Top Crypto Trading Platforms in 2025

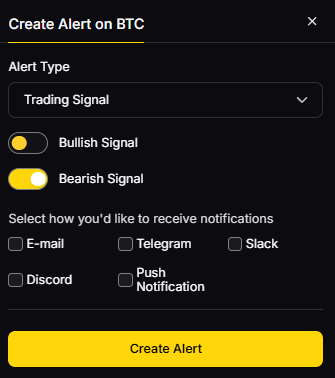

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

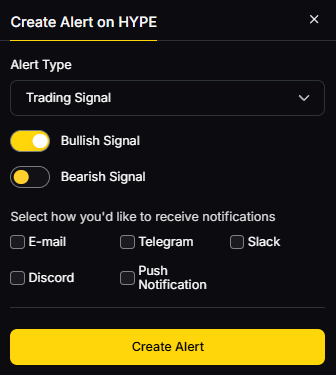

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

The search intent here is commercial investigation: investors want safe ways to protect on-chain and custodied assets. This guide ranks the best insurance protocols 2025 across DeFi and regulated custodial coverage so you can compare options quickly.

Definition: Crypto (DeFi) insurance helps cover losses from smart-contract exploits, exchange halts, custodian breaches, or specific parametric events; custodial insurance typically protects assets held by qualified trustees or platforms under defined “crime”/theft policies.

In 2025, larger treasuries and yield strategies are back, while counterparty and contract risk remain. We focus on real cover products, payout track records, and regulated custodial policies—using only official sources. Secondary considerations include DeFi insurance, crypto custodial insurance, and smart contract coverage capacity, claims handling, and regional eligibility.

Data sources: official product/docs, transparency/security pages, and audited/claims pages; market datasets only for cross-checks. Last updated September 2025.

3. OpenCover— Best for Community-Driven, Transparent Coverage

Why Use It: OpenCover is a decentralized insurance protocol that leverages community-driven liquidity pools to offer coverage against smart contract exploits and other on-chain risks. Its transparent claims process and low-cost structure make it an attractive option for DeFi users seeking affordable and reliable insurance solutions.

Best For: DeFi users, liquidity providers, and investors looking for community-backed insurance coverage.

Notable Features:

Fees/Notes: Premiums are determined by the liquidity pool and the level of coverage selected.

Regions: Global (subject to dApp access).

Consider If: You value community governance and transparency in your insurance coverage.

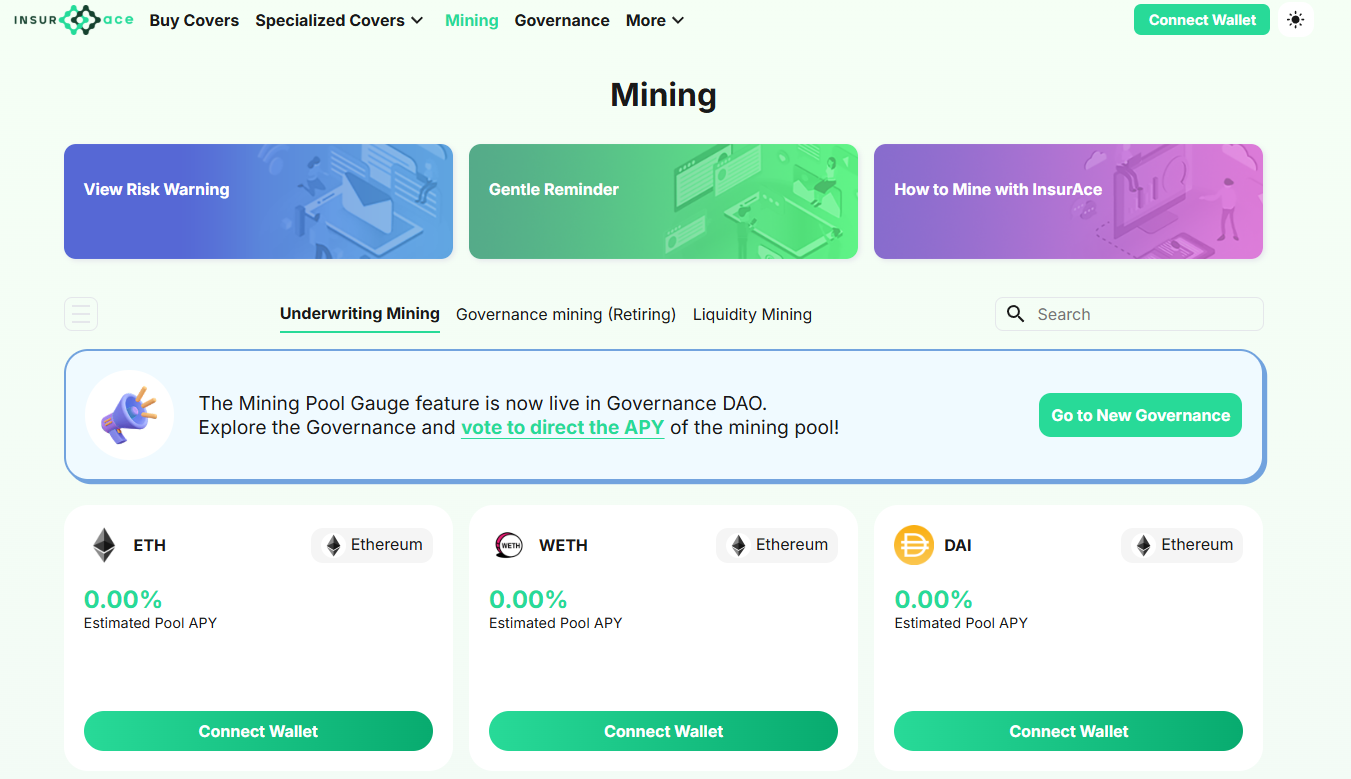

Alternatives: Nexus Mutual, InsurAce.

8. Tidal Finance — Best for Coverage on Niche DeFi Protocols

Why Use It: Tidal Finance focuses on providing coverage for niche and emerging DeFi protocols, offering tailored insurance products for new and innovative projects. Tidal's dynamic risk assessments allow it to offer specialized coverage options for specific protocols.

Best For: Users and protocols seeking insurance for niche DeFi projects with specific risk profiles.

Notable Features:

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What’s the difference between DeFi insurance and custodial insurance?

DeFi insurance protects on-chain actions (e.g., smart-contract exploits or depegs), often via discretionary voting or parametric rules. Custodial insurance covers specific theft/loss events while assets are held by a qualified custodian under a crime policy; exclusions apply. docs.nexusmutual.io+1

How do parametric policies work in crypto?

They pre-define an objective trigger (e.g., flight delay, protocol incident), enabling faster, data-driven payouts without lengthy investigations. Etherisc (flight) and Neptune Mutual (incident pools) are examples. Flight Delay+1

Is Nexus Mutual regulated insurance?

No. It’s a member-owned discretionary mutual where members assess claims and provide capacity; see membership docs and claim pages. docs.nexusmutual.io+1

Do custodial policies cover user mistakes or account takeovers?

Typically no—policies focus on theft from the custodian’s systems. Review each custodian’s definitions/exclusions (e.g., Gemini’s hot/cold policy scope). Gemini

What if I’m primarily on Solana?

Consider Amulet for Solana-native cover; otherwise, verify cross-chain support from multi-chain providers. amulet.org

Which providers are regulated?

Chainproof offers regulated smart-contract insurance; Nayms operates under Bermuda’s DABA framework for on-chain insurance programs. chainproof.co+1

If you need breadth and track record, start with Nexus Mutual or InsurAce. For parametric, faster payouts, look at Neptune Mutual or Etherisc. Building institutional-grade risk programs? Consider Chainproof or Nayms. If you hold assets with a custodian, confirm published insurance capacity—BitGo and Gemini Custody are good benchmarks.

Related Reads:

We verified every claim on official provider pages (product docs, policy pages, security/claims posts) and only used third-party sources for context checks. Updated September 2025.

Gemini — Custody insurance page and blog. Gemini+1

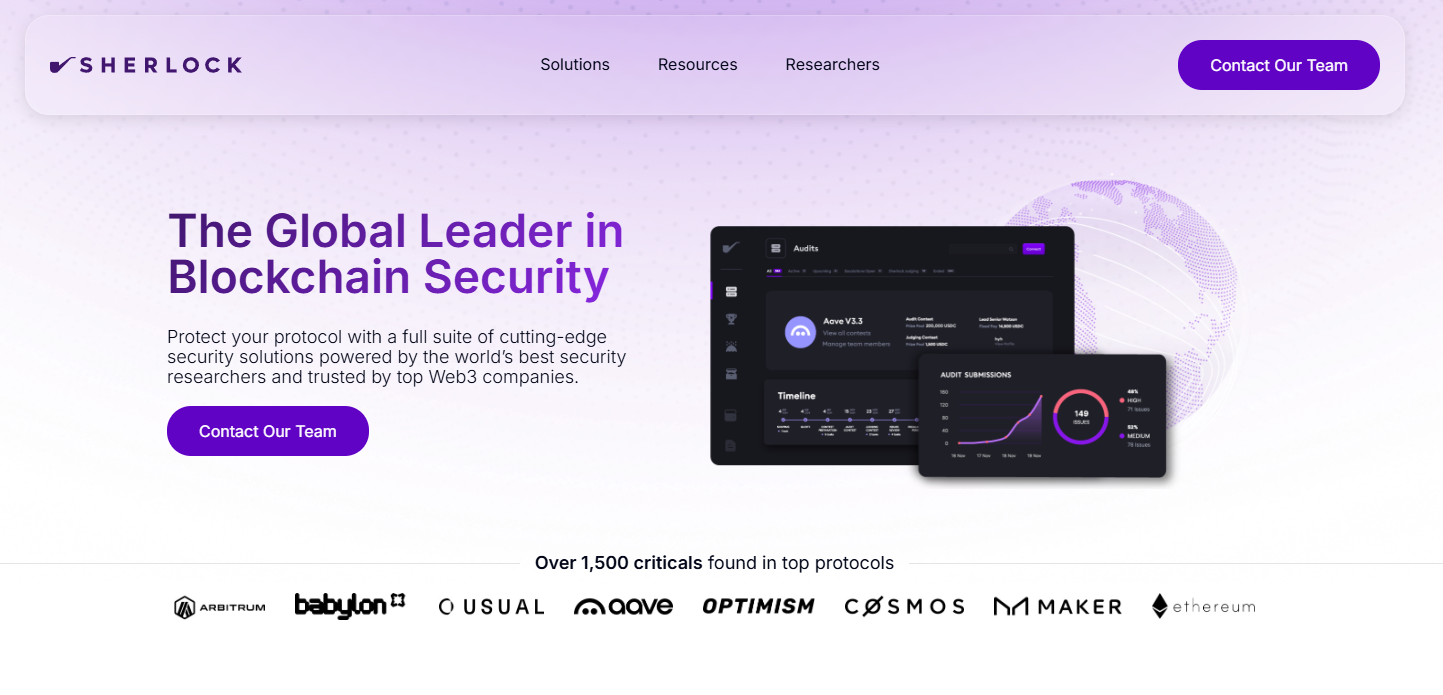

Smart contracts are the critical rails of DeFi, gaming, and tokenized assets—one missed edge case can freeze liquidity or drain treasuries. If you’re shipping on EVM, Solana, Cosmos, or rollups, smart contract auditors provide an independent, methodical review of your code and architecture before (and after) mainnet. In one line: a smart contract audit is a systematic assessment of your protocol’s design and code to find and fix vulnerabilities before attackers do.

This guide is for founders, protocol engineers, PMs, and DAOs comparing audit partners. We combined SERP research with hands-on security signals to shortlist reputable teams, then selected the best 10 for global builders. Secondary considerations—like turnaround time, formal methods, and public report history—help you match the right firm to your stack and stage.

Data inputs: official service/docs pages, public audit report portals, rate disclosures where available, and widely cited market datasets for cross-checks. Last updated September 2025.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What does a smart contract audit include?

Typically: architecture review, manual code analysis by multiple researchers, automated checks (linters, fuzzers), proof-of-concept exploits for issues, and a final report plus retest. Depth varies by scope and risk profile.

How long does an audit take?

From a few weeks to several months, depending on code size, complexity, and methodology (e.g., formal verification can extend timelines). Plan for time to remediate and retest before mainnet.

How much do audits cost?

Pricing is quote-based and driven by complexity, deadlines, and team composition. Some networks (e.g., Spearbit) publish base rate guidance to help with budgeting.

Do I need an audit if my code is forked?

Yes. Integration code, parameter changes, and new attack surfaces (bridges/oracles) can introduce critical risk—even if upstream code was audited.

Should I publish my audit report?

Most credible teams publish at least a summary. Public reports aid trust, listings, and bug bounty participation—while enabling community review.

What if we change code after the audit?

Request a delta audit and update your changelog. Major logic changes merit a retest; minor refactors may need targeted review.

Choosing the right auditor depends on your stack, risk tolerance, and timelines. For Ethereum-first teams, OpenZeppelin, Sigma Prime, and ConsenSys Diligence stand out. If you need high-assurance proofs or tricky mechanisms, look to Runtime Verification, ChainSecurity, or Trail of Bits. Solana/Move builders often pick OtterSec or Zellic. For flexible, elite review pods, Spearbit is strong.

Related Reads:

We reviewed official audit/service pages, public report libraries, and process/rate disclosures for recency and scope fit. Third-party datasets were used only for cross-checks (no external links included). Updated September 2025.

In a market that never sleeps, the best crypto newsletters 2025 help you filter noise, spot narratives early, and act with conviction. In one line: a great newsletter or analyst condenses complex on-chain, macro, and market structure data into clear, investable insights. Whether you’re a builder, long-term allocator, or active trader, pairing independent analysis with your own process can tighten feedback loops and reduce decision fatigue. In 2025, ETF flows, L2 expansion, AI infra plays, and global regulation shifts mean more data than ever. The picks below focus on consistency, methodology transparency, breadth (on-chain + macro + market), and practical takeaways—blending independent crypto analysts with data-driven research letters and easy-to-digest daily briefs.

Secondary intents we cover: crypto research newsletter, on-chain analysis weekly, and “who to follow” for credible signal over hype.

Primary CTA: Start free trial

This article is for research/education, not financial advice.

What makes a crypto newsletter “best” in 2025?

Frequency, methodological transparency, and the ability to translate on-chain/macro signals into practical takeaways. Bonus points for archives and clear disclosures.

Are the top newsletters free or paid?

Most offer strong free tiers (daily or weekly). Paid tiers typically unlock deeper research, models, or community access.

Do I need both on-chain and macro letters?

Ideally yes—on-chain explains market structure; macro sets the regime (liquidity, rates, growth). Pairing both creates a more complete view.

How often should I read?

Skim dailies (Bankless/Milk Road) for awareness; reserve time weekly for deep dives (Glassnode/Coin Metrics/Delphi).

Can newsletters replace analytics tools?

No. Treat them as curated insight. Validate ideas with your own data and risk framework (Token Metrics can help).

Which is best for ETF/flows?

CoinShares’ weekly Fund Flows is the go-to for institutional positioning, complemented by Glassnode/Coin Metrics on structure.

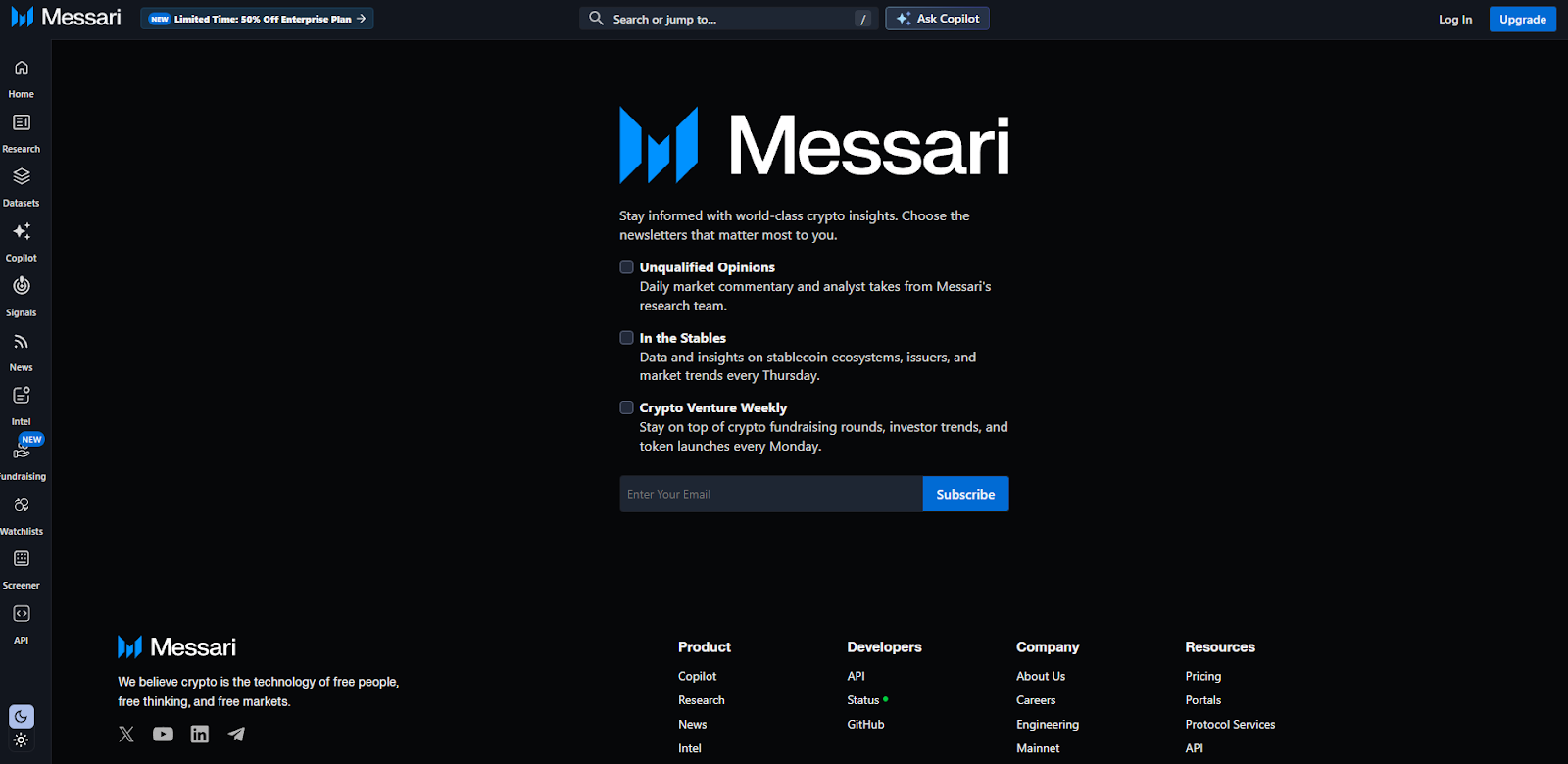

If you want a quick pulse, pick a daily (Bankless or Milk Road). For deeper conviction, add one weekly on-chain (Glassnode or Coin Metrics) and one thesis engine (Delphi or Messari). Layer macro (Lyn Alden) to frame the regime, and use Token Metrics to quantify what you read and act deliberately.

Related Reads:

We reviewed each provider’s official newsletter hub, research pages, and recent posts to confirm availability, cadence, and focus. Updated September 2025 with the latest archives and program pages. Key official references: Bankless newsletter hub Bankless+2Bankless+2; The Defiant newsletter page The Defiant+1; Messari newsletter hub and Unqualified Opinions pages Messari+2messari.substack.com+2; Delphi Digital newsletter page and research site Delphi Digital+2delphidigital.io+2; Glassnode Week On-Chain hub and latest issue insights.glassnode.com+2Glassnode+2; Coin Metrics SOTN hub and archive Coin Metrics+2Coin Metrics+2; Kaiko research/newsletter hub and company site Kaiko Research+1; CoinShares Fund Flows & Research hubs (US/global) and latest weekly example CoinShares+2CoinShares+2; Milk Road homepage and social proof Milk Road+1; Lyn Alden newsletter/archive pages and 2025 issues Lyn Alden+4Lyn Alden+4Lyn Alden+4.