

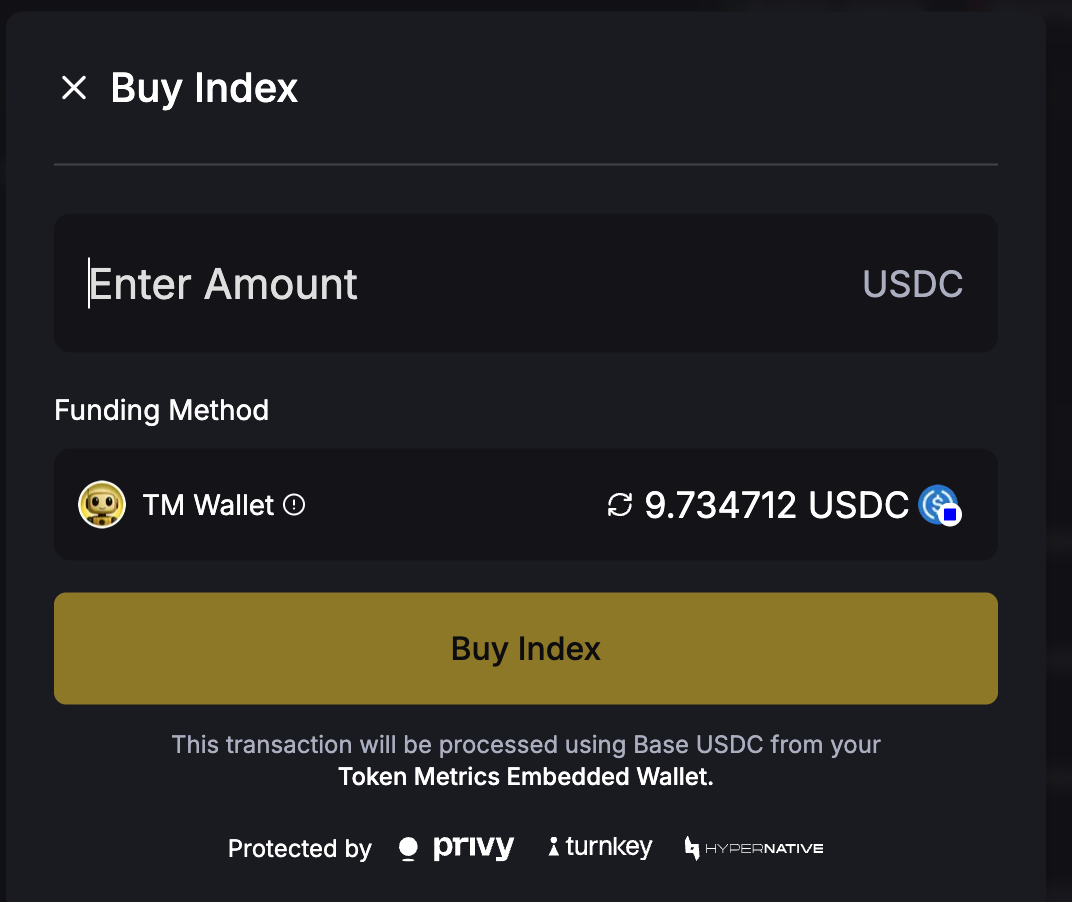

If you’ve ever tried to “own the market” in crypto, you know the pain: opening multiple exchanges, hunting for the right tokens, praying you rebalance on time, and second-guessing every move. This guide shows you how to buy a crypto index in 90 seconds—and why a rules-based approach can save time, reduce mistakes, and keep you aligned with the trend. Our flagship TM Global 100 is a rules-based crypto index that holds the top-100 assets in bull markets and moves to stablecoins in bear markets, with weekly rebalancing and fully transparent holdings/transactions. Below, you’ll see exactly what the flow looks like and how to join early.

→ Join the waitlist to be first to trade TM Global 100.

Crypto’s gotten faster, not simpler. Between regime switching, weekly rebalancing, and dozens of venues, DIY baskets are easy to get wrong. A clear, step-by-step how to buy a crypto index guide helps you execute with confidence, whether you’re optimizing a core position or setting up a long-term plan.

Definition (featured-snippet friendly): A crypto index is a rules-based basket of digital assets that rebalances on a set schedule and may switch to stablecoins during bearish regimes.

Related terms we’ll touch on: crypto index, weekly rebalancing, regime switching.

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a “how to buy a crypto index” flow?

It’s a streamlined checkout to buy a rules-based basket (index) in one place. For TM Global 100, you’ll see fees/slippage upfront, then confirm in a single flow.

How often does the index rebalance?

Weekly. Rebalances update constituents/weights. If the regime flips, the portfolio can switch between top-100 tokens and stablecoins outside the weekly cycle.

What triggers the move to stablecoins?

A proprietary market signal. In bearish conditions, the index exits tokens into stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

At launch, you’ll follow the on-page instructions shown in the Buy Index flow. Funding options may vary by chain/wallet; USDC payout is supported when selling.

Is the wallet custodial?

No—self-custodial embedded smart wallet. You control funds; the flow simplifies execution.

How are fees shown?

Before confirming, you’ll see estimated gas, platform fee, max slippage, and minimum expected value. Nothing’s hidden.

How do I join the waitlist?

Head to the Token Metrics Indices hub and submit your email, or follow the waitlist CTA on the TM Global 100 page.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want broad market exposure without babysitting a portfolio, TM Global 100 gives you a rules-based, transparent way to participate in the upside and sit in stablecoins when conditions turn. The 90-second buy flow removes friction so you can focus on allocation—not logistics.

→ Join the waitlist to be first to trade TM Global 100.

Related Reads:

%201.svg)

%201.svg)

Building your own crypto basket sounds simple—until you’re juggling 10–50 tickers, spreadsheets, rebalance rules, spreads across chains, and the constant fear of missing regime turns. A crypto index removes that manual grind: TM Global 100 holds the top 100 assets when the market is bullish and moves fully to stablecoins when it’s not, with weekly rebalancing and full transparency of holdings and transactions. One click to buy, zero maintenance to keep up.

→ Join the waitlist to be first to trade TM Global 100.

In 2025, time and execution quality are alpha. Manually maintaining a DIY basket multiplies complexity: fragmented liquidity, multiple wallets, chain fees, and coordination across exchanges—all while markets move. A rules-based index compresses that overhead into a single, auditable product with pre-declared logic and scheduled upkeep.

Definition (snippet-ready): A crypto index is a rules-based basket of digital assets that rebalances on a set schedule and/or when market conditions change, so you don’t have to micromanage individual coins.

Traders searching “DIY crypto basket,” “regime switching,” or “weekly rebalancing” usually want one thing: broad exposure without the constant maintenance and the regret of missed rebalances. That’s the exact problem TM Global 100 addresses with weekly updates and regime switching to stablecoins when signals turn bearish.

→ See the strategy and rules. (TM Global 100 strategy)

→ Join the waitlist to be first to trade TM Global 100.

What is a crypto index?

A rules-based basket of assets with scheduled rebalancing and, in TM Global 100’s case, a regime switch between top-100 exposure and stablecoins.

How often does the index rebalance?

Weekly, with additional full-portfolio switches when the market regime changes.

What triggers the move to stablecoins?

A proprietary market signal. When bearish, the index exits tokens into stablecoins and waits for a bullish re-entry.

Can I fund with USDC or fiat?

Funding options surface based on your connected wallet and supported chains; USDC payouts are supported on selling. (Stablecoin entry may come later.)

Is the wallet custodial?

No. The embedded wallet is self-custodial; you control funds.

How are fees shown?

The Buy flow shows estimated gas, platform fee, max slippage, and minimum expected value before you confirm.

How do I join the waitlist?

Visit the Indices hub → TM Global 100 → enter your email to get notified and first access at launch.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you’ve ever missed a rebalance or watched slippage eat into returns, TM Global 100 can help standardize the work: rules-based logic, weekly updates, and a visible log of everything that changed. Join the waitlist to be first to trade, and make a disciplined index your core.

Related Reads:

→ Join the waitlist to be first to trade TM Global 100.

%201.svg)

%201.svg)

Timing crypto cycles is hard. Volatility cuts both ways: you want broad upside when markets run, and you want the discipline to step aside when trend and liquidity flip. That’s exactly what a regime switching crypto index does—using rules to allocate into the market during bullish conditions and to stablecoins during bearish conditions. TM Global 100 is our flagship implementation: a rules-based, top-100 crypto index when bullish that moves fully to stablecoins when not, with weekly rebalancing and transparent holdings/transactions you can verify at a glance. It’s built for people who want market exposure without micromanaging tokens—or their emotions.

→ Join the waitlist to be first to trade TM Global 100.

What it is: A rules-based index that holds the top-100 crypto assets in bull markets and moves to stablecoins in bear markets.

Why it matters: Weekly rebalances + transparent holdings and a transactions log encourage discipline and clarity.

Who it’s for: Hands-off allocators and active traders who want a robust, rules-driven core.

Next step: Join the waitlist to be first to trade TM Global 100.

Crypto runs in regimes—multi-month stretches of risk-on momentum followed by drawdowns that can erase gains quickly. Searchers looking for “regime switching,” “weekly rebalancing,” or “crypto index” want a practical framework that’s simple to follow and easy to execute.

Definition (for snippets): Regime switching in crypto is a rules-based method that changes portfolio exposure based on market conditions, typically rotating between a diversified token basket in uptrends and stablecoins in downtrends.

Why now:

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a regime switching crypto index?

A rules-based portfolio that allocates to a diversified token basket in bullish regimes and rotates to stablecoins in bearish regimes, based on pre-defined signals. TM Global 100 implements this with a top-100 universe and a full stablecoin switch in bears.

How often does the index rebalance?

Weekly, to reflect updated rankings and liquidity thresholds; regime changes can occur outside the weekly cycle when the signal flips.

What triggers the move to stablecoins?

A proprietary market signal. When bearish, the index exits token positions into stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

You purchase through an embedded, self-custodial wallet supporting major chains; funding and settlement options surface based on your wallet and chain. USDC payouts are supported when selling. (Region/asset availability may vary.)

Is the wallet custodial?

No. The embedded wallet is self-custodial—you control funds.

How are fees shown?

Before confirming, you’ll see estimated gas, platform fee, max slippage, and minimum expected value.

How do I join the waitlist?

Visit the Token Metrics Indices hub, open TM Global 100, and tap Join Waitlist. You’ll be notified at launch.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want a disciplined, transparent way to gain broad crypto exposure while sitting out drawdowns, TM Global 100 was built for you. It’s rules-based, weekly-rebalanced, and visible down to the transaction log—so you can focus on allocation, not anxiety.

→ Join the waitlist to be first to trade TM Global 100.

Related Reads

%201.svg)

%201.svg)

If you’ve ever tried to “own the market” in crypto, you know the pain: picking coins, timing rotations, chasing listings, and rebalancing blends research with stress. A crypto index solves this by tracking a defined basket with clear rules—so you don’t babysit a watchlist 24/7. TM Global 100 extends that idea with a rules-based approach: it holds the top 100 assets when the market is bullish, and fully moves to stablecoins when it isn’t, with weekly rebalancing and transparent holdings and transactions. That means less micromanagement, more discipline, and a single place to see what you own and why.

→ Join the waitlist to be first to trade TM Global 100.

Search interest around “what is a crypto index” keeps rising because investors want broad exposure without constant token-picking. Indices meet informational → commercial → transactional intent in one flow: learn the concept, see the rules, then invest. For traders, weekly rebalancing reduces drift from fast-changing market-cap rankings; for allocators, a regime switch (tokens ↔ stablecoins) can help avoid sitting exposed through deep drawdowns. In one sentence: A crypto index is a rules-based basket of crypto assets that rebalances on a schedule to maintain a defined exposure.

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a crypto index?

A crypto index is a rules-based basket that tracks a defined set of assets (e.g., the top-100 by market cap), with a scheduled rebalance to keep exposure aligned. Global 100 applies that idea and adds a regime switch to stablecoins.

How often does TM Global 100 rebalance?

Weekly. Constituents and weights update on schedule; if the market regime changes, the portfolio can switch between tokens and stablecoins outside that cadence.

What triggers the move to stablecoins?

A proprietary market signal. Bullish: hold the top-100 basket. Bearish: exit to stablecoins and wait for a re-entry signal.

Can I fund with USDC or fiat?

At launch you’ll see wallet-funding options supported by the embedded smart wallet and supported chains; USDC payouts are available on selling. Details show in the Buy/Sell flow.

Is the wallet custodial?

No. The embedded wallet is self-custodial—you control funds.

How are fees shown?

Before confirming you’ll see estimated gas, platform fee, max slippage, and minimum expected value.

How do I join the waitlist?

Visit the Token Metrics Indices hub, open TM Global 100, and tap Join Waitlist. We’ll email when trading opens.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want broad market exposure without herding coins—or a disciplined core you can trust to step aside in bad regimes—TM Global 100 was built for you: rules-based, weekly rebalancing, stablecoins when warranted, and full transparency. Join the waitlist now to be first to trade on launch.

Related Reads:

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.