Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

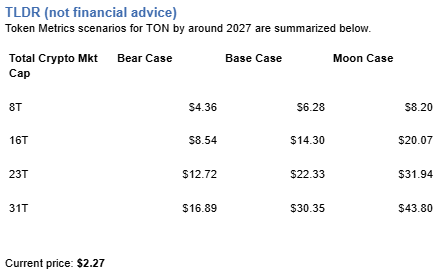

Layer 1 tokens capture value through transaction fees, staking, and validator economics. TON uses proof-of-stake and a multi-blockchain architecture integrated with Telegram services. Token Metrics scenarios model TON outcomes across different total crypto market sizes, reflecting adoption and transaction demand by 2027.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics TM Grade is 74%, Buy, and the trading signal is bullish, indicating positive short-term momentum and strong overall project quality. Concise 12-month numeric view, scenarios cluster roughly between $5 and $14, with a base case near $9.

8T: At an 8 trillion dollar total crypto market cap, TON projects to $4.36 in bear conditions, $6.28 in the base case, and $8.20 in bullish scenarios.

16T: At 16 trillion, the range expands to $8.54 (bear), $14.30 (base), and $20.07 (moon).

23T: The 23 trillion tier shows $12.72, $22.33, and $31.94 respectively.

31T: In the maximum liquidity scenario at 31 trillion, TON reaches $16.89 (bear), $30.35 (base), or $43.80 (moon).

The Open Network is a blockchain designed to support fast, low-cost transactions and a scalable ecosystem of decentralized applications. It integrates with digital services and messaging platforms to reach a broad user base, emphasizing high throughput and accessibility.

TON uses a proof-of-stake consensus mechanism with a multi-blockchain architecture. The TON token powers network activity, facilitating transactions, staking, and governance, and is integrated into Telegram-based services for user-friendly in-app payments and wallets.

Token Metrics AI provides additional context on Toncoin's technical positioning and market dynamics.

Vision: The vision for Toncoin and The Open Network is to create a fast, secure, and scalable blockchain that enables seamless digital transactions and decentralized services, accessible to millions through integration with everyday communication tools like Telegram.

Problem: Many blockchain networks face limitations in speed, cost, and user accessibility, hindering mainstream adoption. Toncoin aims to address the friction of slow transaction times and high fees seen on older networks, while also lowering the barrier to entry for non-technical users who want to engage with decentralized applications and digital assets.

Solution: TON uses a proof-of-stake consensus mechanism with a multi-blockchain architecture to achieve high scalability and fast finality. The network supports smart contracts, decentralized storage, and domain naming, enabling a wide range of applications. Toncoin facilitates transactions, staking, and network governance, and is integrated into Telegram-based services, allowing for in-app payments and wallet functionality through user-friendly interfaces.

Market Analysis: Toncoin operates in the competitive layer-1 blockchain space, often compared to high-performance networks like Solana and Avalanche, though it differentiates itself through deep integration with Telegram's ecosystem. Its potential for mass adoption stems from access to hundreds of millions of Telegram users, which could drive network effects and utility usage. Unlike meme tokens, Toncoin's value is tied to infrastructure and real-world application rather than speculation or community hype. However, its growth depends on sustained development, regulatory clarity, and actual user engagement within Telegram. Competition from established blockchains and shifting market narratives around scalability and decentralization remain key risks. As a top-tier blockchain by ecosystem potential, Toncoin's market position is influenced more by integration milestones and user adoption than direct price dynamics.

Fundamental Grade: 80.88% (Community 83%, Tokenomics N/A, Exchange 100%, VC 84%, DeFi Scanner 85%).

Technology Grade: 77.11% (Activity 55%, Repository 72%, Collaboration 73%, Security N/A, DeFi Scanner 85%).

How does TON accrue value?

Value accrual mechanisms include transaction fees, validator staking rewards, and governance alignment described for TON in the documentation. As Toncoin usage grows through transactions and user activity, TON can capture network fees and staking yields while coordinating governance. Effectiveness depends on sustained adoption and network throughput.

What price could TON reach in the moon case?

Moon case projections range from $8.20 at 8T to $43.80 at 31T. These scenarios require maximum market cap expansion and strong network adoption with robust liquidity conditions. Not financial advice.

• Track live grades and signals: Token Details

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Token Metrics combines fundamental, technical, and on-chain AI-powered analysis for actionable ratings, signals, and research. Use our data platform for scenario-based investing, backtested grades, and bespoke insights for digital asset markets.

%201.svg)

%201.svg)

Layer 1 tokens like Cronos represent bets on specific blockchain architectures winning developer and user mindshare. CRO carries both systematic crypto risk and unsystematic risk from Cronos's technical roadmap execution and ecosystem growth. Multi-chain thesis suggests diversifying across several L1s rather than concentrating in one, since predicting which chains will dominate remains difficult.

The projections below show how CRO might perform under different market cap scenarios. While Cronos may have strong fundamentals, prudent portfolio construction balances L1 exposure across Ethereum, competing smart contract platforms, and Bitcoin to capture the sector without overexposure to any single chain's fate.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

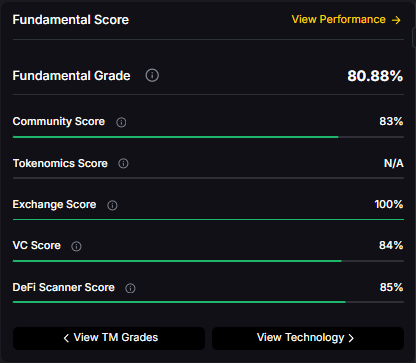

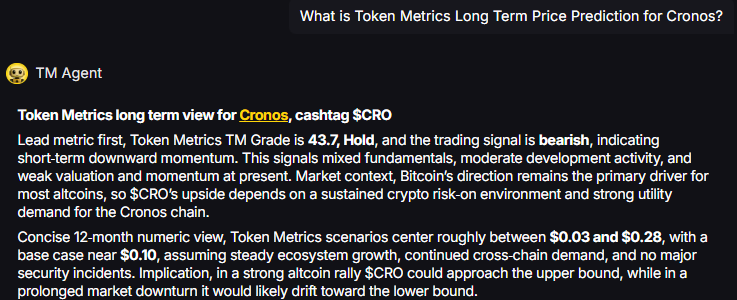

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics scenarios center roughly between $0.03 and $0.28, with a base case near $0.10, assuming steady ecosystem growth, continued cross-chain demand, and no major security incidents.

Portfolio theory teaches that diversification is the only free lunch in investing. CRO concentration violates this principle by tying your crypto returns to one protocol's fate. Token Metrics Indices blend Cronos with the top one hundred tokens, providing broad exposure to crypto's growth while smoothing volatility through cross-asset diversification. This approach captures market-wide tailwinds without overweighting any single point of failure.

Systematic rebalancing within index strategies creates an additional return source that concentrated positions lack. As some tokens outperform and others lag, regular rebalancing mechanically sells winners and buys laggards, exploiting mean reversion and volatility. Single-token holders miss this rebalancing alpha and often watch concentrated gains evaporate during corrections while index strategies preserve more gains through automated profit-taking.

Beyond returns, diversified indices improve the investor experience by reducing emotional decision-making. Concentrated CRO positions subject you to severe drawdowns that trigger panic selling at bottoms. Indices smooth the ride through natural diversification, making it easier to maintain exposure through full market cycles.

Cronos is an EVM-compatible blockchain built to support decentralized applications with high throughput and low transaction costs. The network is designed to bridge the gap between crypto and traditional finance, offering interoperability with Ethereum and Cosmos ecosystems. Its focus on scalability and developer-friendly infrastructure aims to attract DeFi, NFT, and gaming projects.

CRO serves as the native utility token of the Cronos ecosystem, used for transaction fees, staking, and governance. It enables users to participate in network security, pay for smart contract execution, and access services within the Cronos DeFi ecosystem. Common usage patterns include staking for rewards, providing liquidity in DeFi protocols, and facilitating cross-chain transfers.

At an 8 trillion dollar total crypto market cap, CRO projects to $0.14 in bear conditions, $0.29 in the base case, and $0.34 in bullish scenarios.

Doubling the market to 16 trillion expands the range to $0.43 (bear), $0.57 (base), and $0.71 (moon).

At 23 trillion, the scenarios show $0.62, $0.85, and $1.09 respectively.

In the maximum liquidity scenario of 31 trillion, CRO could reach $0.81 (bear), $1.13 (base), or $1.46 (moon).

These ranges illustrate potential outcomes for concentrated CRO positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

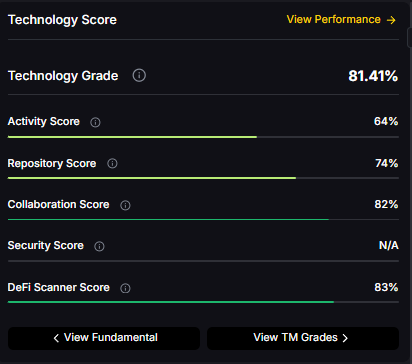

Fundamental Grade: 72.71% (Community 55%, Tokenomics 60%, Exchange 100%, VC N/A, DeFi Scanner 83%).

Technology Grade: 81.41% (Activity 64%, Repository 74%, Collaboration 82%, Security N/A, DeFi Scanner 83%).

Can CRO reach $1?

Based on the scenarios, CRO could reach $1 in the 23T moon case where it projects to $1.09, and in the 31T scenarios where the base case is $1.13 and the moon case is $1.46. These outcomes require both broad market cap expansion and Cronos maintaining competitive position. Not financial advice.

What's the risk/reward profile for CRO?

Risk/reward spans from $0.14 in the lowest bear case to $1.46 in the highest moon case. Downside risks include regulatory or infrastructure shocks and competitive displacement, while upside drivers include liquidity expansion and roadmap execution. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

What gives CRO value?

CRO accrues value through transaction fees, staking, and governance utility across the Cronos ecosystem. Demand drivers include DeFi activity, cross-chain usage, and network services. While these fundamentals matter, diversified portfolios capture value accrual across multiple tokens rather than betting on one protocol's success.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

%201.svg)

%201.svg)

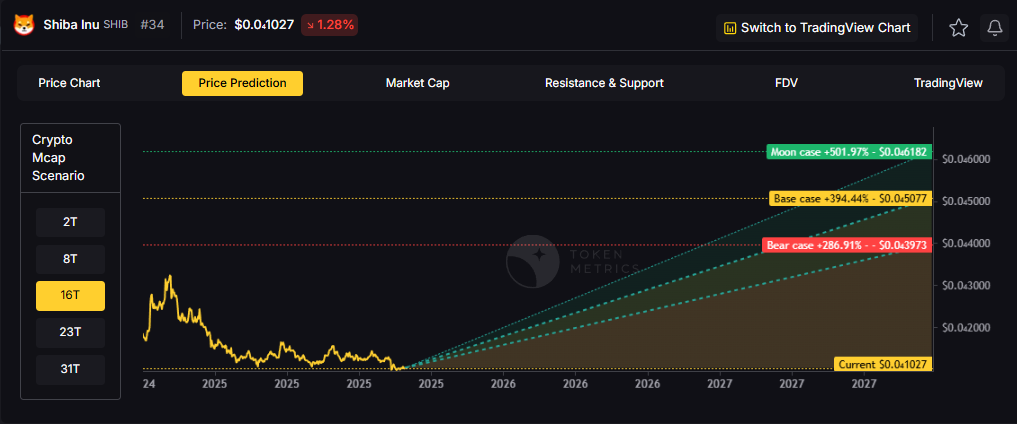

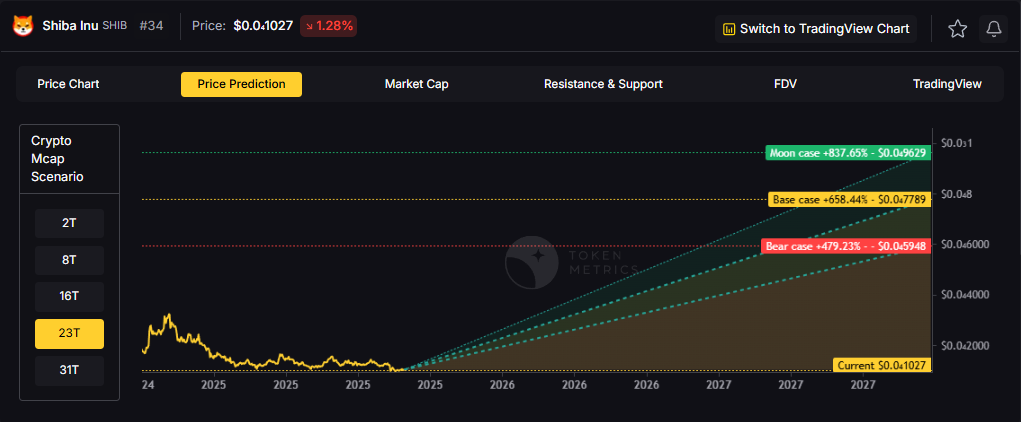

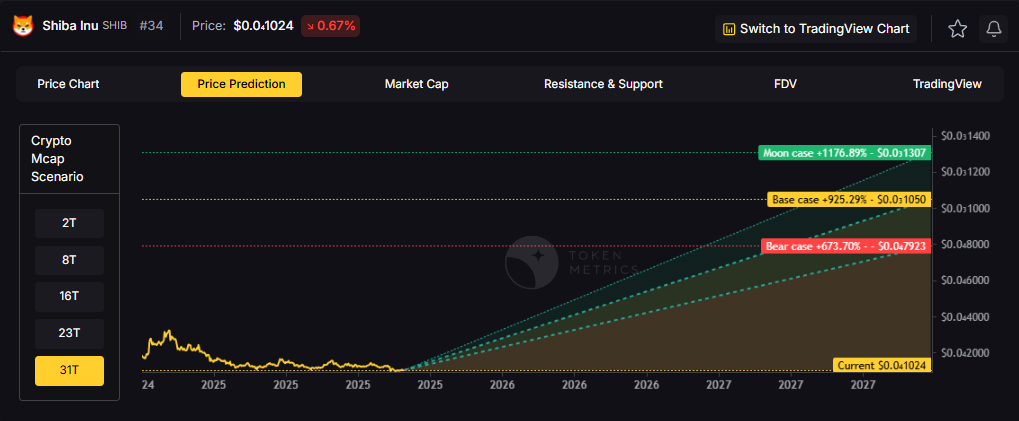

Shiba Inu operates as a community-driven meme token where price action stems primarily from social sentiment, attention cycles, and speculative trading rather than fundamental value drivers. SHIB exhibits extreme volatility with no defensive characteristics or revenue-generating mechanisms typical of utility tokens. Token Metrics scenarios below provide technical Price Predictions across different market cap environments, though meme tokens correlate more strongly with viral trends and community engagement than systematic market cap models. Positions in SHIB should be sized as high-risk speculative bets with potential for total loss.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

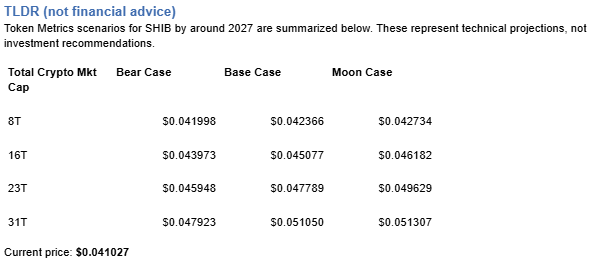

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity. For meme tokens, actual outcomes depend heavily on social trends and community momentum beyond what market cap models capture.

TM Agent baseline: Token Metrics TM Grade is 24.1%, Sell, with a bearish trading signal. The concise 12‑month numeric view centers between

TM Agent numeric view: scenarios center roughly between $0.000005 and $0.000035, with a base case near $0.000012.

Token Metrics scenarios provide technical price bands across market cap tiers:

8T: At 8 trillion total crypto market cap, SHIB projects to $0.041998 (bear), $0.042366 (base), and $0.042734 (moon).

16T: At 16 trillion total crypto market cap, SHIB projects to $0.043973 (bear), $0.045077 (base), and $0.046182 (moon).

23T: At 23 trillion total crypto market cap, SHIB projects to $0.045948 (bear), $0.047789 (base), and $0.049629 (moon).

31T: At 31 trillion total crypto market cap, SHIB projects to $0.047923 (bear), $0.051050 (base), and $0.051307 (moon).

These technical ranges assume meme tokens maintain market cap share proportional to overall crypto growth. Actual outcomes for speculative tokens typically exhibit higher variance and stronger correlation to social trends than these models predict.

Shiba Inu is a meme-born crypto project that centers on community and speculative culture. Unlike utility tokens with specific use cases, SHIB operates primarily as a speculative asset and community symbol. The project focuses on community engagement and entertainment value.

SHIB has demonstrated viral moments and community loyalty within the broader meme token category. The token trades on community sentiment and attention cycles more than fundamentals. Market performance depends heavily on social media attention and broader meme coin cycles.

Token Metrics provides technical analysis, scenario math, and rigorous risk evaluation for hundreds of crypto tokens. Want to dig deeper? Explore our powerful AI-powered ratings and scenario tools here.

Will SHIB 10x from here?

Answer: At current price of $0.041027, a 10x reaches $0.41027. This level does not appear in any of the listed bear, base, or moon scenarios across 8T, 16T, 23T, or 31T tiers. Meme tokens can 10x rapidly during viral moments but can also lose 90%+ just as quickly. Position sizing for potential total loss is critical. Not financial advice.

What are the biggest risks to SHIB?

Answer: Primary risks include attention shifting to newer memes, community fragmentation, developer abandonment, regulatory crackdowns, and liquidity collapse during downturns. Unlike utility tokens with defensive characteristics, SHIB has zero fundamental floor. Price can approach zero if community interest disappears. Total loss is a realistic outcome. Not financial advice.

Next Steps

Disclosure

Educational purposes only, not financial advice. SHIB is a highly speculative asset with extreme volatility and high risk of total loss. Meme tokens operate as entertainment and gambling instruments rather than investments. Only allocate capital you can afford to lose entirely. Do your own research and manage risk appropriately.

%201.svg)

%201.svg)

The internet has become an integral part of modern life, continually evolving since its inception. In recent years, a new paradigm called Web3 has emerged, promising to reshape how users interact with digital platforms. This blog post explores the fundamental differences between Web3 and the current internet, often referred to as Web2, to clarify what Web3 entails and its potential impact.

Web3 represents the next phase of the internet, built on the principle of decentralization. Unlike the current centralized internet infrastructure, Web3 aims to distribute control away from traditional intermediaries like corporations and governments to users and communities. Key technologies underpinning Web3 include blockchain, decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs).

At its core, Web3 is designed to empower users to own and control their data, digital assets, and online identities through cryptographic proof rather than relying on centralized entities. This shift holds the promise of enhanced privacy, improved security, and greater transparency across digital services.

The current internet, or Web2, is characterized by centralized platforms such as social media networks, content-sharing sites, and cloud service providers. These platforms control user data and have significant influence over digital ecosystems. Web3 introduces several pivotal differences:

A few seminal technologies make the Web3 vision feasible:

These technologies collectively foster environments where decentralized applications can function effectively, distinguishing Web3 from legacy web systems.

Analyzing the Web3 space requires comprehensive research and understanding of complex, rapidly evolving technologies. AI-driven research platforms like Token Metrics use machine learning and data analytics to provide insights into blockchain networks, emerging protocols, and token metrics. By leveraging these tools, researchers and enthusiasts can assess technological fundamentals and ecosystem trends in a structured, data-informed manner, facilitating a clearer understanding of Web3 developments.

For those interested in exploring Web3, keeping the following factors in mind can enhance comprehension and engagement:

While Web3 promises a more decentralized and user-empowered internet, it is essential to consider practical implications. Adoption hurdles, scalability, user experience, and regulatory frameworks will shape its trajectory. Unlike Web2, which offers convenience and centralized control, Web3 emphasizes autonomy and distributed governance. The future internet may well integrate strengths from both models, providing a hybrid approach that balances user control with usability.

Web3 represents a transformative vision for the internet, aiming to decentralize control and enhance user ownership of data and digital assets. Its key distinctions from the current internet (Web2) include decentralization, trustless interactions, and new economic models. Technologies like blockchain and smart contracts drive these changes, supported by analytical tools such as Token Metrics that aid in navigating this complex environment. As Web3 continues to evolve, understanding its fundamentals remains crucial for anyone interested in the future of the internet.

This blog post is intended for educational and informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research and consider their risk tolerance before engaging with Web3 technologies or cryptocurrencies.

%201.svg)

%201.svg)

The concept of irreversible transactions is a foundational aspect of blockchain technology and cryptocurrencies. Unlike traditional banking systems where transactions can be reversed or disputed, blockchain transactions are designed to be permanent and unalterable once confirmed. This unique feature raises an important question: why are blockchain transactions irreversible? This article delves into the fundamental principles, technological mechanisms, and security frameworks that underpin transaction irreversibility in blockchains. In addition, it highlights how analytical and AI-driven research platforms such as Token Metrics can help users better understand the underlying dynamics.

To answer why blockchain transactions are irreversible, it is essential to understand what constitutes a blockchain transaction. At its core, a blockchain is a decentralized and distributed digital ledger of transactions, grouped into blocks and linked through cryptographic hashes.

Once a transaction is included in a confirmed block, it becomes part of the immutable ledger, considered permanent and irreversible.

Immutability is the cornerstone of transaction irreversibility. Blockchain achieves immutability using cryptographic techniques and decentralized consensus.

This design ensures that once a transaction is confirmed and embedded in a block, it is computationally infeasible to modify or reverse it without consensus from the majority of the network.

Consensus algorithms play an essential role in determining when transactions are considered final and irreversible.

Network participants generally treat transactions as irreversible after a certain number of confirmations (additional blocks). This requirement reduces risks from temporary forks or reorganizations.

Reversing a blockchain transaction would entail rewriting the blockchain history, which is impeded by several technical realities:

Therefore, even accidental or malicious attempts to reverse a transaction face insurmountable obstacles.

The irreversible nature of blockchain transactions carries both benefits and risks.

Understanding these implications is critical for users engaging with blockchain-based systems, and tools like Token Metrics provide data-driven insights to enhance awareness and decision-making.

With the growing complexity of blockchain ecosystems, AI-driven platforms are increasingly valuable for dissecting transaction behaviors and network health.

Utilizing these resources supports a better grasp of the irreversible nature of transactions and the broader blockchain infrastructure.

Blockchain transaction irreversibility is rooted in the technology’s core principles of immutability, decentralization, and consensus-driven finality. These mechanisms collectively ensure that once a transaction is recorded on the blockchain and sufficiently confirmed, it cannot be altered or undone without prohibitive computational effort and majority network control. While irreversible transactions provide robust security and trustlessness, they also emphasize the importance of user diligence. Leveraging AI-powered analytical tools like Token Metrics can enhance comprehension and navigational confidence within blockchain ecosystems.

This article is intended for educational purposes only and does not constitute financial advice. Readers should conduct their own research using varied sources, including specialized platforms such as Token Metrics, before engaging with blockchain or cryptocurrency activities.

%201.svg)

%201.svg)

If you’re serious about trading cryptocurrency, technical analysis (TA) is an essential skill. It helps you understand price movements, predict trends, and identify high-probability entry and exit points.

But with hundreds of technical indicators available, one common question is: “Which indicators should I use for technical analysis?”

In this guide, we’ll break down the most effective indicators for crypto trading, explain how they work, and show you how Token Metrics combines them with AI-driven insights to help you trade smarter.

Unlike traditional stocks, cryptocurrency markets trade 24/7, are more volatile, and are largely driven by sentiment and speculation.

Technical indicators help you:

The key is not using one indicator in isolation but combining multiple tools for confirmation—which is exactly what Token Metrics does with its AI-driven trading signals.

Here are the must-know indicators for crypto traders:

What they do:

Moving averages smooth out price data to help you identify overall market direction.

How to use them:

Best for:

Spotting long-term trends and momentum.

What it does:

RSI measures price momentum and identifies overbought (70+) or oversold (30-) conditions.

How to use it:

Best for:

Finding reversal points and confirming trend strength.

What it does:

MACD measures the relationship between two EMAs (usually 12-day and 26-day) and generates buy/sell signals based on crossovers.

How to use it:

Best for:

Spotting trend changes early.

What they do:

Bollinger Bands create a price channel around an asset using a moving average plus/minus two standard deviations.

How to use them:

Best for:

Predicting volatility and identifying breakout opportunities.

What they do:

Volume indicators confirm price movements and help spot trend strength.

Best for:

Confirming whether a trend is supported by strong trading volume.

What it does:

Identifies key support and resistance levels based on Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, etc.).

How to use it:

Best for:

Setting targets and identifying price zones for entries/exits.

What it does:

Measures price momentum by comparing closing prices to recent price ranges.

How to use it:

Best for:

Short-term traders looking for momentum shifts.

What it does:

Provides a complete view of trend, momentum, and support/resistance levels in one indicator.

How to use it:

Best for:

Swing traders who need multi-factor confirmation in one tool.

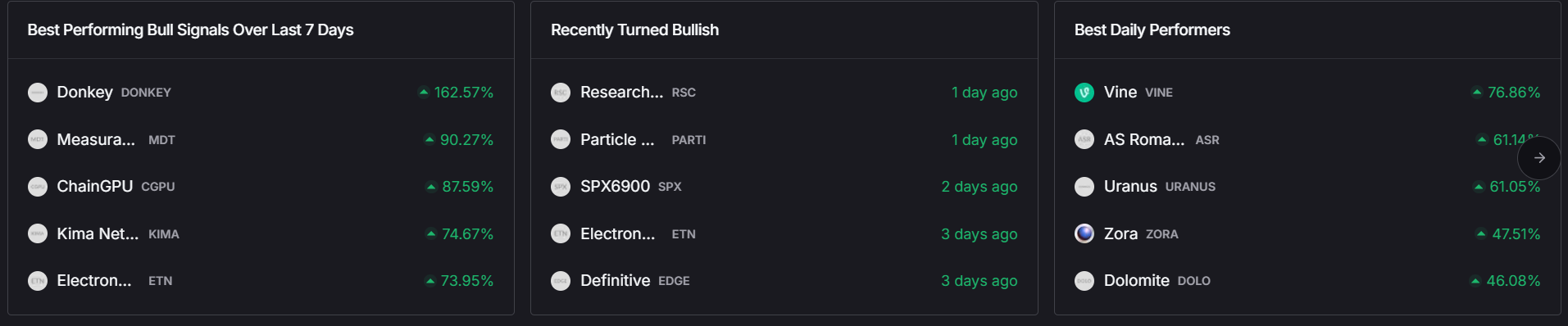

Instead of manually tracking dozens of indicators, Token Metrics uses AI to analyze 80+ technical, fundamental, and sentiment-based data points for each asset—giving you actionable insights without the guesswork.

Here’s how:

Our system combines RSI, MACD, MAs, and more to generate real-time buy/sell signals.

Token Metrics tracks emerging narratives (AI tokens, DeFi, etc.) so you can spot trends before they explode.

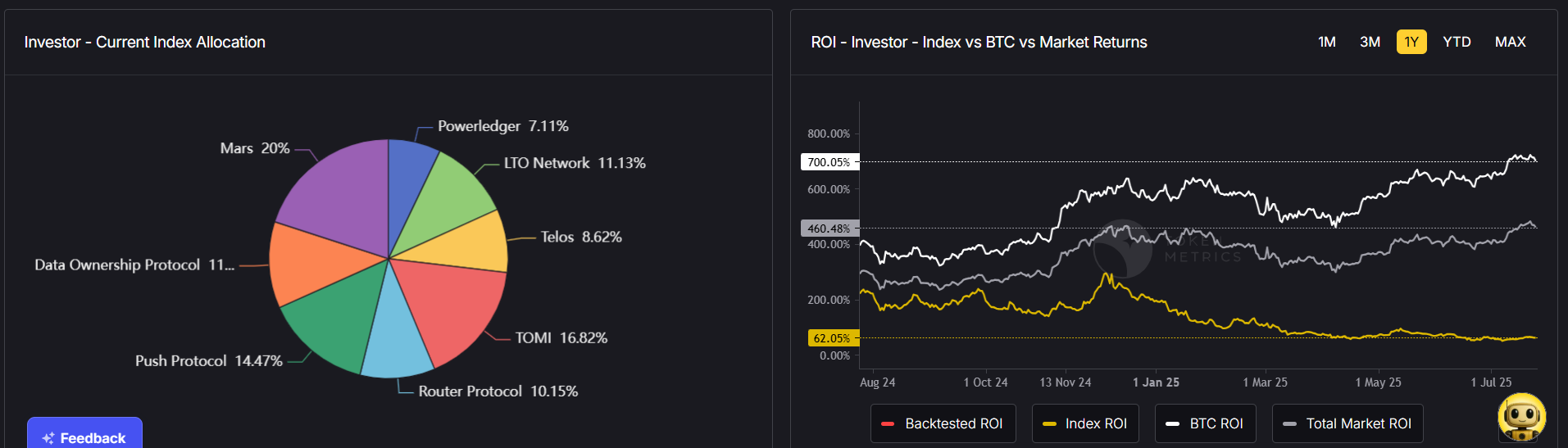

Don’t want to analyze charts? Our AI-driven indices automatically rebalance portfolios using technical indicators and market conditions.

The most successful traders don’t rely on one indicator. Instead, they combine them for confirmation.

Example:

When multiple indicators align, your trade has a higher probability of success—and Token Metrics does this automatically.

So, what indicators should you use for technical analysis?

Start with moving averages, RSI, MACD, Bollinger Bands, and Fibonacci levels—then add volume indicators and advanced tools like the Ichimoku Cloud as you gain experience.

But here’s the truth: indicators are only as good as the trader using them. That’s why Token Metrics simplifies the process by combining dozens of technical indicators with AI-powered analysis, giving you clear, actionable insights for smarter trades.

Whether you’re a day trader or a long-term investor, Token Metrics helps you use technical indicators strategically—not emotionally.

%201.svg)

%201.svg)

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security, making it difficult to counterfeit or double-spend. Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks based on blockchain technology. This decentralization allows for peer-to-peer transactions without intermediaries such as banks.

The concept emerged with the introduction of Bitcoin in 2009, which paved the way for numerous other cryptocurrencies designed to serve various purposes within digital ecosystems.

At the core of cryptocurrencies lies blockchain, a distributed ledger that records all transactions across a network of computers (nodes). Each transaction is grouped into a block, which is then cryptographically linked to the previous block, forming a chain.

This technology underpins various cryptocurrencies and offers applications beyond currency, including smart contracts and decentralized applications (dApps).

When a user initiates a cryptocurrency transaction, it is broadcast to the network of nodes. These nodes verify the transaction’s validity through consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS).

Users store cryptocurrencies in digital wallets protected by private keys, which are critical for accessing and authorizing transactions.

The cryptocurrency landscape is diverse, including:

Understanding these distinctions is essential for analyzing different crypto projects and their use cases.

Due to the complexity and rapid evolution of the crypto space, thorough research is essential. Key approaches include:

Benefits:

Challenges:

The introduction of AI-driven research tools has transformed how individuals dissect the vast and complex cryptocurrency markets. Platforms like Token Metrics employ machine learning and natural language processing techniques to analyze various data streams including market sentiment, on-chain metrics, and project fundamentals.

These tools provide:

Users can complement traditional research methods with AI insights to foster a balanced understanding.

Cryptocurrency represents a revolutionary shift in digital finance, enabled by blockchain technology and supported increasingly by AI analytics. Understanding its fundamentals, technology, and associated risks is essential for meaningful engagement.

This article is for educational purposes only and does not constitute financial advice. Readers should conduct independent research and consult professionals before making decisions related to cryptocurrencies.

%201.svg)

%201.svg)

Cryptocurrency trading can be exciting and profitable, but one thing many traders overlook is taxation. Whether you’re buying Bitcoin, trading altcoins, or earning staking rewards, your activities can create taxable events—and failure to report them properly can lead to hefty penalties.

If you’ve been wondering, “How do taxes work for crypto trading?”, this guide breaks it all down. We’ll explain how crypto taxes work, the most common taxable events, and how Token Metrics can help you make smarter, tax-conscious trading decisions.

Yes. In most countries, cryptocurrencies are treated as property, not currency, for tax purposes. This means:

While tax laws vary by country, the principle is the same: any gain or income from crypto is subject to taxation.

To manage your taxes effectively, you need to know what counts as a taxable event.

If you sell Bitcoin, Ethereum, or any other crypto for fiat currency, you must report capital gains or losses.

Example:

Swapping one crypto for another (e.g., BTC → ETH) is also a taxable event.

Why?

Using crypto to buy a car, laptop, or coffee? That’s a taxable event too.

Example:

DeFi activities like yield farming, lending, or NFT trading may also trigger complex taxable events depending on jurisdiction.

When you sell crypto, your profit is classified as a capital gain—either short-term or long-term.

Pro Tip: Holding crypto for at least a year can significantly lower your tax burden.

Record:

Your cost basis is how much you paid for the asset (including fees).

Subtract your cost basis from the selling price:

Report staking, mining, and airdrop rewards as ordinary income at their market value when received.

Staying compliant doesn’t just mean reporting correctly—it means trading smartly to reduce your tax burden. That’s where Token Metrics can help.

Track all your crypto holdings across exchanges and wallets, making tax reporting easier.

Use Investor Grades to identify cryptos worth holding long-term, reducing your tax liability on gains.

Get AI-powered trading signals to make smarter decisions on when to sell—balancing profits and taxes.

Spot emerging narratives (AI tokens, DeFi trends) early, allowing you to plan tax-friendly entries and exits.

Tax treatment varies by country:

Always consult a crypto tax professional for advice in your jurisdiction.

Let’s say you:

With Token Metrics, you could track purchase dates and AI signals to time your exit strategically—potentially saving on taxes.

So, how do taxes work for crypto trading?

The key to staying compliant and minimizing taxes is tracking transactions, planning trades strategically, and using the right tools.

That’s where Token Metrics helps. With AI-driven portfolio tracking, tax-efficient trading insights, and market analytics, Token Metrics empowers you to trade smarter, reduce taxable events, and keep more of your profits.

Don’t just trade crypto—trade tax-smart.

%201.svg)

%201.svg)

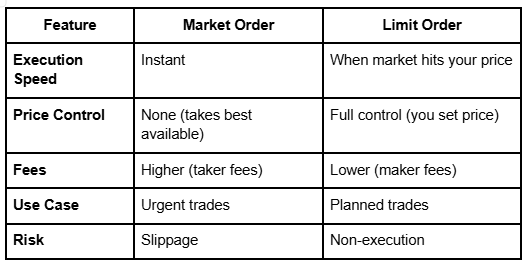

When you trade cryptocurrency, you’ll come across different types of orders—market orders and limit orders being the two most common. Understanding how they work is essential for controlling your entry and exit points, minimizing slippage, and making better trading decisions.

If you’ve ever wondered, “What’s the difference between limit orders and market orders?”, you’re in the right place. This guide will break it down in detail, explain when to use each, and show how Token Metrics helps you execute smarter trades with AI-powered insights.

A market order is the simplest type of trade. It tells an exchange:

“Buy or sell this cryptocurrency at the best available price right now.”

Example:

If Bitcoin is trading at $40,000 and you place a market order for 1 BTC, you may end up paying $40,050 if the price moves up in the milliseconds it takes to execute your trade.

A limit order gives you more control. It tells an exchange:

“Buy or sell this cryptocurrency at this specific price (or better).”

Example:

If Bitcoin is trading at $40,000, you could set a buy limit order at $39,500. If the price dips to that level, your order fills. If it doesn’t, you won’t buy.

Market orders are best when:

Limit orders are best when:

Placing orders is one thing—placing them at the right time is what makes you profitable. That’s where Token Metrics helps.

Get real-time bullish and bearish alerts based on 80+ technical indicators, helping you know when to execute market or limit orders for maximum efficiency.

Use Trader Grades for short-term trading opportunities (perfect for market orders) and Investor Grades for long-term accumulation (ideal for limit orders).

Our AI identifies emerging narratives—like AI tokens or DeFi plays—so you can strategically place limit orders before trends take off.

Don’t want to place manual orders? Token Metrics’ AI-managed portfolios automatically rebalance based on market conditions, helping you avoid constant order management.

Imagine you’re trading Ethereum (ETH):

This combination allows you to enter fast and exit smart—with less emotional stress.

So, what’s the difference between limit orders and market orders?

The key is knowing when to use each—and using data-driven insights to make those decisions.

That’s where Token Metrics gives you an edge. With AI-powered trading signals, narrative tracking, and automated portfolio tools, Token Metrics helps you decide when to use market vs. limit orders, so you can trade confidently and profitably.

In crypto trading, timing is everything—and Token Metrics makes timing smarter.

%201.svg)

%201.svg)

Cryptocurrency trading can be highly profitable—but it’s also one of the riskiest markets in the world. Prices can swing wildly in seconds, projects can collapse overnight, and emotional decisions often lead to costly mistakes.

If you want to survive (and thrive) in crypto trading, you must learn how to manage risk effectively. In this guide, we’ll break down why risk management is critical, the top strategies to protect your capital, and how Token Metrics can help you trade smarter, safer, and with more confidence using AI-driven insights.

In traditional markets, a 5% price movement is big news. In crypto? Daily moves of 10–20% are normal.

Without a solid risk management plan, even experienced traders can lose everything.

This is rule number one.

Don’t put all your funds into one token.

How Token Metrics Helps:

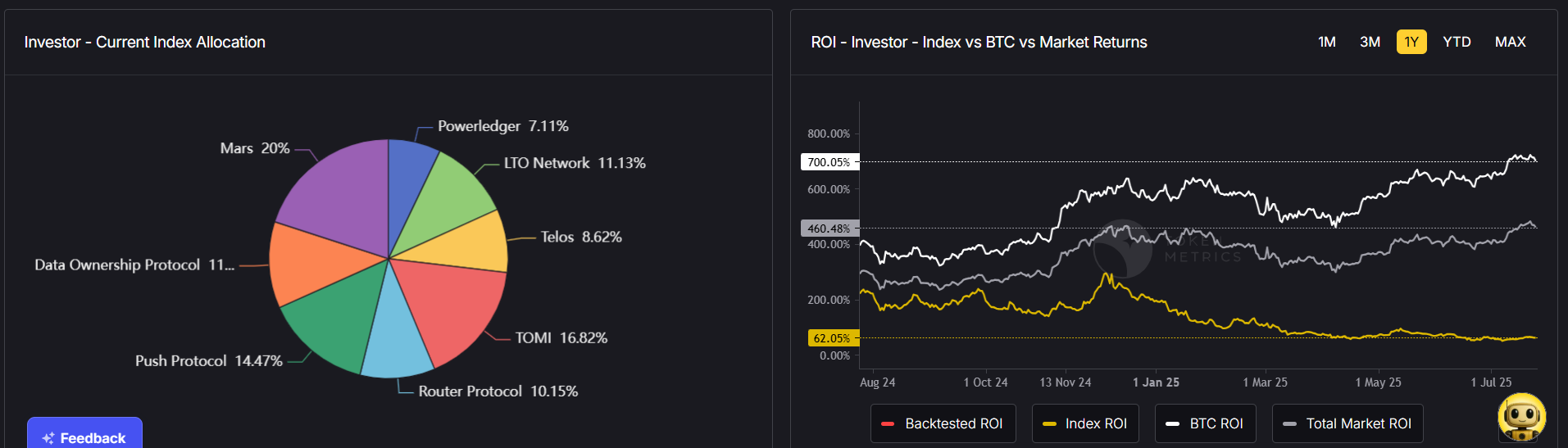

Use AI-driven indices to build a diversified, auto-rebalanced portfolio aligned with your risk tolerance.

Set stop-loss levels to automatically sell if prices fall below a certain threshold.

Pro Tip: Place stops at strategic support levels, not random round numbers.

Don’t go “all-in” on one trade.

Leverage amplifies gains—but also losses.

Fear, greed, and FOMO (fear of missing out) destroy portfolios.

How Token Metrics Helps:

Our AI-powered bullish and bearish signals take emotions out of trading by giving you data-backed entry and exit points.

Markets move on news—regulations, partnerships, or even tweets.

How Token Metrics Helps:

Our AI tracks emerging narratives (e.g., AI tokens, DeFi, RWAs), so you can adjust positions before the crowd reacts.

Before entering a trade, ask:

Risk management isn’t just about trades—it’s also about keeping your crypto safe.

Markets evolve—your plan should too.

Token Metrics isn’t just a research platform—it’s an AI-powered risk management assistant.

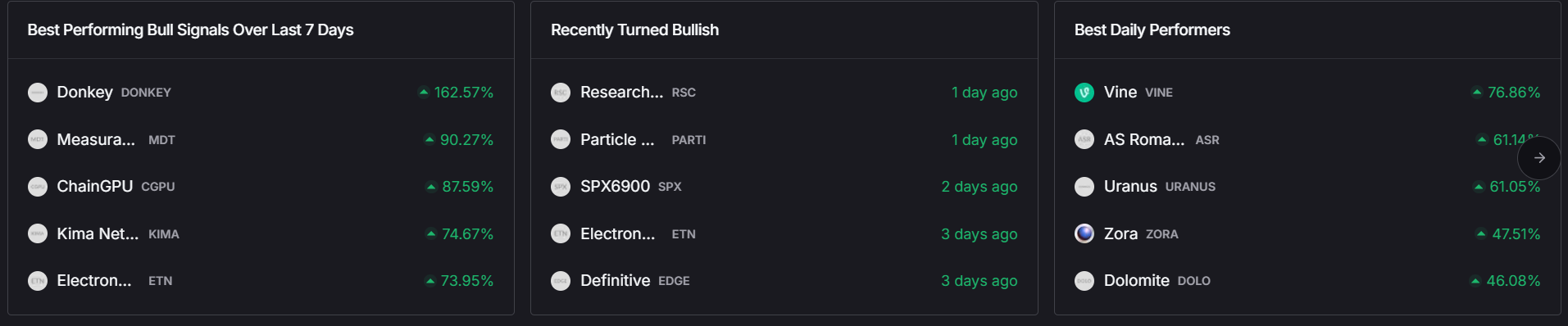

Get real-time bullish and bearish signals to time entries and exits more effectively—reducing impulsive trades.

Quickly assess tokens for short-term trading potential (Trader Grade) or long-term viability (Investor Grade)—helping you avoid high-risk projects.

Use auto-rebalanced AI indices to maintain diversification and reduce risk exposure.

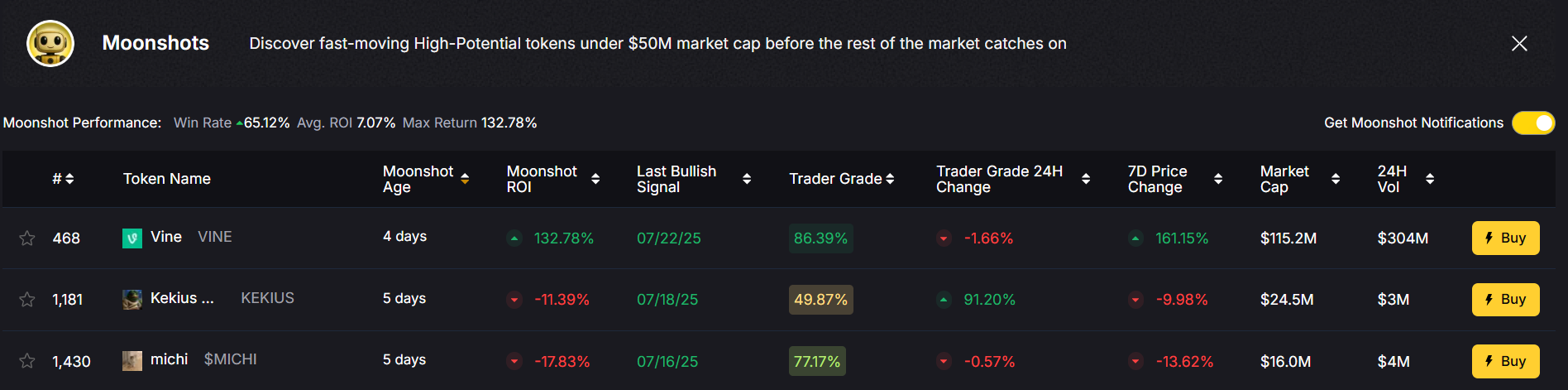

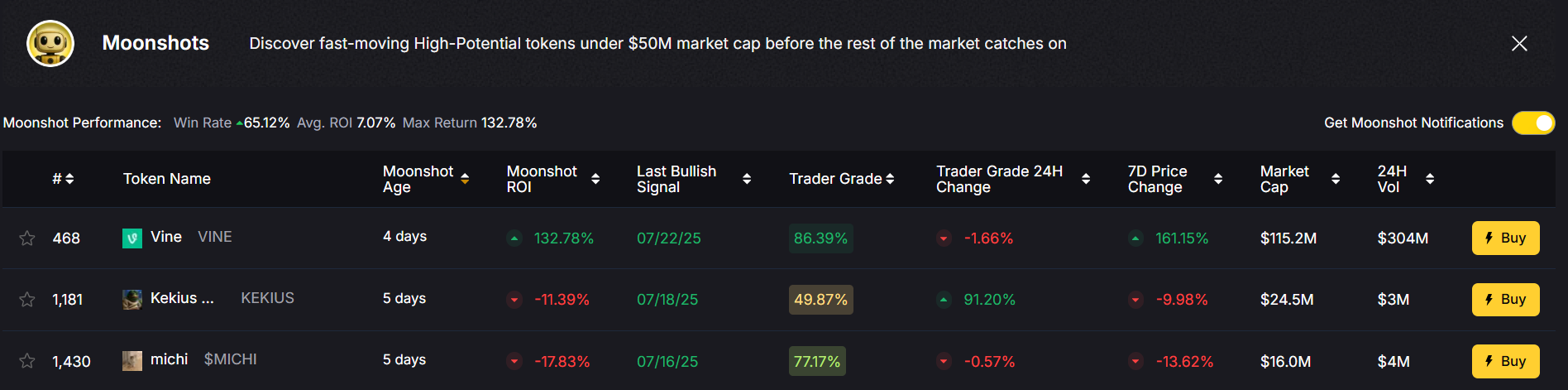

Interested in high-risk, high-reward tokens? Our Moonshot Finder filters low-cap projects using AI, helping you avoid scams and rug pulls.

Our AI tracks emerging narratives so you can anticipate market movements early—reducing exposure to collapsing trends.

Imagine you want to invest $5,000 in crypto:

This is how data-driven trading transforms risk into opportunity.

So, how do you manage risk in crypto trading? It’s about balancing your portfolio, using smart tools, and staying disciplined.

While volatility is unavoidable, you can control how much you’re exposed to it. With Token Metrics, you gain AI-powered insights, trade signals, and portfolio tools that help you reduce risks while maximizing opportunities.

In crypto, it’s not just about making profits—it’s about keeping them.

%201.svg)

%201.svg)

Cryptocurrency trading is a 24/7 market—unlike stocks, there’s no opening or closing bell. This leads many traders to wonder: “When is the best time to trade cryptocurrency?”

The truth is, timing your trades can make a huge difference in profitability. Trading during periods of high liquidity or increased volatility can provide better opportunities, while poorly timed trades can lead to slippage and losses.

In this guide, we’ll explore the best times to trade crypto, how different time zones affect price movements, and how Token Metrics can help you identify the right moments to enter or exit trades using AI-powered insights.

Even though the crypto market never sleeps, trading activity is not equal throughout the day.

Knowing when the market is most active can help you reduce trading fees, minimize slippage, and maximize your gains.

The busiest period for crypto trading is when U.S. and European sessions overlap.

This overlap often sees the biggest price movements of the day—perfect for day traders and scalpers.

The start of the U.S. session brings increased activity from institutional investors and retail traders waking up to market news.

Crypto is unique because weekend trading can be extremely volatile due to:

The “best time” isn’t always about the clock—it’s about market catalysts.

These events can cause instant surges or drops—great for traders who react quickly.

Yes. Research shows:

For swing traders, entering positions midweek may reduce erratic weekend exposure.

Timing trades isn’t just about watching charts—it’s about analyzing multiple data points in real time. That’s where Token Metrics gives you a powerful edge.

Get real-time bullish and bearish alerts based on 80+ data points, helping you know when to enter or exit trades confidently.

Our AI monitors emerging crypto narratives (AI tokens, DeFi, RWA, etc.) so you can act before the crowd—crucial for timing market moves.

Use Trader Grades for short-term opportunities and Investor Grades for long-term positions, aligning your trades with market momentum.

Don’t want to time trades manually? Token Metrics offers auto-managed crypto indices that rebalance based on AI-identified market conditions.

Imagine you’re planning to trade Ethereum. Instead of guessing when to enter:

This data-driven approach takes the guesswork out of timing.

So, what’s the best time to trade cryptocurrency?

But the truth is, there’s no universal “perfect time.” The real key is using data-driven insights to trade at your best time—when probabilities are in your favor.

That’s why Token Metrics is essential for traders. With AI-powered trading signals, narrative tracking, and portfolio management tools, Token Metrics helps you time the market intelligently, not emotionally.

Whether you’re a day trader chasing volatility or a long-term investor, Token Metrics puts the right data at your fingertips—so you can trade with confidence, anytime.

%201.svg)

%201.svg)

The cryptocurrency market has created life-changing wealth for millions, but it has also attracted hackers, scammers, and bad actors. From exchange hacks to phishing scams and rug pulls, billions of dollars in crypto have been lost due to poor security practices.

If you’re serious about trading or investing in crypto, one of your top priorities should be keeping your cryptocurrency safe. In this guide, we’ll walk through the biggest risks to your crypto security, best practices to protect your assets, and how Token Metrics can help you make informed, safe decisions when navigating the crypto market.

Unlike a traditional bank account, cryptocurrency transactions are irreversible. If your funds are stolen, there’s usually no way to recover them.

This means you are your own bank—and you’re responsible for protecting your funds.

Before learning how to protect your crypto, you need to know what you’re up against:

Crypto exchanges are frequent targets for hackers. Even top-tier exchanges like Mt. Gox and FTX have experienced devastating losses.

Scammers use fake websites, emails, or social media accounts to trick you into revealing your private keys or login credentials.

Cybercriminals install malicious software on your devices to steal passwords and seed phrases.

Fraudulent projects lure investors with promises of high returns, then disappear with the funds.

Lost passwords, mishandled private keys, or accidental transfers can lead to permanent loss of funds.

Here’s a step-by-step approach to safeguarding your crypto:

Pro Tip: Use a hardware wallet for long-term holdings and a software wallet for small, active trading balances.

Always enable 2FA on your exchange accounts, wallets, and email addresses.

Your wallet’s seed phrase is the master key to your funds.

Many scams and rug pulls target uninformed investors chasing hype.

How Token Metrics Helps:

Don’t keep all your crypto in one place.

The crypto landscape changes fast.

While Token Metrics isn’t a wallet or exchange, it’s a powerful AI-powered platform designed to help you make safer investment decisions.

Token Metrics uses AI-driven evaluations to score projects, helping you avoid high-risk tokens and scam projects.

Our proprietary grading system helps you quickly identify safe, high-quality assets for both short-term trading and long-term holding.

Interested in low-cap tokens? The Moonshot Finder helps you spot legitimate early-stage projects before they pump—without falling into scams.

Stay ahead of emerging narratives and security concerns with Token Metrics’ real-time AI-driven analysis, helping you dodge risky trends.

So, how do you keep your cryptocurrency safe? It comes down to strong storage practices, personal vigilance, and making informed investment decisions.

While hardware wallets and 2FA secure your assets, knowing where to invest is just as important. That’s where Token Metrics comes in—using AI-powered analysis to help you avoid scams, choose safe projects, and trade with confidence.

In crypto, you are your own bank—so take your security seriously. And with Token Metrics guiding your decisions, you can navigate this high-risk market safely and profitably.

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.