Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

Layer 2 tokens like Mantle offer exposure to Ethereum's scaling roadmap, but with concentration risk around one specific L2's adoption trajectory. MNT performance depends heavily on Mantle winning rollup market share against competing L2s. Diversified L2 exposure or broader L1 and L2 baskets reduce the risk of backing the wrong scaling solution.

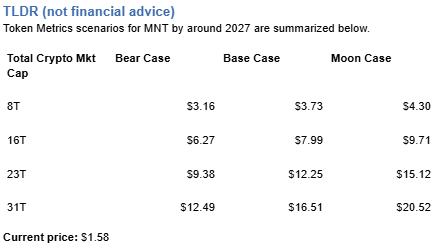

Token Metrics scenarios below project MNT ranges across market environments. These outcomes assume Mantle maintains relevance as Ethereum scales, but portfolio theory suggests hedging this bet by holding multiple L2s or allocating to Ethereum itself, which benefits from L2 success regardless of which specific rollup dominates.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

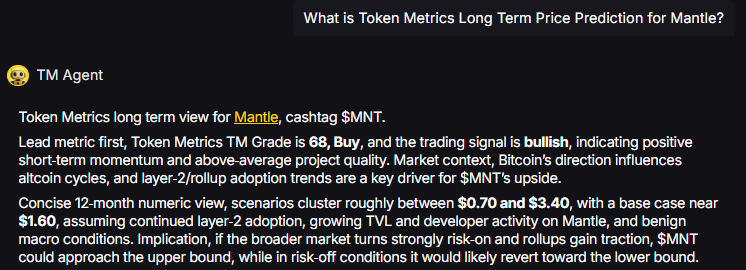

TM Agent baseline: Token Metrics long term view for Mantle, cashtag $MNT. Lead metric first, Token Metrics TM Grade is 68%, Buy, and the trading signal is bullish, indicating positive short-term momentum and above-average project quality. Concise 12-month numeric view, scenarios cluster roughly between $0.70 and $3.40, with a base case near $1.60.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

These ranges illustrate potential outcomes for concentrated MNT positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

Portfolio theory teaches that diversification is the only free lunch in investing. MNT concentration violates this principle by tying your crypto returns to one protocol's fate. Token Metrics Indices blend Mantle with the top one hundred tokens, providing broad exposure to crypto's growth while smoothing volatility through cross-asset diversification. This approach captures market-wide tailwinds without overweighting any single point of failure.

Systematic rebalancing within index strategies creates an additional return source that concentrated positions lack. As some tokens outperform and others lag, regular rebalancing mechanically sells winners and buys laggards, exploiting mean reversion and volatility. Single-token holders miss this rebalancing alpha and often watch concentrated gains evaporate during corrections while index strategies preserve more gains through automated profit-taking.

Beyond returns, diversified indices improve the investor experience by reducing emotional decision-making. Concentrated MNT positions subject you to severe drawdowns that trigger panic selling at bottoms. Indices smooth the ride through natural diversification, making it easier to maintain exposure through full market cycles.

Mantle is a blockchain project focused on scaling Ethereum via layer 2 rollup technology. The goal is to enable faster and cheaper transactions while inheriting Ethereum security. It targets scalable and efficient infrastructure for decentralized applications and financial services.

The MNT token powers network economics such as fees, incentives, or governance depending on implementation. Users interact with dApps and bridges within the ecosystem, and Mantle competes among leading Ethereum scaling solutions.

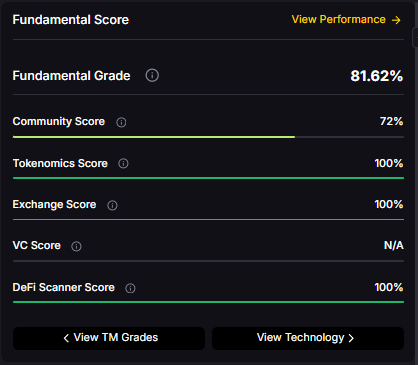

Fundamental and Technology Snapshot from Token Metrics

Can MNT reach $10?

Based on the scenarios, MNT could reach $10 in the higher tiers. The 23T tier projects $12.25 in the base case, and the 31T tier shows $12.49 (bear), $16.51 (base), and $20.52 (moon). Achieving this requires both broad market cap expansion and Mantle maintaining competitive position. Not financial advice.

What's the risk/reward profile for MNT?

Risk and reward spans from $3.16 at 8T bear to $20.52 at 31T moon. Downside risks include competitive pressure among L2s and execution challenges, while upside drivers include adoption growth and liquidity expansion. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

What gives MNT value?

MNT accrues value through network usage, fees, incentives, and governance tied to Mantle's L2 ecosystem. Demand drivers include dApp activity, bridging, and security via restaking integrations. While these fundamentals matter, diversified portfolios capture value accrual across multiple tokens rather than betting on one protocol's success.

Next Steps

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

Token Metrics provides data-driven crypto ratings, on-chain grades, and scenario-based targets—empowering you to make informed investment decisions with confidence. Accelerate your research with unique AI-powered analysis and risk management tools.

%201.svg)

%201.svg)

Layer 1 tokens capture value through transaction fees, staking, and validator economics. TON uses proof-of-stake and a multi-blockchain architecture integrated with Telegram services. Token Metrics scenarios model TON outcomes across different total crypto market sizes, reflecting adoption and transaction demand by 2027.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics TM Grade is 74%, Buy, and the trading signal is bullish, indicating positive short-term momentum and strong overall project quality. Concise 12-month numeric view, scenarios cluster roughly between $5 and $14, with a base case near $9.

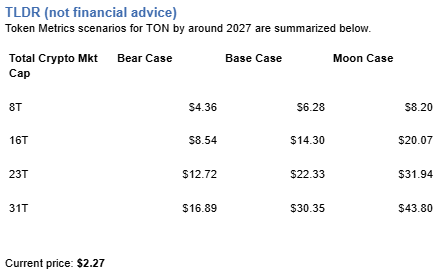

8T: At an 8 trillion dollar total crypto market cap, TON projects to $4.36 in bear conditions, $6.28 in the base case, and $8.20 in bullish scenarios.

16T: At 16 trillion, the range expands to $8.54 (bear), $14.30 (base), and $20.07 (moon).

23T: The 23 trillion tier shows $12.72, $22.33, and $31.94 respectively.

31T: In the maximum liquidity scenario at 31 trillion, TON reaches $16.89 (bear), $30.35 (base), or $43.80 (moon).

The Open Network is a blockchain designed to support fast, low-cost transactions and a scalable ecosystem of decentralized applications. It integrates with digital services and messaging platforms to reach a broad user base, emphasizing high throughput and accessibility.

TON uses a proof-of-stake consensus mechanism with a multi-blockchain architecture. The TON token powers network activity, facilitating transactions, staking, and governance, and is integrated into Telegram-based services for user-friendly in-app payments and wallets.

Token Metrics AI provides additional context on Toncoin's technical positioning and market dynamics.

Vision: The vision for Toncoin and The Open Network is to create a fast, secure, and scalable blockchain that enables seamless digital transactions and decentralized services, accessible to millions through integration with everyday communication tools like Telegram.

Problem: Many blockchain networks face limitations in speed, cost, and user accessibility, hindering mainstream adoption. Toncoin aims to address the friction of slow transaction times and high fees seen on older networks, while also lowering the barrier to entry for non-technical users who want to engage with decentralized applications and digital assets.

Solution: TON uses a proof-of-stake consensus mechanism with a multi-blockchain architecture to achieve high scalability and fast finality. The network supports smart contracts, decentralized storage, and domain naming, enabling a wide range of applications. Toncoin facilitates transactions, staking, and network governance, and is integrated into Telegram-based services, allowing for in-app payments and wallet functionality through user-friendly interfaces.

Market Analysis: Toncoin operates in the competitive layer-1 blockchain space, often compared to high-performance networks like Solana and Avalanche, though it differentiates itself through deep integration with Telegram's ecosystem. Its potential for mass adoption stems from access to hundreds of millions of Telegram users, which could drive network effects and utility usage. Unlike meme tokens, Toncoin's value is tied to infrastructure and real-world application rather than speculation or community hype. However, its growth depends on sustained development, regulatory clarity, and actual user engagement within Telegram. Competition from established blockchains and shifting market narratives around scalability and decentralization remain key risks. As a top-tier blockchain by ecosystem potential, Toncoin's market position is influenced more by integration milestones and user adoption than direct price dynamics.

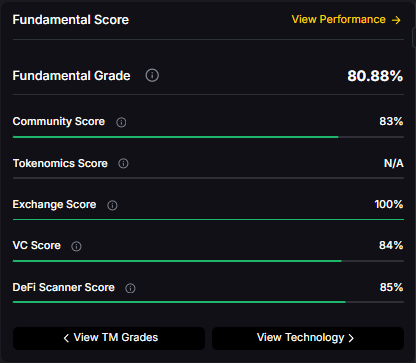

Fundamental Grade: 80.88% (Community 83%, Tokenomics N/A, Exchange 100%, VC 84%, DeFi Scanner 85%).

Technology Grade: 77.11% (Activity 55%, Repository 72%, Collaboration 73%, Security N/A, DeFi Scanner 85%).

How does TON accrue value?

Value accrual mechanisms include transaction fees, validator staking rewards, and governance alignment described for TON in the documentation. As Toncoin usage grows through transactions and user activity, TON can capture network fees and staking yields while coordinating governance. Effectiveness depends on sustained adoption and network throughput.

What price could TON reach in the moon case?

Moon case projections range from $8.20 at 8T to $43.80 at 31T. These scenarios require maximum market cap expansion and strong network adoption with robust liquidity conditions. Not financial advice.

• Track live grades and signals: Token Details

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Token Metrics combines fundamental, technical, and on-chain AI-powered analysis for actionable ratings, signals, and research. Use our data platform for scenario-based investing, backtested grades, and bespoke insights for digital asset markets.

%201.svg)

%201.svg)

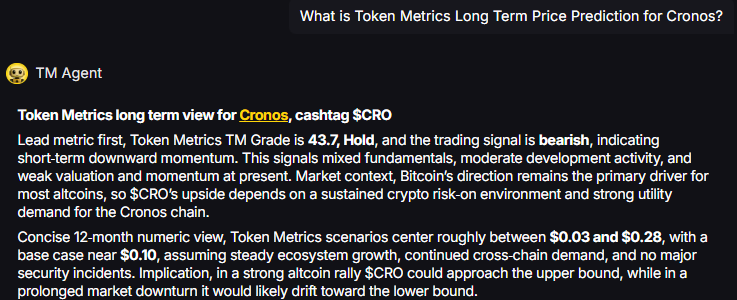

Layer 1 tokens like Cronos represent bets on specific blockchain architectures winning developer and user mindshare. CRO carries both systematic crypto risk and unsystematic risk from Cronos's technical roadmap execution and ecosystem growth. Multi-chain thesis suggests diversifying across several L1s rather than concentrating in one, since predicting which chains will dominate remains difficult.

The projections below show how CRO might perform under different market cap scenarios. While Cronos may have strong fundamentals, prudent portfolio construction balances L1 exposure across Ethereum, competing smart contract platforms, and Bitcoin to capture the sector without overexposure to any single chain's fate.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics scenarios center roughly between $0.03 and $0.28, with a base case near $0.10, assuming steady ecosystem growth, continued cross-chain demand, and no major security incidents.

Portfolio theory teaches that diversification is the only free lunch in investing. CRO concentration violates this principle by tying your crypto returns to one protocol's fate. Token Metrics Indices blend Cronos with the top one hundred tokens, providing broad exposure to crypto's growth while smoothing volatility through cross-asset diversification. This approach captures market-wide tailwinds without overweighting any single point of failure.

Systematic rebalancing within index strategies creates an additional return source that concentrated positions lack. As some tokens outperform and others lag, regular rebalancing mechanically sells winners and buys laggards, exploiting mean reversion and volatility. Single-token holders miss this rebalancing alpha and often watch concentrated gains evaporate during corrections while index strategies preserve more gains through automated profit-taking.

Beyond returns, diversified indices improve the investor experience by reducing emotional decision-making. Concentrated CRO positions subject you to severe drawdowns that trigger panic selling at bottoms. Indices smooth the ride through natural diversification, making it easier to maintain exposure through full market cycles.

Cronos is an EVM-compatible blockchain built to support decentralized applications with high throughput and low transaction costs. The network is designed to bridge the gap between crypto and traditional finance, offering interoperability with Ethereum and Cosmos ecosystems. Its focus on scalability and developer-friendly infrastructure aims to attract DeFi, NFT, and gaming projects.

CRO serves as the native utility token of the Cronos ecosystem, used for transaction fees, staking, and governance. It enables users to participate in network security, pay for smart contract execution, and access services within the Cronos DeFi ecosystem. Common usage patterns include staking for rewards, providing liquidity in DeFi protocols, and facilitating cross-chain transfers.

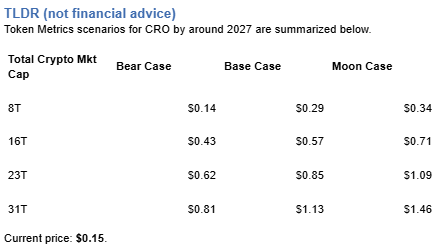

At an 8 trillion dollar total crypto market cap, CRO projects to $0.14 in bear conditions, $0.29 in the base case, and $0.34 in bullish scenarios.

Doubling the market to 16 trillion expands the range to $0.43 (bear), $0.57 (base), and $0.71 (moon).

At 23 trillion, the scenarios show $0.62, $0.85, and $1.09 respectively.

In the maximum liquidity scenario of 31 trillion, CRO could reach $0.81 (bear), $1.13 (base), or $1.46 (moon).

These ranges illustrate potential outcomes for concentrated CRO positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

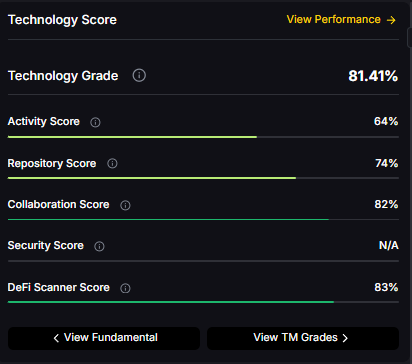

Fundamental Grade: 72.71% (Community 55%, Tokenomics 60%, Exchange 100%, VC N/A, DeFi Scanner 83%).

Technology Grade: 81.41% (Activity 64%, Repository 74%, Collaboration 82%, Security N/A, DeFi Scanner 83%).

Can CRO reach $1?

Based on the scenarios, CRO could reach $1 in the 23T moon case where it projects to $1.09, and in the 31T scenarios where the base case is $1.13 and the moon case is $1.46. These outcomes require both broad market cap expansion and Cronos maintaining competitive position. Not financial advice.

What's the risk/reward profile for CRO?

Risk/reward spans from $0.14 in the lowest bear case to $1.46 in the highest moon case. Downside risks include regulatory or infrastructure shocks and competitive displacement, while upside drivers include liquidity expansion and roadmap execution. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

What gives CRO value?

CRO accrues value through transaction fees, staking, and governance utility across the Cronos ecosystem. Demand drivers include DeFi activity, cross-chain usage, and network services. While these fundamentals matter, diversified portfolios capture value accrual across multiple tokens rather than betting on one protocol's success.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

_%20A%20Complete%20Guide%20to%20the%20Meme%20Coin%20in%202025.png)

%201.svg)

%201.svg)

Shiba Inu (SHIB) started in 2020 as a meme coin inspired by Dogecoin, but in a few short years, it has evolved into one of the largest and most recognizable cryptocurrencies in the world. Initially dismissed as a joke, Shiba Inu has since built an entire ecosystem of decentralized products, proving that meme coins can grow beyond viral popularity.

In 2025, Shiba Inu continues to maintain a massive community, a growing ecosystem, and a spot among the top cryptocurrencies by market cap. This article explores what Shiba Inu is, how its ecosystem works, its investment potential, and how platforms like Token Metrics can help analyze SHIB effectively.

Shiba Inu (SHIB) is an Ethereum‑based token designed to be an experiment in decentralized community building. Dubbed the “Dogecoin killer,” SHIB quickly gained traction thanks to its strong community (the SHIBArmy), viral marketing, and accessibility across major exchanges.

Unlike Bitcoin or Ethereum, SHIB is not a blockchain in itself—it’s an ERC‑20 token that runs on the Ethereum network.

Since its launch, Shiba Inu has expanded far beyond being just a meme token. Its ecosystem now includes:

1. Strong Community (SHIBArmy):

One of the most active and loyal crypto communities drives the project’s growth.

2. Accessibility:

Listed on most major exchanges, SHIB is easy for new investors to buy.

3. Low Entry Point:

With its large supply and low price per token, SHIB appeals to retail investors looking for affordable exposure.

4. Viral Marketing:

Its meme‑driven branding keeps it relevant and highly visible in social media trends.

As an ERC‑20 token, SHIB benefits from the security and scalability of the Ethereum blockchain. The ecosystem uses:

Although both are dog‑themed meme coins, they differ significantly:

In 2025, Shiba Inu’s ecosystem gives it a competitive edge over Dogecoin in terms of utility.

Shiba Inu’s price has experienced extreme volatility since launch, but it remains a top‑20 cryptocurrency by market cap.

Growth drivers include:

For investors, SHIB offers speculative upside, but it’s best approached as part of a diversified portfolio.

While SHIB has strong community support, it carries notable risks:

Investing in Shiba Inu requires data‑driven decision‑making, and that’s where Token Metrics comes in:

This AI‑driven approach helps investors separate hype from sustainable growth.

In 2025, Shiba Inu aims to transition from meme coin to multi‑utility ecosystem, expanding its role in DeFi, metaverse applications, and Layer 2 scaling solutions. Its success will depend on community engagement, continued innovation, and adoption of Shibarium.

Shiba Inu has proven that meme coins can evolve into meaningful projects. With its Layer 2 network, DeFi ecosystem, and strong community, SHIB is more than just internet hype—it’s a project with growing utility and staying power.

For investors, pairing SHIB exposure with AI‑powered insights from Token Metrics provides a smarter way to navigate the volatility of meme coins while capitalizing on their growth potential.

_%20A%20Complete%20Guide%20to%20Ethereum%E2%80%99s%20Native%20Token%20in%202025.png)

%201.svg)

%201.svg)

Ether (ETH) is the native cryptocurrency of the Ethereum blockchain, powering one of the most influential ecosystems in the crypto world. Since its launch in 2015, Ethereum has evolved from a simple smart contract platform into a global hub for decentralized finance (DeFi), NFTs, real‑world asset tokenization (RWA), and blockchain‑based applications.

In 2025, Ether remains a cornerstone of crypto portfolios, offering not only investment potential but also utility within Ethereum’s constantly expanding network. This article breaks down what Ether is, how it works, why it’s valuable, and how platforms like Token Metrics help investors analyze ETH effectively.

Ether (ETH) is the cryptocurrency used to pay for transactions, smart contract execution, and services on the Ethereum network. While Bitcoin is often referred to as “digital gold,” Ether functions as both a digital asset and a fuel (commonly called “gas”) for running decentralized applications (dApps).

Key roles of Ether:

Ethereum is a decentralized, programmable blockchain that allows developers to create and deploy dApps. It introduced smart contracts—self‑executing agreements that operate without intermediaries.

In 2022, Ethereum completed The Merge, transitioning from Proof of Work (PoW) to Proof of Stake (PoS). This shift reduced energy consumption by over 99% and enabled ETH holders to stake their tokens to earn passive rewards.

Ether remains one of the most versatile and valuable cryptocurrencies in the market:

In 2025, Ethereum continues to dominate the decentralized finance (DeFi) space. DeFi protocols like Uniswap, Aave, and MakerDAO run on Ethereum, using Ether as collateral or for gas fees.

Why this matters for investors:

1. Buying ETH:

Ether is available on major crypto exchanges such as Coinbase, Binance, and decentralized platforms like Uniswap.

2. Storing ETH:

Use:

3. Staking ETH:

Stake ETH directly through Ethereum validators or staking platforms to earn rewards while supporting the network.

While Bitcoin and Ether are both top cryptocurrencies, they serve different purposes:

In 2025, ETH has positioned itself as a growth‑driven crypto asset, while Bitcoin remains the ultimate store of value.

With Ethereum’s upgrades and institutional adoption, many analysts expect ETH to outperform in the coming cycle. Key growth drivers include:

Token Metrics offers AI‑powered tools that make investing in ETH smarter:

This gives ETH investors a competitive edge in volatile markets.

While ETH has strong fundamentals, risks remain:

Using Token Metrics helps mitigate these risks by providing real‑time analytics and portfolio insights.

Ether is more than just another cryptocurrency—it’s the lifeblood of the Ethereum ecosystem, powering decentralized applications, DeFi, NFTs, and enterprise solutions.

In 2025, holding ETH offers exposure to one of the most innovative and widely used blockchain platforms, making it a must‑have for serious crypto investors.

By combining long‑term holding strategies with AI‑powered insights from Token Metrics, investors can confidently navigate Ethereum’s growth trajectory and maximize returns in the years ahead.

%201.svg)

%201.svg)

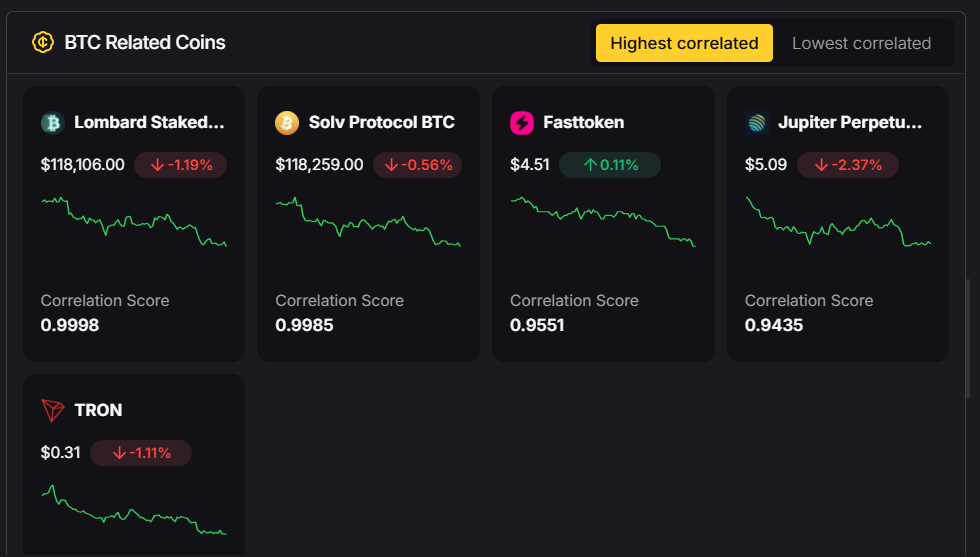

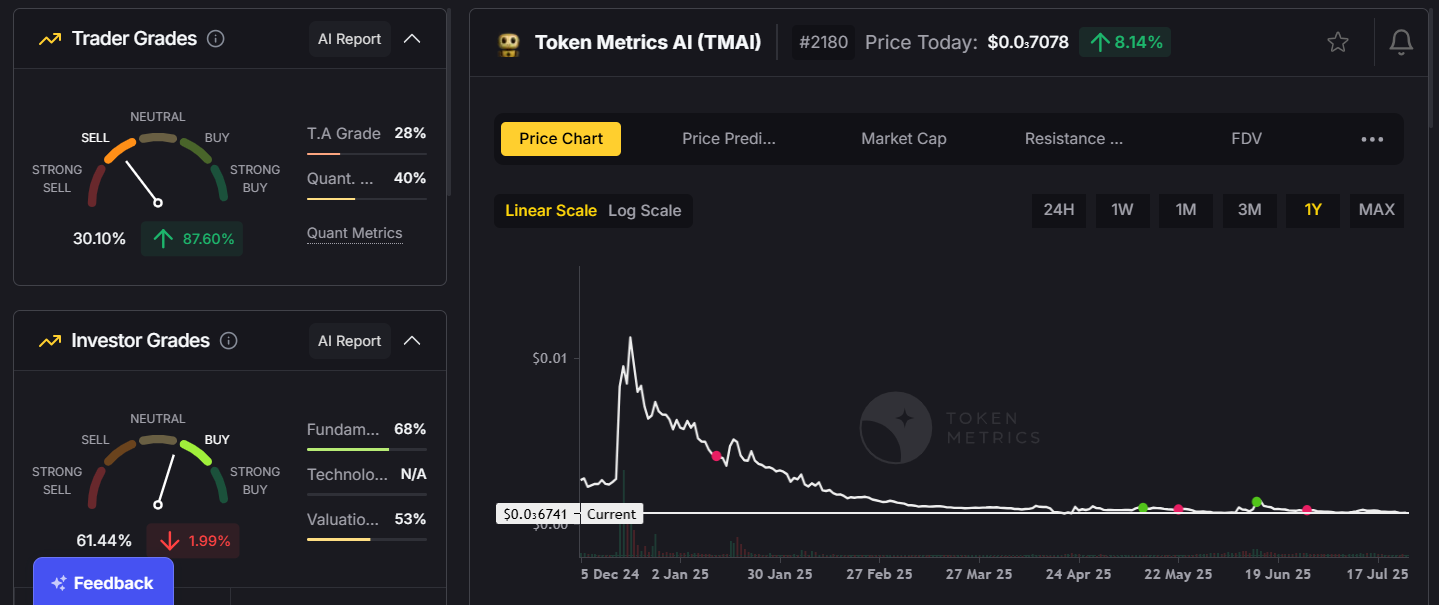

Altcoin bull runs are some of the most exciting periods in cryptocurrency, delivering life‑changing gains for prepared investors. These cycles often follow or coincide with Bitcoin rallies, as capital flows into smaller, high‑growth tokens in search of outsized returns.

In 2025, with AI‑powered platforms, institutional adoption, and innovative sectors like DeFi, AI tokens, and real‑world assets (RWAs) driving growth, the stage is set for a potentially historic altcoin bull run. This guide explains how to prepare, what to watch for, and how tools like Token Metrics can help you capitalize on this opportunity.

Understanding what drives these rallies is key to recognizing when one begins.

Preparation is everything. Here’s how to position yourself before the market takes off:

1. Build a Diversified Portfolio:

Combine large‑cap coins (Ethereum, Solana) with high‑potential small‑caps like Token Metrics AI (TMAI) or narrative‑driven DeFi tokens.

2. Use AI‑Powered Analytics:

Token Metrics leverages over 80 data points per token—including technicals, fundamentals, and sentiment—to help you spot early movers before the crowd.

3. Set Entry and Exit Plans:

Define profit targets and stop‑loss levels before entering trades to avoid emotional decisions during volatility.

4. Stay Liquid:

Keep a portion of your portfolio in stablecoins to seize opportunities during sharp pullbacks.

The next altcoin season will likely be driven by powerful narratives:

With great opportunity comes great risk. Here’s how to protect your gains:

Token Metrics is an essential tool for navigating altcoin bull markets, offering:

This data‑driven approach helps investors stay ahead of the crowd and avoid emotional decision‑making during fast‑moving markets.

As crypto matures, AI‑enhanced analytics, regulatory clarity, and wider institutional adoption are likely to make future altcoin seasons more sustainable and inclusive.

In 2025, the winners will be those who combine smart preparation, narrative awareness, and AI‑powered tools like Token Metrics to maximize returns.

The 2025 altcoins bull run could be one of the most lucrative in crypto history, but success requires preparation, strategy, and discipline.

By diversifying across high‑potential narratives, using AI‑driven insights from Token Metrics, and following a clear plan, you can profit from explosive growth while managing risk effectively.

In altcoin bull runs, timing, data, and psychology are everything—get them right, and the opportunities are limitless.

%201.svg)

%201.svg)

Blockchain is the foundation of modern cryptocurrency and one of the most transformative technologies of the digital age. Initially created to support Bitcoin, blockchain has expanded into countless use cases, from decentralized finance (DeFi) to supply chain tracking, real-world asset tokenization, and artificial intelligence (AI) integration.

In 2025, understanding how blockchain works is essential—not just for crypto investors but for anyone navigating the evolving digital economy. This article explains the structure, components, and applications of blockchain in simple terms and explores how platforms like Token Metrics use blockchain data to help investors make smarter decisions.

At its core, blockchain is a distributed digital ledger that records transactions across a network of computers. Unlike traditional databases controlled by a single entity, blockchain operates on a decentralized network, making it secure, transparent, and tamper-resistant.

Each entry in this ledger is grouped into a “block,” and these blocks are linked (or chained) together in chronological order—hence the name blockchain.

Consensus mechanisms are protocols that ensure all nodes agree on the state of the blockchain.

In 2025, hybrid models combining public and private features are increasingly popular for balancing transparency with privacy.

Platforms like Token Metrics take blockchain a step further by:

By combining blockchain transparency with AI-powered analytics, Token Metrics provides a comprehensive view of crypto investments.

In 2025, blockchain continues to evolve beyond cryptocurrencies. With advances in scalability solutions, real-world asset tokenization, and AI integration, blockchain is shaping the next generation of financial systems, digital identity solutions, and decentralized applications.

As enterprises, governments, and investors adopt blockchain, its role in the digital economy will only grow.

Blockchain is more than a buzzword—it’s a transformative technology driving innovation across industries. By understanding how blockchain works—its structure, consensus mechanisms, and applications—you can better navigate the crypto market and the broader digital landscape.

Platforms like Token Metrics make blockchain analysis accessible and actionable, offering AI-driven insights to help investors capitalize on this rapidly expanding technology. In 2025, mastering blockchain fundamentals isn’t just helpful—it’s essential for participating in the future of finance and digital ownership.

%201.svg)

%201.svg)

In the fast-paced world of cryptocurrency investing, market capitalization, often called market cap, is one of the most essential metrics for evaluating projects. It helps investors quickly gauge a coin’s size, value, and growth potential, making it a cornerstone for portfolio allocation and risk management.

Whether you’re a beginner trying to understand which cryptocurrencies to buy or an experienced trader managing a complex portfolio, understanding coin market cap is critical. In this guide, we’ll break down what market cap is, how to use it effectively, its limitations, and how platforms like Token Metrics can enhance your analysis with advanced data insights.

Market capitalization refers to the total value of a cryptocurrency in circulation. It’s calculated using a simple formula:

Market Cap=Current Price×Circulating Supply\text{Market Cap} = \text{Current Price} \times \text{Circulating Supply}

For example, if a cryptocurrency is priced at $20 and has 50 million coins in circulation, its market cap would be $1 billion. This figure provides a snapshot of the project’s relative size and its standing in the broader crypto market.

Market cap is an invaluable metric for quickly comparing projects, identifying potential opportunities, and understanding the level of risk associated with an investment.

Market cap plays a crucial role in crypto investing for several reasons:

Cryptocurrencies are typically categorized by their market cap:

While market cap is only one part of the puzzle, it’s a powerful tool when used correctly. Here’s how to incorporate it into your strategy:

Although market cap is a useful metric, it has its shortcomings:

This is why market cap analysis should always be combined with other key metrics and qualitative research, which is where Token Metrics becomes invaluable.

While traditional market cap data offers a snapshot, Token Metrics goes deeper by analyzing:

This AI-powered approach allows investors to identify truly undervalued projects that might be overlooked by simply glancing at market cap.

Market cap is most powerful when used alongside:

Combining these insights with market cap offers a more complete view of a project’s health and potential.

Coin market cap remains one of the most fundamental metrics for analyzing cryptocurrencies. It provides a clear picture of project size and helps investors allocate capital effectively.

However, market cap alone isn’t enough. To make smarter, data-driven decisions, investors should combine market cap insights with on-chain data, technical analysis, and AI-driven insights from Token Metrics.

In 2025, using market cap alongside advanced analytics can help you identify undervalued opportunities, manage risk effectively, and build a balanced, growth-oriented crypto portfolio.

%201.svg)

%201.svg)

Over the past decade, cryptocurrency has moved from an experimental technology to a mainstream investment asset. What started with Bitcoin as a digital alternative to cash has evolved into a multi-trillion-dollar ecosystem encompassing altcoins, decentralized finance (DeFi), AI-powered tokens, and NFTs.

In 2025, crypto is no longer a fringe idea—it’s an essential consideration for forward-thinking investors. Whether you’re seeking growth, diversification, or a hedge against inflation, crypto offers multiple paths to wealth creation. This article explores why crypto is a valuable investment, how to approach it strategically, and the role of Token Metrics in making data-driven decisions.

Mitigate these risks by conducting thorough research and using Token Metrics AI to assess tokens based on fundamentals, on-chain activity, and market sentiment.

Token Metrics is a game-changing platform for crypto investors. It provides AI-powered coin ratings, trend analysis, and portfolio management tools. With over 80 data points per token, it helps investors identify undervalued coins and time market entries effectively.

In 2025, crypto remains a compelling investment option for those willing to manage its risks. By leveraging Token Metrics for data-driven insights and combining long-term strategies with diversified holdings, investors can position themselves for strong returns in the evolving digital asset landscape.

%201.svg)

%201.svg)

As the cryptocurrency market evolves, altcoins—cryptocurrencies other than Bitcoin—are becoming increasingly central to the digital asset ecosystem. Investing in altcoins can provide opportunities for higher returns, portfolio diversification, and exposure to innovative blockchain technologies.

Unlike Bitcoin, which is primarily seen as digital gold, altcoins serve varied purposes, such as powering decentralized applications, enabling smart contracts, or facilitating cross-border payments. In 2025, altcoin investments are gaining momentum among both retail and institutional investors, offering unique opportunities in emerging sectors like artificial intelligence (AI), decentralized finance (DeFi), and real-world asset tokenization.

Altcoins are cryptocurrencies designed as alternatives to Bitcoin. They differ in technology, use case, and governance structure, making them essential to a diversified crypto portfolio.

Categories of Altcoins include:

By investing in a mix of these categories, investors gain exposure to multiple narratives driving the crypto market forward.

Investing in altcoins involves buying and holding tokens, trading them for profit, or staking them for passive income. The process starts with choosing a reliable cryptocurrency exchange, creating a secure wallet, and identifying which tokens fit your portfolio strategy.

Key steps for altcoin investment:

1. Higher Growth Potential:

Altcoins often outperform Bitcoin during bull markets. Projects in sectors like AI, DeFi, and NFTs can yield outsized returns when demand surges.

2. Diversification:

Altcoins provide exposure to multiple sectors, reducing reliance on Bitcoin’s price movements.

3. Innovation:

Many altcoins drive technological breakthroughs in blockchain scalability, privacy, and decentralized governance.

4. Passive Income Opportunities:

Through staking and yield farming, investors can earn consistent returns on altcoin holdings.

While altcoins can deliver impressive gains, they also carry significant risks:

Mitigating these risks involves thorough research, diversification, and using analytics tools to assess project viability.

Bitcoin is considered a store of value, while altcoins offer greater utility and innovation. Here’s how they compare:

A balanced strategy typically includes Bitcoin for security and altcoins for growth.

Investing securely in altcoins requires:

Altcoins often face different regulatory classifications than Bitcoin, especially tokens associated with securities or DeFi platforms. In 2025, governments are increasingly requiring Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance for crypto platforms.

Investors should ensure they use regulated exchanges and stay informed about local laws affecting altcoin trading.

When selecting altcoins to invest in:

In 2025, altcoins are poised to play a transformative role in finance, AI integration, and global blockchain adoption. Tokens tied to AI analytics, DeFi platforms, and real-world assets are expected to lead the next wave of growth.

Altcoin investment is more than a high-risk gamble—it’s a way to participate in the future of digital finance. By understanding altcoins’ categories, benefits, risks, and strategies, investors can make informed decisions and unlock substantial growth opportunities.

With the right tools, like AI-powered analytics from Token Metrics, and a disciplined approach, altcoins can become a cornerstone of a well-balanced crypto portfolio in 2025 and beyond.

%201.svg)

%201.svg)

If you’ve spent any time in cryptocurrency communities, you’ve likely seen the term HODL. Originally a misspelling of “hold” on an online Bitcoin forum in 2013, HODL has become much more than a typo—it’s now a core investment philosophy for crypto enthusiasts worldwide.

In 2025, HODLing remains one of the most effective long-term strategies for building wealth in cryptocurrency. By holding onto fundamentally strong assets through market volatility, investors can capture long-term gains while avoiding emotional, short-term trading mistakes. This article explores what HODLing means, why it works, the best assets to HODL, and how platforms like Token Metrics can help optimize your strategy.

HODL means buying and holding cryptocurrency for an extended period, regardless of short-term price fluctuations. Unlike traders who attempt to time the market, HODLers adopt a long-term mindset, trusting that the value of quality assets will increase over time.

This strategy is rooted in the belief that blockchain technology and digital assets are here to stay, and that short-term market noise shouldn’t derail long-term conviction.

Crypto markets are notoriously volatile, with sudden price swings that can lead to emotional decision-making. HODLing combats this by:

By committing to HODLing, investors can overcome emotional biases and stay focused on their long-term goals.

While any coin can be HODLed, the best long-term candidates are projects with strong fundamentals, proven track records, and growing ecosystems:

These coins offer long-term growth potential, making them excellent candidates for a HODL strategy.

While active trading can generate quick profits, it also comes with higher risks and costs. Here’s how HODLing compares:

Platforms like Token Metrics can complement both approaches by providing trading signals and long-term portfolio analytics, helping you decide when (and if) you should adjust your positions.

While HODLing is effective, it’s not without challenges:

To mitigate these risks, rely on data-driven tools like Token Metrics to ensure you’re holding the right mix of assets.

Token Metrics is a powerful platform for long-term crypto investors, providing:

By leveraging AI analytics, Token Metrics makes HODLing smarter, ensuring you’re invested in assets with strong fundamentals and growth potential.

HODLing isn’t just a meme—it’s a time-tested strategy for building wealth in crypto. By holding onto fundamentally strong assets, you can capture long-term growth while avoiding the emotional traps of active trading.

In 2025, pairing HODLing with AI-powered insights from Token Metrics gives you an edge—helping you select the right assets, manage risk, and stay committed to your investment plan. Whether you’re a beginner or a seasoned investor, HODLing remains one of the simplest and most effective ways to build wealth in the dynamic world of cryptocurrency.

%201.svg)

%201.svg)

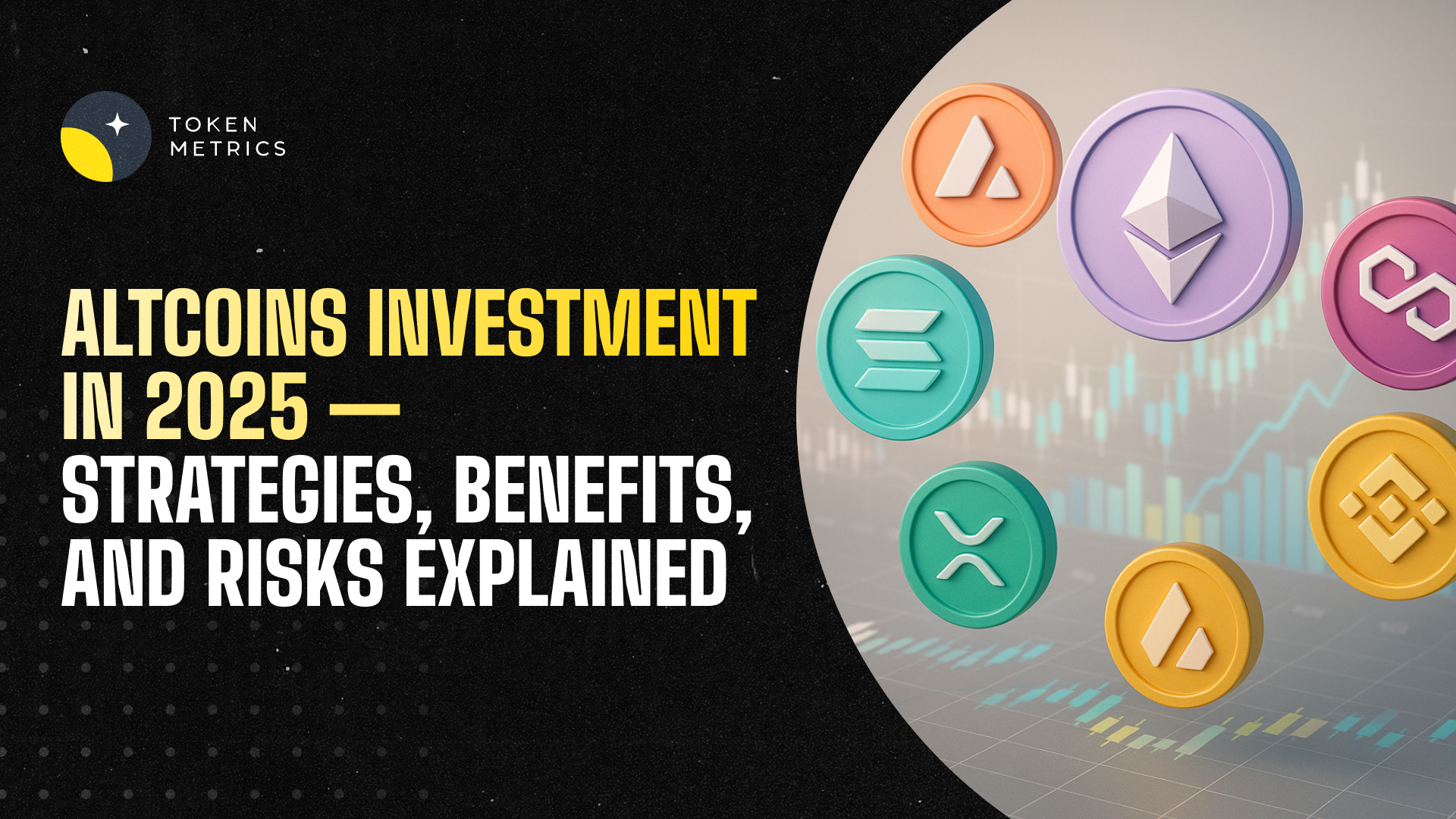

Artificial intelligence (AI) has become one of the most transformative technologies of our time, reshaping industries from healthcare to finance. In the cryptocurrency space, AI crypto coins are merging blockchain with artificial intelligence, creating powerful ecosystems for data analytics, automated decision-making, decentralized AI marketplaces, and predictive trading.

In 2025, AI-powered tokens are one of the most promising sectors in crypto, attracting retail investors, institutional players, and developers seeking the next wave of technological breakthroughs. This article explores what AI crypto coins are, how they work, their benefits, key risks, and the role of Token Metrics in analyzing and investing in them.

AI crypto coins are digital tokens that fuel blockchain platforms integrated with artificial intelligence technologies. These coins serve multiple purposes, including:

By combining the transparency of blockchain with the intelligence of AI, these projects are creating self-sustaining ecosystems where users can buy, sell, and deploy AI services securely.

The AI crypto sector is diverse, with projects addressing various use cases. Here are some of the leading tokens:

One of the most innovative AI-driven analytics platforms in crypto. TMAI leverages over 80 data points per token, offering AI-generated ratings, trend analysis, and portfolio insights to help traders and investors make data-driven decisions.

2. $KAITO Token Utility:

3. Cookie.fun ($COOKIE): Gamified Trading Meets A

Cookie.fun is a Gen-Z-targeted platform that fuses AI-powered trading insights with gamified investing experiences.

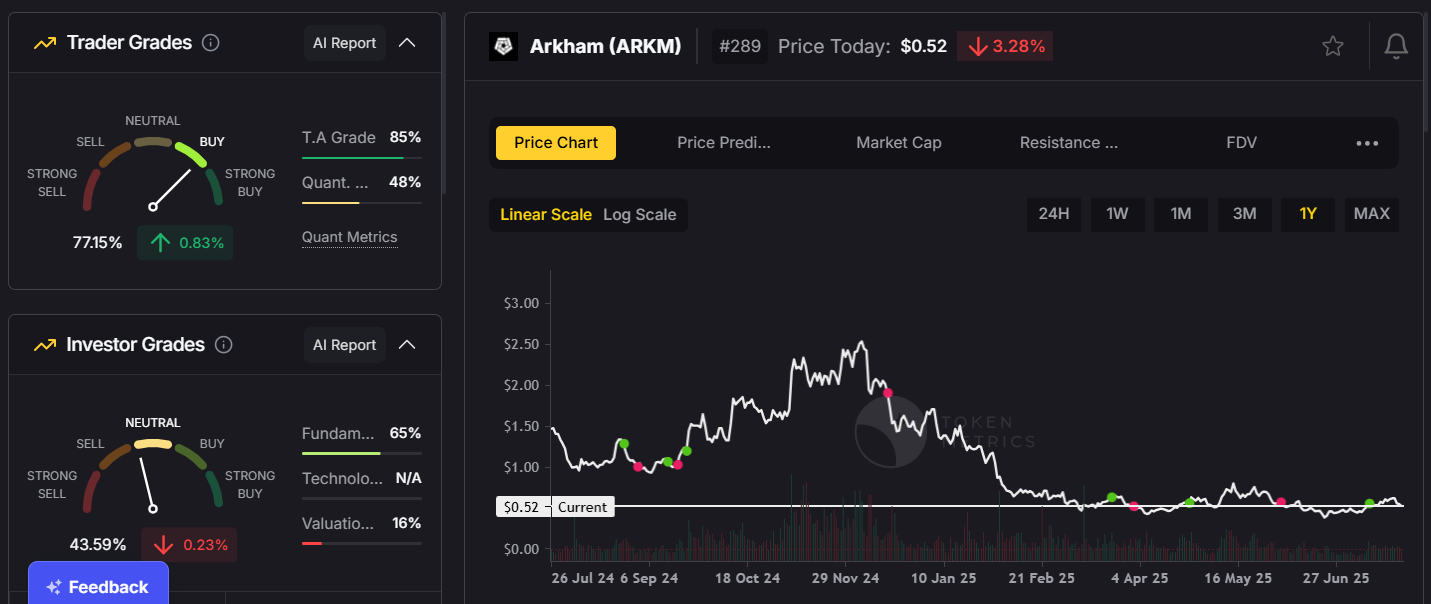

4. Arkham Intelligence (ARKM):

An AI-powered blockchain intelligence platform that analyzes on-chain data for compliance, forensics, and research.

These tokens are part of a fast-growing ecosystem of AI-focused projects poised to disrupt industries ranging from financial trading to decentralized computing.

AI crypto coins work by integrating machine learning and blockchain to create scalable, secure, and transparent AI ecosystems. Key mechanisms include:

This synergy between AI and blockchain creates systems that learn, adapt, and evolve over time, making them highly valuable in the crypto economy.

1. Exposure to Two Revolutionary Technologies:

Investing in AI tokens means gaining exposure to both the blockchain and AI sectors, which are projected to experience massive growth over the next decade.

2. High Growth Potential:

AI crypto coins often see rapid adoption due to their real-world applications and strong narratives.

3. Diversification:

AI tokens provide a unique asset class within the crypto market, helping diversify a portfolio beyond standard altcoins.

4. Early Access to Innovation:

Investors can be part of groundbreaking projects building the infrastructure for decentralized AI networks.

Like all crypto assets, AI coins carry risks:

Using data-driven platforms like Token Metrics can help mitigate these risks by offering detailed project analysis and ratings.

1. Long-Term Holding (HODL):

Invest in leading AI tokens like TMAI, FET, and AGIX for long-term exposure to this emerging sector.

2. Narrative Investing:

Capitalize on market narratives by entering early when AI projects gain traction or announce major updates.

3. Portfolio Diversification:

Balance AI tokens with large-cap cryptocurrencies like Bitcoin and Ethereum to manage overall portfolio risk.

4. Active Monitoring with Token Metrics:

Use Token Metrics to receive real-time AI-generated ratings, alerts, and trend analyses for AI tokens, helping you optimize entry and exit points.

Token Metrics is uniquely positioned at the intersection of AI and crypto. It provides:

For investors seeking to navigate the fast-changing AI crypto sector, Token Metrics delivers data-driven confidence in decision-making.

AI crypto coins are expected to play a transformative role in 2025 and beyond, powering innovations in:

As AI becomes more integrated with blockchain, these coins will likely lead the next technological and financial revolution.

AI crypto coins represent one of the most exciting frontiers in cryptocurrency. By merging the power of blockchain with the intelligence of AI, these tokens are reshaping how we interact with data, trade, and build decentralized systems.

For investors, platforms like Token Metrics provide the insights needed to navigate this dynamic sector—identifying promising projects, managing risk, and seizing opportunities before the market catches up.

In 2025, adding AI tokens to your portfolio isn’t just an investment—it’s a way to participate in the future of intelligent, decentralized finance.

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.