Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

Layer 1 tokens like Hedera represent bets on specific blockchain architectures winning developer and user mindshare. HBAR carries both systematic crypto risk and unsystematic risk from Hedera's technical roadmap execution and ecosystem growth. Multi-chain thesis suggests diversifying across several L1s rather than concentrating in one, since predicting which chains will dominate remains difficult.

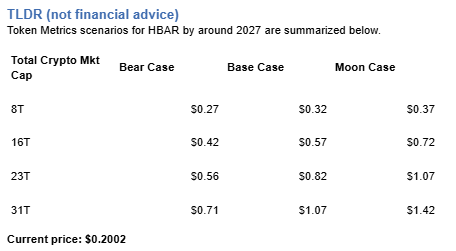

The projections below show how HBAR might perform under different market cap scenarios. While Hedera may have strong fundamentals, prudent portfolio construction balances L1 exposure across Ethereum, competing smart contract platforms, and Bitcoin to capture the sector without overexposure to any single chain's fate.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline:

Token Metrics lead metric for Hedera, cashtag $HBAR, is a TM Grade of 61.8%, which maps to Hold, and the trading signal is bearish, indicating short-term downward momentum. This means Token Metrics views $HBAR as having reasonably solid fundamentals but limited conviction for strong outperformance in the near term.

A concise long-term numeric view for a 12-month horizon: Token Metrics scenarios center around a range of about $0.06 to $0.18, with a base case near $0.10, reflecting steady ecosystem growth, moderate adoption of Hedera services, and continued enterprise partnerships. Implication: if Bitcoin and broader crypto risk appetite improve, $HBAR could revisit the higher end, while a risk-off market or slower-than-expected developer traction would keep it toward the lower bound.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

These ranges illustrate potential outcomes for concentrated HBAR positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

Professional investors across asset classes prefer diversified exposure over concentrated bets for good reason. Hedera faces numerous risks - technical vulnerabilities, competitive pressure, regulatory targeting, team execution failure - any of which could derail HBAR performance independent of broader market conditions. Token Metrics Indices spread this risk across one hundred tokens, ensuring no single failure destroys your crypto portfolio.

Diversification becomes especially critical in crypto given the sector's nascency and rapid evolution. Technologies and narratives that dominate today may be obsolete within years as the space matures. By holding HBAR exclusively, you're betting not only on crypto succeeding but on Hedera specifically remaining relevant. Index approaches hedge against picking the wrong horse while maintaining full crypto exposure.

Tax efficiency and rebalancing challenges also favor indices over managing concentrated positions. Token Metrics Indices handle portfolio construction, rebalancing, and position sizing systematically, eliminating the emotional and logistical burden of doing this manually with multiple tokens.

Early access to Token Metrics Indices

Hedera is a high-performance public ledger that emphasizes speed, low fees, and energy efficiency, positioning itself for enterprise and decentralized applications. It uses a unique Hashgraph consensus that enables fast finality and high throughput, paired with a council-governed model that targets real-world use cases like payments, tokenization, and decentralized identity.

HBAR is the native token used for fees, staking, and network security, and it supports smart contracts and decentralized file storage. Adoption draws from partnerships and integrations, though decentralization levels and reliance on institutional demand are often discussed in the community.

Token Metrics AI provides comprehensive context on Hedera's positioning and challenges.

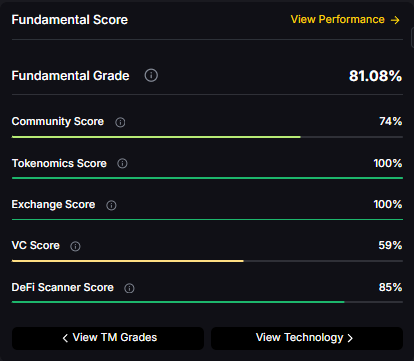

Fundamental Grade: 81.08% (Community 74%, Tokenomics 100%, Exchange 100%, VC 59%, DeFi Scanner 85%).

Technology Grade: 62.39% (Activity 58%, Repository 68%, Collaboration 74%, Security 56%, DeFi Scanner 85%).

Can HBAR reach $1.00?

Yes. Based on the scenarios, HBAR could reach $1.00 or above in the higher tiers. The 23T tier projects $1.07 in the moon case and the 31T tier projects $1.42 in the moon case. Achieving this requires broad market cap expansion and Hedera maintaining competitive position. Not financial advice.

What price could HBAR reach in the moon case?

Moon case projections range from $0.37 at 8T to $1.42 at 31T. These scenarios assume maximum liquidity expansion and strong Hedera adoption. Diversified strategies aim to capture upside across multiple tokens rather than betting exclusively on any single moon scenario. Not financial advice.

What's the risk/reward profile for HBAR?

Risk and reward span from $0.27 in the lowest bear case to $1.42 in the highest moon case. Downside risks include regulatory or infrastructure setbacks and competitive pressure, while upside drivers include improved liquidity and enterprise adoption. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

%201.svg)

%201.svg)

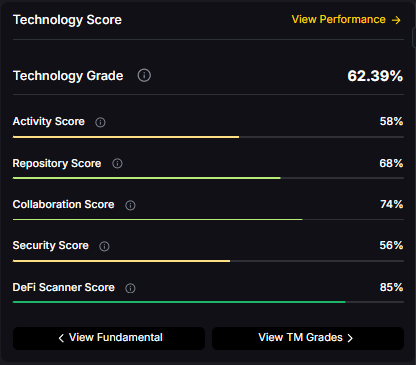

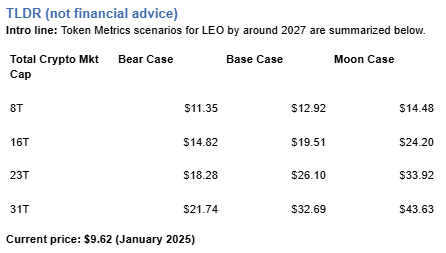

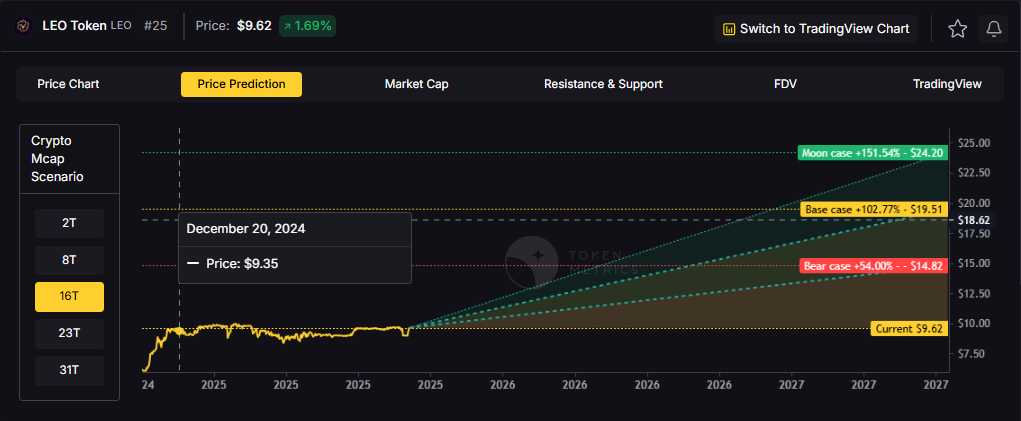

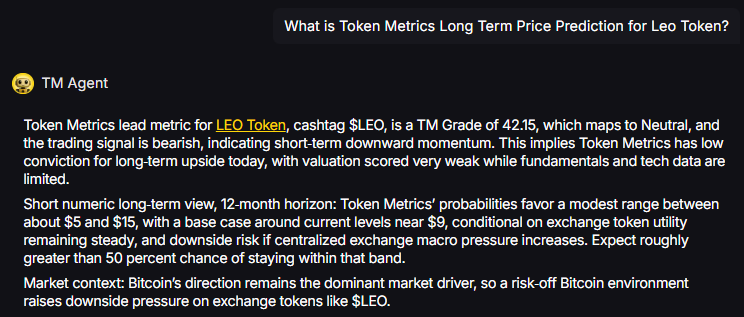

Exchange tokens desrive value from trading volume and platform revenue, creating linkage between crypto market activity and LEO price action. LEO Token delivers utility through reduced trading fees and enhanced platform services on Bitfinex and iFinex across Ethereum and EOS. Token Metrics scenarios below model LEO outcomes across different total crypto market cap environments.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics probabilities favor a modest range between about $5 and $15, with a base case around current levels near $9, conditional on exchange token utility remaining steady, and downside risk if centralized exchange macro pressure increases.

Token Metrics scenarios span four market cap tiers reflecting different crypto market maturity levels:

LEO Token is the native utility token of the Bitfinex and iFinex ecosystem, designed to provide benefits like reduced trading fees, enhanced lending and borrowing terms, and access to exclusive features on the platform. It operates on both Ethereum (ERC-20) and EOS blockchains, offering flexibility for users.

The primary role of LEO is to serve as a utility token within the exchange ecosystem, enabling fee discounts, participation in token sales, and other platform-specific advantages. Common usage patterns include holding LEO to reduce trading costs and utilizing it for enhanced platform services, positioning it primarily within the exchange token sector.

What gives LEO value?

LEO accrues value through reduced trading fees and enhanced platform services within the Bitfinex and iFinex ecosystem. Demand drivers include exchange usage and access to platform features, while supply dynamics follow the token’s exchange utility design. Value realization depends on platform activity and user adoption.

What price could LEO reach in the moon case?

Moon case projections range from $14.48 at 8T to $43.63 at 31T. These scenarios require maximum market cap expansion and strong exchange activity. Not financial advice.

Curious how these forecasts are made? Token Metrics delivers LEO on-chain grades, forecasts, and deep research on 6,000+ tokens. Instantly compare fundamentals, on-chain scores, and AI-powered predictions.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

%201.svg)

%201.svg)

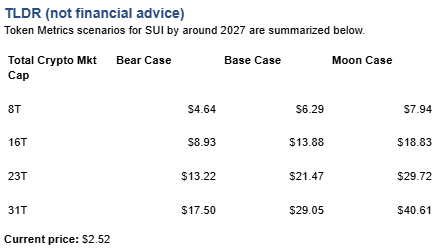

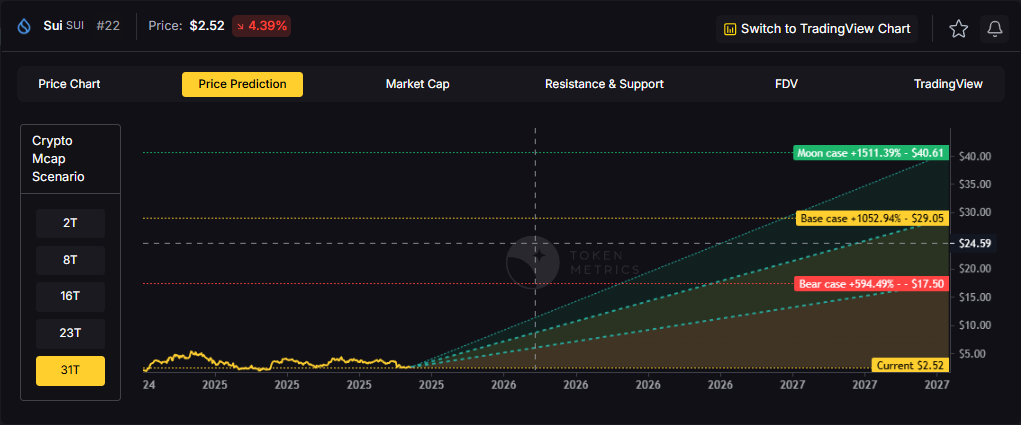

Layer 1 tokens like Sui represent bets on specific blockchain architectures winning developer and user mindshare. SUI carries both systematic crypto risk and unsystematic risk from Sui's technical roadmap execution and ecosystem growth. Multi-chain thesis suggests diversifying across several L1s rather than concentrating in one, since predicting which chains will dominate remains difficult.

The projections below show how SUI might perform under different market cap scenarios. While Sui may have strong fundamentals, prudent portfolio construction balances L1 exposure across Ethereum, competing smart contract platforms, and Bitcoin to capture the sector without overexposure to any single chain's fate.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

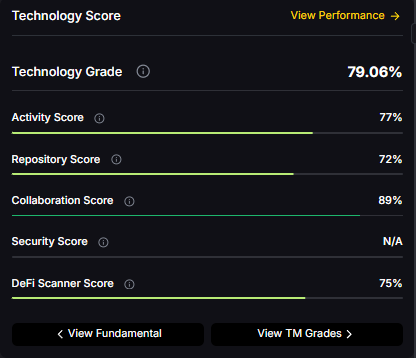

TM Agent baseline: Token Metrics lead metric for Sui, cashtag $SUI, is a TM Grade of 67.4%, which maps to a Hold, and the trading signal is bearish, indicating short-term downward momentum. This suggests Token Metrics sees $SUI as having reasonable fundamentals but not yet strong conviction for substantial outperformance, while near-term momentum is negative and could limit rallies. Market context, brief: Bitcoin’s price direction is currently the primary market driver, and a risk-off Bitcoin environment increases downside pressure on layer-1 tokens like $SUI.

Professional investors across asset classes prefer diversified exposure over concentrated bets for good reason. Sui faces numerous risks - technical vulnerabilities, competitive pressure, regulatory targeting, team execution failure - any of which could derail SUI performance independent of broader market conditions. Token Metrics Indices spread this risk across one hundred tokens, ensuring no single failure destroys your crypto portfolio.

Diversification becomes especially critical in crypto given the sector's nascency and rapid evolution. Technologies and narratives that dominate today may be obsolete within years as the space matures. By holding SUI exclusively, you're betting not only on crypto succeeding but on Sui specifically remaining relevant. Index approaches hedge against picking the wrong horse while maintaining full crypto exposure.

Early access to Token Metrics Indices

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

These ranges illustrate potential outcomes for concentrated SUI positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

Sui is a layer-1 blockchain network designed for general-purpose smart contracts and scalable user experiences. It targets high throughput and fast settlement, aiming to support applications that need low-latency interactions and horizontal scaling.

SUI is the native token used for transaction fees and staking, aligning validator incentives and securing the network. It underpins activity across common crypto sectors such as NFTs and DeFi while the ecosystem builds developer tooling and integrations.

Vision: Sui aims to create a highly scalable and low-latency blockchain platform that enables seamless user experiences for decentralized applications. Its vision centers on making blockchain technology accessible and efficient for mainstream applications by removing traditional bottlenecks in transaction speed and cost.

Problem: Many existing blockchains face trade-offs between scalability, security, and decentralization, often resulting in high fees and slow transaction finality during peak usage. This limits their effectiveness for applications requiring instant settlement, frequent interactions, or large user bases, such as games or social platforms. Sui addresses the need for a network that can scale horizontally without sacrificing speed or cost-efficiency.

Solution: Sui uses a unique object-centric blockchain model and the Move programming language to enable parallel transaction processing, allowing high throughput and instant finality for many operations. Its consensus mechanism, Narwhal and Tusk, is optimized for speed and scalability by decoupling transaction dissemination from ordering. The network supports smart contracts, NFTs, and decentralized applications, with an emphasis on developer ease and user experience. Staking is available for network security, aligning with common proof-of-stake utility patterns.

Market Analysis: Sui competes in the layer-1 blockchain space with platforms like Solana, Avalanche, and Aptos, all targeting high-performance decentralized applications. It differentiates itself through its object-based data model and parallel execution, aiming for superior scalability in specific workloads. Adoption drivers include developer tooling, ecosystem incentives, and integration with wallets and decentralized exchanges. The broader market for high-throughput blockchains is driven by demand for scalable Web3 applications, though it faces risks from technical complexity, regulatory uncertainty, and intense competition.

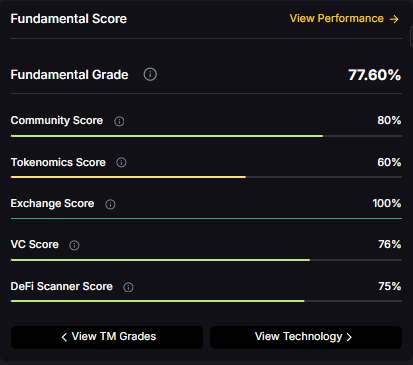

Fundamental Grade: 77.60% (Community 80%, Tokenomics 60%, Exchange 100%, VC 76%, DeFi Scanner 75%).

Technology Grade: 79.06% (Activity 77%, Repository 72%, Collaboration 89%, Security N/A, DeFi Scanner 75%).

Token Metrics empowers you to analyze Sui and hundreds of digital assets with AI-driven ratings, on-chain and fundamental data, and index solutions to manage portfolio risk smartly in a rapidly evolving crypto market.

What price could SUI reach in the moon case?

Moon case projections range from $7.94 at 8T to $40.61 at 31T. These scenarios assume maximum liquidity expansion and strong Sui adoption. Diversified strategies aim to capture upside across multiple tokens rather than betting exclusively on any single moon scenario. Not financial advice.

What's the risk/reward profile for SUI?

Risk/reward spans from $4.64 to $40.61. Downside risks include regulatory pressure and competitive displacement, while upside drivers include ecosystem growth and favorable liquidity. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

What are the biggest risks to SUI?

Key risks include regulatory actions, technical issues, competitive pressure from other L1s, and adverse market liquidity. Concentrated SUI positions magnify exposure to these risks. Diversified strategies spread risk across tokens with different profiles, reducing portfolio vulnerability to any single failure point.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

%201.svg)

%201.svg)

Managing crypto trading across several exchanges can be complicated, especially as the digital asset market expands rapidly. For developers, traders, and automated systems, switching between multiple exchange platforms often leads to fragmented workflows, inconsistent data, and increased operational risks. But can you solve this challenge by using a single API to trade across multiple crypto exchanges?

APIs, or Application Programming Interfaces, have become the backbone of modern crypto trading. Most centralized exchanges—like Binance, Coinbase, or Kraken—offer proprietary APIs, enabling users to execute trades, obtain real-time prices, manage portfolios, and stream account activity programmatically. Traditionally, each exchange requires users to generate unique API keys and implement its specific syntax and rules, which makes integrating multiple platforms into a unified workflow an ongoing challenge.

Multi-exchange trading is increasingly common for several reasons:

Attempting to manage these scenarios manually—or through siloed APIs—can result in lost efficiency and missed opportunities.

A unified API for crypto trading consolidates access to multiple exchanges behind a single set of endpoints, abstracting the idiosyncrasies of each platform. This approach offers several potential benefits:

Several solutions have emerged to deliver this unified experience. Independent aggregator services and open-source libraries—such as CCXT (CryptoCurrency eXchange Trading Library), 1inch (for DEX aggregation), or specialized enterprise APIs—translate commands from a user into the correct format for the targeted exchange and relay responses back to the application.

Despite their promise, there are important technical and operational considerations when using a unified API to trade across exchanges:

Before adopting a unified API, carefully evaluate each provider’s support for your target exchanges, ongoing maintenance, customer support, and transparency regarding reliability and uptime.

Unified API approaches are particularly valuable for:

Choosing the right multi-exchange API solution depends on your operational needs, preferred data formats, scalability goals, and trust in the vendor’s security protocols. Some organizations also combine unified APIs with bespoke integrations for specialized features or liquidity.

Modern trading strategies are increasingly shaped by AI and predictive analytics. When paired with unified APIs, AI tools can:

For example, platforms like Token Metrics offer AI-powered insights that can be integrated into multi-exchange trading workflows via robust APIs. Access to aggregated signals and analytics enhances decision accuracy and automation capabilities in an increasingly complex trading environment.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Coverage varies by provider, but leading multi-exchange APIs often support integrations with major centralized exchanges—like Binance, Coinbase Pro, Kraken, Bitfinex—as well as some decentralized platforms. Always check providers’ documentation for updated support lists.

Yes, consolidating your exchange API keys introduces single points of vulnerability. Use strong authentication, encrypted storage, access controls, and monitor for suspicious access. Select API providers with strong security track records and certifications.

Many unified APIs prioritize compatibility with basic order types (e.g., limit, market orders), but advanced orders may be available only if the destination exchange supports them. Some aggregators implement custom logic to approximate complex order types. Review each API’s documentation for order-type coverage.

Fees are typically passed through transparently to the underlying exchange. Some unified APIs may also levy their own usage or subscription fees. Review the pricing page and terms of service before integrating any multi-exchange API.

Certain unified or aggregator APIs support both exchange types, but you may experience differing levels of feature parity and security requirements. Decentralized exchanges often require wallet-based authentication, which may require additional integration steps.

This article is intended for informational and educational purposes only. It does not constitute financial, investment, or legal advice. Crypto markets carry risk—always conduct your own research and consider regulatory compliance before using trading APIs or integrating with exchanges.

%201.svg)

%201.svg)

As the world of cryptocurrency matures, traders, developers, and analysts are embracing automation to streamline their strategies. Central to this movement is the crypto API—a versatile, programmable gateway that unlocks automated trading, real-time data analysis, and AI-driven decision support. But how exactly do you use a crypto API to create, deploy, and optimize automated trading strategies?

A crypto API (Application Programming Interface) is a set of protocols and tools that enables applications to interact directly with cryptocurrency platforms or data providers. These APIs offer real-time access to market data, trading execution, portfolio balances, and analytics. By integrating APIs, developers and traders can:

This programmability reduces human error, accelerates reaction times, and enables the development of custom trading frameworks tailored to specific risk profiles or market outlooks.

To choose or use a crypto API effectively, it’s important to understand the principal types available:

Selecting the right API or combination depends on your trading objectives, technical skills, and the depth of data or execution automation you require.

Building an automated trading strategy with a crypto API generally involves the following core steps:

By following these steps, you build a feedback loop that can transform manual trade setups into resilient, scalable, and data-driven trading systems.

Utilizing crypto APIs and automated strategies poses unique challenges that require careful planning:

Successful automation relies not only on technical prowess, but also on robust operational safeguards to support consistent performance over time.

Recent advances in AI and machine learning are enhancing the potential of crypto APIs. Here’s how AI is increasingly being woven into automated trading workflows:

Platforms like Token Metrics merge crypto APIs and AI, making it easier for both coders and non-coders to leverage this advanced analytical edge within automated strategies.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Popular crypto APIs provide RESTful or WebSocket endpoints, making them accessible from Python, JavaScript, Java, and other modern languages. Official SDKs or community-developed libraries often exist for faster setup.

Yes, backtesting with historical API data allows you to simulate strategy performance, spot weaknesses, and estimate metrics like volatility or drawdown before risking capital in live markets.

Store keys in encrypted environments or secure vaults, use read-only permissions when possible, and rotate credentials regularly. Avoid hard-coding credentials directly into scripts or repositories.

AI, when combined with reliable API-driven data, can surface new signals, manage risk more dynamically, and adapt strategies as market conditions change. It does not guarantee profitability, but it can enhance analysis and responsiveness.

Common mistakes include exceeding API rate limits, insufficient error handling, hardcoding sensitive credentials, underestimating slippage, and failing to monitor or update strategies as conditions evolve.

This article is for educational purposes only and does not constitute investment, financial, or trading advice. Crypto assets and algorithmic trading involve significant risks. Perform your own research and consult a qualified professional before using any trading tools or APIs.

%201.svg)

%201.svg)

Building a crypto trading bot can unlock efficiencies, automate trading strategies, and enable real-time market engagement across digital asset exchanges. But at the heart of any successful crypto trading bot lies its API connection: the bridge enabling programmatic access to price data, trading actions, and analytics. With so many API options on the market—each offering various data sources, trading permissions, and strengths—developers and quants are left wondering: which API is best for constructing a robust crypto trading bot?

APIs (Application Programming Interfaces) are standardized sets of protocols enabling different software components to communicate. For crypto trading bots, APIs are crucial for tasks such as:

Crypto APIs generally fall into these categories:

Choosing the ideal API is a technical decision based on performance, reliability, security, and data depth. Additionally, the needs—whether you want to simply automate trades, employ AI-driven signals, or monitor on-chain transactions—will guide your search.

Not all APIs are alike. The following framework can help you evaluate which API best fits your bot-building goals:

By rating APIs against these metrics, developers can objectively compare offerings to their specific use case—whether driving a simple DCA (dollar-cost averaging) bot, a multi-exchange arbitrage system, or an AI-powered trading agent.

Here’s a rundown of leading API options for different crypto trading bot needs:

Which option is ‘best’ depends on your priorities. Exchange APIs offer full trade functionality but are limited to a single trading venue. Aggregator APIs like Token Metrics provide broader data and analytics but may not place trades directly. Some advanced APIs merge both, offering signals and price feeds for smarter automation.

The intersection of AI and crypto APIs is reshaping modern trading bots. APIs like Token Metrics provide not just price and volume data, but also AI-generated trading signals, market sentiment scoring, risk analytics, and pattern recognition.

Developers integrating AI-powered APIs benefit from:

This future-proofs bots against rapidly evolving market dynamics—where speed, pattern recognition, and deep learning models can be decisive. Advanced APIs with on-chain metrics further enable bots to tap into otherwise hidden flows and activities, informing smarter actions and portfolio risk adjustments.

To select and adopt the right API for your trading bot project, consider the following action plan:

Combining real-time data with analytics and AI-powered signals from robust APIs positions developers to build more intelligent, adaptive crypto trading bots.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Popular APIs include the Binance API, Coinbase Advanced Trade API, Kraken API for direct exchange access, CCXT library for multi-exchange programming, and analytics-focused APIs like Token Metrics for real-time signals and advanced data.

Open-source libraries offer flexibility and community support, often useful for prototyping or integrating across exchanges. Commercial APIs may provide faster data, enhanced security, proprietary analytics, and dedicated support—suitable for more advanced or enterprise-grade bots.

Keep keys private (env variables, key vaults), restrict permissions, use IP whitelisting and two-factor authentication where available, and monitor for suspicious API activity. Never expose keys in public code repositories.

High latency can translate to missed trades, slippage, and lower performance, especially for bots executing frequent or time-sensitive strategies. Opt for APIs with low latency, real-time websockets, and server locations close to major exchanges when timing is critical.

Yes. APIs like Token Metrics offer AI-powered analytics and trading signals that can be consumed by bots for automated or semi-automated strategies, supporting smarter decision-making without manual intervention.

This blog post is for informational and educational purposes only. It does not constitute investment advice, recommendations, or offer to buy/sell any financial instruments. Readers should conduct their own research and comply with all applicable regulations before using any APIs or trading tools mentioned.

%201.svg)

%201.svg)

Imagine triggering a cryptocurrency trade in milliseconds—automatically, precisely, and on your schedule. Behind much of today’s algorithmic and automated crypto trading lies a powerful tool: the crypto API. But how exactly do APIs let you execute trades, and what are the fundamentals users need to understand before getting started? This guide unpacks the essentials of using crypto APIs for trade execution, including how these interfaces work, real-world applications, risks, and practical integration tips.

APIs, or Application Programming Interfaces, are software intermediaries that enable different applications to communicate. In the context of cryptocurrencies, a crypto trading API allows users, developers, or institutions to connect directly to a crypto exchange’s backend systems. This connection makes it possible to request live data, place and manage orders, check balances, and retrieve trade history—all programmatically.

Common examples include Binance, Coinbase Pro, Kraken, and Bybit APIs, all of which support crucial trading functions. These APIs typically support REST (for single requests) and WebSocket (for real-time updates) protocols. API access levels and capabilities often depend on your account permissions and security settings at the exchange.

Executing trades via a crypto API requires a step-by-step process that generally includes:

These automated processes underpin trading bots, portfolio managers, and sophisticated AI-driven trading agents—turning manual strategies into efficient, round-the-clock executions, all without a traditional front-end user interface.

API-based trading is central to a variety of modern crypto workflows, powering:

AI-powered platforms are increasingly integrating advanced analytics and signals directly into their API workflows, letting traders and developers access sophisticated research and data-driven triggers with minimal manual effort. Token Metrics is a notable example of a service blending advanced crypto analytics with API accessibility for builders and traders alike.

While crypto APIs are powerful, they also introduce unique security considerations:

Responsible API usage helps minimize exposure to hacking, credential leaks, or account abuse—especially as trading volumes and automation scale.

To integrate and utilize a crypto trading API effectively:

Building with APIs requires a combination of technical skills and operational caution, but unlocks the full potential of programmable trading in crypto markets.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Most major crypto exchanges offer trading APIs accessible to users with verified accounts. However, each platform sets its own requirements regarding API access levels, regional restrictions, and compliance, which users should review before starting.

Crypto APIs are designed with robust security features, but safety also depends on user practices. Limiting API key permissions, restricting access via IP, and keeping keys private are essential for minimizing risks.

Yes, APIs are the main mechanism for building automated trading systems (bots) and integrating algorithmic trading strategies. This allows for uninterrupted operation and rapid reaction to market signals based on predefined logic.

At minimum, familiarity with programming (such as Python or JavaScript), API communication (HTTP/websocket), and basic security practices are required to use crypto APIs effectively and safely.

Most APIs enforce rate limits to control the number of allowed requests within specific time frames. They may also restrict order types or trading pairs and require periodic re-authentication or API key refreshes.

This article is for informational and educational purposes only. It does not provide investment advice or endorse specific assets, platforms, or trading strategies. Always perform your own research and consult with qualified professionals before making technical or financial decisions related to cryptocurrency trading or API integration.

%201.svg)

%201.svg)

APIs power the data-driven revolution in crypto and beyond, but nothing derails innovation faster than hitting a rate limit at a critical moment. Whether you’re building trading bots, AI agents, portfolio dashboards, or research tools, understanding and managing API rate limits is essential for reliability and scalability.

Most API providers, especially in crypto, impose rate limits to protect their infrastructure and ensure fair resource usage among clients. A rate limit defines the maximum number of requests your app can make within a specific timeframe—say, 100 requests per minute or 10,000 per day. Exceeding these limits can result in errors, temporary bans, or even long-term blocks, making robust rate management not just a courtesy, but a necessity for uninterrupted access to data and services.

The explosive growth of crypto markets and real-time analytics means data APIs face enormous loads. Providers implement rate limits for several key reasons:

This is especially critical in crypto, where milliseconds count and data volumes can be extreme. Services like trading execution, real-time quotes, and on-chain analytics all rely on consistent API performance.

When your app exceeds rate limits, the API usually responds with a specific HTTP status code, such as 429 Too Many Requests or 403 Forbidden. Along with the status, APIs often return structured error messages detailing the violation, including which limit was breached and when new requests will be allowed.

Common fields and headers to look for:

Proper error handling—such as parsing these headers and logging retry attempts—is the foundation for any robust API integration.

Successfully managing API rate limits ensures both smooth user experiences and API provider goodwill. Here are essential best practices:

The combination of proactive client design and real-time monitoring is the best defense against hitting hard limits, whether you’re scaling a single app or orchestrating a fleet of decentralized AI agents.

As your infrastructure grows—handling multiple APIs, high-frequency trading signals, or deep analytics—you’ll need even more sophisticated approaches, such as:

Planning for scalability, reliability, and compliance with provider guidelines ensures you remain agile as your crypto project or trading operation matures.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Exceeding rate limits typically results in HTTP 429 errors and temporary suspension of requests. Many APIs automatically block requests until your quota resets, so continual violation may lead to longer blocks or even account suspension. Always refer to your provider’s documentation for specifics.

Most APIs include custom headers in responses detailing your remaining quota, usage window, and reset times. Some services offer dashboards to monitor usage statistics and set up alerts for approaching quota boundaries.

Many API providers, especially paid plans or partners, allow you to request increased quotas. This process often involves contacting support, outlining your use case, and justifying why higher limits are needed.

Rate limits vary widely by provider. Well-established platforms like Token Metrics, Binance, and CoinGecko balance fair access with high-performance quotas—always compare tiers and read docs to see which fits your scale and usage needs.

For AI/ML models reliant on real-time data (e.g., trading bots, sentiment analysis), rate limiting shapes data availability and latency. Careful scheduling, data caching, and quota awareness are key to model reliability in production environments.

This content is for educational and informational purposes only. It does not constitute investment, legal, or financial advice of any kind. Crypto services and APIs are subject to provider terms and legal compliance requirements. Readers should independently verify policies and consult professionals as necessary before integrating APIs or automated solutions.

%201.svg)

%201.svg)

APIs power much of the innovation in the crypto space, but developers and analysts often face a key technical crossroads: Should you use a public or a private crypto API? Each API type serves different use cases and comes with its own set of advantages, limitations, and security requirements. Understanding these differences is critical for building effective crypto platforms, bots, and research tools.

Crypto APIs (Application Programming Interfaces) are sets of rules that let software applications interact with blockchain data, exchanges, wallets, or analytical tools. APIs bring order to a decentralized landscape, making it possible to access real-time prices, submit transactions, retrieve on-chain activity, or gather analytics—often without manually interacting with the blockchain itself.

There are two primary categories of crypto APIs:

But how do these two categories truly differ, and why does it matter for crypto application development and data consumption?

Public crypto APIs typically provide access to information that is either non-sensitive or already visible on public blockchains. Examples include:

Key traits of public APIs:

For instance, if you want to build a website displaying the latest Bitcoin price or trending DeFi projects, you’d usually rely on public crypto APIs.

Private crypto APIs open the door to more sensitive and powerful functionality, but require strict controls. They are generally used for:

Key characteristics include:

Developers building personal portfolio management tools, automated trading bots, or custodial dashboards integrate private crypto APIs to enable a customized, authenticated user experience.

Understanding the distinctions helps teams design more robust crypto products:

The choice often comes down to your project requirements: If you just need publicly available blockchain data or market feeds, public APIs suffice. If your solution needs to modify user data or interact on behalf of a user, private APIs with strong authentication are mandatory.

Several factors help determine whether a public or private crypto API is appropriate:

Following best practices for handling API credentials—such as storing secrets off-chain, using environment variables, and enforcing minimal permission scopes—can greatly reduce risk.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Public crypto APIs help developers launch apps like price tickers, market dashboards, blockchain explorers, and analytics tools that require broadly accessible, non-sensitive data. They are ideal for gathering real-time feeds or tracking on-chain activity without user authentication.

Private crypto APIs protect endpoints with authentication mechanisms like API keys, OAuth, or digital signatures. This ensures only authorized clients can fetch sensitive information or perform actions like trading or withdrawals. API providers also employ rate limits and monitor usage for suspicious behavior.

Yes. Public APIs often have stricter rate limits to prevent abuse, since anyone can access them. Private API users, once authenticated, may receive higher quotas, prioritizing account-specific operations.

Exposed, leaked, or improperly stored private API keys can allow malicious actors to access accounts, make unauthorized trades, or withdraw funds. Always use environment variables, restrict permissions, and rotate keys periodically.

Look for reliability, comprehensive documentation, secure authentication, supportive developer communities, and transparent pricing. Solutions like Token Metrics combine robust data coverage and AI-powered insights for flexible crypto app development.

This article is for informational purposes only and does not constitute financial or investment advice. Always perform your own research and implement strong security practices when developing crypto applications or integrating APIs.

%201.svg)

%201.svg)

APIs power everything from mobile apps to crypto trading platforms. As they become the backbone of digital finance and decentralized applications, securing API endpoints is more critical than ever. A single vulnerability can expose sensitive data, undermine user trust, or even lead to costly breaches. So, how can you authenticate and secure your API requests effectively?

API authentication is the process of verifying that API requests come from legitimate sources. This step is essential to prevent unauthorized access and data leaks, especially in industries handling sensitive information like cryptocurrency and finance. There are several standard authentication methods:

Choosing the right authentication mechanism depends on your application's needs, security requirements, and threat model. For example, high-value crypto data or transaction endpoints require more robust solutions than public info APIs.

Authentication can only go so far without communication channel security. APIs must use encryption to safeguard data in transit. Here’s how to reinforce API requests against interception and tampering:

Data protection is not purely about outside attackers. Proper encryption and data minimization also reduce compliance risk and support privacy best practices relevant to digital assets.

API keys and secrets are valuable attack targets—treat them like passwords. Here are practical steps to keep them secure:

In the world of crypto APIs, where unauthorized trades or fund transfers can have major consequences, diligent key management is foundational to API security.

Authentication and encryption are essential, but holistic API security requires additional layers of defense:

Effective API security is an ongoing process. Stay updated with the latest threats and best practices—especially as new technologies and decentralized protocols evolve in the crypto sector.

The rapid growth of digital assets has driven demand for real-time data, automated trading strategies, and personalized user experiences. Crypto APIs, especially those leveraging AI, enable everything from on-chain analytics to dynamic risk scoring. However, these capabilities also come with heightened security stakes: AI-driven agents making transactions or analyzing blockchain data depend on reliable, tamper-proof sources.

Integrating secure APIs backed by strong authentication and threat prevention supports:

Using advanced API security controls helps crypto app developers maximize innovation while safeguarding users and market integrity.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Authentication confirms the identity of the API requestor, while authorization defines what resources and actions that identity can access or perform. Both are needed for secure API usage.

The choice depends on your use case. API keys are simple for service-to-service communication. OAuth offers stronger, user-specific security. JWT excels in stateless authentication. Many robust crypto APIs use combinations depending on endpoint sensitivity.

Provide keys using secure, authenticated user portals. Avoid email or plaintext transmission. Always ensure users understand to treat API credentials like passwords and never share or expose them.

Embedding secrets in frontend code, not enforcing HTTPS, failing to rotate keys, ignoring rate limits, and returning too much sensitive data are common but avoidable risks.

Review security policies and settings at least quarterly, or following any significant change (e.g., new endpoints, user roles, or integration partners). Promptly address newly discovered vulnerabilities and emerging threats.

This content is for educational and informational purposes only. It does not constitute technology, investment, or legal advice. Security strategies and technologies evolve rapidly; always consult with cybersecurity professionals before implementing any measures in critical or regulated environments.

%201.svg)

%201.svg)

As the crypto ecosystem expands, APIs are the bridge connecting developers to real-time prices, blockchain data, and decentralized tools. Choosing the right programming language is critical—whether you're building trading bots, portfolio trackers, or AI research agents for digital assets. How do you select the most effective language for working with crypto APIs? Let's break down the options, trade-offs, and best practices for developers entering this dynamic space.

Python stands out as the top choice for many developers building crypto-powered applications. Its simple syntax, robust standard libraries, and thriving open-source community have propelled it to the forefront of blockchain and crypto development. Here's why:

Python is especially popular for backend services, trading bots, analytics dashboards, and AI-driven crypto research platforms. Its versatility makes it an excellent starting point for most crypto API projects.

JavaScript's ubiquity in web development—and the rise of Node.js for backend—have cemented its importance in the crypto API landscape. Here's why developers favor JavaScript:

JavaScript and Node.js are top picks for projects focused on user-facing dashboards, live trading interfaces, and dApp development where real-time interaction is crucial.

For developers who prioritize performance and scalability, compiled languages like Go, Java, and C# come into play:

While these languages often require more boilerplate and steeper learning curves than Python or JavaScript, they excel in situations where uptime, parallel processing, and performance are vital.

When your project needs to interact deeply with blockchain networks beyond just APIs—such as deploying smart contracts or working at the protocol level—specialized languages become essential:

For API-focused projects, these languages play a role primarily when paired with a more general-purpose language (like Python or JavaScript) for off-chain tasks, with the specialized code handling on-chain logic.

The ideal programming language depends on a few project-specific factors:

Ultimately, the best crypto API projects balance technical strengths, developer proficiency, and the support network a programming language provides.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Both Python and JavaScript are leading choices. Python excels for backend analytics and AI-driven tools, while JavaScript is often used for building interactive dApps and web interfaces directly leveraging APIs. The right choice often depends on your application requirements and team expertise.

Popular libraries include web3.py and ccxt for Python, web3.js and ethers.js for JavaScript, as well as client SDKs provided by leading exchanges and data providers. Token Metrics also offers a powerful API for market data and analytics.

Use secure API key management, implement rate limiting, utilize HTTPS for data transmission, and validate all external responses. Choosing a strongly-typed language (like Go or Rust) and leveraging well-maintained libraries can reduce vulnerabilities.

Solidity and Rust are best suited for smart contract and protocol-level blockchain work—not direct API integration. For most API-driven crypto projects, Python, JavaScript, or Go are more practical; learn Solidity or Rust if you plan to develop on-chain logic or new blockchain platforms.

Token Metrics delivers AI-driven crypto analytics and signals via a unified API, empowering developers to build research, trading, or analytical tools rapidly. The platform provides robust documentation and versatile endpoints compatible with major programming languages.

This content is for informational and educational purposes only. It does not constitute investment, financial, or legal advice. Use all programming languages, APIs, and crypto tools at your own risk and always conduct thorough technical due diligence before integrating third-party services or tools into your projects.

%201.svg)

%201.svg)

Cryptocurrency continues to reshape digital finance, but harnessing its potential in your apps or websites starts with reliable data and functional integrations. Whether you’re building a trading dashboard, NFT platform, or analytics tool, crypto APIs can help your users interact with blockchain data in real time. But what exactly is involved in integrating a crypto API, and which best practices should developers follow to ensure security and scalability?

A crypto API (Application Programming Interface) enables your application to access blockchain data—such as prices, market statistics, trading signals, wallets, or transactions—without running a full node. These APIs expose services from exchanges, data aggregators, or specialized blockchain infrastructure providers, offering an efficient way for developers to query real-time or historical information about one or many cryptocurrencies.

Key types of crypto APIs include:

Integration complexity depends on your project’s requirements, the data you need, and your tech stack. Below is a streamlined process you can follow:

With new blockchain protocols and DeFi innovations, crypto APIs serve a growing variety of development scenarios, including:

Integrating financial APIs brings unique security and privacy considerations. To safeguard both your application and its users, adopt the following best practices:

Not all crypto APIs are built the same. To ensure seamless user experience and reliability for your app or site, regularly assess:

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Most crypto APIs are RESTful and language-agnostic. Popular options include JavaScript (Node.js), Python, Java, Ruby, Go, and C#. Many providers also supply SDKs for quick setup in these languages.

Yes, many crypto API providers, including Token Metrics, offer free tiers with rate limits suitable for development and testing. For production workloads or higher request volume, upgrading may be necessary.

Some APIs allow trade execution and position monitoring, but this requires authentication and additional security considerations. Always follow platform-specific restrictions and compliance requirements when handling trading actions.

Evaluate APIs based on the data scope, latency, documentation quality, scalability, pricing, and available features such as on-chain analytics or advanced trading signals. Community reviews and support responsiveness are also important factors.

API integration can be secure if you use HTTPS, safeguard your API keys, validate all inputs and outputs, and regularly monitor application and network activity. Following best practices and choosing reputable providers is crucial.

This article is for informational purposes only. It does not provide investment advice, guarantees of accuracy, or endorse any specific technology, protocol, or strategy. Always conduct your own technical and security due diligence before integrating any third-party services.

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.